Under Age 65 And Receiving Social Security Disability Benefits

If this is your personal situation, after you receive 24 months of Social Security Disability Income benefits, Medicare automatically enrolls you in both:

- Medicare Part A , which is premium-free.

- Medicare Part B , which has a premium.

However, if you receive SSDI due to a specific disability, such as End-Stage Renal Disease or Lou Gehrig’s disease , you’re automatically enrolled in Medicare without the 24-month waiting period.

In either case, you’ll receive your Medicare card in the mail. If Medicare enrolls you after 24 months of receiving SSDI, you’ll get your card about three months before your 25th month of disability benefits. If you don’t want Part B, follow the instructions that come with the card.

Three Common Social Security Strategies

Get the timing right, and you could potentially boost monthly benefits for yourself and a spouse or dependent. Here are three strategies to consider:

1. Delayed retirement: Waiting to claim Social Security benefits based on your own work record provides what are called “delayed retirement credits” for each year you wait past your full retirement age. If you were born in 1943 or later, you can increase your benefit by up to 8% per year for each year you delay your claim after your full retirement age, up to age 70.

Let’s say you were born in 1960 or later. If you delay your Social Security until age 70, your full retirement benefit would be multiplied by 124%. For example: If you were set to receive $2,000 a month at full retirement age, but you delay to age 70, you would get about $2,480 a month instead.

One note: Even if you delay your Social Security claim, make sure you still sign up for Medicare at age 65 if you need coverage.

2. File and suspend: With this strategy, you could file for Social Security at your full retirement age, but then “suspend” the claim to accrue delayed retirement credits. This strategy used to be more commonly used by married couples, but has been eliminated. However, it may still make sense for individuals in the following situations:

Federal Employees Health Benefits Program

| Learn how and when to remove this template message) |

| Learn how and when to remove this template message) |

| Learn how and when to remove this template message) |

| This article may contain an excessive amount of intricate detail that may interest only a particular audience. Please help by spinning off or relocating any relevant information, and removing excessive detail that may be against Wikipedia’s inclusion policy. |

| This article may lend undue weight to certain ideas, incidents, or controversies. Please help improve it by rewriting it in a balanced fashion that contextualizes different points of view. |

| This article contains weasel words: vague phrasing that often accompanies biased or unverifiable information. Such statements should be clarified or removed. |

The Federal Employees Health Benefits Program is a system of “managed competition” through which employee health benefits are provided to civilian government employees and annuitants of the United States government. The government contributes 72% of the weighted average premium of all plans, not to exceed 75% of the premium for any one plan .

The FEHB program allows some insurance companies, employee associations, and labor unions to market health insurance plans to governmental employees. The program is administered by the United States Office of Personnel Management .

Also Check: Social Security Office In Tupelo Mississippi

Medicare Part B In 2022

Unlike Part A, no Medicare beneficiary receives premium-free Part B. This past year, the standard premium was $148.50. In 2022, it will be increased to $170.10.

The thresholds for income limits have also been increased. While most people do pay the standard premium, high-income individuals or couples could pay more. You will pay the standard premium if you are an individual who makes $91,000 or less or you are part of a married couple who makes $182,000 or less.

After youve reached one of those limits, the monthly premium will go up to $238.10. The next increase applies to those who make $142,000/$284,000 they will pay a monthly premium of $340.20. The adjustments continue to increase, maxing out at a monthly payment of $578.30.

For a full breakdown of the 2022 Medicare Costs and Premiums, visit

The Part B deductible is also increasing from $203 in 2021 to $233 in 2022. Unlike the Part A deductible, this one does just apply annually.

What Does Medicare Part B Cover

Medicare Part B is medical insurance and includes coverage for:

- Certain doctors services

- Durable medical equipment

- Mental health services

Medicare Part B is optional, separate from Medicare Part A . In order to qualify, you typically must be 65 years or older. You must also be a U.S. citizen, or a permanent lawful resident for at least five continuous years.

If you are under age 65, you may also be eligible if you receive Social Security or Railroad Retirement Board disability benefits for more than 24 months.

Read Also: Stockton Social Security Office Stockton Ca

Does Medicare Premiums Reduce Social Security Taxable Income

Asked by: Antwan Feeney

Is Social Security Taxed Before Or After the Medicare Deduction? You may not pay federal income taxes on Social Security benefits if you have low-income. But for most, your Social Security benefits are taxable. That means you’ll pay taxes before Medicare premiums are deducted.

Social Security Annual Cost

Social Security beneficiaries’ monthly benefit amount is adjusted annually to maintain purchasing power over time. In October each year, the Social Security Administration announces the cost-of-living adjustment payable in January of the following year.19 The Social Security COLA is a reflection of inflation measured by the Consumer Price Index-Urban Wage Earners and Clerical Workers ,20 calculated by the Bureau of Labor Statistics. The CPI-W, representing 29% of the population, is an estimate of the average change in prices of the goods and services purchased by households whose income is earned primarily from a clerical or wage occupation. The CPI-W gathers prices on thousands of items and services across the United States, including food, beverages, clothing, transportation, medical care, education, housing, recreation, and energy.21 An average CPI-W is calculated from these prices each quarter. The Social Security COLA equals the percentage increase in the average CPI-W from the third quarter of the base year to the third quarter of the current year. If the CPI-W indicates deflation, the Social Security COLA will equal 0.0% and Social Security benefits will not decrease.

Read Also: How Much Of My Social Security Is Taxable In 2021

Can You Get Medicare If You Are Not A Us Citizen

Specifically, you will qualify for Medicare even if you are not a U.S. citizen if you qualify to receive or currently receive Social Security retirement benefits, Railroad Retirement Benefits , or Social Security Disability Insurance . In any of these cases, you will qualify for premium-free Part A.

Projected Impact Of Medicare Premium Growth On Social Security Benefits

Medicare per capita cost growth is expected to continue to increase at a faster rate than inflation measured by the CPI-W, thus increasing Medicare premiums at a faster rate than Social Security COLAs. The Medicare Trustees project that Medicare beneficiaries will use a larger portion of their Social Security benefits to pay Medicare Part B and Part D premiums in the future. For example, in 2018, the Medicare Part B and Part D premiums account for 12.4% of the average Social Security benefit 68 the Medicare Trustees project that this will increase to approximately 14.0% in 2028 and to 16.8% in 2092.69 Out-of-pocket costs are also expected to continue to absorb an increasing amount of the average Social Security benefit the Medicare Trustees project that out-of-pocket costs as a percentage of the average Social Security benefit will increase from approximately 23.6% in 2018 to approximately 26.9% in 2028 and to approximately 34.5% in 2092.70

The historical and estimated increases in average Social Security benefits, the average Medicare Part B and Part D benefits, average Medicare Part B and Part D premiums, and average out-of-pocket costs as indicated by the Medicare Trustees’ long-range projections are shown in Figure 2.

Acknowledgments

This report was originally authored by Kristanna H. Peris, National Academy of Social Insurance Intern.

Don’t Miss: Social Security Administration Twin Cities Card Center

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

What About Part C And Part D

Youll pay your Part C or Part D bill directly to the insurance company. Each company has their own preferred methods, and not all companies accept all payment types.

Generally, you should be able to:

- pay online with a debit or credit card

- set up automatic payments

- use your banks automatic bill pay feature

You might also be able to set up a direct deduction for your retirement or disability payments.

You can contact your plan provider to find out what payment options are available. They can also let you know if theres anything you should be aware of with each payment type, such as added fees or time delays.

Read Also: South Jordan Social Security Office

What Are Your Medicare Coverage Options

You have several options, starting with Original Medicare.

Original Medicare consists of Parts A and B. Part A covers things like home health services, inpatient hospital care, and nursing home care. Part B helps pay for outpatient services like doctor visits, preventive screenings, mental health services, and yearly wellness exams.

You can also choose Medicare Part C, better known as Medicare Advantage, which combines your Part A and Part B coverage in a single plan. Advantage plans are offered through private insurers and usually include additional benefits, such as prescription drug coverage and routine dental services.

Note that, while most Medicare Advantage plans include Part D benefits, around 10% do not, so you need to review your options carefully if that is what you want. If you do not have a Medicare Advantage plan that covers medications and do not have creditable coverage elsewhere, you will need to enroll in a Medicare Part D drug plan to cover any needed prescriptions.

The Parts Of Medicare

Social Security enrolls you in Original Medicare .

- Medicare Part A helps pay for inpatient care in a hospital or limited time at a skilled nursing facility . Part A also pays for some home health care and hospice care.

- Medicare Part B helps pay for services from doctors and other health care providers, outpatient care, home health care, durable medical equipment, and some preventive services.

Other parts of Medicare are run by private insurance companies that follow rules set by Medicare.

- Supplemental policies help pay Medicare out-of-pocket copayments, coinsurance, and deductible expenses.

- Medicare Advantage Plan includes all benefits and services covered under Part A and Part B prescription drugs and additional benefits such as vision, hearing, and dental bundled together in one plan.

- Medicare Part D helps cover the cost of prescription drugs.

Most people age 65 or older are eligible for free Medicare hospital insurance if they have worked and paid Medicare taxes long enough. You can sign up for Medicare medical insurance by paying a monthly premium. Some beneficiaries with higher incomes will pay a higher monthly Part B premium. To learn more, read .

You May Like: Social Security Office Orangeburg Sc

Aging In To Medicare Coverage

As soon as you or anyone else covered by your health insurance becomes eligible for Medicare, that person must enroll in both Part A and Part B . You must have Medicare parts A and B to enroll in retiree insurance and prescription drug programs. If you, your spouse, or your dependents don’t enroll in Medicare Part B when first eligible, the insurance for that person will be canceled and there is a six-month wait to reenroll.

Tell ORS your Medicare number and effective dates for parts A and B

Once you are enrolled in Medicare you will receive your Medicare card from Social Security. As soon as you receive your card, tell ORS your Medicare number and effective dates for parts A and B.

- Log in to miAccount and send a secure message on Message Board, using the Submit My Medicare Number category. Include the name, Medicare number, and effective dates for parts A and B in your message for the individual going on Medicare.

- Use miAccount to update your Medicare information and complete a plan change to enroll in the Medicare health and prescription drug plan. Print the confirmation page and mail or fax it to ORS.

- Make a copy of your Medicare card. Write your name, member ID, address, and date of birth on the copy and mail or fax the copy of your card.

- Mail or fax a completed Insurance Enrollment/Change Request form to ORS with your Medicare information.

Medicare enrollment is automatic for most people if:

- You have paid into Medicare for 10 years.

- You are turning 65.

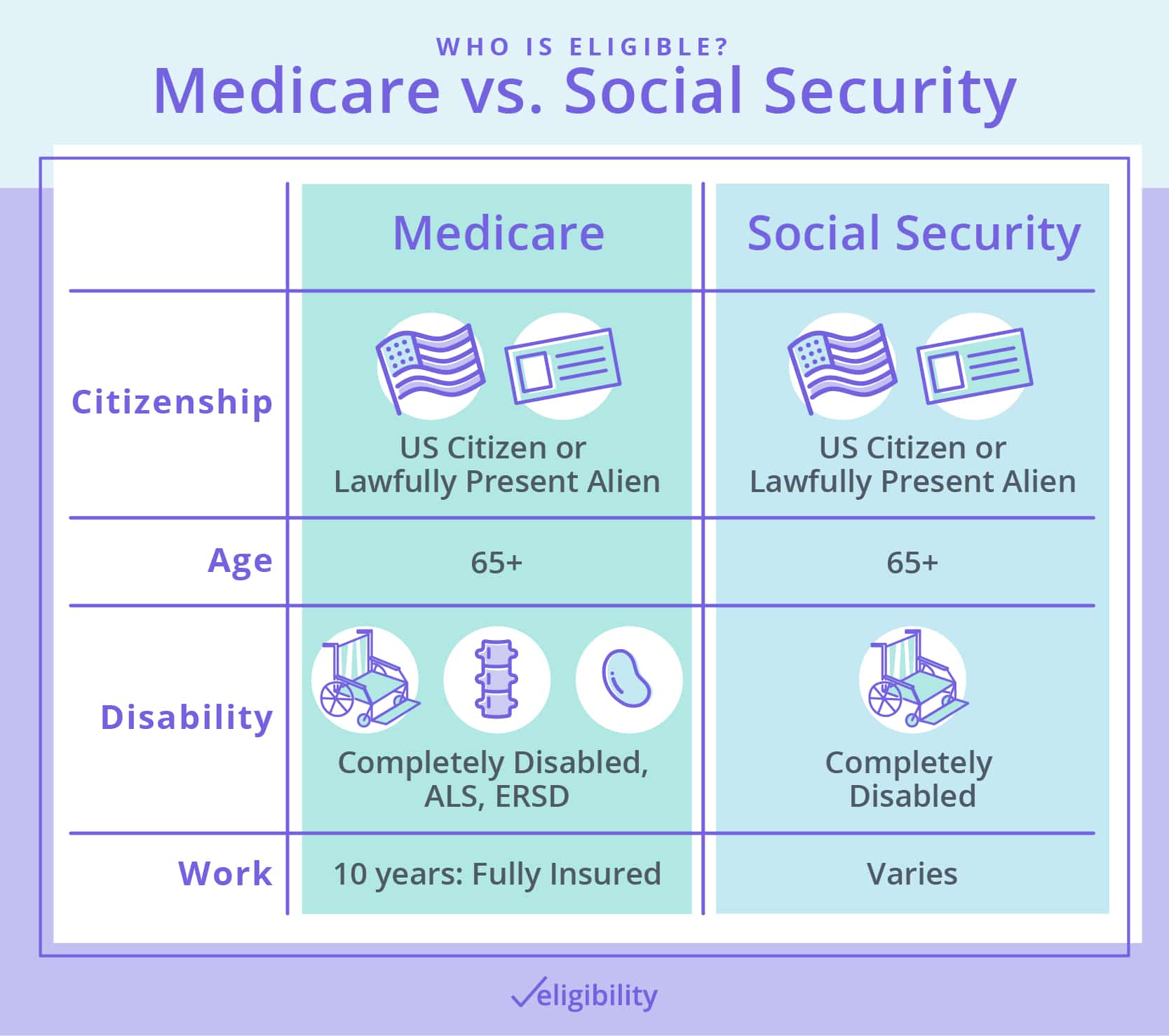

Social Security Vs Medicare

Social Security provides federal income benefits in retirement based on what youve earned over a lifetime of working. Your Social Security benefits are calculated using your highest 35 years of wages, and the amount you receive is based on your pay over your lifetime and how long you wait to claim your benefits. Social Security also pays benefits to people living with disabilities, survivors of workers who have died and dependents of beneficiaries, according to the Social Security Administration

Medicare provides federal health insurance for people age 65 and older and younger people living with certain disabilities or chronic conditions. Medicare is made up of four parts, including Part A , Part B and Part D . It also includes Part C, or Medicare Advantage, which is a bundled alternative to Original Medicare offered by private insurance companies, including all the coverage of Part A and B, plus some additional benefits.

Don’t Miss: How To Get Someone’s Social Security Number

Medicare Part A Premiums And Deductibles Are Going Up In 2023

While Medicare Part B is seeing a decrease in premiums next year, those who have to pay for Medicare Part A will see very slight premium increases in 2023. Those who’ve worked more than 30 calendar quarters will pay $278 a month, versus $274 in 2022. Those with less qualifying employment history will pay $506 a month, compared with $499 in 2022.

It’s important to note that 99% of Medicare recipients don’t have to pay anything for Part A because they’ve worked 40 calendar quarters while paying Medicare taxes.

The deductibles for Medicare Part A are also rising by about 2.8% each. Here’s a breakdown of what’s going up.

Inpatient hospital deductible: $1,600 in 2023, an increase of $44 from $1,556 in 2022.

Daily coinsurance for the 61st through the 90th day: $400 in 2023, an increase of $11 from $389 in 2022.

Daily coinsurance for lifetime reserve days: $800 in 2023, an increase of $22 from $778 in 2022.

Skilled Nursing Facility coinsurance: $200 in 2023, an increase of $5.50 from $194.50 in 2022.

Does Medicare Advantage Have An Irmaa

Some people mistakenly believe that by opting for Medicare Advantage rather than Original Medicare, they can avoid IRMAA charges.However, IRMAA applies to all Medicare beneficiaries whose earnings exceed a certain threshold.

This is because everyone on Medicare Advantage still owes the Part B premium of $164.90 in 2023, in addition to any applicable IRMAA charges.

Also, if you have a Medicare Advantage plan that includes prescription drug coverage, the Part D IRMAA applies.

Also Check: Social Security Office In Toledo Ohio

Medicare Part A In 2022

Most individuals wont notice a premium in change for Part A since the majority of Medicare beneficiaries receive premium-free Part A. As long as youve paid Medicare taxes for ten years, youll have this benefit.

However, there are still some individuals who have to pay a Part A premium. The amount you pay is based on the number of quarters you paid Medicare taxes. If you paid Medicare taxes for more than 30 quarters, but less than 40 quarters, your premium will be $274 in 2022. If you did not reach the 30 quarter mark, youd pay the full Part A premium of $499.

The Part A deductible is also increasing in 2022. In 2021, the deductible was $1484. That will increase to $1556 in 2022. Its important to remember that this deductible applies per benefit period, not calendar year. Its possible for individuals who get hospitalized more than once to have to pay this deductible multiple times in one year.

Medicare Part C And Part D

Medicare Part C and Medicare Part D plans are sold by private companies that contract with Medicare.

Medicare Advantage plans cover everything that Medicare parts A and B do and often include coverage for extra services. Medicare Part D plans cover prescription drugs.

Part C and Part D plans are optional. If you do want either part, youll also have multiple options at various price points. You can shop for Part C and Part D plans in your area on the Medicare website.

Some plans will have an additional premium but others will be premium-free.

You can have your Part C or Part D plan premiums deducted from Social Security. Youll need to contact the company that sells your plan to set it up. It might take several months to set up and for automatic payments to begin.

This means your first payment could end up being very large since itll cover multiple months at once. Your plan will walk you through the details and let you know how long it will take.

Your premiums will be deducted once per month after everything is set up.

You May Like: Social Security Earnings Limit 2021