Social Security Benefit Taxes By State

Aside from federal tax rates, the way Social Security is taxed also varies by state. Only 12 states tax Social Security benefits: Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, North Dakota, Rhode Island, Utah, Vermont and West Virginia. The chart below shows how different states handle Social Security taxes.

|

Taxation |

|

|---|---|

|

State exemptions for Social Security tax based on factors like age and income level |

CO, CT, KS, MN, MO, NE, RI, VT, WV |

|

No Social Security tax |

AL, AR, AZ, CA, DC, DE, GA, HI, IA, ID, IL, IN, KY, LA, MA, MD, ME, MI, MS, NC, NH, NJ, NY, OH, OK, OR, PA, SC, TN, VA, WI |

|

No state income tax |

AK, FL, NV, SD, TX, WA, WY |

State Social Security taxation varies greatly by state and can often be complicated. In Colorado, for example, beneficiaries younger than 65 can exclude up to $20,000 in benefits from their income, along with other retirement income. But beginning in 2022, beneficiaries 65 and older can deduct all federally taxed Social Security income previously, there was a $24,000 limit.

In Connecticut, single filers with AGIs of less than $75,000 and married filers with AGIs of less than $100,000 can fully exempt all of their Social Security income. But even those who exceed these thresholds can still deduct 75% of federally taxable Social Security benefits on their return.

Other states have their own unique tax structures. You should ensure youre in compliance by consulting with your state tax board.

How Much Will Your Divorced Spouse Receive

If you have not applied for retirement benefits, but can qualify for them, your ex-spouse can receive benefits on your record if you have been divorced for at least two continuous years.

If your ex-spouse is eligible for retirement benefits on their own record, we will pay that amount first. If the benefit on your record is higher, they will get an additional amount on your record so that the combination of benefits equals that higher amount.

If your ex-spouse was born before January 2, 1954, and has already reached full retirement age, they can choose to receive only the divorced spouses benefit and delay receiving their own retirement benefit until a later date.

If your ex-spouses birthday is January 2, 1954 or later, the option to take only one benefit at full retirement age no longer exists. If your ex-spouse files for one benefit, they will be effectively filing for all retirement or spousal benefits.

How Much Do Widowed Spouses Receive

Social Security survivors benefits are especially important to women , because wives tend to earn less than their husbands, and they also typically outlive their husbands. When a retired worker dies, the surviving spouse receives a benefit equal to the deceased workers full retirement benefit.

Depending on the widows or widowers circumstances, however, this benefit may substantially reduce her monthly household income because only one Social Security benefit is now arriving , not the two benefits that the couple received before the spouses death. Women who had worked and earned their own Social Security benefits, in particular, may find themselves struggling to meet the rising fixed expenses that come with aging.

For more information on Social Security and survivor benefits, please visit the Social Security Administration at ssa.gov/benefits/survivors/.

Also Check: How Is Calculated Social Security Benefits

Also Check: Social Security Office In Columbus Ohio

How To Calculate My Social Security Benefits

You can use the Money Help Center calculator to determine how much Social Security you will get and how income tax may impact your benefits and income. You need to plan for retirement by considering how you will be taxed once your working life ends. You dont want to get an unpleasant surprise when you start earning your retirement income or getting your benefits and realize it is less than you expected because of tax withdrawals.

At the same time, Social Security can be a smart part of your retirement plan. Even if you are taxed at the highest level, you may still benefit. After all, from virtually any other source of income, 100% of your wages and income will be taxed after retirement. Dollar for dollar, Social Security retirement benefits can still be a better deal as far as taxation, than other sources of retirement.

As you plan for your golden years, it is important to keep in mind all the sources of income you may have once you finish working. Plan ahead and consider the tax impact on your income as well as any tax advantages you can secure today while saving for retirement. Use the Money Help Center calculators to help you plan. Our calculators are free, have no bias and never ask you for your personal information, such as contact information or e-mail address. You can use them at any time and instantly get information to help you plan for your financial future.

Sign up for our newsletter and get the latest news and updates

Money Help Center

Let Us Help With Spousal Social Security Disability Benefits

If you or your spouse need assistance applying for Social Security benefits, at the number at the top of the page! We can guide you on how to apply for benefits and answer any questions you may have about Spousal Social Security benefits. Every case is different with unique circumstances and family dynamics, so contact us today to discuss your options!

Translate:

Let Crest SSD Help You File Your Social Security Disability Claim.

Accreditations & Memberships

Serving Clients In:

Alabama, Alaska, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Virginia, Washington, West Virginia, Wisconsin, Wyoming

Disclaimer: We are a privately owned, nationwide advocacy service. Any information you receive on this site is not intended to be, nor should it be construed as, legal advice. Using this website or contacting us does not create any type of legal or fiduciary relationship. Crest SSD is neither affiliated with nor endorsed by the Social Security Administration or any other government agency or entity.

Google Reviews

Read Also: Social Security Disability Benefit Amount

Read Also: One Becomes Eligible For Social Security Disability

Social Security For The Disabled

People who are disabled, are dependents of retired or disabled workers, or are surviving spouses/children may also receive benefits. Note that this is supplementary information and that the Social Security Calculator only provides calculations for retirement benefits.

The SSA’s definition of disability refers to total disability, so partial or short-term disabilities are not qualified for benefits. Under the SSA’s rules, a person is disabled only if they meet all of the following conditions:

- They cannot do work they did before

- The SSA decides that they cannot adjust to other work because of their medical condition

- The disability has lasted or is expected to last at least one year or to result in death

Benefits usually continue until beneficiaries are able to work again. Disability beneficiaries that reach full retirement age will have their benefits converted into retirement benefits, with the amount remaining the same. It is against the law to receive both disability and retirement benefits at the same time.

Social Security Disability Insurance

Supplemental Security Income

In some situations, it is possible to receive both SSDI and SSI. This usually happens when a qualified application for SSDI is granted low enough an SSDI benefit to make the applicant also eligible for SSI.

What Happens If One Spouse Dies

If your spouse passes away, you can collect a survivors benefit as early as age 60. You will be able to get the maximum benefit, or the full amount of your spouses monthly Social Security payment if youve reached FRA.

Before that, its reduced by 71.5%-99%. The amount its reduced by depends on how many years over 60 you are.

If you are the surviving spouse, you can restrict your application to file for either your own benefit or the survivor benefit. Later, you can switch to the other amount.

You might do this if your own monthly payment at age 70 would be larger than your spouses payment. You could claim the spousal benefit for several years, and then at age 70 switch to your own benefit.

If you are divorced and your ex-spouse dies, you might be able to get the same benefits as any current spouse. This is true if your marriage lasted at least 10 years or you are caring for a qualifying child.

Once you and your spouse have started getting Social Security benefits, the surviving spouse will have to choose one benefit. You can take either your spouses monthly payment or your own. You cannot get both.

If you live in the same household when your spouse passes away, you will also be able to get a one-time lump-sum payment of $255.

Recommended Reading: Check Social Security Retirement Benefits

Recommended Reading: Memphis Tn Social Security Office

Ask Larry: Can I Get A Full Spousal Benefit If I File Now At 65

Ask Larry

Economic Security Planning, Inc.

Today’s Social Security column addresses questions about how spousal benefit rates are calculated, when spousal benefits can become available and when to inform SSA of monthly earnings. Larry Kotlikoff is a Professor of Economics at Boston University and the founder and president of Economic Security Planning, Inc.

Have Social Security questions of your own youd like answered? Ask Larry about Social Security here.

Can I Get A Full Spousal Benefit If I File Now At 65?

Hi Larry, I am 65 and my husband has been collecting his retirement benefit since he turned 70 a couple years ago. Can I receive my full spousal benefit now or do I have to wait until next year to get the full benefit? And is the full amount 50% of his current benefit or 50% of what he would have received at 66? Thanks, Theresa

Hi Theresa, You would need to wait until you reach your full retirement age in order to receive a full 50% of your husband’s primary insurance amount , which is equal to what he would have got if he filed at his FRA. If you start drawing before your FRA, your benefit rate will be reduced for age. And if you have at least 40 Social Security earnings credits, you won’t be able to apply for spousal benefits without applying for your own retirement benefits at the same time.

Calculator: How Much Of My Social Security Benefits Is Taxable

September 15, 2022Keywords: calculator, retirement, Social Security, tax planning

Social Security benefits are 100% tax-free when your income is low. As your total income goes up, youll pay federal income tax on a portion of the benefits while the rest of your Social Security benefits remain tax-free. This taxable portion goes up as your income rises, but it will never exceed 85%. Even if your annual income is $1 million, at least 15% of your Social Security benefits will stay tax-free.

Recommended Reading: Social Security Office In Elizabethtown Ky

What To Expect From Taxes On Social Security Income

Ultimately, in my dads situation, we were able to mitigate some of his tax burden. But for a good part of it, he was stuck.

As you can imagine, he didnt like this one bit. And you might not either if you find yourself in the same position.

Every year individuals retire and are faced with sticker shock when they find out how much theyll have to pay in taxes on Social Security income.

To some, it doesnt seem fair. Youve worked for years and paid your Social Security tax as the admission ticket to a Social Security benefit.

Now that youre collecting that benefit, you have to pay taxes? Again?

How Social Security Benefits Work

As mentioned above, your Social Security benefits are funded through payroll taxes. You typically pay about 6.2% of your paycheck into Social Security up to a taxable maximum income of $147,000 for 2022. If youre self-employed, youll pay the entire 12.4% up to the maximum.

Although youll pay toward Social Security with every paycheck, your money isnt held for you. Instead, your taxes go into a pool to pay for people currently collecting benefits.

More than $1 trillion was collected from payroll taxes for Social Security in 2020. The Social Security retirement benefit you will receive will primarily be paid for by people working when you start collecting.

Read Also: Social Security Office Charleston Wv

Can I Use The Calculator To Figure Out Social Security Disability Insurance And Supplemental Security Income

No. SSDI is aimed at people who cant work because they have a medical condition expected to last a year or more or result in death. Your SSDI benefits last only as long as you suffer from a significant medical impairment while not earning significant other income.

SSI is a separate program for people with little or no income or assets who are 65 or older, as well as for those of any age, including children, who are blind or who have disabilities. The maximum monthly SSI payment for 2022 is $841 for a single person and $1,261 for a couple. But some states add to that payment, and you may receive less than the maximum if you or your family has other income. Get more information about SSDI and SSI from the Social Security Administration.

Also of Interest

When To Apply For Benefits How Much Youll Get

AARP, Updated May 25 , 2022

All the information presented is for educational and resource purposes only. It is not intended to provide specific or investment advice. We don’t guarantee the accuracy of the tool and suggest that you consult with your advisor regarding your individual situation.

Read Also: Social Security Olive Branch Ms

When Should I Start Collecting Social Security

Ultimately, the decision of when to begin collecting Social Security is one you have to make. It depends on your age, your health status, how much you spend and how much you have saved. Its generally best to start collecting as late as you can, because you get a larger monthly payment, which is adjusted for inflation each year.

Consider a retiree who was born in 1950 and averaged $50,000 a year in salary. If she has $3,000 a month in expenses, her Social Security check would cover 48 percent of her expenses if she started Social Security at age 62. If she waited till age 70, her check would cover 85 percent of her expenses. Every year she delays retirement, her Social Security payout which is adjusted annually for inflation rises by about $1,649.

Traditionally, the retirement system in the U.S. has been a three-legged stool: Social Security, savings and pensions. Social Security was never intended to be the sole source of income for retirement. Increasingly, however, employers have been moving away from their employer-sponsored pension plans in favor of tax-deferred retirement savings accounts, such as 401 plans.

Taxation Of Social Security Benefits

The amount of the taxable Social Security benefits becomes part of your gross income on your tax return. Its still subject to your normal deductions to arrive at your taxable income. You still pay at your normal tax rates on the taxable amount. 50% or 85% of your benefits being taxable doesnt mean youll pay a 50% or 85% tax on your benefits. The actual taxation on your benefits is much less.

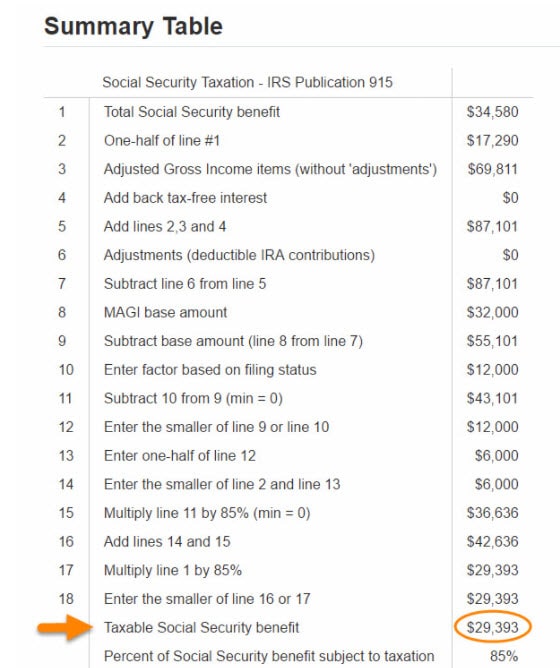

The IRS has a somewhat complex formula to determine how much of your Social Security is taxable and how much of it is tax-free. The formula first calculates a combined income that consists of half of your Social Security benefits plus your other income such as withdrawals from your retirement accounts, interest, dividends, and short-term and long-term capital gains. It also adds any tax-exempt interest from muni bonds. This income is then reduced by a number of above-the-line deductions such as deductible contributions to Traditional IRAs, SEP-IRAs, SIMPLE IRAs, HSAs, deductible self-employment tax, and self-employment health insurance. Finally, this provisional income goes through some thresholds based on your tax filing status . All of these steps are in Worksheet 1 in IRS Publication 915.

Read Also: What Can Someone Do With Your Social Security

Social Security Tax Rates

The Social Security program provides benefits to retirees and those who are otherwise unable to work due to disease or disability. Social Security often provides the only source of consistent income for people who can no longer workespecially for those with modest earnings histories.

Because Social Security is a government program aimed at providing a safety net for working citizens, it is funded through a simple withholding tax that deducts a set percentage of pretax income from each paycheck. Workers who contribute for a minimum of 10 years are eligible to collect benefits based on their earnings history once they retire or suffer a disability.

Social Security benefits are capped at a maximum monthly benefit amount based on earnings history. To prevent workers from paying more in taxes than they can later receive in benefits, there is a limit on the amount of annual wages or earned income subject to taxation, called a tax cap.

For 2021, the maximum amount of income subject to the OASDI tax is $142,800, capping the maximum annual employee contribution at $8,853.60. For 2022, the maximum amount of income subject is $147,000, capping the maximum annual employee contribution at $9,114.00. The amount is set by Congress and can change from year to year.

How Much Of My Social Security Benefit May Be Taxed

Did you know that up to 85% of your Social Security Benefits may be subject to income tax? If this is the case you may want to consider repositioning some of your other income to minimize how much of your Social Security Benefit may be taxed and thereby, maximize your retirement income sources.

This information may help you analyze your financial needs. It is based on information and assumptions provided by you regarding your goals, expectations and financial situation. The calculations do not infer that the company assumes any fiduciary duties. The calculations provided should not be construed as financial, legal or tax advice. In addition, such information should not be relied upon as the only source of information. This information is supplied from sources we believe to be reliable but we cannot guarantee its accuracy. Hypothetical illustrations may provide historical or current performance information. Past performance does not guarantee nor indicate future results.

Don’t Miss: Social Security Number For International Students