Service From 1978 Through 2001

For every $300 in active duty basic pay, you are credited with an additional $100 in earnings up to a maximum of $1,200 a year. If you enlisted after Sep. 7, 1980, and didn’t complete at least 24 months of active duty or your full tour, you may not be able to receive the additional earnings. Check with Social Security for details.

Who Is Qualified For Veteran Social Security Disability

The SSA considers a veteran disabled under Social Security rules if they cannot do work that they did before, the SSA decides that the veteran cannot adjust to other work because of their medical condition, and the veterans disability has lasted or is expected to last for at least one year or to result in death.

The SSA uses a five-step process to determine if a veteran qualifies for benefits:

A veteran can receive SSD benefits and remain on active duty. A veteran should contact Social

Security immediately if there is a change in their Military Occupational Specialty code , Air Force Specialty Codes , Navy Enlisted Classification , or a permanent change of station , as changes in a veterans work status can affect their SSD benefits.

The Basics Of Military Service And Social Security

According to federal guidelines, individuals who have completed military service may be eligible to receive credits that correspond to the length of time they spent in the armed forces. These credits provided a specific dollar amount of additional income to the individual’s lifetime earnings. For example, individuals who were serving in the military between the years of 1978 and 2001 received a $100 Social Security credit for every $300 of income they received as part of their military salary, with a maximum cap of $1,200 in credits per year.

The specific value of the credit issued depended primarily on the period of time in which the individual served. Veterans who served between the years of 1957 and 1977, for example, received an additional credit of $300 for every quarter-year that they received activity duty pay. With that in mind, veterans may have served in overlapping periods of credit evaluation, meaning that their time as a service member generated multiple forms of credits.

Also Check: Social Security Office Milwaukee Wi

Does The Social Security Cola Matter

I hope your fun financial planner has done such an excellent job for you that you don’t even notice the Social Security COLA each year. Sadly, this is not the case for many retirees. Around 12% of men and 15% of women rely on Social Security for more than 90% of their retirement incomes, according to the Social Security Administration.

For 2022, the average Social Security check averaged $1,669 per month. I know most of you would have trouble living off of this amount, which is below the average cost of rent in Los Angeles, not to mention necessities like eating and utilities.

When you are on a fixed income, every penny counts.

When Youre 100% Va Disability But Denied Ssdi

Because youre working with separate entities and differing requirements, you can have a 100% VA disability rating and be denied Social Security disability benefits. The most common reason the Social Security Administration denies disability benefits is because the applicant continues to work and makes too much money. Its also possible that the SSA couldnt find you in its system or didnt recognize the severity of your injury.

You can appeal if you believe the SSDI decision is unjust, but you generally only have 60 days from receiving the denial letter to do so. That means you need to act quickly. A Social Security disability lawyer can assist you through the process.

Read Also: Social Security Office Shawnee Oklahoma

What Kind Of Social Security Disability Payment Is A Veteran Eligible To Receive

There are two types of SSA disability benefits a veteran may be eligible to apply for. One is SSDI, a disability insurance program where the insurance payments in these cases are the monthly Social Security tax deductions from the veterans paycheck, assuming the veteran has worked long enough to qualify for coverage.

The other is something known as Supplemental Security Income or SSI, which is a need-based program. Veterans may be required to submit proof of financial need for SSI.

It’s Not Uncommon For Veterans To Receive Both Social Security And Veteran Disability Benefits

There are several kinds of benefits from Social Security that you may be able to get.

1. Social Security Disability Insurance : Benefits to disabled wage earners and some members of their families if the former wage earners are “insured.”

- Must have worked long enough to become insured and work must be recent

- No resource or asset limits

2. Supplemental Security Income : A means-tested benefit program for the aged , blind, or disabled.

- Work history does not matter

- Monthly maximum payment is the Federal Benefit Rate

- Usually $771 for an individual and $1,157 for a disabled couple in 2019

- Resource or asset limit of $2,000 for an individual or $3,000 for a couple

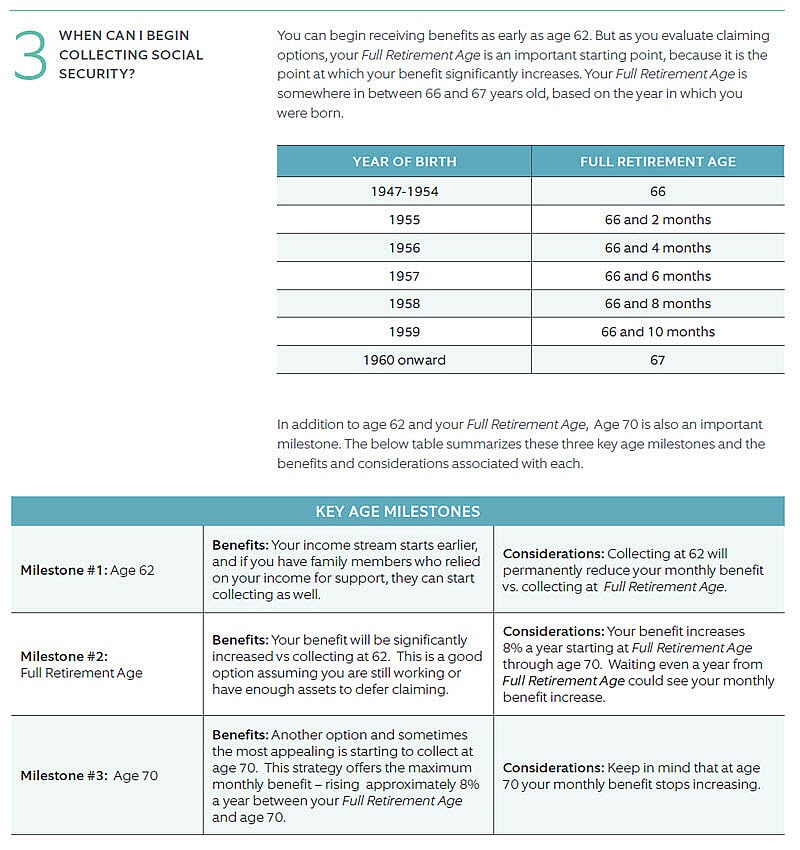

3. Social Security Retirement: Benefits paid once you have reached your full retirement age.

- Your full retirement age is based on when you were born and can be as early as age 62 or as late as age 70

- If you choose to take early retirement” then your monthly benefits will be reduced, and continuing to work can affect your benefit amount

If you are getting VA disability compensation and then apply for Social Security benefits, Social Security will review any evidence that the VA reviewed in making their decision.

NOTE: While you dont need to be totally disabled to be eligible for VA disability compensation, you are either totally disabled or not disabled under Social Security’s definition of disability.

Read Also: Do Employers Need Social Security Number For Background Check

What Is Ssdi And Who Qualifies

Social Security Disability Insurance is a tax-funded federal insurance program to provide monthly compensation to people who are disabled and cant work. Workers and their employers pay into the fund. The Social Security Administration manages it.

SSDI benefits differ from Supplemental Security Income . SSDI benefits are for people who have worked and earned enough work credits. SSI benefits are for people with low-income and disabilities who are unable to work.

SSI is awarded when you are no longer insured during your application period. The receipt of SSI is dependent upon how much income you have, so your receipt of VA compensation benefits at the same time may affect your eligibility for SSI, said Lori Underwood, a VA-certified disability benefits lawyer.

If you are receiving VA benefits above the accepted level through the Social Security Administration, its possible that you will lose your SSI benefits eventually. However, it is in your best interest to pursue VA compensation benefits. VA total disability or individual unemployability rating pays more than your SSI benefits.

To be eligible for Social Security benefits, you must have been employed in a job covered by Social Security and have those earning deductions on your record. The amount you receive depends on how much Social Security was deducted from your earnings and how old you are when you draw Social Security.

Were There To Provide Comfort During Difficult Times

The loss of a loved one can be both emotionally and financially difficult. Some widows, widowers, and children may receive to help them cope with the financial loss. The number of credits needed to provide benefits for survivors depends on the workers age when he or she dies.

Unmarried children who are under age 18 can be eligible to receive Social Security benefits when a parent dies.

Read Also: How Much Is My Social Security Taxed

What Do I Need To Know About The Va And Social Security Programs

Both Social Security and VA pay disability benefits. However, their programs, processes, and criteria for receiving benefits are very different.

A VA compensation rating of 100% Permanent and Total does not guarantee that you will receive Social Security disability benefits. To be approved for Social Security benefits, you must meet Social Securitys definition of “disability.” To be found disabled:

- You must be unable to do substantial work because of your medical condition and

- Your medical condition must have lasted, or be expected to last, at least one year or to result in death.

If you receive VA compensation, this will not affect your Social Security benefits. For a quick, side-by-side comparison of each program, please reference this Fact Sheet.

Qualifying For Ssdi As A Disabled Veteran

Most disabled veterans applying for SSDI already have a VA compensation rating. SSDI and VA programs and criteria are very different, however. The Social Security Administration does not base disability determinations on VA ratings. Instead, you must meet the SSAs definition of disability to receive SSDI benefits.

You must be unable to perform substantial gainful activity Your condition must be expected to last at least 12 months or be terminal

While even claimants with a VA compensation rate of 100% P & T are not guaranteed approval for SSDI benefits, if your rating is 70% or greater, your chance of receiving disability through the SSA is increased significantly.

Don’t Miss: List Of Leaked Social Security Numbers

Social Security Administration Rules For Veteran Disability Compensation

The Social Security Administration has some basic rules for receiving disability pay, and more specific requirements for veterans who need to apply. The basic requirements include:

» MORE:Veterans Can Buy a Home with $0 Down

- The applicant must be unable to perform substantial work because of your medical condition.

- The medical condition must have lasted, or be expected to last, at least one year or to result in death according to the Social Security Administration official site.

There are also rules for applying for benefits for a closed period of disability, which basically means that the applicant had a disability that qualifies for benefits, but the condition has improved. Those rules include:

- A requirement that the medical evidence shows that the applicant was not able to perform substantial work for a continuous period of 12 months.

- Applications for closed-period benefits must be submitted within 14 months after the end of the disability.

- A five-month waiting period may be applicable in these cases before the first monthly benefit payment can be made. Applicants who are approved for this type of disability payment may be permitted to be paid up to 12 months of retroactive SSI benefits from the application date.

Inflation Data Suggests That Social Security Beneficiaries Are Headed For A Big Cost

Nearly nine out of ten people age 65 and older currently receive Social Security benefits, and the past year has been tough for many of those seniors. In 2022, the standard Medicare Part B premium climbed 14.5% to $170 per month. That figure accounts for 10.2% of the average monthly benefit paid to retired workers in August, up from 9.6% in 2021, meaning seniors had to shell out more of their Social Security checks to cover the cost of medical care this year. And that’s only the beginning of the problem.

Not only did the 5.9% cost-of-living adjustment enacted last year fail to cover to the rising cost of Medicare premiums, it also failed to keep up with inflation in general. Retirees have seen their benefits stretched thin by the rapidly rising prices of food, gas, electricity, and other necessities throughout the year. In fact, The Senior Citizens League estimates that the average Social Security benefit fell short by $417 year-to-date through August.

Fortunately, seniors are on pace to see a monster COLA in 2023.

Read Also: Social Security Administration Twin Cities Card Center

What Special Social Security Benefits Do Veterans Receive

Its a little-known fact, but earnings for active duty military service or active duty training are covered under Social Security and have been since 1957. One of the special benefits military members receive is that it is possible to receive both Social Security benefits and military retirement benefits.

Find: 30 Greatest Threats to Your Retirement

According to the Social Security Administration, there is generally no reduction of Social Security benefits because one receives military retirement benefits, as well. This means you can receive two benefit checks at the same time each month. You will receive your Social Security benefit based on your earnings and the age you begin to start receiving benefits just like everyone else.

The SSA states that under certain circumstances, special earnings can be credited to your military pay record for Social Security purposes. Those extra earnings are for periods of active duty or active duty for training. These extra earnings may help you qualify for Social Security or actually increase the amount of your Social Security benefit.

In addition to retirement benefits, the SSA will also pay survivors benefits to veteran families when they pass away. Veterans can also get benefits for themselves and their families if they develop a disability. If you developed a disability while on active military service after October 1, 2001, you can visit Wounded Warriors to find out how to expedite the processing of your disability claim.

How Is The Social Security Cola Calculated Each Year

The short version of this answer is that the annual Social Security COLA is based on the Consumer Price Index for Urban Wage Earners and Clerical Works from the prior year’s third quarter.

The 2023 COLA is based on the CPI-W from the third quarter of 2022. The cost-of-living increases are rounded to the nearest one-tenth of 1%. Looking back, the CPI for August was 8.3%, while the CPI for July was 9.1%.

You May Like: Nearest Social Security Office To Me

Ssi/ssdi And Va Disability Benefits

Veterans may be eligible for Supplemental Security Income or Social Security Disability Insurance , in conjunction with, or as an alternative to VA disability payments. They may also use the Medicaid and Medicare health benefits that come with SSI/SSDI to supplement VA health services.

The definition of disability and application process is different for SSA and VA disability benefits, and Veterans may begin receiving SSA benefits while they are waiting on a VA benefit decision.

What If The Applicant Stays On Or Returns To Active Duty

SSA rules state that it is possible to remain on active duty and still receive disability benefits from the Social Security Administration. This is dependent on whether or not the military member is actually able to perform work.

A permanent change of station move, changes in the recipients military career field specialty, or other factors may require a benefits review. SSA states that in such cases the military member must contact SSA with an update.

Read Also: Does Social Security Count As Income For Extra Help

Were There When You Get Married

Whether youre celebrating your anniversary or starting a new chapter alone or with a new spouse, a part of that new life may include a new name. If you legally change your name due to marriage, divorce, or any other reason, let us know so you can get an updated Social Security card and so we can accurately keep track of your earnings. Theres no charge for a.

A Lifetime Of Security

We are with you from day one when your parents named you, and when you named your children. Most parents apply for their childs Social Security number at birth, usually through the hospital. When the time comes for your childs first job, the number is already in place.

A fun bonus of assigning Social Security numbers at birth is that we know the most popular baby names, which we announce each year. On our website, you can find the top baby names for the last 100 years.

Don’t Miss: Lookup Person By Social Security Number

Extra Social Security Benefits For Veterans

As mentioned previously, military service members are not entirely reliant on Social Security to fund their retirement. In fact, they are eligible to receive both Social Security payments as well as the standard military retirement pension program.

The current military retirement program overseen by the federal government is classified as a “defined benefit” plan. This means that individuals have a thorough understanding of the specific amount of benefits that will be paid to them based upon their years of service. That being said, there are currently talks to change the military retirement program in order to accommodate the changing nature of military service.

According to recent studies, less than 20 percent of all service members remain in the military for the 20 years that is required to receive 100 percent of available retirement benefits. Because of this, new policies have been proposed that will incorporate not only a defined benefit plan but also a defined contribution system which routes contributions directly to a Thrift Savings Plan. Within the defined contribution plan, the federal government would contribute the equivalent of 1 percent of current base pay into the Thrift Savings Plan. After two years of service, the military would offer a matching contribution up to 5 percent made by individuals towards their TSP.

References

Contact A Kentucky Ssd Attorney For Help With Veterans Benefits Today

Many veterans face enormous challenges in finding employment upon discharge from the military. When a veteran is unable to work because of a disability, they can be entitled to federal benefits.

Both SSD and VA benefits application processes can wear on an individual, and any number of issues can arise that make it difficult for veterans to get the benefits they need and earned.

Do you need help filing an SSD claim in Kentucky? Make sure that you get help from a qualified attorney before submitting your application. Active duty status and receipt of military pay may not prevent payment of SSD benefits, and receipt of military payments should never prevent a veteran from applying for SSD benefits.

You May Like: What Part Of Social Security Is Taxable