How Can I Avoid Paying Taxes On Social Security

Here’s how to reduce or avoid taxes on your Social Security benefit:

Social Security Benefits To Jump 87% In 2023 As Top Tax Hits $19865

As inflation runs the hottest in four decades, 70 million Americans will benefit from the largest Social Security cost of living adjustment since 1981.

getty

The Social Security Administration announced today that benefits will jump 8.7% for 2023, the largest increase since 1981, when double digit inflation pushed payments up more than 11%. The cost-of-living adjustment affects 70 million Americans, including 48 million retired workers and their spouses and dependents those receiving disability and survivors benefits and recipients of Supplemental Security Income. The average retired worker will receive $1,827 a month in 2023, up $146 from $1,681 this year.

The 2023 COLA is based on the increase in the Consumer Price Index for Urban Wage Earners between the third quarter of 2021 and the third quarter of 2022meaning it looks backwards at inflation and was sealed this morning when the Bureau of Labor Statistics reported Septembers inflation rate. The large increase, combined with a 2023 drop in Medicare premiums , means seniors who rely on Social Security will be able to make up most of the ground theyve lost to inflation over the past year. In 2022, benefits went up 5.9%, but retirees lost a chunk of that to a 14.5% increase in Medicare Part B premiums.

Here’s How Much You Can Earn Next Year Before It Starts To Impact Your Social Security Benefits

The decision to file for Social Security is a big one. Claim benefits too soon, and you risk slashing them on a monthly basis for life. Wait too long, and you risk losing out on lifetime income.

One factor that may influence your decision to file or not is your job status. If you’re working, you may want to wait on Social Security and grow your monthly benefit. The good news is that you’re allowed to hold a job and collect Social Security at the same time. Whether that impacts your benefits depends on your age and earnings level.

You’re entitled to your full monthly Social Security benefit based on your earnings history once you reach full retirement age. FRA is 66, 67, or 66 and a certain number of months, depending on your year of birth. Once you reach FRA, you can earn as much money as you’d like without impacting your Social Security income. If you claim benefits before FRA and continue working, you’ll have to worry about the earnings test.

Image source: Getty Images.

You May Like: Social Security Ticket To Work Program

Social Security Tax Limits

The government bases the annual Social Security tax limits on changes in the National Wage Index , which tends to increase every year. The changes are intended to keep Social Security benefits on track with current inflation.

Any income you earn beyond the wage cap amount is not subject to a 6.2% Social Security payroll tax. For example, an employee who earns $165,000 in 2022 will pay $9,114 in Social Security taxes .

Keep in mind, however, that there is no wage base limit for Medicare tax. While the employee is only subject to Social Security tax on the first $147,00, they will have to pay 1.45% Medicare tax on the entire $165,000. Workers who earn more than $200,000 in 2022 are also subject to an 0.9% additional Medicare tax.

The combination of the increase in the Social Security tax limit and the additional Medicare tax for high-earners could result in lower take-home pay. Unfortunately, that means workers who earned over $200,000 in 2021 are at risk of owing more taxes in 2022.

Here is an example of how the Social Security limit works in 2021 and 2022:

| Social Security Tax Limit Example |

|---|

| 2021 Income |

You Can Earn A Specific Amount Of Money Next Year Before It Has An Impact On Your Social Security Benefits

One decision many older Americans struggle with is when to file for Social Security. If you claim benefits too early, you might reduce them on a permanent basis. But if you wait too long to sign up for benefits, you’ll risk getting less money in your lifetime if you wind up passing away at a young age.

If you’re still working, the decision to claim benefits can be even trickier. That’s because there are rules you’ll need to take into account that could impact your benefits.

Each year, Social Security imposes what’s known as an earnings test for workers who earn money from a job but also collect benefits. Income that exceeds the earnings test limit could result in withheld benefits, so it’s important to know what those thresholds look like. Here’s what seniors need to know for 2022.

Image source: Getty Images.

You May Like: How Much Is My Social Security Taxed

Retirement Earnings Test Exempt Amounts

Workers who receive benefits before they reach full retirement age are subject to the retirement earnings test. If your income exceeds certain thresholds, then Social Security will withhold benefits until you reach FRA. Like the Social Security tax limit, these thresholds typically increase annually with the national wage index.

There are two annual earnings test exempt amounts: one that applies to individuals younger than retirement age and one that applies to individuals who reach FRA during that year. For younger recipients, Social Security withholds $1 for every $2 in excess of their exempt amount. Individuals who reach retirement age will have $1 withheld for every $3 in excess of their exempt amount.

In 2022, the earnings test exemption amounts will increase to:

- $19,560 for individuals younger than the FRA

- $51,960 for those who reach their FRA

In other words, an individual who earns $19,560 or less in 2022 may be eligible to receive full Social Security benefits. This is up from $18,960 in 2021.

Earning Limits For Social Security Recipients Raised

The SSA has also let workers earn more while drawing Social Security retirement benefits in 2022.

In 2021, you could earn up to $18,960 before triggering a reduction to your benefits, but in 2022, youll be able to earn $19,560, a 3.16 percent increase.

Workers who will not be 66 years old and 8 months in 2022 but receive Social Security retirement benefits will see $1 deducted from their benefits for each $2 earned over $19,560.

Those who reach full retirement age in 2022 can earn up to $51,960 in the months leading up to full retirement age. But if you earn more, Social Security will reduce your benefit by $1 for every $3 earned above the limit.

Also Check: When Does Social Security Pay Each Month

How Working Affects The Taxation Of Your Benefits

Now you know how work affects your benefit payment amounts, but did you know that working can also affect whether or not your benefits are taxed? There is also an earnings test when it comes to the taxability of your retirement benefits. Unlike the earnings test used for potential benefit reduction, almost all your income counts toward the taxability of your Social Security benefits. Even retirement plan income, like IRA or 401k withdrawals, counts toward the annual limit. In 2022, if your adjusted gross income, including half of your Social Security payments, exceeds $25,000, then 50% of your benefits are likely taxable. For a married couple, this limit increases to $32,000.

If your income for the year exceeds $34,000, then up to 85% of your benefits will be taxable. Again, for a married couple, this limit increases to $44,000. For beneficiaries who rely solely on Social Security, these limits are not usually met. However, if you have retirement income from other sources, it likely means that you will pay taxes on a portion of your Social Security benefits. No more than 85% of your Social Security benefits will be taxable. You will also get to keep 15% of your benefits tax-free, regardless of your total income.

The Best Way To Avoid The Earnings Limit

The best way to avoid the earnings limit is to wait until you reach FRA to begin your benefits. Understandably, some people have no choice and must start benefits because they are laid off and they have no other income or assets. If this happens to you but your situation changes and you go back to work, you can withdraw your application for Social Security within 12 months of starting benefits.

Other people, however, do have a choice perhaps they could use some of their savings or retirement money to tide them over until they reach FRA. That may be a better option than starting Social Security early.

Don’t Miss: Social Security Administration Des Moines Iowa

Special Earnings Limit Rule

Theres a limit on how much you can earn and still receive your full Social Security retirement benefits while working. Some people who file for benefits mid-year have already earned more than their yearly earnings limit amount. We have a special rule for this situation.

The special rule lets us pay a full Social Security check for any whole month we consider you retired, regardless of your yearly earnings. If you will:

- Be under full retirement age for all of 2022, you are considered retired in any month that your earnings are $1,630 or less and you did not perform substantial services in self-employment.

- Reach full retirement age in 2022, you are considered retired in any month that your earnings are $4,330 or less and you did not perform substantial services in self-employment.

Example: John Smith retired from his job at age 62 on June 30, 2022. He earned $37,000 before he retired.

On October 5th, John starts his own business. He works at least 15 hours a week for the rest of the year and earns an additional $3,000 after expenses. His total earnings for 2022 are $40,000.

Although his earnings for the year substantially exceed the 2022 annual limit , John will receive a Social Security payment for July, August and September. This is because he was not self-employed and his earnings in those three months are $1,630 or less per month, the limit for people younger than full retirement age.

Beginning in 2023, the deductions are based solely on John’s annual earnings limit.

What To Do If Your Benefits Are Already Being Withheld

If youre subject to the Social Security earnings limit, dont wait for the SSA to start reducing the benefit you receive. Instead, Id recommend voluntarily suspending benefits.

If you wait for the Social Security Administration to discover that youve earned too much working while receiving benefits, your risk of an overpayment notice is higher.

Either way, you arent missing payments that youll never get back. Your benefit amount will be recalculated at your full retirement age to reflect the months that benefits were withheld.

The best way to avoid the earnings limitation is to wait until full retirement age to file for benefits. If you cant wait, make sure you have a clear understanding of how working impacts your Social Security benefits.

If you still have questions, you could leave a comment below, but what may be an even greater help is to join my . Its very active and has some really smart people who love to answer any questions you may have about Social Security. From time to time Ill even drop in to add my thoughts, too.

You should also consider joining the 365,000+ subscribers on my YouTube channel! For visual learners , this is where I break down the complex rules and help you figure out how to use them to your advantage.

Recommended Reading: National Committee To Preserve Social Security And Medicare

More Ssdi Earnings Allowed In 2022

Because Social Security wants the disabled to work if they are able, a certain amount of income earned through substantial gainful activity, or SGA, is allowed before the SSA decides your earnings indicate you are not disabled.

Social Security sets caps for SGA earnings at which eligibility for Social Security Disability Insurance benefits may cease. In 2022, when qualifying for SSDI , you can have earnings up to $1,350 per month for non-blind workers and $2,260 per month if you are legally blind . Compare to the limits set in 2021, this is an increase of a %3.

Applicants for SSDI may test their ability to maintain some gainful activity in a Trial Work Period for at least 9 months, which dont have to be consecutive, and for as long as 5 years on a rolling basis . The SSA determines whether a month counts as a TWP month according to gross earnings for the month.

For 2022, you can earn more in a Trial Work Period before it counts against the time you can spend in the TWP program. This year, any month you earn $940 or more will count toward your TWP eligibility. The monthly maximum was $910 in 2020. For the self-employed, net earnings of $940 or more in a month or working in your business for 80 or more hours in a month counts toward your TWP.

More Of Your Social Security Online

If you have set up a my Social Security account online , you can see and save COLA notices securely via the Message Center inside my Social Security. The SSA began posting COLA notices for retirement, survivors, and disability program beneficiaries at the end of 2018.

This year, you will still receive your COLA notice by mail. In the future, you will be able to choose whether to receive your notice online or in the mail. Online notices will not be available to SSI representative payees, individuals with foreign mailing addresses, or those who pay higher Medicare premiums due to their income.

The SSA plans to expand the availability of COLA notices to additional online customers in the future.

With a my Social Security account, you can receive personalized estimates of future benefits based on your real earnings, see your latest statement, and review your earnings history.

Read Also: Medicare Deduction From Social Security 2022

How Has The Social Security Earnings Limit Changed Over Time

The Social Security earnings limit is the maximum amount of money that you can earn in a year and still collect benefits. The limit is adjusted every year based on the cost of living. For 2021, the limit is $142,800. This means that if you make more than $142,800 in a year, you will not be eligible for benefits.

The Social Security earnings limit was first established in 1972. The limit was originally set at $9,000 per year. The limit has been increased several times since then, most recently in 2020 when it was raised to $142,800. The Social Security earnings limit is designed to ensure that those who rely on Social Security benefits are not disadvantaged by inflation.

What Is The Social Security Tax Limit

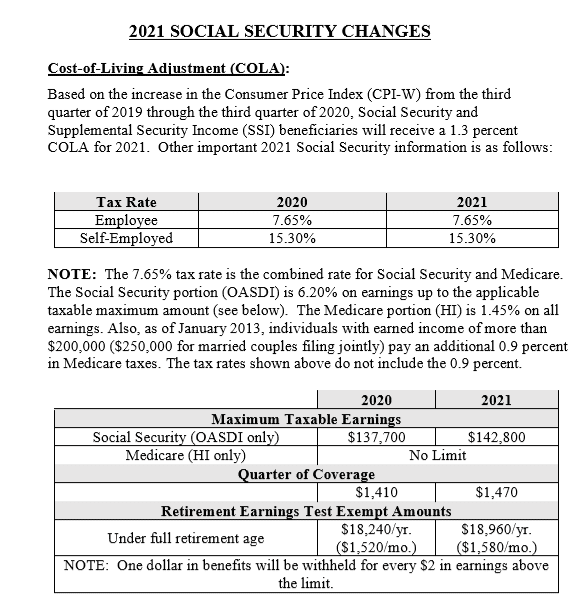

You may not need to pay Social Security tax on all of your earnings if you have a high salary. Workers pay into the Social Security system until their income reaches the Social Security tax limit for that year. In 2021, the Social Security taxable maximum is $142,800. Earnings above this amount are not subject to Social Security tax or factored into Social Security payments in retirement.

What Is the Social Security Tax Limit?

The Social Security tax limit is the maximum amount of earnings subject to Social Security tax. The Social Security taxable maximum is $142,800 in 2021. Workers pay a 6.2% Social Security tax on their earnings until they reach $142,800 in earnings for the year.

When Do You Stop Paying Into Social Security?

Most workers pay 6.2% of their earnings into the Social Security system each year, and employers match this amount. Self-employed workers contribute 12.4% of their paychecks to Social Security. However, high earners only pay into the Social Security system until their pay reaches the Social Security taxable maximum, which is $142,800 in 2021.

What Is the Maximum Amount of Social Security Tax?

An individual who earns $142,800 or more in 2021 contributes $8,853.60 to Social Security, and his or her employer contributes a matching amount. Self-employed individuals who earn more than the taxable maximum must contribute $17,707.20 to Social Security in 2021.

How Has the Social Security Tax Limit Changed Over Time?

Is There a Medicare Tax Limit?

Recommended Reading: Social Security Office In Jackson Tennessee

Social Security Wage Base Cola Set For 2023

Individual taxable earnings of up to $160,200 annually will be subject to Social Security tax in 2023, the Social Security Administration announced Thursday.

This amount, an increase from $147,000 in 2022, is the wage base limit that applies to earnings subject to the old age, survivors, and disability insurance tax. The employee and the employer each will pay $9,932 in tax at the OASDI tax rate of 6.2%.

The Medicare hospital insurance tax of 1.45% each for employees and employers has no wage limit it is unchanged for 2023.

Individuals with earned income of more than $200,000 pay an additional hospital insurance tax under Sec. 3103 of 0.9% of wages with respect to employment .

Self-employed individuals pay self-employment tax equal to the combined OASDI and Medicare taxes for both employees and employers, i.e., 12.4% of net self-employment income up to the OASDI wage base plus 2.9% in Medicare taxes on any amount of net self-employment income, with an offsetting above-the-line income tax deduction of half of the self-employment tax.

The SSA also announced on Thursday a cost-of-living adjustment of 8.7% for both Social Security and Supplemental Security Income benefits beginning in January 2023. The increase, based on the consumer price index, marks a trend of rising COLAs in recent years and compares with an increase of 5.9% in 2022 and 1.3% in 2021.