Using Our Automated Telephone Services

Services for all beneficiaries

- Request a benefit verification letter

- Ask for a form SSA-1099, Social Security Benefit Statement, to request a replacement tax summary

Services for Medicare beneficiaries only

- Request a replacement Medicare Card

- Request a form SSA-1020 to apply for help with Medicare prescription drug costs

Services for people who have applied for benefits

- Ask to receive a claim status

Services everyone can use

- Find the address of your local Social Security office

- Request a form SS-5,Application for a Social Security Card, to:

- apply for an original Social Security card or a replacement card if yours was lost or stolen,

- request a name change on your card, or

- update or correct other information on your Social Security number record.

Informational Messages

You can listen to informational messages on the following subjects:

- Payment delivery dates

- Best times to call our 800 number

- Social Security Internet address and services

- Supplemental Security Income

- Non-receipt of your Social Security benefit

- Representative payee

Services for Social Security Benefits Only

- Change address and/or phone number

Why Did I Receive A Social Security Overpayment

Social Security overpayments are when you receive more money one month than you should have received. They can happen with Supplemental Security Income payments or Social Security Disability Insurance benefits.

Social Security payments are the same each month, so it should be easy to notice if theres a discrepancy. The difference between what you should have gotten and the payment you received is the overpayment.

Overpayments can happen for a few reasons.

S To Take To Contest A Notice Of Overpayment

Make sure you read the notice carefully to understand the amount of the noticed overpayment and the reason the Social Security Administration believes you have been overpaid. Go through all the documents you have received from SSA in the past several years. You want to be sure of your facts and know exactly what income and status you have reported to the agency. If you have questions, talk to a representative at the local SSA office or on the telephone. Always write down the name of anyone you talk to at SSA.

If your reconsideration is denied, there are additional steps you can take to contest the overpayment. You have the right to an administrative hearing where you can present your case to an administrative law judge. You will need to fill out the Request for Hearing By Administrative Law Judge form. If you lose the administrative hearing, your next option is to file an appeal with the appeals council. If you lose after going through all these administrative steps, your only remaining option is to hire a lawyer and take your case to court.

Read Also: Social Security Office Conway Arkansas

What Do I Have To Report To Social Security

- Report if you go to work.

- Report if you get a raise report every raise you get.

- Report if you quit work or lose your job.

- Report if your spouse or child goes to work/gets a raise.

- Report if you get insurance money, an inheritance or win the lottery.

- If you receive SSI report any changes to the amount you pay in rent.

- Always! If in doubt, Report It!

What Is A Social Security Overpayment

If the Social Security Administration finds that you have gotten too much money in your Social Security benefit, they will send you a Notice of Overpayment. Social Security overpayments can happen for many reasons. Sometimes it is because you didnt report something that could affect your eligibility, like how much you worked despite your disability, and sometimes it is for reasons only Social Security would know about.

Don’t Miss: What Is Considered Income For Social Security Benefits

What Happens If My Request Is Denied

If you submit a Request for Reconsideration and it is denied, you can file an appeal.

Suppose you submit a Request for Waiver of Overpayment Recovery, and its denied. In that case, you can file a Request for Reconsideration. If this is also denied, you can file an appeal.

You have 60 days from the day you receive your denied notice to begin your appeal. After that, you initiate the process by requesting an appeal in writing. Further details will be provided on your notice, so keep this handy. You can also find more information on the SSA website.

You may appoint a representative to help you appeal or do it yourself. The SSA is happy to help folks navigate the appeal process, so dont hesitate to contact your local office. If you are appealing an SSI decision, see here.

How Do Overpayments Occur

- Increases in earned or unearned income that isnt reported to SSA

- Changes in living situation or marital status

- Having more resources than the allowable limit

- An error in calculating the benefit amount due to incorrect or incomplete information at SSA

- Receiving an SSDI check for months after the Trial Work Period when the beneficiary earned over the substantial gainful activity amount. Read more about the Trial Work Period.

- A beneficiary being convicted of a criminal offense and confined for more than 30 continuous days and still receiving their benefit

Don’t Miss: Social Security Office Ann Arbor

What If I Lose My Request For Waiver Or Reconsideration

If you disagree with the waiver decision, the next step of appealing is to file a Request for Reconsideration either online or by telephone as described above.

If the request for reconsideration of the waiver decision is denied, you can request a hearing with an Administrative Law Judge . You must do this within 60 days of the date of the denial notice. You can do this online or by telephone at 1 800- 772-1213.

The Best Way To Fix A Social Security Overpayment Letter

Social Security Overpayment letters are becoming more common.

For those who depend on Social Security payments, receiving a Notice of Overpayment is no fun. These notification letters will often show up after a change in income or family status and generally allege that the Social Security Administration has paid you too much money. In this letter they offer you a 30 day window to repay the benefits.

This leaves many shaken who count on this income to buy their groceries or some other necessity. Fortunately, the Administration is often incorrect in their calculations.

However, there is still a process to follow if you receive one of these letters. Unless otherwise stated, you have three options.

- Pay the overpayment within 30 days

- Appeal their determination within 60 days

- Request a waiver

The option you choose depends on your circumstances. Personally, Ive seen too many bad calculations by the Social Security Administration to ever recommend just repaying the amount requested. In my opinion, an appeal should always be the first step.

Also Check: Social Security Office St Louis

Notice Of Potential Overpayment

We may mail you a Notice of Potential Overpayment if we need more information to determine if you were overpaid or the amount you were overpaid.

For a potential unemployment overpayment, you must respond to the notice within 15 days so we can make the correct determination. For disability or PFL, you must respond within 14 days.

If we determine the potential overpayment was not your fault or was not due to fraud, you may qualify for an overpayment waiver. We will send you a Personal Financial Statement with the Notice of Potential Overpayment.

When Both Appeal And Waiver Requests Are Denied

SSA will try to recover the overpayment from you. It usually does this by reducing the amount you get each month.

If you get SSI, SSA can lower your benefits by up to 10% to recover the overpayment. The current SSI benefit is $783 per month. The most SSA could lower your benefit by is $78.30 per month. If you get SSDI, SSA will lower your monthly benefit to $0 until the overpayment has been paid back.

SSA will ask you to repay the overpayment within 30 days. If you cannot afford to pay the full amount all at once, you can ask SSA to pay back the overpayment in installments.

If you do not repay the overpayment, SSA may do one or more of these:

-

Garnish your wages

-

Reduce the overpayment amount from your tax refund

-

Reduce future SSA benefits may you receive, including retirement benefits

-

Report your nonpayment to credit bureaus

You can ask SSA for a compromise or change in repayment rate.

Asking for a compromise means asking to pay SSA less than the full amount of the overpayment. SSA will not compromise the overpayment if you still have the money that was overpaid, or they found you were at fault in causing the overpayment. You can make an offer of compromise in writing and give it to your SSA office.

Asking for a change in repayment rate means asking SSA to collect the full overpayment but in smaller amounts at a time. You can ask for a change even if you agree that you were overpaid and with the amount of the overpayment.

Read Also: Social Security Office In Victoria Texas

Division Of Temporary Disability And Family Leave Insurance

If you get a Demand for Refund notice in the mail, don’t panic!

Carefully read the attached determination to find out how much you owe us and why.

In general, most overpayments are due to information crossing in the mail. Fines and/or interest will not be assessed to the overpayment in most cases.

Regardless of the reason for the overpayment, as the person receiving the benefits you are responsible to reimburse this program. We try to make the process of repayment as easy as possible.

- You may choose to set up a repayment schedule by contacting our Benefit Payment Control office at 609-292-0030.

- You may choose to pay online.

- You may send a check or money order to the address listed below. Make the check or money order payable to NJ Dept. Of Labor and Workforce Development, and be sure to write your name and Social Security number on the payment.

Mail to: Bureau of Benefit Payment Control, Refund Processing Section, PO Box 951, Trenton NJ 08625-0951

If you do not understand why we sent you this notice, call Customer Service at 609-292-7060. If you still disagree with the reason provided, you may file an appeal. to learn about the appeals process.

- Frequently Asked Questions About Overpayments

If I owe money to the Division, can I make an electronic payment?

to make a payment online. Our E-Payment service accepts both credit card and e-check payments for one-time or recurring payments.

Why do I have an overpayment on my claim when I filed only last week?

Appealing A Decision

What If Social Security Says That I Have Money In The Bank Or Some Property That I Do Not Have Or That Is Not Valuable

If you receive SSI, you are only allowed to have $2,000 in the bank or $3,000 if you are a disabled couple. You must show receipts or other documentation proving the money has been spent or is no longer available to you for some other reason. You cannot just give the money to relatives to hold for you. Remember to keep a copy of everything you submit to Social Security!

In the case of property , you can provide documents showing the propertys value is lower than what Social Security claims.

Read Also: Social Security Disability Earnings Limit 2022

Ask For A Waiver When:

- Overpaid but it is not your fault

- Prove it is not your fault AND prove you cannot afford to pay it back

- No deadline for submission

- Prove you were not overpaid – submit evidence in support.

- Must ask for reconsideration within 60 days from the date of the overpayment notice

- Collections cease when asked.

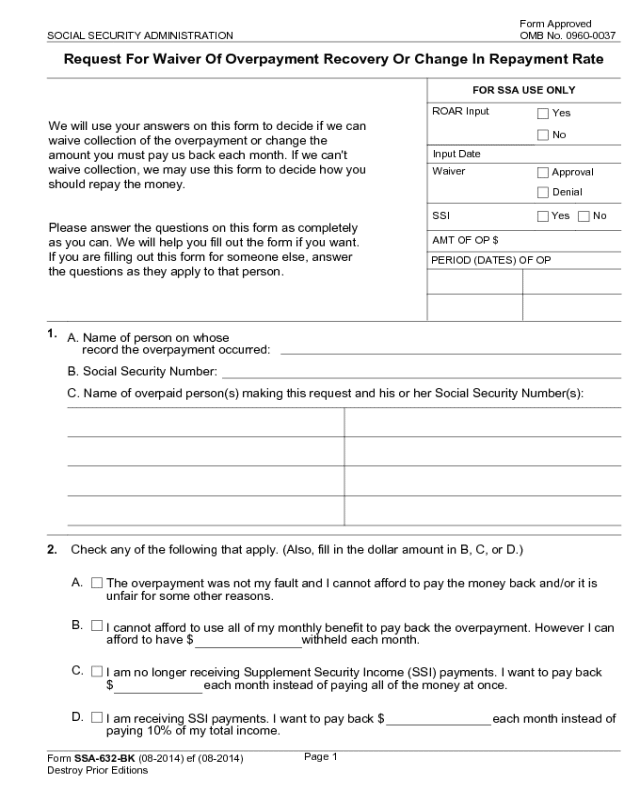

Request A Waiver Of Overpayment

The first option should probably be to request a waiver from the Social Security Administration. This would waive or simply write off the overpayment. To have a waiver approved, you must meet two conditions.

First, you have to convince SSA that the overpayment was not your fault. That would be easy to do in a situation where the government miscalculated your benefit. Thats obviously Administrations fault, not yours. But if you were overpaid because you failed to report some event that should have changed your benefit amount or even altered your basic eligibility for benefits, then youll have a hard time claiming its not your fault.

Even if the Social Security overpayment was not your fault, you must also prove to SSA that repaying the debt would create a financial hardship for you and your family. To do this, you have to provide SSA with records of your income and your expenses. This could include wage statements or tax returns and rent receipts, mortgage statements, utility bills, grocery receipts, etc. A Social Security representative will review your household budget and decide if the overpayment waiver can be granted.

The key points to remember are:

- Sometimes the Social Security Administration is wrong. Challenge them!

- Expect the appeal process to take several weeks.

- File your appeal within 30 days.

- Dont be embarrassed to request a waiver.

- If you must pay it back, set up your own payment terms.

You May Like: How Much Do Veterans Get For Social Security

Negotiating Your Repayment Options

SSA normally tries to recover the full amount of overpayments within three years. However, if that is more than you can afford to pay, SSA will usually negotiate a reasonable payment plan. Sit down and figure out a budget that allows for monthly payments to SSA. Then, call your local SSA office at the number listed on your overpayment notice. Talk to a SSA representative about negotiating repayment options. The representative will discuss your proposal and tell you what documents you will need to provide to support your position. This usually includes, bank statements, bills, receipts and income statements. You will then submit your request along with the required documentation to your local SSA office. The SSA will process your request and get back to you with an answer within 30 days. Unless the agency finds a discrepancy in your income or expenses, the SSA will normally agree to your proposed repayment plan. Repayment amounts will be deducted from your monthly Social Security check unless you make arrangements to pay by credit card or debit.

Lifeline Free Monthly Wireless Service

If you qualify for government assistance, like SSI, you may be eligible for Lifeline service. This federal benefits program gives low-income consumers free or massively discounted communication services. Lifeline helps subsidize the cost of wireless cell phones and internet services. Click here to find out more and apply for this valuable benefit.

Ally is responsible for researching, copywriting, and editing content at StandUp Wireless. She has extensive experience contributing to advertising and marketing campaigns for Tech Data, Bright House Networks, TV, telecom, internet, home security, cybersecurity, and retail. As a freelance author, Ally has penned six celebrity biographies for young readers.

Did you know?

Read Also: Do Employers Need Social Security Number For Background Check

Promptly Report Changes In Income To Ssa :

When beneficiaries begin working, they should let SSA know right away and continue to report their wages to SSA during the first six days of each month to decrease the chance of incurring an overpayment.

SSI beneficiaries can report earnings using any of the following methods:

- Using an automated wage reporting tool

- SSI Telephone Wage Reporting System, which is a quick and easy way to report monthly earnings by phone

- SSI Mobile Wage Reporting application, which allows reporting of the total gross monthly wages for the prior month using an Apple or Android mobile device

- myWageReport, which allows beneficiaries to report their monthly earnings online via their mySocial Security account

SSDI beneficiaries

How Can I Legally Keep The Overpayment

You may believe that the SSA notice is an error and that you were not overpaid, or you may not be able to afford to pay back the payment. If this is the case, you can request to keep your overpayment legally.

If you are unsure which request method to choose, you can ask to see a copy of your file, which contains the information the SSA considered when sending out your notice.

Your Social Security payments will continue uninterrupted until the SSA decides on your case.

There are two main requests you can make:

You have ten days to receive your first overpayment notice to request these options.

If you dont think you were overpaid, you can request a waiver of the overpayment by completing Form SSA-561, the Request for Reconsideration. In this request, you must explain why you believe you were not overpaid and/or why you believe the SSAs requested amount is incorrect.

If you agree that you have received a Social Security overpayment but feel it was not your fault and that you cannot afford to pay it back, you should complete Form SSA 632, the Request for Waiver of Overpayment Recovery.

Also Check: Social Security Office In Bronx