Don’t Want Your Social Security Check Going Into State Coffers Consider Retiring In One Of These States

Stretching a Social Security check far enough to cover basic expenses is a huge challenge for many retirees. According to the Senior Citizens League, Social Security benefits buy approximately 30% less today than they did in 2000. The reason? Senior households spend a disproportionate share of their budgets on things like healthcare and housing, which rise at a much faster pace than the inflation rate that determines cost-of-living adjustments.

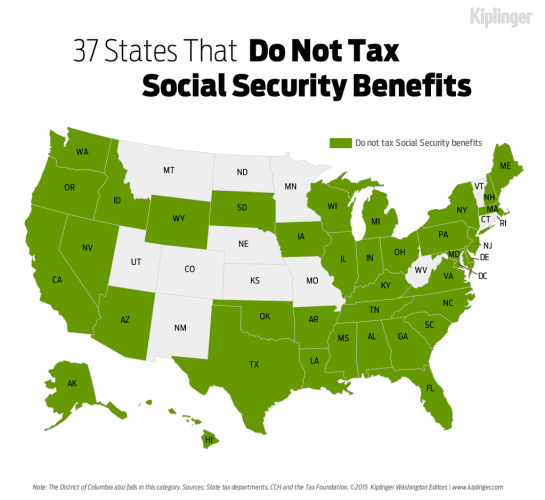

If Social Security will make up a significant part of your retirement income, the last thing you want is to fork over part of your benefit for state taxes. Fortunately, 38 states and the District of Columbia won’t touch your benefits.

Image source: Getty Images.

How Can I Avoid Paying Tax On My Pension

The way to avoid paying too much tax on your pension income is to aim to take only the amount you need in each tax year. Put simply, the lower you can keep your income, the less tax you will pay. Of course, you should take as much income as you need to live comfortably.

Do Senior Citizens Have To File Pa State Taxes

While seniors are exempt from pension and Social Security taxes in PA, the federal government may still tax this income. As of 2018, retirees who file individual tax returns must pay taxes if they receive more than $25,000 in total pensions and other income plus one-half of Social Security benefits each year.

Recommended Reading: Someone Stole My Social Security Number

Rep Frank Ryan Introduced The 314

Sam Dunklau / WITF

State Rep. Frank Ryan speaks at a meeting of the House State Government committee on Jan 10, 2022.

A state lawmaker has come up with a revised version of a plan he first introduced three years ago that would not only eliminate school property taxes but would make it illegal for a Pennsylvania school district to impose one.

Sam Dunklau / WITF

State Rep. Frank Ryan speaks at a meeting of the House State Government committee on Jan 10, 2022.

Of course, the plan calls for some tax shifting to generate the $16 billion needed to replace the lost property tax revenue for schools. It also includes new taxes on certain retirement income and food and clothing.

Rep. Frank Ryan, R-Lebanon County, on Thursday unveiled his a 314-page House Bill 13 that is the product of five years of work and pulls in the expertise of a bipartisan working group of property tax elimination advocates.

Everybody wants to get rid of property taxes as long as the other person is the one who is going to pay the replacement tax, Ryan said at a Capitol news conference flanked by members of his working group. It is clear that any solution will require sacrifice on the part of all Pennsylvanians.

His plan tries to spread that burden around. It would:

Ryan acknowledges applying the tax on retirement income makes the sales pitch for his plan a tough pill to swallow, but said he believes Pennsylvanians will face that eventuality anyway.

Is Social Security Disability Taxed In Pennsylvania

In Pennsylvania, a person is able to apply for Social Security disability benefits if he is out of work for long periods of time or permanently Residents in Pennsylvania are part of the 5,603,669 beneficiaries receiving Socials Security benefits in the Philadelphia Region which also includes West Virginia, Virginia, Maryland, Delaware and Washington, D.C. The Internal Revenue Service taxes SSA disability payments received by Pennsylvania beneficiaries based on household income.

Also Check: What Age Do You Receive Social Security

What Makes Pennsylvania The Best Place To Retire In

Yes, Pennsylvania offers many advantages to retirees making it the absolute best state to retire in. At almost 45 thousand square miles, Pennsylvania is one of the largest states in the country. It is also home to cities like Lancaster, Lebanan, Hershey, and Harrisburg which consistently rank in the best places to retire lists. Several other cities in the Keystone State also made the list.

Approximately 15.4 percent of Pennsylvanias population is 65 years old or older and it is home to more than 870,000 veterans. The VA Medical Center in Lebanon County, PA, located near Cornwall Manor Retirement Community, is consistently ranked as one of the best veterans health care facilities in the country. Pennsylvania is also home to 249 retirement communities.

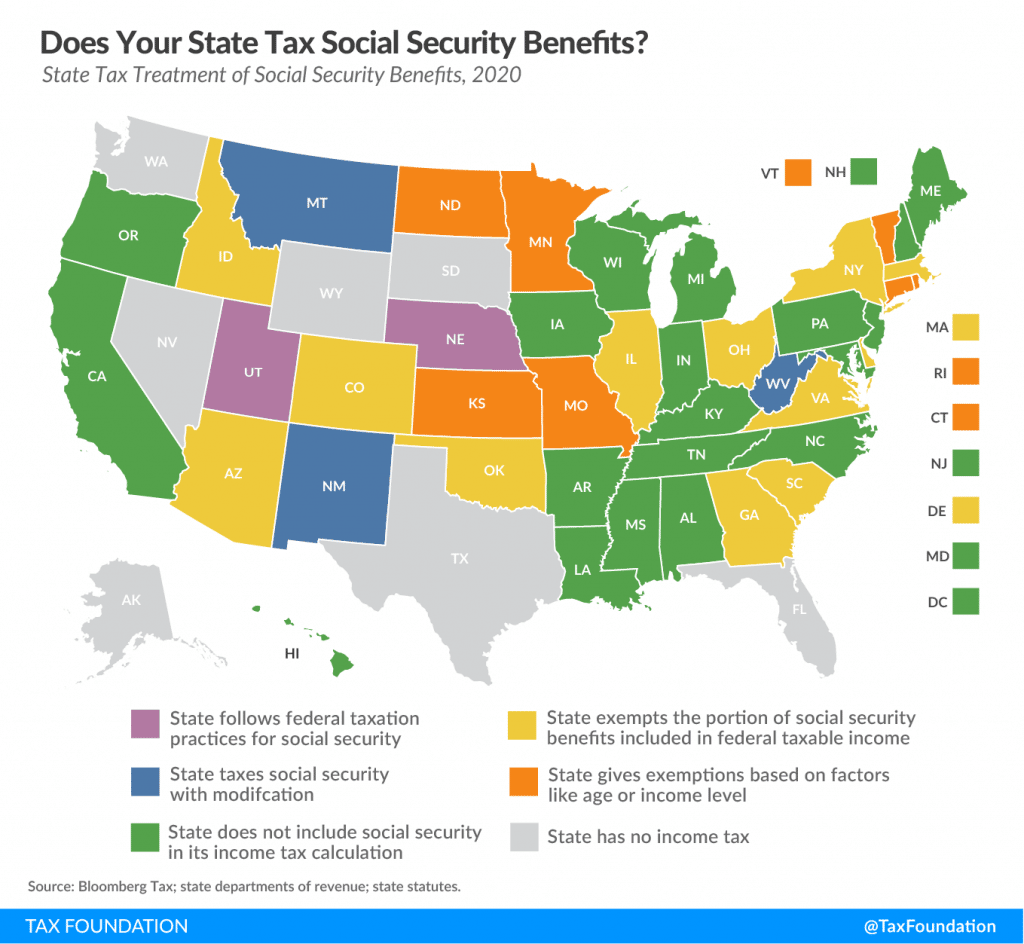

These 38 States Won’t Touch Your Social Security

If you live in one of these 38 states or the District of Columbia, you won’t have to worry about state Social Security taxes. Nine of these states don’t have state income taxes: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming . In the other states, Social Security benefits aren’t considered taxable income.

That doesn’t mean, however, you’ll avoid taxes altogether on your Social Security checks. Benefits are still taxable at the federal level if your income exceeds certain thresholds.

For single filers with incomes between $25,000 and $34,000, up to 50% of benefits are taxable. Up to 85% of your benefit is taxable if you’re a single filer whose income is greater than $34,000.

Up to 50% of benefits are taxable for married couples filing a joint return who have a combined income between $32,000 and $44,000. Up to 85% of benefits are taxable for couples whose combined income exceeds $44,000.

You May Like: Hours Of Operation For Social Security Office

Social Security In The Midwest

Out in the Midwest, only seven of 12 states are free of Social Security taxes. South Dakota doesn’t have an income tax. Meanwhile, Illinois, Indiana, Iowa, Michigan, Ohio, and Wisconsin have full state income tax protection for those receiving Social Security benefits.

On the other hand, Kansas, Minnesota, Missouri, Nebraska, and North Dakota tax Social Security in varying degrees. Minnesota and North Dakota are notable for following the federal rules on taxation.

What Is The Retirement Age In Pa For State Employees

Pennsylvanias statewide State Employees Retirement System, or SERS, is one of the oldest and largest retirement plans for state employees in the country. When the state first hires an employee or when they get close to retirement age, they have lots of decisions to make about their retirement benefits, including at what age they wish to retire.

The SERS normal retirement age is 65, 60, 55 or 50 years of age, depending on what class of service you were in. A SERS employees class of service is determined by when they became a member and the type of work that they did. The annual pension for SERS members is calculated with a formula that includes a few variables about your service as a state employee, including:

- Class of service

Don’t Miss: Social Security Office In Vidalia

Do I Have To Pay Pa Income Tax On Social Security Payments And Disbursement From My Retirement Annuity

Generally, No

Pennsylvania does not tax social security and does NOT tax most types of retirement income as long as “you retired AFTER meeting the eligibility requirements for separation from service by retirement based on old age, infirmity, long-continued service, or a combination of old age and infirmity and long continued years of service.”PARetirement

Eligibility Requirement For Pennsylvania Residents

Being accepted for disability coverage, applicants must have worked the required number of years according to the age younger disabled workers do not have to work as many years as older applicants. They must have also paid into Social Security while working. The applicants disabilities must prevent them from working for more than a year SSA doesnt cover partial or short-term disabilities. They must not be able to do their regular jobs or adjust to any other type of employment as well.

Don’t Miss: How Long Does It Take To Get Social Security Benefits

Taxable Social Security Benefits

Say your Social Security benefits are taxable based on your combined income. The amount of tax you pay depends on your level of income. Specifically, the difference between your combined income and the IRS base amount .

Youll never pay taxes on more than 85% of your Social Security benefits.

Iowa used to assess taxes on benefits, but it phased the taxes out completely in 2014, while New Mexico exempts some benefits for beneficiaries age 65 and over. These states tax Social Security benefits with varying methods, which can include using adjusted gross income or other figures.

Social Security Administration. Retirement Benefits, Page 2.

Dont Miss: Do You Have To Pay Taxes On Unemployment In California

Does Pa Tax 401k Distributions

-

At the state level, 401k distributions are generally not taxable in Pennsylvania. The same exception stated above for IRA accounts applies to 401k accounts as well.

-

Distributions from pre-tax 401k accounts are generally taxable at the federal level. Roth 401k distributions up to the amount you contributed are tax-free, and distributions of earnings are also tax-free as long as 5 years have passed since the first Roth 401k contribution was made.

-

Joe took $10,000 out of his pre-tax 401k account this year. This $10,000 is not taxable for PA state income tax purposes, but it is still taxable federally.

Recommended Reading: Social Security Office In Jackson Tennessee

Senior Citizens In Pennsylvania May Qualify For Property Tax Or Rent Rebate

People over the age of 65, widows and widowers over the age of 50, and people with disabilities over the age of 18 are eligible for the Property Tax/Rent Rebate program in Pennsylvania. Individuals may only earn $35,000 per year for homeowners and $15,000 for renters. Senior citizens in Pennsylvania may be eligible for a property tax rebate if they meet certain requirements. The first and most important requirement is that they be at least 65 years old. It is also available to people over the age of 50, as well as people with disabilities 18 and older. If you are 65 or older, widowed or divorced, or have a disability 18 or older, you may be eligible for a property tax or rent rebate. Visit the Pennsylvania Department of Revenue website if you are eligible for free tax preparation. In the following year, the tax return deadline for property taxes and rent is April 1.

What County In Pennsylvania Has The Lowest Property Taxes

Bedford CountyBedford County has some of the lowest property taxes in PA, with a mill rate of three for the county and school district millage rates ranging from around eight to just over 11. Sullivan County. Property taxes in Sullivan County are also among the lowest in PA, with an effective tax rate around 1.46%.

Also Check: What Is The Tax Rate In Tennessee

Don’t Miss: How Long Does It Take To Apply For Social Security

State Taxes On Social Security Benefits

Everything weve discussed above is about your federal income taxes. Depending on where you live, you may also have to pay state income taxes.

There are 12 states that collect taxes on at least some Social Security income. Two of those states follow the same taxation rules as the federal government. So if you live in one of those two states then you will pay the states regular income tax rates on all of your taxable benefits .

The other states also follow the federal rules but offer deductions or exemptions based on your age or income. So in those nine states, you likely wont pay tax on the full taxable amount.

The other 38 states do not tax Social Security income.

| State Taxes on Social Security Benefits | |

| Taxed According to Federal Rules | Minnesota, Utah |

Overview Of Pennsylvania Retirement Tax Friendliness

Pennsylvania fully exempts all income from Social Security, as well as payments from retirement accounts, like 401s and IRAs. It also exempts pension income for seniors age 60 or older. While its property tax rates are higher than average, the average total sales tax rate is among the 20 lowest in the country.

To find a financial advisorwho serves your area, try our free online matching tool.

| Annual Social Security Income |

| Annual Income from Private PensionDismiss | Annual Income from Public PensionDismiss |

| Your Tax Breakdown |

| is toward retirees. |

| Social Security income is taxed. |

| Withdrawals from retirement accounts are taxed. |

| Wages are taxed at normal rates, and your marginal state tax rate is %. |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

Read Also: One Becomes Eligible For Social Security Disability

No Matter How You File Block Has Your Back

Are Other Forms Of Retirement Income Taxable In Pennsylvania

For most retirees and all seniors, income from retirement accounts, which includes 401s and IRAs, is fully exempt. Income from pensions is also exempt for anyone who is more than 59.5 years old.

So, hypothetically, let’s say you are 65 and receive $15,000 annually in Social Security retirement benefits, $10,000 in pension income and another $20,000 from your IRA. You will not have to pay state taxes on your income in Pennsylvania. Keep in mind, however, that you may have to pay federal taxes.

Recommended Reading: Social Security Office In Puyallup

How High Are Sales Taxes In Pennsylvania

The statewide sales tax rate is 6%, which is relatively high. Only two local governments have their own sales taxes in Pennsylvania. Philadelphia County has an additional 2% rate and Allegheny County has an additional 1% rate. Elsewhere in the state, the rate is 6%.

Additionally, retirees in Pennsylvania benefit from a number of exemptions on common products. Clothing, groceries, prescription drugs and residential fuels are all exempt from the Pennsylvania sales tax.

Delaware Resident Working Out Of State

Q. Im considering taking a job in Maryland. I know the states do not have a reciprocal agreement. How does the credit work for taxes paid to another state? Will I owe County taxes in MD?

A. If you are a resident of Delaware who works in Maryland, you may take credit on line 10 of the Delaware return for taxes imposed by other states. You must attach a signed copy of your Maryland return in order to take this credit.

Even though you may not be liable for Maryland County Taxes, Maryland imposes a Special Non-resident tax on their non-resident income tax return.

Read Also: Social Security Administration Springfield Mo

What Is The Homestead Exemption In Pennsylvania

The Homestead Exemption reduces the taxable portion of your propertys assessed value. With this exemption, the assessed value of the property is reduced by $45,000. Most homeowners will save $629 a year on their Real Estate Tax bill. Once we accept your application, you never have to reapply for the exemption.

Dont Miss: How Much Taxes Deducted From Paycheck Ct

Does Pennsylvania Tax Your Pension And Social Security

Retirement income is not taxable: Payments from retirement accounts like 401s and IRAs are tax exempt. PA also does not tax income from pensions for residents aged 60 and over. Social Security income is not taxable: Just like with a pension, in Pennsylvania, Social Security is tax exempt.

Recommended Reading: Social Security Office On Buffalo

Is Pennsylvania Tax

Pennsylvania exempts all forms of retirement income from taxation for residents 60 and older. That can mean thousands of dollars in annual savings as compared with other states in the region. It also has relatively low sales taxes.

Some ways in which Pennsylvania is not quite so retirement tax-friendly: It has an inheritance tax, and property taxes are higher than average.

How The Math Works

The math works like this:

- If your wages were less than $137,700 in 2020, multiply your earnings by 6.2% to arrive at the amount you and your employer must each pay for a total of 12.4%. If you were self-employed, multiply your earnings up to this limit by 12.4% to calculate the Social Security portion of your self-employment tax.

- If your wages were more than $137,700 in 2020, multiply $137,700 by 6.2% to arrive at the amount you and your employer must each pay. Anything you earned over this threshold is exempt from Social Security tax. You would do the same but multiply by 12.4% if youre self-employed.

For taxes due in 2021, refer to the Social Security income maximum of $137,700 as youre filing for the 2020 tax year.

You May Like: Social Security Office Muskogee Ok