Income Taxes And Your Social Security Benefit

Some of you have to pay federal income taxes on your Social Security benefits. This usually happens only if you have other substantial income in addition to your benefits .

You will pay tax on only 85 percent of your Social Security benefits, based on Internal Revenue Service rules. If you:

- file a federal tax return as an “individual” and your combined income* is

- between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits.

- more than $34,000, up to 85 percent of your benefits may be taxable.

Who Doesn’t Have To Pay Into Fica Taxes

Just about everyone contributes to FICA and withholdings. The major exemptions from FICA include:

- Civilian federal government employees hired before 1984.

- Around 25% of state and local government employees with certain pension plans.

- Some on-campus college student employees.

- Some workers in the country with certain types of non-immigrant visa status.

What Is Fica Withheld

FICA is a U.S. federal payroll tax. It stands for the Federal Insurance Contributions Act and is deducted from each paycheck. Your nine-digit number helps Social Security accurately record your covered wages or self- employment. As you work and pay FICA taxes, you earn credits for Social Security benefits.

You May Like: Social Security Administration Twin Cities Card Center

State Taxes On Social Security

Just over half of states, in addition to Washington D.C., either do not collect income tax or do not factor Social Security income into those tax considerations. The remaining states may tax Social Security income, but they don’t all handle taxes the same way. Some of these states will tax up to the same 85% of benefits as the federal government. Others tax Social Security benefits to some extent but offer breaks based on your age and income level.

Consider touching base with a tax professional to determine what, if any, tax breaks you might qualify for locally.

Withholding Taxes For Disability Benefits

If you believe you may need to pay taxes on your disability benefits, you can ask the SSA to withhold a percentage of your monthly payment. This instance works in the same way as an employer withholding taxes from your check. Doing so is not a requirement but may be a good idea if you worry about putting enough aside to pay your taxes at the end of the year.

For a free legal consultation, call

Recommended Reading: Social Security Office East Liberty

How Can I Avoid Paying Taxes On Social Security

Here’s how to reduce or avoid taxes on your Social Security benefit:

Updating Records And Form W

Dont forget to update your payroll records for each employee you over or underwithheld taxes from. If you dont update your records, you will have inaccurate information for creating Form W-2, Wage and Tax Statement.

Lets say you withheld taxes from an employees wages even after they reached the Social Security wage base. As a result, the information on the employees Form W-2 is incorrect. You already sent Form W-2 to the Social Security Administration and need to fix your mistake.

File Form W-2c, Corrected Wage and Tax Statement to fix reporting errors on Form W-2 if you already sent it to the SSA. On Form W-2c, you must enter previously reported information and the correct information.

Dont make things difficult for yourself. Get guaranteed payroll calculations by using Patriots online payroll software. After you enter employee information, well calculate payroll and income taxes. Want to eliminate your depositing and filing responsibilities? Opt for Full Service Payroll and give our payroll services a go. Get your free trial now.

This article has been updated from its original publication date of February 28, 2018.

This is not intended as legal advice for more information, please

Read Also: Attorneys For Social Security Disability

Do You Pay Taxes On Social Security After Age 65

Are Social Security benefits taxable regardless of age? Yes. The rules for taxing benefits do not change as a person gets older. Whether or not your Social Security payments are taxed is determined by your income level specifically, what the Internal Revenue Service calls your provisional income.

Does Irs Tax Social Security

For the 2021 tax year, single filers with a combined income of $25,000 to $34,000 must pay income taxes on up to 50% of their Social Security benefits. If your combined income was more than $34,000, you will pay taxes on up to 85% of your Social Security benefits.

Read Also: Social Security Office Beaumont Texas

How Fica Tax Or Withholding Tax Are Calculated

The amount of tax your employer withholds from your check largely depends on what you put on your Form W-4, which you probably filled out when you started your job. Here are some things to know:

-

Form W-4 asks about your marital status, dependents and other factors to help you calculate how much to withhold. The less you withhold, the less tax comes out of your paycheck.

-

What you put on your W-4 then gets funneled through something called withholding tables, which your employer’s payroll department uses to calculate exactly how much federal and state income tax to withhold.

-

You can change your W-4 at any time. Just , fill it out and give it to your human resources or payroll team.

How To Have Social Security Tax Withheld

Withholding money from your Social Security payment for income tax is not automatic. However, it can easily be initiated by completing the Voluntary Withholding Request Form, W-4V.

The W-4V only allows four choices of voluntary withholding amounts: 7%, 10%, 12%, and 22%. Check with your tax advisor to determine which amount is best for you. You can change the withholding amount, but that requires you to complete and submit a different W-4V.

It is best to find a percentage that works for you without the need to change the percentage each year.

Keep in mind the combined income test amounts are not indexed for COLA , changes.

Without indexing, this could expose more and more of your Social Security benefits to income tax next year.

Recommended Reading: Social Security Break Even Age

Key Actions For Withholding Requirements

For withholding purposes, you need to get the employee’s:

- Total number of exemptions, and

- Any additional withholding amounts the employee requests to have withheld.

You should also withhold income from tips. Tips are considered part of an employee’s pay and must be taken into account when determining withholding. Employees must report tips from any one job totaling $20 or more in any given month to their employers by the 10th day of the following month. You should use this reported amount to calculate withholding by adding the reported tips to the employee’s pay.

Employees must report the above-listed information on a Form M-4 – Employee’s Withholding Exemption Certificate and claim the proper number of exemptions. Employees can change the number of their exemptions on Form M-4 by filing a new certificate at any time if the number of exemptions increases. If the number of exemptions , they need to file a new certificate within 10 days.

If an employee has more than one job, they may claim exemptions only with their principal employer. Employees who receive other income that is not withheld from can ask their principal employer to withhold extra taxes to cover the additional tax that will be due on that income.

Change Your Federal Tax Withholding

PBGC is required to withhold federal taxes from your pension benefit unless you inform us otherwise. You have three options: 1) no withholding 2) withholding a fixed dollar amount or 3) automatic withholding based on your marital status and number of exemptions. If you do not make an election, we automatically withhold federal taxes as if you are a married individual with three exemptions.

You may change your election at any time.

If you decide not to have PBGC withhold taxes or the withholding amount is too low, you may have to pay an estimated tax directly to the Internal Revenue Service. If your estimated tax or withholding amount is too low, you may also have to pay penalties to the IRS.

Do You Want to Change Your Tax Withholding?

Effective July 5, 2022, you will no longer be able to adjust your federal income tax withholding over the phone. There are three options to update your withholding:

- Print PBGC Form 719 available on PBGCs website. You will need to complete, sign, and mail the form to PBGC.

- Call PBGCs Customer Contact Center and ask to have PBGC Form 719 mailed to your home address. Once you receive the form, complete and sign it, and send it to PBGC.

- Set up a MyPBA account via our website. Once your account is set up, youll have the option to update your federal tax withholding.

Heres how to submit your completed form:

| Online: |

State Income Taxes

Don’t Miss: What Are The 3 Types Of Social Security

Should You Have Taxes Withheld From Social Security Check

It isn’t obligatory for you to have taxes withheld from your Social Security benefits. However, many people voluntarily choose to withhold taxes to cover any taxes that may come due. You don’t need to get taxes withheld if this is your only income. However, if you expect a tax bill, according to the above IRS calculation, it’s better to have a part withheld.

The U.S. taxation system is pay-as-you-go, which means that people are required to pay income taxes as they receive their income during the year. If you have underpaid your taxes at the end of the year, you might face a penalty.

#SocialSecurity encourages you not to carry your Social Security card with you every day. Learn how to #GuardYourCard at

Withholding Income Tax From Your Social Security Benefits

You can ask us to withhold federal taxes from your Social Security benefit payment when you first apply.

If you are already receiving benefits or if you want to change or stop your withholding, you’ll need a Form W-4V from the Internal Revenue Service .

You can or call the IRS toll-free at 1-800-829-3676 and ask for Form W-4V, Voluntary Withholding Request.

When you complete the form, you will need to select the percentage of your monthly benefit amount you want withheld. You can have 7, 10, 12 or 22 percent of your monthly benefit withheld for taxes.

Only these percentages can be withheld. Flat dollar amounts are not accepted.

Sign the form and return it to your local Social Security office by mail or in person.

Also Check: When Can You Claim Social Security

How Does Fica Work For Those Who Are Self

Self-employed workers and independent contractors pay both the employer and employee contributions for FICA. This is mandated by the Self-Employment Contributions Act . You can use Schedule SE to figure out how much tax is due on your self-employment net earnings.

The total contribution amounts taken from net earnings are:

- 12.4% Social Security tax: This amount is withheld from the first $142,800 an employee makes in 2021.

- 2.9% Medicare tax.

- 0.9% Medicare surtax: For single filers earning more than $200,000 per calendar year or joint filers earning more than $250,000 per calendar year.

Self-employed workers will pay self-employment tax based on the net income from their business, which is calculated using form Schedule SE. The Social Security Administration uses your historical Social Security earnings record to determine your benefits under the social security program.

Real Tax Experts On Demand With Turbotax Live Basic

Get unlimited advice and an expert final review. Done right, guaranteed.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

You May Like: Free Legal Aid Social Security Disability

Withholding On Social Security Benefits

You can elect to have federal income tax withheld from your Social Security benefits if you think you’ll end up owing taxes on some portion of them. Federal income tax can be withheld at a rate of 7%, 10%, 12%, or 22% as of the tax year 2021. You’re limited to these exact percentagesyou can’t opt for another percentage or a flat dollar amount.

If you’d like the government to withhold taxes from your Social Security income, file Form W-4V, the Social Security Withholding Tax Form. This will let the Social Security Administration know exactly how much tax you would like to have withheld.

How To Calculate Social Security Tax

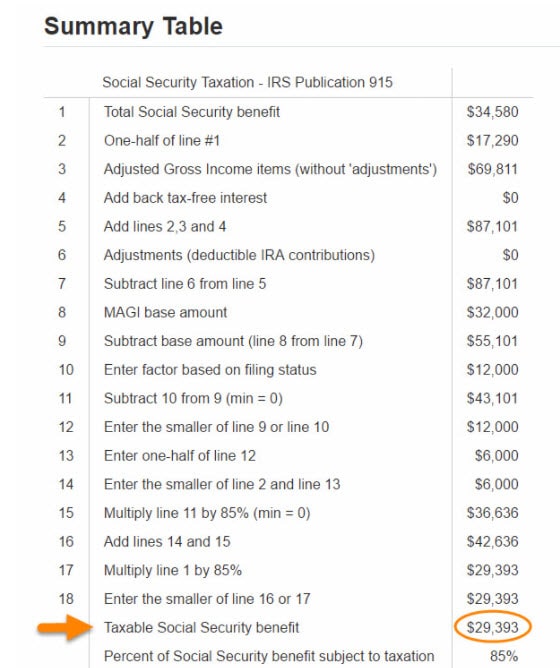

By 1985, the IRS released the Social Security tax formula we follow today. The first important thing to understand is the definition of combined income. Combined income is your adjusted gross income, plus non-taxable interest income, plus 50% of your Social Security payment. See more here.

Once you have calculated your combined income for the year, you can check and see if any of your Social Security benefit will be reported as income. Reference this chart here.

- File a federal tax return as an individual and have your combined income is:

- between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits.

- more than $34,000, up to 85 percent of your benefits may be taxable.

Even at higher income levels, no more than 85% of your Social Security benefit will be reported as income.

This gives Social Security benefits a 15% advantage over money taken from a traditional IRA or similar tax qualified account. In retirement, Social Security dollars go a long way because of this 15% tax free advantage.

You May Like: Social Security Offices In San Antonio

Why Is My Social Security Tax Withheld So High

For tax year 2021, you’ll have excess Social Security withholdings if the sum of multiple employers’ withholdings exceeds $8,853.60 per taxpayer. You don’t need to take any action. We’ll automatically add the excess to your federal refund or subtract it from federal taxes you owe, whichever applies.

When Is Tax Withholding Necessary

Tax withholding is used to pay for any taxes that you may be required to pay. Employers are required by law to deduct a certain amount from employees paychecks to cover taxes that are due.

This is normally income tax, social security contributions and medicare taxes.

For those who receive social security your income will only be taxable if it is above $25,000 for a single person or over $32,000 for a married couple.

Amounts below these levels are not taxable. If you report income amounts above these levels you will be liable for tax on 85% of your benefits.

If you are in receipt of social security benefits then you can ask the Social Security Administration to withhold some of your money when you first apply.

For those who are already getting social security benefits you can request to have tax withholding, or you can change the amount or stop the withholding altogether.

Tax withholding on social security is completely voluntary and is in no way compulsory.

When you request tax withholding on your benefit you will need to specify what percentage you wish to have withheld.

The choices are 7%, 10%, 12% or 22% of your monthly benefit. Only these amounts can be withheld and there is no facility for having flat dollar amounts withheld for tax purposes.

There are tax withholding calculators available so that you can accurately assess how much of your social security benefits you need to have withheld.

Recommended Reading: Social Security Office Sikeston Mo

Choosing Income Tax Withholding Preferences

To change your withholding, complete the following steps: