General Instructions For Forms W

Future Developments

For the latest information about developments related to Forms W-2 and W-3 and their instructions, such as legislation enacted after they were published, go to IRS.gov/FormW2.

What’s New

Disaster tax relief.

Disaster tax relief is available for those affected by recent disasters. For more information about disaster relief, go to IRS.gov/DisasterTaxRelief.

Penalties increased.

Failure to file and failure to furnish penalties, and penalties for intentional disregard of filing and payee statement requirements, have increased due to adjustments for inflation. The higher penalty amounts apply to returns required to be filed after December 31, 2022. See Penalties for more information.

Reminders

Discrepancies when reconciling Forms W-2 and W-3 with Forms 941, 941-SS, 943, 944, CT-1, and Schedule H due to coronavirus related employment tax credits and other tax relief.

You may have a discrepancy when reconciling Forms W-2 and W-3 to Forms 941, 941-SS, 943, 944, CT-1, and Schedule H if you utilized any of the COVID-19 tax relief. See Pub. 15 or Pub. 51, the instructions for your respective employment tax form, and the Caution under Reconciling Forms W-2, W-3, 941, 941-SS, 943, 944, CT-1, and Schedule H , for more information.

Form W-2c reporting of employee social security tax and railroad retirement tax act deferred in 2020.

Due date for filing with SSA.

Extensions of time to file.

.E-file your Forms W-2 and W-2c with the SSA. See E-filing..

Note.

E-filing.

Federal Income Tax Withholding Vs Social Security Wages

The list of payments to employees that aren’t included in FICA tax can be different from the types of payments that aren’t included in income tax calculations. Some payments may be exempt from federal income tax withholding but taxable as Social Security wages.

| Income Tax Withholding | FICA Tax Withholding |

| Wages paid by a parent to a child are taxed. | Wages paid by a parent to a child are not taxed if the child is younger than age 18, or age 21 for domestic workers. |

| Payments to statutory non-employees are taxable for income tax purposes. | Payments to statutory non-employees are not subject to the FICA tax. |

| It applies to all earnings. | Social Security is taxed only on the first $137,700 in earnings annually as of 2020 and $142,800 in 2021. |

The instructions for completing Form W-2 have a list of payments that must be included for federal income tax purposes. IRS Publication 15 also includes a detailed list of payments to employees and whether they’re subject to income tax or includable in Social Security wages.

Who Is Subject To Social Security Wages

The IRS says employees who are subject to Social Security wages are any employee in the United States, regardless of the citizenship or residence of either the employee or employer.

However, for employees who work in another country, Totalization Agreements coordinate Social Security taxation and coverage with some countries to eliminate dual taxation and coverage.

Don’t Miss: Calculate Social Security Retirement Benefits

Whose Wages Are Subject To Social Security

According to the Internal Revenue Service , U.S. Social Security tax applies to payments of wages for work performed as an employee in the United States. This is regardless of citizenship or residence of the employer or the employee.

Before starting work, the employer should be able to inform the employee regarding tax withholding and other important information. For those employees who work in another country, there are Totalization Agreements which the United States has entered into with several nations to prevent double taxation of income.

List Each Years Earnings

Your earnings history is shown on your Social Security statement, which you can now obtain online.

In the table below, sample earnings for a hypothetical worker born in 1953 are shown in Column C. Only earnings below a specified annual limit are included. This annual limit of included wages is called the Contribution and Benefit Base and is shown as Max Earnings in Column H in the table.

Recommended Reading: Social Security Office Miami Fl

Is My Fellowship/scholarship Included On The W2

No, qualified fellowship/scholarship payments to individuals who are 100% appointed as a postdoctoral fellow/scholar are not considered income for services rendered and are therefore not included on the W2. It is possible, however, for a postdoctoral fellow/scholar to have a postdoctoral scholar employee supplement. Any earnings, supplemental salary, or imputed income would be reflected on a W2.

Final Considerations To Calculate Taxable Wages

Note that employers are not responsible for withholding taxes from a contract employee. These contract workers are temporary staff who work independently, and since they are not full-time employees, its up to them to handle their own taxes.

In addition, some types of taxes have a taxable wage base. This means theres a limit to how much an individual can be taxed for certain taxes. An example of a tax that caps the amount taken out of an employees pay is Social Security tax.

For more help, you can look online for a federal taxable wages calculator, which assists in calculating taxable wages. However, depending on the number of employees in the business, its usually better to talk to an accountant to prepare business taxes, and to invest in payroll software to let technology do the heavy lifting while you attend to driving the success of your business.

Recommended Reading: Stockton Social Security Office Stockton Ca

View Employer Report Status

Employer Report Status application allows you to check status of the reports submitted for your company by a third party. The Employer Report Status application is only available for users who are not self-employed and have one of the following roles:

- View File/Wage Report Status, Errors, and Error Notices, or

- View Name and Social Security Number Errors.

EMPLOYER REPORT SELECTION PAGE

Select the View Report Status link on the EWR Home page will take you to the Employer Report Selection page.

- Use the drop-down list to specify the tax year for which you wish to view employer report information. The tax year is the year in which the wages were earned. Report information is not available for reports submitted prior to 2002.

- Employer reports that have not yet been processed cannot be displayed.

- Money amounts displayed reflect how Social Security originally processed a report. Processed money totals may not reflect posted amounts due to corrections to wage reports, item correction based on employee evidence, or an adjustment of duplicate earnings data.

- This information should not be used for reconciliation or tax liability purposes.

- This information should not be used as the basis for a Form W-2c report.

- After you have specified a tax year, select the Continue button to display your Search Results page.

SEARCH RESULTS PAGE

The following information is displayed for each identified report:

REPORT SUMMARY PAGE

ERROR DETAILS PAGE

When Viewing My W

Try accessing UCPath online using a different web browser. For the best UCPath Online experience, use one of the following web browsers:

Note: Internet Explorer 11 is no longer a supported browser. UCPath online pages may appear blank or not fully load.

For alignment issues, try printing your W-2.

If you continue to experience issues, contact the UCPath Center.

Don’t Miss: Social Security Monthly Payment Calculator

What Are Social Security Wages

Social Security wages are an employees earnings that are subject to federal Social Security tax withholding . Employers must deduct this tax even if the employee doesnt expect to qualify for Social Security benefits.

Social Security wages include:

-

Hourly wages and salaried wages

-

Payments in-kind , unless the employee is a household or agricultural worker

-

Elective retirement contributions

Social Security wages have a maximum taxable income limit of $142,800 for the year 2021, which includes qualified employee wages and/or self-employment income. Be sure to check the maximum limit annually since it changes every year to adjust for inflation, improve the systems finances, and provide reasonable benefits for higher wage earners.

When an employee reaches the earnings limit, no more Social Security tax is withheld for the year. At 2021 rates, $142,800 would require $8,853.60 to be withheld for Social Security taxes.

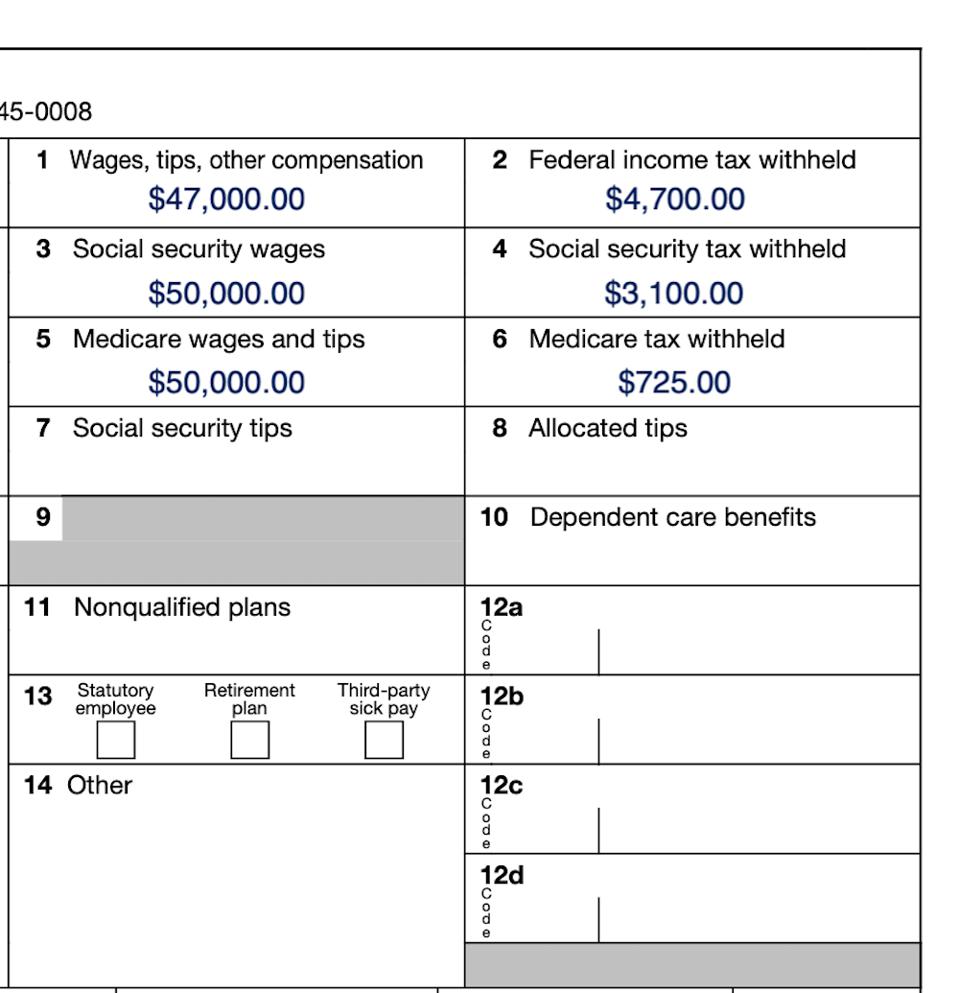

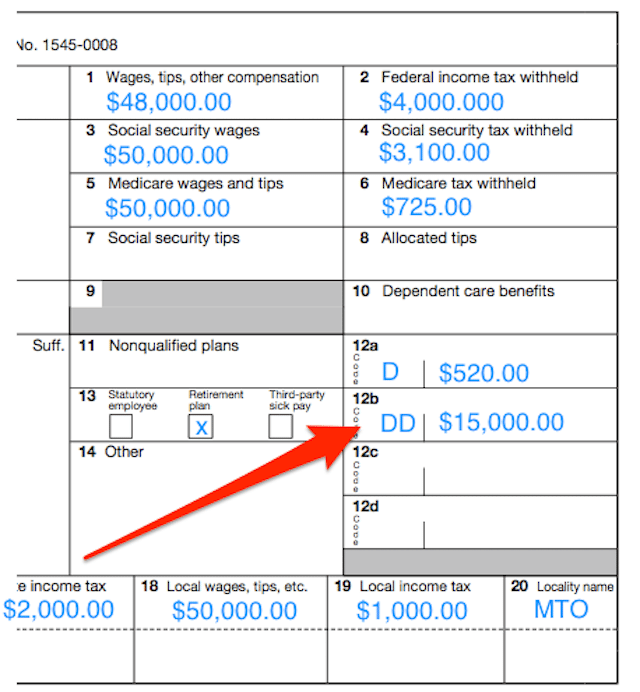

The Employee Elected To Contribute To A Retirement Plan

If an employee elected to contribute to a pre-tax retirement plan, their W-2 Box 1 wages are likely lower than their Box 3 wages.

An employees elected retirement plan contributions are not subject to federal income taxes. However, these contributions are subject to Social Security and Medicare taxes.

Report the amount of an employees retirement plan contributions on Form W-2. Use code D in Box 12 and check the box below Retirement plan in Box 13.

Do you contribute to an employees retirement plan? If so, do not include your contributions on the employees Form W-2.

An employees elected contributions to a Roth retirement account are subject to federal income tax, Social Security, and Medicare taxes.

Lets say an employee earning $50,000 contributed $2,000 to their 401 during the year. The employees taxable wages in Box 1 are $48,000. The employees taxable wages in Boxes 3 and 5 are $50,000.

Retirement plan contributions might be subject to state income tax, depending on the state. Some states follow federal rules when it comes to tax-exempt retirement contributions. Other states tax contributions at the state level.

If retirement contributions are exempt from state income tax, Boxes 1 and 16 may be the same. If contributions are subject to state income tax, Box 16 may be higher than Box 1.

Read Also: Social Security Offices In Colorado

How Can I Change My W

The deadline to change W-2 delivery method for the 2021 tax year is January 10, 2022. You can elect to receive future W-2s by mail or electronically in UCPath online. Review the Enroll to Receive Online W-2 software simulation to see, try, or print the steps needed to change your election in UCPath online .

How Can I Get A Copy Of My Wage And Tax Statements

We can give you copies or printouts of your Forms W-2 for any year from 1978 to the present. You can get free copies if you need them for a Social Security-related reason. But there is a fee of $90 per request if you need them for an unrelated reason. You can also get a transcript or copy of your Form W-2 from the Internal Revenue Service. However, state and local tax information isnt available if you e-filed your tax return.Some examples of non-Social Security program purposes are:

- Filing federal or state tax returns

- Providing income information for workers compensation

- Establishing residency and

- Establishing entitlement to private pension benefits.

If you do not give a reason, we assume you need the forms for non-program purposes. When you write to us, be sure to include:

- Your Social Security number

- The exact name shown on your Social Security card

- Any different names shown on your W-2

- Your complete mailing address

Don’t Miss: Social Security Office In Toledo Ohio

Are Social Security Wages The Same As Gross Income

Social Security wages are not the same as gross income. While the amount of Social Security wages and gross income are oftenidentical, they just as easily may not be.

Gross income is the total of all compensation from which the amount of taxes and other withholdings are calculated. Social Security wages are based on the gross income and have specific inclusions and exclusions .

Which Tax Forms Do I Need To File

Employers must submit IRS Form 941, the Employerâs Quarterly Federal Tax Return, to report both the employee and employersâ portion of Social Security and Medicare. You should submit Form 941 quarterly to report these taxes.

Youâll also have to fill out a W-2, which is a combined wage and tax statement that you have to provide to each of your employees once a year to show how much FICA taxes were withheld that year.

Don’t Miss: Social Security Determination Phone Number

History Of Social Security Tax Rates

The Social Security tax began in 1937. At that time, the employee rate was 1%. It has steadily risen over the years, reaching 3% in 1960 and 5% in 1978. In 1990, the employee portion increased from 6.06 to 6.2% but has held steady ever sincewith the exception of 2011 and 2012.

The Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010 reduced the contribution percentage to 4.2% for employees for those years employers were still required to pay the full amount of their contributions.

The tax cap has existed since the inception of the program in 1937 and remained at $3,000 until the Social Security Amendments Act of 1950. It was then raised to $3,600 with expanded benefits and coverage. Additional increases in the tax cap in 1955, 1959, and 1965 were designed to address the difference in benefits between low-wage and high-wage earners.

The Social Security tax policy in the 1970s saw a number of proposed amendments and re-evaluations. The Nixon Administration was paramount in arguing that tax cap increases needed to correlate with changes in the national average wage index in order to address benefit levels for individuals in different tax brackets. The 1972 Social Security Amendments Act had to be revamped due to problems with the benefits formula that caused financing concerns. A 1977 amendment resolved the financial shortfall and established a tax cap increase structure that correlated with average wage increases.

Social Security Tax And Withholding Calculator

Enter your expected earnings for 2022 :

Social Security Taxes are based on employee wages. There are two components of social security taxes: OASDI and HI. OASDI and HI program. OASDI has been more commonly be known as Federal Insurance Contributions Act . HI has more commonly known as Medicare. For 2017, the OASDI tax rate is set at 6.2% of earnings with a cap at $127,200 . The HI is rate is set at 1.45% and has no earnings cap. Employers must pay a matching amount for each tax component. Self employed persons must pay an amount equal to the sum of both the employeee and employer portions.

Recommended Reading: Social Security Office Hartford Connecticut

Social Security Wage Base 2022

Now, onto the good stuff. The Social Security withholding limit.

Only withhold and contribute Social Security taxes until an employee earns above the wage base. Stay up-to-date with the annual Social Security wage base because it generally changes each year.

The 2022 Social Security wage base is $147,000.

After an employee earns above the annual wage base, do not withhold money for Social Security taxes. And, dont contribute anything else.

Not all employees will earn above the withholding limit. If an employee does not meet this wage base, continue withholding and contributing year-round.

The maximum Social Security contribution in 2022 is $9,114 .

If you withhold more than $9,114 , you surpassed the wage base and must reimburse your employee.

Remember that the amount you withhold for each employee is based on how much they earn.

- Eliminate the need for manual calculations

- Say goodbye to accidentally withholding above the Social Security wage base

- Enjoy free USA-based support

I Am Not A Career Employee Why Is Box 13 Retirement Plan Checked

If you had any DCP deductions at any time during the year Box 13 will be checked. Participation in DCP is mandatory. The only exception to DCP deductions are for students who are enrolled at least half time during academic sessions or nonresident aliens who are present in the U.S. under the F1 or J1 visa programs.

Also Check: Social Security Office Liberty Mo

Upload Formatted Wage File

Under the Upload Formatted Wage File tab on the Electronic Wage Reporting home page, you can:

- Select the Submit a Formatted Wage File link to submit an appropriately formatted electronic file containing annual wage data. You can access the tutorial for the new Wage File Upload from Business Services Online Tutorial website.

- Select the “old” link to resubmit a formatted file if you received a resubmission notice. You can access the tutorial for the old Wage File Upload from the Business Services Online Tutorial website. Note that the old Wage File Upload program will be retired in the Spring of 2023.

- Select the Submit a Special Wage Payments File link to submit an electronic file that contains special wage payment data as defined in Internal Revenue Service Publication 957.

Note: If you used W-2/W-3 Online or W-2c/W-3c Online to submit your wage data, you should not attempt to submit the same wage data through any other method. The PDF documents obtained from W-2/W-3 Online and W-2c/W-3c Online are for your records or distribution to your employees only.

FORMATTED WAGE FILE UPLOAD

Selecting the Submit a Formatted Wage File link under the Upload Formatted Wage File tab on the EWR Home page will take you to the Formatted Wage File Upload page. You should already have a file in EFW2 or EFW2C format generated by your payroll system. Before sending it, you should:

Once you have prepared your wage file for submission:

SUCCESS

ERRORS

COMMUNICATION DISRUPTIONS

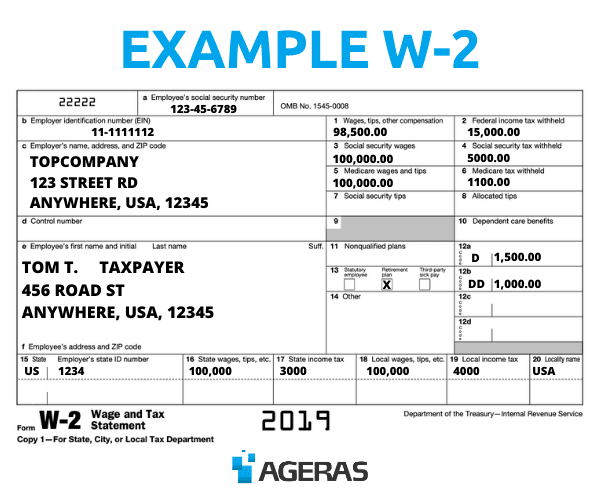

Understand Your W2 Wages

Payroll receives many questions about the W-2. Most of these questions focus on understanding the amounts in the numbered boxes on the W-2.

The most common questions relate to why W-2 Wages differ from your final pay stub for the year, and why Federal and State Wages per your W-2 differ from Social Security and Medicare Wages per the W-2. The short answer is that the differences relate to what wage amounts are taxable in each case. The following steps will walk you through the calculations of the W-2 wage amounts and enable you to reconcile these to your final pay stub for the year.

CALCULATING FEDERAL AND STATE TAXABLE WAGES

Use your last pay stub for the year to calculate the taxable wages in boxes 1 and 16 in your W-2. Begin with the Gross Pay YTD and make the following adjustments, if applicable:

Federal Taxable Wage Adjustments to Gross Pay YTD:

Subtract YTD Before-Tax Deductions, which include

Medical

Add Employer Paid Benefits Taxable* for QDP Medical and Dental YTD

Add GTL imputed income from Box 12C on your W-2

State Taxable Wage Adjustments to Gross Pay YTD:

Subtract YTD Before-Tax Deductions, which include

Medical

Add Employer Paid Benefits Taxable* for QDP Medical and Dental YTD

Add GTL imputed income from Box 12C on your W-2

CALCULATING SOCIAL SECURITY AND MEDICARE TAXABLE WAGES

Social Security and Medicare Taxable Wage Adjustments to Gross Pay YTD:

Subtract the following:

Add Employer Paid Benefits Taxable* for QDP Medical and Dental YTD

You May Like: How Much Do Veterans Get For Social Security