The Ugly News: The Social Security Trust Fund May Be Depleted More Quickly

The aging population has put the Social Security program in hot water. Last year, costs exceeded income by $56 billion, and that trend will continue indefinitely, setting the Social Security trust fund on pace to be depleted by 2035, according to the board of trustees.

Of course, that depletion date is only an estimate, and it is based on a great many assumptions. So the board of trustees actually modeled three different scenarios one high cost, one low cost, and one intermediate to compensate for error. Those three scenarios put the trust fund depletion date at some point between 2031 and 2069, but none of the scenarios accounted for an 8.7% COLA.

The board of trustees estimated the 2023 COLA would land between 3.92% and 5.14%. That means Social Security benefits will rise more sharply than anticipated next year, which could accelerate the depletion of the trust fund.

On the bright side, government officials still have time to solve that problem. And even if the Social Security trust fund does run dry, payroll tax will still cover 80% of scheduled benefits in 2035.

SPONSORED:

The $18,984 Social Security bonus most retirees completely overlook

Trevor Jennewine has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Goldman Sachs. The Motley Fool has a disclosure policy.

Get Ssa Benefits While Living Abroad

U.S. citizens can travel to or live in most, but not all, foreign countries and still receive their Social Security benefits. You can find out if you can receive benefits overseas by using the Social Security Administrations payment verification tool. Once you access the tool, pick the country you’re visiting or living in from the drop-down menu options.

Do I Pay Taxes On Disability Benefits

It can be somewhat confusing for most people to determine whether their long-term disability insurance benefits are taxable. Disability benefits may or may not be taxable depending on who made the premium payments and whether those payments are deductible.

Social Security disability insurance benefits may be taxable the IRS provides further explanation of when these benefits may or may not be taxed.

You May Like: Aging And Disability Services Oregon

Recommended Reading: Social Security Taxable Benefits Worksheet 2021

What Does The Irs Consider A Permanent Disability

A person is permanently and totally disabled if both of the following apply: He or she cannot engage in any substantial gainful activity because of a physical or mental condition, and. A doctor determines that the condition has lasted or can be expected to last continuously for at least a year or can lead to death.

Can You Work While On Disability

The SSA has specific rules regarding your ability to work while on disability, although it should be noted that people on SSDI are initially approved because they are truly unable to work for a variety of reasons.

Since many people with disabilities would prefer to work rather than receive benefits, the SSA will allow a nine-month Trial Work Period to determine if your earnings are substantial. A trial work month is any month where earnings exceed $970, and the trial work period continues until you have nine cumulative trial work months within a 60-month period.

After your trial work period, your benefits will stop if Social Security considers your earnings substantial. In 2022, Social Security considers your earnings substantial if you earn more than $1,350 per month over the following 36 months. At that income level, youre considered able enough to gainfully work and will no longer receive cash payments. This is sometimes referred to as substantial gainful activity, or SGA.

Remember that if you do decide to go back to work â or if your medical condition has improved â you must alert the SSA. While you can earn minimal income while receiving SSDI payments, earning more than the $970 monthly threshold will lead to a more thorough review of your circumstances.

Recommended Reading: United Health Care Employee Benefits

Also Check: Cost Of Living For Social Security

History And Rationale For Taxing Social Security Benefits

For more than four decades, Social Security benefits were not subject to income tax. The Treasury Departments rationale for not taxing Social Security benefits was that the benefits under the Act could be considered as gratuities, and since gifts or gratuities were not generally taxable, Social Security benefits were not taxable.

Former Social Security Commissioner Robert M. Ball long argued that, since Social Security is an earned benefit, it should be taxed like other earned benefits, such as employer pensions. Workers pay income tax on private pensions to the full extent that their benefits exceed their contributions, with no income thresholds.

As a leading member of the Greenspan commission on Social Security in 1982-83, Ball had an opportunity to promote this idea. The subsequent Social Security Amendments of 1983 provided that up to 50 percent of benefits would be taxable for beneficiaries with incomes above certain levels. A decade later, the Omnibus Budget Reconciliation Act of 1993 provided for the taxation of up to 85 percent of benefits for individuals with modified AGI above somewhat higher thresholds. The provision has since remained unchanged.

Calculator: How Much Of My Social Security Benefits Is Taxable

September 15, 2022Keywords: calculator, retirement, Social Security, tax planning

Social Security benefits are 100% tax-free when your income is low. As your total income goes up, youll pay federal income tax on a portion of the benefits while the rest of your Social Security benefits remain tax-free. This taxable portion goes up as your income rises, but it will never exceed 85%. Even if your annual income is $1 million, at least 15% of your Social Security benefits will stay tax-free.

Also Check: Social Security Administration Jackson Ms

Whos Eligible For Social Security Disability Insurance

In addition to meeting the disability requirements, you must have worked long enough and recently enough to qualify for Social Security Disability Insurance.

First, you must meet the work test. This test is based on Social Security work credits and requires you to earn at least a minimum amount of income in wages or self-employment income per calendar year. For each $1,470 in wages or self-employment income that you earn per year you earn one credit. You can earn up to four credit per year. When youve earned $5,880 in 2021, youve earned your four credit for 2021.

Typically, you need at least 40 credits with 20 of these earned in the last 10 year period ending with the year of your disability. However, meeting the work test requirement can also depend on your age. It requires different amounts of Social Security credits since younger workers typically have not had enough time in the workforce to earn the full 40 credits. For those:

- Under age 24: You meet the work test if you earned 6 credits in the 3-year period when your disability began.

- Age 24 to 31: In general, you may qualify if you have credits equivalent to working half the time between age 21 and becoming disabled.

- Age 31 or older: Youll need to have earned at least 20 credits in the 10-year period immediately before becoming disabled.

Second, review the Social Security Administrations table to determine if you meet the duration of work test based on your age and when your disability began.

When Do I Pay Tax On Disability Benefits

The rules for determining whether federal tax is owed on LTD or STD income depend on two things:

- Who paid the premiums you or your employer?

- How were premiums paid with pre-tax dollars or after-tax dollars?

Generally speaking, the tax rules work like this: if your employer paid the premiums, then the income you get on disability is taxable. Likewise, if you paid the premiums with pre-tax dollars, then your disability income is also taxable. However, if you paid the premiums with after-tax dollars, then your disability income payments are free from federal taxes. In other words, the IRS either takes tax upfront , or they take tax on the back-end . That means:

Also Check: What To Do If Someone Has My Social Security Number

How Much Of My Ssdi Benefits Are Taxable

If youre single and your income is more than $25,000, or if youre married and your combined income is above $32,000, you will have to pay at least some tax on your SSDI benefits.

To get a rough estimate of how the IRS calculates your income for tax purposes, take 50% of your total yearly SSDI amount and add any other household income sources.

If you are single and SSDI is your only income source, it would be unusual for you to have to pay taxes on that income. If you are married and your spouse is unemployed or works only part-time, your income may be below $32,000, and therefore, you would not be expected to pay income taxes.

Depending on your family income, either 50% or 85% of your SSDI benefit can be considered taxable.

Calculating Your Provisional Income

You might wonder how much a retired person can earn without paying taxes. To find that out, you would need to figure out your provisional income. Aside from filing status, the biggest factor in figuring out Social Security benefit taxes is your income level outside of Social Security benefits.

Provisional income is defined as your adjusted gross income plus nontaxable interest. Nontaxable interest is interest income that is tax-exempt but you would still report on your federal tax returns. Your provisional income includes pensions, wages, interest, dividends and capital gains.

For example, assume your adjusted gross income is $12,000, you are paid $5,000 in nontaxable interest, and you receive $20,000 in Social Security benefits. By halving your Social Security income and combining those values, you would calculate that your provisional income is $27,000 .

You May Like: Are Social Security Benefits Taxable After Full Retirement Age

Taxes On Benefits Support Social Security And Medicare

The proceeds from taxing Social Security benefits provide an increasingly important source of income for both Social Security and Medicare.

- The revenue from taxing up to 50 percent of Social Security benefits is devoted to the two Social Security trust funds. In 2019, this will provide an estimated $36.9 billion in income to the Old-Age and Survivors and Disability Insurance trust funds, or about 3.5 percent of their total income. Since the income thresholds are not indexed for inflation, taxes on benefits will grow to 7.4 percent of Social Security income by 2028.

- The revenue from taxing 50 to 85 percent of Social Security benefits is devoted to Medicares Hospital Insurance trust fund. This will represent $24.1 billion, or 7.4 percent, of HI income in 2019 and 12.4 percent of income by 2028.

The taxation of benefits will provide almost $1 trillion to the Social Security and Medicare trust funds over the next ten years. Without this income, the programs would face greater funding shortfalls and earlier reserve depletion dates.

Get The Disability Benefits You Deserve

If your claim for disability benefits has been turned down, we can help you file a successful appeal. In many instances, a claim is rejected not because the applicant doesnt qualify for benefits but simply because they failed to provide the SSA, VA or insurance company with the necessary information needed to make a decision. Well make sure to submit all the documentation required to support your claim of disability.

Call Marc Whitehead & Associates at to schedule a free, no-obligation, initial consultation with one of our highly experienced disability benefits lawyers to discuss your claim. We are based in Houston, TX and serve clients all over the U.S.

About Marc Whitehead

Don’t Miss: Can You Get Credit Card Without Social Security Number

When Is Social Security Income Taxed

Social Security income is only taxed when you earn above certain annual limits. This is why most beneficiaries that only live on their Social Security check receive that money tax-free, as it is in most cases below the annual threshold. However, your Social Security benefits are never 100% taxable, no matter how much money you earn. How much of your Social Security income is taxable? Depending on your income, either 50% or 85% of your benefits will be taxable.

Are Social Security Disability Benefits Taxable

They might be, depending on two things: the type of disability benefit you get and your overall income.

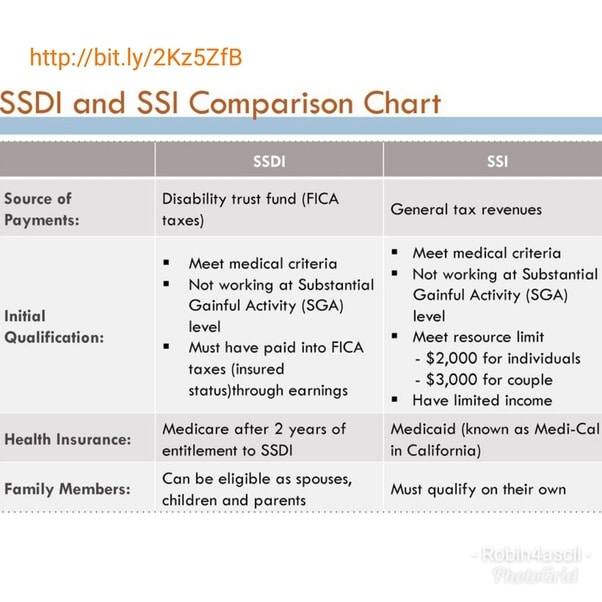

Social Security operates two benefit programs for people with disabilities: Social Security Disability Insurance and Supplemental Security Income .

SSI is cash assistance for disabled, blind and older people with low incomes and limited financial assets. Social Security administers the program, but money from the U.S. Treasury, not your Social Security taxes, pays for it. Federal SSI payments in 2022 max out at $841 a month for an individual and $1,261 for a when both spouses are eligible. Those benefits are not subject to income tax.

However, SSDI is potentially taxable, coming under the same set of tax rules as Social Security retirement, family and survivor benefits.

Whether you pay taxes on SSDI benefits depends on what the Internal Revenue Service calls your provisional income. That’s the sum of your adjusted gross income, tax-exempt interest income and half of your Social Security benefits for a given year. Here’s how it works:

Say you’re a single filer who received the average SSDI benefit of $1,282 a month in 2021. You had a part-time job that paid $15,000, and you received $5,000 from investments and dividends. Your provisional income was $27,692, half of your Social Security benefits plus $20,000 in other income.

Recommended Reading: What Can You Do With Social Security Number

When Is Workers Comp Taxable

If you are an employee and also receive Social Security Disability Insurance or Social Security Income , you may be required to pay taxes on your workers compensation benefits. For instance, if you:

- Have a permanent injury at work and get SSDI and disability benefits, your workers compensation benefits may be subject to taxation and

- Get injured at work and need to take time off to recover. Your lost wages are partially covered by workers compensation, but at the same time you also receive SSI. In this case, you might be required to pay taxes on your benefits.

Keep in mind that the laws for workers compensation vary by state. It is best to research and understand the compensation laws and regulations of your state.

Two Passive Income Tools To Make Extra Money To Pay Your Retirement In The Usa

Extra income during retirement is commonplace for United States citizens. The Social Security benefit is not enough and in order to pay all the monthly bills it is mandatory to have extra money to help. That is why it is common to find retirees who continue to work part-time or have a business. Pension plans are also very common, such as an IRA or 401.

Fortunately, much of the extra income while collecting Social Security is not taxable. Therefore, we can get a good amount of monthly money without the need to have taxes deducted. Its a nice perk to be able to have all our bills paid without affecting our savings too much.

These three main types of income help us with the family economy. They are three very common incomes, moreover, so they are a double advantage, since retirees can receive their retirement payments without the obligation of having to pay the appropriate taxes. In case you have to pay taxes, do not omit it at any time, as it is mandatory. Always consult an advisor if you have any doubts.

Don’t Miss: Negatives Of Getting Social Security Disability

Is Disability Insurance Taxable

Disability benefits may or may not be taxable. You will not pay income tax on benefits from a disability policy where you paid the premiums with after tax dollars. This includes:

- A policy you bought yourself with after-tax dollars

- A employer sponsored policy you contributed to with after-tax dollars. These rules apply to both short-term and long-term disability policies. Income from social security disability isnt taxable if your provisional income isnt more than the base amount. Provisional income is your modified adjusted gross income plus half of the social security benefits you received. The base amount is:

- $25,000 if youre filing single, head of household, or

- $32,000 if youre

- $0 if youre married filing separately and lived together with your spouse at any point in the year

- Your modified AGI includes all other income without subtracting exclusions for:

The Tax Implications Of Disability Income

The Centers for Disease Control and Prevention reports that 61 million adults in the United States have some type of disability affecting mobility, cognition, hearing, or vision . According to the Council for Disability Awareness, just over 1 in 4 of todays young adults will become disabled before retirement. Surprisingly, 90% of disabilities are caused by illnesses, not accidents . One-quarter of disabilities will last for three months or longer, and these disabilities might prevent or limit self-care, independent living, or the ability to work. Financial assistance may be available through government programs, insurance, or employer plans. The source of this income dictates the tax results.

Recommended Reading: Calculator For Social Security Taxes

Social Security Disability Offset

Even though, generally speaking, workers compensation payments are non-taxable, there is still an exemption.

If you are injured worker, you still have to pay taxes if you also receive Social Security Disability Insurance on top of your workers compensation. Your benefits may be reduced or offset if the combined amount of your SSDI and workers compensation benefits is greater than 80% of your pre-disability average monthly income.

Your workers compensation benefits would be taxed equivalent to the amount that Social Security deducts from your SSDI payments. For instance, if your SSDI benefits were reduced by $500, then $500 of your workers compensation benefits are now taxable.

However, the majority of injured employees who receive both SSDI and workers compensation benefits do not earn enough to be required to pay federal taxes.