How Fica Taxes Are Calculated

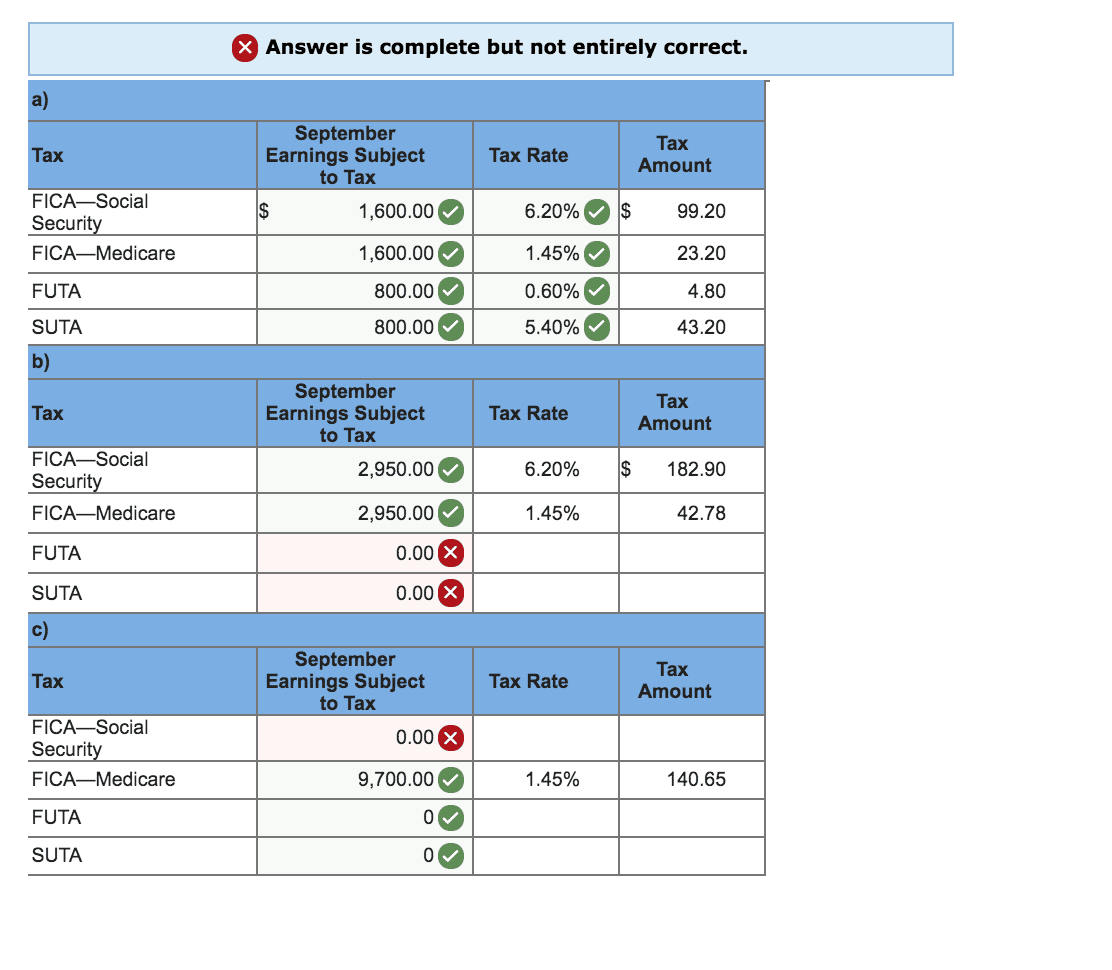

To calculate the FICA withholding for employees, you must take the employee’s gross pay and multiply it by the employee rate of 7.65%. There are two important points you must watch in your calculations:

- You must ensure that each employee’s total gross pay for the year does not exceed the Social Security maximum for the current year because you can’t deduct more than the maximum Social Security amount each year.

- You must also ensure that the additional Medicare tax is withheld on the earnings of higher-paid employees when their earnings reach $200,000 in a year.

Social Security And Medicare Taxes For Self

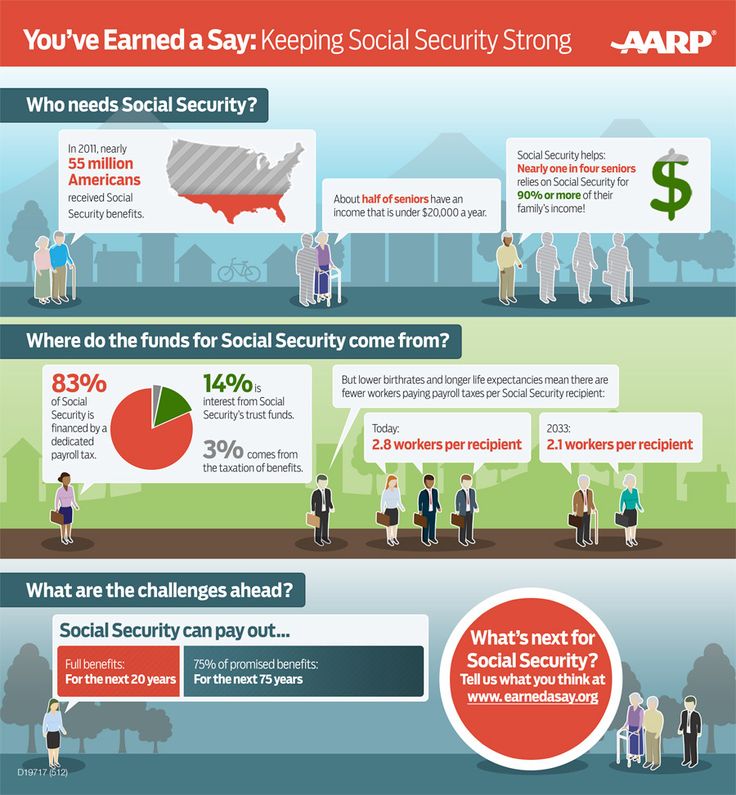

People who are self-employed must account for the employer contributions to their Social Security and Medicare taxes, as well as the employee contributions. This means that they must pay twice the amount of Social Security taxes, which will comprise 12.4 percent of their earnings up to the wage ceiling. They also must pay the full 2.9 percent in Medicare taxes. Finally, they still must pay the 0.9 percent Medicare tax on earnings that exceed the threshold amount. As a result, self-employed individuals face a Social Security and Medicare tax burden covering 15.3 percent of their earnings, and potentially 16.2 percent in some cases.

Why Is Medicare Part B Cheaper In 2023

The Centers for Medicare and Medicaid Services recommended in May that any excess Supplementary Medical Insurance Trust Fund money be passed along to those with Medicare Part B coverage. This is to help decrease the costs of the premium and deductibles. While most Medicare recipients get Part A for free, everyone has to pay for Part B.

This year’s Part B premium was projected to cover spending for a new drug called Aduhelm, which is intended to treat Alzheimer’s disease. Since less money was spent on that drug and other Part B items, there were more reserves left over in the Part B account of the SMI fund, which will now be used to limit future Part B premium increases.

Medicare Part A premiums will rise a little in 2023.

Read Also: Social Security Administration Dayton Ohio

What Is Withholding Tax How Does A Withholding Tax Work

A withholding tax is an income tax that a payer remits on a payee’s behalf . The payer deducts, or withholds, the tax from the payee’s income.

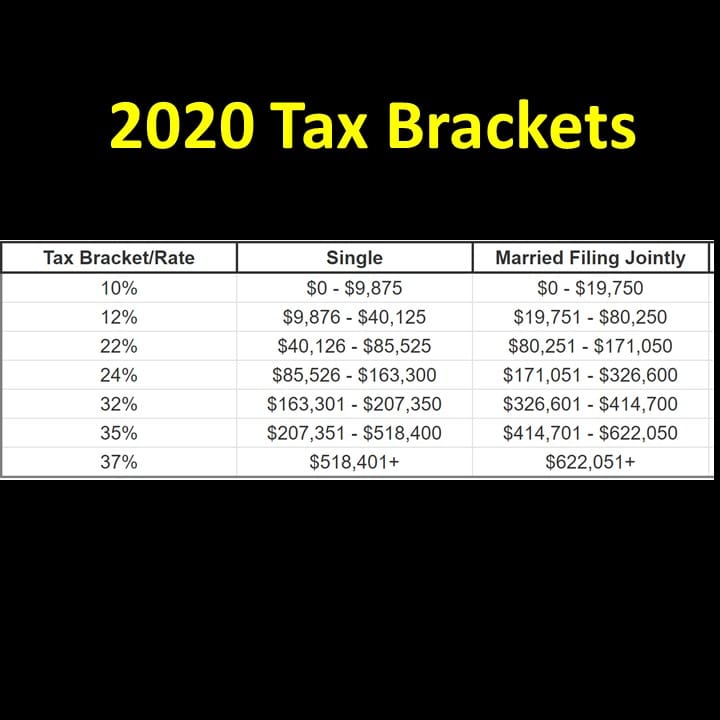

Here’s a breakdown of the taxes that might come out of your paycheck.

-

Social Security tax: 6.2%. Frequently labeled as OASDI , this tax typically is withheld on the first $147,000 in 2022. Paying this tax is how you earn credits for Social Security benefits later.

» MORE:See what the maximum monthly Social Security benefit is this year

-

Medicare tax: 1.45%. Sometimes referred to as the hospital insurance tax, this pays for health insurance for people who are 65 or older, younger people with disabilities and people with certain conditions. Employers typically have to withhold an extra 0.9% on money you earn over $200,000.

-

Federal income tax. This is income tax your employer withholds from your pay and sends to the IRS on your behalf. The amount largely depends on what you put on your W-4.

-

State tax: This is state income tax withheld from your pay and sent to the state by your employer on your behalf. The amount depends on where you work, where you live and other factors, such as your W-4 .

-

Local income or wage tax: Your city or county may also have an income tax. This money might go toward such expenses as the bus system or emergency services.

|

Employer pays |

Medicare Taxes For The Self

Even if you are self-employed, the 2.9% Medicare tax applies.

Typically, people who are self-employed pay a self-employment tax of 15.3% total which includes the 2.9% Medicare tax on the first $142,800 of net income in 2021.2

The self-employed tax consists of two parts:

- 12.4% for Social Security

- 2.9% for Medicare

You can deduct the employer-equivalent portion of your self-employment tax in figuring your adjusted gross income. If youre unsure of how to do this, a tax professional may be able to help.

You May Like: Lansing Mi Social Security Office

Should I Sign Up For Medical Insurance

With our online application, you can sign up for Medicare Part A and Part B. Because you must pay a premium for Part B coverage, you can turn it down.

If youre eligible at age 65, your Initial Enrollment Period begins three months before your 65th birthday, includes the month you turn age 65, and ends three months after that birthday.

Note: Important Upcoming Change Rules for 2023 and later: If you accept the automatic enrollment in Medicare Part B or if you sign up during the first three months of your IEP, your coverage will start the month youre first eligible. Beginning January 1, 2023, if you sign up during the month you turn 65 or during the last three months of your IEP, your coverage starts the first day of the month after you sign up.

The following chart shows when your Medicare Part B becomes effective in 2022:

| In 2022, if you sign up during this month of your IEP | Your Part B Medicare coverage starts |

|---|---|

| One to three months before you reach age 65 | The month you turn age 65. |

| The month you reach age 65 | One month after the month you turn age 65. |

| One month after you reach age 65 | Two months after the month of enrollment. |

| Two or three months after you reach age 65 | Three months after the month of enrollment. |

The following chart shows when your Medicare Part B becomes effective in 2023:

Social Security And Medicare Taxes

An employer generally must withhold social security and Medicare taxes from employees’ wages and pay the employer share of these taxes.

Social security and Medicare taxes have different rates and only the social security tax has a wage base limit. The wage base limit is the maximum wage subject to the tax for the year. Determine the amount of withholding for social security and Medicare taxes by multiplying each payment by the employee tax rate.

For the current year social security wage base limit and social security and Medicare tax rates refer to Publication 15, , Employer’s Tax Guide.

Read Also: Social Security Office Liberty Mo

Social Security And Medicare Withholding Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, , Employer’s Tax Guide for more information or Publication 51, , Agricultural Employers Tax Guide for agricultural employers. Refer to Notice 2020-65PDF and Notice 2021-11PDF for information allowing employers to defer withholding and payment of the employee’s share of Social Security taxes of certain employees.

Who Must Pay Self

You must pay self-employment tax and file Schedule SE if either of the following applies.

- Your net earnings from self-employment were $400 or more.

- You had church employee income of $108.28 or more.

Generally, your net earnings from self-employment are subject to self-employment tax. If you are self-employed as a sole proprietor or independent contractor, you generally use Schedule C to figure net earnings from self-employment.

If you have earnings subject to self-employment tax, use Schedule SE to figure your net earnings from self-employment. Before you figure your net earnings, you generally need to figure your total earnings subject to self-employment tax.

Note: The self-employment tax rules apply no matter how old you are and even if you are already receiving Social Security or Medicare.

You May Like: Social Security Office Troy Ny

What Do Medicare Parts A And B Cover

Medicare Part A covers inpatient hospital, skilled nursing facility, hospice, inpatient rehabilitation and some home health care services.

Medicare Part B covers physician services, outpatient hospital services, certain home health services, durable medical equipment and certain other medical and health services not covered by Medicare Part A.

Medicare Part D helps cover prescription drug costs.

For more information, here’s what to know about signing up for an Affordable Care Act plan.

Get the So Money by CNET newsletter

Social Security Tax Withholding

FICA taxes are paid by both you and your employer. You pay for half the FICA taxes, and your employer will pay the other half. If you are self-employed, you will need to pay 100% of your FICA taxes. For self-employed individuals, it is best to pay FICA and income taxes on a quarterly basis to avoid paying penalties when filing your taxes in April. If you have questions, we recommend you talk to an accountant on how best to pay your taxes.

You May Like: Social Security Office In Enid Oklahoma

Social Security Benefits Get A Historic Cost

Each year, a cost-of-living adjustment is applied to Social Security benefits to offset the impact of rising prices. Since inflation is lingering near a four-decade high, beneficiaries will receive an unusually large 8.7% COLA in 2023. That ranks as the largest increase in benefits in more than four decades.

How big is the impact? According to the Social Security Administration, the average monthly benefit paid to retired workers will reach $1,827 next year, which would equal an increase of $146 per month . That extra cash should provide retirees with some additional financial security in 2023.

The Tax Is Also Subject To An Income Cap

Kirsten Rohrs Schmitt is an accomplished professional editor, writer, proofreader, and fact-checker. She has expertise in finance, investing, real estate, and world history. Throughout her career, she has written and edited content for numerous consumer magazines and websites, crafted resumes and social media content for business owners, and created collateral for academia and nonprofits. Kirsten is also the founder and director of Your Best Edit find her on LinkedIn and Facebook.

The Old-Age, Survivors and Disability Insurance program taxmore commonly called the Social Security taxis calculated by taking a set percentage of your income from each paycheck. Social Security tax rates are determined by law each year and apply to both employees and employers.

For both 2021 and 2022, the Social Security tax rate for employees and employers is 6.2% of employee compensation, for a total of 12.4%. Those who are self-employed are liable for the full 12.4%.

The combined taxes withheld for Social Security and Medicare are referred to as the Federal Insurance Contributions Act . On your pay statement, Social Security taxes are referred to as OASDI, and Medicare is shown as Fed Med/EE. Both Social Security and Medicare are federal programs that provide benefits for retirees, people with disabilities, and children of deceased workers.

You May Like: The Number To Social Security Office

Additional Medicare Tax Withholding Rate

Additional Medicare Tax applies to an individual’s Medicare wages that exceed a threshold amount based on the taxpayer’s filing status. Employers are responsible for withholding the 0.9% Additional Medicare Tax on an individual’s wages paid in excess of $200,000 in a calendar year, without regard to filing status. An employer is required to begin withholding Additional Medicare Tax in the pay period in which it pays wages in excess of $200,000 to an employee and continue to withhold it each pay period until the end of the calendar year. There’s no employer match for Additional Medicare Tax. For more information, see the Instructions for Form 8959 and Questions and Answers for the Additional Medicare Tax.

Social Security And Fica

Most employees and employers each pay Social Security and Medicare taxes on Social Security and Medicare covered wages. These taxes comprise FICA .

Social Security Portion of FICA

- The Social Security portion of FICA is 6.2% of the maximum taxable wages.

- If you reach the maximum payment, you do not pay any more Social Security tax until the next calendar year.

- The maximum taxable wage for Social Security is adjusted each year. Visit Social Security Administration site to learn more about your Social Security Contribution and Benefit Base.

Medicare Portion of FICA

- The Medicare portion of FICA is 1.45% for wages up to 200,000 and 2.35% for wages above $200,000.

- There is no cap on wages for the Medicare portion of FICA.

FICA Refunds

Find out about FICA Refunds as a result of the Doctors Council v. NYCERS court decision.

Also Check: Social Security Office Open Hours

Employees And Employers Share The Cost Of Fica Taxes

Dotdash

There are certain taxes on income that everyone has to pay, and Federal Insurance Contributions Act taxes for Social Security and Medicare are at the top of the list. Employers must withhold these taxes from employee paychecks and pay them to the IRS. FICA taxes are called payroll taxes because they are based on income paid to employees.

How To Apply Online For Just Medicare

Are you within three months of turning age 65 or older and not ready to start your monthly Social Security benefits yet? You can use our online retirement application to sign up just for Medicare and wait to apply for your retirement or spouses benefits later. It takes less than 10 minutes, and there are no forms to sign and usually no documentation is required.

To find out what documents and information you need to apply, go to the .

You May Like: Brockton Ma Social Security Office

Is It Better To Withhold Taxes

Remember, one of the big reasons you file a tax return is to calculate the income tax on all of your taxable income for the year and see how much of that tax youve already paid via withholding tax. If it turns out youve overpaid, youll probably get a tax refund. If it turns out youve underpaid, youll have a tax bill to pay.

If you ended up with a huge tax bill this year and dont want another, you can use Form W-4 to increase your tax withholding. Thatll help you owe less next year.

If you got a huge tax refund, consider using Form W-4 to reduce your tax withholding. Youre giving the government a free loan and even worse you might be needlessly living on less of your paycheck all year. It may feel great to get a tax refund from the IRS, but think of how life mightve been last year if youd had that extra money when you needed it for groceries, overdue bills, getting the car fixed, paying off a credit card or investing.

Promotion: NerdWallet users get 25% off federal and state filing costs. |

Promotion: NerdWallet users can save up to $15 on TurboTax. |

How Fica Tax Or Withholding Tax Are Calculated

The amount of tax your employer withholds from your check largely depends on what you put on your Form W-4, which you probably filled out when you started your job. Here are some things to know:

-

Form W-4 asks about your marital status, dependents and other factors to help you calculate how much to withhold. The less you withhold, the less tax comes out of your paycheck.

-

What you put on your W-4 then gets funneled through something called withholding tables, which your employer’s payroll department uses to calculate exactly how much federal and state income tax to withhold.

-

You can change your W-4 at any time. Just , fill it out and give it to your human resources or payroll team.

Read Also: Social Security Office Queens Ny

What Is The Maximum Amount You Can Earn While Collecting Social Security In 2020

$18,240 per yearThe Social Security earnings limits are established each year by the SSA. For 2020, those who are younger than full retirement age throughout the year can earn up to $18,240 per year without losing any of their benefits. After that, youll lose $1 of annual benefits for every $2 you make above the threshold.

History Of Social Security Tax Rates

The Social Security tax began in 1937. At that time, the employee rate was 1%. It has steadily risen over the years, reaching 3% in 1960 and 5% in 1978. In 1990, the employee portion increased from 6.06 to 6.2% but has held steady ever sincewith the exception of 2011 and 2012.

The Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010 reduced the contribution percentage to 4.2% for employees for those years employers were still required to pay the full amount of their contributions.

The tax cap has existed since the inception of the program in 1937 and remained at $3,000 until the Social Security Amendments Act of 1950. It was then raised to $3,600 with expanded benefits and coverage. Additional increases in the tax cap in 1955, 1959, and 1965 were designed to address the difference in benefits between low-wage and high-wage earners.

The Social Security tax policy in the 1970s saw a number of proposed amendments and re-evaluations. The Nixon Administration was paramount in arguing that tax cap increases needed to correlate with changes in the national average wage index in order to address benefit levels for individuals in different tax brackets. The 1972 Social Security Amendments Act had to be revamped due to problems with the benefits formula that caused financing concerns. A 1977 amendment resolved the financial shortfall and established a tax cap increase structure that correlated with average wage increases.

Also Check: What Is Considered Income For Social Security Benefits