Ssdi And Ssi Combined Disability Payment Schedule

Sometimes, you can receive both SSDI and SSI payments. You may have earned enough credits for SSDI. You may also meet the financial requirements for SSI. However, you must get approved medically for SSDI but receive low monthly payments to receive concurrent benefits. Social Security sends payments for both SSDI and SSI on the third day of the month.

Payment Schedule For Ssi Benefits

SSI monthly benefit payments are paid on the 1st day of each month. If the 1st is a Saturday, Sunday, or holiday, then you will receive the monthly benefits on the earliest previous working day. Heres the SSI payment schedule for 2023-

Contact an experienced SSD lawyer today

Clauson Law boasts of a capable team of disability lawyers who are out there to get you the disability benefits that you are entitled to receive. We are not just a law firm, and we want to do everything possible to help you with your disability. Contact us today to talk to an experienced disability lawyer about your claim and start fighting for the benefits you deserve.

About Author

Clauson

Clauson Law has focused on representing the injured and disabled for over 10 years. We have handled thousands of cases. Each client is important to us and has a unique situation.

What Are The Maximum Social Security Disability Benefits

The monthly benefits issued for 2022 include:

- The current maximum Supplemental Security Income for an individual is $841 per month.

- The current maximum amount for Social Security Disability Insurance benefits is $3,148 per month.

- The average disability payment for a disabled worker receiving SSDI is $1,358 per month.

Also Check: Social Security Earnings Limit 2021

Ssd Payments And Schedule

The inability to work due to a disability can place a significant financial strain on an individual and their family. Social Security Disability benefits offer relief for those who qualify. If you have applied for benefits or are considering doing so, you might want to know how much you can expect to receive with each payment and when you can expect your SSD payments to begin.

The caring attorneys at Disability Law Group can help you understand the SSD payment schedule for benefits and calculate what you will receive. Our law firm works exclusively with individuals with conditions that prevent them from working. We can help you pursue the benefits you deserve. Whether this is your first time seeking benefits or youre planning to appeal a denial, our lawyers can guide you through this often-confusing process.

Contact our Social Security Disability lawyers in Michigan today to get started with a free consultation.

Can Social Security Take Away My Ssdi Benefits

Yes, you can lose your disability benefits if your condition improves to the point that you no longer meet the SSAs definition of disabled.

For your benefits to be taken away, the SSA must show there has been medical improvement related to your ability to work before they can cut your SSDI benefit payments.

Recommended Reading: Does Workers’ Comp Affect Social Security Retirement Benefits

Understanding The Social Security Disability System

Social Security is formally called the Old Age, Survivors, and Disability Insurance program. It provides monthly benefit payments to qualified workers and their dependents. Eligibility and benefit amounts for the Social Security programs are based on the number of years for which the applicant worked, and the amount deposited into Social Security over those years. While Social Security includes different kinds of benefits, Social Security Disability includes two programs administered by the SSA-

What Is Supplemental Security Income

Supplemental Security Income is a federal program that pays monthly benefits to low-income aged, blind and disabled individuals. The Social Security Administration runs the program, which is financed from general tax revenues, not from Social Security taxes. The SSI test of disability for adult applicants is the same as the test in the Social Security disability insurance program. Only people who have low incomes and limited financial assets are eligible for SSI. The federal SSI payment in 2017 for an individual with no other countable income is $735 a month. Payments are reduced as other income rises, and some states supplement the federal payment. Each month on average in 2016, 8.3 million low-income adults received SSI. These beneficiaries included 4.8 million adults under age 65 who were eligible based on disability or blindness and 2.2 million adults aged 65 and older. In addition, 1.3 million children under age 18 receive SSI based on disability or blindness.

You May Like: Calculate Social Security Retirement Benefits

I Got My First Benefit Payment Why Wasnt I Paid For The First Seven Days

The first seven days of every new claim is a non-payable waiting period. The first payable day is the eighth day of your claim. Review the step-by-step overview for the DI Claim Process to learn more.

The Governors Executive Order N-25-20, signed March 12, 2020, waives the one-week unpaid waiting period for COVID-related DI claims with a start date of January 24, 2020, through September 30, 2021. You can collect DI benefits for the first week you are out of work.

Note: The Governors Executive Order N-08-21, signed June 11, 2021, returns the requirement to serve the one-week unpaid waiting period for COVID-related DI claims with a start date on or after October 1, 2021. You can collect DI benefits starting on the eighth day you are out of work.

If you are eligible, the EDD processes and issues payments within a few weeks of receiving a claim.

Waiting For Benefits Payments After Approval

If you got a letter from the Social Security Administration notifying you that your application for SSD was approved, you may be wondering when your first benefits check will arrive.

According to the SSA, once your application is approved, it can take six months from the approval date for you to receive your first payment. However, in our experience, the SSA usually processes your benefits much faster than that. Delays can occasionally occur, however. For example, if you received Workers Compensation for an injury, you will need to submit your documentation to the SSA for review, which can delay the arrival of your first SSD payment.

Also Check: Calculate Spousal Social Security Benefits

Benefits For People With Disabilities

The Social Security and Supplemental Security Income disability programs are the largest of several Federal programs that provide assistance to people with disabilities. While these two programs are different in many ways, both are administered by the Social Security Administration and only individuals who have a disability and meet medical criteria may qualify for benefits under either program.

Social Security Disability Insurance pays benefits to you and certain members of your family if you are “insured,” meaning that you worked long enough and paid Social Security taxes.

pays benefits based on financial need.

When you apply for either program, we will collect medical and other information from you and make a decision about whether or not you meet Social Security’s definition of disability. Periodically, we will need updated information about your condition. You may receive a Disability Update Report . This form can now be completed online.

Use the Benefits Eligibility Screening Tool to find out which programs may be able to pay you benefits.

If your application has recently been denied, the Internet Appeal is a starting point to request a review of our decision about your eligibility for disability benefits.

If your application is denied for:

If You Receive Benefits As:

- A retired or disabled worker, the payment day will be determined by your own date of birth.

- A spouse, the payment day will be determined by your spouses date of birth.

- A survivor, the payment day will be determined by your parents/spouses date of birth.

- A retired or disabled worker and as a spouse, the payment day will be determined by the date of birth of the beneficiary of the benefit first received.

Beneficiaries receiving benefits prior to May 1997 will have a payment date of the third of the month

Beneficiaries receiving both Social Security benefits and SSI payments will have a payment date of the third of the month.

Beneficiaries paid on the third of the month can, under certain circumstances, volunteer to change their payment date but will not be able to choose the payment day. The birth date will determine the new payment day. The decision to volunteer for cycling is permanent but the payment cycle could change if entitlement on a new record occurs.

Read Also: Nearest Social Security Office To Me

What Are Social Security Disability Benefits

Social Security disability benefits come from payroll deductions required by the Federal Insurance Contributions Act to cover the cost of Social Security benefits, such as retirement and spousal and survivor benefits. Some of this funding goes into the Disability Insurance Trust Fund and pays for disability benefits.

According to the Social Security website, to qualify for Social Security disability benefits, you must have worked a certain length of time in jobs covered by Social Security. Generally, you need 40 credits, 20 of which were earned in the past 10 years, ending with the year you became disabled. You must also have a medical condition that meets Social Securitys definition of disability.

Younger workers might qualify with fewer credits.

SSDI should not be confused with Supplemental Security Income , which pays benefits to those who have financial needs regardless of their work history. Although these two names sound similar, the qualifications to get the payments and what you might receive are very different.

How To Calculate Social Security Ssdi Benefits

To qualify for Social Security Disability Insurance benefits, you must have worked a minimum of five years within ten years, paying taxes into Social Security. You will not qualify for this benefit if you have not worked the equivalent of five full-time years or you have not paid into the system.

SSDI can get complicated. Two important questions when looking at SSDI benefits are:

Note: Just like any other insurance, you will eventually stop being insured once you stop paying for it.

Any disability insurance you qualify for through working and paying into the system will typically lapse five years after you stop working. To be eligible for DIB, you must prove you met the rules of disability before your disability insurance lapses. These timeframes are calculated for each individual based on their specific work history.

Social Security uses a formula to determine how much you should receive as your monthly SSDI benefit. SSDI payments average is $1,358 per month. The SSA has an online benefits calculator that you can use to estimate your monthly benefits.

The monthly SSDI you receive is based on your lifetime earnings paid into Social Security taxes. Social Security uses your average indexed monthly earnings or AIME to begin the process of calculating your monthly benefit.

There are several options on how you can find out what your PIA is from SSA:

Also Check: Social Security Office In Poteau Oklahoma

How Do You Calculate What My Weekly Benefit Amount For Disability Insurance Will Be

We will calculate your weekly benefit amount using a base period. This base period covers 12 months and is divided into four consecutive quarters of three months each.

Your weekly benefit amount is about 60 to 70 percent of wages earned 5 to 18 months before your claim start date, up to the maximum weekly benefit amount. You must have been paying SDI taxes on these wages . Your base period does not include wages paid at the time your disability begins.

You can get a general estimate of your weekly benefit amount using our Weekly Benefit Calculator. This calculator should be used as an estimate only.

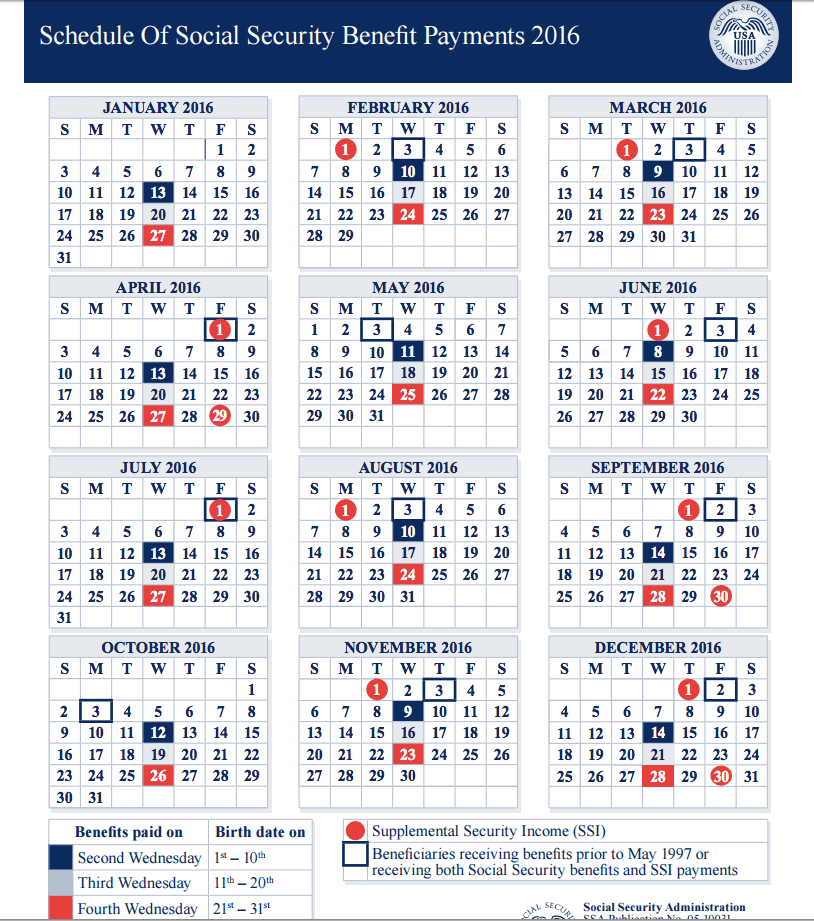

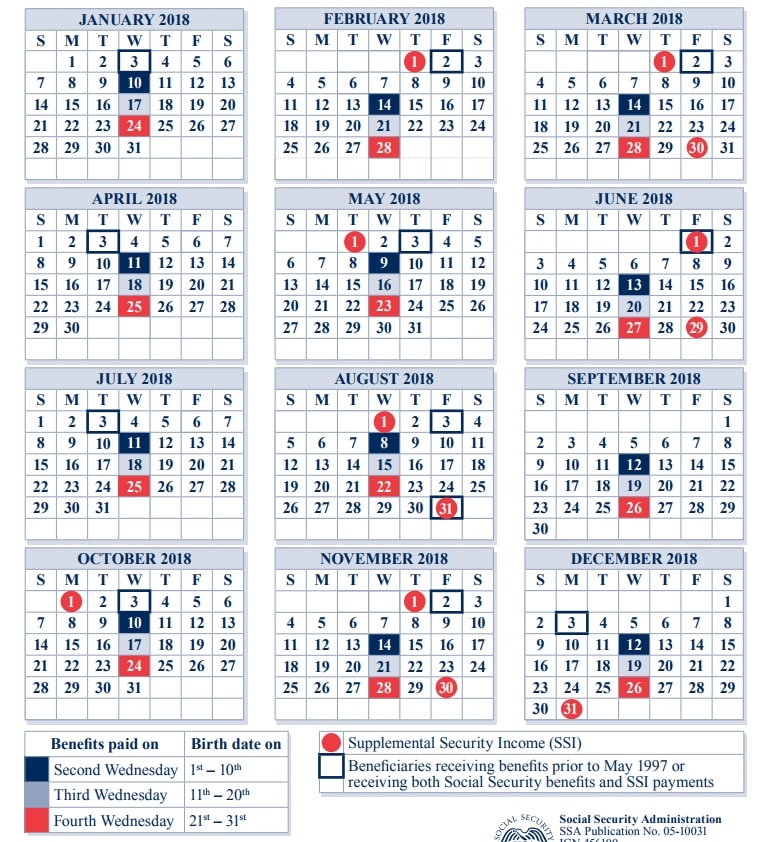

Social Security Benefit Payments Schedule 2023

The Social Security Administration provides monthly benefits to retired Americans, disabled workers, and survivor spouses. If you worked during the course of your life and paid into the social security system, you will be eligible to apply to receive Social Security Disability Insurance benefits following a disabling illness or injury. Supplemental Security Income , on the other hand, is a needs-based, cash assistance program that assists those who are disabled, elderly , or blind. Unlike the SSDI, an applicant for SSI need not have paid into the Social Security system. To be eligible, the applicant must have little to no income or assets.

If you are eligible under a Social Security Disability program, you will get your disability benefits in the form of monthly lump sum payments. The payment dates for Social Security benefits are pre-determined by the Social Security Administration. Depending on the Social Security program for which you are eligible, you will get monthly benefits either on the basis of your date of birth or on a particular day of the month fixed by the Social Security Administration.

Recommended Reading: Social Security Office San Angelo

The 2021 Social Security Payment Schedule

Social Security checks are deposited on the second, third, or fourth Wednesday of each month, depending on your day of birth. The Social Security check schedule works as follows:

- If your birthday is from the 1st to the 10th, you will receive your payment on the second Wednesday of each month.

- If you were born between the 11th and the 20th, your benefits will arrive on the third Wednesday of the month.

- If your birthday is from the 21st to the end of the month, youll receive your benefits payment on the fourth Wednesday of each month.

How Much Is The Disability Benefit

The disability benefit is linked through a formula to a workers earnings before he or she became disabled. The following figures show how the disability insurance benefits compare to prior earnings for a worker who became eligible for benefits in 2014 at age 55.

| Earnings Before Disability | Annual DI Benefit |

|---|---|

| 26% |

*Average indexed earnings

The average benefit paid to disabled workers in June 2017 was $1,172 a month or about $14,064 a year.

Recommended Reading: Social Security Office In Fayetteville Nc

Social Security Schedule: When November 2022 Benefits Will Be Sent

Social Security recipients only have a couple more months left to gut it out with 2022 payments before they can look forward to much bigger checks next year. Earlier this month, the Social Security Administration announced that the 2023 cost-of-living adjustment will be 8.7% the biggest boost in 41 years.

Find: 5 Things You Must Do When Your Savings Reach $50,000

When you get your November 2022 payment, however, it will still reflect this years 5.9% COLA an adjustment that has done little to help seniors deal with an inflation rate that has been running above 8%.

As usual, Social Security payments in November will be made according to the same monthly schedule, with payments going out on the second, third and fourth Wednesdays of the month. Heres a quick rundown:

-

If your birth date is on the 1st-10th of the month, your payment will be distributed on Wednesday, Nov. 9.

-

If your birth date is on the 11th-20th, your payment will be distributed on Wednesday, Nov. 16.

-

If your birth date is on the 21st-31st, your payment will be distributed on Wednesday, Nov. 23.

If you dont receive your payment on the expected date, the SSA advises allowing three additional mailing days before contacting Social Security.

Explore: How Social Security Benefits Are Impacted at Every Age From 62 to 70

More From GOBankingRates

For Some Seniors The 2023 Cola Still Might Be Enough

The 2023 COLA will give seniors an average added benefit of $144 for individuals and $240 for couples filing jointly. Even though thats the highest increase in more than four decades, some senior advocates say it might not be enough for beneficiaries already struggling to keep up with inflation.

For example, the latest Consumer Price Index data shows that food prices have risen 11.4% over the previous year. Gasoline prices are up 18.2% over the same period, heating oil is up 58.1%, natural gas has risen 33.1% and electricity is up 15.5%. Given these increases, a COLA of 8.7% still lags well behind. The wild card is when prices will finally start coming down.

Also Check: Social Security Office Columbia Sc

How To Report Misuse Of Your Social Security Number

The Federal Trade Commission , the nations consumer protection agency, recommends that you take the following steps if you think someone is misusing your social security number:

Step 1: Fraud AlertPlace a fraud alert on your credit file by contacting one of the three companies:Equifax 1-800-525-6285 / Trans Union 1-800-680-7289 / Experian 1-888-397-3742. The credit agency you contact then will contact the other two, the alert is put on your credit report.

Step 2: Review Credit ReportReview your credit report for suspicious inquiries, accounts or debts that you cannot explain.

Step 3: Close Accounts

Ways To Receive Your Ssd And Ssi Payments

There are numerous ways that you can receive your SSD and SSI payments each month, including:

- Direct deposit to your bank account

- Direct Express Card, a swipe-able debit card that many people use to receive federal benefits such as SSD and SSI each month

- Electronic Transfer Account , which is an alternative bank account that federal benefit recipients use to receive payments when they dont have a checking or savings account

You can also receive your monthly benefit payments by check, which is sent through the mail. However, if youre able to receive your payments via electronic means, that is preferable since your check could get lost or stolen in transit.

You May Like: Social Security Office In Bronx

Social Security Payment Schedule

For most people collecting Social Security benefitswhether retirement, disability, and/or survivors benefitsthe date on which they receive those benefits depends on their birthday. With a staggered payment schedule, the government can spread payments out during the course of an entire month, rather than paying them out to every recipient at the same time each month.

63 million Americans receive some kind of Social Security benefits, and for many seniors especially, these benefits comprise their primary source of income therefore, knowing exactly when you will receive your payments can help you plan your expenses for the month.

If you started collecting benefits prior to May 1997 or if you are receiving both Social Security Disability Insurance and Supplemental Security Income benefits concurrently, your benefits are paid on the third day of every month, unless the third falls on a holiday or weekend, in which case it will be received the business day before. In 2021, you will receive benefits on the following days : February 3 March 3 April 2 May 3 June 3 July 2 August 3 September 3 October 1 November 3 and December 3.

If your birthday falls between the 11th and 20th, you will receive your benefits on the third Wednesday of every month. For 2021, you will receive payments on the following days: January 20 February 17 March 17 April 21 May 19 June 16 July 21 August 18 September 15 October 20 November 17 and December 15.

Need Help?