Full Medicare Part B Coverage Premiums And Immunosuppressive Drug Coverage For High

For individuals with incomes over $97,000 but not greater than $123,000 and couples with incomes of more than $194,000 but not exceeding $246,000 will pay an adjusted amount of $65.90 for a full Part B monthly premium of $230.80. The optional Immunosuppressive Drug Coverage premiums will be $161.80 per month.

For individuals with incomes over $123,000 but not greater than $153,000 and couples with incomes of more than $246,000 but not exceeding $306,000 will pay an adjusted amount of $164.80 for a full Part B monthly premium of $329.70. The optional Immunosuppressive Drug Coverage premiums will be $258.90 per month.

For individuals with incomes over $153,000 but not greater than $183,000 and couples with incomes of more than $306,000 but not exceeding $366,000 will pay an adjusted amount of $263.70 for a full Part B monthly premium of $428.60. The optional Immunosuppressive Drug Coverage premiums will be $356.00 per month.

For individuals with incomes over $183,000 but not greater than $500,000 and couples with incomes of more than $366,000 but not exceeding $750,000 will pay an adjusted amount of $362.60 for a full Part B monthly premium of $527.50. The optional Immunosuppressive Drug Coverage premiums will be $453.10 per month.

How To Appeal A Part B Premium Income Adjustment

You may request an appeal if you disagree with a decision regarding your income-related monthly adjustment amount. Complete a Request for Reconsideration or contact your local Social Security office to file an appeal.

You may be able to skip the formal appeal and simply provide documentation if your income changed due to any of the following:

- You married, divorced or became widowed.

- You or your spouse stopped working or reduced your work hours.

- You or your spouse lost income-producing property due to a disaster or other event beyond your control.

- You or your spouse experienced a scheduled cessation, termination or reorganization of an employers pension plan.

- You or your spouse received a settlement from an employer or former employer because of the employers closure, bankruptcy or reorganization.

These methods apply to the Part B premium. Contact the IRS if you disagree with your adjusted gross income amount, which is provided to Medicare by the IRS.

The Truth About Your Medicare Part B Premium

You probably know that your Medicare Part B premium can change each year. Do you know why? Or how the amount is calculated? Or why it may increase?

Medicare costs, including Part B premiums, deductibles and copays, are adjusted based on the Social Security Act. And in recent years Part B costs have risen. Why? According to CMS.gov, The increase in the Part B premiums and deductible is largely due to rising spending on physician-administered drugs. These higher costs have a ripple effect and result in higher Part B premiums and deductible.1

Don’t Miss: Social Security Office Sikeston Mo

What Isn’t Covered By Medicare Part B

Medicare Part B doesnt cover expenses that are covered by other parts of Medicare, such as inpatient care in hospitals, skilled nursing facility care, hospice care, and prescription drugs.

There are also a few notable types of care not covered. Most dental care, including dentures, is not covered under any portion of Medicare Parts A and B. Eye exams related to prescribing glasses , cosmetic surgery, hearing aids, fitting exams related to hearing aids, and concierge services arent covered under Medicare Parts A and B. You wont find long-term care as a covered service.

Medicare Payment And Delivery System Reform

Policymakers, health care providers, insurers, and researchers continue to debate how best to introduce payment and delivery system reforms into the health care system to tackle rising costs, quality of care, and inefficient spending. Medicare has taken a lead in testing a variety of new models that include financial incentives for providers, such as doctors and hospitals, to work together to lower spending and improve care for patients in traditional Medicare. The goals of these financial incentives generally link a portion of Medicareâs payments for services to âvalueâ as determined by providersâ performance on spending and quality targets.

Accountable Care Organizations are one example of a delivery system reform model currently being tested within Medicare. With over 10 million assigned beneficiaries in 2018, ACO models allow groups of providers to accept responsibility for the overall care of Medicare beneficiaries and share in financial savings or losses depending on their performance in meeting spending and care quality targets. Other new models include medical homes, bundled payments , and initiatives aimed to reduce hospital readmissions.

Don’t Miss: Social Security Office St Louis County

What If Your Medicare Premium Payment Is Late

If you miss a payment, or if we get your payment late, your next bill will also include a past due amount.

If you get a Medicare premium bill that says Delinquent Bill at the top, pay the total amount due, or youll lose your Medicare coverage. Get a sample of the delinquent bill in English.

Dont risk losing your Medicare coverage

When Do You Use This Application

Use this form:

- If youre in your Initial Enrollment Period and live in Puerto Rico. You must sign up for Part B using this form.

- If youre in your IEP and refused Part B or did not sign up when you applied for Medicare, but now want Part B.

- If you want to sign up for Part B during the General Enrollment Period from January 1 March 31 each year.

- If you refused Part B during your IEP because you had group health plan coverage through your or your spouses current employment. You may sign up during your 8-month Special Enrollment Period .

- If you have Medicare due to disability and refused Part B during your IEP because you had group health plan coverage through your, your spouse or family memberscurrent employment.

- You may sign up during your 8-month SEP.

NOTE: Your IEP lasts for 7 months. It begins 3 months before your 65th birthday and ends 3 months after you reach 65 .

Also Check: Dekalb County Social Security Office

Medicare Part B Premiums For Tricare For Life

When you use TRICARE For Life, you don’t pay any enrollment fees, but you must have Medicare Part A and Medicare Part B.

- Medicare Part A is paid from payroll taxes while you are working.

- Medicare Part B has a monthly premium, which is based on your income.

If you get Social Security or Railroad Retirement Board benefits, your Medicare Part B premium will get deducted from your benefit payment.

Cost Of Medicare Supplement

For 2022, a Medicare Supplement plan costs an average of $163 per month. However, costs will depend on two factors: the policy you choose and the pricing structure in your state.

Firstly, different plan letters have different prices since each policy provides a different level of coverage. For example, Medigap Plan G, a more comprehensive plan, costs more than Plan K, a cheaper plan with less coverage.

| Medigap plan |

|---|

| $102-$302 |

Monthly premium for a 65-year-old female nonsmoker. A range is given since costs can vary.

Secondly, Medigap prices will differ based on state regulations and whether the plan can set rates based on age or health status. There are three different ways in which Medigap policies can be priced:

- Community-rated

- Issue-age-rated

- Attained-age-rated

The simplest rating system is community-rated, which means the same monthly premium is charged to everyone who has the same Medigap policy. This means your premium will not be based on your age but could go up because of inflation.

Issue-age-rated has a premium structure in which your monthly premium is based on the age you are when you buy the Medicare Supplement plan. In this case, premiums will be lower for people who buy at a younger age. For example, if you bought a Medigap policy at age 65, your premium could be $200, but if you bought the same plan at 80, that policy might cost $300.

Recommended Reading: Social Security Administration Des Moines Iowa

Social Security Annual Cost

Social Security beneficiaries’ monthly benefit amount is adjusted annually to maintain purchasing power over time. In October each year, the Social Security Administration announces the cost-of-living adjustment payable in January of the following year.19 The Social Security COLA is a reflection of inflation measured by the Consumer Price Index-Urban Wage Earners and Clerical Workers ,20 calculated by the Bureau of Labor Statistics. The CPI-W, representing 29% of the population, is an estimate of the average change in prices of the goods and services purchased by households whose income is earned primarily from a clerical or wage occupation. The CPI-W gathers prices on thousands of items and services across the United States, including food, beverages, clothing, transportation, medical care, education, housing, recreation, and energy.21 An average CPI-W is calculated from these prices each quarter. The Social Security COLA equals the percentage increase in the average CPI-W from the third quarter of the base year to the third quarter of the current year. If the CPI-W indicates deflation, the Social Security COLA will equal 0.0% and Social Security benefits will not decrease.

Ways To Find Out If Medicare Covers What You Need

Recommended Reading: Is The Social Security Office Open On Saturday

Dropping Medicare Part B

Medicare Part B offers health insurance coverage for medically necessary services and preventive care. Medicare Part B is also optional. If you choose to drop your Medicare Part B coverage, you can do so by contacting a Social Security representative at 1-800-772-1213 .

Learn more about your Medicare coverage options and Medicare eligibility requirements by speaking with an agent at .

What Is The Medicare Part B Giveback Benefit

The Medicare Giveback Benefit is a Part B premium reduction offered by some Medicare Part C plans.

If you enroll in a Medicare Advantage plan with this benefit, the plan carrier will pay some or all of your Part B monthly premium. The amount covered can range from 10 cents to the full Part B premium cost .

You May Like: Do Employers Need Social Security Number For Background Check

Medicare Part A Premiums And Deductibles Are Going Up In 2023

While Medicare Part B is seeing a decrease in premiums next year, those who have to pay for Medicare Part A will see very slight premium increases in 2023. Those who’ve worked more than 30 calendar quarters will pay $278 a month, versus $274 in 2022. Those with less qualifying employment history will pay $506 a month, compared with $499 in 2022.

It’s important to note that 99% of Medicare recipients don’t have to pay anything for Part A because they’ve worked 40 calendar quarters while paying Medicare taxes.

The deductibles for Medicare Part A are also rising by about 2.8% each. Here’s a breakdown of what’s going up.

Inpatient hospital deductible: $1,600 in 2023, an increase of $44 from $1,556 in 2022.

Daily coinsurance for the 61st through the 90th day: $400 in 2023, an increase of $11 from $389 in 2022.

Daily coinsurance for lifetime reserve days: $800 in 2023, an increase of $22 from $778 in 2022.

Skilled Nursing Facility coinsurance: $200 in 2023, an increase of $5.50 from $194.50 in 2022.

The Cost Of Health Insurance Coverage

To get the many benefits of Medicare Part B, you must pay a monthly premium. The standard premium in 2022 is $170.10 per month . But some people may get a lower premium.

Besides your premium, youll also pay $233 per year for your Part B deductible in 2022. Once you meet your deductible, youll typically pay for 20 percent of the Medicare-approved amount for medical services.

If you don’t enroll in Medicare Part B during your Initial Enrollment Period, you may face a late enrollment penalty. You may be able to avoid this penalty if you qualify for a special Medicare enrollment period.

Recommended Reading: How To Get Someone’s Social Security Number

B Deductibles In Previous Years

The Part B deductible has generally increased over time, although there have been some years when it stayed the same or even decreased. The increase for 2022 is the largest year-over-year dollar increase in the programs history. Heres an historical summary of Part deductibles over the last several years :

When And How To Apply For Medicare

If you already receive benefits from Social Security , you will automatically be enrolled in Part B, and Part A, starting the first day of the month in which you turn 65. If you’re not receiving Social Security, though, be sure to contact the Social Security Administration about three months prior to your 65th birthday in order to receive Medicare.

You May Like: When Did They Start Taxing Social Security

Characteristics Of People On Medicare

Many people on Medicare live with health problems, including multiple chronic conditions and limitations in their activities of daily living, and many beneficiaries live on modest incomes. In 2016, nearly one third had a functional impairment one quarter reported being in fair or poor health and more than one in five had five or more chronic conditions, . More than one in seven beneficiaries were under age 65 and living with a long-term disability, and 12 percent were ages 85 and over. Nearly two million beneficiaries lived in a long-term care facility. In 2016, half of all people on Medicare had incomes below $26,200 per person and savings below $74,450.

Figure 1: Characteristics of the Medicare Population

Know What Costs You’re In For

Healthcare tends to be a substantial expense for seniors. While some Medicare costs are shrinking, you could be in for higher expenses, depending on your medical needs, coverage, and income. Be mindful of that as you work Medicare expenses into your budget.

The $18,984 Social Security bonus most retirees completely overlook

If you’re like most Americans, you’re a few years behind on your retirement savings. But a handful of little-known “Social Security secrets” could help ensure a boost in your retirement income. For example: one easy trick could pay you as much as $18,984 more… each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we’re all after. Simply click here to discover how to learn more about these strategies.

The Motley Fool has a disclosure policy.

Don’t Miss: Social Security Office Queens Ny

Why Medicare Part B Costs Are Falling In 2023

Part B requires monthly premium payments. Most people will pay $164.90 per month for full Part B coverage, which is down from $170.10 per month in 2022.

The decrease stems from the partial reversal of a big increase last year. That came as Medicare initially expected that the new Aduhelm treatment for Alzheimer’s disease would be extremely expensive but also qualify for general coverage under the program. In the end, Medicare chose instead to offer more limited coverage, and that prompted the drop in premiums for 2023.

There’s new coverage under Medicare Part B available this year for those who are 36 months or more past having received a kidney transplant. These patients don’t qualify for full Part B coverage, but they can elect to get partial coverage of immunosuppressive drugs for a lower amount of $97.10 per month.

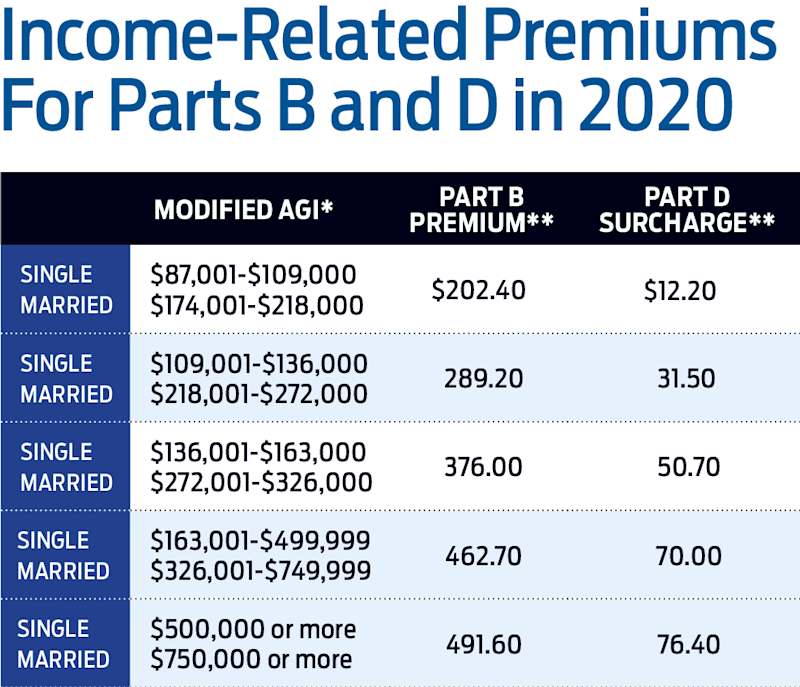

Some people with higher incomes, however, pay additional amounts for their Medicare Part B coverage. As you can see below, those in certain income levels have to pay as much as $560.50 per month in premiums. Note that the income levels date back two years, so that it’s your 2021 modified adjusted gross income that determines what you pay in 2023.

|

For individuals with this income in 2021: |

Or joint filers with this income in 2021: |

Total monthly premium in 2023 for Full Part B will be: |

Total monthly premium in 2023 for Partial Part B will be: |

|---|---|---|---|

|

$97,000 to $123,000 |

How Much Will Medicare Cost In 2022

Find Cheap Medicare Plans in Your Area

For all Medicare plans, costs will vary depending on what plans you decide to purchase, the company you purchase your plan from, your income and sometimes your age. For this reason, you should carefully balance your coverage needs and the costs of the plans when choosing the right mix of Medicare policies.

Recommended Reading: Medicare Deduction From Social Security 2022

What Medicare Part B Gives You

For the most part, if you need medical treatment that doesn’t require staying at a hospital or other treatment facility, Part B is what covers you. Anything from a regular medical checkup to outpatient surgical procedures can qualify for Part B coverage. Moreover, if you need medical equipment, ambulance transportation, diagnostic testing, or treatment for mental health issues, Part B provides the coverage there, as well as for a wide range of other healthcare issues.

Image source: Getty Images.

Medically necessary conditions are generally covered under Medicare Part B, with the goal of providing the resources necessary to detect, diagnose, and treat an illness, injury, or other medical condition. You can also get some preventive care services under Part B, such as an initial wellness intake appointment when you turn 65 as well as checkups every year thereafter to ensure your continued health.

However, Medicare Part B doesn’t cover everything. If you need dental care, eye exams for glasses or contact lenses, or hearing aids, you typically can’t count on Part B to cover you. Some more experimental or less medically accepted treatment options also don’t qualify under Medicare Part B.