If You Are The Survivor

Just as you plan for your family’s protection if you die, you should consider the Social Security benefits that may be available if you are the survivor that is, the spouse, child, or parent of a worker who dies. That person must have worked long enough under Social Security to qualify for benefits.

How Your Spouse Earns Social Security Survivors Benefits

A worker can earn up to four credits each year. In 2022, for example, your spouse can earn one credit for each $1,510 of wages or self-employment income. When your spouse has earned $6,040 they have earned their four credits for the year.

The number of credits needed to provide benefits for survivors depends on the worker’s age when they die. No one needs more than 40 credits to be eligible for any Social Security benefit. But, the younger a person is, the fewer credits they must have for family members to receive survivors benefits.

Some survivors can get benefits if the worker has credit for one and one-half years of work in the three years just before their death. Each persons situation is different and you need to talk to one of our claims representatives about your choices.

Other Things You Need To Know

There are limits on how much survivors may earn while they receive benefits.

Benefits for a widow, widower, or surviving divorced spouse may be affected by several additional factors:

- If you remarry before age 60 , you cannot receive benefits as a surviving spouse while you are married.

- If you remarry after age 60 , you will continue to qualify for benefits on your deceased spouse’s Social Security record.

- If you receive benefits as a widow, widower, or surviving divorced spouse, you can switch to your own retirement benefit as early as age 62. This assumes you are eligible for retirement benefits and your retirement rate is higher than your rate as a widow, widower, or surviving divorced spouse.

- In many cases, a widow or widower can begin receiving one benefit at a reduced rate and allow the other benefit amount to increase.

- If you will also receive a pension based on work not covered by Social Security, such as government or foreign work, your Social Security benefits as a survivor may be affected.

However, if your current spouse is a Social Security beneficiary, you may want to apply for spouse’s benefits on their record. If that amount is more than your widow’s or widower’s benefit, you will receive a combination of benefits that equals the higher amount.

Lump Sum Death Benefit

First, lets deal with the one-time payment formerly called a funeral benefit. Upon the death of a Social Security beneficiary, the Social Security Administration pays a lump-sum death payment of $255. Needless to say, the $255 one time payment doesnt quite cover the cost of a funeral. Its been stuck at that level for several years and inflation has significantly eroded its useful value.

There are three categories of people who may receive the death payment:

If there are no eligible survivors in either of these three categories, then no death benefit is paid.

Even though $255 isnt a lot, who wants to pass on money thats rightfully theirs? If the eligible spouse or child is not receiving benefits at the time of death, they must apply for benefits within two years in order to receive the death payment.

You May Like: Is The Social Security Office Open On Saturday

Were There With Support If Youre Raising A Grandchild

More and more grandparents are finding themselves raising their grandchildren. Social Security will pay benefits to grandchildren when the grandparent retires, becomes disabled, or dies, if certain conditions are met. Generally, the biological parents of the child must be deceased or disabled, or the grandparent must legally adopt the grandchild.

To receive this benefit, your grandchild must have begun living with you before age 18 and received at least one half of his or her support from you for the year before the month you became entitled to retirement or disability insurance benefits, or died. Also, the natural parent of the child must not be making regular contributions to his or her support.

If your grandchild was born during the one-year period, you must have lived with and provided at least one-half of the child’s support for substantially the entire period from the date of birth to the month you became entitled to benefits.

Your grandchild may qualify for benefits under these circumstances, even if he or she is a step-grandchild. However, if you and your spouse are already receiving benefits, you would need to adopt the child for them to qualify for benefits.

Working While On Social Security

Just because a young person is disabled and on Social Security disability does not mean they cannot hold a job. Their earning capacity is limited if they are to remain eligible for benefits, but as of 2019 they may earn a maximum of $1,220 per month without jeopardizing benefits. The amount is $2,040 for blind individuals. Should they exceed that maximum in a particular month, they will not receive benefits for that month, but that does not mean they are not eligible for benefits in the long term. If a person starts regularly earning amounts above the Social Security maximum and loses benefits, the Social Security Administration will allow benefits to be reinstated within a five-year period if the disability forces them to stop working.

References

Read Also: Bend Oregon Social Security Office

How To Maximize Survivor Benefits

The survivor benefit amount depends on whether both the deceased worker and the survivor had already started collecting benefits. Generally, the longer you wait to claim benefits , the larger they will be. So if you can afford to, delaying will pay off.

If you have your own earned retirement benefit, there are also strategies to maximize the two benefits. Remember: you cannot simply add together your survivor benefit and your own retirement benefit. Instead, Social Security will pay you the higher of the two. However, you can receive one benefit for a time and later file for the other. If your own retirement benefit would grow to be more at 70 than your survivors benefit, you could claim your survivors benefit first, and later switch to your own. If youre already receiving retirement benefits and the survivors benefit would be larger, you can switch to survivors benefits. And if you became eligible for retirement benefits within the last 12 months and suffered the loss of a spouse, you might be able to withdraw your retirement application and instead apply for survivors benefitsthen reapply for retirement benefits later, when they will be worth more.

Social Security Survivors Benefits Eligibility

To qualify for survivors benefits, you must be one of the following:

- Widow or widower, age 60 or older , who was married to the deceased for at least nine months, and did not remarry before 60

- Widow or widower at any age who is caring for a deceased workers child who is younger than age 16 or disabled

- Divorced spouse of the deceased

- Minor or disabled child

- Stepchild or grandchild of the deceased

- Dependent parent of the deceased age 62 or older

The worker who died must have paid into the Social Security system during his or her career. Workers earn up to four credits a year . Once the worker has earned 40 credits, his or her family is fully insured under the program. But the families of workers who have less than 40 credits can still qualify for some survivors benefits. And under a special rule, if someone worked for only a year and a half in the three-year period before their death, their children and spouse can be eligible for benefits.

Also Check: Cuts To Social Security Benefits

What Happens To Disability Benefits When My Child Turns 18

Many disability beneficiaries are children and teenagers about 4.4 million, according to the Social Security Administration . But what happens when your disabled child reaches age 18? Does Supplemental Security Income go away, or continue? Do you need to reapply? Our disability lawyers explore the SSI rules and regulations that take effect when a beneficiary turns 18.

What Can You Spend Social Security Child Survivor Benefits On

The parent or legal guardian who is managing survivor benefits on behalf of a child will be required to prove how this money is spent. The SSA will require an annual report, though they can request this information at any point in time. You can spend social security child survivor benefits a few different ways:

-

Basic needs such as food, water, and housing

-

Medical costs including the childs portion of a deductible or insurance payment

-

Recreational activities, for example if the child is enrolled in sports

-

New clothes and other miscellaneous items related to their care

You May Like: How To Pass Social Security Disability Mental Exam

How To Apply For Benefits

You should not wait until you have all the required documentation to contact the office, but rather gather as much of the following information possible before your appointment:

- A death certificate or documentation from a funeral home showing proof of death.

- Your birth certificate.

- The Social Security number of the deceased worker.

- A marriage certificate, if you are applying as a widow or widower.

- A divorce decree if you are applying as a divorced widow or widower.

- The Social Security numbers of any dependent children, as well as their birth certificates.

- The most recent W-2 forms of the deceased worker.

- Your bank account number and the name of the bank if you want to have funds directly deposited.

Re: What Happens To Minors’ Saved Survivor Benefits When They Turn 18

Told by who? The grocer, the auto mechanic, the pool boy?Unless you were told by somebody at the SSA office, I would seriously doubt anything anybody else tells you.So far, all I can find on the SSA website is that children can receive survivors’ benefits until they are 18 .I haven’t found anything to indicate that anything gets taken away when they turn 18, other than the benefits just stop.If you are saving up portions of their monthly benefits that they have already been entitled to it doesn’t make any sense that the money would have to be returned to SSA when they reach 18.Does it make any sense to you?I suggest you call the SSA office to clear this up.

You May Like: Can I Collect Social Security At 60

How To Claim Survivors Benefits

To begin receiving survivors benefits, you must make a claim with the Social Security Administration. Survivors benefits claims may not be made online. You can start the claims process over the telephone, 1-800-772-1213, or go to your local Social Security office. Making an appointment may reduce your wait time.

The death should be reported to the Social Security Administration as soon as possible. In many cases, the funeral home can make that notification. You will have to provide the funeral home with the deceaseds Social Security number.

When Do Survivor Benefits End

As weve mentioned, the age until someone can collect survivors benefits for a deceased parent depends on their situation. For most people, benefits are only available until age 18. Benefits may be available until 19 for elementary and secondary students, or longer for those diagnosed with a disability before age 22.

For surviving spouses, there isnt necessarily a limit on how long they can collect benefits. Widows and widowers who arent old enough to collect retirement benefits can collect survivor benefits until their child reaches 16. However, surviving spouses who reach the minimum age to collect retirement benefits can collect based on their deceased spouses work record for the rest of their lives.

You May Like: North Carolina Social Security Office

With You Through Lifes Journey

The makeup of American families has changed in the last 20 to 30 years. Today, family units are diverse, rich in culture, and may include two parents, same-sex parents, only one parent, grandparents, and other relatives. Social Security knows that whether single parent, blended, diverse, small or large, every family is important.

For more than 80 years, Social Security has helped families secure today and tomorrow by providing financial benefits, tools, and programs that help support millions throughout lifes journey. Our programs and services have evolved to meet your unique family needs and especially the children in your care.

Children Receiving Ssdi Benefits Through Their Parents

In some cases, a child is eligible to receive SSDI benefits through a qualified parent, adoptive parent, or step-parent. Under certain circumstances, a child could obtain these benefits through a grandparent. If the adult qualifies for and is receiving SSDI benefits or was entitled to benefits before their death, their child could receive benefits based on the Social Security record of their parent. These types of SSDI benefits are known as dependent or auxiliary benefits. Typically, these benefits terminate when your child turns 18.

If your child is under the age of 18, they are entitled to up to 50% of your monthly benefits, subject to a maximum per family. However, these benefits are only available until your child is 18 or in high school. If they are in high school when they turn 18, the benefits will continue until their 19th birthday. Additionally, if your child marries, their benefits will stop.

Read Also: Social Security Office Odessa Texas

Advanced Filing Strategies For Survivors

In early 2018 the Office of the Inspector General released a report with some shocking news. 82% of widows and widowers who are receiving Social Security survivors benefits are actually entitled to a higher monthly benefit payment. The only problem is, the SSA never made them aware of this. This affected an estimated 9,224 widows and widowers 70 and older who could have received an additional $131.8 million in Social Security benefits had they been told they could delay filing for retirement benefits until reaching age 70.

Theres no need to wait for them to tell you about itlets jump in right now.

Prior to 2016 there were several popular Social Security filing strategies that would allow an individual to file for certain benefits and later switch back to their own benefits. The benefit of this was to allow their own benefits to grow with the 8% per year delayed retirement credits However, law changes in 2016 did away with many of the Social Security filing strategies. The one that remains belongs to survivors and it can be powerful. Heres how it works.

If you have a benefit based on your own work history, it could make sense to file for a reduced survivors benefit as early as 60. While you are drawing your survivor benefit, your own benefit grows every month you delay filing for it. Generally, these adjustments could grow your benefit by 77% from age 62 to age 70. At age 70, you simply switch back to your own benefit .

Ssdi For Your Disabled Adult Child

If your child is disabled, they could qualify for a category of benefits known as adult child benefits. These benefits are an extension of the SSDI benefits mentioned above. However, the extension is only for disabled children.

If your child is disabled before turning 18 or becomes disabled before reaching the age of 22, the benefits they received through your SSDI could continue for as long as your child is disabled. This means that as long as the parent, step-parent, or adoptive parent is eligible for, and receiving, SSDI or Social Security retirement benefits, their disabled child is eligible for dependent benefits. If the parent should die, if they were eligible at the time of their death, their childs benefits continue. In some cases, if the parents are deceased, a disabled child could receive these benefits through their grandparents.

To qualify, your adult child must meet the SSAs definition of an adult disability. As stated above, SSA has a different definition of child and adult disability. To qualify for SSDI auxiliary benefits under their parents earning record, a young adult must experience a disability that completely impairs their ability to perform any substantial gainful activity. This impairment could be either physical or mental in nature. Additionally, the impairment must be expected to result in the death of the adult child or last for a period of at least 12 continuous months.

Other qualifications include the following.

Don’t Miss: Do Employers Need Social Security Number For Background Check

How Are Survivor Benefits Calculated

Survivor benefits are based on a deceased workers earnings. If the deceased person hadnt claimed their Social Security benefits before they died, the survivor are entitled to a percentage of the benefit the deceased would have received at full retirement age. If the deceased person lived longer than full retirement age, that amount will be higher because they would have earned delayed retirement credits.

If the deceased person had already started collecting their benefits before they died, their survivors can receive a percentage of the actual benefit the deceased worker received. That amount will vary depending on what age the deceased claimed their benefits.

If a survivor claims these benefits before their survivors full retirement age, the benefits are reduced by a percentage based on birth year and the number of months until full retirement age.

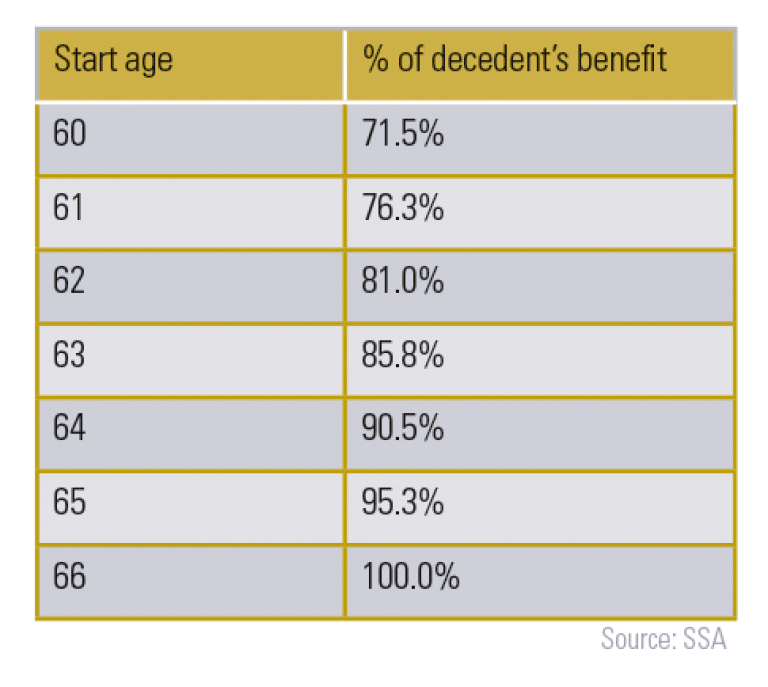

The percentage of benefits survivors can receive based on their age and their relationship to the deceased worker is as follows:

The average monthly survivors benefit for a spouse who is not disabled and not raising minor children is $1,431. Like all Social Security benefits, survivor benefits may increase year to year based on the cost of living.