What Is The Extra Deduction For Over 65

If you are age 65 or older, your standard deduction increases by $1,700 if you file as Single or Head of Household. If you are legally blind, your standard deduction increases by $1,700 as well. If you are Married Filing Jointly and you OR your spouse is 65 or older, your standard deduction increases by $1,350.

Medicare Part C Costs

Beneficiaries of Part C, also called Medicare Advantage, have to pay the Part B premium as well as a monthly premium, although a good number of Advantage plans donât charge a monthly premium, and they generally have lower costs than traditional Medicare plans.

The average monthly premium for Medicare Advantage plans in 2022 has decreased to $19.

Also Check: Social Security Office In Poteau Oklahoma

How Do Medicare And Social Security Work Together

Youll get Medicare automatically if youre already receiving Social Security retirement or SSDI benefits. For example, if you took retirement benefits starting at age 62, youll be enrolled in Medicare three months before your 65th birthday. Youll also be automatically enrolled once youve been receiving SSDI for 24 months.

Youll need to enroll in Medicare if you turn 65 but havent taken your Social Security benefits yet. The Social Security Administration and Medicare will send you a Welcome to Medicare packet when youre eligible to enroll. The packet will walk you through your Medicare choices and help you enroll.

SSA will also determine the amount you need to pay for Medicare coverage. You wont pay premiums for Part A unless you dont meet the coverage rules discussed above, but most people will pay a premium for Part B.

In 2020, the standard premium amount is $144.60. This amount will be higher if you have a large income. Social Security uses your tax records to determine the rates you need to pay.

If you make more than $87,000 a year, SSA will send you an Income-Related Monthly Adjustment Amount . Your IRMAA notification will tell you the amount above the standard premium you need to pay. Youll also be responsible for an IRMAA if you choose to buy a separate Part D plan and you make over $87,000.

Also Check: Social Security Office In Victoria Texas

You Still Have To Pay Into The System

InvestopediaForbes AdvisorThe Motley Fool, CredibleInsider

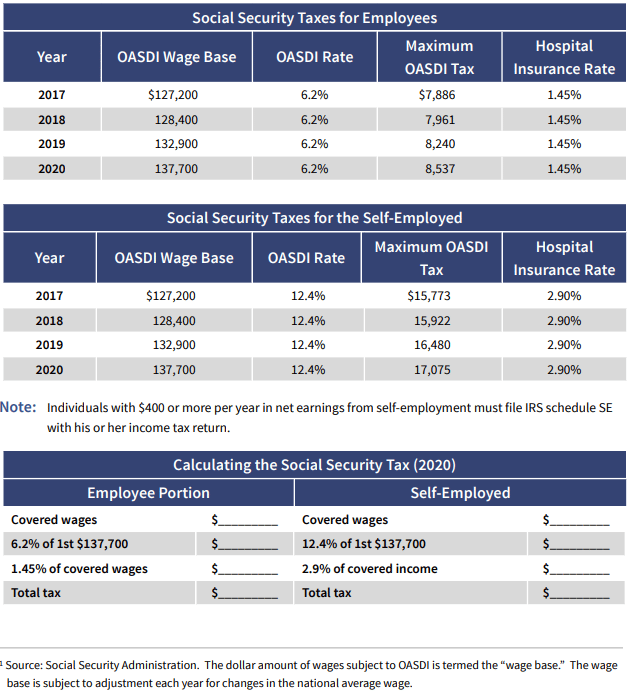

When you work for someone else, that employer takes Social Security taxes out of your paycheck and sends the money to the Internal Revenue Service . But things work a little differently for people who are self-employed. If you fall into this category, keep reading. This article will help you understand how to calculate the Social Security taxes you owe.

Recommended Reading: How To Sign Up For Medicare Online

The Five Ways To Pay For Medicare

There are several ways to pay for Medicare premiums. They accommodate the preferences and user situations by offering several modes in addition to online bill pay.

- Automatic deductions from Social Security

- Automatic payment from a bank accounts online bill pay service

- Medicare Easy Pay is a free service from Medicare that deducts the payment from the members bank account on an agreed date of the month.

- Medicare offers the paper mail method for payments. The pre-addressed coupon directs the check to the Medicare Premium Collection Center.

You May Like: Social Security Office Queens Ny

Automatic Deduction For Part B

While most people pay for Part B, less frequently, people must pay Part A premiums as well.

For these applicants, Social Security can deduct for both Part A and Part B. Of course, this only occurs if a person receives Social Security income benefits.

Generally, if you join and have to pay for Part A then you must join and pay for Part B as well. If claiming no income benefits and choosing to get Part B only, Medicare either automatically deducts from Social Security income, or sends a quarterly bill.

Further, if a person wishes to get any prescription coverage or additional benefits beyond Original Medicare, this requires having Parts A and B.

Comparison shopping assesses whether to stick with Original Medicare or to join Medicare Advantage.

What Are The Differences Between Medicare And Social Security

When you retire or go on disability, you receive a Social Security Income or Social Security Disability Income check each month if you qualify. The Social Security Administration will determine Medicare eligibility and handle some of Medicares administrative work, like enrollment.

While these programs serve different purposes, both programs are funded through payroll taxes, provide benefits to those eligible, and help people with certain disabilities. Although they are different programs, the National Committee to preserve Social Security and Medicare help to protect both programs.

Read Also: Social Security Windfall Elimination Provision

The Interaction Between Medicare Premiums And Social Security Colas

Social Security and Medicare assist in providing financial security to most elderly and disabled individuals in the United States. Certain interactions between Social Security and Medicare may have important financial implications for individuals who are enrolled in both programs.

Social Security provides monthly cash benefits to retired or disabled workers and their family members. The Social Security benefits that are paid to retired workers are based on workersâ past earnings. Medicare is a federal insurance program that pays for covered health care services for most individuals aged 65 and older. Medicare Part B and Part D are voluntary, premium-based programs for Medicare beneficiaries providing coverage for physician services and prescription medications . Standard Medicare Part B and Part D premiums are set at a rate each year to cover approximately 25% of per capita program costs. High-income beneficiaries may pay higher than standard premiums. Individuals who are enrolled in both Social Security and Medicare must have their Medicare Part B premiums automatically deducted from their monthly Social Security benefit and may choose to have their Medicare Part D premiums automatically deducted from their monthly Social Security benefit.

Get Help From A Medicare Savings Program

Medicare Savings Programs, or MSPs, are special programs designed to help low-income seniors pay their Medicare expenses Part B premiums included. These programs are funded via Medicaid, so theyre run at the state level .

To qualify, your monthly income cant exceed a certain limit. Also, your personal resources must fall within a specific limit. But if youre deemed eligible for assistance via an MSP, you could lower your Part B premium costs.

Don’t Miss: Social Security Office In Harrisburg Pa

Medicare Advantage Premiums And Social Security Benefits

Medicare Advantage, also known as Medicare Part C, is a type of insurance provided by private insurance companies that contract with Medicare. Private insurance companies manage the plans but have to work within guidelines provided by the federal government. They are only available to people who are eligible for Original Medicare.

Medicare Advantage premiums vary in price just like other private insurance plans. This means that there is no way to say how much you will pay without getting a quote.

To have your Medicare Advantage monthly premium deducted from your Social Security benefit, you have to contact the Social Security Administration. Otherwise, you will have to pay the premium directly to your insurance company.

Can I Use Social Security Benefits To Pay My Medicare Premiums

Your Social Security benefits can be used to pay some of your Medicare premiums.

In some cases, your premiums can be automatically deducted If you receive Social Security Disability Insurance or Social Security retirement benefits.

However, this doesnt apply to all Medicare premiums. Each part of Medicare has its own premiums and rules for interacting with Social Security.

Well discuss how this works for each part next.

You May Like: What Was The Social Security Act

Can You Have Medicare Premiums Deducted From Your Social Security Check

- You may be able to have your Medicare premiums deducted directly from your Social Security check each month. Learn more about how to have your Medicare premiums automatically deducted each month if youre eligible.

You may receive a Social Security check each month, and you likely pay monthly premiums for Medicare Part B, which is administrated by the Centers for Medicare & Medicaid Services and the Social Security Administration.

So can your Medicare premiums simply be deducted right from your Social Security check?

The answer is yes, Medicare premiums may be automatically deducted from your Social Security check each month, saving you the hassle of having to pay them manually. Below is a rundown of various Medicare premiums, how they relate to Social Security and some of the options you may have for paying your Medicare premiums.

Medicare Part B Premiums For Those Not Held Harmless

As noted earlier, certain individuals receiving Social Security benefits and those not receiving Social Security benefits are not protected under the hold-harmless provision. However, by law, standard Medicare Part B premiums are calculated to cover 25% of the expected costs of Medicare Part B program costs. In years in which a large number of individuals are held harmless and pay reduced premiums, aggregate Part B premiums may not cover 25% of costs unless the entire share of a premium increase is shifted onto those not held harmless. Thus, in certain years, those not held harmless may bear the burden of meeting the 25% requirement disproportionately. For example, in 2010 there was no Social Security COLA and approximately 70% of Medicare Part B enrollees were held harmless from the Medicare Part B premium increase. Those who were held harmless, on average, paid a Medicare Part B premium of $96.40 whereas Medicare Part B beneficiaries not held harmless paid the 2010 standard Medicare Part B premium of $110.50 .65

Low-income beneficiaries who receive premium assistance from Medicare Savings Programs are not held harmless. However, because they do not pay the Medicare Part B premiumâMedicaid will typically pay low-income beneficiaries’ Medicare Part B premiumâthe costs of low-income beneficiaries’ rising Medicare Part B premiums generally would be borne by Medicaid rather than by the beneficiaries themselves.

Read Also: Social Security Office San Angelo

Is Social Security Based On The Last 5 Years Of Work

A: Your Social Security payment is based on your best 35 years of work. And, whether we like it or not, if you don’t have 35 years of work, the Social Security Administration still uses 35 years and posts zeros for the missing years, says Andy Landis, author of Social Security: The Inside Story, 2016 Edition.

What Are The Medicare Part B Premiums For Each Income Group

| File individual tax return |

Source: Medicare.gov

In 2021, based on the average social security benefit of $1,514, a beneficiary paid around 9.8 percent of their income for the Part B premium. Next year, that figure will increase to 10.6 percent.

This means that the average beneficiary will see never see ten percent of their total income, before accounting for the other health care costs they may have to pay throughout the year.

Deductible increases

In addition to premiums, the CMM also announced an increase to the Part B deductible.

The deductable refers to the amount a member is expected to pay before their coverage kicks in.

The deductible will increase from $203 to $230 in 2022. After the deductible has been reached, members will be required to pay twenty percent of the costs for various services including, most doctor services, outpatient therapy, and medical equipment.

What is causing the increase in costs?

The CMM provided a series of reasons as to why the price is increasing.

The first is that each year based on the continuous increase in the costs of providing health care. Each year, the premium increases a small amount to reflect this market-wide trend. However, from 2020 to 2021, the price only increased two percent, whereas from 2021 to 2022 it will be more than fifteen percent.

Also Check: Social Security Office In Lumberton North Carolina

How To Pay Your Medicare Premiums

There are a few ways to make payments.

- You can sign up for a My Medicare.gov account and pay online by credit or debit card.

- You can sign up for Medicare Easy Pay. They will deduct premium payments from your checking or savings account every month.

- You can pay from your checking or savings account by using your banks online bill pay service.

If your first payment is late, then youll get another bill. If you miss the second bill payment due date then you get a delinquent bill. And if you miss that delinquent due date then youll lose your Medicare coverage.

Who Is Eligible For Ssi

You can qualify for SSI if you:

- are legally blind

- have a disability

As with all Social Security benefits, youll also need to be a United States citizen or legal resident and have limited income and resources. However, to apply for SSI, you dont need work credits.

You can receive SSI in addition to SSDI or retirement benefits, but it can also be a standalone payment. The amount you receive in SSI will depend on your income from other sources.

Social Security Disability Insurance is a type of Social Security benefit for those with disabilities or health conditions that prevent them from working.

You May Like: Moss Point Social Security Office

B Automatically Deducted From Social Security

Does Social Security deduct Medicare Part B premiums from your benefit check? The answer is yes.

If you receive benefits from Social Security, Railroad Retirement Board , or Office of Personnel Management , then your Part B premium will be deducted from your benefit payment. It will come out of your check every month starting with your Part B effective month.

How Can I Avoid Paying Taxes On Social Security

Here’s how to reduce or avoid taxes on your Social Security benefit:

Read Also: The Number To Social Security Office

How Are Medicare Premiums Taken Out Of Your Paycheck

But unlike premiums for insurance plans you get through an employer, Medicare premiums are generally not considered pretax. Pretax deductions are those taken out of your wages before its taxed. For example, if you have a plan through your employer that costs $85 per paycheck, that $85 is taken out of your total pay before taxes are.

Do you have to deduct Medicare premiums on your taxes?

Your Medicare premiums, however, wont be taken out pretax. Youll need to deduct them when you file your taxes instead. This is the case even if you pay your premiums by having the money deducted from your Social Security retirement benefits check.

How To Make Premium Payments

Your Part B Medicare premiums are billed directly through Medicare, while your Part C premiums are billed through the private insurance company associated with your Medicare Advantage plan. Heres how you pay Medicare and your private insurance company.

- Premium Payments to Medicare: If you receive Social Security, Office of Personnel Management, or Railroad Retirement Board benefits, Medicare will automatically deduct your Part B premiums from your benefits check. If you dont receive these benefits, you will receive a bill called Notice of Medicare Premium Payment Due. You can then pay by mailing a check, using online banking services, or signing up for Medicares bill pay, which will automatically draft the premium from your bank account each month.

- Part C Premium Payments to Private Insurance Companies: If your insurance company charges a premium for your Medicare Part C plan, you can set your payments to come from your Social Security benefits. But this is not an automatic action. You must submit a request to Social Security, and they have to approve your request before your Part C premium payments will be deducted. If you dont get Social Security, you can mail in a check or have your premium automatically drafted from your bank account.

Recommended Reading: How To Pay Into Social Security

Is Health Insurance Deducted From Gross Or Net Pay

Health premiums are classified as post-tax earnings if they are paid with a taxpayers net income. Gross income is the amount of money a person earns before any taxes are withheld, while net income is defined as the amount of take-home pay that is left over after any taxes other payroll deductions.Jum. I 8, 1440 AH

Does Medicare payment come out of Social Security check?

Medicare Part B premiums are normally deducted from any Social Security or RRB benefits you receive. Your Part B premiums will be automatically deducted from your total benefit check in this case. Youll typically pay the standard Part B premium, which is $148.50 in 2021.Rab. II 19, 1442 AH

What Are The 2023 Income Adjustments For Medicare Part D

If you receive Medicare Part D for prescription drug coverage which received a massive boost this year from the passage of the Inflation Reduction Act and earn more than a certain amount, youll need to pay extra monthly. The adjustment amounts for each income tier havent changed much at all from 2022, but the income brackets themselves all rose about 6%.

You May Like: Chapter 7 Medicare Benefit Policy Manual

You May Like: Social Security Administration Office Locations

How Much Is Taken Out For Part D Drug Plans

Medicare Part D plans help pay for prescription drug costs. This coverage is not included with Original Medicare . However, some Medicare Advantage plans also provide drug coverage. If you join a Medicare Advantage Prescription Drug plan , you cannot also join a standalone Part D plan.

As with Medicare Advantage plans, Part D plans are sold by private insurance companies. This means that their costs will vary, just like Part C plans. However, you may also owe the Income-Related Monthly Adjustment Amount for your Part D plan. The IRMAA table above includes the Part D surcharge at each income bracket.

This amount, as well as your premium itself, can be deducted from your Social Security benefit. Contact the Social Security Administration to set this up.