Workers With Too Few Social Security Credits

Can you get Social Security if you never worked? No, because a minimum requirement to collect Social Security retirement benefits is performing enough work. The Social Security Administration defines enough work as earning 40 Social Security credits. More specifically, in 2022, an individual receives one credit for each $1,510 in income, and they can earn a maximum of four credits per year. So, 40 credits are roughly equal to 10 years of work.

If you earn the federal minimum wage of $7.25 an hour, then youll need 208.28 hours of work to receive one . By working just 17 hours a week for 50 weeks at this wage , you can earn the maximum credits per year. That means even those who work part-time so they can attend school or care for a childor those who work part-time because they cannot find full-time workcan amass Social Security credits without too much trouble.

Earned credits are accrued over a person’s lifetime and never expire, so anyone who has left the workforce with close to 40 credits might consider going back and doing the minimum additional work they need to qualify. You can check the number of credits you have so far by opening a Social Security account on the Social Security website and downloading your Social Security statement.

If A Section 218 Agreement Is In Effect: Is The Position Optionally Excluded From Coverage Under The Section 218 Agreement/modification

A list of mandatory and optional exclusions is included in Chapter 5: “Social Security and Medicare Coverage” of Publication 963, Federal-State Reference GuidePDF.

The optional exclusions include:

- Agricultural labor, but only those services that would be excluded if performed for a private sector employer,

-

All services in any class or classes of elective positions,

-

Services performed by election workers and election officials paid less than the calendar year threshold amount mandated by law unless Section 218 agreement covers election workers.

- Services in any class or classes of positions compensated solely by fees received directly from the public, by an individual who is treated by the entity as self-employed unless Section 218 agreement covers these services.

- All services in any class or classes of part-time positions,

- Services performed by students enrolled and regularly attending classes at the school, college or university where they are working.

The effective date of coverage is the date specified in the Section 218 Agreement/Modification for coverage to begin.

Is The Employee Covered By A Section 218 Agreement Or A Modification Amending The Agreement

Your State Social Security Administrator is responsible for determining whether a position occupied by a particular government employee is covered by a Section 218 Agreement. Contact that office if you are uncertain whether you have a Section 218 Agreement or have questions about coverage for particular positions. You can identify your state Social Security Administrator at the National Conference of State Administrators website.

Read Also: Social Security Disability Phone Number Florida

Csrs And The Windfall Elimination Provision

If you are a CSRS employee who is eligible for social security, you may be impacted by the Windfall Elimination Provision . The WEP applies to people who receive retirement income from a non-covered source. The CSRS pension is a non-covered source because employees did not pay OASDI tax while in that job. The WEP reduces the social security benefit CSRS employees would have otherwise been qualified for based on their outside employment.

If this applies to you, definitely check out the social security associations explainer on the WEP. You may also wish to talk to a qualified benefits professional to understand how much money you may receive from social security.

Financing Pension Benefits For Federal Employees

As of September 30, 2017, the CSRDF had net assets of $908.7 billion available for benefit payments under both CSRS and FERS. At the same time, the civil service trust fund had an unfunded actuarial liability of $968.1 billion, with $812.5 billion in unfunded liability attributable to CSRS and $155.6 billion in unfunded liability attributable to FERS.31 Federal law has never required that employee and agency contributions must equal the present value of benefits that employees accrue under the CSRS. In contrast, the FERS Act requires that the benefits accrued each year by employees must be fully funded by contributions from employees and their employing agencies.

Read Also: Social Security Office On Buffalo

Does Mandatory Social Security Coverage Apply To The Employee

Full Social Security coverage was mandated beginning July 2, 1991, for state and local government employees who are not members of a qualifying public retirement system and who are not covered under a Section 218 Agreement, unless a specific exclusion applies under the law. A list of specific exclusions is included in Chapter 5: “Social Security and Medicare Coverage” of Publication 963PDF.

How Much Do You Have To Earn To Get Maximum Social Security

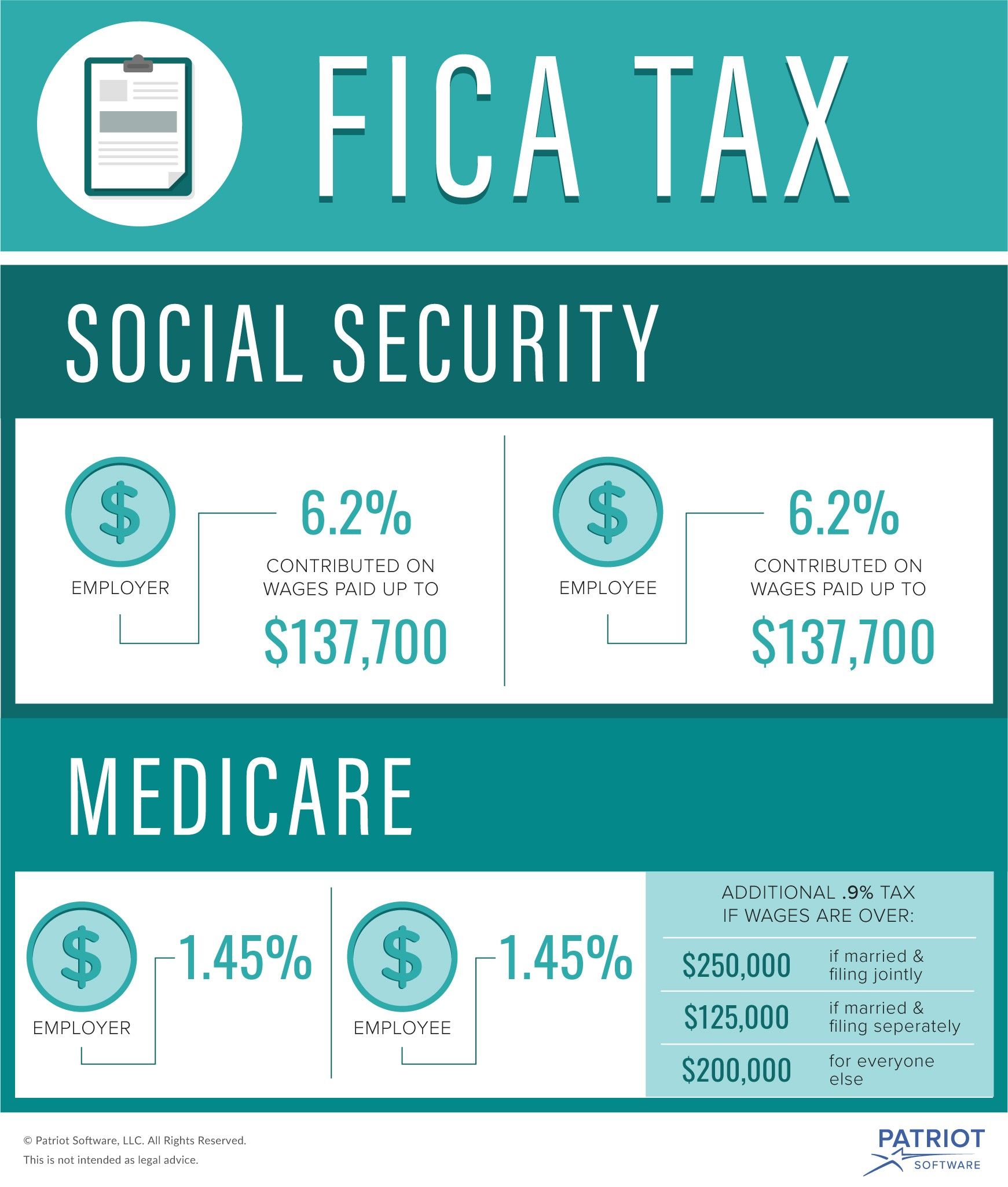

In recent years, you have to earn a six-figure salary to receive a top-down Social Security payment. The maximum taxable salary of Social Security is $ 142,800 in 2021. However, the exact amount changes annually and has increased over time. It was $ 137,700 in 2020 and $ 106,800 in 2010.

How much Social Security will I get if I make 20000 a year?

If you earned $ 20,000 for a half career, then your average monthly earnings will be $ 833. In this case, your Social Security payment will be a full 90% of that amount, or nearly $ 750 a month, if you retire at full retirement age.

What is the average Social Security monthly check?

Social Security offers a monthly benefit check to many types of recipients. As of August 2021, the average check is $ 1,437.55, according to the Social Security Administration but that amount can differ drastically depending on the type of recipient. In fact, retirees usually do more than the general average.

You May Like: Social Security Office In Miami

What Is The Average Social Security Check At Age 66

| Age |

|---|

| $ 1,522 |

What is the average Social Security benefit in 2019?

Currently, the average retiree receives $ 1,422 a month in Social Security benefits. But because recipients will receive a 2.8% cost-of-living adjustment next year, that figure will rise to $ 1,461 a month. This means the average senior will receive $ 17,532 in benefits for the year.

Can I Take My Fers Pension As A Lump Sum

you may request that your retirement contributions be returned to you in a lump sum payment, or. If you have at least five years of credible service, you can wait until you are of retirement age to apply for monthly pension payments.

Can I get an FERS and Social Security pension? Normally, the numbers dont make sense. Big question. So the short answer is no, your FERS pension did not reduce your Social Security. As an FERS employee, you can certainly get your full Social Security while you get your FERS pension.

Don’t Miss: Social Security Office In Shreveport Louisiana

Receiving Benefits While You Work

When you reach your full retirement age, you can work and earn as much as you want and still receive your full benefits. If you are younger than full retirement age and if your earnings exceed $19,560/yr., some of your benefit payments during the year will be withheld.

This does not mean you must try to limit your earnings. If Social Security withholds some of your benefits because you continue to work, they will pay you a higher monthly benefits amount when you reach your full retirement age.

IMPORTANT: If you continue to work and earn more than the exempt amount, you should know that it will not, on average, reduce the total value of lifetime benefits you receive from Social Security and may actually increase them.

Here is how it works: after reaching full retirement age, Social Security will recalculate your benefit amount to give you credit for any months in which you did not receive some benefit because of your earnings. In addition, as long as your continue to work, they will check your record every year to see whether the additional earnings will increase your monthly benefit.

Which States Public Employees Do Not Pay Social Security

Most to almost all public employees in Alaska, Colorado, Louisiana, Maine, Massachusetts, Nevada and Ohio are not in Social Security. Employers and employees who do not participate in Social Security do not pay the Social Security portion of the FICA tax .

What states do not tax your pension or Social Security?

Alaska, Nevada, Washington and Wyoming have no state income taxes at all, and Arizona, California, Hawaii, Idaho and Oregon have special provisions excluding Social Security benefits from state taxation.

What workers are not covered by Social Security?

But there are groups of uncovered employees. These include: Some state, county, and municipal employees who are covered by state pension plans rather than Social Security. Employees of the U.S. government who were employed before 1984, the year federal agencies came under the Social Security umbrella.

You May Like: How Much Is Social Security Taxed

Why Dont Federal Employees Pay Into Social Security

CSRS employees do not pay into social security. When social security was established, federal government employees were already covered within a pension program and therefore were excluded from the program. CSRS employees contribute 7-8% of their salary to their pensions. This is just slightly higher than the amount that FERS employees pay in OASDI tax. Compared to most employees who pay OASDI, CSRS get a great return on their money withheld for retirement.

Social Security Benefits For Federal Workers

The federal government has special retirement programs for its employees. How this affects your Social Security benefit amount depends on when you worked for the federal government.

If you worked for the federal government in 1983 or earlier, you did not pay Social Security taxes on your earnings, and your Social Security earnings record will not show those earnings. This is because the Civil Service Retirement System not Social Securityprovided retirement benefits for federal workers at the time.

A newer program called the Federal Employees Retirement System replaced CSRS. Workers who participate in FERS are eligible for Social Security.

you are covered under the Medicare program

Your CSRS pension could affect your Social Security benefit amount if you:

- Had less than 30 years of substantial earnings under Social Security.

Read Also: How Much Is Social Security Taxable

Federal Employees Pay Social Security Taxes

All federal employees hired in 1984 or later pay Social Security taxes. This includes the president, the vice president, and members of Congress. It also includes federal judges and most political appointees.

They all pay the same amount of Social Security taxes as people working in the private sector.

Can You Retire After 20 Years Of Service

Eligibility. I am eligible to retire at any age after completing 20 years of credible service. Read also : What does a GS 15 make in retirement?. You can still receive a service pension at the age of 62, even if you do not have 20 years of credible service.

How many years do you have to work to retire?

All those born in 1929 or later need 40 credits to be eligible for Social Security retirement benefits. Since you can earn 4 credits a year, you need at least 10 years of work that you submit to Social Security to be eligible for Social Security retirement benefits.

How much retirement do you get after 20 years?

| Years of service |

|---|

| 50% |

Read Also: How Much Is My Social Security Taxed

An Overview Of Federal Generosity Requirements For State And Local Retirement Plans

Until the 1950s, wages in the public sector were not subject to payroll taxes, and employees earned no Social Security credit for their time in government. A series of amendments to the Social Security Act, enacted beginning in 1951, allowed state and local governments to enroll some of their employees by establishing job-specific agreements with the Social Security Administration under Title II, Section 218 of the act, Voluntary Agreements for Coverage of State and Local Employees .2 The Omnibus Budget Reconciliation Act of 1990 ) mandated coverage for all state and local government employees who do not participate in their employer’s retirement plan. Because Section 218 at that time did not clarify the definition of an employer retirement system,OBRA 1990 also amended IRC Section 3121 to help government employers determine whether their employees were exempt from mandatory Social Security coverage. Specifically, IRC Section 3121 authorized the Secretary of the Treasury, in coordination with the SSA, to limit the definition of a retirement plan by setting minimum benefit requirements. IRC Section 3121 was meant to ensure that state and local government employees would be covered either by Social Security or by an employer-sponsored pension providing meaningful benefits comparable to those of Social Security .

Federal Employees Retirement System: Benefits And Financing

Most civilian federal employees who were hired before 1984 are covered by the Civil Service Retirement System . Federal employees hired in 1984 or later are covered by the Federal Employeesâ Retirement System . Both CSRS and FERS require participants to contribute toward the cost of their pensions through a payroll tax to the Civil Service Retirement and Disability Fund .

The Office of Personnel Management estimates CSRS to cost an amount equal to 36.6% of employee pay. Of this amount, the federal government pays 29.6% and employees pay 7.0%. CSRS employees do not pay Social Security taxes or earn Social Security benefits.

Effective beginning October 1, 2019, OPM estimates the FERS basic annuity to cost an amount equal to 16.8% of pay for employees first hired before 2013, 17.3% for employees first hired in 2013, and 17.5% for employees first hired in 2013 or later. Of this amount, for regular FERS employees first hired

before 2013, the federal government contributes 16.0% and employees pay the other 0.8%,

in 2013, the federal government contributes 14.2% and employees pay the remaining 3.1%, and

after 2013 the federal government contributes 14.4% and employees pay 4.4% going to pay down the CSRS unfunded liability).

All FERS employees contribute 6.2% of wages up to the Social Security taxable wage base to the Social Security trust fund.

Don’t Miss: How To Calculate Social Security Wages On W2

Public Service Loan Forgiveness Program

Through the Public Service Loan Forgiveness Program, the government forgives the remaining balance on eligible student loans for people who have worked in a public service job for at least 10 years.

To qualify, program applicants must have already made 120 monthly payments and be employed full time in AmeriCorps, the Peace Corps or another public service organization such as:

- The federal government or a state or local government.

- A public child or family service agency.

- A 501 nonprofit organization.

- A private organization that provides public safety, public interest law services, public health, law enforcement or another a public service.

Will State And Local Retirement Benefits Be Paid In The Future As Currently Promised

In the wake of the 2008 financial crisis, the aggregate funded ratio reported by state and local defined benefit plan sponsors declined from 86 percent to 72 percent, and the trust funds have yet to fully recover .28 Additionally, a handful of governments have persistently failed to make the actuarially required contributions to build a meaningful stock of assets. What might happen if a public pension exhausts the assets in its trust fund and reverts to pay-as-you-go status?

Moreover, Monahan argues that retirees may have little legal recourse even in states such as Illinois, where the state constitution grants strong pension rights. Of course, such constitutional protections exert strong political pressure on state legislatures to respect pension promises because the legal challenges to pension cuts would likely prove costly.

Chart 11 shows the distribution of defined benefit public plans by projected exhaustion dates under the two investment-return assumptions. Under either assumption, two plans for noncovered workers in Chicagothe Municipal Employees’ Annuity and Benefit Fund and the Policemen’s Annuity and Benefit Fundare projected to exhaust their assets by 2026 . Another six plans are projected to exhaust their trust funds by 2035 under both investment-return assumptions.31

Public Plans Database

Read Also: Social Security Office In Clarksville Tennessee

Information For Government Employees

Some federal employees and employees of state or local government agencies may be eligible for a pension based on earnings not covered by Social Security.

If you didn’t pay Social Security taxes on your government earnings and you are eligible for Social Security benefits, the formula used to figure your benefit amount may be reduced.

If you are eligible for Social Security benefits on your own record and a pension not covered by Social Security, the Windfall Elimination provision, or WEP may affect your benefits.

- The “How It Works” section of the Windfall Elimination Provision fact sheet explains the formula Social Security may use to compute your benefit amount.

- How the Windfall Elimination Provision Can Affect Your Social Security Benefit provides a chart to show how your benefit amount changes based on your years of substantial earnings and the year you became eligible for benefits.

- Use the WEP Online Calculator to calculate your estimated retirement or disability benefits.

Some government pensions do not affect your benefit amount when you apply on your own record.

You can find a table that lists the amount of substantial earnings for each year at the bottom of the second page of our Windfall Elimination Provision fact sheet.

If you are eligible for Social Security benefits on your spouse’s record, and a pension not covered by Social Security, the Government Pension Offset, or GPO, may affect your benefits.

Calculating Social Security Benefits According To Irc Section 3121

The first step in this calculation is to alter the worker’s earnings history by entering zero covered earnings for the years when the worker was not employed in the noncovered state or local job, regardless of actual earnings in those years.

The next step is to cap the altered earnings at the Social Security taxable maximum in any year when it may apply. To do this, the tax max in future years must be projected according to a legislated formula . The tax max formula depends on the Social Security AWI, which must also be projected:

Don’t Miss: Can I Go To Any Social Security Office