What To Do After You’ve Received A Denial

The first thing you’ll want to do is file a request for reconsideration. This means that you’re asking a different disability claims examiner to look at your application and decide if the first decision was correct.

Social Security doesn’t often find that claims examiners have made mistakes at the initial stage. To increase your chances of getting awarded at reconsideration, it helps to provide the agency with information that addresses why you were initially denied. For example, if you received a technical denial because the agency found you were over the resource limit for SSI, you could submit a recent bank statement with your appeal. Or, if you were denied because Social Security didn’t think you had enough medical evidence, try to set up an appointment with your doctor.

You can start your appeal in any of the following ways:

- Go online at www.ssa.gov/benefits/disability/appeal.html.

- Send your request by mail, using the Request for Reconsideration form and a Disability Report Appeal .

- Go in person to your local Social Security field office. You can locate your field office here.

Do You Plan To Continue Working In Your 60s

Working in your 60s will help you maximize your income and savings.

Your benefits are based on your highest 35 years of earnings. Each year of work can add higher earnings to your record by replacing years with low earnings such as those when you were a student, were unemployed, or took time off to care for someone. When you work and wait to claim until age 70, you can increase your monthly benefit by more than 75 percent! Working in your 60s also gives you more time to save on your own for retirement.Review your earnings record on my SocialSecurity.

Working in your 60s will help you maximize your income and savings.

Your benefits are based on your highest 35 years of earnings. Each year of work can add higher earnings to your record by replacing years with low earnings such as those when you were a student, were unemployed, or took time off to care for someone. When you work and wait to claim until age 70, you can increase your monthly benefit by more than 75 percent! Working in your 60s also gives you more time to save on your own for retirement.Review your earnings record on my SocialSecurity.

You can maximize your benefits even if you work fewer hours or stop working.

You can maximize your benefits even if you work fewer hours or stop working.

Consider working in your 60s for an extra boost to your income and savings.

Consider working extra years in your 60s for an extra boost to your income and savings

Whats Your Life Expectancy

No one knows how long theyll live, but part of deciding when to start Social Security requires making a guess about this. Why does it matter? If youre age 62, you’re basically healthy, and longevity runs in your family, you might wait until full retirement age or even age 70 to start, so you can maximize your benefits.

On the other hand, if youre 62 and have health issues you think may shorten your life, you could decide to claim benefits as soon as possible, thinking you wont have as many years to receive them.

A client of mine decided to start his retirement benefits at age 66, says Fuehrmeyer. He recently had a liver transplant and believes he has a life expectancy of eight to 10 years. For him, it made sense to start his benefits at full retirement age.

A client of Roses, Jerry McGee, from White Lake, Wisconsin, was diagnosed with distal muscular dystrophy when he was 62. He chose to start benefits soon after because he was finding it hard to work. His wife, Laurie, retired a couple of years later. Since then, theyve focused on enjoying these years, spending time with family, and traveling and sightseeing around their region in a convertible they purchased.

Its not just about how long you live, says McGee. Its also about how long you have quality of life.

The goal for timing is to maximize the amount of retirement benefits you can get, minimize your tax liability, and meet your needs. Thats different for everyone.

Recommended Reading: Social Security Office In Murfreesboro Tn

Theres An Annual Social Security Cost

One of the best features of Social Security benefits is that the government adjusts the benefits each year based on inflation. This is called a cost-of-living adjustment, or COLA, and helps your payments keep up with increasing living expenses. The Social Security COLA is significant. Its the equivalent of buying inflation protection on a private annuity, which can get expensive.

Because the COLA is calculated based on changes in a federal consumer price index, the size of the COLA depends largely on broad inflation levels determined by the government . In 2023, Social Security beneficiaries will likely see a 9.7% COLA in their monthly Social Security benefits, the biggest increase since 1981. The COLA for 2023 will be announced on October 13.

Heres what COLAs have been in other recent years:

Should I Claim Early Because The Trust Funds Are Running Low

Recent research from the University of Pennsylvania’s Wharton School found that Social Security’s trust funds could run dry four years earlier due to the coronavirus pandemic.

That would push the date they are projected to run out to 2032 rather than 2036.

However, that does not mean that at that point there would be no benefits at all. The Social Security Administration’s most recent estimate pegs the depletion date at 2035, at which point 79% of promised benefits will be payable.

To anticipate those changes, people should try to save more toward retirement,said Kent Smetters, faculty director of the Penn Wharton Budget Model, a nonpartisan research organization at the school.

Don’t Miss: Social Security Office St Louis

How The Cola Is Tied To Inflation

The COLA applies to about 70 million Social Security and Supplemental Security Income beneficiaries.

The change is based on the Consumer Price Index for Urban Wage Earners and Clerical Workers, or CPI-W.

The SSA calculates the annual COLA by measuring the change in the CPI-W from the third quarter of the preceding year to the third quarter of the current year.

Benefits do not necessarily go up every year. While there was a record 5.8% increase in 2009, the following two years had 0% increases.

“For seniors, because they spend so much on health care, those years were difficult,” Adcock said.

A similar pattern may happen if the economy goes into a recession, according to Johnson.

Administrative Law Judge Hearing

If the reconsideration doesnt go your way, you can request a hearing in front of an administrative law judge. This hearing typically goes by fairly fast, often taking no more than an hour in total, and its typically located within 75 miles of your home, but often closer. Its best to have a lawyer with you at this point if you dont already. While these hearings are far more informal than a typical court hearing, a lawyer will still know the process inside, what evidence to present, and how best to present it.

You May Like: Social Security Office In Brooklyn

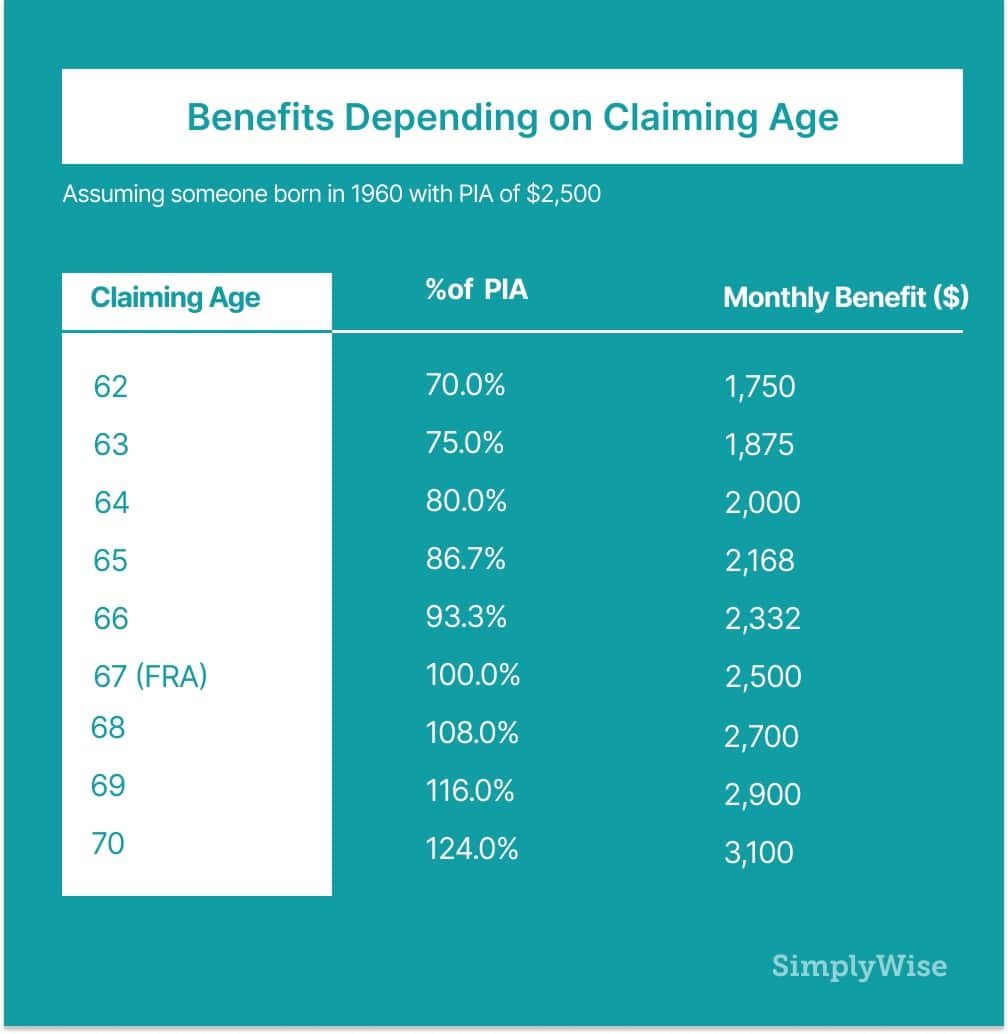

How Does Full Retirement Age Affect Your Social Security Benefits

If you claim your benefits at full retirement age, you will receive your standard Social Security benefit amount. If you claim prior to FRA, you will be subject to early filing penalties that reduce your benefit by the following amounts:

- 5/9 of 1% for each of the first 36 months before FRA

- 5/12 of 1% for each subsequent month before FRA

This amounts to a 6.7% annual reduction for each of the first three years and an additional 5% reduction for each following year before FRA. If you claim benefits at 62 with an FRA of 67, you will face a full 30% reduction in benefits.

By contrast, if you claim benefits after FRA, you receive delayed retirement credits valued at 2/3 of 1% per month. This results in an 8% annual increase to your monthly benefit. Delayed retirement credits can be earned until age 70, after which time there is no financial benefit to delaying your claim. Delayed retirement credits cannot be earned if you are claiming either spousal or survivor benefits.

Determining Which Retirement Age Is Best For You

Should you take the money and run at age 62? Or hold out until you’re 70? Approximately 50% of people don’t wait past age 62, usually because they need the money, are convinced that Social Security might collapse at a later date, or are fearful of a short life span.

But is early retirement a good option for you? The questions below will help you decide.

Are you still working? Some people, especially construction workers and other physical laborers, are less physically able to handle work at 62, even though they don’t qualify for disability. They may be good candidates for early retirement. However, if you’re still able-bodied and interested in working, you might want to avoid claiming early retirement benefits. If you’re earning a high salary, you’ll miss the opportunity to boost your Social Security payment amount.

Second, you’ll lose one dollar in benefits for every two dollars you earn over the SSA’s earnings limit . There are no such deductions if you work after reaching full retirement age. The SSA provides an online earnings test calculator to determine whether working will lower your retirement benefits.

How’s your health? If you’re convincedâeither by genetics, research, or the amount of time you spend in doctors’ officesâthat you’ll have a shorter lifespan than your peers, it doesn’t make much sense to delay your retirement benefits.

You could be eligible for up to $3,148 per month in SSDI benefits

Also Check: Social Security Office In Victoria Texas

Heres How Working After 62 Can Change Your Social Security Benefits

getty

Continuing to work after age 62 can affect your level of Social Security retirement benefits, whether you are receiving benefits at the time or not. Knowing how continuing to work might change benefit levels can lead to better decisions about when to claim benefits and whether to continue working.

You can begin claiming Social Security retirement benefits as early as age 62, whether you are working or not. You know that the level of benefits increases for each year you wait to claim them through age 70. Theres no benefit for delaying claiming past age 70. In addition, the level of benefits might increase if you continue working after 62, whether you claim benefits at 62 or later.

Social Security retirement benefits are calculated using your 35 highest-earning years. If you dont have 35 years of earnings, youll be assigned an income of $0 for each of the missing years. After you turn 62, Social Security recalculates your benefits every year that you dont claim benefits. It will take your earnings for the latest year, add that to your record of lifetime earnings and select the 35 years with the highest inflation-adjusted earnings. Those are the only details of how benefits are calculated you need for this discussion.

Do You Expect To Live A Long Life

Many people live longer than they expect.

Because Social Security provides guaranteed income for life, it’s especially valuable to you when you reach age 80 and beyond. Claiming benefits at your full Social Security benefit age or later could be a good way to secure your monthly income during your later years. Your benefit increases the longer you wait to claim, up to age 70, and is adjusted annually with the cost of living. If you live into your 80s but claim at age 62 instead of your full retirement age or later, your total lifetime benefits will be lower by thousands of dollars.Calculate your expected longevity.

Claiming at your full benefit age could still make sense for you.

We understand it’s difficult to make predictions. You may want to plan for the possibility that you may spend 20 or more years in retirement. On average, a woman reaching age 65 today will live to age 87, and a man will live to age 84. Waiting to claim as long as you can could still make sense for you if you are married, are the higher earner in the household, and want your surviving spouse to keep the highest monthly benefit after you die. Remember, you can claim at any point between age 62 and 70. Each additional month that you wait to claim gives you a permanent increase in your monthly benefit which becomes more valuable as you age.Calculate your longevity.

There’s a good chance that you’ll live into your 80s and beyond.

Also Check: Social Security Office In Poteau Oklahoma

When Can You Claim Social Security

Claiming Social Security can be a long process, but its one that can leave you with life-saving benefits that let you live with dignity even after suffering an injury or developing a condition that leaves you unable to work. Social Security Disability Benefits can be difficult to get, and its common for applicants to be rejected the first time around.

Whether youve already tried to apply or are preparing for your very first application, theres one question youll need to have a solid answer to. When can you claim Social Security? Find out what lets you qualify, and discover exactly how the Social Security Administration determines disability status and the benefits to provide.

Youre Only Working Part Time

If you claim Social Security prior to your full retirement age while still holding down a part-time job, you might have your benefits reduced if your work income exceeds the annual limit. For 2022, if you are under full retirement age, your benefits go down by $1 for every $2 your income exceeds $19,560. If you reach full retirement age in 2022, your benefits go down by $1 for every $3 your income exceeds $51,960 prior to reaching full retirement age. If youre working part-time to help make ends meet, taking Social Security at 62 might make sense.

Also Check: What Is The Phone Number To Social Security Administration

When A Spouse Dies

When one spouse dies, the surviving spouse is entitled to receive the higher of their own benefit or their deceased spouses benefit. Thats why financial planners often advise the higher-earning spouse to delay claiming. If the higher-earning spouse dies first, then the surviving, lower-earning spouse will receive a larger Social Security check for life.

When the surviving spouse hasnt reached their FRA, they will be entitled to prorated amounts starting at age 60. Once at their FRA, the surviving spouse is entitled to 100% of the deceased spouses benefit or their own benefit, whichever is higher.

You Need To Pay Down Debt

There are some debts you need to tackle before you retire. If you have high-interest debt, claiming Social Security early can help you pay the debt down. Depending on the interest rate you’re paying, the 8% yearly boost to your benefits that you receive for each year you wait past full retirement age might not be worth the increased monthly benefit. Using the early benefits to reduce or eliminate your debt earlier could mean you’ll be able to keep more of your benefits in the future.

Also Check: Real Social Security Number And Name

What About Taxes On Social Security

Social Security benefits may be taxable, depending on your “combined income.” Your combined income is equal to your adjusted gross income , plus non-taxable interest payments , plus half of your Social Security benefit.

As your combined income increases above a certain threshold , more of your benefit is subject to income taxâup to a maximum of 85%. For help, talk with a CPA or tax professional.

In any case, if you’re still working, you may want to postpone Social Security either until you reach your full retirement age or until your earned income is less than the annual limit. In no situation should you postpone benefits past age 70.

What To Consider Before Filing For Social Security

A larger benefit check sounds great, but there are tradeoffs, and soon-to-retire folks should consider multiple issues before they decide one way or the other on when to file. If you really want to consider all the avenues, then youll have to think about your finances and longevity two issues that people have a hard time grappling with.

But heres the key trade-off: you can file early and take a reduced benefit, expecting that a shorter life span will mean you receive more now, or you could file at full retirement age or later and claim a bigger check, and eventually live long enough to claim more than the first approach.

Social Security is like longevity insurance, says Brent Neiser, a Certified Financial Planner and former chair of the Consumer Advisory Board at the Consumer Financial Protection Bureau. Its a stream of payments that will not stop throughout your life, so delaying your benefits to keep those payments as large as possible forms a helpful base to your retirement plan.

Neiser urges those who have not saved enough for retirement to use whatever means possible to postpone their Social Security benefits until after their full retirement age to help boost their future income.

You can use personal savings to help bridge the gap, but ideally you should plan to work a little longer , Neiser says.

Recommended Reading: Social Security Office In Jackson Tennessee

At What Age Do You Break Even On Social Security

If youre looking to maximize the amount that you withdraw from Social Security over your lifetime, you might consider doing a break-even analysis to see when its best to file. In other words, do you max out your lifetime take-home amount by claiming early and having more years of Social Security or by waiting and then claiming a much larger benefit?

For simplicity, lets assume your full retirement benefit would be $1,000. Well also assume 2 percent annual increases in the benefit, applying that to both the actual paid benefit starting at age 62 as well as the accumulated benefit to be claimed later at age 70.

So at age 62, your first monthly benefit would be 30 percent lower than your full benefit, or $700 total. At age 70, your benefit would be $1,240 plus the cost-of-living adjustments in the interim.

Heres how the numbers break down and a break-even age for claiming Social Security.

| Age |

|---|