Delay Starting Your Benefits

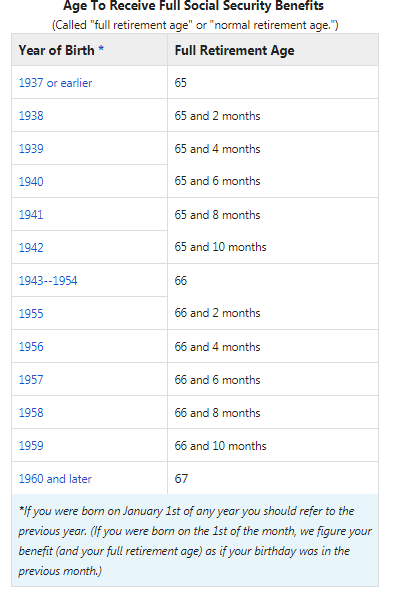

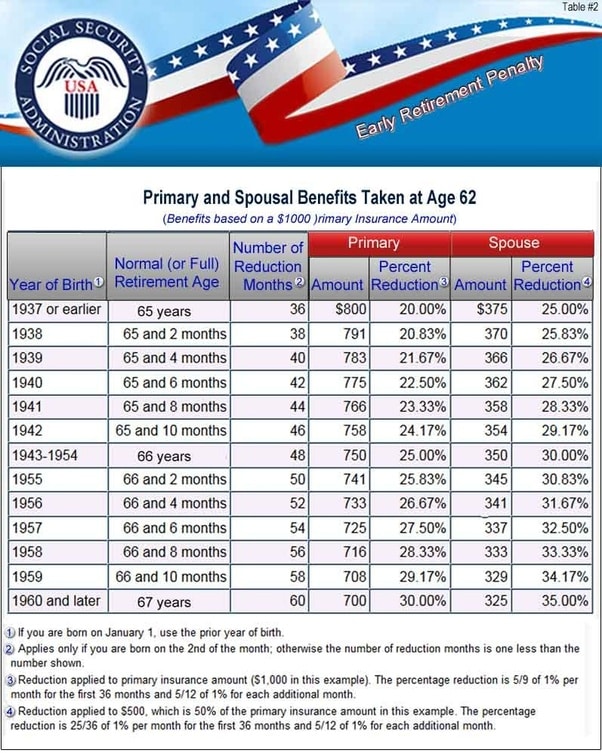

If you are financially able to delay starting your benefits, this can significantly impact how much you get. Waiting just a couple of years can increase your monthly payment by as much as $800 in some cases. Remember that those payments will last for your lifetime, so that amount can really add up. On the flip side, starting your benefits too soon will have the opposite effect. Starting your benefits a few years before retirement age can reduce them by as much as 25%. Again, since these payments last for the rest of your life, you could lose out on a lot of money. In addition, your spouse might receive lower spousal benefits and survivor benefits for the rest of his or her life. Though it is inevitable in some cases, you should do everything you can to wait as long as possible to start your benefits. Since your delayed retirement credits will max out at age 70, there is no need to wait past this age to start your payments.

How To Get A Social Security Card

Claim Of Discrimination Against The Poor And The Middle Class

Workers must pay 12.4 percent, including a 6.2 percent employer contribution, on their wages below the Social Security Wage Base , but no tax on income in excess of this amount. Therefore, high earners pay a lower percentage of their total income because of the income caps because of this, and the fact there is no tax on unearned income, social security taxes are often viewed as being regressive. However, benefits are adjusted to be significantly more progressive, even when accounting for differences in life expectancy. According to the non-partisan Congressional Budget Office, for people in the bottom fifth of the earnings distribution, the ratio of benefits to taxes is almost three times as high as it is for those in the top fifth.

Don’t Miss: How To Freeze My Social Security Number

Fact #: Social Security Is Especially Beneficial For Women

Social Security is especially important for women, because they tend to earn less than men, take more time out of the paid workforce, live longer, accumulate less savings, and receive smaller pensions. Women represent more than half of Social Security beneficiaries in their 60s and 7 in 10 beneficiaries in their 90s. In addition, women make up 96 percent of Social Security survivor beneficiaries.

If You Have Lived In Canada Less Than 40 Years

Not everyone receives the full Old Age Security pension. The amount you receive depends on the number of years you have lived in Canada.

If you lived in Canada for less than 40 years you will receive a partial payment amount. Your payment amount is based on the number of years in Canada divided by 40.

You can delay your first payment up to 5 years to get a higher amount.

Example

If you lived in Canada for 20 years

If you lived in Canada for 20 years after age 18, you would receive a payment equal to 20 divided by 40, or 50%, of the full Old Age Security pension.

Recommended Reading: Social Security Office In Eugene Oregon

Average Social Security Check By Type

While most people think of Social Security as a program just for retirees, it serves many other groups, including the disabled, spouses and minor children of retirees as well as the spouses and minor children of deceased workers. The amount that each group receives differs substantially.

In fact, the average retired worker receives $1,669.44 each month about 8 percent more than Social Security recipients as a whole. Heres how the figures break down by recipient, as of June 2022.

| Type of beneficiary |

|---|

Social Security Schedule: When June 2022 Benefits Will Be Sent

In April, the Consumer Price Index for All Urban Consumers rose 0.3% and the all items index increased 8.3% over the last 12 months. Rising inflation has pushed the Social Security cost-of-living increase to 5.9%, the largest in nearly 40 years.

Find Out: 20 Best Places To Live on Only a Social Security Check

For Junes payments, the Social Security schedule is as follows:

- If your birth date is on the 1st-10th of the month, your payment is distributed on Wednesday, June 8.

- If your birth date is on the 11th-20th, your payment is distributed on Wednesday, June 15.

- If your birth date is on the 21st-31st, your payment is distributed on Wednesday, June 22.

POLL: Have You Skipped Any of These Essential Expenses Due to Rising Prices?

Social Security benefits have increased by 64% since 2000, according to The Senior Citizens League and as reported by GOBankingRates. Mary Johnson, Social Security policy analyst for TSCL, found that expenses for typical seniors rose 130% during that same period. To maintain the same buying power from 2000, Social Security benefits would need to be $540 higher per month.

You may also qualify for Supplemental Security Income if Social Security isnt enough to cover basic living expenses. To qualify, you must be age 65 or older, disabled or blind and you have limited income and financial resources.

Also Check: Alabama Social Security Office Phone Number

When Should You File To Maximize Your Social Security Income

Social Security is designed so that it shouldn’t matter at what age you claim benefits, and you’d still receive the same amount of total lifetime income. If you file early, you get more checks but at a lower amount. If you file late, you get fewer checks but a higher amount. However, people don’t always die at the time that actuarial tables predict. If you outlive your projected lifespan, you’d do better by waiting to claim so you get higher benefits for a longer time. If you die before the SSA projected you would, you’d have done better to claim benefits early.

No one has a crystal ball to predict their date of death, so it’s impossible to know when to file to get the absolute most income from Social Security. You can, however, calculate how long you’d need to live to break even for delaying benefits and make an educated guess about whether you’ll live that long by taking into account your family’s health history and your own health history.

To calculate your break-even point for delayed filing:

It would take you about 11.36 years to break even. If you begin receiving benefits at 67, you would have to live until 78.36 years old to break even. Live any longer, and you’ll get more total Social Security income than you otherwise would’ve because you keep getting that extra $396 per month for the rest of your life.

Report The Death Of A Social Security Or Medicare Beneficiary

You must report the death of a family member receiving Social Security or Medicare benefits. The Social Security Administration processes death reports for both. Find out how you can report a death and how to cancel benefit payments. In addition to canceling SSA and Medicare benefits, find out what other benefits and accounts you should cancel.

Recommended Reading: Social Security Office In Madison Tennessee

Changes To Your Ssdi Amount

Most years, your monthly SSDI payment will go up, thanks to Social Security’s annual cost of living adjustment . You can find the annual COLA here.

Once you’re eligible for Medicare benefits , the cost of Medicare Part B will be taken directly out of your Social Security check. Most people will pay a premium of $158.50 for Part B in 2022, but the amount can be quite a bit higher for those with high income. If you have low income, on the other hand, a Medicare Savings Program can pay your Part B premium.

Claim That Politicians Exempted Themselves From The Tax

Critics of Social Security have said that the politicians who created Social Security exempted themselves from having to pay the Social Security tax. When the federal government created Social Security, all federal employees, including the president and members of Congress, were exempt from having to pay the Social Security tax, and they received no Social Security benefits. This law was changed by the Social Security Amendments of 1983, which brought within the Social Security system all members of Congress, the president and the vice president, federal judges, and certain executive-level political appointees, as well as all federal employees hired in any capacity on or after January 1, 1984. Many state and local government workers, however, are exempt from Social Security taxes because they contribute instead to alternative retirement systems set up by their employers.

Read Also: Jefferson County Social Security Office

How Payments Are Updated Using The Consumer Price Index

Old Age Security payment amounts are reviewed each year in January, April, July and October to ensure they reflect cost of living increases, as measured by the Consumer Price Index .

Notably:

- monthly payment rates will increase if the cost of living goes up

- monthly payment rates will not decrease if the cost of living goes down

Note: Based on changes in the CPI, OAS benefit amounts increased by 2.8% for the July to September 2022 quarter.

Quarterly adjustment calculations

The quarterly adjustment for all OAS benefits, including the Guaranteed Income Supplement , is based on the difference between the average CPI for 2 periods of 3 months each:

- the most recent 3-month period for which the CPI is available

- the last 3-month period where a CPI increase led to an increase in OAS benefit amounts

When Are The Payment Days For Ssi

SSI payments are usually dated and delivered on the first dayof the month that they are due. However, if the first falls on aSaturday, Sunday, or Federal holiday, they are dated and deliveredon the first day preceding the first of the month that is not a Saturday,Sunday, or Federal holiday.

Last Revised: Apr. 18, 2006

Recommended Reading: Does Social Security Count As Income For Obamacare

What If I Change My Mind

If you receive Social Security benefits at a reduced rate but then change your mind, you have the option of withdrawing your application within the first 12 months of receiving benefits and paying back to the government what you’ve already received . Then, you could restart benefits at a later date to take advantage of a higher payout. Be aware that you’re limited to one withdrawal per lifetime.

For example, let’s say you elected to receive early benefits at age 62 but then decided to go back to work at age 63. You could withdraw your Social Security application, pay back the years’ worth of benefits you received, go back to work, and then wait until your full retirement age to restart your benefit checks at a higher level.

Once you reach full retirement age, another option is to voluntarily stop benefits at any point before age 70 to receive delayed retirement credits . Benefits will automatically restart at age 70 at a higher amountâunless you choose to start taking benefits before then. Note that when you withdraw your application or stop your benefits after full retirement age, you must specify if your Medicare coverageâif you have itâshould be included in the withdrawal.

Coronavirus Stimulus Checks And Social Security

On April 3, 2020, the federal government began sending eligible Americans stimulus checks as part of a relief package to help workers and the economy during the COVID-19 pandemic. Senior citizens and retirees who receive Social Security benefits are eligible for coronavirus stimulus checks as long as they meet the basic eligibility requirements.

The maximum stimulus payment is $1,200 for eligible adults who file separately and $2,400 for eligible married couples who file jointly. There is also an additional $500 payment per qualifying child.

In December 2020, an additional $600 stimulus check was sent out to every eligible adult and child.

Everyone who has a Social Security number and filed a tax return in the last two years generally qualified for both stimulus checks if their income falls within the governments limits. Income is based on your 2019 federal tax return.

However, if you receive Social Security benefits and dont usually need to file a tax return, dont worry you dont have to start now. You should still receive the stimulus payment, if you havent already the government will use the information on file with the Social Security Administration to send you your payment. You can expect to receive the stimulus check the same way you get your Social security payment.

Beneficiaries of Supplemental Security Income can now check the status of their payment on the IRS website.

Senior Editor & Disability Insurance Expert

Also Check: Social Security Disability Overpayment Statute Of Limitations

Fact #: Social Security Lifts Millions Of Older Adults Above The Poverty Line

Without Social Security benefits, about 4 in 10 adults aged 65 and older would have incomes below the poverty line, all else being equal, according to official estimates based on the 2021 Current Population Survey. Social Security benefits lift more than 16 million older adults above the poverty line, these estimates show.

An important study on retirement income from the U.S. Census Bureau that matches Census estimates to administrative data suggests that the official estimates overstate older people’s reliance on Social Security. The study finds that in 2012, 3 in 10 older adults would have been poor without Social Security, and that the program lifted more than 10 million older adults above the poverty line.

No matter how it is measured, its clear that Social Security lifts millions of older adults above the poverty line and dramatically reduces their poverty rate.

Average Social Security Payment By Age

The average Social Security retirement benefit is significantly lower than the maximum. It was $1,539.68 per month in May 2022, according to the most recent data available from the SSA. Heres what the average benefit looks like at different ages for those who started collecting at FRA, according to an annual report published by the SSA in 2021.

| Average Social Security Benefit by Age |

|---|

| Age |

Recommended Reading: How Long Does It Take To Apply For Social Security

How Much Would Your Monthly Social Security Payment Be If You File For Benefits At Full Retirement Age

Not everyone receives the same standard benefit amount if they retire at FRA, because your monthly benefit is determined based on your specific work history. The standard benefit amount you receive at FRA is called your primary insurance amount , and there’s a specific formula to determine it. To calculate PIA, the Social Security Administration:

You’ll receive your PIA only if you file for benefits to begin at exactly FRA. If you claim benefits even one month before, PIA must be adjusted downward. If you claim even one month after, it must be adjusted upward.

Demographic And Revenue Projections

| This section’s factual accuracy may be compromised due to out-of-date information. The reason given is: Several of these projected dates have passed, and some language referring to data as ‘current’, ‘latest’, ‘most recent’, etc. is as old as 2005, or undated. Please help update this article to reflect recent events or newly available information. |

In 2005, this exhaustion of the OASDI Trust Fund was projected to occur in 2041 by the Social Security Administration or by 2052 by the Congressional Budget Office, CBO. Thereafter, however, the projection for the exhaustion date of this event was moved up slightly after the recession worsened the U.S. economy’s financial picture. The 2011 OASDI Trustees Report stated:

Annual cost exceeded non-interest income in 2010 and is projected to continue to be larger throughout the remainder of the 75-year valuation period. Nevertheless, from 2010 through 2022, total trust fund income, including interest income, is more than is necessary to cover costs, so trust fund assets will continue to grow during that time. Beginning in 2023, trust fund assets will diminish until they become exhausted in 2036. Non-interest income is projected to be sufficient to support expenditures at a level of 77 percent of scheduled benefits after trust fund exhaustion in 2036, and then to decline to 74 percent of scheduled benefits in 2085.

Ways to eliminate the projected shortfall

You May Like: Social Security Office Muskogee Ok

Fact #: Social Security Provides A Guaranteed Progressive Benefit That Keeps Up With Increases In The Cost Of Living

Social Security benefits are based on the earnings on which people pay Social Security payroll taxes. The higher their earnings , the higher their benefit.

Social Security benefits are progressive: they represent a higher proportion of a workers previous earnings for workers at lower earnings levels. For example, benefits for a low earner retiring at age 65 in 2021 replace about half of their prior earnings. But benefits for a high earner replace about 30 percent of prior earnings, though they are larger in dollar terms than those for the low-wage worker.

Many employers have shifted from offering traditional defined-benefit pension plans, which guarantee a certain benefit level upon retirement, toward defined-contribution plans s), which pay a benefit based on a workers contributions and the rate of return they earn. Social Security, therefore, will be most workers only source of guaranteed retirement income that is not subject to investment risk or financial market fluctuations.

Once someone starts receiving Social Security, their benefits increase to keep pace with inflation, helping to ensure that people do not fall into poverty as they age. In contrast, most private pensions and annuities are not adjusted for inflation.