Working After Beginning Benefits May Temporarily Reduce Them

If you file for Social Security benefits before your full retirement age but keep working, the Social Security Administration will temporarily reduce your benefit payments. For 2022, the amount of the reduction is $1 for each $2 you earn above $19,560.

If you reach full retirement age in 2022, the reduction drops to $1 for every $3 you earn above $51,960, until the month you reach full retirement age. Thereafter, there is no reduction no matter how much you earn.

Bear in mind that these reductions are only temporary. Once you reach full retirement age, your monthly benefit will be adjusted upwards to compensate you for the original reductions.

How Social Security Benefits Are Impacted At Every Age From 62 To 70

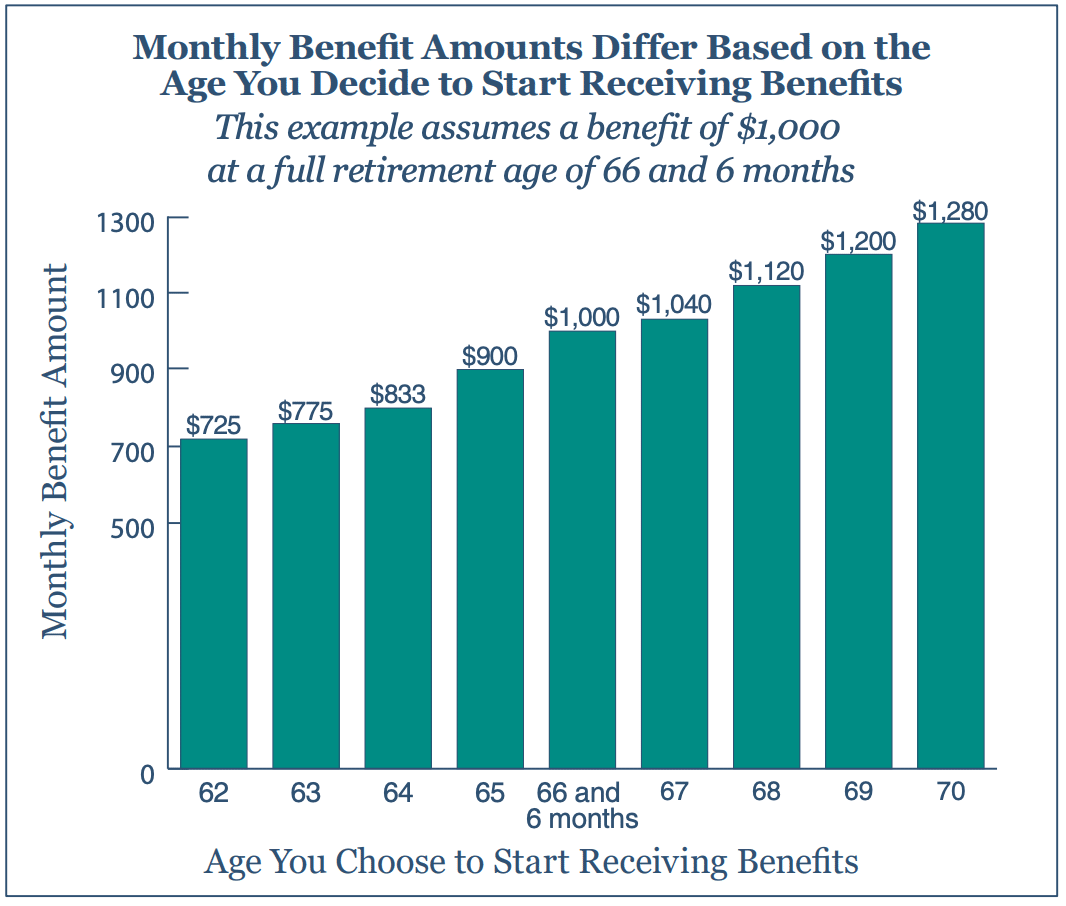

Theres a lot of discussion in the financial world about when is the best time to claim Social Security retirement benefits, and rightly so. The age at which you claim is one of the two main factors determining exactly how large your benefit will be, along with your earnings record. Although you can claim your benefits at age 67, which is full retirement age for those born in 1960 or later, you also have the option to file as early as age 62 or wait as late as age 70. The amount you receive will be different at every single one of those ages in between.

But how exactly are Social Security benefits impacted at every age from 62 to 70? Heres a black-and-white look at the changes.

How Social Security Credits Work

Qualifying for Social Security isn’t that difficult. Over the course of your working life, you need 40 credits to be eligible for benefits, which is equal to 10 years of full-time work. In 2021, you get one credit for each $1,470 of earnings , up to a maximum of four credits per year.

Social Security calculates your benefit amount based on your earnings over the years, whether you were self-employed or worked for an employer. The more money you earned, the more you paid into Social Securityand the higher your future benefitsup to certain limits. The math is much more complicated than this sounds, but that’s basically how it works.

Recommended Reading: Social Security Disability Health Insurance

Exceptions To The Calendar Rule

Although the rules for Social Security payouts are fairly straightforward, as with any rule, there are a few exceptions. For example, the above-listed payment dates do not apply in the following circumstances:

-

You first filed for benefits before May 1997.

-

You are receiving both Supplemental Security Income and Social Security payments.

-

Your Medicare premiums are paid by the state.

-

You reside in a foreign country.

In each of these cases, regardless of your birth date, you will receive payments on the third of each month.

More From GOBankingRates

Things Are Looking Up

Undeterred by temporary staffing shortages, Bricker reassured during the company’s Q3 earnings call, “As our rapid hiring works through our training program, we expect fleet utilization to continue to improve into the beginning of 2023.” He also remarked that it had been 96 days since the airline had canceled a flight.

Anticipating a busy fourth quarter for leisure travel, Sun Country forecasts total flight hours to grow between 9% to 12% during the quarter, compared to prior-year levels. After last quarter’s scheduled service revenue grew by 39% year over year, and 46% versus Q3 2019, the company predicts a similar increase in Q4.

Sun Country expects to see continued strength for the foreseeable future. The airline’s current TRASM growth outpaces the industry, thanks to Sun Country’s flexible scheduling and brand loyalty in its home market.

For an already well-diversified airline, Sun Country CFO Dave Davis claims that the carrier is “even more resilient than it has been in the past.” With much of Sun Country’s business already under contract, predictable repeat business certainly helps defend against swings in leisure demand.

There’s no doubt that Sun Country Airlines is on a positive flight path at the moment. If this low-cost carrier can replenish its staff and maintain scheduling efficiencies while growing its charter and cargo operations, watch for company success to be reflected in the stock’s performance.

Don’t Miss: Calculator For Social Security Taxes

Why You Need To Supplement Your Social Security Benefits

First off, Social Security was intended to be a supplement to people’s retirement savings. The National Institute on Retirement Security describes retirement income as a ‘three-legged stool’, consisting of Social Security, a pension plan, and individual retirement savings through accounts like a 401 or an individual retirement account.

However, since the 1980s, fewer and fewer companies have been offering pension plans to their employees. The onus for saving for retirement has fallen on the employee.

And most people aren’t doing great when it comes to saving for the future: A 2020 NIRS study found that 40% of Americans rely on Social Security as their sole source of retirement income. The average annual Social Security benefit for a worker is nearly $20,000, hardly enough money for most retirees to subsist on.

When it comes to saving for retirement, it’s important to start as early as you can, whether that’s through an employer-sponsored 401 or a traditional or Roth IRA. By saving for retirement early in life, you’ll reap the benefits of compound interest, which is interest earned on interest.

For example, if you started saving for retirement when you’re 25 and had investments yielding a more conservative 6% return, you would need to invest $530 per month for 40 years to reach $1 million. If you waited until you were 40 and had investments yielding a 6% return, you would need to invest $1,500 per month for 25 years to end up with $1 million.

You Cant Work Anymore

Even the best retirement financial plans and projections can go awry. For example, you might have planned on working until youre 70 so you could maximize your retirement benefits. If you get laid off at 62, however, and have difficulty finding another job, you might need to start taking your benefits just to get by.

Additionally, continuing to work in your industry simply might not be possible or healthy for you later in life. If your job requires manual labor, you might decide the risk of injury or other damage to your health isnt worth continuing to work. In this case, the healthier lifestyle youll get by retiring early could outweigh the smaller monthly Social Security benefit.

Recommended Reading: Beaumont Tx Social Security Office

Delivering Sun And Warmth

“The leisure demand environment remains very strong,” Sun Country CEO Jude Bricker said in the third-quarter release. Indeed, Q3 scheduled service revenue jumped 39% versus last year, despite higher-than-expected fuel costs and the impact of Hurricane Ian on Florida operations.

Based in Minneapolis, Minnesota, Sun Country carries passengers from the Great Lakes region to destinations in the southern U.S., Caribbean, and Mexico. Although Sun Country’s fares were 16% more expensive than last year, robust vacation demand helped propel a nearly 10% surge in scheduled service year over year.

Total Q3 revenue came in just shy of $222 million, marking a 28% increase year over year and a 29% improvement over 2019. Sun Country’s adjusted operating margin of 7.2% surpassed management’s prior guidance, as total revenue per seat mile, or TRASM, steadily improved during the third quarter.

Charter revenue, which supplements earnings and helps diversify the business, enjoyed a 27% rise. Aside from long-term contracts with Major League Soccer and Caesars Entertainment, Sun Country’s other charter customers include collegiate sports teams and the U.S. Department of Defense.

Why Did I Get Two Social Security Checks This Month

MILLIONS of Supplemental Security Income claimants will see two checks this month as the holidays approach. This will apply to the 8million people that are projected to receive SSI in 2022, according to the Social Security Administration. … Further, the more you earn the less your SSI benefit will be.

Read Also: Social Security Administration San Antonio

When Can I Get Social Security

The earliest you can start receiving Social Security benefits is age 62. But the earlier you elect to receive your benefits, the smaller your monthly checks will be . To receive full benefits, you will have to avoid collecting Social Security until you reach your full retirement age. For people born in 1960 or later, that age is 67. And with the delay retirement credits, you can get your largest benefit at age 70.

If you decide to retire early, you have the option of delaying your Social Security benefits. This strategy may work particularly well for married couples.

Do These Changes Change Your Plans

As financial planners, we often advocate for not taking your Social Security benefits while youre still earning income, as you receive less than youre eligible to collect, but if you wait, your benefits will keep increasing for the years that you arent earning later.

While you can begin collecting Social Security at age 62 on a reduced benefit, you can wait as late as age 70 on a full benefit. If youre older than 70, theres no additional benefit to waiting, as youve already achieved the most benefit possible.

When youre determining when to take your own Social Security, there are many factors to consider, beyond your age and when you stop working. Take into account your investments and at what rate theyll be taxed, in addition to what other fixed incomes you may have during retirement.

Recommended Reading: Social Security Office In Fayetteville Nc

How Do You Become Eligible For Social Security Benefits

To be eligible for Social Security benefits in retirement, you must earn at least 40 “credits” throughout your career. You can earn up to four credits each year, so it takes 10 years of work to qualify for Social Security.

In 2022, you must earn $1,510 to get one Social Security work credit and $6,040 to get the maximum four credits for the year. And yes, that means that it is possible to have money withheld for Social Security and never get it back. The minimum is the minimum.

How To Calculate Your Social Security Benefit

Calculating your estimated Social Security benefit is no easy task. Your best bet may be to request a Social Security benefits estimate from the SSA. This will contain an estimate of your benefit at age 62, at your FRA, and at age 70, based on your current work history.

In addition to these estimates, the SSA also has a series of Social Security benefits calculators that can help you plan for retirement. You can also use this calculator from AARP to estimate the best age to start claiming your benefits.

Don’t Miss: Does Social Security Count As Income For Obamacare

How Are Your Social Security Benefits Calculated

Social Security uses your highest 35 years of earnings, indexed to a national average wage index, to calculate your primary insurance amount If you have fewer than 35 years of earnings, each year with no earnings will be entered as zero. You can increase your Social Security benefit at any time by replacing a zero or low-income year with a higher-income year.

There is a maximum Social Security benefit amount you can receive, though it depends on the age you retire. For someone at full retirement age in 2022, the maximum monthly benefit is $3,345. For someone filing at age 70, the maximum monthly amount is $4,194. And for someone retiring early, at age 62, the maximum monthly benefit is $2,364.

To estimate your benefits, use the Social Securitys online Retirement Estimator.

Waiting To Claim Social Security Benefits Could Boost Your Income By A Surprising Amount

When you’re planning for how to support yourself in retirement, chances are good that Social Security benefits will be a big source of funds. While Social Security benefits are designed to replace around 40% of your preretirement income, the specific amount you receive will vary, depending on many factors including what you earned during your career.

One of the most important factors in determining your Social Security benefit amount — and the one you have the most control over — is the age at which you claim benefits. You can claim benefits anytime starting at the age of 62, but waiting to claim benefits increases your income. In fact, depending on how long you wait, you might be able to get more than a 75% increase in your monthly benefit compared with claiming at 62.

Waiting can increase your retirement income substantially, because claiming benefits early results in a permanent benefits reduction, while claiming benefits late results in a permanent benefits increase. This guide will explain why waiting can raise your benefits and will also help you determine if waiting is the best course of action in your situation.

Image source: Getty Images.

Read Also: How Do Social Security Numbers Work

Should I Use 401k Before Social Security

While many people collect Social Security right after retirement, most wait until 70 to begin spending their 401ks. Living off 401k vs. Social Security payments in the early years of your retirement can allow you to defer the date you claim Social Security, thus increasing your later Social Security payments.

What Is The Maximum Social Security Benefit At Age 62

Asked by: Ola Senger

What is the maximum Social Security retirement benefit payable? The maximum benefit depends on the age you retire. For example, if you retire at full retirement age in 2022, your maximum benefit would be $3,345. However, if you retire at age 62 in 2022, your maximum benefit would be $2,364.

Also Check: Social Security Office Georgesville Road

When Can I See My Cost Of Living Adjustment For 2023

As long as you set up your My Social Security account online by Nov. 15, you’ll be able to see how much your benefits will be increased, Acting Commissioner of the Social Security Administration Kilolo Kijakazi said. You’ll then log in to your My Social Security account in early December and check the message center to see your new 2023 benefit amount.

If you don’t sign up for a My Social Security account, you’ll receive a COLA notice in the mail in December.

Note that your higher Social Security payment will take effect in January 2023. If you’re a Supplemental Security Income beneficiary, your first increased payment will be on Dec. 30.

What About Taxes On Social Security

Social Security benefits may be taxable, depending on your “combined income.” Your combined income is equal to your adjusted gross income , plus non-taxable interest payments , plus half of your Social Security benefit.

As your combined income increases above a certain threshold , more of your benefit is subject to income taxâup to a maximum of 85%. For help, talk with a CPA or tax professional.

In any case, if you’re still working, you may want to postpone Social Security either until you reach your full retirement age or until your earned income is less than the annual limit. In no situation should you postpone benefits past age 70.

Don’t Miss: Pikeville Ky Social Security Office

You Have A Shorter Life Expectancy

The government incentivizes waiting to collect your Social Security benefits by giving you a larger monthly amount the longer you delay. For example, if you start collecting benefits at age 62 when your full retirement age is 66, your monthly benefit will be about 75% of your full-age benefit. So if you expected your monthly benefit to be $1,000 per month at 66, you would only receive around $750 at 62.

Although a larger monthly benefit might sound great, keep in mind that youd have to wait four years to get that extra $250 per month. You would receive $36,000 during those four years at the reduced amount of $750 per month.

When you start collecting $1,000 at age 66, that extra $250 per month wont let you break even for 12 years compared to collecting early. If your health is declining and you dont expect to live until youre 78, youll receive more in benefits during your lifetime if you start claiming as soon as possible.

Working Can Mean Lower Benefits Until You Reach Full Retirement Age

You can collect Social Security benefits if you are still working and earning income. But if you earn more than a certain amount from your workand haven’t reached your full retirement ageyour benefit will temporarily be smaller. Here’s a rundown of how earned income can reduce your Social Security benefits.

Don’t Miss: Phone Number For The Social Security Administration

Can A Couple Live On 60000 A Year In Retirement

Plan to maintain your standard of living Most retirees want to maintain their standard of living during retirement. To accomplish this, financial experts say you’ll need between 70-80% of your pre-retirement income. So, for example, a couple earning $60,000 per year would need between $42,000 ($60,000 x .

Reasons You Should Claim Social Security Early

Learn why Social Security at 62 might not be a bad idea. Social Security 101

Your retirement planning likely includes getting income from the Social Security Administration, but when you start collecting Social Security benefits can have a big impact on your planning. The earliest you can collect is age 62, but youll get more money if you delay your benefits past your initial Social Security eligibility. If you wait until after your full retirement age to start collecting Social Security you can earn delayed retirement credits, which will increase your benefits even more.

Learn: 7 Surprisingly Easy Ways To Reach Your Retirement Goals

You might think that waiting for bigger benefits is better, but thats not always the case. There is no definitive answer to when you should collect Social Security benefits, and taking them as soon as you hit the early retirement age of 62 might be the best financial move. Learn why you might want to start taking Social Security at 62.

Recommended Reading: Social Security Determination Phone Number