Cancelling Medicare During A Special Enrollment Period

Certain circumstances may make you eligible for a Medicare Special Enrollment Period.

A Special Enrollment Period may be granted at any time outside of the Annual Enrollment Period to people who move outside of their plans coverage area, lose Medicaid coverage or other experience other specific life events.

If you qualify for a Special Enrollment Period, you may be able to switch or cancel your Medicare Advantage or Part D plan.

The Parts Of Medicare

Social Security enrolls you in Original Medicare .

- Medicare Part A helps pay for inpatient care in a hospital or limited time at a skilled nursing facility . Part A also pays for some home health care and hospice care.

- Medicare Part B helps pay for services from doctors and other health care providers, outpatient care, home health care, durable medical equipment, and some preventive services.

Other parts of Medicare are run by private insurance companies that follow rules set by Medicare.

- Supplemental policies help pay Medicare out-of-pocket copayments, coinsurance, and deductible expenses.

- Medicare Advantage Plan includes all benefits and services covered under Part A and Part B prescription drugs and additional benefits such as vision, hearing, and dental bundled together in one plan.

- Medicare Part D helps cover the cost of prescription drugs.

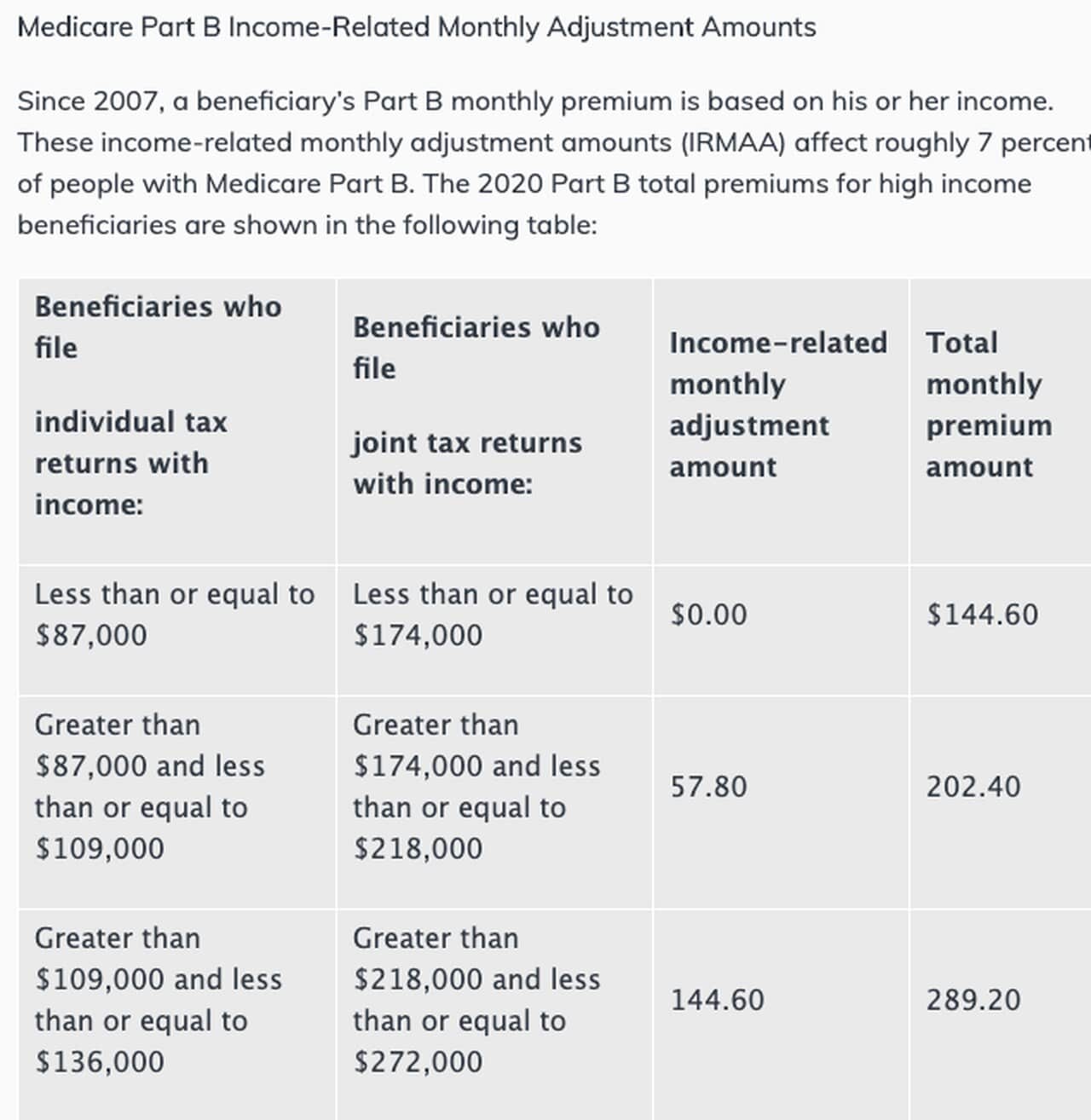

Most people age 65 or older are eligible for free Medicare hospital insurance if they have worked and paid Medicare taxes long enough. You can sign up for Medicare medical insurance by paying a monthly premium. Some beneficiaries with higher incomes will pay a higher monthly Part B premium. To learn more, read .

How Do I Sign Up For Medicare Part B If I Already Have Part A

If you are already enrolled in Medicare Part A and you would like to enroll in Part B under the Special Enrollment Period , you can apply online at Apply for Medicare Part B Online during a Special Enrollment Period. You can upload your application and documents that verify your group health plan coverage through your employer.

You can also fax or mail your completed CMS-40B, Application for Enrollment in Medicare Part B and the CMS-L564, Request for Employment Information enrollment forms and evidence of employment to your local Social Security office. If you have questions, please contact Social Security at 1-800-772-1213 .

Note: When completing the forms CMS-40B and CMS-L564:

- State I want Part B coverage to begin in the remarks section of the CMS-40B form or online application.

- If your employer is unable to complete Section B, please complete that portion as best as you can on behalf of your employer without your employer’s signature.

- Also submit one of the following forms of secondary evidence:

- Income tax returns that show health insurance premiums paid.

- W-2s reflecting pre-tax medical contributions.

- Pay stubs that reflect health insurance premium deductions.

- Health insurance cards with a policy effective date.

- Explanations of benefits paid by the GHP or LGHP.

- Statements or receipts that reflect payment of health insurance premiums.

Also Check: Social Security Administration Twin Cities Card Center

How To Apply Online For Just Medicare

Are you within three months of turning age 65 or older and not ready to start your monthly Social Security benefits yet? You can use our online retirement application to sign up just for Medicare and wait to apply for your retirement or spouses benefits later. It takes less than 10 minutes, and there are no forms to sign and usually no documentation is required.

To find out what documents and information you need to apply, go to the .

The Cost Of Health Insurance Coverage

To get the many benefits of Medicare Part B, you must pay a monthly premium. The standard premium in 2022 is $170.10 per month . But some people may get a lower premium.

Besides your premium, youll also pay $233 per year for your Part B deductible in 2022. Once you meet your deductible, youll typically pay for 20 percent of the Medicare-approved amount for medical services.

If you don’t enroll in Medicare Part B during your Initial Enrollment Period, you may face a late enrollment penalty. You may be able to avoid this penalty if you qualify for a special Medicare enrollment period.

You May Like: Social Security Percentage By Age

What About Part D Medicare Advantage Or Medigap

If you choose to get extra coverage from a private insurer to help pay Medicares out-of-pocket costs or drug coverage, you may have to pay additional premiums to the plan:

Part D prescription drug coverage. Youll receive monthly bills or an annual coupon book with monthly payment sheets from the plan. You can sign up to make automatic payments using your bank account or credit card.

You can ask your plan to deduct your premium from your monthly Social Security benefits, called a premium withhold. The automatic payments can take up to three months to take effect after youve requested the premium withhold. You may have to pay premiums directly to your plan until then.

If you have to pay a high-income surcharge for Part D, also called an Income-Related Monthly Adjustment Amount , that extra monthly premium goes to Medicare rather than to the plan. If you receive Social Security benefits, the IRMAA is deducted automatically from your payments. Otherwise, youll receive a monthly bill from Medicare for the extra amount and will have the same payment options as listed in Part B above.

Medicare Advantage plans. If you have coverage from a private Medicare Advantage plan rather than original Medicare, you still need to sign up for Medicare Parts A and B and pay the monthly premiums. You may have to pay an additional monthly premium to your Medicare Advantage plan although many plans dont charge more.

Keep in mind

If You Disagree With Our Decision

If you disagree with the decision we made about your income-related monthly adjustment amounts, you have the right to appeal. The fastest and easiest way to file an appeal of your decision is online. You can file online and provide documents electronically to support your appeal. You can file an appeal online even if you live outside of the United States.

You may also request an appeal in writing by completing a Request for Reconsideration , or contact your local Social Security office. You can use the appeal form online, or request a copy through our toll-free number at 1-800-772-1213 . You dont need to file an appeal if youre requesting a new decision because you experienced one of the events listed and, it made your income go down, or if youve shown us the information we used is wrong.

If you disagree with the MAGI amount we received from the IRS, you must correct the information with the IRS. If we determine you must pay a higher amount for Medicare prescription drug coverage, and you dont have this coverage, you must call the Centers for Medicare & Medicaid Services to make a correction at 1-800-MEDICARE . We receive the information about your prescription drug coverage from CMS.

Don’t Miss: Social Security Widow Benefits Income Limits 2021

What If I Want To Disenroll From My Current Medicare Part D Prescription Drug Plan But Dont Want To Enroll In Another Plan

If you disenroll from a Medicare Part D prescription drug plan and wait to join another Medicare prescription drug plan at a later time and do not have creditable coverage a Part D Late Enrollment Penalty may apply. To learn more about the Medicare Part D Late Enrollment Penalty, call Medicare at . TTY users call , 24 hours a day, 7 days a week.

Read Also: Does Medicare Pay For Cpap Cleaner Machine

Medicare Part B And Coinsurance/copayments

You usually pay a 20% coinsurance amount for covered services. If your doctor or health care provider accepts Medicare assignment for a covered service, you would pay the Part B deductible along with 20% of the Medicare-approved amount for services rendered. Accepting assignment means that your doctor will not charge you more than the Medicare-approved amount for the covered service. You would still be responsible for cost-sharing.

You May Like: Social Security Office In South Bend

Appealing Your Part B Premium

First, you must request a reconsideration of the initial determination from the Social Security Administration.writing to SSA

Below are the situations which may qualify a beneficiary for a new Part B determination:

| Situation | Description |

|---|---|

| Tax return inaccurate or out of date |

|

| Life-changing event that affects the beneficiarys modified adjusted gross income |

There are 7 qualifying life-changing events:

|

Events that result in the loss of dividend income or affect a beneficiary’s expenses, but do not affect the beneficiary’s modified adjusted gross income are not considered qualifying life-changing events.

Medicare Part A Premiums And Deductibles Are Going Up In 2023

While Medicare Part B is seeing a decrease in premiums next year, those who have to pay for Medicare Part A will see very slight premium increases in 2023. Those who’ve worked more than 30 calendar quarters will pay $278 a month, versus $274 in 2022. Those with less qualifying employment history will pay $506 a month, compared with $499 in 2022.

It’s important to note that 99% of Medicare recipients don’t have to pay anything for Part A because they’ve worked 40 calendar quarters while paying Medicare taxes.

The deductibles for Medicare Part A are also rising by about 2.8% each. Here’s a breakdown of what’s going up.

Inpatient hospital deductible: $1,600 in 2023, an increase of $44 from $1,556 in 2022.

Daily coinsurance for the 61st through the 90th day: $400 in 2023, an increase of $11 from $389 in 2022.

Daily coinsurance for lifetime reserve days: $800 in 2023, an increase of $22 from $778 in 2022.

Skilled Nursing Facility coinsurance: $200 in 2023, an increase of $5.50 from $194.50 in 2022.

Recommended Reading: Social Security Administration Knoxville Tennessee

Seniors To Get A Break On Medicare Part B Premiums In 2023

Medicare beneficiaries will see their Part B premiums decrease in 2023, the first time in more than a decade that the tab will be lower than the year before, the Centers for Medicare and Medicaid Services announced Tuesday.

The standard monthly premiums will be $164.90 in 2023, a decrease of $5.20 from 2022.The reduction, which was signaled earlier this year by Health and Human Services Secretary Xavier Becerra, comes after a large spike in 2022 premiums. Medicare beneficiaries had to contend with a 14.5% increase in Part B premiums for 2022, which raised the monthly payments for those in the lowest income bracket to $170.10, up from $148.50 in 2021.

President Joe Biden highlighted the drop in premiums at an afternoon event in the Rose Garden on Tuesday, using the announcement to tout Democrats as the party that will protect Social Security and Medicare.

That message targeted toward the key demographic of older voters comes six weeks before the midterm elections.

Biden criticized the plan laid out last week by House Minority Leader Kevin McCarthy and Republicans, calling their agenda a thin set of policy rules, with little or no detail. The President also slammed Republican Sens. Ron Johnson of Wisconsin and Rick Scott of Florida for their plans that suggest Social Security and Medicare should be discretionary spending rather than mandatory programs.

How To Cancel Medicaid Or Chip Programs

- Income Adjustment: Expect the state to notify you If your household income increases or state qualification standards change, and you, therefore, are no longer eligible for Medicaid or the Childrens Health Insurance Program. If you lose your Medicaid or CHIP coverage, you will have a 60-day special enrollment window to buy a Marketplace plan, assuming you can afford to do that after receiving common government subsidies. Nearly 90% of those with Obamacare get subsidies.

- Notify Your Caseworker: If you must cancel your Medicaid or CHIP plan because you get a new job or your child turns 19 and ages out, you will have to research the process in your state. State rules vary significantly. Start by calling your state Medicaid department caseworker. Typically, you will have up to 30 days to enroll in a Marketplace plan before losing your Medicaid or CHIP coverage.

You May Like: Social Security Retirement Benefit Calculator

What If Your Medicare Premium Payment Is Late

If you miss a payment, or if we get your payment late, your next bill will also include a past due amount.

If you get a Medicare premium bill that says Delinquent Bill at the top, pay the total amount due, or youll lose your Medicare coverage. Get a sample of the delinquent bill in English.

Dont risk losing your Medicare coverage

Already Enrolled In Medicare

If you have Medicare, you can get information and services online. Find out how to .

If you are enrolled in Medicare Part A and you want to sign up for Part B, please complete form CMS-40B, Application for Enrollment in Medicare Part B . If you are applying for Medicare Part B due to a loss of employment or group health coverage, you will also need to complete form CMS-L564, Request for Employment Information.

You can use one of the following options to submit your enrollment request under the Special Enrollment Period:

Note: When completing the forms CMS-40B and CMS-L564:

- State I want Part B coverage to begin in the remarks section of the CMS-40B form or online application.

- If possible, your employer should complete Section B.

- If your employer is unable to complete Section B, please complete that portion as best as you can on their behalf and submit one of the following forms of secondary evidence:

- Income tax form that shows health insurance premiums paid.

- W-2s reflecting pre-tax medical contributions.

- Pay stubs that reflect health insurance premium deductions.

- Health insurance cards with a policy effective date.

- Explanations of benefits paid by the GHP or LGHP.

- Statements or receipts that reflect payment of health insurance premiums.

Some people with limited resources and income may also be able to get .

Also Check: Social Security Administration Chattanooga Tennessee

Why Is Medicare Part B Cheaper In 2023

The Centers for Medicare and Medicaid Services recommended in May that any excess Supplementary Medical Insurance Trust Fund money be passed along to those with Medicare Part B coverage. This is to help decrease the costs of the premium and deductibles. While most Medicare recipients get Part A for free, everyone has to pay for Part B.

This year’s Part B premium was projected to cover spending for a new drug called Aduhelm, which is intended to treat Alzheimer’s disease. Since less money was spent on that drug and other Part B items, there were more reserves left over in the Part B account of the SMI fund, which will now be used to limit future Part B premium increases.

Medicare Part A premiums will rise a little in 2023.

Get Help Switching Or Enrolling In A Medicare Advantage Plan

If you would like further help learning how to cancel your current Medicare coverage for a new Medicare Advantage plan, a licensed insurance agent can help guide you through the process.

Learn more about Medicare Advantage plans in your area and find a plan that fits your coverage needs and your budget.

MedicareAdvantage.com is a website owned and operated by TZ Insurance Solutions LLC. TZ Insurance Solutions LLC and TruBridge, Inc. represent Medicare Advantage Organizations and Prescription Drug Plans having Medicare contracts enrollment in any plan depends upon contract renewal.

The purpose of this communication is the solicitation of insurance. Callers will be directed to a licensed insurance agent with TZ Insurance Solutions LLC, TruBridge, Inc. and/or a third-party partner who can provide more information about Medicare Advantage Plans offered by one or several Medicare-contracted carrier. TZ Insurance Solutions LLC, TruBridge, Inc., and the licensed sales agents that may call you are not connected with or endorsed by the U.S. Government or the federal Medicare program.

Plan availability varies by region and state. For a complete list of available plans, please contact 1-800-MEDICARE , 24 hours a day/7 days a week or consult www.medicare.gov.

Medicare has neither reviewed nor endorsed this information.

Don’t Miss: Social Security Office Beaumont Texas

How Do I Use The Part B Sep

To use this SEP you should call the Social Security Administration at 1-800-772-1213 and request two forms: the Part B enrollment request form and the request for employment information form . Youll complete the Medicare enrollment application and give the request for employment information form to the employer to fill out. You want to request additional copies of form L564 from Social Security if youve been covered through more than one job-based plan since you qualified for Medicare.

If an employer is unable to fill out the form, Social Security may accept the following items as evidence you had job-based coverage:

- Income tax forms showing you paid health insurance premiums

- W-2s or pay stubs showing pre-tax medical insurance premiums withheld

- health insurance cards with a policy effective date

- explanations of benefits or

- statements or receipts showing you paid health insurance premiums.

You should write down what you talk about with Social Security, and keep copies of the enrollment forms you submit in case you need to follow up. If your enrollment request is denied, youll have the chance to appeal.

People 65 and older only qualify for this SEP if they have coverage through their own or their spouses job, but disabled individuals can also qualify because theyre covered by a non-spouse family members plan.