Social Security Benefits: What Will Get Taxed From Your Monthly Check

According to the IRS, your Social Security benefits may be taxable if the total of one-half of your benefits plus all of your other income is greater than the threshold amount for your filing status. Other income includes pensions, wages, interest, dividends and capital gains. Social Security benefits include monthly retirement, survivor and disability benefits.

The thresholds are:

-

$25,000 if youre single, head of household or qualifying widow

-

$25,000 if youre married filing separately and lived apart from your spouse for the entire year

-

$32,000 if youre married filing jointly

-

$0 if youre married filing separately and you lived with your spouse at any time during the tax year

Youll be taxed on 50% of your Social Security benefits if your income is between $25,000 and $34,000 for an individual or $32,000 and $44,000 for a married couple filing jointly. Youll be taxed on 85% of your Social Security benefits if your income is more than $34,000 for an individual or $44,000 if youre married filing jointly. Youll be taxed on all your benefits if youre married and file a separate return.

Find: 7 Reasons You Might Not Receive Social Security Benefits

The Social Security Administration estimates that about 56% of Social Security recipients owe income taxes on their benefits, AARP reports, but recipients will never have to pay taxes on more than 85% of their Social Security benefits.

More From GOBankingRates

Taxation For Married Couples

If youre married, your spouses earnings are calculated as part of your total annual income for tax purposes. This means that even if youre not working or making a substantial amount at your job, your spouses income can affect your Social Security benefits. As of 2012, if your annual combined income tops $32,000, up to 50 percent of your Social Security benefits are taxed. If the total household income surpasses $44,000 per year, up to 85 percent of your benefits are taxed.

Three Ways To Reduce The Taxes That You Pay On Benefits

Is Social Security taxable? For most Americans, it is. That is, a majority of those who receive Social Security benefits pay income tax on up to half or even 85% of that money because their combined income from Social Security and other sources pushes them above the very low thresholds for taxes to kick in.

But there are three strategies you can useplace some retirement income in Roth IRAs, withdraw taxable income before retiring, or purchase an annuity, to limit the amount of tax you pay on Social Security benefits.

Read Also: Social Security Retirement Benefit Calculator

Income And Taxation Of Benefits

Continuing to work, however, may lower current payments, if any, taken during the year full retirement age is reached, according to a Social Security Administration limit, which changes every year.

If the full retirement age is reached in July, for instance, the total benefit income earned from January to July must be below the limit, or Social Security benefits are lowered by $1 for every $3 of income over the limit, which is $50,520 for 2021 and $51,960 for 2022.

That money is held by the Social Security Administration and repaid incrementally once the taxpayer is no longer working. There are no limits on income earned past the month that full retirement age is reached when the full benefit amount is paid no matter how much income is earned.

Read Also: What Is The Max Social Security Benefit

State Taxation Of Social Security Benefits

Most states don’t tax Social Security benefits. But the ones that do either follow the same federal provisional income rules or have special rules and income thresholds to determine what’s taxable.

These 4 states use the federal PI formula: Minnesota, North Dakota, Vermont, and West Virginia. The taxable portion of Social Security for these states is the same as the federal amount.

Nine states have special rules and income thresholds. Most use the federal modified adjusted gross income formula rather than the federal PI formula for taxing Social Security income.

These states are: Colorado, Connecticut, Kansas, Missouri, Montana, Nebraska, New Mexico, Rhode Island, and Utah.

If you live in a state that counts Social Security benefits as taxable income, you should consult your state tax department for details and a qualified tax advisor.

Also Check: Can I Lock My Social Security Number

Is Social Security Taxable

Social Security income is generally taxable at the federal level, though whether or not you have to pay taxes on your Social Security benefits depends on your income level. If you have other sources of retirement income, such as a 401 or a part-time job, then you should expect to pay some income taxes on your Social Security benefits. If you rely exclusively on your Social Security checks, though, you probably wont pay taxes on your benefits. State taxes on Social Security, on the other hand, vary from state to state. Regardless, it can be helpful to work with a financial advisor who can help you understand how different sources of retirement income are taxed.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

Read Also: What To Do When You Lose Your Social Security Card

How To Determine If Social Security Benefits Are Taxable

Seniors whose only source of income is Social Security do not have to pay federal income taxes on their benefits. If they receive other sources of income, including tax-exempt interest income, they must add one-half of their annual Social Security benefits to their other income and then compare the result to a threshold set by the IRS. If the total is more than the IRS threshold, some of their Social Security benefits are taxable.

For 2020, the threshold amount is $25,000 for singles and $32,000 for married couples filing jointly. Married couples who live together but file separately have a threshold of $0 and must pay taxes on Social Security benefits regardless of other income earned.

The formula for calculating your combined income includes adding your adjusted gross income plus nontaxable interest plus half of your Social Security benefits. Your other income, which is included in adjusted gross income, can come from a part-time job or 401 withdrawals.

More specifically, Social Security benefits are taxed as follows:

- Up to 50% of Social Security benefits are taxed on income from $25,000 to $34,000 for individuals or $32,000 to $44,000 for married couples filing jointly.

- Up to 85% of benefits are taxable if the income level is over $34,000 for individuals or $44,000 for couples.

Is Social Security Disability Taxable

You may need to pay taxes on your Social Security Disability Insurance benefits. This can happen if you receive other income that places you above a certain threshold. But, because SSDI requires you to be disabled and have limited income to be eligible, you might not have other income to exceed this threshold.

Common examples for when your Social Security Disability Insurance benefits may be taxable are if you receive income from other sources, such as dividends or tax-exempt interest, or if your spouse earns income. If this describes your situation, you will need to know the thresholds for when your SSDI becomes taxable.

The IRS states that your SSDI benefits may become taxable when one-half of your benefits, plus all other income, exceeds an income threshold based on your tax filing status:

- Single, head of household, qualifying widow, and married filing separately taxpayers: $25,000

For example, if you are married and file jointly, you can report up to $32,000 of income before needing to pay taxes on your SSDI benefits. If you earn more than these limits for these tax filing statuses, you have two different benefit inclusion rates that can apply.

For 2021:

- As a single filer, you may need to include up to 50% of your benefits in your taxable income if your income falls between $25,000 and $34,000.

- Up to 85% gets included on your tax return if your income exceeds $34,000.

For married couples who file jointly, you’d pay taxes:

Read Also: Social Security Disability Rules After Age 60

Do I Pay Taxes On 50% Or 85% Of My Social Security Benefits

After determining if your Social Security benefits are taxable, you will next need to determine what portion of them are taxable. When taxing Social Security income, you will either pay taxes on 50% or 85% of your benefits. See below to determine what portion you will pay taxes on.

50% of your benefits may be taxable if you are filing as:

- Single, head of household, or qualifying widow or widower with an income of $25,000 to $34,000

Up to 85% of your benefits may be taxable if you are filing as:

- Single, head of household, or qualifying widow with an income of more than $34,000

How To Reduce Your Social Security Tax Liability

If you expect you may owe taxes on your Social Security benefits, there are a few things you can do to potentially minimize them.

- Reduce business profits: If you own a business, you can reduce your tax liability by taking advantage of business tax write-offs you may be entitled to.

- Limit retirement withdrawals: You may also want to consider reducing your withdrawals from retirement income to reduce your tax liability, but you should consider the required minimum distribution rules while doing so. If you dont withdraw at least a minimum from most taxable retirement accounts after age 72, you may actually increase your tax burden.

- Sell capital assets strategically: If you own capital assets, such as stocks, bonds or real estate, you should discuss with a tax professional the best time to sell your assets. Any capital assets sold at a loss can reduce your overall income. Any assets sold at a gain may be subject to capital gains taxes, depending on how long you held them.

Don’t Miss: How To Get Someone’s Social Security Number

Next Steps To Consider

A qualified distribution from a Roth IRA is tax-free and penalty-free. To be considered a qualified distribution, the 5-year aging requirement has to be satisfied and you must be age 59½ or older or meet one of several exemptions .

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Fidelity does not provide legal or tax advice. The information herein is general and educational in nature and should not be considered legal or tax advice. Tax laws and regulations are complex and subject to change, which can materially impact investment results. Fidelity cannot guarantee that the information herein is accurate, complete, or timely. Fidelity makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information. Consult an attorney or tax professional regarding your specific situation.

Investing involves risk, including risk of loss.

Past performance is no guarantee of future results.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

Taxable Social Security Benefits

Say your Social Security benefits are taxable based on your combined income. The amount of tax you pay depends on your level of income. Specifically, the difference between your combined income and the IRS base amount .

Youll never pay taxes on more than 85% of your Social Security benefits.

Iowa used to assess taxes on benefits, but it phased the taxes out completely in 2014, while New Mexico exempts some benefits for beneficiaries age 65 and over. These states tax Social Security benefits with varying methods, which can include using adjusted gross income or other figures.

Social Security Administration. “Retirement Benefits,” Page 2.

Recommended Reading: Social Security Administration Wichita Kansas

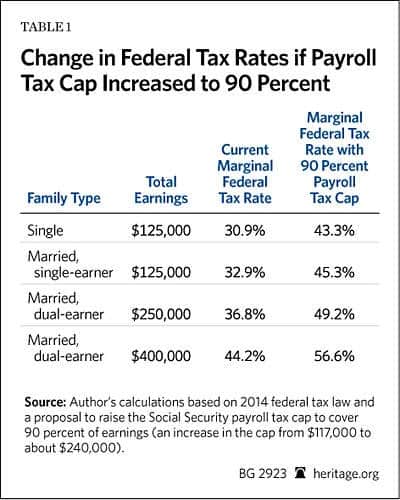

If You Earn Enough Money For Your Benefits To Be Taxable You Could End Up Paying The Highest Income Taxes In The Country

Social Security benefits are tax free unless you earn too much income during the year. To know whether you might be subject to such taxes you have to figure your “combined income.” This is actually quite easy: Simply add one-half of the total Social Security you received during the year to all your other income, including any tax-exempt interest .

You’ll have to pay tax on part of your benefits if your combined income exceeds these thresholds:

- $32,000 if you’re married and file a joint tax return , or

- $25,000 if you’re single.

If a married couple files their taxes separately, the threshold is reduced to zerothey always have to pay taxes on their benefits. The only exception is if they did not live together at any time during the year in this event the $25,000 threshold applies.

This applies to all types of Social Security benefits: disability, retirement, dependents, and survivors benefits.

How much of your Social Security benefits will be taxed depends on just how high your combined income is.

Individual filers. If you file a federal tax return as an individual and your combined income is between $25,000 and $34,000, you have to pay income tax on up to 50% of your Social Security benefits. If your income is above $34,000, up to 85% of your Social Security benefits is subject to income tax.

Once you start receiving Social Security benefits, to keep your income below the applicable threshold, or at least as low as possible, you should:

Federal Taxation Of Social Security Benefits And Effect On Vermont

At the federal level, the personal income of a Social Security beneficiary determines how much of the Social Security benefits are taxed. This taxable portion of Social Security benefits may become part of a Vermonters Adjusted Gross Income at the federal level. Federal AGI flows through to Vermont and becomes the starting point for determining Vermont taxable income.

The Vermont exemption allows income-eligible taxpayers to subtract all or part of federally taxable Social Security benefits from their AGI. This means that the federally taxable portion of Social Security benefits is eliminated or reduced for Vermont income-eligible taxpayers receiving Social Security benefits.

For a breakdown of the federal taxation of Social Security benefits, see the table below. For more on federal taxation of Social Security benefits, please read this overview by the Social Security Administration.

| Table 1: Federal Taxation of Social Security Benefits by Income and Filing Status |

|---|

| Single/Separate/Widow/HoH |

| Up to 85% |

Don’t Miss: Hours For Social Security Office

No Matter How You File Block Has Your Back

Benefit Income Owed As Income Tax Above And Below The Median

Some beneficiary families owe considerably more or less than the median percentage of their benefits in taxes. As Chart 1 shows, 5658 percent of beneficiary families will owe some income tax on their benefits over the next several decades. Conversely, 4244 percent of beneficiary families will owe no income tax on their Social Security benefits in any given year, again assuming that tax brackets will be indexed to wages rather than prices after 2023.

Under current law, the highest percentage of Social Security benefits that any family pays as income tax is 33.7 percent. That figure represents the product of the maximum proportion of benefit income that is taxable and the highest marginal income tax rate . In 2015, the 39.6 percent marginal tax rate applies to taxable income above $411,200 for single persons and to taxable income above $464,850 for married couples filing joint returns. MINT projects that less than 1 percent of beneficiaries will owe 33.7 percent of their benefits as income tax in 2015 or in any year through 2050 . In 2015, an estimated 80 percent of beneficiaries filing singly and 79 percent of married couples filing jointly are in either the 15 percent or 25 percent marginal tax brackets .

| 1.5 |

| NOTE: Data are for the 52 percent of beneficiary families estimated to owe tax on their benefits. |

| a. Less than 0.5 percent. |

Recommended Reading: Social Security Office Sikeston Mo