Check With Prior Employers

If you can remember the names of previous employers, its worth contacting the human resources department and asking the HR officer to verify your start and end dates. Ask if the company kept your job application or resume on file, as this may contain details of the jobs you had before you applied for that position. Unfortunately, theres no national database for employment history verification. Instead, youll have to contact every employer you worked for to get your dates of employment.

Fact #: Social Security Lifts Millions Of Older Adults Above The Poverty Line

Without Social Security benefits, about 4 in 10 adults aged 65 and older would have incomes below the poverty line, all else being equal, according to official estimates based on the 2021 Current Population Survey. Social Security benefits lift more than 16 million older adults above the poverty line, these estimates show.

An important study on retirement income from the U.S. Census Bureau that matches Census estimates to administrative data suggests that the official estimates overstate older people’s reliance on Social Security. The study finds that in 2012, 3 in 10 older adults would have been poor without Social Security, and that the program lifted more than 10 million older adults above the poverty line.

No matter how it is measured, its clear that Social Security lifts millions of older adults above the poverty line and dramatically reduces their poverty rate.

Why Does Social Security Want To Know About My Work History

On Behalf of Midwest Disability, P.A. | Jan 2, 2019 | Social Security Disability Process And Benefits |

Through the process of applying for Social Security disability benefits, applicants will be required to complete various forms to the Social Security Administration . There are forms that ask for information about medical treatment and providers. The SSA wants this information in order to determine if the applicant is receiving treatment for disabling conditions and to obtain records from these facilities. The SSA will also ask applicants to complete a form that asks a series of questions about their symptoms and the manner in which their disability interfere with daily life. This form is intended to allow the applicant to describe in their own words the impact of their disability. Additionally, the Social Security Administration will ask you to complete a questionnaire regarding your work history.

Also Check: Social Security Disability Overpayment Statute Of Limitations

Policy Basics: Top Ten Facts About Social Security

Social Security provides a foundation of income on which workers can build to plan for their retirement. It also provides valuable social insurance protection to workers who become disabled and to families whose breadwinner dies.

Eighty-six years after President Franklin Roosevelt signed the Social Security Act on August 14, 1935, Social Security remains one of the nations most successful, effective, and popular programs.

Why Does Your Work History Affect Your Social Security Income

The Social Security benefit formula is calculated such that you receive benefits equal to a specific percentage of your inflation-adjusted average wage earned over the 35 years your income was the highest.

When calculating your benefits, the Social Security Administration:

Looks at your entire earnings record over your career and adjusts the wages each year to account for wage growth. Only wages up to a certain maximum wage level are considered in determining your annual income.

Adds up all the inflation-adjusted wages you earned in the 35 years when you earned the most.

Divides this number by 420 to calculate your average monthly wage.

The resulting number is your Average Indexed Monthly Wages, or AIME. AIME isn’t the amount you are paid in benefits, though — it’s the average earnings that the benefit formula uses to calculate your benefits. The Social Security Administration applies a formula to your AIME to determine your primary insurance amount . Under the Social Security benefits formula, your primary insurance amount is equal to:

-

90% of your AIME up to a “bend point,” which is a set level of income determined in the year you turned 62

-

32% of your AIME between the first bend point and a second bend point

-

15% of AIME above the second bend point

Also Check: Social Security Administration Phone Number

Pay Records On The Employee Personal Page

Employment and Pay Information from Former Non-Government Employers

OHR does not have access to your employment records from a private or non-government employer. To get a copy of your non-government employment/pay history, we recommend you visit your local Social Security Administration office or visit . You can request your Social Security Earnings Information and it will contain the names and addresses of your former employers along with your pay information for the years you specify in your request.

Former- and Non-DOL Federal Employees

The Department of Labor, like other federal agencies, only stores your employment records from federal employment and it only maintains that information while you are employed with the Department of Labor. Once you transfer to another agency, leave federal service or retire, your electronic Official Personnel Folder is then either transferred to your new employing agency and must be requested from them, or it is transferred to the National Archives for storage. Through the archives, you can also request a copy of your Official Military Personnel Files , as well as any historical and .

Current DOL and Federal Employment Records

Pay Records

Current federal employees can print earning and leave statements, create and delete pay deductions, review their FEHB and TSP information, and access their pay and tax information on the National Finance Center’s Employee Personal Page . This system is available 24/7.

If You’re Not Sure Why You Received A Payment

If you receive a check or direct deposit payment from the Treasury Department and do not know what its for, contact the regional financial center that issued it. Only the agency that authorized the payment can explain why you received it.

If you received a check, look for the RFCs city and state at the top center. Then contact that RFC to find out which federal agency authorized the payment. It will be one of these:

If you received payment byelectronic funds transfer , or direct deposit, follow the directions under Find Information About a Payment.

Use the Treasury Check Verification System to verify that the check is legitimate and issued by the government.

Recommended Reading: What Part Of Social Security Is Taxable

Start With Your Benefits Estimates

Your first step in maximizing your Social Security benefits should be to visit the Social Security Administration website. If you know your ex’s Social Security number, you can check for his or her benefits as well. Or you can ask your ex about his or her benefits if the two of you are on good terms.

If you’re not, the SSA can give you information about your ex’s benefits. You’ll need both your and your ex-spouse’s benefits estimates to determine your best Social Security claiming strategy.

When you file for Social Security, you file for all the benefits for which you’re eligible, including divorced spousal benefits. So even if you don’t know your former spouse’s Social Security number, you can still file for and receive divorced spousal benefits.

Report The Death Of A Social Security Or Medicare Beneficiary

You must report the death of a family member receiving Social Security or Medicare benefits. The Social Security Administration processes death reports for both. Find out how you can report a death and how to cancel benefit payments. In addition to canceling SSA and Medicare benefits, find out what other benefits and accounts you should cancel.

Don’t Miss: Lee County Social Security Office

Court Interpretation Of The Act To Provide Benefits

The United States Court of Appeals for the Seventh Circuit has indicated that the Social Security Act has a moral purpose and should be liberally interpreted in favor of claimants when deciding what counted as covered wages for purposes of meeting the quarters of coverage requirement to make a worker eligible for benefits. That court has also stated: “… he regulations should be liberally applied in favor of beneficiaries” when deciding a case in favor of a felon who had his disability payments retroactively terminated upon incarceration. According to the court, that the Social Security Act “should be liberally construed in favor of those seeking its benefits can not be doubted.” “The hope behind this statute is to save men and women from the rigors of the poor house as well as from the haunting fear that such a lot awaits them when journey’s end is near.”

Why A Social Security Earnings Record Mistake Matters

A mistake in your earnings history can make a big difference in how your Social Security benefits are calculated. How? It all goes back to the benefits formula. The Social Security Administration uses your highest 35 years of earnings as a cornerstone of the benefit calculation. If any of these 35 years are incorrect or missing altogether, the average is skewed. One year of missing earnings can make a difference of $100 per month in your benefit amount. Over your lifetime, that could be nearly $30,000 in missed benefits from one year of missing earnings.

You need to check your Social Security earnings record today. Thankfully, its pretty easy to do.

Heres how to accomplish this in five easy steps.

Also Check: Social Security Disability Income Limits

Claim Of Discrimination Against The Poor And The Middle Class

Workers must pay 12.4 percent, including a 6.2 percent employer contribution, on their wages below the Social Security Wage Base , but no tax on income in excess of this amount. Therefore, high earners pay a lower percentage of their total income because of the income caps because of this, and the fact there is no tax on unearned income, social security taxes are often viewed as being regressive. However, benefits are adjusted to be significantly more progressive, even when accounting for differences in life expectancy. According to the non-partisan Congressional Budget Office, for people in the bottom fifth of the earnings distribution, the ratio of benefits to taxes is almost three times as high as it is for those in the top fifth.

How Can I Estimate My Social Security Benefits Based On My Work History

Estimating your benefits based on your work history is more complicated than it seems. That’s because you need to adjust all your earnings for inflation.

The Social Security Administration uses the Average Wage Index to adjust for inflation. In particular, it uses the AWI in effect two years before you first become eligible for Social Security benefits. You become eligible for retirement benefits at 62, so the AWI from the year you turn 60 is used to determine how much your wages are adjusted upward to account for wage growth.

If you turn 62 in 2019, the AWI from 2017 is used to adjust each year’s wages. The wages are adjusted based on an “indexing factor,” which is calculated by dividing the AWI in the year you turned 62 by the AWI in the year you earned the wages being adjusted. You then multiply that year’s earnings by the indexing factor. This can be confusing, so here’s an example:

-

If you turn 62 in 2019, you use the AWI from 2017, when you turned 60. That AWI is $50,321.89.

-

If you want to adjust your wages from 2016, figure out the indexing factor for 2016 by dividing $50,321.89 by $48,642.15 . Your indexing factor is 1.035.

-

Multiply 1.035 times the wages earned in 2016, since that’s the year you’re adjusting the wages for. If you earned $50,000 in 2016, multiply $50,000 by the indexing factor of 1.035 to find out your index-adjusted annual wage is $51,750.

Don’t Miss: Social Security Office Mcalester Oklahoma

Your Social Security Record

application for a number into a card that is called an “Actuarial Card.” Having placed the information about you in punch card form other machines can later file, sort, and print this information as it is needed. First of all, your card is placed into a reading and printing machine called an Interpreter. Interpreter can’t read Russian, but he can read the punched hole codes in your card and then he can translate the information back into English and finally print it in English on your card. Quite a boy, that Interpreter! After Interpreter gets through with your card, it is given to a reviewer to check and to make sure that the information you gave has been correctly coded in the card and also agrees with your name and number as they appear on the copy of your social security account number card. When your information has been checked, your card goes to an automatic reproducing machine which like an old mother hen turning out one egg after another, each just like the one before it. This machine makes an exact duplicate of your punch card and this, too, is given to our friend Interpreter to be translated into printed English and then to be placed in a file in its proper numerical position.

THE HEN

THE BRAIN

Office Of Hearings Operations

On August 8, 2017, Acting Commissioner Nancy A. Berryhill informed employees that the Office of Disability Adjudication and Review would be renamed to Office of Hearings Operations . The hearing offices had been known as “ODAR” since 2006, and the Office of Hearings and Appeals before that. OHO administers the ALJ hearings for the Social Security Administration. Administrative Law Judges conduct hearings and issue decisions. After an ALJ decision, the Appeals Council considers requests for review of ALJ decisions, and acts as the final level of administrative review for the Social Security Administration .

You May Like: List Of Leaked Social Security Numbers

Fact #: Social Security Benefits Are Modest

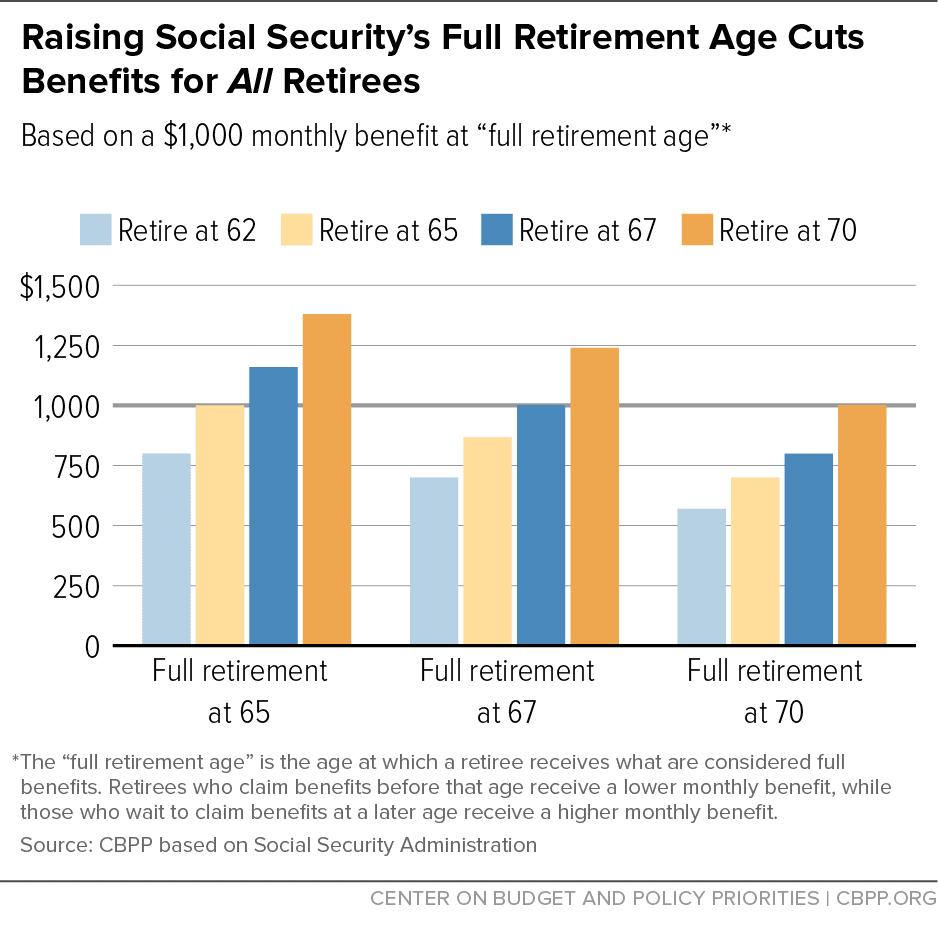

Social Security benefits are much more modest than many people realize the average Social Security retirement benefit in January 2022 was about $1,614 per month, or about $19,370 per year. For someone who worked all of their adult life at average earnings and retires at age 65 in 2022, Social Security benefits replace about 37 percent of past earnings. Social Securitys replacement rate fell as the programs full retirement age gradually rose from 65 in 2000 to 67 in 2022.

Most retirees enroll in Medicares Supplementary Medical Insurance and have Part B premiums deducted from their Social Security checks. As health care costs continue to outpace general inflation, those premiums will take a bigger bite out of their checks.

Social Security benefits are also modest by international standards. The U.S. ranks just outside the bottom third of developed countries in the percentage of an average workers earnings replaced by the public pension system.

Social Security is important for children and their families as well as for older adults. Over 6.5 million children under age 18 lived in families who received income from Social Security in 2019. That number included nearly 2.8 million children who received their benefits as dependents of retired, disabled, or deceased workers, as well as others who lived with parents or relatives who received Social Security benefits.

Social Security lifted 1.1 million children above the poverty line in 2020, as the chart shows.

What Does Your Work History Have To Do With Your Social Security

Your work history determines:

If you are eligible to receive Social Security benefits. You must earn a certain number of work credits over your lifetime to become eligible to receive retirement income from Social Security.

The amount of monthly Social Security benefits you’re entitled to receive. Social Security considers your highest 35 years of earnings, after adjusting for inflation, to determine your monthly benefits.

Because Social Security benefits are calculated across 35 years, not working this full span may result in reduced benefits, or possibly no benefits at all. But if you work and pay into the Social Security system throughout your career, Social Security retirement benefits are designed to replace around 40% of your preretirement income. The Social Security benefits formula is progressive, though, so lower-earning workers receive a higher percentage of preretirement income than higher earners.

Let’s look a little more closely at how work history affects both eligibility for Social Security benefits and the amount you earn.

Read Also: Social Security Administration Wichita Kansas

Quick Facts About Claiming On Your Ex’s Earnings Record:

- You can claim even if your ex has remarried.

- You can claim even if your ex hasn’t retired and isn’t receiving Social Security benefits .

- Claiming won’t reduce your ex’s Social Security benefits or his or her current spouse’s benefits.

- The SSA won’t notify your ex that you’ve claimed on his or her record.

Amendments Of The 1970s

1972 Amendments

In June 1972, both houses of the United States Congress approved by overwhelming majorities 20% increases in benefits for 27.8 million Americans. The average payment per month rose from $133 to $166. The bill also set up a cost-of-living adjustment to take effect in 1975. This adjustment would be made on a yearly basis if the Consumer Price Index increased by 3% or more. This addition was an attempt to index benefits to inflation so that benefits would rise automatically. If inflation was 5%, the goal was to automatically increase benefits by 5% so their real value didn’t decline. A technical error in the formula caused these adjustments to overcompensate for inflation, a technical mistake which has been called double-indexing. The COLAs actually caused benefits to increase at twice the rate of inflation.

In October 1972, a $5 billion piece of Social Security legislation was enacted which expanded the Social Security program. For example, minimum monthly benefits of individuals employed in low income positions for at least 30 years were raised. Increases were also made to the pensions of 3.8 million widows and dependent widowers.

These amendments also established the Supplemental Security Income . SSI is not a Social Security benefit, but a welfare program, because the elderly and disabled poor are entitled to SSI regardless of work history. Likewise, SSI is not an entitlement, because there is no right to SSI payments.

1977 Amendments

You May Like: Jefferson County Social Security Office