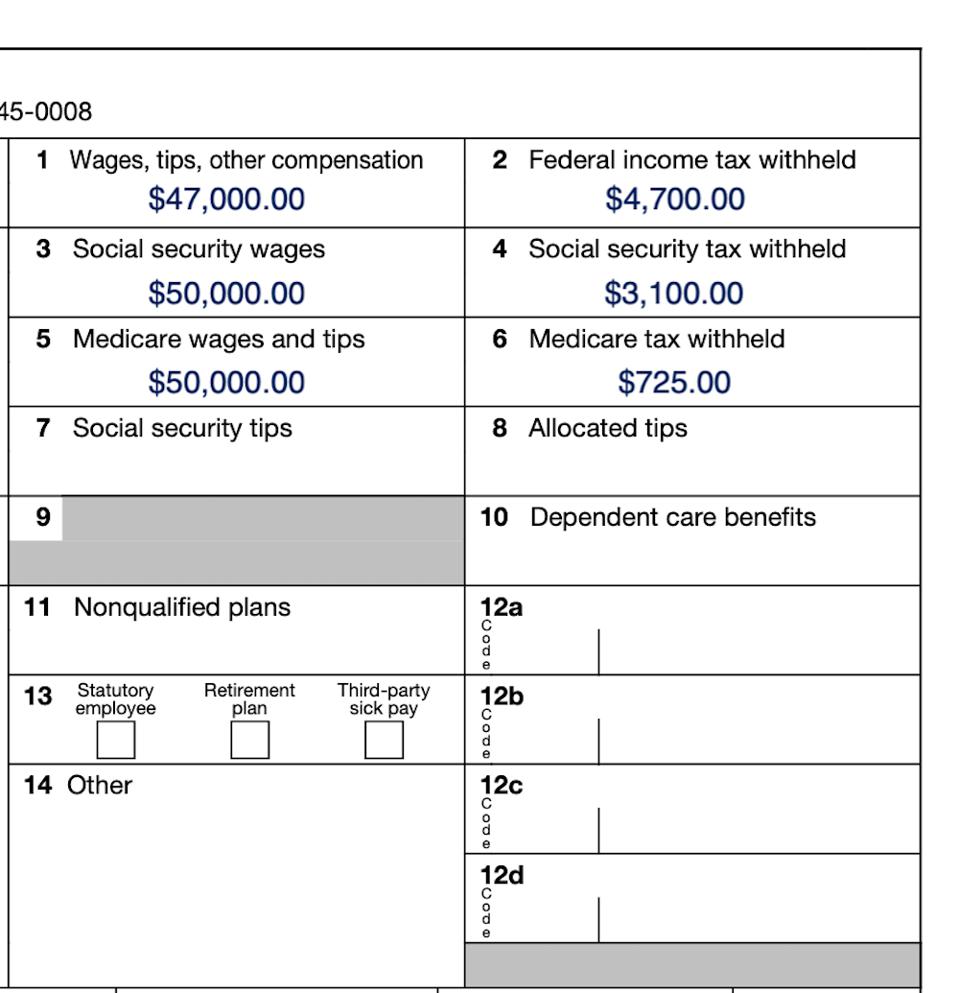

Taxable Wages In Box 1

Box 1 of the W-2 shows your taxable wages for federal income tax purposes. To arrive at your total salary using Box 1, add your federal taxable wages shown in that box to your nontaxable wages plus your pretax deductions that are exempt from federal income tax. Nontaxable wages include business expenses offered under an IRS-approved plan, such as lodging, meal and mileage reimbursements. Pretax deductions include qualified pretax 401 contributions, group-term life insurance premiums that exceed $50,000 in coverage and adoption assistance benefits.

Box : Dependent Care Benefits

These are the contributions to Dependent Care Assistance Program made through payroll deductions.

Contributions to DeCAP are not subject to federal, social security, and Medicare taxes. The amounts in Box 1 for taxable wages and Boxes 3 and 5 for social security and Medicare wages are reduced by the amount of the contribution.

Social Security Wage Base 2022

Now, onto the good stuff. The Social Security withholding limit.

Only withhold and contribute Social Security taxes until an employee earns above the wage base. Stay up-to-date with the annual Social Security wage base because it generally changes each year.

The 2022 Social Security wage base is $147,000.

After an employee earns above the annual wage base, do not withhold money for Social Security taxes. And, dont contribute anything else.

Not all employees will earn above the withholding limit. If an employee does not meet this wage base, continue withholding and contributing year-round.

The maximum Social Security contribution in 2022 is $9,114 .

If you withhold more than $9,114 , you surpassed the wage base and must reimburse your employee.

Remember that the amount you withhold for each employee is based on how much they earn.

- Eliminate the need for manual calculations

- Say goodbye to accidentally withholding above the Social Security wage base

- Enjoy free USA-based support

Don’t Miss: Social Security Office Milwaukee Wi

Box : Social Security Tax Withheld

This is the total social security tax withheld from your pay during the year.

Most employees pay 6.2% of covered wages, up to the maximum social security wage base which is adjusted each year. If more than 6.2% of that amount was withheld, OPA will issue you a refund in February. If you do not receive a refund that is owed to you, contact your agency’s Payroll Office.

What Are Social Security Wages

Social Security wages are an employees earnings that are subject to federal Social Security tax withholding . Employers must deduct this tax even if the employee doesnt expect to qualify for Social Security benefits.

Social Security wages include:

-

Hourly wages and salaried wages

-

Payments in-kind , unless the employee is a household or agricultural worker

-

Elective retirement contributions

Social Security wages have a maximum taxable income limit of $142,800 for the year 2021, which includes qualified employee wages and/or self-employment income. Be sure to check the maximum limit annually since it changes every year to adjust for inflation, improve the systems finances, and provide reasonable benefits for higher wage earners.

When an employee reaches the earnings limit, no more Social Security tax is withheld for the year. At 2021 rates, $142,800 would require $8,853.60 to be withheld for Social Security taxes.

Also Check: Social Security Office In Shreveport Louisiana

Box A: Employee’s Social Security Number

This is your taxpayer identification.

The IRS uses your social security number to verify the data it receives from the City against the amounts shown on your tax returns.

The Social Security Administration uses your SSN to record your earnings for future social security and Medicare benefits.

If your SSN is incorrect, present your social security card to your Personnel Office immediately. The Personnel Office will forward a copy of your social security card to OPA along with a W-2 Duplicate Request Form or a W-2 Correction Request Form. OPA will verify your information with the Social Security Administration and then issue a corrected W-2.

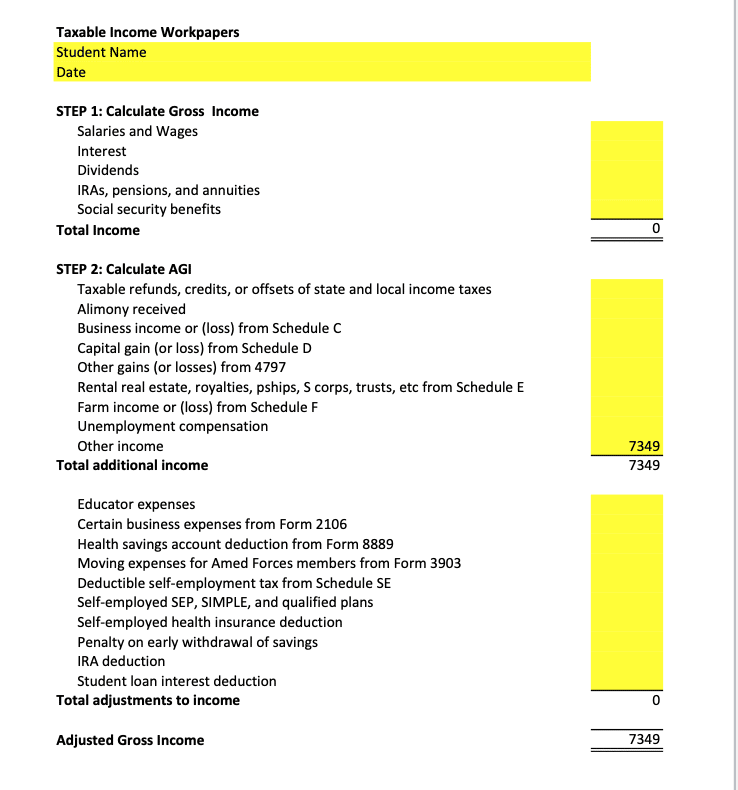

Final Considerations To Calculate Taxable Wages

Note that employers are not responsible for withholding taxes from a contract employee. These contract workers are temporary staff who work independently, and since they are not full-time employees, its up to them to handle their own taxes.

In addition, some types of taxes have a taxable wage base. This means theres a limit to how much an individual can be taxed for certain taxes. An example of a tax that caps the amount taken out of an employees pay is Social Security tax.

For more help, you can look online for a federal taxable wages calculator, which assists in calculating taxable wages. However, depending on the number of employees in the business, its usually better to talk to an accountant to prepare business taxes, and to invest in payroll software to let technology do the heavy lifting while you attend to driving the success of your business.

You May Like: Social Security Office On 3rd Street

List Each Year’s Earnings

Your earnings history is shown on your Social Security statement, which you can now obtain online.

In the table below, sample earnings for a hypothetical worker born in 1953 are shown in Column C. Only earnings below a specified annual limit are included. This annual limit of included wages is called the “Contribution and Benefit Base” and is shown as Max Earnings in Column H in the table.

History Of Social Security Tax Rates

The Social Security tax began in 1937. At that time, the employee rate was 1%. It has steadily risen over the years, reaching 3% in 1960 and 5% in 1978. In 1990, the employee portion increased from 6.06 to 6.2% but has held steady ever sincewith the exception of 2011 and 2012.

The Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010 reduced the contribution percentage to 4.2% for employees for those years employers were still required to pay the full amount of their contributions.

The tax cap has existed since the inception of the program in 1937 and remained at $3,000 until the Social Security Amendments Act of 1950. It was then raised to $3,600 with expanded benefits and coverage. Additional increases in the tax cap in 1955, 1959, and 1965 were designed to address the difference in benefits between low-wage and high-wage earners.

The Social Security tax policy in the 1970s saw a number of proposed amendments and re-evaluations. The Nixon Administration was paramount in arguing that tax cap increases needed to correlate with changes in the national average wage index in order to address benefit levels for individuals in different tax brackets. The 1972 Social Security Amendments Act had to be revamped due to problems with the benefits formula that caused financing concerns. A 1977 amendment resolved the financial shortfall and established a tax cap increase structure that correlated with average wage increases.

You May Like: Disadvantages Of Social Security Disability

Calculating Fica Taxes: An Example

An employee who makes $165,240 a year collects semi-monthly paychecks of $6,885 before taxes and any retirement-plan withholding. Though Medicare tax is due on the entire salary, only the first $147,000 is subject to the Social Security tax for 2021. Since $147,000 divided by $6,885 is 21.3, this threshold is reached after the 22nd paycheck.

For the first 21 pay periods, therefore, the total FICA tax withholding is equal to + , or $526.70. Only the Medicare HI tax is applicable to the remaining three pay periods, so the withholding is reduced to $6,885 x 1.45%, or $99.83. In total, the employee pays $8,964.27 to Social Security and $2,395.98 to Medicare each year. Though it does not affect the employee’s take-home pay, the employer must contribute the same amount to both programs.

As mentioned above, those who are self-employed are considered both the employer and the employee for tax purposes, meaning they are liable for both contributions. In the example above, a self-employed person with the same salary pays $17,928.54 to Social Security and $4,791.96 to Medicare.

Box : Social Security Wages

These are the total wages paid that are subject to social security.

The total in Box 3 should not be more than the maximum social security wage base for that tax year.

Social security wages are reduced for health insurance premiums, Commuter Benefits, and some flexible spending program contributions.

Social security wages are not affected by deferred compensation or pension contributions.

Also Check: Social Security Office In Russellville Arkansas

Social Security Tax And Withholding Calculator

Enter your expected earnings for 2022 :

Social Security Taxes are based on employee wages. There are two components of social security taxes: OASDI and HI. OASDI and HI program. OASDI has been more commonly be known as Federal Insurance Contributions Act . HI has more commonly known as Medicare. For 2017, the OASDI tax rate is set at 6.2% of earnings with a cap at $127,200 . The HI is rate is set at 1.45% and has no earnings cap. Employers must pay a matching amount for each tax component. Self employed persons must pay an amount equal to the sum of both the employeee and employer portions.

Determine Your Taxable Income

You can find the year to date totals on your most recent paycheck. For better accuracy, get this information from the last paycheck of the year. Also, make sure that you’re not using the number for the most recent pay period. You’ll want the total of all the wages that you’ve earned that year. This amount may need to be adjusted if you have any deductions that are excluded from taxable income.These types of deductions will include:

- Premiums for group life insurance

- Vision and dental insurance premiums

- Dependent care reimbursement accounts

You will subtract any of these items from your gross taxable wages. The number you come to should match the number you see in Box 1 on your W2 when you receive it. You’ll take these same steps when figuring out your state taxable income. Should this information be incorrect, you may need to reach out to your company’s payroll department for an explanation.

Calculate Medicare and Social Security Taxable Wages

Calculating your W2 wages for Medicare and Social Security taxable wages is similar to finding your taxable income. However, there is a maximum amount of wages that is taxable for social security tax. For any wages earned during the year of 2017, this is capped at $127,200. You’ll start by looking at your most recent pay stub. Look at the gross taxable income for the year to date.

- Insurance premiums

- Life insurance premiums up to $50,000 in life insurance coverage

Also Check: Social Security Office Bear Me

How To Read And Understand Your Form W

KPE

With tax season in full swing, you probably have a number of tax forms either in hand on on the way. If you’re an employee, one of those forms is the form W-2, Wage and Tax Statement. No matter whether you’re self-preparing your tax return or having your return prepared professionally, you should have a basic understanding of what the form says and how it affects your bottom line. Here’s what you need to know:

A form W-2 is issued by an employer to an employee. An employer has certain reporting, withholding and insurance requirements for employees that are a bit different from those owed to an independent contractor.

The threshold for issuing a form W-2 is based on dollars. Not time worked. Not position held. Just dollars earned. The magic number is $600. Every employer who pays at least $600 in cash or cash equivalent, including taxable benefits to an employee must issue a form W-2. If any taxes are withheld, including those for Social Security or Medicare, a form W-2 must be issued regardless of how much was paid out to an employee. If you were paid less than $600 and still received a form W-2, don’t panic: Sometimes, an employer will issue a form W-2 to all employees because it’s easier for them.

As an employee, you get three copies:

The left side of the form is for reporting taxpayer information:

Box b. Your employer’s EIN is reported in box . An EIN is the employer’s equivalent of your SSN.

The right side of the form is used to report dollars and codes:

Social Security Tax Rates

The Social Security program provides benefits to retirees and those who are otherwise unable to work due to disease or disability. Social Security often provides the only source of consistent income for people who can no longer workespecially for those with modest earnings histories.

Because Social Security is a government program aimed at providing a safety net for working citizens, it is funded through a simple withholding tax that deducts a set percentage of pretax income from each paycheck. Workers who contribute for a minimum of 10 years are eligible to collect benefits based on their earnings history once they retire or suffer a disability.

Social Security benefits are capped at a maximum monthly benefit amount based on earnings history. To prevent workers from paying more in taxes than they can later receive in benefits, there is a limit on the amount of annual wages or earned income subject to taxation, called a tax cap.

For 2021, the maximum amount of income subject to the OASDI tax is $142,800, capping the maximum annual employee contribution at $8,853.60. For 2022, the maximum amount of income subject is $147,000, capping the maximum annual employee contribution at $9,114.00. The amount is set by Congress and can change from year to year.

Don’t Miss: Social Security Office In Newark

Do Other Taxes Have A Wage Base

Social Security tax is the only federal tax employees pay with a wage base. Although Medicare also makes up FICA tax, it does not have a wage base. Instead, it has an additional tax once an employee earns a certain amount.

Keep in mind that some state taxes, like SUTA tax, and federal unemployment tax also have a wage base.

Difference Between Social Security And Earnings On A W

Related

A W-2 is the form issued annually by employers to employees that includes how much the company paid the employee during the calendar year, the taxes that were withheld from paychecks and information on other payroll withholdings that affect how much the employee owes in income tax. Consisting of many boxes, numbers and codes, a W-2 form can be confusing to understand.

Two essential aspects of a W-2 are the earnings in Box 1 and Social Security earnings in Box 3. Earnings represent taxable wages, tips and other compensation, while Social Security wages refers only to the wages that are subject to the Social Security tax. Certain pretax deductions and wages are not subject to taxation and are excluded from these sections of a W-2.

Read Also: Social Security Office In Victoria Texas

Box : Medicare Wages And Tips

The wages subject to Medicare tax are the same as those subject to social security tax in Box 3, except there is no wage base limit for Medicare tax.

Medicare wages are reduced for health insurance premiums, Commuter Benefits, DeCAP, and HCFSA contributions.

Medicare wages are not affected by deferred compensation or pension contributions.

What Is Excluded From Medicare Wages On W2

Also, qualified retirement contributions, transportation expenses and educational assistance may be pretax deductions. Most of these benefits are exempt from Medicare tax, except for adoption assistance, retirement contributions, and life insurance premiums on coverage that exceeds $50,000.Oct 31, 2018

You May Like: Social Security Administration Wichita Kansas

What’s Included In Medicare Wages

The Social Security Wage Base for 2019 was $132,900. To determine Social Security and Medicare taxable wages on your W-2, again begin with the Gross Pay YTD from your final pay stub and make the following adjustments if applicable: Social Security and Medicare Taxable Wage Adjustments to Gross Pay YTD: Subtract the following:

Social Security Tax Rate

The Social Security tax withholding rate is 6.2%. You must withhold 6.2% from each employees wages. The Social Security employer contribution is also 6.2%.

Lets say an employee receives $1,000 each paycheck. You must withhold $62 from their wages and pay an additional $62 for Social Security tax.

Again, both Social Security and Medicare make up FICA tax. Medicare tax is 1.45%. So, FICA tax is 7.65% for the employee portion and 7.65% for the employer portion .

Read Also: 10 Year Social Security Employment History

Which Tax Forms Do I Need To File

Employers must submit IRS Form 941, the Employerâs Quarterly Federal Tax Return, to report both the employee and employersâ portion of Social Security and Medicare. You should submit Form 941 quarterly to report these taxes.

Youâll also have to fill out a W-2, which is a combined wage and tax statement that you have to provide to each of your employees once a year to show how much FICA taxes were withheld that year.

What Is Social Security Tax

Social Security tax is a federal tax that pays for things like the Social Security benefits you get from the federal government when you retire, survivor benefits for your family if you die, disability benefits, etc.

If you, your children or your widow ever receive any kind of Social Security income, these taxes are probably what paid for it.

Both employees and employers have to pay into Social Security tax. Payroll taxes like Medicare and Social Security are usually grouped together as FICA . Itâs also referred to as âold age, survivors, and disability insurance taxâ , Social Security taxes pay into the United States Social Security Administrationâs Social Security programsâretirement benefits, disability benefits, dependent and survivor benefits, etc.

If youâre self-employed, youâll hear tax professionals refer to your Social Security and Medicare tax as âself-employment tax.â

Also Check: Social Security Office Wyandotte Mi