Business Credit Cards With Ein Number

Another option is to apply for an Employer Identification Number . This is a nine-digit number issued by the IRS to businesses for tax purposes. To apply for an E IN, you must complete Form SS-4.

#CaminoTip Here is a guide to How to Open a Bank Account Without an Ssn in the Us

If you are a foreign national who is not eligible for an SSN or ITIN, you may be able to apply for a credit card by providing your passport number and country of citizenship.

When you make a business credit card application, it is essential to remember that financial institutions may ask you to provide additional documentation to prove your identity and creditworthiness.

Can You Have A Credit Score If You Dont Have A Social Security Number

The credit bureaus use sensitive information to keep track of your credit history. This information includes your Social Security number, your name, your date of birth, your address, and your employment history. While a Social Security number is an identifier that credit bureaus use to locate and collect your information, itâs only one of several identifiers. If you donât have a Social Security number, credit bureaus can access your credit history using the other identifiers like your name, date of birth, address, and employment history.

While a Social Security number does improve the accuracy of matching credit history with a consumer, a Social Security number isnât necessarily required to create a credit report and an accompanying credit score.

Which Credit Card Is Best For International Students

Some of the best credit cards for international students who dont have SSNs but have ITINs include the Deserve EDU Card, the Capital One Journey Student Card, the Bank of America Unlimited Cash Rewards for Students Card, the Bank of America® Travel Rewards credit card for Students Card, the Petal 2 Visa Credit Card, the Oportun Visa Credit Card and the Tomo Credit Card. The Citi Rewards Student Card used to be a good alternative as well but is now unavailable for new applicants.

If you dont have an SSN or an ITIN, you may consider applying for the Deserve EDU Card, any of the student cards from Bank of America or the Oportun Visa Credit Card.

International students who have existing credit histories in their home countries may consider applying for credit cards from American Express, provided they meet other eligibility criteria. This is because Amex can access credit reports of applicants from different countries.

You may also consider applying for a secured credit card. Some of your top alternatives include the Discover it Secured Credit Card, the Capital One Platinum Secured Credit Card, the OpenSky Secured Visa Credit Card and the Citi® Secured Mastercard®.

You may also want to consider being an authorized user on someone else’s credit card. You can easily pay them for your charges each month, and is an easy way to begin building your credit. Brett Holzhauer

You May Like: 10 Year Social Security Employment History

Use Credit Wisely To Maintain Good Credit Scores

Once you establish a credit account, manage it carefully pay your bills on time every month and stay within your credit limit. Not paying, paying late, or going over your credit limit will lower your credit score.

The 3 credit reporting agencies will update your credit history monthly, and if you manage your credit responsibly over time, your credit score will reflect that youre a responsible borrower. A strong credit history and credit score may help you qualify for other types of credit in the future like an auto loan, store credit card, mortgage, or home equity account.

As you apply for more credit, be sure to do it strategically and slowly. Dont apply for 5 different accounts at the same time only apply for credit accounts that will help you reach important goals.

Can You Establish Credit Without A Social Security Number

Lenders typically require a Social Security number when you apply for a credit account. However, if you opened an account without an SSN and the lender reports its accounts to Experian, the account should still appear on your credit report, helping you establish credit. That’s because Experian doesn’t match information to a person’s credit history using only the SSN: Experian matches information using all of the identification information provided by the lender.

If you are just starting to establish credit in your name, or if you have not used credit in quite some time, it is possible that you may not have a credit score even if you have a credit report. There are many different credit scoring models available for lenders to use. While some may be able to calculate a score with as little as one account appearing on your report, others may require multiple accounts to be reported for a certain period of time in order to generate a credit score. Credit scores often require three to six months of activity to be reported before the account will be included in score calculations.

Even if you had an established credit history in the past, some credit score models may not be able to generate a score if there has been no activity on any of your accounts in the past several months.

You May Like: How Long Does It Take To Get Social Security Benefits

Capital One Spark Classic For Business

This card is currently not available.

Business Rating

| $0 | Good/Excellent |

With the Ink Business Cash® Credit Card, you can earn 5% cash back on the first $25,000 you spend at office supply stores and on internet, cable, and phone services each year. The card also offers 2% cash back on the initial $25,000 you spend at gas stations and restaurants. Youll earn 1% cash back on everything else.

Although you do need good credit to get this card, it will accept your ITIN instead of a SSN.

Why Is An Ssn Required To Get A Credit Card

The most basic reason is that it allows the banks to track your credit history easily and, therefore, your risk level as it applies to your likelihood of paying your bill.

The federal government requires all financial institutions to verify the identity of people who want to open a financial account. This includes checking accounts, savings accounts, credit cards, and other loans.

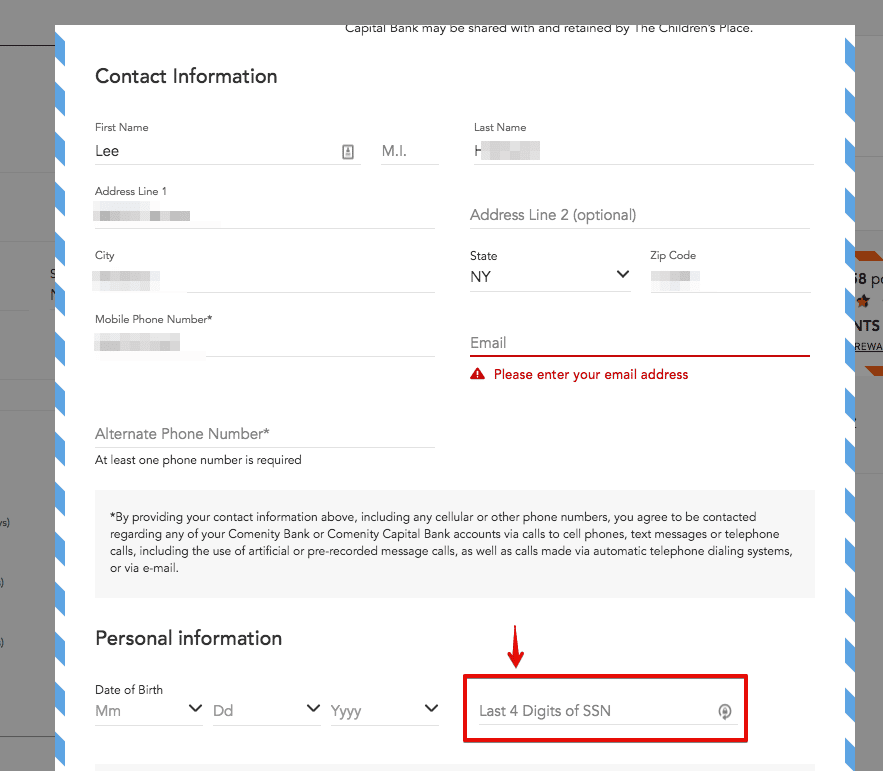

The financial institution has some leeway regarding what it considers adequate information for identification purposes. However, all will require your legal name, address, and birthdate, as well as some identification number.

#DidYouKnowYou can obtain a bank loans with ITIN number.

Read Also: Social Security Disability Earnings Limit 2022

Best For International Students: Deserve Edu Mastercard For Students

The Deserve EDU Mastercard provides an interesting credit option for college students, including international students who are studying in the U.S. You dont need an SSN to apply because Deserve checks other factors to determine your credit risk potential. This includes seeing how you manage your money and whether you pay your bills on time.

The Deserve EDU offers free year of Amazon Prime Student after spending $500 in the first 3 months. It also has a $0 annual fee and you can earn 1% cash back on all purchases. This card is likely best for international students because they might not have many other credit card options that also offer rewards.

For more details, check out our Deserve EDU Mastercard review.

American Express Credit Card Without Ssn

American Express also offers a business credit card without SSN. To apply for its Business Gold Card, you must have an EIN.

This card offers a 0% introductory APR on all purchases made within the first 12 months after you open your card.

The variable APR after that will range between 13.24% and 19.24%.

You can qualify for up to two times the Membership Rewards points on the first $50,000 of your purchases every year. There is no annual fee to have this card, and they also have online banking options.

You May Like: Social Security Requirements For Disability

If You’re A Student Without An Ssn You Have A Special Option

Some student credit cards are designed specifically for international students, and you’ll just need your passport, student visa, and immigration forms to apply for them. You will probably also need a U.S. bank account to maintain the credit card, however. Student credit cards have similar parameters to secured credit cards, such as low limits, although they don’t generally require a security deposit. They’re geared toward people with lower income who are new to using credit and want to establish a good credit history.

How To Apply For A Student Credit Card Without An Ssn

You may consider applying for a student credit card without an SSN by following different measures. If youre in the U.S. on an F-1 or a J-1 visa, you may consider applying for an SSN to increase your options. If not, you have these alternatives:

Apply for an ITIN

No matter your student visa status, you may apply for an individual taxpayer identification number . Some credit card issuers let you use your ITIN instead of an SSN during the application process.

Have income

If you are 18 to 21 years old, you need to show that you earn adequate independent income to repay any possible debt or get a co-signer to apply with you. If youre over 21 years old, you may show income from different sources, including money you regularly receive from your parents.

Build credit history

Since most student credit card providers look at applicants credit histories, international students might have problems dealing with this aspect. With no credit history at all, you may consider applying for a secured credit card and using it to build your credit history. You may then consider applying for a student credit card by using your ITIN.

Look for cards that dont require SSNs

Look for credit cards that dont require an SSN during the application process and make do with your ITIN instead. Some let you go through the application process without both.

Recommended Reading: Do Employers Need Social Security Number For Background Check

How To Apply For An Itin

Here’s the easiest way to apply for an ITIN.

Go to the Internal Revenue Service websiteâIRS.gov.

- Search “apply for ITIN.”

- Download and print the form, Form W-7, Application for IRS Individual Taxpayer Identification Number.

- Complete the form.

Return the completed form and documentation to the IRS by US mail, or take it to any approved IRS acceptance agent, usually an accounting firm or IRS taxpayer assistance center for processing. You can find these agencies, listed by individual states, on the IRS.gov website.

Get An Individual Taxpayer Identification Number

In general, only U.S. citizens and noncitizens authorized to work in the U.S. are eligible for a Social Security number. But youre generally not required to provide one if you dont have one, according to the Social Security Administration.

Instead, you can obtain an Individual Taxpayer Identification Number, or ITIN, which is available regardless of your immigration status. It follows the same nine-digit format as a Social Security number and can be used in place of one on credit card applications.

The Petal® 2 “Cash Back, No Fees” Visa® Credit Card, for example, does require applicants to be U.S. residents, but you can apply with either a Social Security number or an ITIN. Petal’s issuing bank, WebBank, can also decide to consider more than just your credit scores, which is good news if you have little or no U.S. credit history. It can weigh creditworthiness using a proprietary algorithm that takes into account your income, as well as your savings and spending. The card offers a rewards program, and the annual fee is $0. Terms apply.

» MORE:Review of the Petal® 2 “Cash Back, No Fees” Visa® Credit Card

You May Like: Social Security Office On Buffalo

Best Starter Credit Card

- Requires a refundable minimum security deposit

- No rewards program

Verdict

The Capital One Platinum Secured Credit Card is a great credit card for immigrants and permanent residents who have an ITIN or Social Security number. Though this card doesnt offer any type of rewards program, paying your bill on time consistently will help you build your credit and eventually graduate to an unsecured card.

There is a $0 annual fee, but this card requires a refundable minimum security deposit of either $49, $99 or $200 which will earn you an initial credit line of $200. However, if you deposit more money before your account opens you are eligible to get a higher credit line. You will also automatically be considered for a higher credit line after six months from account opening.

Why Credit Card Companies Want A Tax Id

The Federal government has a long list of requirements that all financial companies have to follow. Among those regulations are a set of rules that require money companies to âknow your customer.â In the industry, this is commonly referred to as KYC.

KYC laws started with the Patriot Act in 2001. These laws are designed to prevent terrorists, fraudsters, and other criminals from using the US financial system. For us good guys and gals, it means a few more hoops to jump through when opening a new account. If you want to learn more about KYC laws, check out this great article from financial technology company Plaid.

This is in addition to the credit reporting issues described above. If a company doesnât know who you are and canât find a credit history for you, they donât know if you are a safe bet or a risky one.

If you donât have a Social Security number, you can usually input an ITIN in its place. If you donât have an ITIN, follow along with the next section to learn how to get one.

Don’t Miss: Social Security Office Kennett Mo

Best Credit Cards For International Students Immigrants And Students Without An Ssn Or Itin In 2022

With several great options to choose from, the best overall credit card for international students and immigrants is the Capital One Platinum Secured Credit Card. It has no annual fee and only requires an ITIN.

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been reviewed, approved or otherwise endorsed by the credit card issuer. This site may be compensated through a credit card issuer partnership.Terms apply to American Express benefits and offers. Visit americanexpress.com to learn more. Citi is an advertising partner.

Jump to

There are several options available for international students and immigrants seeking a credit card in the United States, even without a Social Security number or ITIN.

Though it can be challenging, it is possible for non-U.S. citizens living in the United States to get a credit card. Ones immigration status will dictate the number of credit card options available, but it’s important to note that you don’t necessarily need to have a Social Security number or Individual Taxpayer Identification Number in order to get a credit card in the United States. Many immigrants and international students may be able to apply for secured credit cards or become authorized users on someone elses account.

Getting A Credit Card Without An Ssn Can Help You Build Credit In The Us

You can have a credit history and credit scores in the US regardless of whether you have an SSN or are a U.S. citizen because the major credit bureaus â Equifax, Experian, and TransUnion â donât require an SSN to create and build a U.S. credit history.

Once you open credit cards and loans in the U.S., your payments can be reported to the credit bureaus. The bureaus can then generate credit reports by matching you with your accounts based on identifying information, such as your name and address. Credit scores can also be created based on those credit reports.

If youâre still in the early stages of building credit in the US, you could still benefit by using your credit history from your home country. Nova Credit helps you bring your credit history with you, and creates a Credit Passport® that lenders, card issuers, and property managers can use to review your application based on your foreign credit history.

More resources:

Don’t Miss: Do Government Employees Get Social Security

Top Credit Card Wipes Out Interest Until 2023

If you have credit card debt, transferring it to this top balance transfer card secures you a 0% intro APR into 2023! Plus, you’ll pay no annual fee. Those are just a few reasons why our experts rate this card as a top pick to help get control of your debt. Read our full review for free and apply in just 2 minutes.

We’re firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.American Express is an advertising partner of The Ascent, a Motley Fool company. Citigroup is an advertising partner of The Ascent, a Motley Fool company. The Motley Fool has positions in and recommends Visa. The Motley Fool has a disclosure policy.

Beware Of Predatory Lending

Immigrants searching for a credit card need to carefully examine any contracts or cardmember agreements before applying you should understand all the fees and charges associated with a new account. People with low credit scores and limited credit histories are often targeted with extremely high interest rates and fees.

Some guidelines:

- Dont accept credit cards with a purchase APR higher than 29%.

- If a card comes with an annual fee, it should be less than $50.

- Other types of fees are not common. Origination, monthly membership or upkeep fees are generally a sign of a card being a so-called fee harvester, and should be avoided.

- Look out for other surprises in the cards terms and conditions .

Don’t Miss: Social Security Office Shawnee Oklahoma