The Extended Period Of Eligibility

After your nine-month trial work period expires, you begin the 36-month extended period of eligibility. During this time, you can earn less than the SGA limit and still receive your full monthly SSDI benefits.

The first month you exceed the SGA limit, the SSA no longer considers you disabled. You will get your benefits for that month and the next two months, and then benefits will stop.

If your monthly income later falls below the SGA limit again, the SSA can restart your benefits without requiring a new application if you are still within the 36-month extended period of eligibility.

How Can I Avoid Paying Taxes On Social Security

How to pay the least amount of tax on your Social Security benefits Put your income-producing assets in an IRA. Reduce the amount of money your company makes. Reduce the amount of money you take out of your retirement accounts. Make a donation to meet your minimum distribution requirement. Make sure youre taking the largest amount of capital loss possible.

How Much Money Can You Make On Social Security Disability

Using the above information, we can now summarize to answer this question. You can make up to $970 per month on an ongoing basis without worrying about losing your disability benefits. However, you can make over this amount for nine months in a rolling 60 month period in what is considered a trial work period.

But dont forget about SSI. Suppose you also receive SSI or regular Social Security Retirement income. In that case, those amounts count as income unless youre blind, so you should subtract those amounts from the $970/mo or $1350/mo, depending on your disability income earning strategy. This allows you to determine how much work income you can make without threatening your benefits.

You May Like: What Is Your Social Security Number

Employment: Social Security Disability Work Incentives At A Glance

SSDI WORK INCENTIVES

Trial Work Period – The trial work period allows you to test your ability to work for at least nine months. During your trial work period, you will receive your full Social Security benefits regardless of how much you are earning as long as you report your work activity and you continue to have a disabling impairment. In 2021, a trial work month is any month in which your total earnings are $940 or more, or, if you are self employed, you earn more than $940 or spend more than 80 hours in your own business. The trial work period continues until you have worked nine months within a 60-month period.

Extended Period of Eligibility – After your trial work period, you have 36 months during which you can work and still receive benefits for any month your earnings are not substantial. In 2021, earnings of $1,310 or more are considered substantial. No new application or disability decision is needed for you to receive a Social Security disability benefit during this period.

Expedited Reinstatement – After your benefits stop because your earnings are substantial, you have five years during which you may ask Social Security to start your benefits immediately if you find yourself unable to continue working because of your condition. ou will not have to file a new disability application, and you will not have to wait for your benefits to start while your medical condition is being reviewed to make sure you are still disabled.

Working While Receiving Ssdi

An SSDI lawyer at NY Disability can help you to explore options available through Social Security that allow you to work without jeopardizing your benefits. One of them is a trial work period that lets you determine whether you can engage in work activities without losing SSDI benefits.

As long as you notify Social Security that you are working, you have nine months as a test period to work. The months do not have to be consecutive, but the trial period ends in 60 months regardless of whether or not you used the entire nine-month period.

Any month in which you earn more than $940 is counted as one of the nine months. Whatever you earn during a trial month does not affect your SSDI benefits. In other words, the substantial gainful activity threshold of $1,310 a month if you are disabled or $2,190 if you are blind would not apply.

If you reach the end of the nine-month trial work period, you can continue to work under an extended period of eligibility of up to 36 months additional months. Your SSDI benefits will continue to be paid for any month that you do not exceed the substantial gainful activity earnings limits. You will not receive SSDI for any month during the extended period that you exceed the earnings limits.

Read Also: How To Report Social Security Card Lost

Can You Receive Retroactive Payments

Once the SSA approves your SSDI application and calculates your monthly benefit, you may be entitled to a back pay award. How many months of payments you will receive will depend on the date you applied for benefits and your disability onset date.

If you are applying for SSDI benefits, you need the assistance of a skilled Social Security disability lawyer to get your application approved and receive the benefits you deserve. To schedule a free consultation with a member of our legal team, fill out the online form on this page or call our Roswell office today.

|

Related Links: |

Can You Do Any Other Type Of Work

If you cant do the work you did in the past, we look to see if there is other work you could do despite your medical impairment.

We consider your medical conditions, age, education, past work experience, and any transferable skills you may have. If you cant do other work, well decide you qualify for disability benefits. If you can do other work, well decide that you dont have a qualifying disability and your claim will be denied.

Recommended Reading: Find My 401k With Social Security Number

How Much Can You Earn And Still Keep Your Social Security Disability

Posted on:Categories:Social Security DisabilitySocial Security Disability Benefits

Many people receiving Social Security Disability can work part-time without losing their disability benefits as long as their earnings do not surpass a set amount per month. Disability benefit recipients should consult a disability lawyer to determine whether they can earn extra income without losing their benefits.

How To Qualify For Disability Income

There are a few factors that Social Security looks at to determine your eligibility for disability benefits.

First, you must have held a job that Social Security covers. Essentially, that means you pay into Social Security, either through self-employment taxes or directly from your payroll. According to the Social Security Administrations data, 89% of working U.S. citizens between the ages of 21 and 64 meet this qualification. While you do that, you earn Social Security work credits which help you qualify for disability benefits.

The amount you need to earn for a work credit varies between years. For 2021, you can earn one credit per $1,470 in income. Earning $5,880 in wages or self-employment income earns you four credits in total the maximum available annually.

Don’t Miss: Social Security Office Sikeston Mo

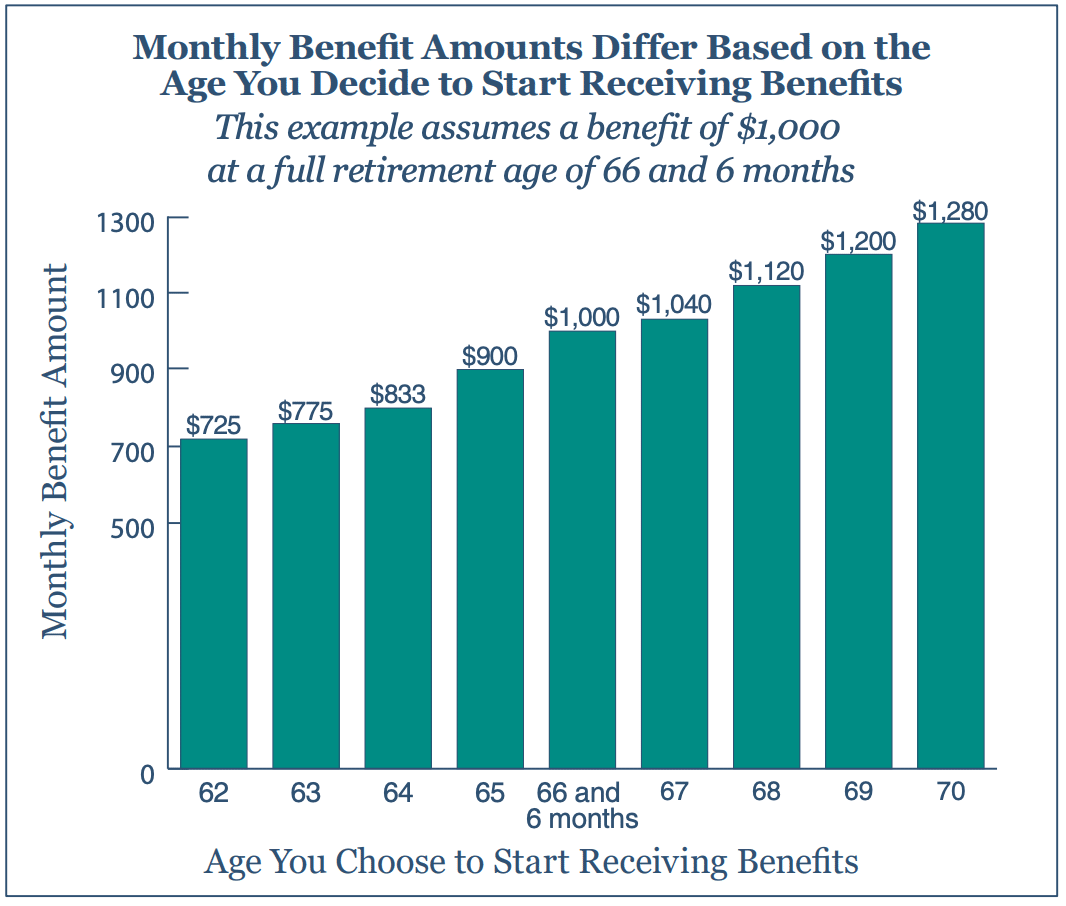

Calculating Your Monthly Ssdi Payment

The exact amount of money people get for SSDI each month is unique for every individual. The Social Security Administration uses a complex weighted formula to calculate benefits for each person, up to 2022’s maximum benefit of $3,345.

Doing the math yourself is difficult, but here’s how the formula works.

AIME. Social Security bases your retirement and disability benefits on the amount of income on which you’ve paid Social Security taxescalled “covered earnings.” Your average covered earnings over the past 35 years are known as your “average indexed monthly earnings” .

Bend points. The SSDI formula uses fixed percentages of different amounts of income. These percentages, called “bend points,” are adjusted each year. In 2022, here are the bend points and how they come together:

- 90% of the first $1,024 of your AIME

- plus 32% of your AIME from $1,024 to $6,172

- plus 15% of your AIME over $6,172.

PIA. Adding those three figures together gives the SSA your primary insurance amount . Your PIA is the base figure the SSA uses in setting your benefit amount.

How Much Can You Earn In 2022 And Draw Social Security Disability

Each year, the Social Security Administration adjusts the threshold monthly income eligibility amounts and the benefit payments are adjusted to reflect the rate of inflation over the previous year. At London Disability, we focus 100% of our attention and all our professional skill on keeping SSDI and SSI applicants and benefit recipients up to date on the latest developments that might affect benefits. We want everyone who already receiving benefits and all those thinking about applying for SSD or SSI benefits to be fully informed. For more answers to your questions, contact London Disability disability advocates and Attorney Scott London by clicking here or call 877-978-3405.

Also Check: Fort Worth Social Security Office

What Is Maximum Disability Payment

For 2021, the average CPP disability payment is $1,031.55 per month. The maximum CPP disability benefit anyone can get is $1,413.66. Of course, these amounts increase each year for inflation. In addition to your CPP disability payment amount, you also get an additional payment for each dependent child.

Expedited Reinstatement Of Benefits

At the end of the EPE there is an additional five year period called âexpedited reinstatement of benefits.â If the original impairment flairs up within five years of the end of the 36-month EPE, preventing the individual from earning SGA, Social Security can reinstate the SSDI benefits provisionally while a medical review is completed. If the medical review confirms the disability condition or blindness, then the provisional SSDI benefits will be made permanent. If the medical review concludes that there is not a medical disability, SSDI benefits will be immediately terminated but with no overpayment for benefits paid provisionally.

Recommended Reading: Social Security Office Shawnee Oklahoma

How To Make Sure You Dont Lose Your Ssdi Benefits

If youre thinking about applying for disability but are still employed, or if youve been receiving benefits but are considering part-time work to help make ends meet, its crucial that you get all the facts before making any decisions that could put your disability benefits in jeopardy.

To get help with applying for Social Security programs, appealing a decision, or just to talk about all your legal options, consider contacting an experienced Social Security disability lawyer at Social Security Disability Advocates USA.

Our friendly legal team will schedule a free consultation to review your case and help you understand the possible impacts of SSDI income limits. Call us today at , chat with us via LiveChat, or send us a message using our secure contact form.

How Many Hours Can You Work On Disability If Youre Self

When you work for yourself, you can work hours without receiving an hourly wage. In that case, the SSA will look at how many hours youve worked, plus your monthly income.

Social Security typically allows up to 45 hours of work per month if youre self-employed and on SSDI. That comes out to around 10 hours per week. The SSA will also see whether or not youre the only person working for your business. You must not be earning SGA, along with not working too many hours.

Recommended Reading: Do Employers Need Social Security Number For Background Check

How Much Money Can A Person On Disability Have In The Bank

The general rule is that if you have more than $2000 as a single person or $3000 as a married couple, then you will likely not be able to receive SSI benefits even if you are disabled. These assets can include: Any money in any bank accounts, including savings, or any cash you have. More than one vehicle to your name.

Special Rules For People Who Are Blind Or Have Low Vision

We consider you to be legally blind under Social Security rules if your vision cannot be corrected to better than 20/200 in your better eye. We will also consider you legally blind if your visual field is 20 degrees or less, even with a corrective lens. Many people who meet the legal definition of blindness still have some sight and may be able to read large print and get around without a cane or a guide dog.

If you do not meet the legal definition of blindness, you may still qualify for disability benefits. This may be the case if your vision problems alone or combined with other health problems prevent you from working.

There are several special rules for people who are blind that recognize the severe impact of blindness on a person’s ability to work. For example, the monthly earnings limit for people who are blind is generally higher than the limit that applies to non-blind workers with disabilities.

In 2022, the monthly earnings limit is $2,260.

You May Like: Can You Open Bank Account Without Social Security Number

Do Seniors Pay Taxes On Social Security Income

Many seniors are astonished to hear that their Social Security checks are taxed. A portion of a retirees benefit is liable to taxes if they are still working. These earnings are added to half of your social security payments by the IRS, and if the total exceeds the established income level, the benefits are taxed.

Title Ii Disability Benefits

This article discusses how work can affect a personâs eligibility for Title II disability benefits, commonly referred to as âSocial Security Disability.â The next Voice article will discuss preserving Medicare and Medicaid benefits when a Title II disability recipient begins to work.

Title II of the Social Security Act provides three types of insurance benefits for individuals with disabilities. Some people receive Title II disability benefits on their own work history . Others receive Title II disability insurance on the account of a deceased spouse or former spouse s Benefits or DWB). Some adult children receive Title II disability benefits on the account of a disabled, retired or deceased parent . In order for a worker, spouse, or child to qualify for Title II disability benefits, the worker on whose account benefits are paid must have paid Social Security taxes on earnings and must have earned the requisite number of work credits. Title II disability benefits are a type of insurance and are not affected by a personâs assets or unearned income.

Read Also: Greenville South Carolina Social Security Office

Can You Work While On Ssdi

Generally, SSDI recipients can’t do what’s considered “substantial gainful activity” and continue to receive disability benefits. In a nutshell, doing SGA means you’re working and making more than $1,350 per month in 2022 . So that’s how much you can make in 2022 without affecting your disability benefits. And, you can deduct disability-related work expenses from that total. For more information, see our article on SSDI income limits.

But, to encourage SSDI recipients to go back to work, Social Security has created some exceptions to this rule. SSDI recipients are entitled to a “trial work period” during which they can make more than the SGA amount without losing benefits.

Trial work period. For a nine-month trial work period, SSDI recipients are entitled to test their ability to work and continue to receive full benefits regardless of whether they make more than the SGA amount. For 2022, the Social Security Administration considers any month where a person has a monthly income of more than $970 to be a trial work month. If you’re self-employed, any month where you work more than 80 hours can also be considered a trial work month.

For more information, see our article on the trial work period, the extended period of eligibility, and expedited reinstatement.

Ssi And The Pass Program

If you’re receiving SSI, you can take part in a Plan for Achieving Self-Support . This is a plan to go back to work that you develop with the help of the SSA or a vocational rehabilitation worker. While participating in PASS, any money you earn isn’t counted toward the SSI income limits and won’t reduce your SSI benefits.

You May Like: Social Security Office Austin Tx

Ticket To Work Program

The SSAs Ticket to Work program allows you to continue receiving monthly benefits while also working. You can work in your previous job or even try out a different job in a new industry.

The only thing you need to do to qualify for this program is notify your local Social Security office of your interest in obtaining at Ticket to Work. After you get your ticket, you can begin looking for a job. Then, you will report your earnings to the SSA for as long as you continue to work.

It is vital to report your return to work to the SSA before you earn your first paycheck. If you fail to take this step, the SSA may assume you are no longer disabled and schedule you for a re-examination of your qualifications or cancel your benefits outright.

Other Income That Could Reduce Your Ssdi Payment

Any disability benefits you receive from a private long-term disability insurance policy won’t affect your SSDI benefits. Nor will SSI or VA benefits impact your SSDI amount. But government-regulated disability benefits, such as workers’ comp or temporary state disability benefits, can affect your SSDI benefits. Here’s how that works: If the amount in SSDI plus the amount from government-regulated disability benefits is more than 80% of the amount you earned before you became disabled, the SSDI or other benefits will be reduced.

Before Inez became disabled, her average earnings were $5,000 per month. Inez, her spouse, and her two children would be eligible to receive a total of $3,000 a month in Social Security disability benefits. But Inez also receives $2,000 a month from workers’ compensation.

The total amount of benefits Inez and her family would receive$5,000is more than 80% of her average earnings. So, her family’s Social Security benefits will be reduced by $1,000, from $3,000 to $2,000. That way, the $2,000 a month from workers’ comp and the $2,000 in disability benefits means they will receive a total of $4,000 per month, which is 80% of the earnings figure of $5,000.

The following types of government benefits could lower your SSDI payment:

- workers’ comp payments

- civil service disability benefits, and

- state or local government retirement benefits based on disability.

Don’t Miss: Social Security Office In Victoria Texas