How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

If You Receive Social Security Benefits And Work

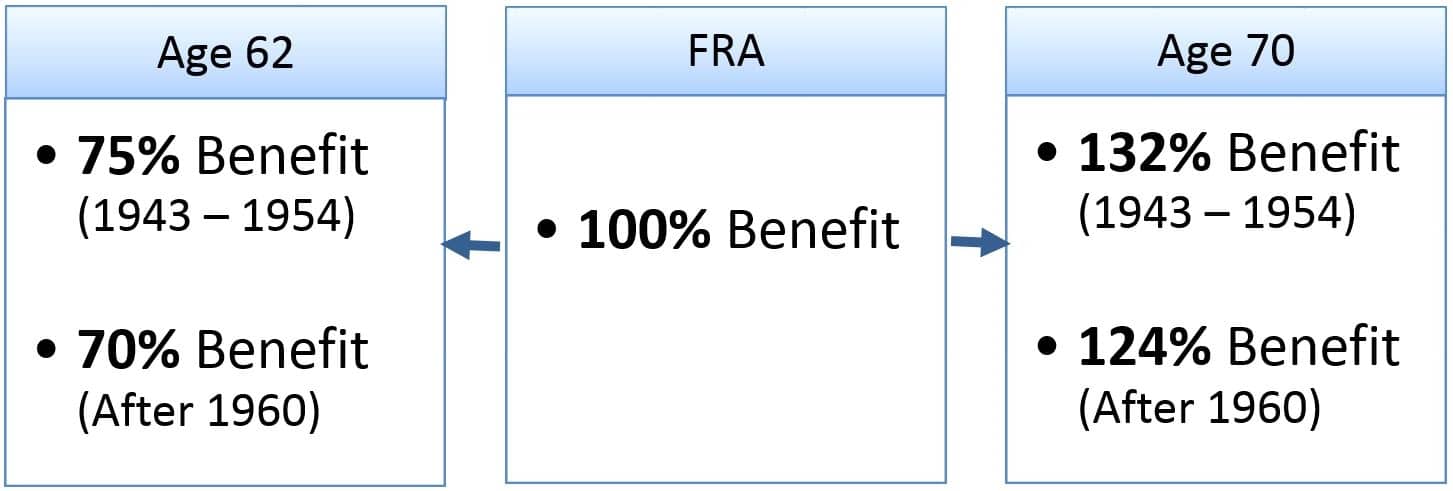

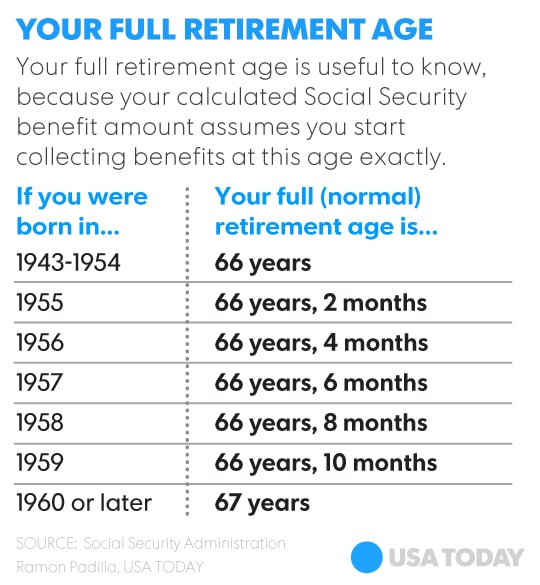

The work limit for these earnings are $1,310 a month or $15,720 a year. If you collect Social Security before your full retirement age of 66 or 67, your benefits will be reduced by $1 for ever $2 that you make over that limit.

In the year that you reach your full retirement age, your benefit will be reduced by $1 for ever $3 made above that limit.

Note: For retirees that make high income, the benefits that you receive will be taxed but this is a separate issue from a direct reduction of your benefits.

You May Be Able To Suspend Your Benefits In Order To Maximize How Much You Receive

Once you’ve started collecting Social Security retirement benefits, you’re not necessarily locked into receiving benefits for the rest of your life. If you’ve reached full retirement age and wish you would have waited longer to receive a greater percentage of your benefits, you have the option of suspending your benefits.

Since an individual’s benefits increase by percent each month or 8 percent each year after full retirement age, suspending your benefits after you’ve started collecting allows you to wait longer, so you can earn more.

For every month you choose to delay credits, you’ll earn percent more each month. After you’ve suspended your benefits, you can also request that the Social Security administration resume payments for you at any time before the age of 70. However, if you have anyone like a spouse or ex-spouse collecting benefits on your work record, they won’t be able to collect their benefits.

Catch up on Select’s in-depth coverage of personal finance, tech and tools, wellness, and to stay up to date.

Read Also: Social Security Office In Eugene Oregon

Your Social Security Benefits And Taxes That You May Need To Pay

Social security payments are going to be the main income for most retirees. You will need to check for other income to ensure that your taxes will be at a minimum amount.

In order to estimate if you may owe taxes on your benefits, you will need to add your adjusted gross income, one-half of your benefits, and tax exempt interest. If you happen to be married and your joint income is less than $32,000, you will not be taxed on your benefits but if your joint income is above $32,000 but below $44,000, then up to 50% of your benefits may be taxed. If you have an income over $44,000, then 85% of the social security benefits may be taxed. If you are single filer, then those amounts will be $25,000 $34,000.

This tax does come as a surprise for most.

If you are receiving benefits, and want to have taxes taken out of your benefits, then go to , and simply download the W-4V, which is a Voluntary Withholding Request. This form will give you a choice of holding 7, 10, 15, or 25% of your benefits. Sign the form and then mail it to your social security office, which you will find on your website.

After reaching age 66, you can earn any amount and still collect full benefits

Is Social Security Ever Tax Free

Contents

From a couple of Treasury Department tax rulings in 1938 and another in 1941, social security benefits have been explicitly excluded from federal income taxation. Beginning in 1984, a portion of Social Security benefits have been subject to federal income taxes.

Is social security never taxable? What is the taxable social security percentage? If you are filing as an individual, your Social Security is not taxable only if your total income for the year is less than $ 25,000. Half is taxable if your income is between $ 25,000 and $ 34,000. If your income is higher, up to 85% of your benefits may be taxable.

Read Also: Social Security Offices In San Antonio

How Will Your Social Security Be Taxed

If a portion of your Social Security benefit is taxable, there’s no avoiding the federal income tax. But you won’t pay taxes based on your entire Social Security benefit. Instead, you will pay taxes on 50% or 85% of your total Social Security amount.

If you’re a single filer with an income between $25,001 and $34,000, you’ll pay taxes on 50% of your Social Security benefits. But as a single filer who has a total income of more than $34,000, you’ll pay taxes on 85% of your Social Security benefits.

Exceptions to This Rule

Every rule has an exception. In this case, filers in certain states need to be aware of their state’s tax requirements.

There are 12 states that tax Social Security benefits. These include Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, Rhode Island, Utah, Vermont and West Virginia. However, almost every one of these states allows for some kind of deduction, credit or income limit to minimize the tax burden at a state level.

New Mexico doesn’t provide a way to minimize the burden. Instead, you’ll pay state taxes on all of the Social Security income taxed at a federal level.

When Is Social Security Income Taxable

To determine when Social Security income is taxable, youll first need to calculate your total income. Generally, the formula for total income for this purpose is: your adjusted gross income, including any nontaxable interest, plus half of your Social Security benefits.

If youre married and filing jointly with your spouse, your combined incomes and social security benefits are used to figure your total income.

Then youll compare your total income with the base amounts for your filing status to find out how much of your Social Security income is taxable, if any.

Youll see that you fall into one of three categories. If your total income is:

- Below the base amount, your Social Security benefits are not taxable.

- Between the base and maximum amount, your Social Security income is taxable up to 50%.

- Above the maximum amount, your Social Security benefits are taxable up to 85%.

Don’t Miss: Social Security Office In Madison Tennessee

Delaying Your Social Security Benefit Claim

“The other strategy, says Kumar, involves postponing when you first take Social Security. Both approaches can help shave dollars off your tax bill in retirement every yearit just takes a little forward planning.”

Consider a hypothetical couple named Natalie and Juan: For every year they delay taking Social Security past their full retirement age , they get up to an 8% increase in their annual benefit.

A hypothetical couple claiming Social Security at age 65 vs. age 70

| Natalie and Juan | |

|---|---|

| Net tax savings | $1,921 |

In general, many people would benefit from waiting to age 70 to take Social Security. Others may need the income sooner and may lack the resources necessary to meet expenses during the delay period, or they may not live long enough to reap the rewards of delaying their claim.

Natalie and Juans strategy is to reduce the amount they withdraw from their taxable IRAs over time and make up the difference in income by waiting until age 70 to claim Social Security. This has a big payoff for them because by delaying claiming Social Security until age 70, the percentage of their Social Security income that gets taxed is cut from 85% to 48.33%.

It gets better: While Natalie and Juans retirement paycheck of $70,000 remains the same, they pay approximately 37% less in taxes and withdraw smaller amounts from their respective IRAs each year.

Tip: To learn more about timing and Social Security, read Viewpoints on Fidelity.com: Should you take Social Security at 62?

At What Age Do Seniors Stop Paying Taxes

As long as you are at least 65 and your income from sources other than Social Security is not high, the senior or disabled tax credit can reduce your tax burden on a dollar-for-dollar basis.

How much can you earn without paying taxes over the age of 65? If youre 65 and over and applying on your own, you can earn up to $ 11,950 in work-related wages before applying. For married couples applying jointly, the earned income limit is $ 23,300 if you are both over 65 and $ 22,050 if just one of you is 65 years of age.

You May Like: Social Security Office On Buffalo

Next Steps To Consider

A qualified distribution from a Roth IRA is tax-free and penalty-free. To be considered a qualified distribution, the 5-year aging requirement has to be satisfied and you must be age 59½ or older or meet one of several exemptions .

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Fidelity does not provide legal or tax advice. The information herein is general and educational in nature and should not be considered legal or tax advice. Tax laws and regulations are complex and subject to change, which can materially impact investment results. Fidelity cannot guarantee that the information herein is accurate, complete, or timely. Fidelity makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information. Consult an attorney or tax professional regarding your specific situation.

Investing involves risk, including risk of loss.

Past performance is no guarantee of future results.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

Does Working After Full Retirement Age Increase Social Security Benefits

Working after full retirement age could increase your Social Security benefits. Your benefits are based on average wages over your 35 highest-earning years .

Even after you’ve reached full retirement age, and even if you’ve already claimed benefits, the Social Security Administration continues to recalculate your average annual wage to account for new income. If your earnings after FRA are higher than previous years and raise your average wage for your 35 top-earning years, your benefits could rise accordingly.

Recommended Reading: Social Security Disability Overpayment Statute Of Limitations

How Will Working Affect Social Security Benefits

In a recent survey, 70% of current workers stated they plan to work for pay after retiring.1

And that possibility raises an interesting question: how will working affect Social Security benefits?

The answer to that question requires an understanding of three key concepts: full retirement age, the earnings test, and taxable benefits.

No Matter How You File Block Has Your Back

Don’t Miss: Social Security Office Beaumont Texas

Buy An Annuity Contract

A qualified longevity annuity contract is a deferred annuity funded with an investment from a qualified retirement plan or an IRA. QLACs provide monthly payments for life and are shielded from stock market downturns. As long as the annuity complies with IRS requirements, it is exempt from the RMD rules until payouts begin after the specified annuity starting date.

QLAC income can be deferred until age 85. A spouse or someone else can be a joint annuitant, meaning that both named individuals are covered regardless of how long they live.

Keep in mind that a QLAC shouldnt be bought just to minimize taxes on Social Security benefits. Retirement annuities have advantages and disadvantages that should be weighed carefully, preferably with help from a retirement advisor.

Do I Pay Taxes On Social Security After Age 66

Have you been searching Do I pay taxes on social security after age 66 or do you have to pay tax on social security? If you have, then this article will help you to find those answers. Paying taxes on social security depends on a number of income factors that we will explore below.

To inquire about any benefits from Social Security, you will need to make a statement of your personal account that will state what benefits you have or what the benefits will be. It can also show you a list of contributions of your benefits which allows you to check for accuracy.

Simply go to in order to create a personal social security information site where it can track your earnings and even verify them each year to get an estimate of future benefits if you are working.

Also Check: Social Security Office In Clarksville Tennessee

Does Your Social Security Count As Income

Since 1935, the US Social Security Administration has provided benefits to retired or disabled people and their families. Although Social Security benefits are not counted as part of gross income, they are included in combined income, which the IRS uses to determine whether benefits are taxable.

Is social security considered income? Some of you have to pay federal income taxes on your Social Security benefits. between $ 25,000 and $ 34,000, you may have to pay income tax up to 50 percent of your benefits. more than $ 34,000, up to 85% of your benefits may be taxable.

How Much Can I Earn If I Work After My Full Retirement Age

If you continue to work after reaching full retirement age, you may work and earn as much as you’d like. You will not be subject to the retirement earnings test, and your Social Security benefits will not be affected.

If you work prior to FRA, you may forfeit part of your benefits if you earn above annual thresholds. However, your benefit amount will be recalculated at full retirement age to account for most of those forfeited funds.

Also Check: Social Security Office Muskogee Ok

What You Need To Know About Social Security

First off, let’s establish some basics about Social Security. The Social Security administration determines a worker’s benefit, known as the primary insurance amount , by using a calculation based on a worker’s 35 highest earning years, says Kiner.

Workers are able to start collecting benefits at age 62 but their benefit will be reduced if they don’t wait until full retirement age. Full retirement age is between 66 and 67, depending on when you were born.

If you wait until you’re at full retirement age to collect, you’re eligible to receive 100% of the benefits that you’re entitled to. For every year after full retirement age that you delay receiving benefits, your benefits will increase 8% each year.

Claiming Social Security At Age 65

Those whose Full Retirement Age is 65 are already that age or older. For those born after 1955 and before 1960, Full Retirement Age is 66 and some months. By retiring at age 65, those beneficiaries lose at least 12 months worth of increases. For those born in 1960 or after, Full Retirement Age is 67, so they lose up to 24 months of increases if they retire at age 65.

Below, we show how a person born in 1960 and entitled to a full benefit of $2,500 could see his or her monthly benefit change based on claiming age:

Recommended Reading: Memphis Tn Social Security Office

I Have Reached Full Retirement Age Why Are My Social Security Benefits Being Taxed

Up to 85% of your Social Security benefits can be taxable. There is no age limit for having to pay taxes on Social Security benefits if you have other sources of income along with the SS benefits. When you have other income such as earnings from continuing to work, investment income, pensions, etc. up to 85% of your SS can be taxable.

What confuses people about this is that before you reach full retirement age, if you continue working while drawing SS, your benefits can be reduced if you earn over a certain limit. After full retirement age, no matter how much you continue to earn, your benefits are not reduced by your earnings your employer will still have to withhold for Social Security and Medicare.

Will You Pay Taxes On Your Social Security Benefits

If, in addition to Social Security benefits, your retirement income includes taxable income in the form of wages, interest, dividends, and other sources, you could end up paying taxes on part of your benefits.

It all depends on your provisional income. Provisional income includes your adjusted gross income, plus tax-exempt interest, plus half of your Social Security benefits. Single taxpayers reporting $25,000 or less in provisional income pay no taxes on their Social Security benefits. For married taxpayers filing jointly, the threshold is $32,000. If your provisional income exceeds those limits, a part of your Social Security benefits will be taxable.

You May Like: Social Security Administration Wichita Kansas