Medicare Premiums See A Rare Decrease

Senior citizens will also see their Medicare Part B premiums drop in 2023, the first time in more than a decade that the tab will be lower than the year before, the Centers for Medicare and Medicaid Services announced last month.

Its only the fourth time that premiums are set to decline since Medicare was created in 1965.

This is a once-in-a-retirement event, said Johnson. We have a historically high COLA, and at the same time, Part B premiums are going down next year.

The standard monthly premiums will be $164.90 in 2023, a decrease of $5.20 from 2022.

The reduction comes after a large spike in 2022 premiums, which raised the standard monthly premium to $170.10, up from $148.50 in 2021.

A key driver of the 2022 hike was a projected jump in spending due to a costly new drug for Alzheimers disease, Aduhelm. However, since then, Aduhelms manufacturer cut the price and CMS limited coverage of the drug.

Also, spending was lower than projected on other Part B items and services, which resulted in much larger reserves in the Part B trust fund, allowing the agency to limit future premium increases.

The combination of the large Social Security adjustment and the reduction in Medicare premiums for 2023 will give seniors more peace of mind and breathing room, said Kilolo Kijakazi, acting commissioner of the Social Security Administration.

How Workers Can Get Estimates Of Benefits

The Social Security Administration provides benefit estimates to workers through the Social Security Statement. The Statement can be accessed online by opening an online account with SSA called my Social Security. With that account, workers can also construct “what if” scenarios, helping them to understand the effect on monthly benefits if they work additional years or delay the start of retirement benefits. The my Social Security account also offers other services, allowing individuals to request a replacement Social Security card or check the status of an application.

A printed copy of the Social Security Statement is mailed to workers age 60 or older.

In 2021, SSA began producing Retirement Ready fact sheets, available online and as part of the online Statement, that tailor retirement planning information to different age groups .

SSA also has a Benefits Calculators web page with several stand-alone online calculators that help individuals estimate their benefits and prepare for retirement. These include benefit calculators for spouses, calculators for persons affected by the Windfall Elimination Provision or the Government Pension Offset and calculators to determine a person’s full retirement age or the effect of the earnings test on benefits.

SSA also provides a life expectancy calculator to help with retirement planning.

Why Is There So Much Interest In The Cola

Social Security is Americans only universal retirement benefit nearly all retirees receive it, so interest in the annual adjustment is always high. And the COLA is one of Social Securitys most valuable features because it holds benefits steady against the erosion of rising prices.

Inflation consistently surfaces in surveys as one of the top worries of retirees and the COLA sets Social Security apart from other retirement benefits. For example, private-sector pension plans generally do not have COLAs, although they are built into most state and local government pension plans.

And theres no cap, said Nancy Altman, president of the advocacy group Social Security Works. If inflation goes up 20 percent, you get a 20 percent increase.

Living costs and inflation rates vary considerably around the country, and that means a Social Security check goes farther in some regions than in others. The Elder Index shows that the average benefit covers 90 percent of living costs in rural West Virginia but just 38 percent in San Francisco.

Rising housing costs can be a major problem for seniors especially those who rent. Asking rents rose 12 percent nationally last year, and increases exceeded 20 percent in some regions of the West and South, according to the Joint Center for Housing Studies at Harvard.

Read Also: Customer Service Number For Social Security

What Is The Average Social Security Benefit At Age 62

Read: 7 Surprisingly Easy Ways To Reach Your Retirement Goals

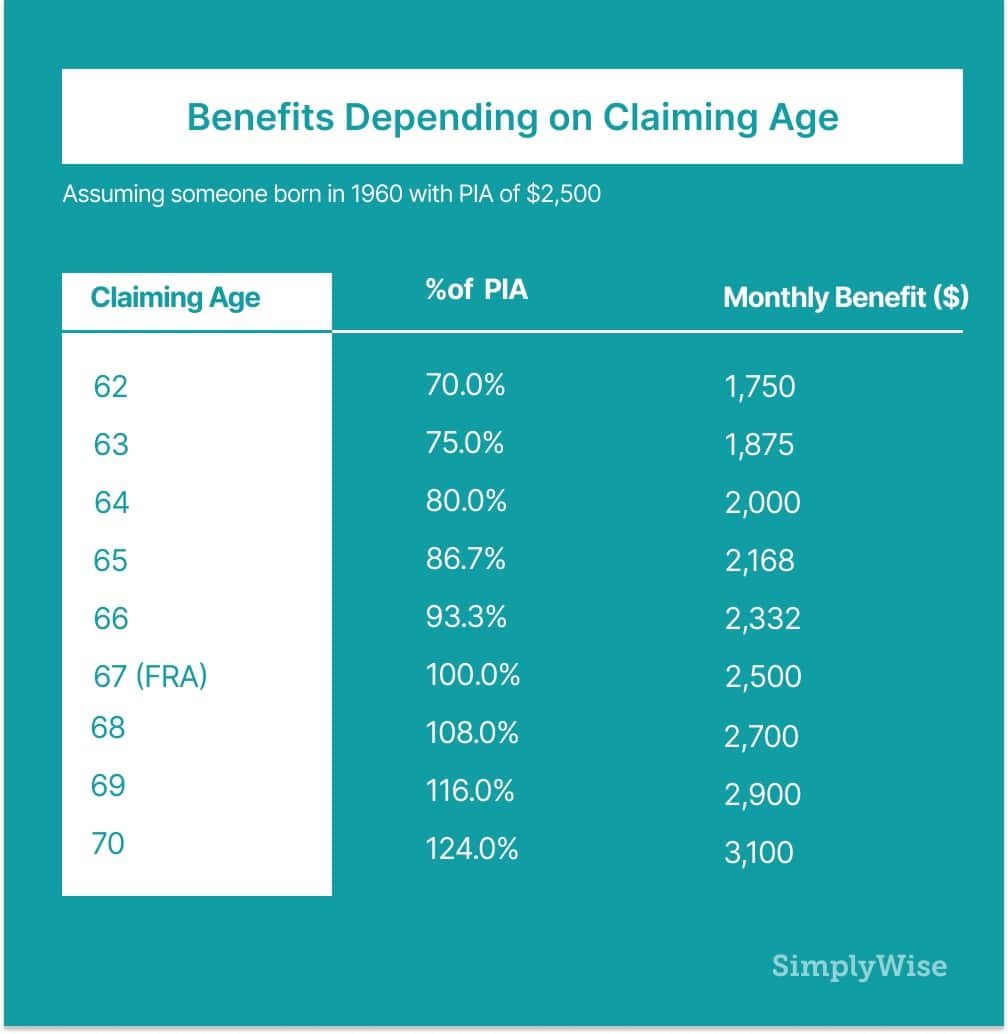

According to the Social Security Administration , if you were born between 1943 and 1954, your full retirement age is 66. By claiming at the age of 62, a hypothetical $1000 retirement benefit would be reduced by 25% and you would only receive $750 per month. A $500 monthly spousal benefit would be reduced to $350.

Take Our Poll: Whats the Table Time Limit on a $400 Restaurant Meal?

The greater the gap between age 62 and FRA, the higher the percentage of reduction in retirement benefits. For those born in 1960 or later, retirement benefits are reduced by 30% and spousal benefits are reduced by 35%. This means a $1000 retirement benefit would be reduced to $700 per month.

According to the SSAs 2021 Annual Statistical Supplement, the monthly benefit amount for retired workers claiming benefits at age 62 earning the average wage was $1,480 per month for the worker alone. The benefit amount for workers with spouses claiming benefits was $2,170 at age 62.

Although claiming before FRA allows you to collect retirement benefits for a longer period of time, your benefit amount will be significantly reduced. The SSA says that if you delay your benefits until after FRA, you will be eligible for delayed retirement credits that would increase your monthly benefit.

More From GOBankingRates

Continuing To Work May Reduce Your Benefits

Another consideration when determining whether to take Social Security benefits before your full retirement age is that your work activity during this time may decrease your benefit payments.

After you reach your full retirement age, you can earn as much as you like and still receive your full Social Security benefits. However, the rules for how work affects your benefits are complicated if you would like to work while receiving benefits, you should contact the Social Security Administration before making any decisions.

Note: You should apply for Medicare at age 65, even if you decide to continue working. If youre still working, you might need just Part A of Medicare your local Social Security office can tell you whether taking Part B is a good idea. In some cases, waiting to apply will result in higher premiums.

Generally, Social Security recipients who have not yet reached full retirement age will see their benefits reduced by $1 for every $2 they earn over an annual limit. Once recipients reach the year in which they attain their full retirement age, the reduction changes to $1 for every $3 they earn over a different limit. Once recipients reach the month and year of full retirement age, there is no limit on work activity.

Don’t Miss: Social Security Office In Madison Tennessee

When You Start Collecting Social Security Matters

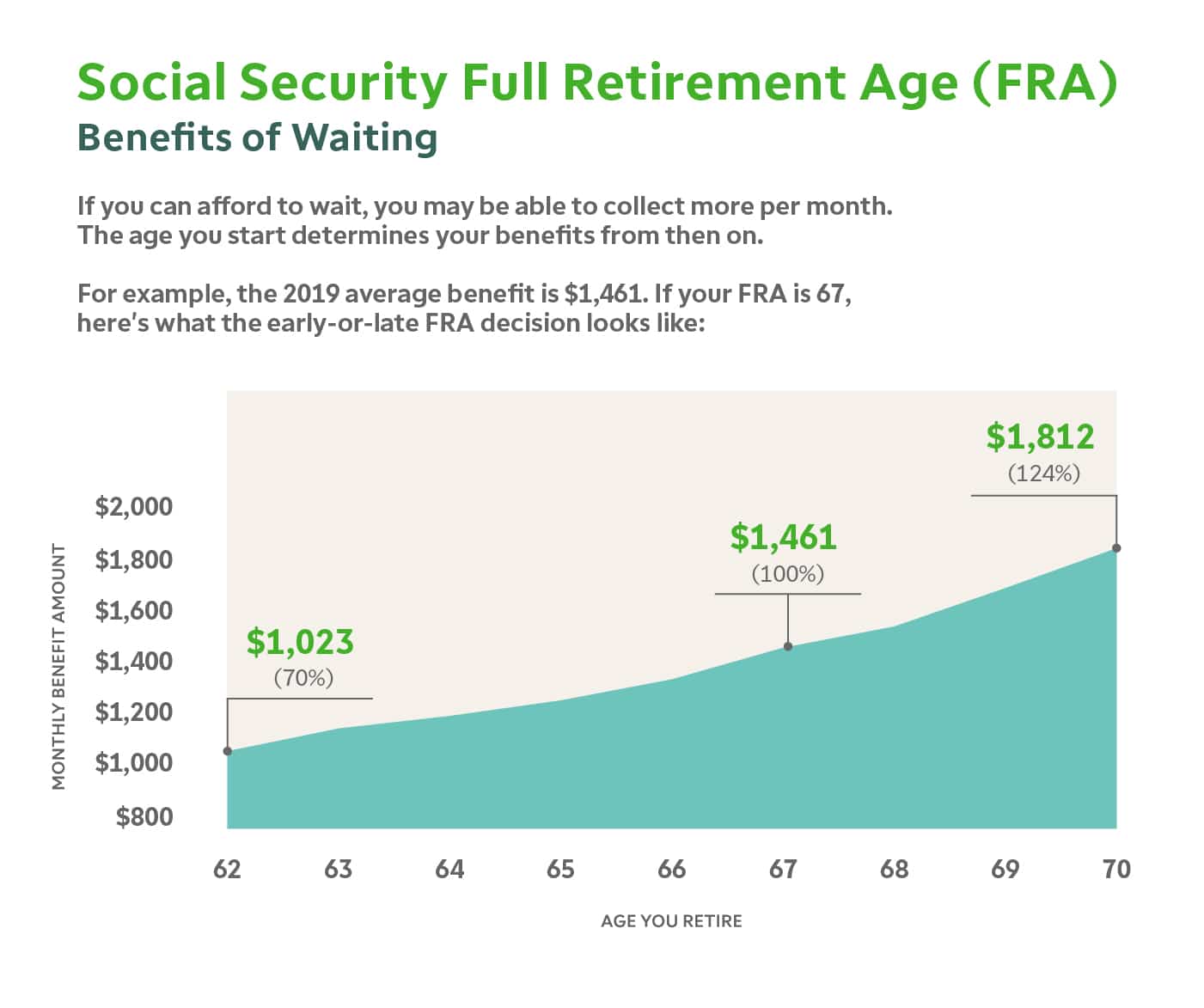

The age you begin receiving your retirement benefit affects how much you will receive in monthly Social Security benefits.

There are three factors about when you retire that affect the benefits you receive:

Full Retirement Age

Full retirement age, or FRA, is the age when you are entitled to 100 percent of your Social Security benefits.

Depending on the year you were more, your Social Security full retirement age is between age 65 and 67.

Claiming Social Security benefits before the full retirement age will lower your monthly payments.

You can increase your retirement benefits by waiting past your FRA to retire.

Early Retirement Age

You can start receiving your Social Security retirement benefits as early as age 62.

However, your benefit amount will be cut. Thats because you are collecting benefits earlier than your full retirement age .

Delayed Retirement Age

When you delay benefits beyond your full retirement age, the amount of your retirement benefit will continue to increase up until age 70.

There is no incentive to delay claiming your Social Security benefits after age 70.

How Does Full Retirement Age Affect Your Social Security Benefits

If you claim your benefits at full retirement age, you will receive your standard Social Security benefit amount. If you claim prior to FRA, you will be subject to early filing penalties that reduce your benefit by the following amounts:

- 5/9 of 1% for each of the first 36 months before FRA

- 5/12 of 1% for each subsequent month before FRA

This amounts to a 6.7% annual reduction for each of the first three years and an additional 5% reduction for each following year before FRA. If you claim benefits at 62 with an FRA of 67, you will face a full 30% reduction in benefits.

By contrast, if you claim benefits after FRA, you receive delayed retirement credits valued at 2/3 of 1% per month. This results in an 8% annual increase to your monthly benefit. Delayed retirement credits can be earned until age 70, after which time there is no financial benefit to delaying your claim. Delayed retirement credits cannot be earned if you are claiming either spousal or survivor benefits.

You May Like: Social Security Office Lancaster California

Set Your Alarm: Here’s When Social Security’s Cost

The easiest way to think about Social Security’s COLA is as a mechanism designed to take into account the effects of inflation — the rising price of goods and services. If it costs more to buy the same amount of goods and services from one year to the next, ideally, Social Security checks increase by the same amount so retired workers don’t lose purchasing power. COLA is the “raise” passed along most years to program recipients that factors in inflation.

Prior to 1975, Social Security’s cost-of-living adjustments were completely random and passed by special legislative sessions of Congress. But over the last 47 years, the Consumer Price Index for Urban Wage Earners and Clerical Workers has been the program’s annual inflationary tether. The CPI-W has a long list of major and minor spending categories, each of which have their own respective percentage weightings. These weightings allow the CPI-W to be expressed as a single figure, which can easily be compared to the previous month or year to determine if prices for a predetermined basket of goods and services have risen or fallen.

To calculate Social Security’s COLA, the average CPI-W reading from the third quarter of the current year is compared to the average CPI-W reading from Q3 of the previous year. Since the September inflation data hasn’t been released yet, we don’t have the final puzzle piece needed to concretely calculate the cost-of-living adjustment for 2023.

Early Benefits Can Still Pay Off

However, taking early benefits can still pay off despite the reduced monthly check. But youll want to be sure you budget for a reduced benefit.

No one can predict how long youll live, but if youre facing a potentially significant reduction in life expectancy and are short of income, taking Social Security early may be appropriate, Neiser says.

Married women are also good candidates for claiming early benefits because they are likely to outlive their husbands. Those widows then become eligible to receive the greater of either their benefit or their late husbands benefit.

However, this scenario works only if the husband does not claim his benefits early. By not claiming early benefits, the husband effectively increases the monthly benefit his wife eventually receives. So, youll want to calculate how filing early will affect your spousal benefit here.

Don’t Miss: Social Security Offices In Chicago

The Ssa Has Announced An 87 Percent Cola That Will Be Applied To Social Security Benefits Starting In January 2023

Consumers are paying 8.2 percent more on food, energy, and shelter than they were a year ago, and for those on a fixed income, like Social Security, keeping ones head above water has become increasingly difficult.

To help seniors and other beneficiaries keep up with inflation, the Social Secuirty Administration offers a yearly Cost-of-living adjustment which this year will hit 8.7 percent.

#BREAKING! About 70 million Americans will get a 8.7% increase in monthly #SocialSecurity benefits and #SSI payments in 2023. Check our blog for more information: #COLA#2023COLA

Social Security

This is one of the largest on record and will bump the average benefit from $1,666.49 to $1,808,14.

The SSA has said that the bonus in benefits will bump up the average payment by around $140.

Retirees Are Expected To Get The Biggest Social Security Cost

Social Security will soon announce the largest inflation adjustment to benefits in four decades a welcome development for millions of older Americans struggling to keep up with fast-rising living costs.

The cost-of-living adjustment for 2023 is likely to be around 8.7 percent, based on the latest government inflation figures. The final COLA, as the adjustment is known, will be released Thursday, when the federal government announces inflation figures for September. Medicare enrollees can anticipate some additional good news: The standard Part B premium, which is typically deducted from Social Security benefits, will decline next year.

The COLA, one of Social Securitys most valuable features, will give a significant boost to more than 70 million Americans next year. While retirement comes to mind when most people think about Social Security, the program plays a much broader role in providing economic security.

In August, the program paid benefits to 52.5 million people over age 65, but younger beneficiaries survivors of insured workers and recipients of disability benefits and Supplemental Security Income, the program for very low income people added 17.9 million people to the total, according to Social Security Administration data.

With an eye-popping COLA on the horizon, The New York Times examined the back story of Social Securitys inflation adjustment how it works, how it could be revised and how it affects pocketbooks.

Also Check: What Is The Social Security Phone Number

Fraud In The Acquisition And Use Of Benefits

Given the vast size of the program, fraud sometimes occurs. The Social Security Administration has its own investigatory unit to combat and prevent fraud, the Cooperative Disability Investigations Unit . The Cooperative Disability Investigations Program continues to be one of the most successful initiatives, contributing to the integrity of SSA’s disability programs. In addition when investigating fraud in other SSA programs, the Social Security Administration may request investigatory assistance from other law enforcement agencies including the Office of the Inspector General as well as state and local authorities.

Are Social Security Benefits Taxable At Full Retirement Age

Your age does not have an impact on whether you will owe tax on Social Security benefits. Depending on your earnings, you may pay federal taxes on Social Security benefits regardless of the age at which you claim.

Social Security benefits are taxed on amounts exceeding the “provisional income” limit set by the IRS. To calculate your provisional income, add up all non-Social Security sources of income, including nontaxable income such as municipal bond interest, and include half of your annual Social Security income.

Single filers earning provisional income between $25,000 and $34,000 and married joint filers earning between $32,000 and $44,000 will owe income taxes on 50% of their Social Security benefits. For single filers with provisional income above $34,000 and married filers above $44,000, up to 85% of Social Security benefits will be taxable.

Recommended Reading: National Committee To Preserve Social Security And Medicare

Fact #: Social Security Benefits Are Modest

Social Security benefits are much more modest than many people realize the average Social Security retirement benefit in January 2022 was about $1,614 per month, or about $19,370 per year. For someone who worked all of their adult life at average earnings and retires at age 65 in 2022, Social Security benefits replace about 37 percent of past earnings. Social Securitys replacement rate fell as the programs full retirement age gradually rose from 65 in 2000 to 67 in 2022.

Most retirees enroll in Medicares Supplementary Medical Insurance and have Part B premiums deducted from their Social Security checks. As health care costs continue to outpace general inflation, those premiums will take a bigger bite out of their checks.

Social Security benefits are also modest by international standards. The U.S. ranks just outside the bottom third of developed countries in the percentage of an average workers earnings replaced by the public pension system.

Social Security is important for children and their families as well as for older adults. Over 6.5 million children under age 18 lived in families who received income from Social Security in 2019. That number included nearly 2.8 million children who received their benefits as dependents of retired, disabled, or deceased workers, as well as others who lived with parents or relatives who received Social Security benefits.

Social Security lifted 1.1 million children above the poverty line in 2020, as the chart shows.

Can You Collect Social Security At 66 And Still Work

Yes. You can work while you receive Social Security retirement or survivors benefits.

When you reach your full retirement age, you can work and earn as much as you want and still get your full Social Security benefit payment.

However, if you start collecting benefits before your full retirement age, say at age 62, and if your earnings exceed the earnings limit, some of your benefit payments during the year will be withheld.

When you reach full retirement age, Social Security will pay you a higher monthly benefit.

Note that if you turn 62 in 2022, your full retirement age is 67.

Also Check: Social Security Office Decatur Alabama

Trends In Social Security Claiming

IB#15-8

The briefs key findings are:

- Over the past 25 years, the average retirement age for U.S. workers has been rising, a trend that should align with when people first claim Social Security.

- But the percentage of all initial claimants who are age 62 shows little change until recently.

- A better metric to capture claiming behavior over time when the population is aging is the percentage of workers turning age 62 who claim at 62.

- This measure, based on unpublished Social Security data, shows a steep decline in claiming at 62 since the mid-1990s: from 56 percent to 36 percent for men.

- In short, while more than a third of workers still claim right away, a growing number are waiting until their mid-60s or later.