Average The Highest 35 Years

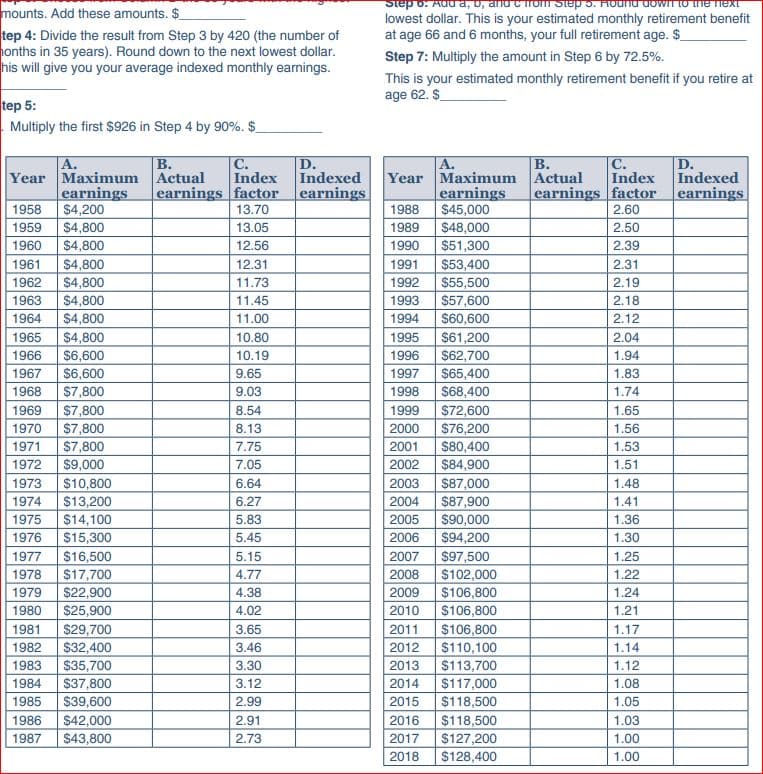

The Social Security benefits calculation uses your highest 35 years of earnings to calculate your average monthly earnings. If you do not have 35 years of earnings, a zero will be used in the calculation, which will lower the average. In the table below, the highest 35 years are listed in Column G.

Total the highest 35 years of indexed earnings, and divide that amount by 420, which is the number of months in a 35-year work history, to find the Average Indexed Monthly Earnings.

For our example worker, who was born in 1953 and turned 60 in 2013, the highest 35 years of wages total $1,919,040. Divide by 420 to get an AIME of $4,569.

| How to Calculate Your AIME for Social Security Benefits |

|---|

| A |

Are Social Security Benefits Taxable

If you have a lot of income from other sources, up to 85% of your Social Security benefits will be considered taxable income. If the combination of your Social Security benefits and other income is below $25,000, your benefits wonât be taxed at all. The amount of your benefits that is subject to taxes is calculated on a sliding scale based on your income. Money that Social Security recipients pay in income taxes on their benefits goes back into funding Social Security and Medicare.

If your retirement income is high enough that your benefits are taxable, how do you pay those benefits? You can ask Social Security for an IRS Voluntary Withholding Request Form if youâd like the government to withhold taxes from your Social Security benefits. Otherwise, youâre expected to file quarterly tax returns to pay these taxes over the course of the year.

That covers federal income taxes. What about state income taxes? That depends. In 12 states, your Social Security benefits will be taxed as income, either in whole or in part the remaining states do not tax Social Security income.

Please Answer A Few Questions To Help Us Determine Your Eligibility

Social Security disability insurance is designed to help workers who can no longer work because of a disability. Unlike Supplemental Security Income , which also pays disability benefits but is based on limited income and resources, SSDI requires that you have worked and paid Social Security taxes for a certain time.

The average SSDI payment is currently $1,358. The highest monthly payment you can receive from SSDI is $3,345 . This article covers how your monthly SSDI benefit is calculated.

Also Check: Social Security Administration Phone Number

How Is Disability Payment Calculated

After filing for Social Security Disability Insurance coverage, an individuals payment will be determined by their average earnings before they become disabled. Those who have paid more taxes on their wages are better compensated when it comes to insurance payments. Your household income or the severity of your disability does not matter if you qualify for disability benefits.

Averaged Indexed Monthly Earnings is calculated based on up to 35 years of working experience. By adding the highest indexed earnings over the years and dividing them by the number of months for those years, the Social Security Administration calculates the retirement benefit. This average is then rounded down to find your AIME.

In addition to your average index monthly earnings, SSDI pays out benefits based on your

You receive 90% of the earnings at the first bend point, 32% at the second bend point, and 15% at the third bend point. According to SSDI data from 2022, the average monthly benefit is $1,657. For the highest earners, the monthly benefit is $4,194.

Social Security offers a tool that lets you calculate your expected payment. Create an account and see your Social Security covered earnings for every year, as well as the amount you will receive if approved for SSDI.

The SSA implemented Trial Work Period to motivate people to return to work if they feel capable of doing so for over 60 months, although not necessarily consecutively. Your benefits will not be affected if you earn an unlimited amount for nine months within this period.

Your Extended Period of Eligibility begins when your TWP is finished. As long as you remain disabled and your earnings do not exceed the substantial gainful activity threshold, you are entitled to receive your full monthly benefit for 36 months.

Every year, the threshold for SGA changes according to the poverty level for an individual. As of 2022, the threshold is $1,350.

Last Full Year Of Work

Secondly, the last full year of work is essential for estimating the amount you are entitled to receive from social security benefits. Similar to how this calculator adjusts to your year of birth, the last full year you worked will have a dramatic effect on your potential disability earnings. The manner in which this adjustment takes place is somewhat arbitrary, especially since this calculator provides a basic estimate.

If you have not worked in the last 20 years, this calculator will not be able to accurately estimate what your benefit amount could be. Generally, individuals who have lost their ability to work normally in more recent years are able to collect more benefits than those who have lost this ability farther in the past. However, this is not always the case.

Yearly Income

Like any ordinary government assistance program, annual income plays a huge factor in determining how much benefits you can qualify for. According to this calculator, individuals who earn more are usually able to earn more benefits. This is evidenced by the primary model expressed by the calculator.

An individual born in 1968 that earns $3,000 annually, who last worked in 2017, would be entitled to receive $587. On the contrary, a person with the same background information that earns $5,000 annually is estimated to obtain $636 in social security benefits.

Company Information

Disability Help Center San Diego 1833 Fourth Ave. San Diego, CA 92101

Don’t Miss: Social Security Requirements For Disability

How Other Disability Payments Can Affect Your Ssdi

If you receive disability benefits from a private source, like a private pension or private insurance, these benefits won’t affect your SSDI benefits. But your private long-term disability benefit will likely be reduced by the LTD insurance company once you start collecting Social Security disability. How much you receive in SSDI benefits could change if you’re also getting certain other public disability benefits.

Adjust Your Pia For The Age You Will Begin Benefits

The final amount of Social Security retirement benefit that you receive is based on the age when you begin benefits.

The earliest you can begin retirement benefits is age 62 . You will get more by waiting until a later ageas late as age 70to begin receiving benefits.

Of course, another complex formula is used to determine how much more you will receive if you wait.

This formula uses your Primary Insurance Amount calculated in the previous step. This is the amount you will get if you start benefits at your full retirement age . Your FRA can vary, depending on the year you were born. For people born between 1943 and 1954, as in our example, the FRA is age 66.

For people born on January 1, the FRA is based on the year prior. Someone born on January 1, 1955, will have an FRA based on 1954.

A reduction is applied to your PIA if you begin benefits before your FRA. A credit, referred to as a “delayed retirement credit,” is applied if you begin to receive benefits after your FRA.

Read Also: Does Social Security Count As Income For Extra Help

Can You Receive Retroactive Payments

Once the SSA approves your SSDI application and calculates your monthly benefit, you may be entitled to a back pay award. How many months of payments you will receive will depend on the date you applied for benefits and your disability onset date.

If you are applying for SSDI benefits, you need the assistance of a skilled Social Security disability lawyer to get your application approved and receive the benefits you deserve. To schedule a free consultation with a member of our legal team, fill out the online form on this page or call our Roswell office today.

|

Related Links: |

How Does Ssdi Back Pay Get Calculated

Back payments, also known as back pay, cover the time between when your disability started and when you got approval. There is a five-month waiting period after you become disabled. After that waiting period, you are eligible for benefits beginning on the sixth whole month of disability.

Many SSDI applications take time to process. Sometimes, it can take years. After approval, you can receive back pay for the months you should have received benefits. The SSA will look at when you became disabled, subtract the waiting period, and send back pay up until your approval.

Many applicants get their back payments around 60 days after approval. However, if your disabled status started well before applying for benefits, you could receive retroactive payments for up to 12 months.

You May Like: Greenville South Carolina Social Security Office

Estimating Your Ssdi Benefit Amount

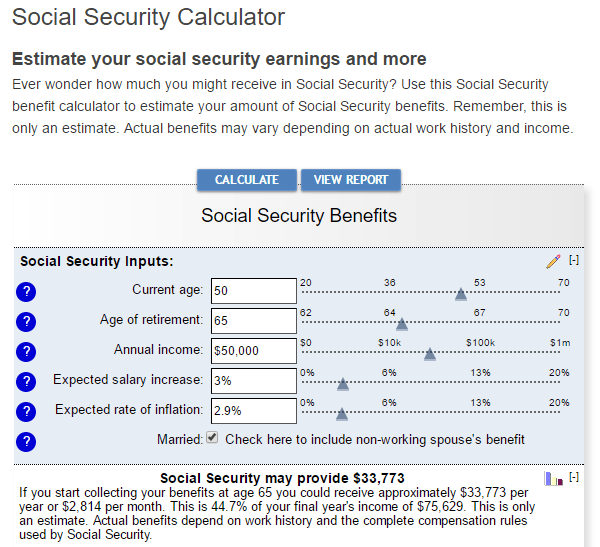

Your SSDI payment will be based on your average covered earnings over a period of years. The SSA calls this your “average indexed monthly earnings” . A formula is then applied to your AIME to calculate your primary insurance amount the base figure the SSA uses in setting your actual benefit amount.

For example, someone in their fifties whose income averaged $100,000 for the past few years might expect a disability payment of $2,500 per month. Someone in their fifties who made $60,000 per year might expect a disability payment of $2,000 per month.

You can check your annual Social Security Statement to see your covered earnings history. You’ll need to set up an account to see your statement online at my Social Security. You can also use theSSA’s benefits calculator to estimate the amount of your disability benefits. Or, call your local Social Security office, and they can help you estimate what your benefits would be.

Why It’s Smart To ‘plan Under Current Rules’

It’s also important to remember the current depletion date projections are subject to change, as the Social Security trustees amend their projections each year.

Moreover, Congressional legislation could change the program’s funding status before that date. That may include higher taxes, benefit cuts or a combination of both. Washington Democrats have put forward proposals that call for raising taxes on the wealthy while making benefits more generous.

For his part, Elsasser doesn’t necessarily tell his clients to plan for a benefit cut, but it is important to gauge their potential impact.

“We advise them to plan under current rules, because in the past, there’s always been a compromise,” he said. “But then stress test the plan and say, ‘Are we OK if we do get a benefit cut? And if we do, what is our plan?'”

If the outcome is unacceptable, then it may be time to make changes like reducing spending, saving more or working longer to make sure you can weather those possible cuts, Elsasser said.

Recommended Reading: Jefferson County Social Security Office

How Your Ssdi Payments Are Calculated

The severity of your disability will not affect the amount of SSDI benefits you receive. The Social Security Administration will determine your payment based on your lifetime average earnings before you became disabled. Your benefit amount will be calculated using your covered earnings. These are your earnings at jobs where your employer took money out of your wages for Social Security or FICA.

Your SSDI monthly benefit will be based on your average covered earnings over a period of time, which is referred to as your average indexed monthly earnings . The SSA uses these amounts in a formula to determine your primary insurance amount . This is the basic amount used to establish your benefit.

SSDI payments range on average between $800 and $1,800 per month. The maximum benefit you could receive in 2020 is $3,011 per month. The SSA has an online benefits calculator that you can use to obtain an estimate of your monthly benefits.

How To Get The Maximum Social Security Benefit

Few people receive the maximum Social Security check from the government. To defy this and potentially become one of a small handful to bag $4,194 per month, you’ll need to be a high earner over many decades and delay receiving the benefits.

The checklist is as follows:

Read Also: Social Security Disability Phone Number Florida

Does Working Past Age 70 Affect Your Social Security Benefits

Dear Carrie,

I’m turning 70 and about to start collecting Social Security even though I’m still working and intend to keep working for a couple more years. Since I’m past full retirement age, will I continue to pay Social Security taxes? Also, will continuing to work affect my monthly benefit?

A Reader

Dear Reader,

First, congratulations on waiting until 70 to collect your Social Security benefits. By doing so, you maximized your monthly payout. That’s a smart move for many folks!

But while Uncle Sam gives you a bonus for waiting to collect Social Security benefits, he doesn’t give you a dispensation from paying Social Security taxes. As long as you have earned income , you’re required to pay Social Security taxes on up to the annual payroll limitation$147,000 in 2022. So, yes, if you continue to work, you’ll continue to pay into Social Security and other payroll taxes.

Fortunately for you, since you’re past your full retirement age , there’s no benefit reduction based on income. You’re entitled to full benefits no matter your income level. However, earned income may impact your benefit if you take Social Security before your FRA.

Whether or not your continued income has a positive effect on the amount of your monthly Social Security benefit depends on how much money you made in the past and how much you’re making now. Here’s why.

Calculate My Social Security Income

These days thereâs a lot of doom and gloom about Social Securityâs solvency – or lack thereof. And regardless of whether you think Social Securityâs future is secure, the fact remains that you shouldnât plan on living exclusively off your Social Security benefits. After all, Social Security wasnât designed to make up a retireeâs entire income.

Still, many people do find themselves in the position of having to live off their Social Security checks. And even if you have other income sources in retirement, Social Security can make up a significant part of your retirement income plan. That’s why itâs important to know all the rules surrounding eligibility, benefit amounts, taxation and more.

Do you need help managing your retirement savings? To find a financial advisor who serves your area, try our free online matching tool.

You May Like: Social Security Office In Toledo Ohio

Do You Plan To Continue Working In Your 60s

Working in your 60s will help you maximize your income and savings.

Your benefits are based on your highest 35 years of earnings. Each year of work can add higher earnings to your record by replacing years with low earnings such as those when you were a student, were unemployed, or took time off to care for someone. When you work and wait to claim until age 70, you can increase your monthly benefit by more than 75 percent! Working in your 60s also gives you more time to save on your own for retirement.Review your earnings record on my SocialSecurity.

Working in your 60s will help you maximize your income and savings.

Your benefits are based on your highest 35 years of earnings. Each year of work can add higher earnings to your record by replacing years with low earnings such as those when you were a student, were unemployed, or took time off to care for someone. When you work and wait to claim until age 70, you can increase your monthly benefit by more than 75 percent! Working in your 60s also gives you more time to save on your own for retirement.Review your earnings record on my SocialSecurity.

You can maximize your benefits even if you work fewer hours or stop working.

You can maximize your benefits even if you work fewer hours or stop working.

Consider working in your 60s for an extra boost to your income and savings.

Consider working extra years in your 60s for an extra boost to your income and savings

Waiting Til Age 70 Yields The Highest Benefit But Only Big Earners Get The Max

Institutional Investor NewsFamily Wealth Report

A Tea Reader: Living Life One Cup at a Time

The maximum Social Security retirement benefit that you can receive depends on the age when you begin collecting and your earnings history, among other factors. In 2022, the maximum is $3,345 per month for someone who files at full retirement age at age 66. But $4,194 is the absolute highest benefit for those who qualify and delay claiming until age 70.

Recommended Reading: Customer Service Number For Social Security