Report Your Social Security Number Theft To The Irs

Once your social security number has been stolen, you don’t merely have to worry about credit card fraud. Unfortunately, you may also become a victim of tax-related identity theft.For this reason, you shouldn’t delay contacting the IRS to let them know that your social security number may be at risk.

The IRS will be able to advise you on what to do if:

- Your online tax return is refused, because someone else has already filed a return using your social security number

- You didn’t receive the tax refund you were expecting

- You’re being asked to pay taxes on wages received from an employer you didn’t work for

You can report social security number theft to the IRS online by following these directions or by calling 1-800-908-4490.

Contact The Ssa To Block Electronic Access

- Do this by calling the SSA at 1-800-772-1213 , or the Teletypewriter number at 1-800-325-0778.

- Once you request a block, nobody can access your Social Security record â not even you. It will be impossible for anybody to view or edit any information on the record until you contact the SSA to remove the block.

Contact The Social Security Fraud Hotline

When you submit a fraud report through the Social Security fraud hotline, the Office of Inspector General will review and investigate the alleged fraud.

Hereâs how:

- Contact the OIG fraud hotline at 1-800-269-0271.You can also submit a fraud report to the OIG via their online submission portal.

- Indicate that your SSN was stolen and might be at risk. Provide as much information as possible, including your reports from the police and FTC.

- Remember that federal regulations prevent law enforcement agencies, including the OIG, from sharing information about investigations.

Also Check: Social Security Break Even Calculator Aarp

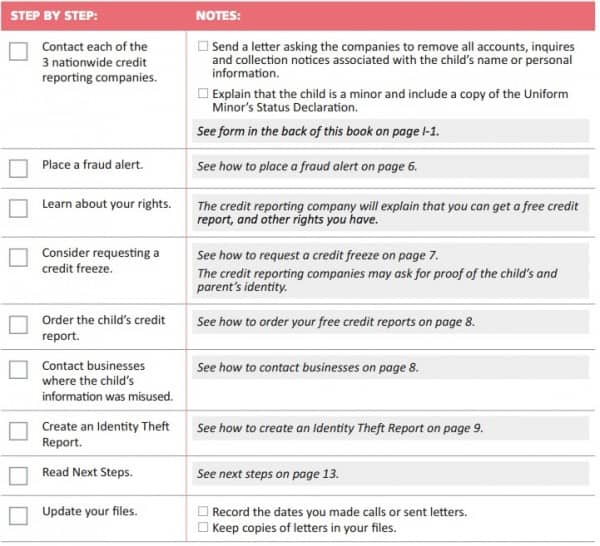

Fraud Alerts For Children And How To Check Your Childs Credit Report

Children are among the most common victims of identity theft. Unfortunately, many parents may not realize their childrens information has been stolen and misused until their children become adults and check their credit for the first time. Additionally, many children have their identity stolen and misused by adult family members or friends, making the issue much worse.

If your minor child has a credit report, this is a giant red flag and a good indication of child identity theft!

Simply put, you wont know whether or not your need to be concerned about child identity theft until your check to determine if your child has a credit report, and examine what information is on it. And even if you dont find any report, it may be a good idea to create one and then place a credit freeze on that report to prevent misuse in the future.

Minors aged 14-17 can contact any of the credit reporting agencies to check their own credit report. Parents of children under the age of 18 can do this at any time as well.

Active Military Fraud Alert

The active duty alert is designed for members of the military who have been stationed overseas for an extended period of time. Deployed service members are can place this type of credit alert on their credit to help reduce the risk of identity theft.

To get an active duty alert on your credit report, you will need to follow the same steps as with getting an initial or extended fraud alert but ask for the active duty alert instead.

Active military fraud alerts last for 1 year until re-instated. However, this fraud alert also removes your name from prescreened credit card marketing offers for 2 years.

Also Check: Social Security Office Hammond La

What Is Identity Theft

Identity theft occurs when a person knowingly transfers or uses, without lawful authority, a means of identification of another person with the intent to commit or to aid or abet any unlawful activity ). It is one of the fastest growing segments of financial crime in America. According to a study by Javelin Strategy & Research, 42 million Americans were victims of identity theft in 2021, costing consumers $52 billion in total losses.

Consider Taking The Following Actions

-

Contact any of the three credit reporting agencies and ask that a free fraud alert be placed on your credit report. Also ask for a free credit report. You only need to contact one of the three agencies because the law requires the agency you call to contact the other two.

-

TransUnion 1-888-909-8872

Once you have a fraud alert on your credit report place, a business must verify your identity before it issues new credit in your name. The alert remains active for a year and can be renewed by you for up to seven years.

-

Change the passwords, pin numbers, and log in information for all of your potentially affected accounts, including your email accounts, and any accounts that use the same password, pin, or log in information.

-

Contact your police department, report the crime and obtain a police report.

-

Go to the webpage of the Federal Trade Commission, report the ID theft and create an identity theft recovery plan: IdentityTheft.gov

A security freeze is different from a fraud alert. Once your report is frozen, the credit reporting agency cannot release it without your prior express approval . Under federal law, a security freeze is free, and obtaining one will not affect your credit score. To obtain a freeze, you must contact each of the credit reporting agencies and comply with their requirements. The agency must place the freeze within one business day, and if you request the freeze be lifted, they must do so within one hour. Learn more at their websites below:

Don’t Miss: Social Security Office In Sioux City Iowa

How Does Social Security Identity Theft Happen

There are several ways an SSN can end up with a thief. Some involve physical theft, and others can take the digital route. To what extent are SSNs at risk? Notably, there was the Equifax breach of 2017, which exposed some 147 million SSNs. Yet just because an SSN has been potentially exposed does not mean that an identity crime has been committed with it.

So, lets start with the basics: how do SSNs get stolen or exposed?

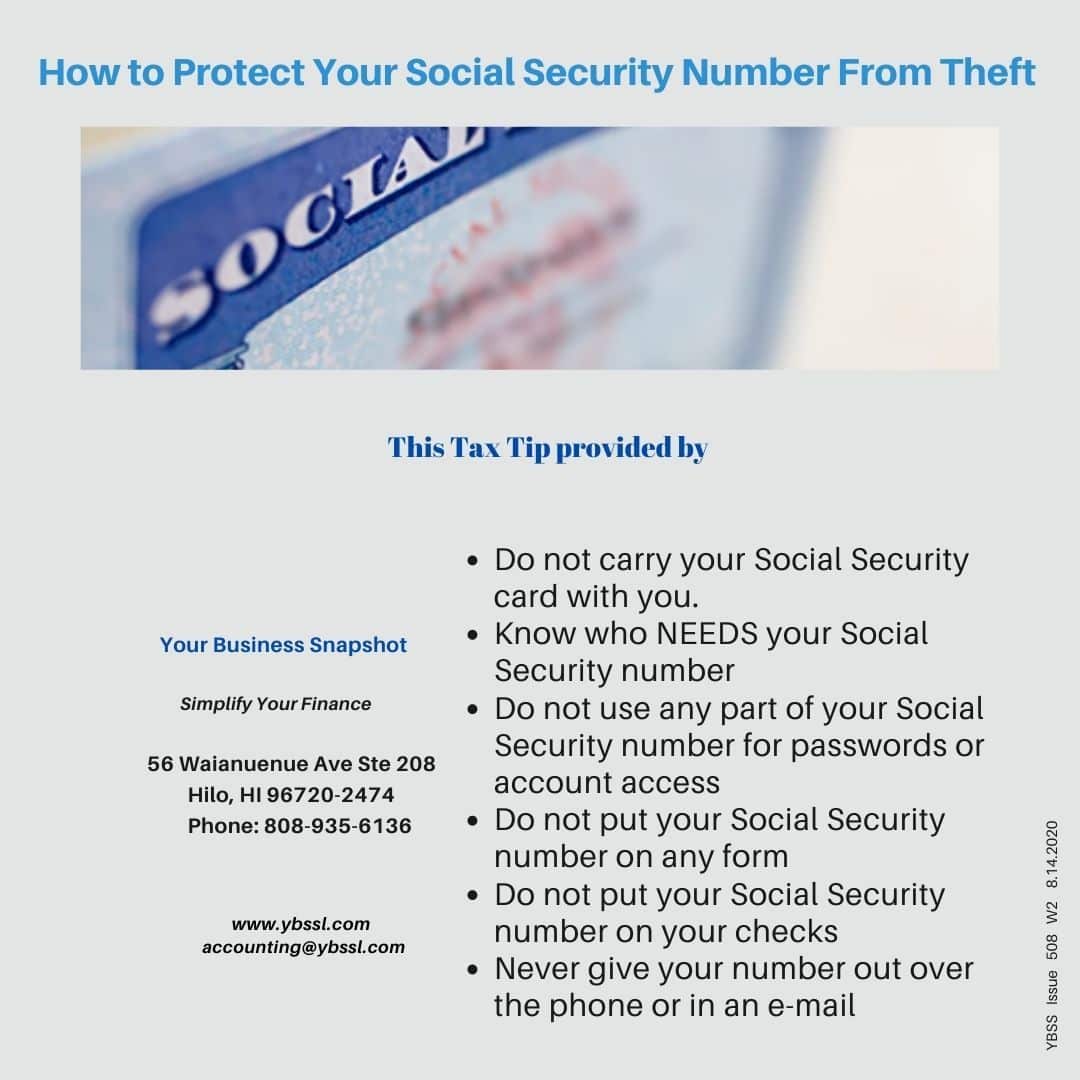

Thats quite the list. Broadly speaking, the examples above give good reasons for keeping your SSN as private and secure as possible. With that, its helpful to know that there are only a handful of situations where your SSN is required for legitimate purposes, which can help you can make decisions about how and when to give it out. The list of required cases is relatively short, such as:

- When applying for credit or a loan.

- Transactions that require IRS notification, like working with investment firms, real estate purchases, auto purchases, etc.

- Registering with a business as a full-time or contract employee .

Your Most Unique Identifier Calls For Extra Care And Protection

Of all the forms of identity theft, the theft of a Social Security Number is certainly one of the most potentially painful because it can unlock so many vital aspects of your life. Its uniquely you, even more than your name alone at least in the eyes of creditors, banks, insurance companies, criminal records, etc. Your SSN calls for extra protection, and if you have any concerns that it may have been lost or stolen, dont hesitate to spring into action.

Try Identity Theft Protection

Get alerts up to 10 months ahead of similar services, if we detect that your info was stolen

Don’t Miss: When Does Social Security Disability Convert To Regular Social Security

Should You Contact Local Law Enforcement Directly

Although the IC3 will direct your complaint to the appropriate regulatory agencies, they encourage you to contact local law enforcement directly if you have a complaint that’s time-sensitive.

Some credit card companies won’t dismiss fraudulent charges until you’ve filed a police report. Therefore, taking the time to contact your local police department, in addition to the IC3, may be in your best interest.

Social Security Identity Theft Explained And How Donotpay Can Help

Identity theft has become a prevalent issue and one of the fastest-growing crimes in the United States. An identity thief can use your social security number to get other personal data about you and use that data to impersonate you and possibly access your financial information.

Social security identity theft is a real thing, and most people don’t always know that someone else is using their SSN until it is too late. Someone using your social security pin and impersonating you can cause you many problems, both legally and financially.

This post discusses social security identity theft and how DoNotPay can help protect your identity from being stolen.

Recommended Reading: Wichita Falls Social Security Office

Signs That You May Be A Victim Of Social Security Identity Theft

Unfortunately, there’s no easy way to check if you’re a victim of social security number identity theft. A hacker can abuse your SSN for months without you realizing it. Most people only become aware that someone else is using their SSN when they are turned down for credit or receive calls from unknown creditors for payment for items they never bought.

Here are some common indicators that you may be a victim of social security identity theft:

Signs That You May Be A Victim Of Identity Theft

There are several signs that you may have been the victim of identity theft. Some of these signs include:

- You receive suspicious emails or texts asking for your personal or financial information.

- Someone has opened new accounts in your name without your knowledge or consent.

- Your credit score has dropped significantly due to fraudulent activity.

- You’re receiving harassing telephone calls.

- A stranger shows up at your home claiming to be from the IRS or another government agency.

- An unknown person has applied for a loan or mortgage in your name.

- Unauthorized charges appear on your bank statement.

- Any of the above issues repeatedly happen over time.

Recommended Reading: Social Security Office Columbus Georgia

What To Do If Thieves Keep Targeting Your Ssn

If youâre in a situation in which someone is repeatedly using your SSN, you need to contact the SSA to stop the fraud. Here are some ways to get in touch with the SSA:

- Locate your nearest SSA office and make an appointment.

- Send written requests to this address: Social Security Administration, Office of Public Inquiries and Communications Support, 1100 West High Rise, 6401 Security Blvd., Baltimore, MD 21235.

Take 5 Steps For Better Online Security

In addition, its important to strengthen your online security to help avoid all types of online scams. Take action to improve your digital posture by following these steps:

Recommended Reading: South Jordan Social Security Office

Protect Your Information From Scammers Online And On Your Phone

If you use tax preparation software like TurboTax, TaxAct, or TaxSlayer, use multi-factor authentication. Multi-factor authentication offers extra security by requiring two or more credentials to log in to your account. The additional credentials you need to log in to your account fall into two categories: something you have like a passcode you get via text message or an authentication app, or something you are like a scan of your fingerprint, your retina, or your face. Multi-factor authentication makes it harder for scammers to log in to your accounts if they do get your username and password.

Dont give your personal information to someone who calls, emails, or texts and says theyre with the IRS. It could be a scammer impersonating the IRS to steal your information or money. If you need to contact the IRS, call them at 1-800-829-1040.

How To Prevent Identity Theft

Preventing identity theft is all about implementing strict security best practices to guide how you handle your personal and financial data. Here are some quick tips for setting you on the right path:

| Set strong passwords and keep them secret | Never share your password with anyone, including family members. If you suspect that your password has been compromised, change it immediately. |

| Keep an eye out for any suspicious activities on your credit reports | These activities include unauthorized purchases, late payments, and collection notices. |

| Keep your computer safe | |

| Be wary of unsolicited email messages and text messages | Requesting your personal or financial information, especially if they come from unfamiliar sources. |

| Never give out your personal or financial information to strangers | If you get a call from someone claiming to be from the SSA or another government agency, hang up immediately. |

| Report identity theft to the social security administration | If you suspect that your identity has been stolen, contact the social security administration immediately. This will help stop crime before it escalates. |

Also Check: Extra Help From Social Security

Identity Theft: What You Need To Know

Identity theft cases surged in New York State in 2020, inflicting financial losses on individuals and threatening disruption to government programs as well as private financial institutions, according to Federal Trade Commission . Read the May 2021 New York State Comptroller’s report The Increasing Threat of Identity Theft to learn more

Thieves with access to personal information Social Security number, birth certificate, PIN or credit card numbers, even pre-approved credit card solicitations can steal your identity and apply for credit in your name, racking up huge debts without you even knowing that it has happeneduntil its too late. Identity thieves also use individuals personally identifiable information for a variety of other purposes, including fraudulently obtaining medical services, unemployment insurance, prescription drugs or medical insurance coverage. To protect yourself, follow these suggestions:

Safeguard Your Personal Information:

Protect Your Bank Accounts and Your Mail:

Protect Yourself on the Internet and Protect Your Computer:

- If you must use a public computer, confirm first that it is not running a desktop search engine and that the proprietor has denied users administrative privileges so they can’t install any programs that might be used to capture your emails or passwords.

If You Are a Victim of Identity Theft:

Understanding Social Security Fraud

According to the SSA, “Fraud involves obtaining something of value through willful misrepresentation. In the context of our programs, fraud exists when a person with intent to defraud makes, or causes to be made, a false statement or misrepresents, conceals or fails to disclose a material fact for use in determining rights under the Social Security Act.”

The Social Security Act is what grants you Social Security rights, including things like Social Security benefits. Types of fraud can include:

-

Buying or selling Social Security cards

-

Filing a claim for unemployment benefits, tax returns, Social Security benefits, or other types of benefits using another person’s SSN

-

Collecting Social Security funds on behalf of someone whos deceased

-

Impersonating an employee of the SSA

-

Making false statements on claims submitted to the SSA

-

Misusing the benefits of a representative payee

-

Concealing information that affects benefit eligibility

If you discover that you are the victim of Social Security fraud, there are a few things you’ll want to do to help protect your assets and prevent the identity thief from using your information in the future.

Also Check: How Do I Apply For Social Security Online

Is There An Easier And Faster Way To Deal With Identity Theft

If you wish to bypass the lengthy and tedious DIY process and report your SSA identity theft quicker and more conveniently, DoNotPay has your cover! And the best part? You simply need to complete a simple three-step procedure and let DoNotPay take care of the rest. The steps are as follows:

And that’s it. DoNotPay will make sure your issue gets sent to the right place. We’ll upload confirmation documents to your task for you to view, and if the contacts need more information, they will reach out to you personally via email or mail.

Proactive Financial Management Can Put You On The Path To Success

When it comes to financial management, being proactive can put you on the path to success. Regularly monitoring your credit reports, credit card statements and other personal data can help protect your sensitive information.

The sooner you’re able to catch identity theft, the easier it is to reverse any damage that has been done. If you do happen to be the victim of identity theft, you need to know things like how to report Social Security fraud.

Of course, identity monitoring is just one component of financial management. There are others, like paying down credit card debt and working toward your savings goals. If you’re looking for the latest financial management tips and tricks, be sure to. The newsletter is delivered straight to your inbox and can help you stay up to date with the latest financial information.

To get the benefits of a Tally line of credit, you must qualify for and accept a Tally line of credit. The APR will be between 7.90% and 29.99% per year and will be based on your credit history. The APR will vary with the market based on the Prime Rate. Annual fees range from $0 – $300.

Recommended Reading: Social Security Phone Number For Medicare