What Other Requirements Are Beneficiaries Required To Meet

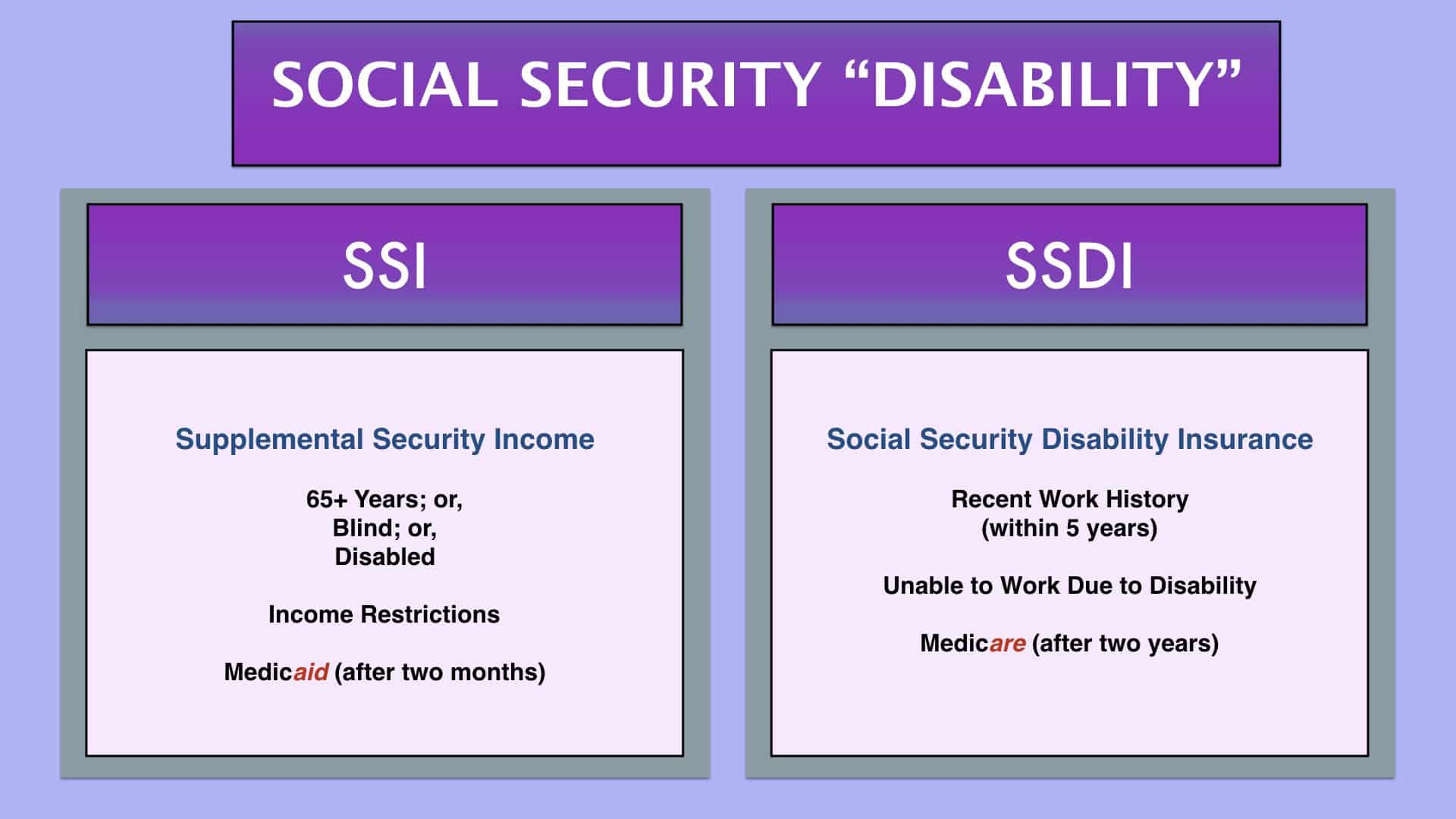

In order to receive Disability Insurance, a worker must have worked during at least one-fourth of his or her adult lifetime and during at least 5 of the 10 years before disability onset. There is also a five-month waiting period before a worker can qualify for benefits.

Supplemental Security provides assistance to people with severe disabilities who have very low incomes and assets and who either lack sufficient work history to be covered for Disability Insurance or receive only a very small Disability Insurance benefit. It is important to note that many Supplemental Security beneficiaries, although lacking the sustained work history necessary to be insured under Disability Insurance, have worked and paid into the Disability Insurance system. And others, particularly women, are not eligible for Disability Insurance because they took time out of the paid labor force to care for children or other family members.

Workers must apply for and exhaust all other available benefits before qualifying for Disability Insurance or Supplemental Security. Accordingly, Social Securitys disability programs serve as a true last resort for people with severe disabilities and little to no ability to work.

How Common Is It For Beneficiaries To Return To Work

Both Disability Insurance and Supplemental Security provide incentives for beneficiaries to work. Disability Insurance beneficiaries are encouraged to work up to their full capacity and can earn an unlimited amount for up to 12 months without losing any benefits. Beneficiaries who work for more than 12 months and have earnings above the substantial gainful activity level cease to receive a monthly benefit. If at any point in the next five years their condition worsens and they are not able to continue working above the substantial gainful activity level, however, they are eligible for expedited reinstatement of their benefits. This means they do not need to repeat the entire, and typically lengthy, disability-determination process that they initially went through to qualify for benefits.

Supplemental Security beneficiaries who are able to work are encouraged to do so as well. Their benefits are reduced based on their earningsafter the first $85 of earnings each month, which is not counted against the benefitbut by only $1 for every $2 of earnings. Beneficiaries who are able to do some work will therefore always be better off with both earnings and a reduced benefit than just the benefit alone.

Ive Heard That My Ssdi Payments May Be Reduced If I Receive Other Benefits How Does This Happen

If you receive other disability benefits such as Workers Compensation, your benefits may be recalculated or reduced. This may take place based on the SSDI index which is also the same index used to compute all Social Security benefits. The SSDI index looks at average wage indexes and applies them to a beneficiarys average current earnings.

Don’t Miss: Social Security Offices In San Antonio

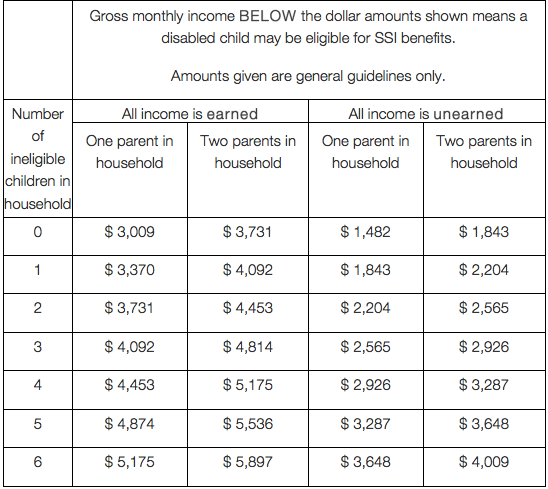

Do Some States Have Higher Limits

There’s another wrinkle that raises the income limits in most states: the “state supplement.”

Most states add money to the federal SSI payment called a state supplement. This means that the allowed income level, as well as the SSI payments, are higher than the federal maximums in those states. Every state except Arizona, North Dakota, and West Virginia has a state supplement.

The amount of the state supplement varies between states, from about $10 to about $400. In some states, the amount of the state supplement can depend on whether you are single or married and on your living arrangements. For instance, some states pay a supplement only to those living in a nursing home other states pay a higher supplement to those without full kitchens. For these reasons, unless you live in a state without a state supplement, it might be difficult for you to estimate whether your income falls under the SSI limit.

For more information, see our article on the supplemental payments, including state supplement amounts.

How Much Money Can You Make While Receiving Social Security Disability

Home » Frequently Asked Questions » How Much Money Can You Make While Receiving Social Security Disability?

When applying for Social Security Disability benefits, there is an upper limit on how much income you can earn. As of 2021, the limit for disability applicants who are not blind is $1,310, while blind applicants can make up to $2,190 and still receive benefits.

However, the Social Security Administration wants to encourage people to return to work and has programs in place that allow them to earn money while receiving disability benefits. At Berger and Green, we understand how complex the rules surrounding your SSD benefits can seem. We are here to help you determine whether you qualify for benefits.

You May Like: Social Security Office Muskogee Ok

Limit On Substantial Gainful Activity

A person with a disability applying for or receiving SSDI can’t earn more than a certain amount of money per month by working this isn’t because of an income limit, but rather because the SSA wouldn’t consider that person disabled.

If you can do what the SSA calls “substantial gainful activity” , you aren’t disabled. A person who earns more than a certain monthly amount is considered to be “engaging in SGA,” and thus not eligible for SSDI benefits. In 2022, the SGA amount is $1,350 for disabled applicants and $2,260 for blind applicants.

The rules differ for business owners, since their monthly income may not reflect the work effort they put into their business. For more information, see our article on SGA for small business owners.

What Income Is Excluded From The Ssi Income Limit

The SSA does not count the following income and benefits when calculating your income level:

- $20 per month of income other than wages

- $65 per month of wages and one-half of wages over $65

- wages that go toward special impairment-related work expenses for disabled persons or blind persons

- the first $30 of infrequent or irregularly received earned income in a quarter

- the first $60 of infrequent or irregularly received unearned income in a quarter

- medical care

- reimbursement of expenses from a social services agency

- food stamps, and

- housing or home energy assistance.

Generally, if someone gives you an item that can’t be used as — or used to obtain — food, clothing, or shelter — it will not be considered as income. For example, if someone pays a doctor’s bill for you, it won’t be counted as part of your income.

In addition, income set aside for an SSI “Plan for Achieving Self-Support” is not counted.

To learn about the dollar amounts for the SSI income limits, see our article Income Limits & SSI Disability Eligibility.

You could be eligible for up to $3,148 per month In SSDI Benefits

You May Like: Social Security Office Apache Junction

Talk To A Social Security Disability Lawyer For Free Today

At John Foy & Associates, we know how vital SSDI is for individuals and families. Were here to help if you need assistance with your claim. We do not collect a fee unless we win you money, so there is no risk when working with us.

Contact us today to schedule a FREE, no-risk consultation. Well listen to your concerns and answer any questions. To get started for FREE, call , or contact us online.

Call or text or complete a Free Case Evaluation form

Information You Need To Apply

Before applying, be ready to provide information about yourself, your medical condition, and your work. We recommend you print and review the . It will help you gather the information you need to complete the application.

Information About You

- Your date and place of birth and Social Security number.

- The name, Social Security number, and date of birth or age of your current spouse and any former spouse. You should also know the dates and places of marriage and dates of divorce or death .

- Names and dates of birth of children not yet 18 years of age.

- Your bank or other and the account number.

Information About Your Medical Condition

- Name, address, and phone number of someone we can contact who knows about your medical conditions and can help with your application.

- Detailed information about your medical illnesses, injuries, or conditions:

- Names, addresses, phone numbers, patient ID numbers, and dates of treatment for all doctors, hospitals, and clinics.

- Names of medicines you are taking and who prescribed them.

- Names and dates of medical tests you have had and who ordered them.

Information About Your Work:

- Award letters, pay stubs, settlement agreements, or other .

We accept photocopies of W-2 forms, self-employment tax returns, or medical documents, but we must see the original of most other documents, such as your birth certificate.

Do not delay applying for benefits because you do not have all the documents. We will help you get them.

You May Like: Social Security Disability Overpayment Statute Of Limitations

The Basics About Disability Benefits

The SSDI program pays benefits to you and certain if you are insured. This means that you worked long enough and recently enough – and paid Social Security taxes on your earnings. The program pays benefits to adults and children with disabilities who have limited income and resources.

While these two programs are different, the medical requirements are the same. If you meet the non-medical requirements, monthly benefits are paid if you have a medical condition expected to last at least one year or result in death.

What Is A Substantial Gainful Activity Limit And How Does It Apply To The Benefits

The SSA sets an upper limit for how much earned income you can make and still fit their definition of disabled. This is the substantial gainful activity limit. The SSA adjusts this limit annually to account for changes in the cost of living.

In 2021, disabled workers can earn up to $1,310 per month and still qualify under the SGA limit. There is a higher limit for blind workers, who can earn up to $2,190 per month. If you earn above this limit, you may not qualify for SSD benefits. However, if you earn above this level while already receiving SSDI payments, it will not automatically stop your benefits. You may be entitled to a trial work period.

For a free legal consultation, call

Also Check: Social Security Office On Buffalo

What Is The Disability Standard For Disability Insurance And Supplemental Security

Disability Insurance and Supplemental Security are reserved for workers with the most severe disabilities and conditions, and both use the same strict disability standard: inability to engage in substantial gainful activitydefined as being able to earn $1,040 a month in 2013due to one or more severe physical or mental impairments that are expected to last at least a year or could result in death. A workers impairment or combination of impairments must be so severe that the applicant is not only unable to do his or her previous work but also unableconsidering his or her age, education, and work experienceto engage in any other kind of substantial gainful work that exists in significant numbers in the national economy.

Medical evidence is the cornerstone for the determination of disability in both programs. To qualify, there must be medical evidence from a doctor, specialist, or certain other licensed or certified medical sources that documents a severe impairment. Evidence from other health care providerssuch as nurse practitioners or clinical social workersis not sufficient to document a severe medical impairment. And statements from the applicants themselves, their families, co-workers, friends, or neighbors are not treated as medical evidence.

How The Earnings Limit Is Applied

The most confusing part of the benefit reduction due to income is how its reflected in your monthly benefits deposits. Instead of taking out a little bit every month, the SSA will withhold several months of benefits at a time.

If you predict in advance that you will have excess earnings and report this to the Social Security Administration, they may take a few months of benefits before you actually earn the anticipated excess earnings.

For example, if your Social Security payment is $1,667 per month, and you expect to receive $29,560 in wages from your job, the Administration would calculate that youll be over your earnings limit by $10,000 and thus $5,000 in benefits should be withheld. So, they would withhold your benefit payment from January to March. In April, your checks would resume.

If you dont report excess income before you earn it, then you have to report this information after the fact. You can do this when you file your income tax return, but the preferred method is to be proactive and call your local Social Security Administration office.

If you wait for the Social Security Administration to learn of your excess earnings via your tax return, there could be a significant gap between the time you earn the excess income and the time that they withhold your benefits. In most cases, its better to report the excess earnings quickly so the benefits reduction occurs closer to the time you actually earn that extra income.

Read Also: Bend Oregon Social Security Office

Trial Work Periods For Ssdi

If youre working or want to work while on SSDI, the SSA has work programs and incentives. Work incentives include:

- Medicare or Medicaid while you work

- Cash benefits while you work

- Training, education, and rehabilitation

Through the Ticket to Work program, you can get:

- Training

- Job referrals

- Other support

If you start working, the SSA can enter you into a trial work period. As long as youre still disabled and report your work, you can keep receiving benefits. A trial work period in 2020 is any month you earn over $910.

If youre self-employed, the trial work period is during any month you make over $910 after business expenses. It can also be when you work over 80 hours while self-employed.

You can stay in a trial work period until youve had nine trial work months within 60 months. Regardless of how much youre earning, you can still receive benefits until the trial work period is over. If youre making over SGA after that, the SSA will probably stop your benefits.

If you cant keep working because of your condition, you can start your SSDI benefits again.

What Is The Sga Limit

If an SSI applicant has monthly earnings of $1,350 or more in 2022, Social Security considers the applicant to be “engaging in substantial gainful activity” and won’t consider the applicant disabled.

But after starting to receive SSI benefits, the SGA limit no longer applies. An SSI recipient can work and make more than $1,350 without losing disability benefits , as long as the recipient is still considered disabled.

Continuing SSI recipients are still bound by the SSI income limit discussed above though . But remember, Social Security will deduct an SSI recipient’s countable income from his or her SSI payment, meaning that those who work will receive an SSI payment that’s less than the full amount.

Read Also: Social Security Office In Poteau Oklahoma

Income Excluded By The Monthly Limit

There are certain forms of income you may be able to exclude from being counted in your monthly income. This way, you can remain within or below the income limits outlined by the SSA. For example, SSI applicants do not have to include the following in their monthly income limits:

- Food stamps

- The first $20 of any income you receive from any source

- The first $65 you receive from your job if you still work

- Certain educational scholarships

- Money you spend on work-related items

Understanding and calculating what forms of income apply to your monthly limit for Social Security Disability can be confusing. A lawyer who handles Social Security Disability cases may be able to help you figure out whether you qualify for benefits based on monthly income.

Losing Your Social Security Disability Benefits

There are a few ways you can lose your Social Security Disability benefits, including:

- Earning more than the allowed amount: If you return to work and earn more than the maximum threshold for eligibility for benefits, you may lose your benefits. Alternatively, if you report your income incorrectly, you might give the impression that you earn more than you do and thus lose benefits.

- Losing your disability status: If your condition improves and you are no longer deemed disabled, you may lose benefits. Also, if you fail to provide the SSA with sufficient medical information, they may incorrectly conclude that you are not disabled.

- Other circumstances: Becoming incarcerated or leaving the country can also cause you to lose your Social Security Disability benefits.

If you have been denied benefits, a Social Security Disability lawyer can determine why and help you get back the money you need.

Complete a Case Evaluation form now

Also Check: Social Security Office In Victoria Texas

Situations That Can Change The Maximum Benefit

As we just saw, if youre a person who lives alone, the maximum SSI benefit is $1,040.21 . The maximum is different if you are an eligible couple, if you live in someone elses household and you dont pay the full costs of food and shelter, or if you live in an institution, such as a hospital, nursing home, or prison.

How Many People Currently Receive Social Security Disability Benefits And What Is The Value Of The Benefits They Receive

About 8.8 million workers with disabilities currently receive Disability Insurance. The amount of Disability Insurance benefits that a disabled worker receives is based on his or her earnings before becoming disabled. As Table 1 shows, Disability Insurance benefits typically replace less than half of a disabled workers previous earnings.

As of March 2013, the average monthly benefit for a disabled worker was about $1,129, with male workers receiving $1,255 per month and female workers receiving $993 per month on average. About 1.9 million children of disabled workers and 160,000 spouses of disabled workers also receive supplemental benefits from Social Securityroughly $300 a month on average.

For most beneficiaries of Disability Insurance and Supplemental Security, disability benefits make up most or all of their income. For the vast majority of Disability Insurance beneficiariesabout 71 percenthalf or more of their income comes from Disability Insurance. And for nearly half of beneficiaries, 90 percent or more of their income comes from Disability Insurance. Given the modest extent to which benefits replace lost earnings and the limited sources of other income upon which they can depend, people who receive Disability Insurance are rarely able to maintain the same standard of living they had before becoming disabled. Disability Insurance provides a floor, however, that moderates the decline in their living standards.

Also Check: Social Security Administration Phone Number