More Ssdi Earnings Allowed In 2022

Because Social Security wants the disabled to work if they are able, a certain amount of income earned through substantial gainful activity, or SGA, is allowed before the SSA decides your earnings indicate you are not disabled.

Social Security sets caps for SGA earnings at which eligibility for Social Security Disability Insurance benefits may cease. In 2022, when qualifying for SSDI , you can have earnings up to $1,350 per month for non-blind workers and $2,260 per month if you are legally blind . Compare to the limits set in 2021, this is an increase of a %3.

Applicants for SSDI may test their ability to maintain some gainful activity in a Trial Work Period for at least 9 months, which dont have to be consecutive, and for as long as 5 years on a rolling basis . The SSA determines whether a month counts as a TWP month according to gross earnings for the month.

For 2022, you can earn more in a Trial Work Period before it counts against the time you can spend in the TWP program. This year, any month you earn $940 or more will count toward your TWP eligibility. The monthly maximum was $910 in 2020. For the self-employed, net earnings of $940 or more in a month or working in your business for 80 or more hours in a month counts toward your TWP.

Ssdi Income Limits For 2022 Are:

| Substantial Gainful Activity | |

| $940 | $910 |

The Social Security tax on earnings remains at 6.2 percent for 2022 , but the maximum taxable amount of earnings has been increased to $147,000. The max was $142,800 in 2021. Theres no limit on earnings subject to the Medicare tax.

However, this also means the maximum amount of earnings used by the SSA to calculate retirement benefits increases. For the record, in 2022, the maximum monthly retirement benefit for a worker retiring at full retirement age was $3,148. In 2021, it increased $137 per month to $3,148.

Inflation Could Cause 85% Of Your Social Security Income To Be Taxed

With inflation running at 8.5% after running as high as 9.1% this year compared to a year ago, people collecting Social Security retirement benefits can expect to see a tidy cost-of-living adjustment next year. After inflation hit 7% for 2021, Social Security checks increased by 5.9%. For someone receiving the average benefit amount, thats meant an increase of nearly $96 a month this year.

Also Check: Lookup Person By Social Security Number

What Is The Social Security Limit For 2022

For 2022 the earnings limit is $19,560 bucks. For every $2 you go over that amount, they reduce your social security by $1. So if you make $25,000, you went over the limit by $5,500. Your social security benefit would be reduced by $2,500. Thats fine. Youre still up in the grand scheme of things. But if youre making $100,000, you went over the limit by $80,440. This would reduce your benefit by $40,220 which, in most cases, would wipe out your entire social security benefit! Not only that, but since you took your Social Security, your benefit will stop growing. What a mistake! We have people contact us all the time who do this. They either thought they had to take Social Security or werent aware of the earnings limit.

How Inflation Affects Social Security

Social Security is a fixed-income source that’s adjusted for inflation each year to help maintain its purchasing power. This boost in benefits is called a cost-of-living adjustment .

Most years, the COLA is relatively small — generally just a 1% to 3% increase in benefits per year. However, because inflation has been surging throughout 2022, next-year’s COLA will be significantly larger than average.

Also Check: How To Report Social Security Card Lost

Best Pet Sim X Discord Servers

If you receive benefits and are under full retirement age and you think your earnings will be different than what you originally told us, let us know right away. You cannot report a change of earnings online. Please call us at 1-800-772-1213 , 8:00 am â 7:00 pm, Monday through Friday, or contact your local Social Security.

Other Ways Low Income Seniors And Americans Arent Getting Payments

In California, a new rebate called the Middle Class Tax Rebate has rolled out for Americans struggling with inflation. While there are income requirements, there are tax requirements as well.

In order to qualify, you need to have filed a tax return. Around 3 million California residents do not make enough money to be required to file tax returns. They financially qualify for the rebate, but wont be getting it.

In Georgia, there are many seniors who wont get the $500 benefit payment. Those between the ages of 62 and 64 who are retired cannot make over $35,000 per year. That number dramatically increases to $65,000 for those 65 and older. This is unfortunate because many 62 year olds are in the same exact position as 65 year olds.

You May Like: Can I Collect Social Security At 60

Don’t Miss: How Much Is My Social Security Taxed

London Disability Keep You Informed And Receiving The Maximum Ssd Benefits Possible

As experienced SSD and SSI eligibility experts, London Disability works every day to keep up to date on all the newest developments that might affect the SSD and SSI benefits you and your family depend on.

The laws, rules, and thousands of government regulations relating to Social Security Disability Insurance benefits or Supplemental Security Income benefits are overwhelming to anyone unfamiliar with the system. Our entire team of SSDI and SSI advocates and legal experts has served thousands of disabled clients over the years. We can get you the benefits you deserve.

How Is The Social Security Cola Calculated Each Year

The short version of this answer is that the annual Social Security COLA is based on the Consumer Price Index for Urban Wage Earners and Clerical Works from the prior year’s third quarter.

The 2023 COLA is based on the CPI-W from the third quarter of 2022. The cost-of-living increases are rounded to the nearest one-tenth of 1%. Looking back, the CPI for August was 8.3%, while the CPI for July was 9.1%.

Also Check: Athens Ga Social Security Office

Do Other Taxes Have A Wage Base

Social Security tax is the only federal tax employees pay with a wage base. Although Medicare also makes up FICA tax, it does not have a wage base. Instead, it has an additional tax once an employee earns a certain amount.

Keep in mind that some state taxes, like SUTA tax, and federal unemployment tax also have a wage base.

How We Deduct Earnings From Benefits

In 2022, if youre under full retirement age, the annual earnings limit is $19,560. If you will reach full retirement age in 2022, the limit on your earnings for the months before full retirement age is $51,960.

Starting with the month you reach full retirement age, there is no limit on how much you can earn and still receive your benefits.

Let’s look at a few examples. You are receiving Social Security retirement benefits every month in 2022 and you:

-

Are under full retirement age all year. You are entitled to $800 a month in benefits.

You work and earn $29,560 during the year. Your Social Security benefits would be reduced by $5,000 . You would receive $4,600 of your $9,600 in benefits for the year.

-

Reach full retirement age in August 2022. You are entitled to $800 per month in benefits.

You work and earn $63,000 during the year, with $52,638 of it in the 7 months from January through July.

- Your Social Security benefits would be reduced through July by $226 . You would still receive $5,374 out of your $5,600 benefits for the first 7 months.

- Beginning in August 2022, when you reach full retirement age, you would receive your full benefit , no matter how much you earn.

If you are eligible for retirement benefits this year and are still working, you can use our earnings test calculator to see how your earnings could affect your benefit payments.

You May Like: Social Security Office In Bronx

Social Security Benefits Get A Boost In 2022

With inflation picking up, Social Security benefits will jump a whopping 5.9% in 2022.

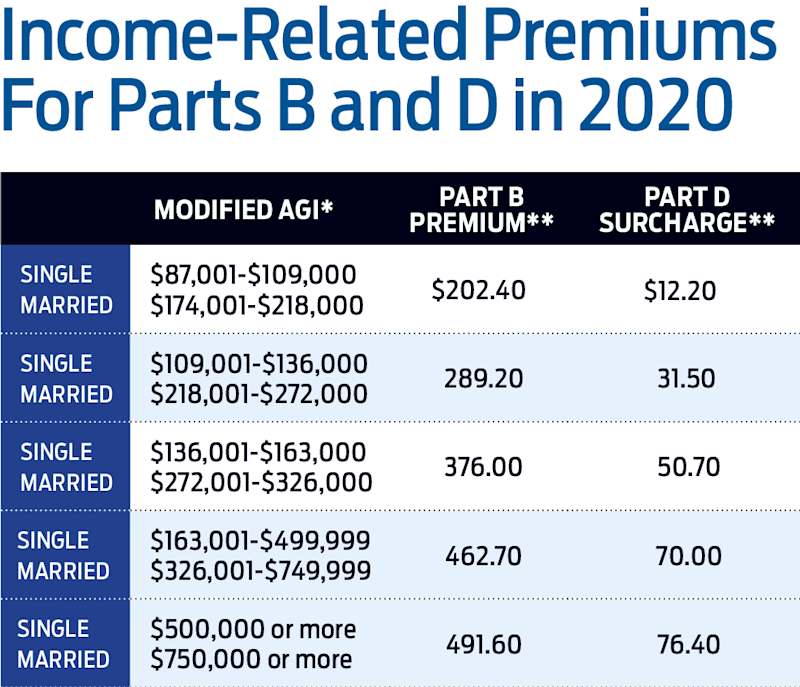

Benefit recipients will see the raise beginning with the checks to be issued the first week of January 2022. Unfortunately, the Medicare Part B premium that is automatically deducted from Social Security check will rise from $148.50 to $170.10 for the vast majority of beneficiaries. Fortunately, however, because of a hold harmless provision, those who were on Medicare prior to 2022 and were receiving Social Security benefits wont see their premium increase in excess of the increase in their Social Security. On the other hand, all seniors with higher incomes will pay an increased Medicare Part B premium. Seniors with modified adjusted gross income of at least $91,000 a year are subject to the Medicare premium surcharge.

With this 2022 Social Security cost-of-living adjustment, the maximum retirement benefit for a worker retiring at full retirement age in 2022 increases slightly to a lofty $3,345 per month. Remember, however, that full retirement age is now age 66 and 2 months for those born in 1955, and 66 and 4 months for those born in 1956. Full retirement age will gradually increase so that it will eventually become age 67 for those born in 1960 or later. The earliest a person can start receiving Social Security retirement benefits will remain at age 62. The average monthly benefit for all retired workers in 2022 will rise to $1,657.

THE 2022 EARNINGS LIMITS

Why We Ask This Question

If you:

-

Are under full retirement age next year, we will deduct $1 from your benefits for each $2 you earn above $19,560.

Example: If you will earn $21,960 next year, we will withhold the first $1,200 in benefits.

-

Will reach full retirement age next year, we will deduct $1 from your benefits for each $3 you earn above $51,960 until the month you reach full retirement age.

Example: If you will earn $53,520 next year, we will withhold the first $520 in benefits.

Exception: If there are months when you do not expect to perform substantial services in self-employment or earn over $1,630 , we may still be able to pay benefits based on a special rule regardless of your yearly earnings. The rule, which can only be used for one year, lets us pay you a full Social Security check for any whole month we consider you retired.

Don’t Miss: The Number To Social Security Office

Earnings Limits For Recipients Were Increased

If you work while collecting Social Security benefits, then all or part of your benefits may be temporarily withheld, depending on how much you earn. However, those income limits have increased slightly for 2022.

Prior to reaching full retirement age, you will be able to earn up to $19,560 in 2022. After that, $1 will be deducted from your payment for every $2 that exceeds the limit. The 2022 annual limit represents a $600 increase over the 2021 limit of $18,960.

If you reach full retirement age in 2022, then you will be able to earn $51,960, up $1,440 from the 2021 annual limit of $50,520. For every $3 you earn over the limit, your Social Security benefits will be reduced by $1, but that will only apply to money earned in the months prior to hitting full retirement age. Once you reach full retirement age, no benefits will be withheld if you continue working.

Does The Social Security Cola Matter

I hope your fun financial planner has done such an excellent job for you that you don’t even notice the Social Security COLA each year. Sadly, this is not the case for many retirees. Around 12% of men and 15% of women rely on Social Security for more than 90% of their retirement incomes, according to the Social Security Administration.

For 2022, the average Social Security check averaged $1,669 per month. I know most of you would have trouble living off of this amount, which is below the average cost of rent in Los Angeles, not to mention necessities like eating and utilities.

When you are on a fixed income, every penny counts.

Read Also: Social Security Office Williamsburg Va

Special Earnings Limit Rule

Theres a limit on how much you can earn and still receive your full Social Security retirement benefits while working. Some people who file for benefits mid-year have already earned more than their yearly earnings limit amount. We have a special rule for this situation.

The special rule lets us pay a full Social Security check for any whole month we consider you retired, regardless of your yearly earnings. If you will:

- Be under full retirement age for all of 2022, you are considered retired in any month that your earnings are $1,630 or less and you did not perform substantial services in self-employment.

- Reach full retirement age in 2022, you are considered retired in any month that your earnings are $4,330 or less and you did not perform substantial services in self-employment.

Example: John Smith retired from his job at age 62 on June 30, 2022. He earned $37,000 before he retired.

On October 5th, John starts his own business. He works at least 15 hours a week for the rest of the year and earns an additional $3,000 after expenses. His total earnings for 2022 are $40,000.

Although his earnings for the year substantially exceed the 2022 annual limit , John will receive a Social Security payment for July, August and September. This is because he was not self-employed and his earnings in those three months are $1,630 or less per month, the limit for people younger than full retirement age.

Beginning in 2023, the deductions are based solely on John’s annual earnings limit.

Retirement Earnings Test Exempt Amounts

Workers who receive benefits before they reach full retirement age are subject to the retirement earnings test. If your income exceeds certain thresholds, then Social Security will withhold benefits until you reach FRA. Like the Social Security tax limit, these thresholds typically increase annually with the national wage index.

There are two annual earnings test exempt amounts: one that applies to individuals younger than retirement age and one that applies to individuals who reach FRA during that year. For younger recipients, Social Security withholds $1 for every $2 in excess of their exempt amount. Individuals who reach retirement age will have $1 withheld for every $3 in excess of their exempt amount.

In 2022, the earnings test exemption amounts will increase to:

- $19,560 for individuals younger than the FRA

- $51,960 for those who reach their FRA

In other words, an individual who earns $19,560 or less in 2022 may be eligible to receive full Social Security benefits. This is up from $18,960 in 2021.

You May Like: Social Security Office In Jackson Tennessee

How To Calculate Your Social Security Income Taxes

If your Social Security income is taxable, the amount you pay will depend on your total combined retirement income. However, you will never pay taxes on more than 85% of your Social Security income.

Again, if you file as an individual with a total income thats less than $25,000, you wont have to pay taxes on your Social Security benefits in 2022. For the 2022 tax year , single filers with a combined income of $25,000 to $34,000 must pay income taxes on up to 50% of their Social Security benefits. If your combined income is more than $34,000, you will pay taxes on up to 85% of your Social Security benefits.

For married couples filing jointly, you will pay taxes on up to 50% of your Social Security income if you have a combined income of $32,000 to $44,000. If you have a combined income of more than $44,000, you can expect to pay taxes on up to 85% of your Social Security benefits.

If 50% of your benefits are subject to tax, the exact amount you include in your taxable income will be the lesser of either:

- half of your annual Social Security benefits OR

- half of the difference between your combined income and the IRS base amount

The example above is for someone whos paying taxes on 50% of their Social Security benefits. Things get more complex if youre paying taxes on 85% of your benefits. However, the IRS helps taxpayers by offering software and a worksheet to calculate Social Security tax liability.

Reach Full Retirement Age In August 2022

Lets say you are entitled to $1,500 in Social Security benefits a month .

You work and earn $63,900 during the year, with $52,920 of it in the 7 months from January through July.

Your Social Security benefits would be reduced through July by $320 .

You would still receive $10,180 out of your $10,500 benefits for the first 7 months. $320 = $10,180)

However, beginning in August 2022, when you reach full retirement age, you would receive your full benefit , no matter how much you earn in income from your job.

Read Also: Social Security Office Coconut Creek

Ssd 2022 Maximum Monthly Income Limit Rises From $1310 To $1350

Social Security Disability benefits are reserved exclusively for workers or former workers who earned sufficient work credits and whose physical or mental impairments are serious and long-lasting enough to prevent them from performing substantial gainful activities for at least 12 months.

Eligibility for SSD benefits requires a disability as defined by the Social Security Disability Insurance program guidelines. The definition of a qualified disability includes an inability to earn a monthly income higher than the amount set by the Social Security Administration. In 2021, an SSD benefits recipient could earn no more than $1,350 in earned income per month to continue to be eligible for benefits. Beginning January 1, 2022, the monthly income limit for SSD will be $1,350.

What Income Is Not Counted? Not all income you receive is considered income for purposes of the SSDI monthly earned income limit. Any unearned income, interest, or dividends from investments are not counted toward the monthly limit. Neither is a spouses income. SSDI also has no limit on the number of assets you have available. The only income that does count is income earned from performing work or in exchange for services you provided.