The Social Security Tax Limit For 2022 And How It Works Explained

- 8:37 ET, Mar 2 2022

MILLIONS of senior citizens and disabled Americans claim Social Security benefits.

About nine out of 10 individuals aged 65 and older receive monthly Social Security benefits, which account for nearly 33% of income for the elderly.

To qualify, seniors must have worked for a certain number of years and paid into the Social Security system for a certain amount of time.

The amount received depends upon when you were born, your earnings history, and when you begin to claim benefits.

Some households are also subject to pay taxes on their Social Security benefits, usually if there are additional significant earnings including wages, self-employed earnings, dividends, or other taxable income.

It’s important to note that Supplemental Security Income differs from monthly Social Security benefits. SSI payments are not taxable.

What Do Social Security Wages Fund

Social Security tax funds a number of things, including benefits for:

- Retired workers

- Disabled workers dependents

According to the Social Security Administration, retired workers receive an average monthly Social Security benefit of $1,514. Disabled workers receive an average monthly benefit of $1,259.

Social Security taxes also go towards paying for the administration of the program. After paying out benefits and administration costs, there is a surplus. The federal government borrows remaining money from the Social Security fund. The government is responsible for paying interest on the borrowed funds.

Social Security Tax Limits

The government bases the annual Social Security tax limits on changes in the National Wage Index , which tends to increase every year. The changes are intended to keep Social Security benefits on track with current inflation.

Any income you earn beyond the wage cap amount is not subject to a 6.2% Social Security payroll tax. For example, an employee who earns $165,000 in 2022 will pay $9,114 in Social Security taxes .

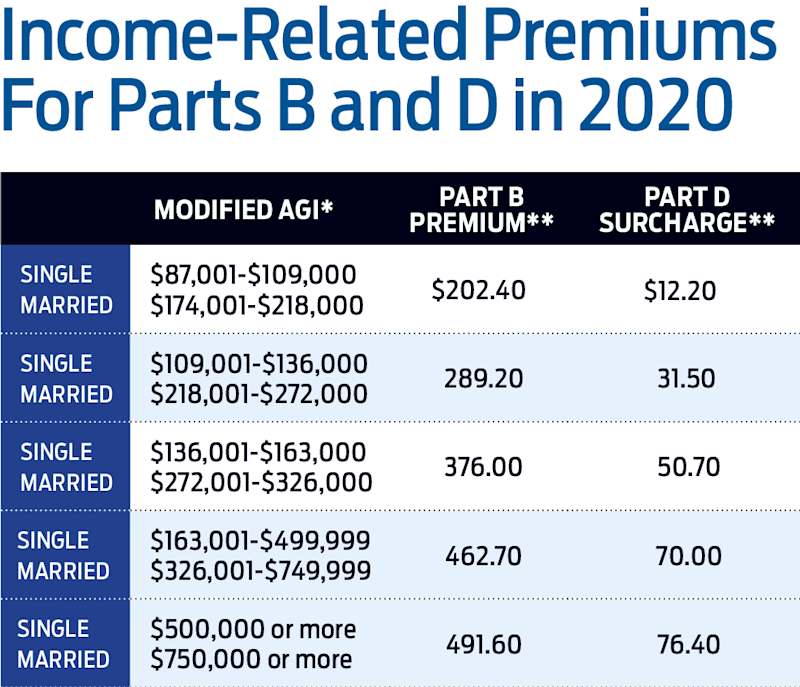

Keep in mind, however, that there is no wage base limit for Medicare tax. While the employee is only subject to Social Security tax on the first $147,00, they will have to pay 1.45% Medicare tax on the entire $165,000. Workers who earn more than $200,000 in 2022 are also subject to an 0.9% additional Medicare tax.

The combination of the increase in the Social Security tax limit and the additional Medicare tax for high-earners could result in lower take-home pay. Unfortunately, that means workers who earned over $200,000 in 2021 are at risk of owing more taxes in 2022.

Here is an example of how the Social Security limit works in 2021 and 2022:

| Social Security Tax Limit Example |

|---|

| 2021 Income |

Recommended Reading: Social Security Offices In Chicago

The Maximum Social Security Benefit And How To Get It

As mentioned above, in 2022, the maximum Social Security benefit is $3,345 per month if you started receiving benefits at full retirement age . Theres only one way to get more than that: wait until age 70 to receive the true maximum benefit of $4,194. But for most people, receiving even $3,345 is a stretch. Heres what you would need to do to maximize your benefit.

How The Social Security Tax Works

The Social Security tax, also known as the Old-Age, Survivors, and Disability Insurance tax, funds the Social Security program in the United States. As of September 2021, more than 65 million people were receiving Social Security payments of around $1,439 per month. According to the SSA, approximately 70 million Americans will receive a slightly larger amount of $1,657 due to the cost-of-living adjustment in 2022.

The tax has two parts. The first is the payroll tax mandated by the Federal Insurance Contributions Act and the self-employment tax mandated by the Self-Employment Contributions Act . Medicare tax, or hospital insurance tax, makes up the second part.

Payroll taxes are based on an employees net wages, salaries, and tips. These taxes are typically withheld by an employer and forwarded to the government on the employees behalf. In 2022, the Social Security tax rate is 6.2% for the employer and 6.2% for the employee.

Medicare taxes are split between the employer and the employee, with a total tax rate of 2.9% for both the 2021 and 2022 tax years.

You May Like: Does Social Security Count As Income For Obamacare

Do Other Taxes Have A Wage Base

Social Security tax is the only federal tax employees pay with a wage base. Although Medicare also makes up FICA tax, it does not have a wage base. Instead, it has an additional tax once an employee earns a certain amount.

Keep in mind that some state taxes, like SUTA tax, and federal unemployment tax also have a wage base.

Information You Need To Apply

Before applying, be ready to provide information about yourself, your medical condition, and your work. We recommend you print and review the . It will help you gather the information you need to complete the application.

Information About You

- Your date and place of birth and Social Security number.

- The name, Social Security number, and date of birth or age of your current spouse and any former spouse. You should also know the dates and places of marriage and dates of divorce or death .

- Names and dates of birth of children not yet 18 years of age.

- Your bank or other and the account number.

Information About Your Medical Condition

- Name, address, and phone number of someone we can contact who knows about your medical conditions and can help with your application.

- Detailed information about your medical illnesses, injuries, or conditions:

- Names, addresses, phone numbers, patient ID numbers, and dates of treatment for all doctors, hospitals, and clinics.

- Names of medicines you are taking and who prescribed them.

- Names and dates of medical tests you have had and who ordered them.

Information About Your Work:

- Award letters, pay stubs, settlement agreements, or other .

We accept photocopies of W-2 forms, self-employment tax returns, or medical documents, but we must see the original of most other documents, such as your birth certificate.

Do not delay applying for benefits because you do not have all the documents. We will help you get them.

Also Check: Social Security Windfall Elimination Provision

Who Is Exempt From Paying Social Security Tax

Certain individuals may claim an exemption and not be required to pay Social Security taxes. Some religious groups that openly oppose Social Security benefits may claim a religious exemption. Non-resident aliens may be exempt depending on their type of visa. Students working at their university may be exempt. Last, workers for a foreign government may be exempt under certain circumstances. If you believe you may fall into one of these groups, consult your tax advisor.

How Much Money Can You Make While Receiving Social Security Disability

Home » Frequently Asked Questions » How Much Money Can You Make While Receiving Social Security Disability?

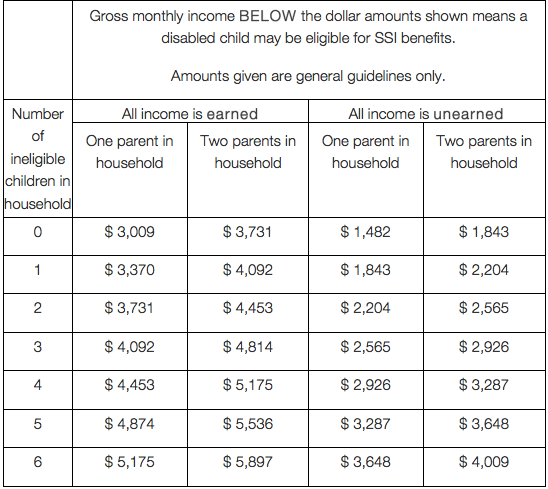

When applying for Social Security Disability benefits, there is an upper limit on how much income you can earn. As of 2021, the limit for disability applicants who are not blind is $1,310, while blind applicants can make up to $2,190 and still receive benefits.

However, the Social Security Administration wants to encourage people to return to work and has programs in place that allow them to earn money while receiving disability benefits. At Berger and Green, we understand how complex the rules surrounding your SSD benefits can seem. We are here to help you determine whether you qualify for benefits.

You May Like: Social Security Office Muskogee Ok

Also Check: Social Security Office Beaumont Texas

Social Security Income Limits By Age

A person who is under full retirement age for the entire year can earn up to $18,960 before they start seeing deductions to their Social Security benefits. For every $2 a person earns over that annual limit, $1 is deducted from their benefit payments.

In the year a person is due to reach full retirement age, the income limit is changed to $50,520. For the purposes of benefit calculations, the government looks at the claimants income for the month up to when they reach full retirement age. For every $3 the claimant earns above the $50,520 limit, they have $1 deducted from their benefit payments.

When a person reaches full retirement age, a person can receive Social Security benefits even if they are working, and their income is not taken into account. Pensions, annuities, interest and other forms of income are all disregarded.

Employers: The Social Security Wage Base Is Increasing In 2022

The Social Security Administration recently announced that the wage base for computing Social Security tax will increase to $147,000 for 2022 . Wages and self-employment income above this threshold arent subject to Social Security tax.

Background information

The Federal Insurance Contributions Act imposes two taxes on employers, employees, and self-employed workers one for Old Age, Survivors and Disability Insurance, which is commonly known as the Social Security tax, and the other for Hospital Insurance, which is commonly known as the Medicare tax.

Theres a maximum amount of compensation subject to the Social Security tax, but no maximum for Medicare tax. For 2022, the FICA tax rate for employers is 7.65% 6.2% for Social Security and 1.45% for Medicare .

2022 updates

For 2022, an employee will pay:

- 6.2% Social Security tax on the first $147,000 of wages , plus

- 1.45% Medicare tax on the first $200,000 of wages , plus

- 2.35% Medicare tax on all wages in excess of $200,000 .

For 2022, the self-employment tax imposed on self-employed people is:

- 12.4% OASDI on the first $147,000 of self-employment income, for a maximum tax of $18,228 plus

- 2.90% Medicare tax on the first $200,000 of self-employment income , plus

- 3.8% on all self-employment income in excess of $200,000 .

More than one employer

We can help

Contact us if you have questions about payroll tax filing or payments. We can help ensure you stay in compliance.

Recommended Reading: Hours Of Operation For Social Security Office

How Much Can I Earn In 2020 And Still Collect Social Security

In 2020, the yearly limit is $18,240. During the year in which you reach full retirement age, the SSA will deduct $1 for every $3 you earn above the annual limit. For 2020, the limit is $48,600. The good news is only the earnings before the month in which you reach your full retirement age will be counted.

Other Ways Low Income Seniors And Americans Arent Getting Payments

In California, a new rebate called the Middle Class Tax Rebate has rolled out for Americans struggling with inflation. While there are income requirements, there are tax requirements as well.

In order to qualify, you need to have filed a tax return. Around 3 million California residents do not make enough money to be required to file tax returns. They financially qualify for the rebate, but wont be getting it.

In Georgia, there are many seniors who wont get the $500 benefit payment. Those between the ages of 62 and 64 who are retired cannot make over $35,000 per year. That number dramatically increases to $65,000 for those 65 and older. This is unfortunate because many 62 year olds are in the same exact position as 65 year olds.

You May Like: Can I Collect Social Security At 60

Income Earned During The Year You Reach Fra

During the year you reach FRA, and up to that month you reach FRA, Social Security will deduct $1 for every $3 you earn that is over the annual earnings limit. For the year in which you will reach FRA, the earnings limit is different.

In 2021, this earnings limit is $50,520 , which means that you can earn up to $50,520 before having any pay deducted. The limit is $51,960 for those reaching FRA in 2022. During the year in which you reach FRA, Social Security only counts earnings that you receive before the month you reach FRA.

For example, let’s assume you were born in 1955, which means your FRA is age 66. You turned 66 in June 2021 and began your Social Security benefits at that time. You earned $44,000 from January through May of 2021. Your benefits will not be reduced, because you earned less than $50,520 during the months before you attained full retirement age.

The Social Security Administration website provides additional examples of how this deduction works. You can also use the earnings test calculator and plug in your date of birth and expected earnings to see whether you think a reduction will apply to you.

Full Retirement Age Continues To Rise

The absolute earliest that you can start claiming Social Security retirement benefits is age 62. However, claiming before your full retirement age will result in a permanently reduced payout.

Under current law, the retirement age for Social Security purposes is set to increase by two months each year until it hits 67. If you turned 62 in 2021, then your full retirement age is 66 and 10 months. Unless the law changes, anyone born in 1960 or later will not reach full retirement age until they are 67.

If you delay collecting Social Security past your full retirement age, then you can collect more than your full, or normal, payout. In fact, if you put off claiming until age 70, then you will receive an annual payout up to 32% higher than if you started receiving benefits at full retirement.

After age 70, there is no further incentive for delaying: Your monthly benefit stops increasing, with or without put-offs.

Also Check: Social Security Disability Income Limits

How Working Affects The Taxation Of Your Benefits

Now you know how work affects your benefit payment amounts, but did you know that working can also affect whether or not your benefits are taxed? There is also an earnings test when it comes to the taxability of your retirement benefits. Unlike the earnings test used for potential benefit reduction, almost all your income counts toward the taxability of your Social Security benefits. Even retirement plan income, like IRA or 401k withdrawals, counts toward the annual limit. In 2022, if your adjusted gross income, including half of your Social Security payments, exceeds $25,000, then 50% of your benefits are likely taxable. For a married couple, this limit increases to $32,000.

If your income for the year exceeds $34,000, then up to 85% of your benefits will be taxable. Again, for a married couple, this limit increases to $44,000. For beneficiaries who rely solely on Social Security, these limits are not usually met. However, if you have retirement income from other sources, it likely means that you will pay taxes on a portion of your Social Security benefits. No more than 85% of your Social Security benefits will be taxable. You will also get to keep 15% of your benefits tax-free, regardless of your total income.

Contribution And Benefit Base

|

Social Security’s Old-Age, Survivors, and Disability Insurance program limits the amount of earnings subject to taxation for a given year. The same annual limit also applies when those earnings are used in a benefit computation. This limit changes each year with changes in the national average wage index. We call this annual limit the contribution and benefit base. This amount is also commonly referred to as the taxable maximum. For earnings in 2022, this base is $147,000. The OASDI tax rate for wages paid in 2022 is set by statute at 6.2 percent for employees and employers, each. Thus, an individual with wages equal to or larger than $147,000 would contribute $9,114.00 to the OASDI program in 2022, and his or her employer would contribute the same amount. The OASDI tax rate for self-employment income in 2022 is 12.4 percent. For Medicare’s Hospital Insurance program, the taxable maximum was the same as that for the OASDI program for 1966-1990. Separate HI taxable maximums of $125,000, $130,200, and $135,000 were applicable in 1991-93, respectively. After 1993, there has been no limitation on HI-taxable earnings. Tax rates under the HI program are 1.45 percent for employees and employers, each, and 2.90 percent for self-employed persons. |

Also Check: Social Security Office Traverse City Mi

Benefits People With Social Security Stop Qualifying For Due To Inflation Boosting Their Benefits Too High

According to The Sun, seniors in Pennsylvania who are low income can qualify for a property tax rebate program that could pay them as much as $975.

There are a few requirements to qualify. First, you must be 65 or older, or a widow/widower ages 50 and older. You may also qualify if you are 18 or older and have a disability. Unfortunately, many of those seniors received a COLA boost to their Social Security benefits.

The boost increased the average monthly payment to $1,657. Homeowners may not have an income surpassing $35,000, and renters cannot exceed $15,000 annually. 50% of Social Security checks are excluded from income. This means if your payment increase put you past the threshold for income, you potentially lost that $975 for 2022. The $35,000 and $15,000 income limits werent boosted for inflation like everything else.

In addition to this, even with the payment boosts, Social Security recipients still cant afford to live. Purchasing power has decreased by 40% since 2000.

The Senior Citizens League reports that COLA increases have given Social Security recipients a 64% boost. Expenses have risen by 130%. Those do not add up.

What Is The Sga Limit

If an SSI applicant has monthly earnings of $1,350 or more in 2022, Social Security considers the applicant to be engaging in substantial gainful activity and wont consider the applicant disabled.

But after starting to receive SSI benefits, the SGA limit no longer applies. An SSI recipient can work and make more than $1,350 without losing disability benefits , as long as the recipient is still considered disabled.

Continuing SSI recipients are still bound by the SSI income limit discussed above though . But remember, Social Security will deduct an SSI recipients countable income from his or her SSI payment, meaning that those who work will receive an SSI payment thats less than the full amount.

Read Also: Social Security Office In Poteau Oklahoma

Read Also: Who Benefits From Social Security