Box : Wages Tips Other Compensation

These are your taxable wages during the year. You need it for filing federal and New York State tax returns.

The taxable wages consist of the gross wages and other compensation paid to you during the year, including the following taxable fringe benefits:

- Union Legal Service Benefit

- Commuter Benefits Administrative Fringe Fee

- Domestic Partner Health Insurance Premiums

- Health and Fitness Reimbursement

- Wellness Program

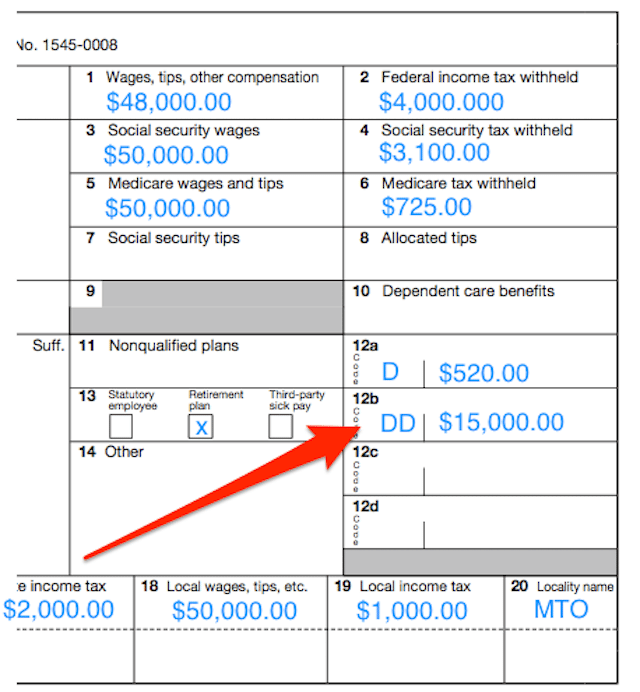

Your taxable wages are reduced by contributions to deferred compensation and/or tax deferred annuity accounts, pension plan, Commuter Benefits, and other programs that are not subject to federal taxes. These amounts are shown in Boxes 12 and 14.

The above listed taxable fringe benefits are shown in Box 14.

Preventing And Fixing Errors

Even if you hire a tax preparation organization for your tax paperwork, errors on a W-2 are still your responsibility. The best time to fix mistakes is before you make them. Ask employees to verify their names and Social Security numbers before you prepare the W-2s. Double-check spellings, numbers and whether you’ve used a nickname instead of their legal name.

You can use SSN’s online verification service to check the SSA’s records. You can also ask employees to clarify the name on their Social Security card. If your employee’s card names them James Richardson Smith, is Richardson a middle name? A hyphenated last name? Last name but with no hyphen? If it’s last-name Richardson Smith, putting Smith alone on the W-2 will generate a no-go letter from the SSA.

If an error slips through, it’s your responsibility to fix it. You do that by sending in a W-2c form to the SSA, correcting the mistake on the original form. If you’re not sure where the mistake lies, contact your employee. If they’ve left the company, do your best to reach out to them. Document whatever steps you take to track them down. The documentation will help when the SSA asks why you haven’t resolved the problem.

As an employer, it’s your responsibility to mail out accurate W-2s for a calendar year before January 31st of the following year. Get them out late, and you could face IRS penalties. The sooner you fix things, the less likely you are to pay a price.

References

Writer Bio

How Can I Get A Copy Of My Wage And Tax Statements

We can give you copies or printouts of your Forms W-2 for any year from 1978 to the present. You can get free copies if you need them for a Social Security-related reason. But there is a fee of $90 per request if you need them for an unrelated reason. You can also get a transcript or copy of your Form W-2 from the Internal Revenue Service. However, state and local tax information isnt available if you e-filed your tax return.Some examples of non-Social Security program purposes are:

- Filing federal or state tax returns

- Providing income information for workers compensation

- Establishing residency and

- Establishing entitlement to private pension benefits.

If you do not give a reason, we assume you need the forms for non-program purposes. When you write to us, be sure to include:

- Your Social Security number

- The exact name shown on your Social Security card

- Any different names shown on your W-2

- Your complete mailing address

You May Like: Jefferson County Social Security Office

Truncated Taxpayer Identification Numbers

To reduce the risk of identity theft, you may truncate a payee’s identification number on the statements you give to them on paper or in electronic format . This includes the following:

- Substitute and composite substitute statements

- Form 1098 series

- Form 1099 series

- Form 5498 series

If you truncate an identification number on Copy B, the other copies you give the payee should also include the truncated number.

In the following instances, you may replace the first five digits of the nine-digit number with an asterisk or X on most payee statements:

- Payees Social Security number

- Individual taxpayer identification number

- Employer identification number

- Adoption taxpayer identification number

Remember:

- You may not truncate on any forms filed with the IRS or with state or local governments.

- You cannot truncate your own identification number.

- These rules do not apply to Form W-2.

A payee is any person who is required to receive a copy of the form. For some forms, the term payee will refer to beneficiary, borrower, debtor, insured, participant, payer, policyholder, recipient, shareholder, student or transferor.

Who Is Subject To Social Security Wages

The IRS says employees who are subject to Social Security wages are any employee in the United States, regardless of the citizenship or residence of either the employee or employer.

However, for employees who work in another country, Totalization Agreements coordinate Social Security taxation and coverage with some countries to eliminate dual taxation and coverage.

Don’t Miss: Does Pennsylvania Tax Social Security

What Small Businesses Need To Know About W

As a small business owner, it is crucial to know when you can or cannot truncate an employee’s Social Security Number to avoid issues, delays, and possible fines.

Employers should always have their employee’s safety as their number one priority. While physical safety is essential, employers can’t forget about their duty to keep an employee’s personal and confidential information safe from predators. Truncating an employee’s Social Security Number is a simple way to help protect your employee’s identity.

What Is The Difference Between A W

A W-4 is filled out by employees to provide their employer with their tax ID number , marital status, number of allowances and dependents, and how much tax to withhold with each paycheck. The W-4 is filled out when an employee is first hired or if any changes must be made to filing status or withholding. The W-2 is filled out by employers at the end of the tax year and sent to employees to input on their tax returns.

Recommended Reading: Social Security Office Buford Ga

You Can Request Your Card Online Today

Sign in or create an account to submit your request

You can replace your card online and receive it in 14 days. You can also use your account to check the status of your request and manage other benefits you receive from us.

Trouble signing in?

Start the application online and visit your local SSA office for additional guidance for completing your application.

Prefer to talk to someone?

Contact your local SSA office.

You can start your Social Security number card application online. Once you’ve submitted your request, visit your local SSA office for additional guidance for completing your application. You will need to give us some of the information you provided again.

Box : Social Security Wages

These are the total wages paid that are subject to social security.

The total in Box 3 should not be more than the maximum social security wage base for that tax year.

Social security wages are reduced for health insurance premiums, Commuter Benefits, and some flexible spending program contributions.

Social security wages are not affected by deferred compensation or pension contributions.

Also Check: Social Security Ticket To Work Program

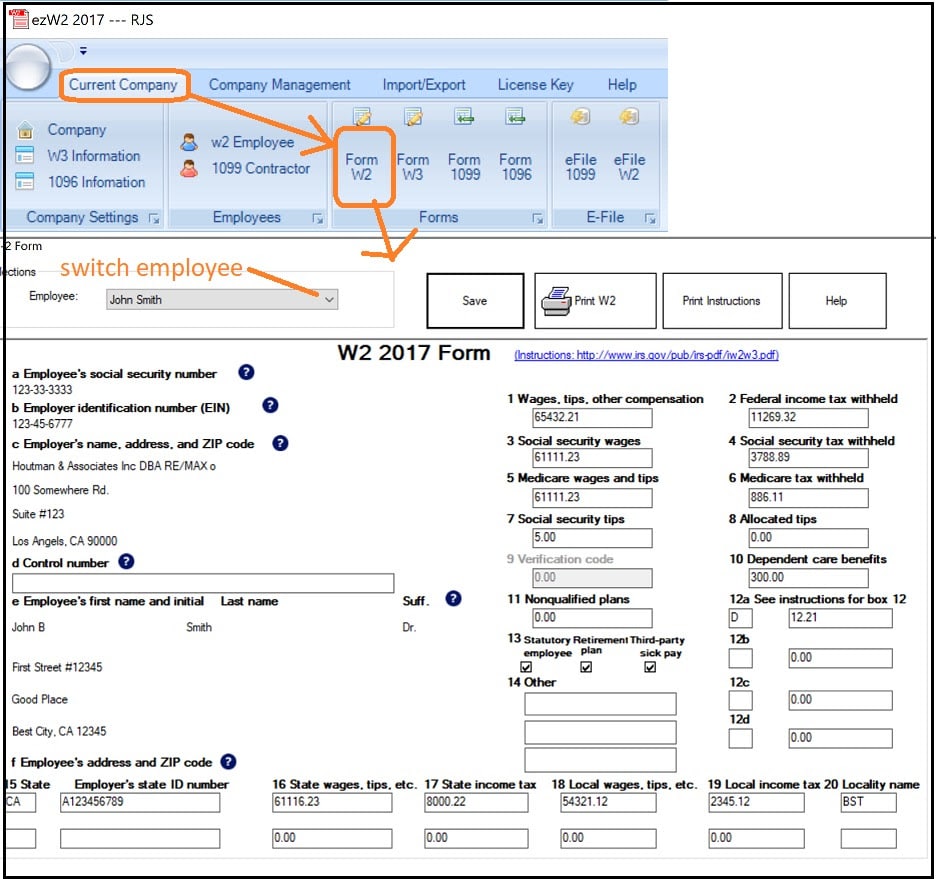

My W2 Form Doesn’t Have A Control Number Box D Has My Social Security Number What Do I Do

This is an issue that you should be easily able to get around, as long as you are willing to manually type in your W-2 information and do not need to import your tax document directly into TurboTax. Please allow us to explain.

Form W-2 Box D is called the Control Number field. It usually contains a code that uniquely identifies your unique W-2 document in your employer’s records. This number is assigned by the company’s payroll processing software, and is needed if attempting to electronically import your W-2 into a tax software program .

Please note that not all W-2s will necessarily include or support a Box D Control number. Your alternative to importing a W-2 document is to simply input your wage information manually into TurboTax.

The actual Control Number itself is not necessary in completing your tax return, unless you wish to import your W-2 into TurboTax and it that one instance it is required. In other words, the W-2 Control Number, whatever it is or it should ideally be, will never increase or decrease your actual tax refund by a single penny.

If you choose to type in your W-2 manually, rather than importing it electronically, then you should not have to enter anything from Box D at all, if you do not want to. In fact, you can simply leave the Control field blank. Try doing that first.

How To Keep Your W2 Secure

- Passwords: Use a unique, strong password for each of your accounts that contain sensitive information, including your ADP account, your benefits, payroll and bank accounts and any other sensitive accounts that may include tax information. Make sure that you do not share your password with anyone, and do not use the same password across multiple accounts.

- Check The Mail: If your W2 is mailed to you, make sure that your mailbox is adequately protected and that you retrieve the mail frequently.

- Send Securely: The most secure way to transfer your documents is in person because you can verify what you are providing, who you are giving it to, what they are receiving, and there is no intermediary between you and your tax preparer. However, if you need to transfer your documents electronically, keep in mind the below.

- Dont send your W2 or other sensitive documents via email.

- If you must send your files digitally, encrypt them using an online encryption tool and verbally provide your tax preparer with the encryption key. Do not email it.

Recommended Reading: Social Security Office Winter Haven Fl

Can I Truncate The Employee’s Social Security Number On A Form W

As the employer, it is crucial to know when you can truncate a Social Security Number, potentially keeping your employees from falling victim to identity fraud, and when you cannot. When sending an employee their Form W-2, you may be sending it by USPS mail or through email and linking them to a portal.

According to the IRS’ General Instructions for Form W-2, you can truncate the Employee’s Social Security Number on their copy of the Form W-2. Since the employee knows their own Social Security Number, they do not need the full number on their copy of Form W-2. However, it is imperative that employers do not truncate the Social Security Number, or any other identifying numbers, on Copy A of the Form W-2, the copy going directly to the Social Security Administration.

Employers should also check with their state to ensure no overruling regulations prevent them from truncating an identification number. The American Payroll Association recently published an article regarding Montana’s new guidance on truncated Social Security Numbers. Montana’s Department of Revenue will not accept any documents filed that include a truncated identification number. Before truncating an Employee’s Social Security Number or any other identification numbers on an employee’s documents, it is important to check the IRS website and state regulations first.

Box : Social Security Tax Withheld

This is the total social security tax withheld from your pay during the year.

Most employees pay 6.2% of covered wages, up to the maximum social security wage base which is adjusted each year. If more than 6.2% of that amount was withheld, OPA will issue you a refund in February. If you do not receive a refund that is owed to you, contact your agency’s Payroll Office.

You May Like: Social Security New Haven Ct

Passed Bill Seeks To Protect Employees From Identity Theft

According to an email released on 1/25/2016 by Vern Buchanan, United States congressman from Florida 16th district, the President has signed legislation that seeks to safeguard Social Security numbers by allowing employers to keep them from being printed on W2s that are sent to employees. The legislation is noted as H.R. 3568 and is titled the Taxpayer Identity Protection Act of 2015.

In the email message, Representative Buchanan states:

As tax filing season kicks off this week, I wanted to let you know of an important development. A sweeping measure I introduced to safeguard the Social Security numbers of more than 100 million working Americans is now law. The Taxpayer Identity Protection Act allows employers to keep Social Security numbers off the most commonly used tax form, the W-2, which is a prime target of identity thieves.

Upon reading this email several questions immediately came to mind:

- Since W2s must be distributed this month, how will employers possibly make the systems changes in time for this years filing season?

- Can employees make a request to their employer to not print their SSN info on their W2? If so, how does that happen and is the employer obliged to comply with the employees request?

- Does the W2 copy sent to the IRS still use the employees SSN if the employer has elected to use an alternate identifier? If not, then how will the IRS match the employees claimed W2 earnings with the earnings reported to the IRS by the employer?

Foreign Persons And Irs Employer Identification Numbers

Foreign entities that are not individuals and that are required to have a federal Employer Identification Number in order to claim an exemption from withholding because of a tax treaty , need to submit Form SS-4 Application for Employer Identification Number to the Internal Revenue Service in order to apply for such an EIN. Those foreign entities filing Form SS-4 for the purpose of obtaining an EIN in order to claim a tax treaty exemption and which otherwise have no requirements to file a U.S. income tax return, employment tax return, or excise tax return, should comply with the following special instructions when filling out Form SS-4. When completing line 7b of Form SS-4, the applicant should write “N/A” in the block asking for an SSN or ITIN, unless the applicant already has an SSN or ITIN. When answering question 10 on Form SS-4, the applicant should check the “other” block and write or type in immediately after it one of the following phrases as most appropriate:

“For W-8BEN Purposes Only””For Tax Treaty Purposes Only””Required under Reg. 1.1441-1″”897 Election”

To expedite the issuance of an EIN for a foreign entity, please call . This is not a toll-free call.

You May Like: Social Security Office On 3rd Street

Boxes E F: Employee’s First Name And Initials Last Name Suff Employees Address And Zip Code

This box shows your name and address which is currently in the City’s Payroll Management System.

If your name changes, your earnings cannot be posted by SSA until your social security records are updated. You can report a name change to SSA by calling 1-800-772-1213.

If your name is incorrect, you should notify your agency. A corrected W-2 will be issued.

If your address is incorrect, you can still use the W-2. You should change your home address in NYCAPS Employee Self-Service or report address changes to your agency.

Box : Dependent Care Benefits

These are the contributions to Dependent Care Assistance Program made through payroll deductions.

Contributions to DeCAP are not subject to federal, social security, and Medicare taxes. The amounts in Box 1 for taxable wages and Boxes 3 and 5 for social security and Medicare wages are reduced by the amount of the contribution.

Also Check: Social Security Office Traverse City Mi

Wage Reports And No Employee Ssn

What do you do if you need to file Form W-2 for an employee with no SSN?

If your employee applied for a card and has not received it yet, write Applied For in Box A on Form W-2.

If youre electronically filing Form W-2 for an employee without an SSN, enter 0s in the Social Security number field.

If your worker receives their SSN after you file a wage report, file Form W-2c, Corrected Wage and Tax Statements, to report corrections.

Need an easy way to pay your employees? Patriots payroll software lets you streamline your payroll responsibilities so you can get back to your business. Our friendly and free support is only a call, email, or chat away. What are you waiting for? Get started with your self-guided demo today!

This article has been updated from its original publication date of July 1, 2019.

This is not intended as legal advice for more information, please

Truncated Social Security Numbers To Be Allowed On W

In a move designed to assist employees in protecting the privacy of their personal financial data, the Internal Revenue Service has authorized employers to redact the first five digits of employees Social Security numbers on Forms W-2 produced after 12/31/2020. The rulingTreas. Reg. § 301.6109-4applies to the employee copies of the document , while Copy A will still need to contain the full Social Security Number. Read the details of this ruling here

Notice: The link provided above connects readers to the full content of the posted article. The URL for this link is valid on the posted date socialsecurityreport.org cannot guarantee the duration of the links validity. Also, the opinions expressed in these postings are the viewpoints of the original source and are not explicitly endorsed by AMAC, Inc. the AMAC Foundation, Inc. or socialsecurityreport.org.

Recommended Reading: Nearest Social Security Office To Me

What To Do If Your Employee Does Not Have An Ssn

Again, have your employee apply for a Social Security card immediately by filling out Form SS-5. Follow the steps below to ensure you are meeting IRS requirements when hiring an employee.

Steps to follow when hiring an employee without an SSN:

After your employee begins working, be sure to add them to payroll and withhold payroll taxes from their wages.

If an employee does not receive an SSN or gets turned down for one, they cannot legally work for you.

Do not accept an ITIN in place of an SSN. An ITIN cannot be used for employee identification or work. ITINs are only available to resident and nonresident aliens who are not eligible to work in the U.S.