Is Social Security Income Taxable

According to the IRS, the best way to see if youll owe taxes on your Social Security income is to take one half of your Social Security benefits and add that amount to all your other income, including tax-exempt interest. This number is known as your combined income, and this is how its calculated:

Combined Income = Adjusted Gross Income + Nontaxable Interest + 1/2 of Social Security benefits

If your combined income is above a certain limit , you will need to pay at least some tax. The limit for 2022 is $25,000 if you are a single filer, head of household or qualifying widow or widower with a dependent child. The 2022 limit for joint filers is $32,000. However, if youre married and file separately, youll likely have to pay taxes on your Social Security income.

At What Age Do You Plan To Retire

The age at which you retire can have a major effect on the size of the Social Security benefits youll receive. The longer you wait up until age 70, the more benefits you may be able to collect.

Enter the age at which you would like to retire and begin collecting benefits. You can get retirement benefits as early as age 62.

Calculating Fica Taxes: An Example

An employee who makes $165,240 a year collects semi-monthly paychecks of $6,885 before taxes and any retirement-plan withholding. Though Medicare tax is due on the entire salary, only the first $147,000 is subject to the Social Security tax for 2021. Since $147,000 divided by $6,885 is 21.3, this threshold is reached after the 22nd paycheck.

For the first 21 pay periods, therefore, the total FICA tax withholding is equal to + , or $526.70. Only the Medicare HI tax is applicable to the remaining three pay periods, so the withholding is reduced to $6,885 x 1.45%, or $99.83. In total, the employee pays $8,964.27 to Social Security and $2,395.98 to Medicare each year. Though it does not affect the employee’s take-home pay, the employer must contribute the same amount to both programs.

As mentioned above, those who are self-employed are considered both the employer and the employee for tax purposes, meaning they are liable for both contributions. In the example above, a self-employed person with the same salary pays $17,928.54 to Social Security and $4,791.96 to Medicare.

You May Like: Social Security Office In Puyallup

Alternative Minimum Tax Rate Changes

The alternative minimum tax rate, or AMT, is a secondary tax system that applies to higher-income individuals. The AMT was created in the 1960s to prevent wealthier taxpayers from using legal loopholes to avoid federal income taxes. Functionally, the AMT disallows some otherwise permissible deductions and adds in extra taxable items.

Under the AMT, taxpayers are allowed to exempt a portion of their income from the Alternative Minimum Taxable Income calculation. This prevents low- and middle-income taxpayers from becoming caught in the net, so to speak.

But higher-income taxpayers are required to calculate their taxes twice: once under the regular system, and again under the AMTI. Then, the taxpayer is required to pay the higher of the two.

Under the 2023 IRS tax inflation adjustments, the AMT exemption amount begins at $81,300, or $126,500 for joint filers. Married individuals filing separately will see the exemption phase in at $63,250. For estates and trusts, the line is drawn at $28,400.

Earned Income Tax Credit Changes

The Earned Income Tax Credit helps certain low- to moderate-income filers reduce their tax bill or even increase their income.

For the 2023 tax year, the EITC tax credit ranges from $600 to $7,430 depending on your income and family size. The complete phaseout income under the tax credit now sits at:

- $17,640 for filers with no children

- $46,560 for filers with one child

- $52,918 for filers with two children

- $56,838 for filers with three or more children

The IRS revenue procedural document contains more information on the EITC changes for specific incomes, categories and phase-outs.

You May Like: Fort Worth Social Security Office

Dont Rely On Irs Tax Inflation Adjustments Alone

The IRS tax inflation adjustments represent big news for consumers and investors alike. However, a 7% rise in the dollar values applied to each tax bracket may not be enough to take the sting out of inflation that, in some areas of the economy, exceeds 15-30%.

To counteract these impacts, we here at Q.ai recommend investing for your future. While you may not see inflation-beating returns this year, or even next, history has shown time and again that a well-diversified portfolio is key to kicking inflation in the rear long-term.

for access to AI-powered investment strategies. When you deposit $100, well add an additional $50 to your account.

What Is Social Security

Social Security is a federal program that pays monthly benefits to retirees, surviving spouses and children, and disabled people. An average of 65 million Americans collect Social Security monthly.

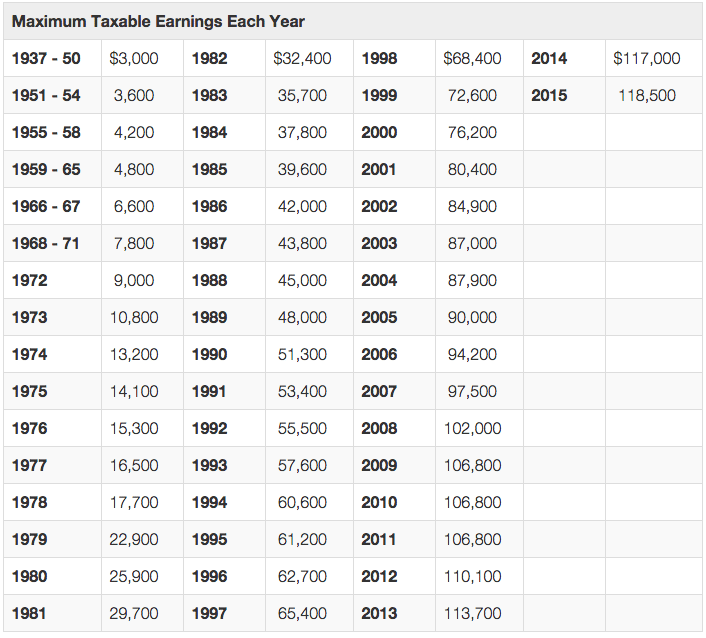

The money for Social Security, as well as Medicare, comes from a tax that every working American pays. It’s a 7.65% tax on every paycheck, or a 15.3% tax for self-employed people that covers both the employee and the employer portions. That tax is levied on the first $147,000 of a worker’s income in 2022.

So, while workers pay a tax to fund the Social Security program, other people are benefiting by collecting a monthly check. Those benefit checks are then often taxed as income, returning a portion of the money to the federal government.

You May Like: Call The Social Security Administration

Is Social Security All You Need To Retire

Generally not. Social Security is not intended to be your only source of retirement income. On average, beneficiaries receive about 40% of their pre-retirement income through Social Security benefits. According to the Social Security Administration, most financial advisers say youll need at least 70% of your pre-retirement income to comfortably meet your expenses in retirement.

Here are few other ways to save for retirement:

How Social Security Benefits Work

As mentioned above, your Social Security benefits are funded through payroll taxes. You typically pay about 6.2% of your paycheck into Social Security up to a taxable maximum income of $147,000 for 2022. If youre self-employed, youll pay the entire 12.4% up to the maximum.

Although youll pay toward Social Security with every paycheck, your money isnt held for you. Instead, your taxes go into a pool to pay for people currently collecting benefits.

More than $1 trillion was collected from payroll taxes for Social Security in 2020. The Social Security retirement benefit you will receive will primarily be paid for by people working when you start collecting.

Don’t Miss: Social Security Administration Springfield Mo

Calculate My Social Security Income

These days thereâs a lot of doom and gloom about Social Securityâs solvency – or lack thereof. And regardless of whether you think Social Securityâs future is secure, the fact remains that you shouldnât plan on living exclusively off your Social Security benefits. After all, Social Security wasnât designed to make up a retireeâs entire income.

Still, many people do find themselves in the position of having to live off their Social Security checks. And even if you have other income sources in retirement, Social Security can make up a significant part of your retirement income plan. That’s why itâs important to know all the rules surrounding eligibility, benefit amounts, taxation and more.

Do you need help managing your retirement savings? To find a financial advisor who serves your area, try our free online matching tool.

How Does Social Security Work

When you work, some of your taxes fund Social Security. The government uses those tax dollars to pay benefits to people who have already retired, people who are disabled, the survivors of workers who have died, and dependents of beneficiaries.

While the money is used to pay people currently getting benefits, any unused money goes to the Social Security trust fund. When you retire, the Social Security contributions of people in the workforce, together with the money in the fund, will pay monthly benefits to you and your family.

Don’t Miss: What Is The Social Security Phone Number

Calculating Your Combined Income

Your combined income determines whether or not you owe taxes on your Social Security benefits. You can calculate yours by adding up:

Your AGI is your annual income minus certain tax deductions, like tax-deferred retirement contributions. Married couples filing jointly must consider both partners’ incomes and deductions. If you have municipal bonds or some tax-exempt savings bonds, you might also have nontaxable interest. Calculating half of your annual Social Security benefits is pretty straightforward. You can create a my Social Security account if you’re not sure how much you’re set to receive in benefits.

So someone with an AGI of $25,000 with $2,000 in nontaxable interest and $14,000 in annual Social Security benefits would have a combined income of $34,000 .

Tax Withholding And Estimated Tax Payments For Social Security Benefits

If you know in advance that a portion of your Social Security benefits will be taxed, it’s a good idea to have federal income taxes withheld from your payment each month. Simply fill out Form W-4V to request withholding at a rate of 7%, 10%, 12% or 22%, and then send the form to your local Social Security office.

If you don’t want to have taxes withheld from your monthly payments, you can make quarterly estimated tax payments instead. Either way, you just want to make sure you have enough withheld or paid quarterly to avoid an IRS underpayment penalty when you file your income tax return for the year.

Don’t Miss: How Much Can You Earn On Social Security Disability

How To Calculate Your Social Security Benefit Taxes

Just because you could owe taxes on up to 50% or 85% of your Social Security benefits doesn’t mean you’ll actually owe taxes on that amount. If you fall into the 50% taxation range, the government says you should owe taxes on the lesser of half of your Social Security benefits or half of the difference between your combined income and the taxation threshold set by the IRS for your tax filing status.

Examples make this easier to understand, so let’s consider an individual who receives $12,000 in Social Security benefits annually and has a combined income of $30,000. You’d calculate the amount they’d owe taxes on this way:

Things get even more complicated if you fall into the 85% taxation range. If our individual had a combined income of $40,000 instead and still received $12,000 in annual Social Security benefits, you would calculate how much they would owe in taxes this way:

State Taxes On Social Security

Twelve states tax Social Security benefits in some cases. Check with your state tax agency if you live in one of these statesColorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, Rhode Island, Utah, Vermont, or West Virginia. As with the federal tax, how these agencies tax Social Security varies by income and other criteria.

Recommended Reading: Greenville South Carolina Social Security Office

Social Security Taxable Benefits Calculator

Use this calculator to estimate how much of your Social Security benefit is subject to income taxes. For modest and low incomes, none of your Social Security benefit is subject to income taxes. However, once your income plus 50% of your Social Security benefit exceeds $32,000 for married couples filing jointly and $25,000 for everyone else, an ever increasing portion of your benefit is subject to income taxes. For higher incomes, up to 85% of your Social Security benefit is subject to incomes taxes and can have a significant impact on your net after-tax benefit.

Calculated amounts and results are for informational purposes only. Actual amounts, durations, rates, and values will vary based on your creditworthiness, individual circumstances, and other unique variables. These results should in no way be construed as an offer or guarantee of credit.

Avoiding Social Security Benefit Taxes

You might be able to tweak your spending if your combined income is close to the taxation thresholds listed above to reduce or avoid taxes on your Social Security benefits. Consider cutting back on spending or withdrawing more money from your Roth savings, if you have any, because this money does not count toward your combined income for the year. Charitable donations will also help reduce your combined income because you can write these off on your taxes.

If you’re still working, consider delaying Social Security until you retire. This could help lower your combined income because you stop getting paychecks, which in turn might help you avoid Social Security benefit taxes. It’ll also help boost your Social Security checks when you do finally begin claiming them. But don’t delay your Social Security benefits past age 70. Your checks won’t increase anymore after this, and avoiding Social Security benefit tax isn’t worth giving up all the money your Social Security checks could provide.

Social Security benefit taxes aren’t the easiest thing to understand, but it’s important that you take the time to learn the rules. It can help you make more educated decisions about your Social Security benefits and your retirement savings so you can hold on to more of your hard-earned cash.

The Motley Fool has a disclosure policy.

You May Like: W2 With Full Social Security Number

Paying Taxes On Social Security

You should get a Social Security Benefit Statement each January detailing your benefits during the previous tax year. You can use it to determine whether you owe federal income tax on your benefits. The information is available online if you enroll on the Social Security website.

If you owe taxes on your Social Security benefits, you can make quarterly estimated tax payments to the IRS or have federal taxes withheld from your payouts before you receive them.

How Do I Determine If My Social Security Is Taxable

Add up your gross income for the year, including Social Security. If you have little or no income besides your Social Security, you wont owe taxes on it. However, if youre an individual filer with at least $25,000 in gross income, including Social Security for the year, then up to 50% of your Social Security benefits may be taxable. For a couple filing jointly, the minimum is $32,000. If your gross income is $34,000 or more , then up to 85% may be taxable.

Also Check: Social Security Administration San Antonio

How Much Is Social Security Taxed At Full Retirement Age

Even if you work past full retirement age, you still have to make applicable Social Security contributions on your income. However, if you work past full retirement age, you can increase the amount of Social Security Benefits you receive.

Once you start receiving Social Security benefits, your income will determine if you pay income tax on part of your Social Security income. For more information, refer to question #2: How Much Social Security Income Is Taxable?

State Taxes On Social Security Benefits

Everything weve discussed above is about your federal income taxes. Depending on where you live, you may also have to pay state income taxes.

There are 12 states that collect taxes on at least some Social Security income. Two of those states follow the same taxation rules as the federal government. So if you live in one of those two states then you will pay the states regular income tax rates on all of your taxable benefits .

The other states also follow the federal rules but offer deductions or exemptions based on your age or income. So in those nine states, you likely wont pay tax on the full taxable amount.

The other 38 states do not tax Social Security income.

| State Taxes on Social Security Benefits | |

| Taxed According to Federal Rules | Minnesota, Utah |

Don’t Miss: Social Security Office Crown Point

Social Security Tax Calculator: Are Your Retirement Benefits Taxable

Depending on your income, up to 85% of your Social Security benefits may be taxable. There’s a worksheet in IRS Publication 915 that can help determine whether your Social Security is subject to tax or not. However, the easiest way to figure it out is with a Social Security tax calculator, which can help you determine how much will be taxable at your marginal tax rate.

States That Do Not Tax Ssi Benefits:

These 37 states do not tax Social Security retirement income: Alabama, Alaska, Arizona, Arkansas, California, Delaware, District of Columbia, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Mississippi, Nevada, New Hampshire, New Jersey, New York, North Carolina, Ohio, Oklahoma, Oregon, Pennsylvania, South Carolina, South Dakota, Tennessee, Texas, Virginia, Washington, Wisconsin and Wyoming.

Read Also: Social Security Office Milwaukee Wi

The Ssa Announced A Record Cost

Social Security recipients will be receiving a notice from the Social Security Administration during the month of December to inform them of the cost-of-living adjustment increase to their benefits in 2023. The average retired worker will see a monthly benefits payment of $1,827 an increase of $146. That will translate into an extra $1,752 over the course of next year.

Unfortunately, the IRS doesnt use the same inflation figures to calculate their adjustment to income thresholds, standard deductions and credit amounts. Most taxpayers over 65 will only be able to take an additional $1,500 through the standard deduction when they file 2023 tax returns in 2024. Not to mention those increased benefits could get taxed at a higher rate.