How To Calculate Fica Tax

The FICA tax tax is an employee payroll tax that funds Social Security benefits and Medicare health insurance. The tax is split between employers and employees. They both pay 7.65% of their income to FICA, the combined contribution totaling 15.3%. The maximum taxable earnings for employees as of 2020 is $137,700. There is no wage limit for Medicare.

Increasing Payroll Taxes Would Strengthen Social Security

Social Security faces a significant though manageable long-term funding shortfall, which policymakers should address primarily by increasing Social Securitys tax revenues. If policymakers elect to reduce Social Security benefits, those cuts will need to be limited and carefully targeted to avoid causing significant hardship. Moreover, the cuts will almost certainly be phased in slowly, which means they could not produce significant savings for many years. Increasing Social Securitys revenues will be necessary.

Social Securitys tax base has eroded since the last time policymakers addressed solvency.Boosting Social Securitys payroll tax revenue also is justified by recent trends: Social Securitys tax base has eroded since the last time policymakers addressed solvency in 1983, largely due to increased inequality and the rising cost of non-taxed fringe benefits, such as health insurance. And it enjoys broad support: the majority of Americans oppose cuts to Social Security and support strengthening the program by contributing more in taxes.

This paper presents three approaches to increasing payroll taxes that would improve the programs solvency:

Federal Withholding Term Definitions

Before we get into calculations, lets define a couple of key terms related to federal withholding tax tables:

Gross pay: The full amount of your salary before deductions, withholdings, and contributions are taken out of it

Net pay: Your take-home pay, once deductions, withholdings, and contributions are removed from your gross pay

Withholdings: The amount taken out of an employees paycheck to pay their income taxes during that pay period

Deductions: The amount taken out of an employees paycheck to pay for specific benefits/donations the employee has chosen, such as retirement or health care

These are all common terms that have to do with withholding tax, so it is important to understand these definitions as an employer.

Read Also: What Is The Last Day To File Taxes In Texas

Recommended Reading: Social Security Office Evansville Indiana

How Can Employers Prepare For New Changes To The Wage Base

Employers can prepare themselves for the 2023 social security payroll tax changes by taking the following steps:

Withdraw From Retirement Accounts Before Signing Up For Social Security

One way to lower your combined income is to start taking withdrawals from IRAs and 401s before you start collecting Social Security. You can begin taking penalty-free distributions as early as age 59 1/2 and even 55 in some cases. Theoretically, you could withdraw all of your retirement account money before you start collecting Social Security, but thats probably not the best long-term strategy if you want to live comfortably.

Also Check: Phone Number For The Social Security Administration

No Matter How You File Block Has Your Back

A Formula For Determining Taxable Social Security

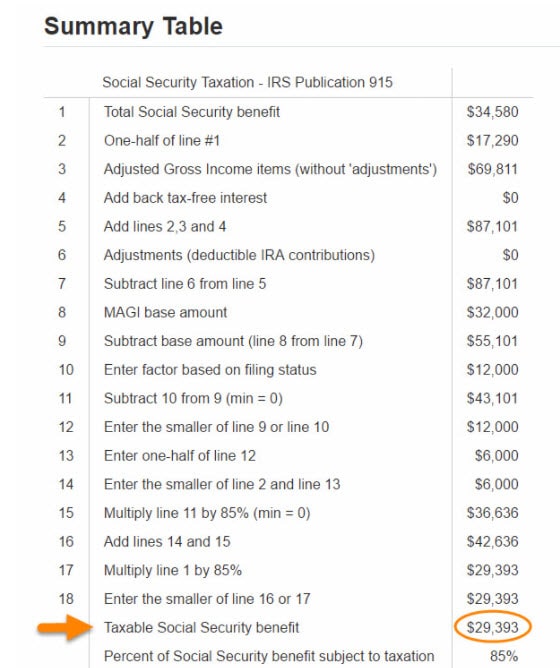

Many people and financial planning software programs assume that singles with over $34,000 of income or married couples with over $44,000 of income will have 85% of their Social Security benefit taxed, but that isnt always the case. You can use the worksheet in IRS Publication 915, fill out a 1040, or use this formula to calculate the taxable portion of Social Security benefits.

Step 1: Determine Provisional Income

Step 2: Subtract the first threshold and multiply by .5.

Step 3: Subtract the second threshold and multiply by .35.

Step 4:Add them up.

Step 5: Calculate and apply the maximum.

Example

These clients are married, filing jointly, and have $75,000 of total income. None of it is tax-free . The IRA withdrawals alone are well over the second threshold.

|

Step 1: |

Don’t Miss: Social Security Office Merrillville Indiana

Are Social Security Disability Benefits Taxed

Generally speaking, people work their entire adult lives paying into the Social Security and Medicare systems to receive both retirement and health benefits when they reach a qualifying age and leave the workforce.

Sometimes, however, something unexpected happens along the way, and a worker may need to tap into those accumulated funds because a medical condition leaves them unable to work. In this case, they may qualify for what is called Social Security Disability Insurance .

Some individuals may qualify for Supplemental Security Income if they are in need of income support but may not have contributed enough in qualifying work credits. These people are usually of limited income, and they must be age 65 or older, disabled, or blind to qualify, though benefits are also available for blind or disabled children.

The question is, âAre these benefits taxable even if youâre out on disability and receiving SSDI?â The answer varies and depends to a large extent on your marital status and sources of income, if any, outside of SSDI.

If you are on SSDI, applying for the program, or have been denied benefits in or around Raleigh, North Carolina, contact me at Lloyd King Law Firm PLLC. I have more than four decades of experience working on both sides of the fence, first as a disability judge for the Social Security Administration and now as a private attorney protecting the rights of citizens to obtain the full benefits they deserve.

State Taxation Of Social Security Benefits

In addition to federal taxes, some states tax Social Security benefits, too. The methods and extent to which states tax benefits vary. For example, New Mexico treats Social Security benefits the same way as the federal government. On the other hand, some states tax Social Security benefits only if income exceeds a specified threshold amount. Missouri, for instance, taxes Social Security benefits only if your income is at least $85,000, or $100,000 if you’re married filing a joint return. Utah includes Social Security benefits in taxable income but allows a tax credit for a portion of the benefits subject to tax.

Although you can’t have state taxes withheld from your Social Security benefits, you generally can make estimated state tax payments. Check with the state tax agency where you live for information about the your state’s estimated tax payment rules.

Recommended Reading: Moss Point Social Security Office

How To Calculate Your Social Security Income Taxes

If your Social Security income is taxable, the amount you pay will depend on your total combined retirement income. However, you will never pay taxes on more than 85% of your Social Security income.

Again, if you file as an individual with a total income thats less than $25,000, you wont have to pay taxes on your Social Security benefits in 2022. For the 2022 tax year , single filers with a combined income of $25,000 to $34,000 must pay income taxes on up to 50% of their Social Security benefits. If your combined income is more than $34,000, you will pay taxes on up to 85% of your Social Security benefits.

For married couples filing jointly, you will pay taxes on up to 50% of your Social Security income if you have a combined income of $32,000 to $44,000. If you have a combined income of more than $44,000, you can expect to pay taxes on up to 85% of your Social Security benefits.

If 50% of your benefits are subject to tax, the exact amount you include in your taxable income will be the lesser of either:

- half of your annual Social Security benefits OR

- half of the difference between your combined income and the IRS base amount

The example above is for someone whos paying taxes on 50% of their Social Security benefits. Things get more complex if youre paying taxes on 85% of your benefits. However, the IRS helps taxpayers by offering software and a worksheet to calculate Social Security tax liability.

What To Expect From Taxes On Social Security Income

Ultimately, in my dads situation, we were able to mitigate some of his tax burden. But for a good part of it, he was stuck.

As you can imagine, he didnt like this one bit. And you might not either if you find yourself in the same position.

Every year individuals retire and are faced with sticker shock when they find out how much theyll have to pay in taxes on Social Security income.

To some, it doesnt seem fair. Youve worked for years and paid your Social Security tax as the admission ticket to a Social Security benefit.

Now that youre collecting that benefit, you have to pay taxes? Again?

Don’t Miss: Social Security Office San Francisco

Social Security Tax Rates

The Social Security program provides benefits to retirees and those who are otherwise unable to work due to disease or disability. Social Security often provides the only source of consistent income for people who can no longer workespecially for those with modest earnings histories.

Because Social Security is a government program aimed at providing a safety net for working citizens, it is funded through a simple withholding tax that deducts a set percentage of pretax income from each paycheck. Workers who contribute for a minimum of 10 years are eligible to collect benefits based on their earnings history once they retire or suffer a disability.

Social Security benefits are capped at a maximum monthly benefit amount based on earnings history. To prevent workers from paying more in taxes than they can later receive in benefits, there is a limit on the amount of annual wages or earned income subject to taxation, called a tax cap.

For 2021, the maximum amount of income subject to the OASDI tax is $142,800, capping the maximum annual employee contribution at $8,853.60. For 2022, the maximum amount of income subject is $147,000, capping the maximum annual employee contribution at $9,114.00. The amount is set by Congress and can change from year to year.

Federal Income Tax : 2019 Or Prior

Federal Income Tax is calculated using the information from an employees completed W-4, their taxable wages, and their pay frequency. Based on Publication 15-T , Federal Income Tax Withholding Methods, you can use either the Wage Bracket Method or the Percentage Method to calculate FIT.

We will use the Percentage Method in our example, looking at tables found in the 2022 IRS Publication 15-T PDF file. You can open the file to follow our calculations below.

Using Worksheet 1 on page 5, we will determine how much federal income tax to withhold per pay period.

Step 1. Adjust the employees wage amount

1a) This is the same as gross wages: $2,083.33.

1b) Our employee is paid semi-monthly or 24 times per year.

1c) This should equal your employees annual salary: $2,083.33 x 24 = $50,000

Because we are using the 2019 W-4 form, we now skip to step 1j:

1j) Our employee has claimed 2 allowances

1k) $4,300 x 2 = $8,600

1l) $50,000 $8,600 = $41,400

To continue, you will need to refer to the tax tables on page 10:

Step 2: Figure the tentative withholding amount

2a) This amount is from line 1l, $41,400

2b) We are referring to the table labeled Single or Married Filing Separately on the left . Our employees adjusted annual wage amount is greater than $13,900 and less than $44,475. So, we would enter an amount of $13,900 .

2c) The amount in column C is $995.

2d) The percentage from column D is 12%.

2e) $41,400 $13,900 = $27,500

2f) $27,500 x 12% = $3,300

4a) $0

Read Also: Lansing Mi Social Security Office

Control Your Taxes Now & Later

The longer you wait to claim Social Security benefits, the better chance you’ll have to boost the overall tax efficiency of your retirement income plan. Here’s how.

Drawing down traditional tax-deferred assets before collecting Social Security can enable you to control both your current and future taxes.

The amount you withdraw from a traditional IRA, for example, lowers your account balance, which may reduce your future required minimum distributions .

Since your RMD is considered ordinary income, having smaller distributions while you’re collecting benefits may reduce the taxes on your benefitsor keep you from paying taxes altogether.

In addition, managing your retirement income in this way can also help you qualify to pay lower Medicare parts B and D premiums, which are income-based.

Be Prepared For The Year Ahead

As an employer, changes in payroll tax rates and limits can greatly impact your budget and processes. That’s why it’s essential to be aware of changes to the SSA’s wage base.

If you handle payroll in-house, make sure your system accounts for the new cap or consider outsourcing your payroll to Hourly so all of the changes and calculations will be handled for you.

Also Check: Social Security Office Muskogee Ok

Is Social Security Taxable

Social Security income is generally taxable at the federal level, though whether or not you have to pay taxes on your Social Security benefits depends on your income level. If you have other sources of retirement income, such as a 401 or a part-time job, then you should expect to pay some income taxes on your Social Security benefits. If you rely exclusively on your Social Security checks, though, you probably wont pay taxes on your benefits. State taxes on Social Security, on the other hand, vary from state to state. Regardless, it can be helpful to work with a financial advisor who can help you understand how different sources of retirement income are taxed.

How Social Security Taxation Boosts The Marginal Tax Rate

Because the formulas to determine the amount of Social Security benefits to include in income are themselves based on income, the net result is that the inclusion of Social Security functions like a surtax on income while it is phasing in. And because of the high percentage of Social Security benefits that become taxable as income rises, the effect can be significant.

Notably, the net result of these formulas is that while 50% of Social Security benefits are being phased in, the marginal tax rate is essentially boosted by 50%, from 15% to 22.5%. For those whose income exceeds the upper threshold, the marginal tax rate is boosted by extra 85%, from 15% to 27.75%! This essentially results in a tax bracket “bubble” that occurs as Social Security benefits are being phased in, until the maximum phase-in is reached and the client’s tax rate returns his/her normal tax bracket again.For individual clients, the effect can be even more severe, because the taxation of Social Security benefits potentially overlaps not just the 15% tax bracket, but the 25% tax bracket . As a result, individual clients face a potential tax rate boost from 25% to 46.25%!

You May Like: Social Security Office In Jackson Tennessee

Will You Owe Taxes On Your Social Security Benefits

As with most questions about taxes, the answer is “it depends.”

About 40% of people who get benefits pay income taxes on them, according to the Social Security Administration . That’s because their income in retirement exceeds limits set by tax rules and regulations.

Generally, if Social Security is your only retirement income, you won’t have to pay taxes on it. But if you have at least moderate income, you’ll most likely owe the government some money.

The good news is that while up to 85% of your benefits may be taxed at ordinary income rates, it’s never 100%. That’s considered tax-efficient compared with other retirement plans whose distributions may be fully taxable. In addition to the federal tax bite, 13 states also tax Social Security benefits using either the federal provisional income formula or their own.

Social Security And Medicare Withholding Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, , Employer’s Tax Guide for more information or Publication 51, , Agricultural Employers Tax Guide for agricultural employers. Refer to Notice 2020-65PDF and Notice 2021-11PDF for information allowing employers to defer withholding and payment of the employee’s share of Social Security taxes of certain employees.

Don’t Miss: Social Security Administration Alexandria Va