What It Means For High Earners’ Tax Bills

Social Security tax is charged at a 6.2% rate and applies to all earned income, up to the annual maximum mentioned in the previous section. This means that any income you have from salaries, wages, tips, bonuses, or self-employment qualifies .

If your earned income is $160,200 or greater in 2023, the maximum Social Security tax is $9,932.40. For comparison, the contribution and benefit base in 2022 was $147,000, which translates to a maximum Social Security tax of $9,114. So, high earners could see their Social Security tax increase by as much as $818.40 next year.

Example Of Maximum Social Security Benefits

Say that someone who turned 62 in 2021 will reach FRA at 66 years and 10 months, with earnings that make them eligible at that point for a monthly benefit of $1,000. Opting to receive benefits at age 62 will reduce their monthly benefit by 29.2%, to $708, to account for the longer time that they could receive benefits, according to the Social Security Administration . That decrease is usually permanent.

If that same person waits to get benefits until age 70, their monthly benefit increases to $1,253. The larger amount is due to the delayed retirement credits earned for the decision to postpone receiving benefits past FRA. In this example, that higher amount at age 70 is about 77% more than the benefit that they would receive each month if benefits started at age 62a difference of $545 each month.

Of course, the best time for someone to start taking Social Security benefits depends on a variety of factors, not just the dollar amount of the benefit. Things such as current income and employment status, other available retirement funds, and life expectancy also must be factored into the decision.

The SSA has calculators to help you estimate your benefits.

The Maximum Social Security Benefit Will Be Bigger

The size of your retirement benefit depends on lifetime earnings and age. Specifically, a formula is applied to your average, inflation-adjusted earnings from the 35 highest-paid years of your career. The output is your primary insurance amount , the benefit you will receive if you claim Social Security at full retirement age .

Anyone who claims benefits earlier than FRA receives a permanent reduction, and anyone who claims benefits later than FRA receives a permanent increase.

The PIA formula is adjusted each year to account for wage inflation. That means the maximum benefit payable to new retirees typically increases from one year to the next. This chart shows the maximum benefit amounts for 2023.

Age When Retirement Benefits Start

|

Maximum Benefit Amount |

|---|

|

$4,555 |

Data source: Social Security Administration.

As a caveat, not many people actually get the maximum benefit. To qualify, your wages need to meet or exceed the maximum taxable earnings limit for 35 years. As mentioned, that figure is $147,000 in 2022.

Of course, most people won’t know offhand whether they qualify for the maximum amount, but anyone can use the my Social Security portal to estimate their future benefit.

You May Like: Social Security Office In Eugene Oregon

What Is The Social Security Payroll Tax

Federal Insurance Contributions Act taxes are the primary source of revenues for Social Security, and are the largest component of taxes that are commonly referred to as payroll taxes. Employers and employees each pay 7.65 percent of wages in FICA taxes the portion dedicated to Social Security is 6.2 percent and is only levied up to a maximum amount, or income limit, that is determined annually. Self-employed individuals also contribute to those funds through Self-Employment Contributions Act taxes. The rates for SECA taxes are identical to those for FICA taxes, with the only difference being that the individual is responsible for paying both the employee and employer portions of the tax.

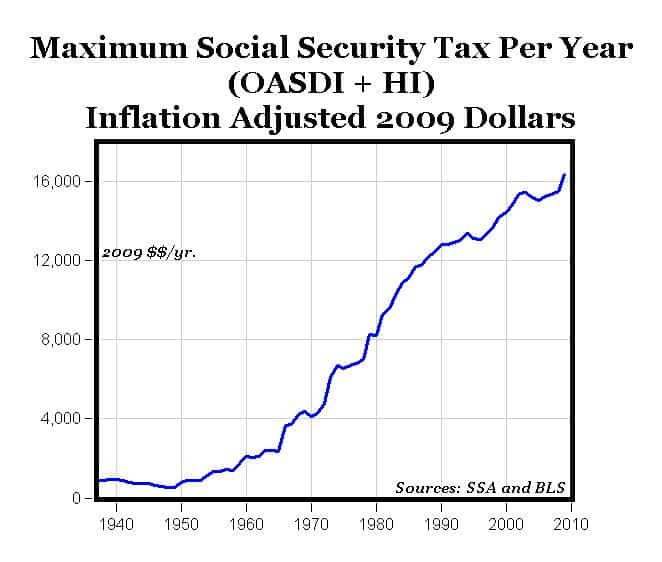

The limit on annual earnings subject to Social Security taxes is referred to as the taxable maximum or the Social Security tax cap. For 2021, that maximum is set at $142,800, an increase of $5,100 from last year. When the tax dedicated to Social Security was first implemented, it was capped by statute at the first $3,000 of earnings . Since 1975, the taxable maximum has generally been increased each year based on an index of national average wages. About 6 percent of the working population earns more than the taxable maximum.

Employee Contribution Changes In 2011

As part of the Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010 enacted on December 17, 2010, the employee Social Security tax rate is reduced from 6.2% to 4.2% for wages paid during the year 2011 and 2012. The employer Social Security tax rate and the Social Security Wage Base were not directly impacted by this act, though they did change only the employee’s tax rate changes. This is reflected in the above table, showing the reduction from $6,621.60 to $4,485.60.

You May Like: Can You Get Credit Card Without Social Security Number

Exemptions From Social Security Taxes

Some people aren’t required to pay Social Security taxes. For instance, exemptions from Social Security taxes may be available if certain requirements are met for:

- Ministers and church employees

- Members of certain religious groups who waive their rights to all Social Security benefits

- Students employed by their school

- Foreign students temporarily in the U.S. under certain types of visas

- Minors employed in a family business

- Non-citizens working for a foreign government in the U.S. and

- Self-employed people with less than $400 of self-employment income.

Other exemptions may also apply.

Tips For Navigating Retirement

- If all of the age thresholds and eligibility requirements and conditions for your Social Security benefits have you feeling overwhelmed, you may be interested in using our Social Security calculator. You can fill in your information, and well do the rest. Well let you know what you can expect in annual benefits once you retire.

- Social Security isnt intended to be your sole source of retirement income you should also have retirement savings. To make sure these savings are on pace to meet your income needs, its a great idea to work with a financial advisor who can develop a financial plan and help you invest. Finding a financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

Also Check: Social Security Office Rockland Maine

Other Key Social Security Increases In 2022

Along with the wage base, the retirement earnings test exempt amount rises every year. The exempt amount applies to people who are receiving benefits but have not reached full retirement age . If you earn more than this amount, the Social Security Administration will withhold $1 in benefits for every $2 you earn above the limit. The amount is higher the year you reach FRA, and the SSA will withhold $1 in benefits for every $3 you earn above the limit.

For workers who have yet to reach their FRA, the 2022 earning limit is $19,560, up from the 2021 earning limit of $18,960. If 2022 is the year you will reach your FRA, the limit is $51,960, up from $50,520 in 2021.

Another number that generally increases every year is the benefit amount, which gets a cost-of-living adjustment . For 2022, the COLA jumped 5.9%, the highest in decades. However in 2023 the COLA climbs 8.7%.

Are Payroll Taxes Changing In 2022

In 2022, the Social Security tax rate is 6.2% for the employer and then 6.2% for the employee, so there is no change coming in this regard.

It is worth noting that the Social Security tax rate very rarely changes, as evidenced by the fact that employees have been paying 6.2% tax since 1990.

Unlike the tax rate, though, the Social Security tax limit is adjusted on an annual basis and is there to keep Social Security benefits in line with the current rate of inflation.

The Social Security tax limit has been increased in 10 of the last 11 years, with 2020 and 201 seeing increases of 3.6% and 3.7% respectively. The increase is less in 2022, however, as it will be 2.9%.

Recommended Reading: Social Security Office Hartford Connecticut

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

Social Security is the largest program in the federal budget and makes up almost one-quarter of total federal spending. It provides benefits to nearly 9 out of 10 individuals over the age of 65, or 15 percent of the American population. Without Social Security, research finds, two-thirds of the elderly would be considered in poverty.

The program, however, is facing financing shortfalls, and its reserves are currently projected to be depleted in a little over a decade. At that point, unless Congress acts, it wont be able to pay full benefits to its beneficiaries. One potential solution for improving the programs financial outlook is increasing or eliminating the cap on earnings that are subject to Social Security payroll taxes.

Does Social Security Count As Income

Since 1935, the U.S. Social Security Administration has provided benefits to retired or disabled individuals and their family members. … While Social Security benefits are not counted as part of gross income, they are included in combined income, which the IRS uses to determine if benefits are taxable.

Don’t Miss: Protect Your Social Security Number

How Raising The Wage Base Could Work

Once a worker crosses the threshold of paying Social Security taxes on the first $147,000 of their annual earnings, their paychecks are no longer subject to those levies.

As a result, workers who are above the earnings threshold may pay Social Security payroll taxes for part of the year only.

“A lot of people don’t even know there is a maximum, and when they find out, they think the law should be changed so that everybody pays in all year,” Altman said.

A Medicare tax of 1.45% also applies to wages. Combined with Social Security, this represents a 7.65% tax paid both by employees and employers and is known as FICA, which stands for the Federal Insurance Contributions Act.

Notably, there is no wage limit for the Medicare tax, after Congress did away with it starting in 1994.

Today, lawmakers could choose to make the same change to Social Security. They could also choose to increase the tax rate from 6.2%.

Other Taxes Withheld From Your Paycheck

Take a look at your most recent pay stub. You’ll notice that there are other taxes withheld from your paycheck other than the Social Security tax. For example, federal income tax is withheld from your pay, because Uncle Sam like to get his cut a little bit at a time . State income taxes will also be withheld, unless you live in a state without an income tax.

You also have a Medicare tax taken out of your wages. This tax is equal to 1.45% of your pay. Unlike the Social Security tax, there is no cap on wages to which the Medicare tax applies. So, even if you earn more than $160,200 in 2023, you’ll pay the 1.45% Medicare tax on all your wages. In fact, if you make too much money, you have to pay even more in Medicare taxes. That’s because workers must also pay an additional 0.9% Medicare surtax on wages over $200,000 for singles and $250,000 for married couples filing a joint tax return .

Recommended Reading: Social Security Office Pensacola Florida

What Is Social Security Withholding

The Social Security tax is a federal tax imposed on employers, employees, and self-employed individuals. It is used to pay the cost of benefits for Social Security recipients, survivors of recipients, and disabled individuals and is referred to as OASDI, or Old-Age, Survivors and Disability Insurance.

The Social Security tax is one of the payroll taxes paid by employees, employers, and self-employed individuals each year known as FICA taxes. Medicare tax is the other tax in this package. There is no maximum taxable income for the Medicare tax, but there is an additional Medicare tax of 0.9% for high-income single taxpayers with earned income of more than $200,000 .

The Social Security tax rate for both single and married taxpayers is 2022 is 12.4% both the employer and the employee pay 6.2% of the employee’s salary. The standard Medicare rates are 1.45% for each, for a total of 2.9%. Therefore, the total FICA tax amount is 15.3%.

Social Security Tax Limits

The government bases the annual Social Security tax limits on changes in the National Wage Index , which tends to increase every year. The changes are intended to keep Social Security benefits on track with current inflation.

Any income you earn beyond the wage cap amount is not subject to a 6.2% Social Security payroll tax. For example, an employee who earns $165,000 in 2022 will pay $9,114 in Social Security taxes .

Keep in mind, however, that there is no wage base limit for Medicare tax. While the employee is only subject to Social Security tax on the first $147,00, they will have to pay 1.45% Medicare tax on the entire $165,000. Workers who earn more than $200,000 in 2022 are also subject to an 0.9% additional Medicare tax.

The combination of the increase in the Social Security tax limit and the additional Medicare tax for high-earners could result in lower take-home pay. Unfortunately, that means workers who earned over $200,000 in 2021 are at risk of owing more taxes in 2022.

Here is an example of how the Social Security limit works in 2021 and 2022:

| Social Security Tax Limit Example |

|---|

| 2021 Income |

Read Also: Social Security Office In Harrisburg Pa

How The Math Works

The math works like this:

- If your wages were less than $137,700 in 2020, multiply your earnings by 6.2% to arrive at the amount you and your employer must each pay for a total of 12.4%. If you were self-employed, multiply your earnings up to this limit by 12.4% to calculate the Social Security portion of your self-employment tax.

- If your wages were more than $137,700 in 2020, multiply $137,700 by 6.2% to arrive at the amount you and your employer must each pay. Anything you earned over this threshold is exempt from Social Security tax. You would do the same but multiply by 12.4% if you’re self-employed.

For taxes due in 2021, refer to the Social Security income maximum of $137,700 as you’re filing for the 2020 tax year.

Social Security And Medicare Withholding Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, , Employer’s Tax Guide for more information or Publication 51, , Agricultural Employers Tax Guide for agricultural employers. Refer to Notice 2020-65PDF and Notice 2021-11PDF for information allowing employers to defer withholding and payment of the employee’s share of Social Security taxes of certain employees.

Don’t Miss: 1800 Number For Social Security

Retirement Earnings Test Exempt Amounts

Workers who receive benefits before they reach full retirement age are subject to the retirement earnings test. If your income exceeds certain thresholds, then Social Security will withhold benefits until you reach FRA. Like the Social Security tax limit, these thresholds typically increase annually with the national wage index.

There are two annual earnings test exempt amounts: one that applies to individuals younger than retirement age and one that applies to individuals who reach FRA during that year. For younger recipients, Social Security withholds $1 for every $2 in excess of their exempt amount. Individuals who reach retirement age will have $1 withheld for every $3 in excess of their exempt amount.

In 2022, the earnings test exemption amounts will increase to:

- $19,560 for individuals younger than the FRA

- $51,960 for those who reach their FRA

In other words, an individual who earns $19,560 or less in 2022 may be eligible to receive full Social Security benefits. This is up from $18,960 in 2021.

How Will Taxes Affect Your Benefits In Retirement

Although you’ll no longer be subject to Social Security payroll taxes once you retire, you could owe income taxes on your benefits.

Your Social Security benefits are subject to both state and federal income taxes. Fortunately, only 13 states tax benefits, so depending on where you live you may already be in the clear. But federal taxes will depend on your income, and many retirees won’t be able to avoid this type of tax.

To determine whether you’ll owe federal taxes, you’ll need to know your “provisional income.” This number is half your annual benefit amount plus your adjusted gross income and any nontaxable interest. Keep in mind that Roth IRA withdrawals do not count toward your provisional income.

If you have a provisional income of $25,000 or more per year , you will owe federal income taxes on a portion of your benefits. The good news, though, is that regardless of your income, you won’t owe federal taxes on more than 85% of your benefit amount.

Social Security taxes can be confusing. However, they can affect both your income during your working years and your retirement income. The more you understand how your income will affect your taxes during your career and in retirement, the easier it will be to prepare for your senior years.

The Motley Fool has a disclosure policy.

Also Check: Social Security Administration San Antonio