Should I Take Survivor Benefits At 60

If You Haven’t Applied for Retirement Benefits Yet If both payouts currently are about the same, it may be best to take the survivor benefit at age 60. It’s going to be reduced because you’re taking it early, but you can collect that benefit from age 60 to age 70 while your own retirement benefit continues to grow.

How To Use This Information

Each survivor’s situation is different. Talk to a Social Security representative before you decide to take benefits.

If you know what the worker’s yearly lifetime earnings were, you can use our Online Calculator to get a rough estimate of what the benefits would be for the surviving spouse at full retirement age.

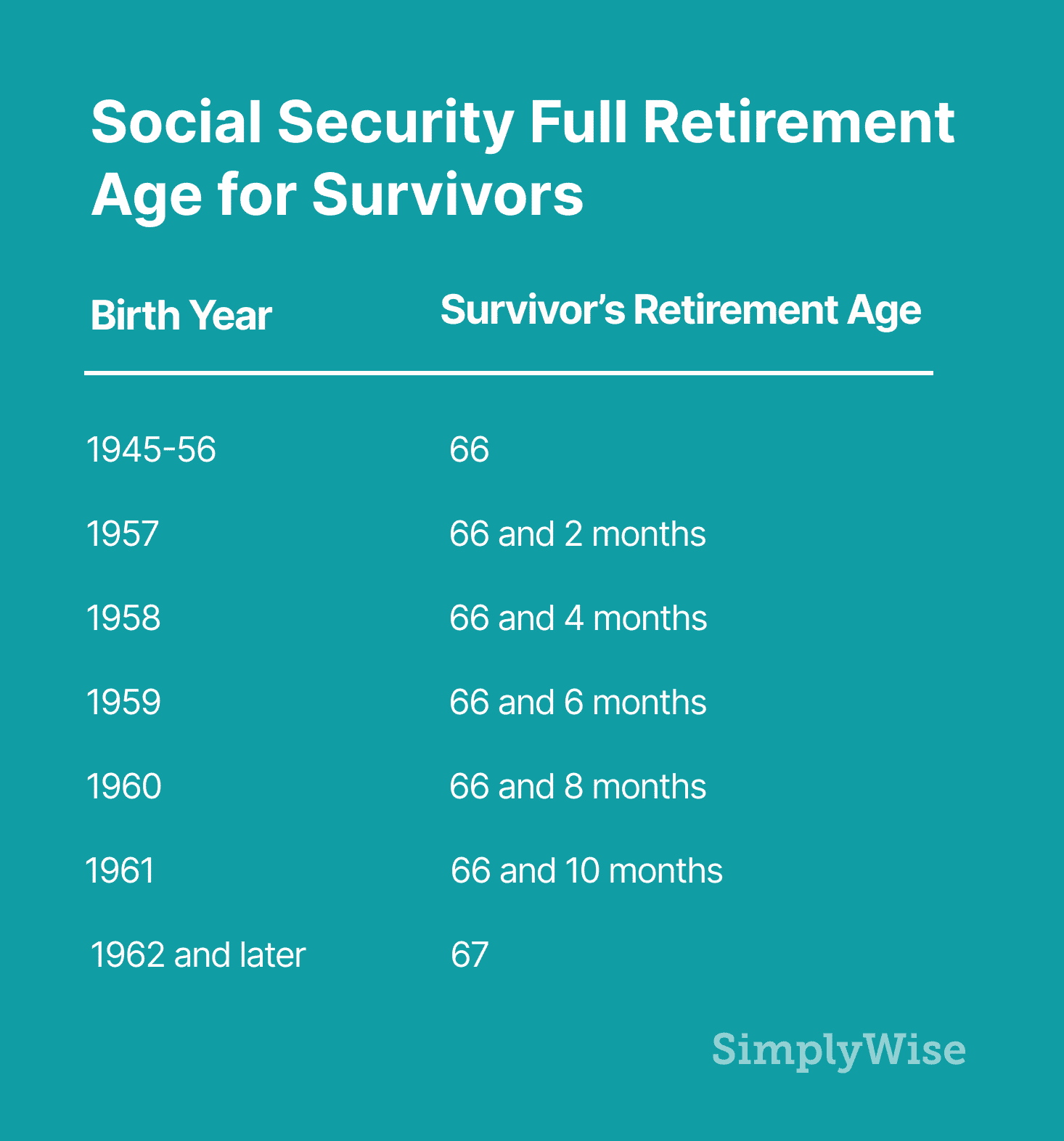

If you know what the widow or widowers benefit is at full retirement age, you can use the information for the survivor’s year of birth to find out how much the widows or widowers benefit would be at various ages.

How Long Do You Have To Be Married To Get Social Security Survivor Benefits

A surviving spouse must have been married for at least one year to be eligible to receive their spouse’s Social Security death benefits. However, if the surviving spouse is the parent of the spouse’s child, the one-year rule is waived. A divorced spouse may be eligible to receive benefits if they were married to their former spouse for at least 10 years.

Recommended Reading: Does Social Security Count As Income For Extra Help

Tips For Getting Retirement Ready

- Retirement planning with a financial advisor can be extremely helpful. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- Figure out how much youll need to save to retire comfortably. An easy way to get ahead on saving for retirement is by taking advantage of employer 401 matching.

What Percentage Of Social Security Benefits Does A Widow Or Widower Receive

The surviving spouse can receive 100% of the benefits at full retirement age. If the surviving spouse is between age 60 and their full retirement age, they can receive reduced benefitsusually 71.599%. If the surviving spouse is disabled, they can begin receiving 71.5% of the benefits at age 50. Surviving spouses with children under 16 receive 75% of the benefits

Don’t Miss: Social Security Administration Des Moines Iowa

Working While Receiving Benefits

You may work after you start receiving benefits, which could mean a higher benefit for you in the future. We may withhold some of your benefits if you earn more than the yearly earnings limit. Sometimes people who retire in mid-year already have earned more than the annual earnings limit. However:

- We have a special rule that applies to earnings for one year, usually the first year you begin receiving benefits. This means we cannot withhold benefits for any month we consider you retired, regardless of your yearly earnings.

- After you reach full retirement age, we will recalculate your benefit amount to take into account any months you did not receive benefits because your earnings were too high.

Can You Get Medicare At 62

You can only enroll in Medicare at age 62 if you meet one of these criteria: You have been on Social Security Disability Insurance for at least two years. You are on SSDI because you suffer from amyotrophic lateral sclerosis, also known as ALS or Lou Gehrig’s disease. … You suffer from end-stage renal disease.

Don’t Miss: Back Of Social Security Card

Please Answer A Few Questions To Help Us Determine Your Eligibility

Winning a disability claim generally gets easier for people as they become older. This is particularly true for people over the age of 60. However, some older folks choose to apply for early retirement at age 62 or 63 rather than applying for disability. Even though this may seem an easier option, it can reduce the amount of benefits you are entitled to. You can get disability benefits up until full retirement age, which is 66 right now.

Will Retirement Age Increased To 62

VIJAYAWADA: The State government on Monday promulgated an ordinance enhancing the retirement age of employees from 60 to 62 years.While announcing the fitment after holding talks with the employees’ unions on the Pay Revision Commission report, Chief Minister YS Jagan Mohan Reddy stated that the retirement age of …

Recommended Reading: Both Social Security And Medicare

How Much Can I Earn If I Work After My Full Retirement Age

If you continue to work after reaching full retirement age, you may work and earn as much as you’d like. You will not be subject to the retirement earnings test, and your Social Security benefits will not be affected.

If you work prior to FRA, you may forfeit part of your benefits if you earn above annual thresholds. However, your benefit amount will be recalculated at full retirement age to account for most of those forfeited funds.

The Worn Out Worker Rule

In addition to the above grid rules, the “work out worker” rule can be used to approve disability benefits for people whose primary work was physical labor and who have only a marginal education. This rule allows for a quick approval of benefits if the following criteria are met:

- The claimant didn’t go past the 6th grade in school.

- The claimant has worked at least 35 years doing only “arduous unskilled physical labor” .

- The claimant can’t do his or her old job because of his or her impairments.

Read Also: Medicare Deduction From Social Security 2022

Examples Of Using The Grid For Ages 60

Here are examples of where a person aged 60-65 will be approved based on the grids.

- In one case, a 61-year-old man applied for disability based on arthritis in his knees and a hip replacement. He had a high school education but had worked only as an unskilled laborer. The SSA determined that the claimant had the RFC to perform sedentary work due to his physical limitations. Therefore, the grids directed a finding of disabled, and the claimant was approved.

- In another case, a 62-year-old man applied for disability because of chronic asthmatic bronchitis and heart disease. He had a 6th grade education and hadn’t worked in the last 15 years. The SSA found that, despite his bronchitis, he still had the RFC to do medium work. The grids directed a finding of disabled.

Here are some examples of where a person aged 60-65 would be found not disabled by the grids.

Be Prepared For Smaller Social Security Checks

Unfortunately, if you’re unlucky enough to turn 60 in a year when average wages go down, there’s nothing you can do to fix the Social Security benefits formula.

You canraise your check amount by delaying the start of your benefits, as well as by working longer if you’re earning more now at the end of your career than you did at the start. But each of these options could require substantial sacrifice on your part.

And regardless of whether you take these steps or not, you may also want to aim higher when it comes to saving a big retirement nest egg. After all, no matter what you do, a low average wage in 2020 is likely going to leave you with less than those born in the years before or after you.

The Motley Fool has a disclosure policy.

Recommended Reading: Social Security Lump Sum Payment

Questions About The Social Security Administration

How Do I Apply For Disability Benefits?

To apply for benefits, contact the Social Security Administration at 1-800-772-1213. They have a TTY phone connection at 1-800-325-0778. You can ask SSA to send you the correct forms, and they can answer questions you may have.

How Do I Apply For Supplemental Security Income ?

To apply for benefits or to ask questions, contact the SSA at 1-800-772-1213. They have a TTY phone connections as well at 1-800-325-0778.

Supplemental Security Income is an income assistance program administered by the Social Security Administration for people who are elderly , blind, or disabled who don’t have many assets and who don’t earn much money

To apply for benefits or to get more information about the SSA retirement program, call 1-800-772-1213. They have a TTY phone connection as well at 1-800-325-0778.

How Do I Apply for Survivors’ Benefits?

A family member or other person responsible for the beneficiary’s affairs should do the following:

How Do I Apply For Medicare Benefits?

If you are already getting Social Security retirement or disability benefits or railroad retirement checks, Social Security will contact you a few months before you become eligible for Medicare and give you the information you need to register.

If you are not already getting checks, you should contact Social Security at 1-800-772-1213 about three months before your 65th Birthday to sign up for Medicare. They also have a TTY phone connection at 1-800-325-0778.

When Can My Spouse Collect Half Of My Social Security

Spousal benefits may be claimed as early as age 62, but you wont get as much as if you wait until your own full retirement age. For example, if you reach full retirement age at 67 and opt to claim spousal benefits at 62, youll earn 32.5 percent of your spouses entire benefit amount.

Similarly, When can my wife start drawing half of my Social Security?

A spouse may retire as early as 62 years old, but the compensation may be as low as 32.5 percent of the workers main insurance amount. For each month before regular retirement age, up to 36 months, the spousal benefit is decreased by 25%/36 percent.

Also, it is asked, Does my spouse automatically get half my Social Security?

Your ex-spouse, spouse, or child may be eligible for a monthly payment of up to one-half of your retirement benefit amount if they qualify. The amount of your retirement benefit will not be reduced as a result of these Social Security payments to family members.

Secondly, When can I apply for half of my husbands Social Security?

Form SSA-2 | Information for Applying for Spouse or Divorced Spouse Benefits You may apply online if you are 62 or older and have been for at least 3 months, or you can apply in person if you are 62 or older and have been for at least 3 months. By phoning our toll-free number, 1-800-772-1213 , or going to your local Social Security office.

Also, Can I collect half of my husbands Social Security at 60?

Related Questions and Answers

You May Like: Social Security Office Buford Ga

Do Survivor Benefits Increase After Full Retirement Age

If you are the surviving spouse who is claiming benefits based on your deceased partner’s work record, there is no benefit to waiting until after FRA to claim your benefits. You do not earn delayed retirement credits, so your benefit will not increase.

However, if you are the higher-earning spouse, delaying your claim for benefits until after FRA can result in your widow receiving more monthly income, as your widowed partner will receive the higher of the two monthly benefits you were each receiving.

What If I Delay Taking My Benefits

If you retire sometime between your full retirement age and age 70, you typically earn a “delayed retirement” credit for your own benefits . For example, say you were born in 1960, and your full retirement age is 67. If you start your benefits at age 69, you would receive a credit of 8% per year multiplied by two . This means your benefit would be 16% higher than the amount you would have received at age 67.

Recommended Reading: Can I Get Va Pension And Social Security

Fact #: Social Security Is Especially Beneficial For Women

Social Security is especially important for women, because they tend to earn less than men, take more time out of the paid workforce, live longer, accumulate less savings, and receive smaller pensions. Women represent more than half of Social Security beneficiaries in their 60s and 7 in 10 beneficiaries in their 90s. In addition, women make up 96 percent of Social Security survivor beneficiaries.

Can I Collect On My Husband Social Security At Age 62

The Most Important Takeaways The maximum spousal benefit is equal to half of the entire benefit received by the other spouse. If youre married, formerly married, divorced, or widowed, you could be eligible. You may start receiving spousal benefits as early as age 62, but in most situations, your payments would be permanently reduced if you start too soon.

Recommended Reading: Social Security Office Coconut Creek

Fact #: Social Security Lifts Millions Of Older Adults Above The Poverty Line

Without Social Security benefits, about 4 in 10 adults aged 65 and older would have incomes below the poverty line, all else being equal, according to official estimates based on the 2021 Current Population Survey. Social Security benefits lift more than 16 million older adults above the poverty line, these estimates show.

An important study on retirement income from the U.S. Census Bureau that matches Census estimates to administrative data suggests that the official estimates overstate older people’s reliance on Social Security. The study finds that in 2012, 3 in 10 older adults would have been poor without Social Security, and that the program lifted more than 10 million older adults above the poverty line.

No matter how it is measured, its clear that Social Security lifts millions of older adults above the poverty line and dramatically reduces their poverty rate.

When A Family Member Dies

We should be notified as soon as possible when a person dies. However, you cannot report a death or apply for survivors benefits online.

If you need to report a death or apply for benefits, call 1-800-772-1213 . You can speak to one of our representatives between 8:00 am 7:00 pm. Monday through Friday. You can also contact your local Social Security office.

Also Check: Alabama Social Security Office Phone Number

Eligible For Benefits In The Last 12 Months

There’s an exception for those who recently applied for retirement benefits. If you became entitled to retirement benefits less than 12 months ago, you might be allowed to withdraw your retirement application and apply for survivor benefits only. You can then reapply for your retirement benefits later when the benefits will be a higher amount.

Full Retirement Age: Age 6567 Depending On Date Of Birth

Your full retirement age is determined by your day and year of birth, and it is the age in which you get your full amount of Social Security benefits. For every year you delay taking your benefits from full retirement age up until you turn 70, your benefit amount will increase by almost 8% a year. It is referred to as a delayed retirement credit. This increase can result in more lifetime income for you and your spouse. Even after factoring in a potential return on investment and the monthly benefits you could have received if you claimed early, there can still be a $50,000$100,000 increase in lifetime benefits by waiting until you are older.

Also Check: What Will Happen When Social Security Runs Out

What Is A Good Monthly Retirement Income

Median retirement income for seniors is around $24,000 however, average income can be much higher. On average, seniors earn between $2000 and $6000 per month. Older retirees tend to earn less than younger retirees. It’s recommended that you save enough to replace 70% of your pre-retirement monthly income.

Full Retirement Age For Getting Social Security

Full retirement age is the age at which you can claim your standard Social Security benefit, or your primary insurance amount , from Social Security. Your PIA is the standard amount you can expect to receive based on your inflation-adjusted average wages earned throughout your career. Full retirement age is 66 for those born in 1954 and 67 for those born in 1960 or later — it varies depending on your birth year.

It is important to know your full retirement age, as it affects when you can claim Social Security without reducing your benefits, the amount of delayed retirement credits you can earn in order to raise your benefits, and how much you can earn from working while receiving Social Security without forfeiting any of your benefits.

You May Like: How To Find Someone By Social Security Number

Bridge To Medicare At Age 65

Remember that while you are eligible for reduced Social Security benefits at 62, you won’t be eligible for Medicare until age 65, so you will probably have to pay for private health insurance in the meantime. That can eat up a large chunk of your Social Security payments.

Read Viewpoints on Fidelity.com: Your bridge to Medicare

Take Full Advantage Of Social Security

Social Security is complex, and there are many provisions that most Americans don’t even know about. In order to get every penny of Social Security that you deserve, make sure you stay up to date about the various types of benefits you can claim, and when you become eligible for them.

The Motley Fool has a disclosure policy.

Also Check: Social Security Office In Newark

How Are Your Social Security Benefits Calculated

Social Security uses your highest 35 years of earnings, indexed to a national average wage index, to calculate your primary insurance amount If you have fewer than 35 years of earnings, each year with no earnings will be entered as zero. You can increase your Social Security benefit at any time by replacing a zero or low-income year with a higher-income year.

There is a maximum Social Security benefit amount you can receive, though it depends on the age you retire. For someone at full retirement age in 2022, the maximum monthly benefit is $3,345. For someone filing at age 70, the maximum monthly amount is $4,194. And for someone retiring early, at age 62, the maximum monthly benefit is $2,364.

To estimate your benefits, use the Social Securitys online Retirement Estimator.