How High Are Property Taxes In New York

New York’s overall average effective rate is 1.69%, which implies $1,690 in annual property taxes for every $100,000 in home value. Rates in New York City are far lower than that, averaging 0.88% across the citys five boroughs.

High home values mean property tax bills can still be quite high, though. For example, the median annual property tax paid by homeowners in Manhattan is more than $8,900.

Are Other Forms Of Retirement Income Taxable In South Carolina

Yes, but they are also largely deductible. For taxpayers under the age of 65 the deduction is $3,000. For seniors 65 and older, the deduction is $15,000. This can be applied across all types of retirement income, including income from a 401, an IRA, a government pension or a public pension. Those with a military retirement plan can exclude up to $30,000 of income.

If you are a senior and your total income from all those sources is less than $15,000, you will not pay any South Carolina income taxes. Above that limit, you may need to pay taxes at the rates shown in the table below.

Social Security And Railroad Retirement Benefits

If your social security or railroad retirement benefits were taxed on your federal return, you may take a deduction for those benefits on your North Carolina individual income tax return. You may take this deduction because this income has already been included as part of your federal adjusted gross income and North Carolina does not tax this income. This deduction will increase your refund or decrease the amount you must pay.

Any social security benefits you received that are not included in your federal adjusted gross income cannot be deducted on your North Carolina return. If your federal adjusted gross income includes social security benefits, enter the taxable amount of social security benefits on Form D-400 Schedule S, Part B Deductions from Federal Adjusted Gross Income, Line 18. The total deductions from federal adjusted gross income entered on Form D-400 Schedule S, Line 38, also needs to be entered on Form D-400, Line 9.

You May Like: Social Security Office In Lubbock Texas

Overview Of California Retirement Tax Friendliness

California fully taxes income from retirement accounts and pensions at some of the highest state income tax rates in the country. Social Security retirement benefits are exempt, but California has some of the highest sales taxes in the U.S.

To find a financial advisorwho serves your area, try our free online matching tool.

| Annual Social Security Income |

| Annual Income from Private PensionDismiss | Annual Income from Public PensionDismiss |

| Your Tax Breakdown |

| is toward retirees. |

| Social Security income is taxed. |

| Withdrawals from retirement accounts are taxed. |

| Wages are taxed at normal rates, and your marginal state tax rate is %. |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

Delay Benefits Until 70

You become eligible for Social Security at 62, but claiming at that age can permanently shrink your benefit checks. If you want the amount you’ve earned based on your work history, you must delay benefits until your full retirement age . That’s between 66 and 67 for today’s workers.

Claiming prior to this age shrinks your benefit up to 25% if your FRA is 66 or 30% if your FRA is 67. This doesn’t mean signing up early is always a bad choice, though. It can make sense for those with short life expectancies and those who are already retired and in need of some financial assistance.

But those who want the largest possible checks will have to wait a while. Every month you delay increases your benefit a little at a time until you turn 70. Waiting until then adds another 24% to your checks if your FRA is 67 or 32% if your FRA is 66.

Delaying Social Security often leads to a larger lifetime benefit for those who live into their 80s or beyond. But if you plan to do this, you have to be comfortable paying for all of your own living expenses until retirement.

You May Like: Disadvantages Of Social Security Disability

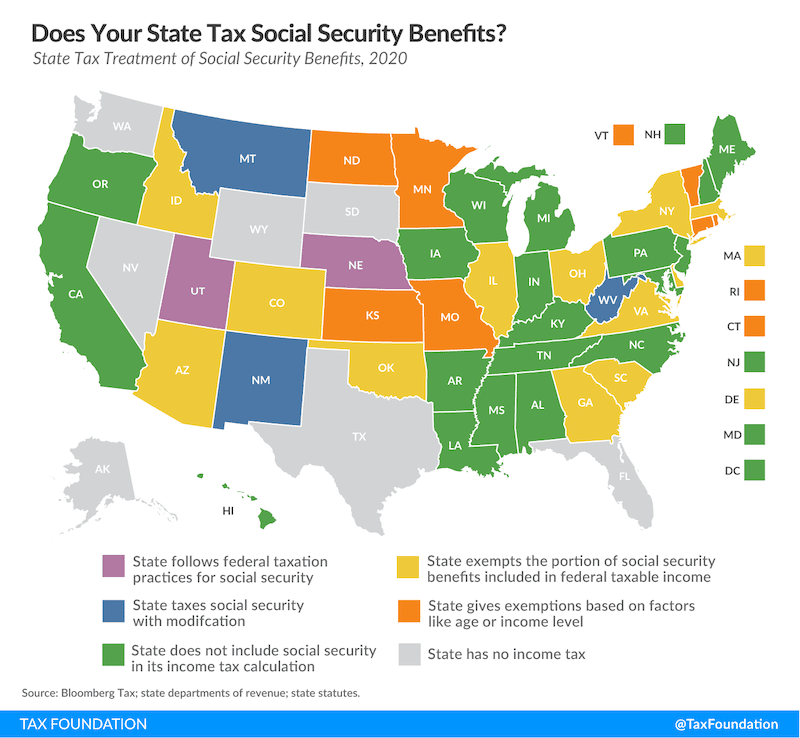

Social Security Benefit Taxation By State

Out of all 50 states in the U.S., 38 states and the District of Columbia do not levy a tax on Social Security benefits. Of this number, nine statesAlaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyomingdo not collect state income tax, including on Social Security income.

Out of the nine states that do not levy an income tax, New Hampshire still taxes dividend and interest income.

Below is a list of the 12 states that do levy a tax on Social Security benefits on top of the federal tax, with details on each states tax policy.

States Tax Social Security Benefits

Currently, 12 states in the U.S. tax Social Security benefits. A brief overview of the current tax rates and exemptions for each of those states is provided below.

Colorado: The state tax rate is 4.55%. Residents can deduct all federally taxed Social Security income when calculating their Colorado taxable income.

Connecticut: The state tax rate ranges from 3% to 6.99%. Benefits are not taxed if single filers report an adjusted gross income below $75,000 or joint filers report an AGI below $100,000. Residents at or above those thresholds can still deduct 75% of federally taxable Social Security income when calculating Connecticut taxable income.

Kansas: The state tax rate ranges from 3.1% to 5.7%. Residents who report an AGI of $75,000 or less will not pay tax on benefits.

Minnesota: The state tax rate ranges from 5.35% to 9.85%. Joint filers can deduct $5,290 if provisional income is below $80,270. Single filers can deduct $4,130 if provisional income is below $62,710. Those thresholds are adjusted annually for inflation.

Missouri: The state tax rate ranges from 1.5% to 5.4%. Residents do not pay tax on benefits if they are single filers who report a Missouri AGI below $85,000 or joint filers who report a Missouri AGI below $100,000.

Montana: The state tax rate ranges from 1% to 6.75%. Benefits are not taxed if single filers report a Montana modified AGI below $25,000 or joint filers report a Montana modified AGI below $32,000.

Recommended Reading: Social Security Benefits For Released Prisoners

What Other New York Taxes Should I Be Concerned About

New York State has its own estate tax, which is collected in addition to the federal estate tax. The exemption for tax year 2021 is $5.93 million, while the 2022 exemption is $6.11 million. Estate tax rates for amounts above these exemptions range from 3.06% to 16%.

Retirees who plan on supplementing their retirement income with investment income may also have to pay capital gains taxes. Capital gains are considered regular income in New York and taxed at the states income tax rates .

Is South Carolina Tax

South Carolina does not tax Social Security retirement benefits whatsoever. It provides a substantial deduction on all other types of retirement income, including income from retirement accounts. Retirees who own a home in South Carolina will fare especially well, as the state has some of the lowest property taxes in the country.

You May Like: Lubbock Tx Social Security Office

Vermonts Social Security Exemption

Vermonts personal income tax exemption of Social Security benefits reduces tax liabilities mainly for lower- and middle-income Vermonters who are retired or disabled. It does this by excluding from taxable income all or part of taxable Social Security benefits reported on the federal Form 1040, U.S. Individual Income Tax Return, which are included in federal AGI. The exemption does not exclude other types of income.

For those who are married filing jointly and civil union partner filing jointly, the exemption applies in full up to an AGI of $60,000, phases out between $60,000-$70,000, and does not apply to filers with AGI greater than or equal to $70,000. For all other filing statuses, the Vermont exemption applies in full to an AGI up to $45,000. It then phases out smoothly for filers earning between $45,000-$55,000. It does not apply to filers with AGI greater than or equal to $55,000. The exemption reduces a taxpayers Vermont taxable income before state tax rates are applied.

Table 2 illustrates how the Vermont exemption is applied by filing status and income level. Graph 1 shows the percentage of taxable Social Security benefits that are exempt from Vermont taxable income based on filing status and AGI.

State Taxes On Social Security Benefits

Everything weve discussed above is about your federal income taxes. Depending on where you live, you may also have to pay state income taxes.

There are 12 states that collect taxes on at least some Social Security income. Two of those states follow the same taxation rules as the federal government. So if you live in one of those two states then you will pay the states regular income tax rates on all of your taxable benefits .

The other states also follow the federal rules but offer deductions or exemptions based on your age or income. So in those nine states, you likely wont pay tax on the full taxable amount.

The other 38 states do not tax Social Security income.

| State Taxes on Social Security Benefits | |

| Taxed According to Federal Rules | Minnesota, Utah |

Don’t Miss: Olive Branch Ms Social Security Office

Which States Do Not Tax Social Security Benefits

Only eleven states Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, Rhode Island, Utah, and Vermont impose some form of income taxes on social security benefits. The remaining states and District of Columbia do not levy taxes on social security benefits. Even among those states that collect such a tax, many offer exemptions for tax filers based on age or income considerations.

Dont Forget Social Security Benefits May Be Taxable

Tax Tip 2020-76, June 25, 2020

Taxpayers receiving Social Security benefits may have to pay federal income tax on a portion of those benefits.

Social Security benefits include monthly retirement, survivor and disability benefits. They don’t include supplemental security income payments, which aren’t taxable.

The portion of benefits that are taxable depends on the taxpayer’s income and filing status.

Recommended Reading: Social Security New Haven Ct

For Years New Mexico Was One Of Just A Few States That Still Taxed Social Security Benefits New Mexico Seniors Deserve To Hold Onto Their Hard

Beginning with tax year 2022, most seniors will be exempt from paying taxes on their Social Security benefits when they file their New Mexico Personal Income Tax returns. Tax relief from the new Social Security exemption is expected to total $84.1 million in the first year. The exemption is available to single taxpayers with less than $100,000 in income, to married couples filing jointly, surviving spouses and heads of household with under $150,000 in income, and to married couples filing separately with under $75,000 in income.

Instructions on how to claim the exemption will be available beginning with the 2022 Tax Year Personal Income Tax instructions.

Do you know someone who could benefit? Please share this page. Are you considering retiring in New Mexico? Retire New Mexico can help. Learn more here:

Latest News

How The West Taxes Social Security

Nine of the 13 states in the West don’t have income taxes on Social Security. Alaska, Nevada, Washington, and Wyoming don’t have state income taxes at all, and Arizona, California, Hawaii, Idaho, and Oregon have special provisions exempting Social Security benefits from state taxation. That leaves Colorado, Montana, New Mexico, and Utah, which impose taxes on Social Security for some individuals.

Don’t Miss: Who Benefits From Social Security

Request For Copies Of Returns

Q. How do I request a copy of a tax return I have filed?

A. In order to give you this information, please provide your social security number, name, your filing status for that year, the amount of refund or balance due, and your address on the return at that time. You may email your request by clicking the personal income tax email address in the contact file, or contact our Public Service Bureau at 577-8200.

How High Are Sales Taxes In California

California has the highest state sales tax rate in the country at 7.25%. That is the minimum you will pay anywhere in the state, but local taxes as high as 2.50% mean you will likely pay an even higher rate. Overall, the average rate you can expect to pay in California is 8.82%.

The good news is that not all goods are taxable. In fact, a number of exemptions are designed specifically to benefit seniors and retirees. That includes an exemption for prescription drugs and an exemption for most types of groceries.

Read Also: Are The Social Security Offices Open Now

Simplifying Your Social Security Taxes

During your working years, your employer probably withheld payroll taxes from your paycheck. If you make enough in retirement that you need to pay federal income tax, then you will also need to withhold taxes from your monthly income.

To withhold taxes from your Social Security benefits, you will need to fill out Form W-4V . The form only has only seven lines. You will need to enter your personal information and then choose how much to withhold from your benefits. The only withholding options are 7%, 10%, 12% or 22% of your monthly benefit. After you fill out the form, mail it to your closest Social Security Administration office or drop it off in person.

If you prefer to pay more exact withholding payments, you can choose to file estimated tax payments instead of having the SSA withhold taxes. Estimated payments are tax payments that you make each quarter on income that an employer is not required to withhold tax from. So if you ever earned income from self-employment, you may already be familiar with estimated payments.

In general, its easier for retirees to have the SSA withhold taxes. Estimated taxes are a bit more complicated and will simply require you to do more work throughout the year. However, you should make the decision based on your personal situation. At any time you can also switch strategies by asking the the SSA to stop withholding taxes.

Don’t Be Too Discouraged

Claiming the $4,194 maximum Social Security benefit isn’t going to happen for most of us. But that’s OK. The tips above are useful no matter what your income level. If you haven’t already done so, think about when you plan to claim and brainstorm ways to boost your income today so you can claim your largest possible checks when you’re ready to retire.

The $18,984 Social Security bonus most retirees completely overlook

If you’re like most Americans, you’re a few years behind on your retirement savings. But a handful of little-known “Social Security secrets” could help ensure a boost in your retirement income. For example: one easy trick could pay you as much as $18,984 more… each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we’re all after. Simply click here to discover how to learn more about these strategies.

The Motley Fool has a disclosure policy.

Don’t Miss: What Are The 3 Types Of Social Security

Are States That Tax Social Security Benefits Worse For Retirees

Including Social Security benefits in taxable income doesnt make a state a more expensive place to retire. According to the Missouri Economic Research and Information Center, as of the third quarter of 2021, while four of the states that tax Social Security benefits have notably high cost-of-living index scores, the remaining eight fell within the two lowest-scoring groups. Kansas, in particular, had the second-lowest score in the U.S., after Mississippi.

The inverse is also true, as states that dont levy a Social Security tax arent inherently tax-friendlier places to live. When a state government doesnt garner income from one potentially taxable source, it typically makes up for it with other forms of taxation.

For instance, while Texas doesnt levy a state income tax at all , it relies heavily on taxes from a variety of other sources, including insurance taxes sin taxes on mixed beverages, tobacco products, and coin-operated machines and motor fuel taxes.

Other states that dont earn revenue from Social Security incomesuch as Arkansas, California, Louisiana, and New Yorkhave some of the highest income and/or sales tax rates in the U.S.

Living in a state that levies fewer taxes may be good for your budget, but it can limit the local governments ability to invest in social services that you or your loved ones may rely on, such as healthcare, infrastructure, and public transportation.

States That Tax Benefits

That leaves 13 states that have some level of taxation on these benefits. Nine states offer some reduction in the level of taxation based on certain age or income levels. They are: Colorado, Connecticut, Kansas, Minnesota, Missouri, Nebraska, North Dakota, Rhode Island, and Vermont.

Two states, New Mexico and Utah, include all Social Security benefits in the taxable income base. But Utah allows a tax credit to do away with liability for those earning under certain income thresholds.

The remaining two states, Montana and West Virginia, have different approaches and formulas for determining the tax liability of certain Social Security benefits. However, West Virginia is in the process of ultimately phasing out all taxation of benefits by 2022.

Read Also: Social Security Disability Earnings Limit 2022