Tips For Navigating Social Security

- A financial advisor can help you account for the various sources of retirement income, including Social Security benefits. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free toolmatches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- If youre applying for Social Security disability benefits, youll need to fill out form SSA-827. This provides your consent for the SSA and Disability Determination Services to view your medical records.

- Dealing with a disability, either temporary or permanent, is hard enough without considering the financial impact. Having an emergency fund in place for unpredictable things like this can be a huge relief.

Minutes To See If You Qualify

If you are unable to work because of a medical condition and you are 65 or older, you should consult with a disability attorney. You might be eligible for disability benefits, so you wont have to retire earlier than you anticipated. Complete the Free Case Evaluation Form, so you can have your case reviewed by a Social Security disability lawyer right away and your claim can get on the right track!

Differences Between Social Security Retirement And Disability

The main difference between social security disability insurance and social security retirement is simple. With Social Security disability insurance, you have to prove that youre disabled. Social Security retirement, however, is based on age. We typically advise our clients not to work unless they plan to work full-time because you will lose your benefits if you exceed a certain amount of earnings. You can start receiving retirement benefits at 62, but there is a deduction if you start claiming them before 67. To learn more, watch this short video.

You May Like: Social Security Office In Newark

What Age Are You When Social Security Disability Stops

Social Security Disability can stay active for as long as youre disabled. If you receive benefits until age 65, your SSDI benefits will stop, and your retirement benefits will begin. In other words, your SSDI benefits change to Social Security retirement benefits.

Sometimes, SSDI benefits will stop before age 65. If you begin earning more income or dont continue documenting your condition, you might stop receiving benefits.

to find a John Foy office near you

To Wait Or Not To Wait

Consider taking benefits earlier if . . .

- You are no longer working and can’t make ends meet without your benefits.

- You are in poor health and don’t expect the surviving member of the household to make it to average life expectancy.

- You are the lower-earning spouse, and your higher-earning spouse can wait to file for a higher benefit.

Consider waiting to take benefits if . . .

- You are still working and make enough to impact the taxability of your benefits.

- Either you or your spouse are in good health and expect to exceed average life expectancy.

- You are the higher-earning spouse and want to be sure your surviving spouse receives the highest possible benefit.

Also Check: How To Withhold Taxes From Social Security

Why Does Social Security Disability End

The most common reasons that SSDI ends include:

- You return to work.

- Your disabling condition improves.

- You serve jail or prison time.

If any of these things happen, the SSA could stop your benefits. It will depend on the details of what changes and when. When your benefits go under review also matters. The SSA will discontinue your benefits if they determine you are no longer disabled.

You could get a review every 18 months, three years, or seven years. If your doctor expects your condition to get better, the SSA will review your case more often than others on SSDI.

If you are in jail for over 30 days, the SSA will stop your SSDI benefits. However, you might be able to restart your benefits after you get out of jail.

The Amount Of Your Social Security Benefits Check Is Not Likely To Change

When you become eligible for disability benefits, Social Security sets your benefit amount as if you had reached full retirement age. For most beneficiaries, the amount of their Social Security retirement benefit check remains the same as their Social Security disability benefits check.

One exception to this rule is if you are receiving workers compensation or a public disability benefit from a government job for which you did not pay Social Security taxes. These additional benefits can reduce your actual Social Security disability payment amount. That reduction may end when you reach full retirement age, and your monthly check amount may increase at that time.

Also Check: Social Security Overpayment Phone Number

How Much Can You Get From Social Security Disability At Age 63

The amount that you receive each month from Social Security disability depends on the earnings record you have from working at jobs or through self-employment. Only earnings on which you paid into the Social Security retirement system through the payment of taxes count.

The maximum monthly SSDI benefit that you can receive in 2022 is $3,345. What you receive may be less based on your earnings record.

If you are age 63 and have a medically determinable physical or mental impairment, expected to last for at least 12 months or result in death, you may qualify for SSDI if the impairment or impairments prevents you from engaging in substantial gainful activity. In other words, it prevents you from doing the activities associated with work, including:

Retirement And Social Security Disability

Clients often ask whether they can receive social security disability benefits and retirement benefits. The quick answer is no. Once you reach full retirement age between ages 66 and 67, depending on the year you were born the Social Security Administration converts an individual SSDI benefits to regular retirement benefits. An exception applies for individuals who opt for early retirement, thought it comes with an important caveat, which well discuss below.

However, whether you can receive retirement and SSDI benefits depends on what you mean by retirement. For SSDI purposes, retirement means benefits paid through the SSA. Yet Social Security retirement benefits are not always the only benefit people receive when they retire. Pensions or 401 plans through an employer also pay benefits at retirement. While many people generically refer to each of these as retirement benefits, for purposes of receiving both SSDI and retirement benefits, they are very different.

The longer answer, then, is that you cannot receive SSDI and retirement benefits from the SSA. You may, however, be able to receive SSDI and benefits through a pension or 401.

Recommended Reading: Social Security Office Miami Fl

Working After Beginning Benefits May Temporarily Reduce Them

If you file for Social Security benefits before your full retirement age but keep working, the Social Security Administration will temporarily reduce your benefit payments. For 2022, the amount of the reduction is $1 for each $2 you earn above $19,560.

If you reach full retirement age in 2022, the reduction drops to $1 for every $3 you earn above $51,960, until the month you reach full retirement age. Thereafter, there is no reduction no matter how much you earn.

Bear in mind that these reductions are only temporary. Once you reach full retirement age, your monthly benefit will be adjusted upwards to compensate you for the original reductions.

Filing For Early Retirement Benefits

For most people, it does not make sense to file for early retirement benefits at age 62 if you are already receiving SSDI because of a disability. Your disability payments equal your full retirement amount, and those who opt for early retirement receive reduced benefits.

Imagine that, at age 60, you suffer a back injury leading to a disability. You are approved for SSDI benefits, and you begin drawing an amount equal to your full retirement amount. When you reach age 62, nothing changes you continue to draw your full SSDI amount.

Once you reach your full retirement age, the SSA swaps you from SSDI to traditional retirement benefits. However, this occurs automatically, so you will not see a break in your benefits and do not need to do anything to ensure this happens.

For a free legal consultation, call

Don’t Miss: Social Security Administration Twin Cities Card Center

How Long Do You Continue To Receive Disability Benefits

Once your application has been approved for benefits through either the Social Security Disability Insurance or Supplemental Security Income programs, you receive monthly payments as long as you continue to be disabled. As long as you have a physical or mental impairment that satisfies the Social Security Administration definition for disabled and, in case you qualify for benefits through SSI, continue to meet financial criteria, your benefits will continue.

How income affects Social Security disability benefits depends on the program through which you receive payments. If you qualify for Social Security Disability Insurance, income from the following sources may reduce how much you receive each month:

1). Workers compensation

4). Vacation pay

5). Pension benefits through work that was not subject to Social Security taxes

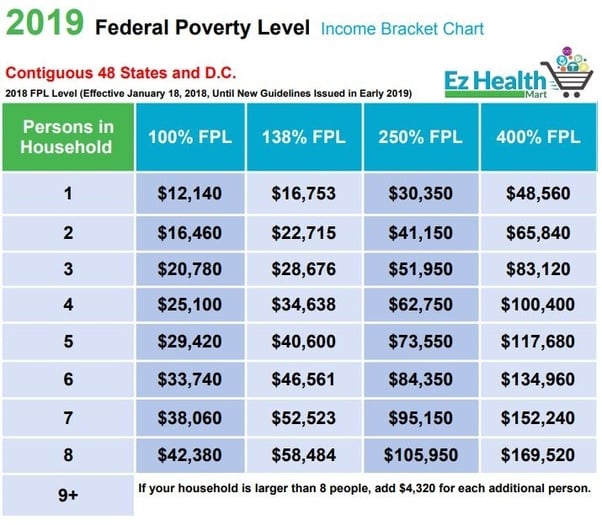

Monthly income earned through a job or self-employment that exceeds $1,310, or $2,190 if you cannot work because you are blind, indicates an ability to engage in substantial gainful activity. A determination by the SSA of the existence of a qualifying disability is based, in part, on the fact that your medical condition prevents you from engaging in substantial gainful activity, so your earned income could prove otherwise.

Social Security’s Trial Work Programs

To encourage you to return to work, Social Security will allow you to try to work for a limited time without taking away your SSI or SSDI benefits. The SSA wants to encourage you to work. To that end, Social Security lets you test yourself without risking your disability benefits to see if you can return to work long term.

You May Like: Social Security Part B Cost

Please Answer A Few Questions To Help Us Determine Your Eligibility

Winning a disability claim generally gets easier for people as they become older. This is particularly true for people over the age of 60. However, some older folks choose to apply for early retirement at age 62 or 63 rather than applying for disability. Even though this may seem an easier option, it can reduce the amount of benefits you are entitled to. You can get disability benefits up until full retirement age, which is 66 right now.

When Does Social Security Pay More Than Disability

The reverse of the above situation is true if you are between your FRA and age 70. After you reach your FRA, your Social Security benefit amount increases by 0.8% for every month you hold off on claiming your benefits. This continues until you reach 70, at which point your benefit reaches its maximum. In this situation, your monthly Social Security benefit would be larger than your monthly disability benefit.

Don’t Miss: When Can You Claim Social Security

Do Ssdi Benefits Always Convert To Retirement Benefits At Age 65

If you were born before 1937, your SSDI benefits would change to retirement benefits at age 65. However, younger people will have to wait longer. When your benefits convert depends on your birth year.

Here is when SSDI benefits switch to retirement benefits based on birth years:

- Born in 1938: 65 years and two months

- Born in 1939: 65 years and four months

- Born in 1940: 65 years and six months

- Born in 1941: 65 years and eight months

- Born in 1942: 65 years and 10 months

- Born 1943 through 1954: 66 years

- Born in 1955: 66 years and two months

- Born in 1956: 66 years and four months

- Born in 1957: 66 years and six months

- Born in 1958: 66 years and eight months

- Born in 1959: 66 years and 10 months

- Born 1960 or later: 67 years

Unlike SSDI, your income does not limit your Social Security retirement benefits. The SSDI rules will no longer count for your retirement benefits.

For a free legal consultation, call

Claiming Social Security Retirement Early

The law allows a person to claim their Social Security retirement benefits early, that is before they reach their full retirement age. You can file a claim to begin receiving your Soc. Sec. retirement benefits as early as age 62, but doing so will permanently forfeit a large portion of the amount you would receive in monthly benefits if you waited until your full retirement age to claim benefits.

To learn how the amount of your full Social Security retirement benefit amount is calculated, read the section below about Calculating Your Social Security Benefit Amount.

Only people who claim their Social Security retirement benefits before their full retirement age are limited as to what they may earn in other income before their early retirement benefits are reduced.

Read Also: What Do Social Security Cards Look Like

What Happens To Ssd Benefits After Age 65

Reaching 65 years of age does not affect your benefits received through SSI. The primary reason for this is that SSI, unlike SSDI, receives its funding through general funds of the U.S. Treasury and not through Social Security taxes. As long as there is no change in your income or resources, your SSI benefits will not change solely because you reach retirement age.

If you receive SSDI benefits, they will not stop when you reach 65 years of age. They will, however, convert to Social Security retirement benefits when you reach the full retirement age. The age at which you may retire with full Social Security retirement benefits depends on your birth year. Someone born in 1955 reaches full-retirement age at 66 years and 2 months while someone born in 1960 or later must wait until they are 67 years of age.

The conversion from SSDI to Social Security retirement automatically happens at the age of full retirement. You should not see any change in the amount of the monthly benefit after the conversion unless you elected to take early retirement benefits.

How Much Social Security Will I Get At Age 63

A common misconception about Social Security is that you must wait to collect retirement benefits until you reach reaching age 65 It is wrong for two reasons: The age at which you become eligible for full retirement benefits through Social Security may be older than 65 depending on the year you were born, and early Social Security retirement benefits may be available at age 62.

The taxes paid on what you earn from a job or through self-employment do more than fund the Social Security retirement and disability benefits programs. It also makes you eligible to receive Social Security disability benefits if you become disabled and unable to continue working and earning a living before reaching full retirement age. Your earnings record also determines how much you may receive as monthly retirement or disability benefits.

If you elect to retire sooner than the age of full retirement, the monthly benefit payment is reduced from what you would be eligible to receive by waiting until full retirement. It also may affect how much you receive in benefits through the Social Security Disability Insurance program.

Its important for someone who may be thinking about applying for early retirement at age 63 to understand how it results in a reduced monthly benefit that does not end at full retirement age. You also need to be aware of what effect applying for early retirement benefits at age 63 will have on your SSDI benefits if you are disabled and unable to work.

Recommended Reading: Social Security Retirement Benefit Calculator

The Disability Application Process

Whether you apply online, by phone, or in person, the disability benefits application process follows these general steps:

- You gather the information and documents you need to apply. We recommend you print and review the . It will help you gather the information and documents you need to complete the application.

- You complete and submit your application.

- We review your application to make sure you meet our for disability benefits.

- We confirm you worked enough years to qualify.

- We evaluate any current work activities.

- We process your application and forward your case to the Disability Determination Services office in your state.

- This state agency makes the disability determination decision.

To learn more about who decides if you have a disability, read our publication .

Once You’ve Applied

Processing time for disability applications vary depending on the nature of the disability, necessary medical evidence or examinations, and applicable quality reviews.

Once we receive your application, well review it and contact you if we have questions. We might request additional documents from you before we can proceed.

Look For Our Response

When the state agency makes a determination on your case, youll receive a letter in the mail with our decision. It generally takes three to six months for an initial decision. If you included information about other family members when you applied, well let you know if they may be able to receive benefits on your record.

Check The Status

You Must Meet Eligibility Requirements To Receive Ssi Payments

According to Benefit.gov, the SSI benefits program has different criteria than the SSDI program for determining eligibility. Because the funding for SSI benefits comes from the federal governments general funds instead of Social Security taxes, you do not need work credits to qualify for SSI.

You do have to meet the same level of disability as with SSDI. In other words, you must have a severe, long-term medical condition that prevents you from working. The SSA does not count all of your assets or income toward the program limits.

For example, the SSA does include your wages, pensions, and Social Security benefits as income. However, it does not count assistance from the Supplemental Nutrition Assistance Program , previously called food stamps, the majority of home energy assistance program benefits, and shelter you receive from private and nonprofit organizations. Your countable income will reduce your SSI benefits.

Individuals cannot own more than $2,000 in countable resources. The limit for couples is a total of $3,000. The SSA does not count your residence, your car , term life insurance, and burial plots.

Recommended Reading: My Wallet Was Stolen With Social Security Card