How To Calculate Your Social Security Income Taxes

If your Social Security income is taxable, the amount you pay will depend on your total combined retirement income. However, you will never pay taxes on more than 85% of your Social Security income.

Again, if you file as an individual with a total income thats less than $25,000, you wont have to pay taxes on your Social Security benefits in 2022. For the 2022 tax year , single filers with a combined income of $25,000 to $34,000 must pay income taxes on up to 50% of their Social Security benefits. If your combined income is more than $34,000, you will pay taxes on up to 85% of your Social Security benefits.

For married couples filing jointly, you will pay taxes on up to 50% of your Social Security income if you have a combined income of $32,000 to $44,000. If you have a combined income of more than $44,000, you can expect to pay taxes on up to 85% of your Social Security benefits.

If 50% of your benefits are subject to tax, the exact amount you include in your taxable income will be the lesser of either:

- half of your annual Social Security benefits OR

- half of the difference between your combined income and the IRS base amount

The example above is for someone whos paying taxes on 50% of their Social Security benefits. Things get more complex if youre paying taxes on 85% of your benefits. However, the IRS helps taxpayers by offering software and a worksheet to calculate Social Security tax liability.

Ui Trust Fund Fix/frontline Worker Pay

After months of negotiating, the House and Senate were able to agree on replenishing the states Unemployment Insurance Trust Fund and provide bonuses to frontline workers. The agreement also puts $190 million into the COVID response account that Governor Walz can use to cover emergent needs related to the pandemic.

The states UI Trust Fund was drained during the pandemic and owed the federal government more than $1 billion. The agreement repaid the federal government and restores the UI Trust Fund to pre-pandemic levels using a combination of American Rescue Plan Act funds and the states surplus. Without action, Minnesota employers would have been required to replenish the UI Trust Fund through a surcharge and significantly increased base rates, which would have been reflected in the first quarter payment due April 30th. The state will refund or credit excess payments made by employers who paid the higher rate after receiving their statements in March.

Employers in a frontline sector must provide notice to employees advising them who may be eligible for a frontline worker payment and how to apply for benefits. This notice must be provided no later than 15 days after the application window opens and be in a form approved by DOLI. Notice must be provided using the same means an employer normally uses to provide notice to their employees and must at least be as conspicuous as:

Overview Of Minnesota Retirement Tax Friendliness

Minnesota taxes Social Security retirement benefits and most other forms of retirement income. Sales taxes in the state are relatively high, while property taxes are close to average.

To find a financial advisorwho serves your area, try our free online matching tool.

| Annual Social Security Income |

| Annual Income from Private PensionDismiss | Annual Income from Public PensionDismiss |

| Your Tax Breakdown |

| is toward retirees. |

| Social Security income is taxed. |

| Withdrawals from retirement accounts are taxed. |

| Wages are taxed at normal rates, and your marginal state tax rate is %. |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

Read Also: Social Security Break Even Chart

Before You Keep Reading

Did you know that MPR News is supported by Members? Gifts from individuals power the headlines, clarity and context found here. Give during the Fall Member Drive to become a Member today.

There were 565,000 state tax returns that reported Social Security Income in 2017, according to the nonpartisan Minnesota House Research Department. More than half of those returns 55 percent paid no tax on their benefits.

Nelsons proposal has supporters and opponents.

Why tax more from the citizens who already worked so hard for this money? The Minnesota government can afford not to tax Social Security, said Barry Bisbee of Stewartville, during a hearing on the bill.

Collecting taxes from people in my economic situation or better is one of the ways were able to fund the programs and services that keep Minnesota a good place to live, said Mary Jo Malecha, a retiree from New Brighton and member of the group ISAIAH, was among those who spoke against the bill.

Gov. Tim Walz also opposes a full elimination of the tax on Social Security earnings. The DFL governor said a further reduction on the lower end of income would be fair, and hes open to that discussion. But Walz doesnt want to go too far.

Eliminating this will give the most massive tax break to the very wealthiest Minnesotans, who aren’t depending, to live, on Social Security, Walz said.

Is Social Security Income Taxable

According to the IRS, the best way to see if youll owe taxes on your Social Security income is to take one half of your Social Security benefits and add that amount to all your other income, including tax-exempt interest. This number is known as your combined income, and this is how its calculated:

Combined Income = Adjusted Gross Income + Nontaxable Interest + 1/2 of Social Security benefits

If your combined income is above a certain limit , you will need to pay at least some tax. The limit for 2022 is $25,000 if you are a single filer, head of household or qualifying widow or widower with a dependent child. The 2022 limit for joint filers is $32,000. However, if youre married and file separately, youll likely have to pay taxes on your Social Security income.

Read Also: Do Government Employees Get Social Security

Will Minnesota Eliminate Taxes On Social Security Benefits

MINNEAPOLIS — Minnesota is one of just 12 states that taxes social security benefits.

Republicans have long led the charge to repeal that tax.

Minnesota Republicans are arguing that if ever there was a year to eliminate taxes on social security income, this is it. Minnesota, after all, has a $9.25 billion budget surplus. But the push to at least partially roll back that tax is even getting some support from Democrats.

In their tax bill, House Democrats are proposing eliminating taxes on social security income for those earning less than $75,000 a year. While Democrats have traditionally argued that the social security tax only hits high income individuals, a Minnesota House Research study indicates that’s not true. The study found that 62% of Minnesotans filing taxes do pay taxes on social security income. The study also found that couples earning $58,000 or more were paying taxes on their benefits.

Senate Majority Leader Jeremy Miller was a guest on WCCO Sunday Morning.

“I hope this was the year. It is a priority for Republicans to eliminate state income taxes on social security benefits,” he said. “We’ve been working on it for a number of years. With a $9.3 billion budget surplus, now is the time to provide seniors this much-deserved tax relief.”

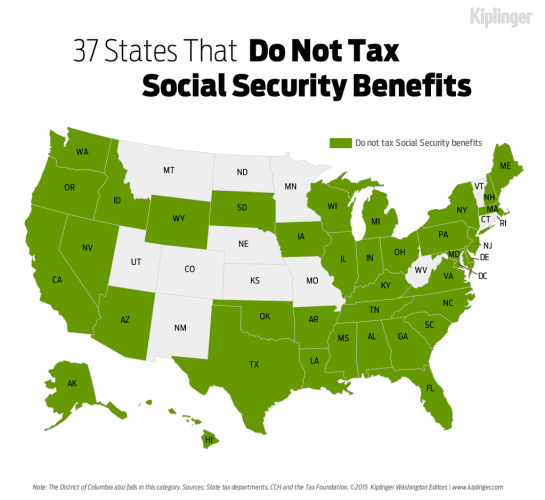

Among the 38 states that do not collect social security taxes are our neighbors, Iowa, Wisconsin and the Dakotas.

First published on April 24, 2022 / 5:40 PM

Craigs Legislation Would Help Minnesota Retirees Especially Those Living On Fixed Incomes Contend With Inflation

WASHINGTON, DC Today, U.S. Representative Angie Craig introduced the You Earned It, You Keep It Act, which would repeal federal taxes on Social Security benefits for retirees across the country. Over the past year, inflationary pressures have stretched the already limited budgets of many retired Americans. Craig’s legislation would allow seniors to keep the benefits they rightfully earned after decades of working and contributing to the American economy.

“Social Security is a promise we have made to the American people if you work hard and play by the rules, the dignity of a secure retirement will be within your reach. But taxing the very benefits American workers have earned after decades on the job diminishes our promise and threatens to undermine the financial security of retirees already struggling with rising prices,” said Representative Craig. “Eliminating this tax will help Social Security benefits go further and ensure that American retirees have all the resources they need after a lifetime of hard work.”

You May Like: Lansing Mi Social Security Office

Will You Owe Taxes On Your Social Security Benefits

As with most questions about taxes, the answer is “it depends.”

About 40% of people who get benefits pay income taxes on them, according to the Social Security Administration . That’s because their income in retirement exceeds limits set by tax rules and regulations.

Generally, if Social Security is your only retirement income, you won’t have to pay taxes on it. But if you have at least moderate income, you’ll most likely owe the government some money.

The good news is that while up to 85% of your benefits may be taxed at ordinary income rates, it’s never 100%. That’s considered tax-efficient compared with other retirement plans whose distributions may be fully taxable. In addition to the federal tax bite, 13 states also tax Social Security benefits using either the federal provisional income formula or their own.

State Taxation Of Social Security Benefits

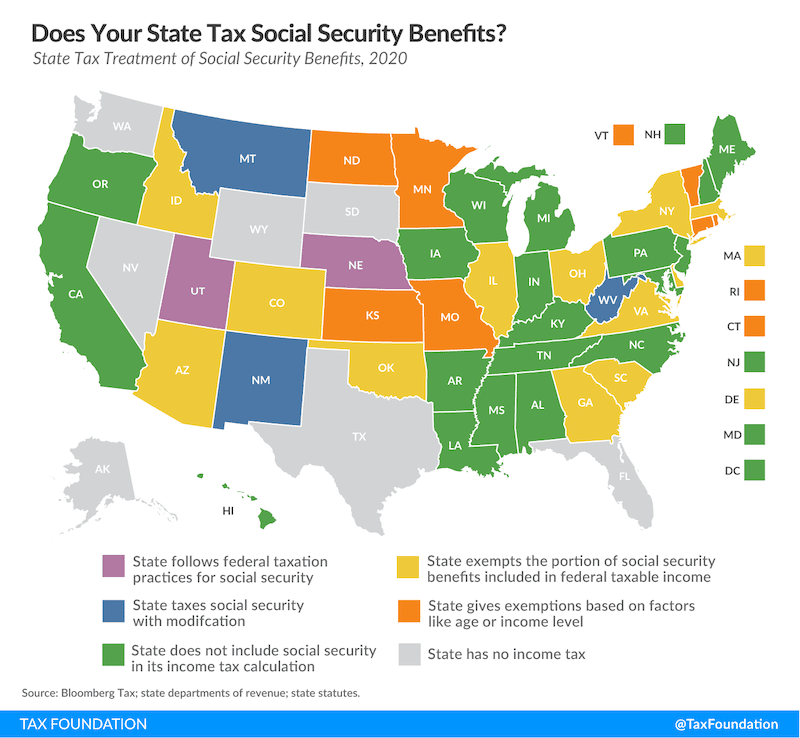

Most states don’t tax Social Security benefits. But the ones that do either follow the same federal provisional income rules or have special rules and income thresholds to determine what’s taxable.

These 4 states use the federal PI formula: Minnesota, North Dakota, Vermont, and West Virginia. The taxable portion of Social Security for these states is the same as the federal amount.

Nine states have special rules and income thresholds. Most use the federal modified adjusted gross income formula rather than the federal PI formula for taxing Social Security income.

These states are: Colorado, Connecticut, Kansas, Missouri, Montana, Nebraska, New Mexico, Rhode Island, and Utah.

If you live in a state that counts Social Security benefits as taxable income, you should consult your state tax department for details and a qualified tax advisor.

Read Also: Social Security Appointment Name Change

What Does The Social Security Check Boost Mean For You

On Thursday morning, the Social Security Administration announced a cost-of-living increase of nearly 9%.

So, maybe you don’t get Social Security yet. But, you very likely pay into it. And there’s a good chance it pays out to your grandparents or maybe your parents each month.

Sixty-five-million Americans are Social Security beneficiaries, and three-quarters of them are seniors.

About 9% are children or widows or widowers of people who’ve died, and the rest – 14% – are disabled workers. Starting in January, all of these people will see an 8.7% increase. So what does that mean in dollar amounts?

“This is average because everyone’s Social Security record is based on their own work life, right? But on average it means an extra $140 a month,” said CBS News Business Analyst Jill Schlesinger.

The average monthly benefit right now is $1,547. Here’s another average for you: Social Security covers about 40% of what people made before retirement. Congress used to give increases every few years. But back in 1975, lawmakers decided to make these jumps automatic and annual.

There have only been four years – back in the late 70s and 80s – where this number has been higher than what it is now. Back then, like it is now, inflation was high, and that’s how this increase is calculated.

Because Minnesota is one of 12 states that taxes Social Security benefits for some people, here’s the big question: Will it increase taxes for Minnesotans?

Control Your Taxes Now & Later

The longer you wait to claim Social Security benefits, the better chance you’ll have to boost the overall tax efficiency of your retirement income plan. Here’s how.

Drawing down traditional tax-deferred assets before collecting Social Security can enable you to control both your current and future taxes.

The amount you withdraw from a traditional IRA, for example, lowers your account balance, which may reduce your future required minimum distributions .

Since your RMD is considered ordinary income, having smaller distributions while you’re collecting benefits may reduce the taxes on your benefitsor keep you from paying taxes altogether.

In addition, managing your retirement income in this way can also help you qualify to pay lower Medicare parts B and D premiums, which are income-based.

Read Also: Memphis Tn Social Security Office

State And Local Government Employers Must Provide Social Security And Medicare Coverage To Employees Who Are Subject To Mandatory Withholding Under Federal Law And To Employees Whose Positions Require Coverage Under A Section 218 Agreement Between The State And The Social Security Administration

Each state has a State Social Security Administrator who is designated to provide information and assistance to governmental employers concerning Section 218 Agreements. The Public Employees Retirement Association is Minnesotas SSSA.

The following Q& A provides helpful information about Social Security and Medicare coverage for public employees and include guidelines on when your governmental entity should contact PERA in its capacity as the SSSA.

The State of Minnesota has made numerous modifications to its original Section 218 Agreement on behalf of governmental employers. The modifications give Social Security and Medicare coverage to employees covered under various public retirement systems including, but not limited to, positions covered under:

· The St. Paul Teachers Retirement Fund Association

· The General and Correctional Plans of the Minnesota State Retirement System

· The Legislators Retirement Plan and the Elective Officers Retirement Plan

Additionally, a number of employers have individually extended Social Security and Medicare coverage to their employees who are members of the PERA Correctional Plan and to local elected governing-body officials who cannot join the Coordinated Plan but who qualify for membership under the PERA Defined Contribution Plan. In these situations, the 218 Agreements cover a specific employer and do not affect any other employer.

Senate Passes Historic Ongoing Permanent Tax Relief For Minnesota Families

Fresh off passing the largest tax cut in state history last month, Minnesota Senate Republicans yesterday approved a second round of historic tax relief for working families and small businesses.

The bill includes the top two tax priorities for Senate Republicans this year a full exemption of the Social Security benefits from state taxes and a significant reduction of the lowest income tax rate and builds on the previous historic tax bill with additional relief aimed at helping working families afford daily life under the pressure of out-of-control inflation.

Rising costs are devastating our family budgets, Senator Gary Dahms said. Our bill provides historic tax relief and eliminates the unfair tax on Social Security income. Minnesota is one of the highest tax states in the country and its time we give meaningful permanent ongoing tax relief to Minnesota families.

Senate Republicans top two tax priorities for the year are the marquee items in the second tax bill:

TAX RELIEF FOR FAMILIES

With inflation spiraling out of control and the cost of basic necessities becoming more and more unaffordable, the Senates second tax cut bill provides badly needed relief for working families.

SUPPORT FOR SMALL BUSINESSES AND ENTREPRENEURS

The Senates second tax cut bill continues Republicans support for the small businesses that are the lifeblood of communities across the state by making it easier to operate in Minnesota.

OTHER PROVISIONS

Don’t Miss: Social Security Office In Miami

Is 2020 The Year Minnesota Gets Rid Of Taxes On Social Security

ST. PAUL There’s probably not a single person in the Legislature who doesn’t want to eliminate state taxes on Social Security, said DFL Rep. Paul Marquart, chairman of the House Taxes Committee.

But it’s not clear if that will happen in full this session.

Minnesota is one of 14 states that taxes Social Security, according to an report. The taxes vary by “adjusted gross income and other criteria” and benefits in other states may be subject to federal taxes depending on income.

Senate Republicans have made elimination of all Minnesota taxes on Social Security income part of their Vision 2020 plan.

Democrats control the House and the executive branch, and Republicans hold the Senate. The session started Tuesday and ends in mid-May.

Lawmakers reduced state taxes on Social Security benefits in 2017 and 2019.

Right now 60% of Social Security benefits are not taxed, Marquart said. Couples whose only income comes from Social Security do not pay any taxes on those benefits.

“I think it’s going to have to be phased in ultimately. We want to get there, get to the next 40%,” Marquart said.

RELATED: St. Cloud dementia group hopes to launch national model, revolutionize care

About 61 million Americans collect Social Security benefits and 169 million Americans pay Social Security taxes to support the system, according to the National Academy of Social Insurance. Beneficiaries include retirees, disabled people and the families of workers who are retired, disabled or deceased.

Are States That Tax Social Security Benefits Worse For Retirees

Including Social Security benefits in taxable income doesnt make a state a more expensive place to retire. According to the Missouri Economic Research and Information Center, as of the third quarter of 2021, while four of the states that tax Social Security benefits have notably high cost-of-living index scores, the remaining eight fell within the two lowest-scoring groups. Kansas, in particular, had the second-lowest score in the U.S., after Mississippi.

The inverse is also true, as states that dont levy a Social Security tax arent inherently tax-friendlier places to live. When a state government doesnt garner income from one potentially taxable source, it typically makes up for it with other forms of taxation.

For instance, while Texas doesnt levy a state income tax at all , it relies heavily on taxes from a variety of other sources, including insurance taxes sin taxes on mixed beverages, tobacco products, and coin-operated machines and motor fuel taxes.

Other states that dont earn revenue from Social Security incomesuch as Arkansas, California, Louisiana, and New Yorkhave some of the highest income and/or sales tax rates in the U.S.

Living in a state that levies fewer taxes may be good for your budget, but it can limit the local governments ability to invest in social services that you or your loved ones may rely on, such as healthcare, infrastructure, and public transportation.

Recommended Reading: When Can You Claim Social Security