How To Get A Social Security Card

Spouses Who Dont Qualify For Their Own Social Security

Spouses who didnt work at a paid job or didnt earn enough credits to qualify for Social Security on their own are eligible to receive benefits starting at age 62 based on their spouses record. As with claiming benefits on your own record, your spousal benefit will be reduced if you take it before reaching your FRA. The highest spousal benefit that you can receive is half of the benefit that your spouse is entitled to at their FRA.

While spouses get a lower benefit if they claim before reaching their own FRA, they will not get a larger spousal benefit by waiting to claim after their FRAsay, at age 70. However, a nonworking or lower-earning spouse may get a larger spousal benefit if the working spouse has some late-career, high-earning years that boost their benefits.

Recommended Reading: Penn State Retirement Health Insurance

How Do I Apply For Medicare Benefits

If you are already receiving Social Security retirement or disability benefits or railroad retirement checks, Social Security will contact you a few months before you become eligible for Medicare and give you the information you need to register. You should sign up for Medicare even if you dont plan to retire at age 65, or you may be penalized a 10% premium surcharge for each year past age 65 that you do not have Medicare. However, if you are age 65 or older and are covered under a group health plan either from your own employment or you are covered from your spouses employment, you may delay enrolling in Medicare medical insurance without having to wait for a general enrollment period or pay the 10% premium surcharge for late employment. The rules allow you to:

- Enroll in Part B any time you are covered under the group health plan, or

- Enroll in Part B during an eight-month special enrollment period that begins with the month your group health coverage ends or the month your employment ends, whichever comes first

I disagree with the SSAs decision on my claim. How can I appeal? Please visit www.ssa.gov/pubs/10041.html or call 1-800-772-1213 to file an appeal. All appeals should be sent to your local office to find your local office, please visit www.ssa.gov/locator.

Recommended Reading: What Is Ssi Benefits From Social Security

How Much Can I Make If I Reach Full Retirement Age This Year And I Am Already Receiving Social Security

You can make more money if you delay claiming your benefits to the calendar year you reach full retirement age. If you reach full retirement age in July and you claim your benefits earlier in January of the same year then you can earn up to $48,600 up to the month you reach full retirement age. If you exceed the $48,600 then you must repay $1 for every $3 you exceed the $48,600.

You May Like: How To Suspend Social Security Benefits

Which Tax Forms Do I Need To File

Employers must submit IRS Form 941, the Employerâs Quarterly Federal Tax Return, to report both the employee and employersâ portion of Social Security and Medicare. You should submit Form 941 quarterly to report these taxes.

Youâll also have to fill out a W-2, which is a combined wage and tax statement that you have to provide to each of your employees once a year to show how much FICA taxes were withheld that year.

Read Also: Are Social Security Offices Open In Florida

Working May Affect Your Retirement Income Benefit

You can work and still receive Social Security retirement benefits, but the income that you earn before you reach full retirement age may affect the amount of benefit that you receive. Heres how:

- If youre under full retirement age: $1 in benefits will be deducted for every $2 in earnings you have above the annual limit

- In the year you reach full retirement age: $1 in benefits will be deducted for every $3 you earn over the annual limit until the month you reach full retirement age

Once you reach full retirement age, you can work and earn as much income as you want without reducing your Social Security retirement benefit. And keep in mind that if some of your benefits are withheld prior to your full retirement age, youll generally receive a higher monthly benefit at full retirement age, because after retirement age the SSA recalculates your benefit every year and gives you credit for those withheld earnings

How To Calculate Your Social Security Income Taxes

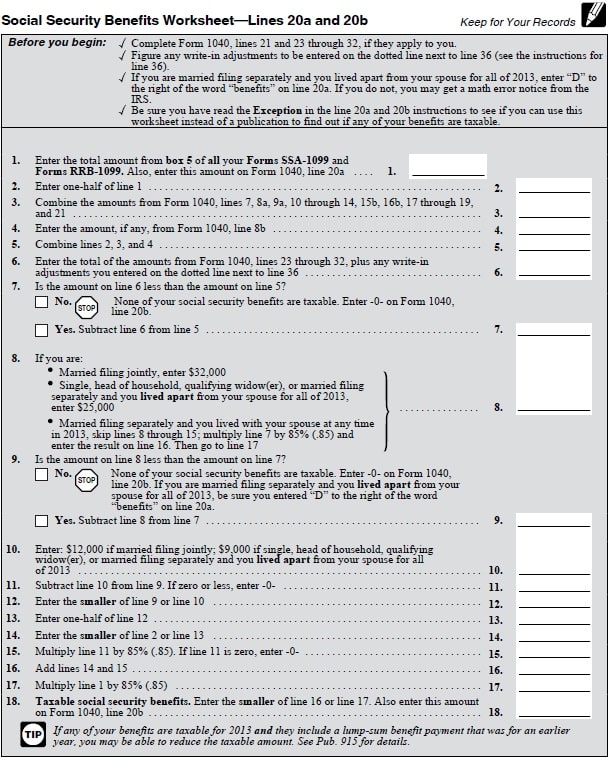

If your Social Security income is taxable, the amount you pay will depend on your total combined retirement income. However, you will never pay taxes on more than 85% of your Social Security income.

Again, if you file as an individual with a total income thats less than $25,000, you wont have to pay taxes on your Social Security benefits in 2022. For the 2022 tax year , single filers with a combined income of $25,000 to $34,000 must pay income taxes on up to 50% of their Social Security benefits. If your combined income is more than $34,000, you will pay taxes on up to 85% of your Social Security benefits.

For married couples filing jointly, you will pay taxes on up to 50% of your Social Security income if you have a combined income of $32,000 to $44,000. If you have a combined income of more than $44,000, you can expect to pay taxes on up to 85% of your Social Security benefits.

If 50% of your benefits are subject to tax, the exact amount you include in your taxable income will be the lesser of either:

- half of your annual Social Security benefits OR

- half of the difference between your combined income and the IRS base amount

The example above is for someone whos paying taxes on 50% of their Social Security benefits. Things get more complex if youre paying taxes on 85% of your benefits. However, the IRS helps taxpayers by offering software and a worksheet to calculate Social Security tax liability.

You May Like: Social Security Disability Health Insurance

Fraud In The Acquisition And Use Of Benefits

Given the vast size of the program, fraud sometimes occurs. The Social Security Administration has its own investigatory unit to combat and prevent fraud, the Cooperative Disability Investigations Unit . The Cooperative Disability Investigations Program continues to be one of the most successful initiatives, contributing to the integrity of SSA’s disability programs. In addition when investigating fraud in other SSA programs, the Social Security Administration may request investigatory assistance from other law enforcement agencies including the Office of the Inspector General as well as state and local authorities.

How Workers Can Get Estimates Of Benefits

The Social Security Administration provides benefit estimates to workers through the Social Security Statement. The Statement can be accessed online by opening an online account with SSA called my Social Security. With that account, workers can also construct “what if” scenarios, helping them to understand the effect on monthly benefits if they work additional years or delay the start of retirement benefits. The my Social Security account also offers other services, allowing individuals to request a replacement Social Security card or check the status of an application.

A printed copy of the Social Security Statement is mailed to workers age 60 or older.

In 2021, SSA began producing Retirement Ready fact sheets, available online and as part of the online Statement, that tailor retirement planning information to different age groups .

SSA also has a Benefits Calculators web page with several stand-alone online calculators that help individuals estimate their benefits and prepare for retirement. These include benefit calculators for spouses, calculators for persons affected by the Windfall Elimination Provision or the Government Pension Offset and calculators to determine a person’s full retirement age or the effect of the earnings test on benefits.

SSA also provides a life expectancy calculator to help with retirement planning.

You May Like: Maximum For Social Security Tax

Are There Ways To Avoid Social Security Tax

Not everyone has to pay the Social Security tax. If you are a nonresident alien, either as a student or an employee of a foreign government, then you wont have to worry about paying. Furthermore, if you are part of a religious group that opposes the receipt of Social Security benefits, then you wont have to pay either.

However, these are all rare circumstances. Plus, these people wont receive Social Security benefits in retirement. If you want to avoid paying the Social Security tax but still receive benefits when you retire, you should know that the amount youve paid into the system determines your benefits to some degree.

How Does Social Security Tax Work

Currently, employers and employees each pay 6.2% of the employees earnings, or 12.4% total, in Social Security tax. Social Security taxes are withheld from every employees paycheck until these taxes are paid in full. Thats why some employees with larger salaries may see bigger paychecks toward the end of the year, after they have paid 6.2% on their earnings up to $137,700 in full, the maximum amount of tax required.

An additional 1.45% of tax is collected from employers and employees on all gross income to fund the Medicare program.

If youre employed by an organization, your employer will match whats taken from your earnings, and, together, these payments will be deposited with the federal government.

Check Your Credit Score

Also Check: Social Security Office On 3rd Street

How Is Social Security Funded

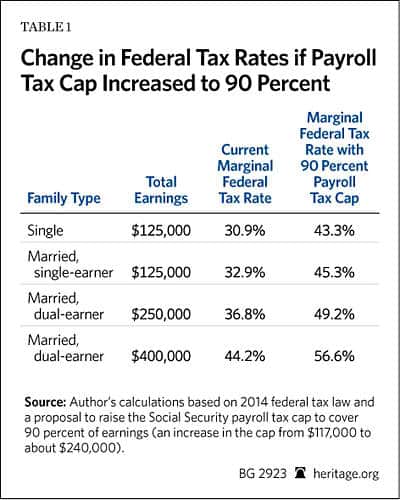

Social Security is mainly funded through a dedicated payroll tax created by the Federal Insurance Contributions Act of 1935. Employers and employees each pay 6.2 percent of wages, with a cap on the amount of wages subject to the tax .3 Those who are self-employed pay both the employee and the employer share of the tax. Those revenues are credited to the OASI and DI trust funds, which keep track of the programs receipts and expenses.

The programs also receive income from a tax on Social Security benefits paid by higher-income beneficiaries, as well as income generated by the investment of the trust fund reserves in non-marketable U.S. Treasury securities. However, from the perspective of the governments overall budget, the interest income paid to the trust funds by the Treasury has no effect. Although it is a receipt to the trust funds, it is an equal dollar expense to the Treasury.

The Social Security Tax Wage Base

All wages and self-employment income up to the Social Security wage base are subject to the 12.4% Social Security tax. The wage base is adjusted periodically to keep pace with inflation. It was increased from $132,900 to $137,700 in 2020 and to $142,800 for 2021. Here’s how it broke down year by year from 2012 to 2021:

| Social Security Wage Base by Year |

|---|

| 2021 |

Also Check: York County Social Security Office

Who Receives Social Security Benefits

Retired workers account for 73 percent of the programs beneficiaries. Disabled workers make up another 12 percent of beneficiaries. The remainder are the survivors of deceased workers as well as spouses and children of retired and disabled workers.

Social Security is a major source of post-retirement income for low-income seniors. For seniors at the bottom of the income distribution, benefits make up over 80 percent of their total yearly income. However, the benefits received by low-income retirees are modest. Workers who earned an average of $26,400 per year before retirement would receive only $15,127 per year in Social Security benefits if they retired this year at the full retirement age.

Can You Get Social Security If You Havent Worked

You can still get Social Security retirement benefits based on a current, former or deceased spouses record even if youve never worked. Otherwise, youll need to pay into the system to collect benefits.

Children of a deceased worker qualify for survivors benefits until theyre 18 or 19 if theyre still enrolled in high school full time. If the child is over 18 but has a disability that began before age 22, they can also qualify for survivors benefits.

Recommended Reading: Social Security Office Hinesville Ga

Court Interpretation Of The Act To Provide Benefits

The United States Court of Appeals for the Seventh Circuit has indicated that the Social Security Act has a moral purpose and should be liberally interpreted in favor of claimants when deciding what counted as covered wages for purposes of meeting the quarters of coverage requirement to make a worker eligible for benefits. That court has also stated: “… he regulations should be liberally applied in favor of beneficiaries” when deciding a case in favor of a felon who had his disability payments retroactively terminated upon incarceration. According to the court, that the Social Security Act “should be liberally construed in favor of those seeking its benefits can not be doubted.” “The hope behind this statute is to save men and women from the rigors of the poor house as well as from the haunting fear that such a lot awaits them when journey’s end is near.”

Are Social Security Benefits Taxable

So, do you have to pay income taxes on your Social Security benefits? The answer really depends on how much total retirement income you have. The average Social Security check in 2022 is $1,657. American workers who rely solely on Social Security for their only source of income will not have to pay income taxes on it. As long as your income is below $25,000, then you will not owe taxes on your Social Security payments. If your income is between $25,000 and $34,000, then you will be required to pay taxes on 50% of your benefits. Finally, if your income is above $34,000, then you will be taxed on 85% of your benefits. These amounts increase for a married couple filing jointly.

When filing your tax return, remember that income is not only money earned from working a job. This could also be income from an IRA, 401k, or other retirement accounts. You should always consult a professional for help with your personal finances and tax questions. They can assist you with strategies to help maximize your income and minimize the taxes that will be due.

Recommended Reading: The 1-800 Number To Social Security

Office Of Hearings Operations

On August 8, 2017, Acting Commissioner Nancy A. Berryhill informed employees that the Office of Disability Adjudication and Review would be renamed to Office of Hearings Operations . The hearing offices had been known as “ODAR” since 2006, and the Office of Hearings and Appeals before that. OHO administers the ALJ hearings for the Social Security Administration. Administrative Law Judges conduct hearings and issue decisions. After an ALJ decision, the Appeals Council considers requests for review of ALJ decisions, and acts as the final level of administrative review for the Social Security Administration .

How Social Security Benefits Are Calculated

The SSA keeps a record of your earned income every year along with the portion subject to Social Security taxes used to calculate your retirement benefits. The more you earn while working , the higher your monthly benefit will be, up to a certain maximum. For 2022, that maximum is $4,194 a month .

If you paid into the system for more than 35 years, the SSA only uses your 35 highest-earning years and does not include any others in its formula. If you did not pay into the system for at least 35 years, then a value of $0 is substituted for any missing years.

After you apply for benefits, these earnings are adjusted or indexed to account for past wage inflation and used to calculate your primary insurance amount . The PIA reflects the benefit that you are eligible to receive once you reach what Social Security calls your full retirement age :

- For anyone born from 1943 to 1954, the FRA is 66

- For people born after 1954, the age rises by two months annually until it hits 67 for anyone born in 1960 or later

The age at which you start collecting your Social Security benefits is another important factor. You can begin receiving benefits as early as age 62. But your benefits are permanently reduced unless you wait until your FRA. Conversely, your monthly benefit increases by 8% annually if you postpone collecting past your FRA, up to age 70. Thats when benefits max out and theres no further incentive to delay.

You May Like: Can I Get Va Pension And Social Security

Aliens Employed In The Us Social Security Taxes

Wages paid to resident aliens employed within the United States by an American or foreign employer are subject to Social Security/Medicare taxes under the same rules that apply to U.S. citizens.

Wages paid to nonresident aliens employed within the United States by an American or foreign employer, in general, are subject to Social Security/Medicare taxes for services performed by them within the United States, with certain exceptions based on their nonimmigrant status.

The following classes of nonimmigrants and nonresident aliens are exempt from U.S. Social Security and Medicare taxes:

- A-visas. Employees of foreign governments, their families, and their servants are exempt on salaries paid to them in their official capacities as foreign government employees.

- Note: Employees, attendants, or domestic workers admitted under an A-3 visa may be subject to Social Security taxes unless a U.S. totalization/social security agreement provides an exemption.