How To File Social Security Income On Your Federal Taxes

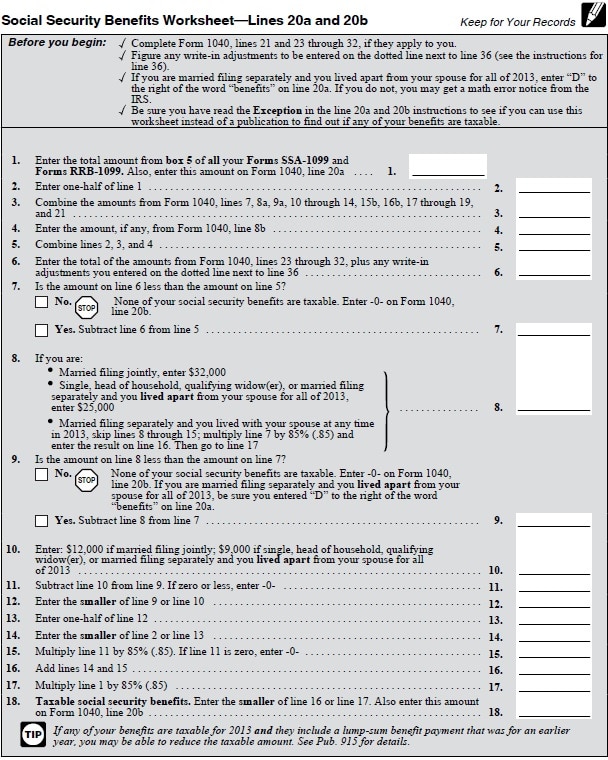

Once you calculate the amount of your taxable Social Security income, you will need to enter that amount on your income tax form. Luckily, this part is easy. First, find the total amount of your benefits. This will be in box 3 of your Form SSA-1099. Then, on Form 1040, you will write the total amount of your Social Security benefits on line 5a and the taxable amount on line 5b.

Note that if you are filing or amending a tax return for the 2017 tax year or earlier, you will need to file with either Form 1040-A or 1040. The 2017 1040-EZ did not allow you to report Social Security income.

Place Some Retirement Income In Roth Accounts

Contributions to a Roth IRA or Roth 401 are made with after-tax dollars. This means theyre not subject to taxation when the funds are withdrawn. Thus, the distributions from your Roth IRA are tax-free, provided that theyre taken after you turn 59½ and have had the account for five or more years. As a result, the Roth payout wont affect your taxable income calculation and wont increase the tax you owe on your Social Security benefits. Distributions taken from a traditional IRA or traditional 401 plan, on the other hand, are taxable.

The Roth advantage makes it wise to consider a mix of regular and Roth retirement accounts well before retirement age. The blend will give you greater flexibility to manage the withdrawals from each account and minimize the taxes you owe on your Social Security benefits. A similar effect can be achieved by managing your withdrawals from conventional savings, money market accounts, or tax-sheltered accounts.

What Is ‘combined Income’ And How Is It Calculated

Its your adjusted gross income or AGI plus your nontaxable interest plus one-half of your Social Security benefits.

Now the thing about these taxes is this: No one should really be surprised by them. These taxes on Social Security have been with us since the Greenspan Commission created them in 1983, according to David Freitag, a financial planning consultant with MassMutual.

But you might be surprised by the following details:

The thresholds are not indexed for inflation. So as income in retirement has increased, more and more people are paying more and more income tax on their Social Security benefits, Freitag explains.

Others see the same trend. Because the thresholds that determine whether or not Social Security benefits are taxable were never adjusted for inflation, it is pretty hard today to avoid paying taxes on Social Security benefits, says Elaine Floyd, director of retirement and life planning at Horsesmouth.

Recommended Reading: Social Security Office Killeen Tx

No Change In Tax Rate For Social Security Benefits

There is more good news for workers with payroll taxes in 2021: There will be no change in the tax rate for Social Security benefits, which will remain at 6.2%. That amount will be matched by their employers. The payroll tax rate for Medicare Part A will remain at 1.45%, also matched by their employers.

Will You Owe Here’s How To Know

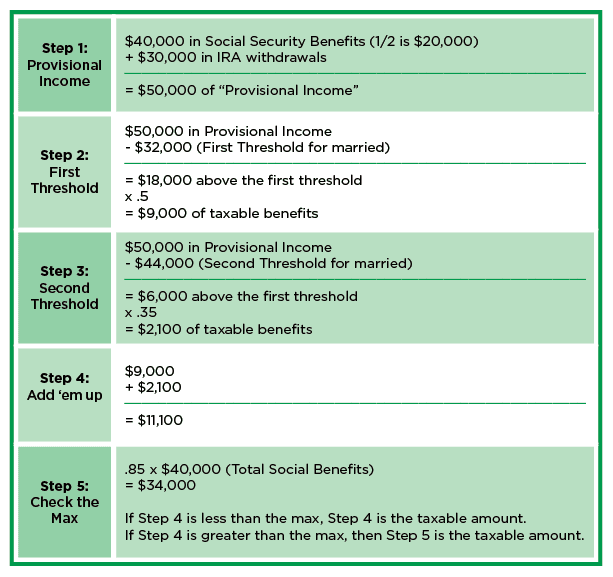

If you file a federal tax return as an “individual” and your combined income is:

- Between $25,000 and $34,000: You may have to pay income tax on up to 50% of your benefits

- More than $34,000: Up to 85% of your benefits may be taxable.

If you file a joint return, and you and your spouse have a combined income that is:

- Between $32,000 and $44,000: You may have to pay income tax on up to 50% of your benefits.

- More than $44,000: Up to 85% of your benefits may be taxable.

And if you are married and file a separate tax return, you probably will pay taxes on your benefits.

Also Check: Social Security Office In Kansas City Missouri

New Benefit Awards 2020

Benefits were awarded to about 5.8 million persons of those, 58% were retired workers and 11% were disabled workers. The remaining 31% were survivors or the spouses and children of retired or disabled workers. These awards represent not only new entrants to the benefit rolls but also persons already on the rolls who become entitled to a different benefit, particularly conversions of disabled-worker benefits to retired-worker benefits at FRA.

| Beneficiary |

|---|

Paying Taxes On Social Security

You should get a Social Security Benefit Statement each January detailing your benefits during the previous tax year. You can use it to determine whether you owe federal income tax on your benefits. The information is available online if you enroll on the Social Security website.

If you owe taxes on your Social Security benefits, you can make quarterly estimated tax payments to the IRS or have federal taxes withheld from your payouts before you receive them.

Don’t Miss: How To Pay Social Security Tax Self Employed

Taxes On Retirement Income

In retirement, different kinds of income are taxed differently:

- Most interest on bank deposit accounts is taxed at the same federal income tax rate as the money you receive from paid work.

- Distributions from traditional 401s and IRAs are typically subject to the tax rates associated with your current marginal tax bracket.

- Dividends paid or gains from the sale of stocks are taxed at 0%, 15%, or 20%, depending on how long you’ve held the stock, your taxable income, and your tax filing status.

- Other incomesuch as qualified withdrawals from a Roth IRA, a Roth 401, or a health savings account are not subject to federal income taxation and do not factor into how your Social Security benefit is taxed.1

When the total income calculated under the combined income formula for Social Security is more than the threshold , up to 85 cents of every Social Security income dollar can be taxed.

So as you work with financial and tax professionals, consider the following 2 strategies.

Family Caregivers And Self

Special rules apply to workers who perform in-home services for elderly or disabled individuals . Caregivers are typically employees of the individuals for whom they provide services because they work in the homes of the elderly or disabled individuals and these individuals have the right to tell the caregivers what needs to be done. See the Family Caregivers and Self-Employment Tax page and Publication 926 for more details.

You May Like: Disadvantages Of Social Security Disability

Inheritance Estate And Gift Taxes

The United States imposes a federal estate tax on the fair market value of assets that an individual owns at death. Individuals who are domiciled in the United States are subject to federal estate tax on their worldwide assets . Individuals who are not US-domiciled are subject to US federal estate tax on only US-situs assets. Because the term ‘domicile’ is extremely subjective, it is often difficult to know whether a particular individual is resident or not for estate tax purposes.

The American Taxpayer Relief Act of 2012 increased the top estate, gift, and generation-skipping transfer tax rates from 35% to 40% for estates of decedents dying after 31 December 2012.

P.L. 115-97 maintained the estate, gift, and generation-skipping transfer taxes at the 40% tax rate. For estates of decedents dying and gifts made after 2017, P.L. 115-97 almost doubled the exemption for all three taxes the exemption for 2022 is USD 12,060,000 per person and USD 11,700,000 for 2021. The gift and estate tax exemptions remain unified, so any use of the gift tax exemption during one’s lifetime would decrease the estate tax exemption available at death. The current law allowing a step-up in basis to fair market value at date of death will continue. The gift tax exclusion for annual gifts is USD 16,000 per donee for 2022, up from the previous USD 15,000 per donee in 2021. The provisions for unlimited transfers directly to educational institutions and health care providers are retained.

Other Things To Watch Out For

While everyone likes to minimize their taxes, especially ones that you can avoid without too much legwork, its important that you keep things in perspective.

Tax strategy should be part of your overall financial planning, says Crane. Dont let tax strategy be the tail that wags the dog.

In other words, make the financial moves that maximize your after-tax income, but dont make minimizing taxes your only goal. After all, those who earn no income also pay no taxes but earning no income is not a sensible financial path. For example, it can be better to find ways to maximize your Social Security benefits rather than minimizing your taxes.

And it could be financially smart to first avoid some of the biggest Social Security blunders.

Dont forget that these rules apply to minimizing your tax at the federal level, but your state may tax your Social Security benefit. The laws differ by state, so its important to investigate how your state treats Social Security.

There really arent any tricks, you just have to be careful with your interest and dividends, says Paul Miller, CPA, of Miller & Company in the New York City area.

Read Also: Social Security Administration Wichita Kansas

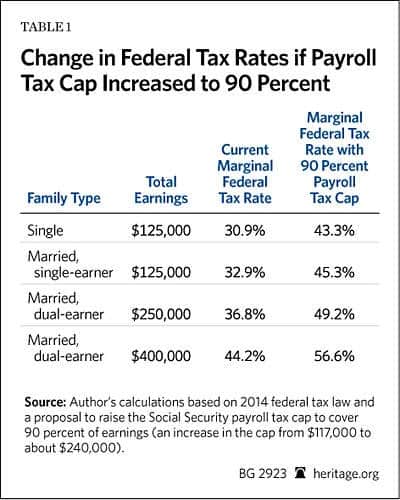

If You Earn Enough Money For Your Benefits To Be Taxable You Could End Up Paying The Highest Income Taxes In The Country

Social Security benefits are tax free unless you earn too much income during the year. To know whether you might be subject to such taxes you have to figure your “combined income.” This is actually quite easy: Simply add one-half of the total Social Security you received during the year to all your other income, including any tax-exempt interest .

You’ll have to pay tax on part of your benefits if your combined income exceeds these thresholds:

- $32,000 if you’re married and file a joint tax return , or

- $25,000 if you’re single.

If a married couple files their taxes separately, the threshold is reduced to zerothey always have to pay taxes on their benefits. The only exception is if they did not live together at any time during the year in this event the $25,000 threshold applies.

This applies to all types of Social Security benefits: disability, retirement, dependents, and survivors benefits.

How much of your Social Security benefits will be taxed depends on just how high your combined income is.

Individual filers. If you file a federal tax return as an individual and your combined income is between $25,000 and $34,000, you have to pay income tax on up to 50% of your Social Security benefits. If your income is above $34,000, up to 85% of your Social Security benefits is subject to income tax.

Once you start receiving Social Security benefits, to keep your income below the applicable threshold, or at least as low as possible, you should:

Make Sure Youre Taking Your Maximum Capital Loss

If youve invested in stocks or bonds and have a loss on paper, you might want to sell and realize that loss so you can claim it as a tax deduction. The process is called tax-loss harvesting, and it can net you a sizable deduction from your income.

The tax code allows you to write off up to a net $3,000 each year in investment losses. A write-off first reduces any other capital gains that youve incurred throughout the year. For example, if you have a $3,000 gain on one asset but a $6,000 loss on another, you can claim a deduction for the full $3,000 net loss.

Any net loss beyond that $3,000 has to be carried forward to future years, at which point it can be used. And even if you cant realize the full value of that net loss, it can still make sense to realize some loss, especially if it pushes your Social Security benefit into the tax-free area.

Tax-loss harvesting works only in taxable accounts, not special tax-advantaged accounts such as an IRA.

Don’t Miss: Social Security Office In Columbus Ohio

Are Social Security Benefits Taxed After Age 66

Is it true that Social Security payouts are taxed regardless of age? Yes. As a person becomes older, the regulations for taxation benefits do not alter. Your income level especially, what the Internal Revenue Service refers to as provisional income determines whether or not your Social Security benefits are taxed.

Other Income December 2020

Almost 57% of SSI recipients aged 65 or older received OASDI benefits, as did 28.2% of those aged 1864 and 6.3% of those under age 18. Other types of unearned income, such as income from assets, were reported most frequently among those under age 18 and those aged 65 or older . Earned income was most prevalent among those aged 1864.

You May Like: Social Security Office Buford Ga

When Seniors Must File

For tax year 2021, unmarried seniors will typically need to file a return if:

- you are at least 65 years of age, and

- your gross income is $14,250 or more

However, if your only income is from Social Security benefits, you don’t typically include these benefits in your gross income. If this is the only income you receive, then your gross income for taxes equals zero, and you typically don’t have to file a federal income tax return.

But if you do earn other income including certain tax-exempt income, then each year you must determine whether the total exceeds the filing threshold.

- For tax years prior to the 2018 tax year , these amounts are based on the year’s standard deduction plus the exemption amount for your age and filing status.

- Beginning in 2018, only your standard deduction is used since exemptions are no longer part of calculating your taxable income under the new tax law passed in late 2017.

For the 2021 tax year,

- If you are married and file a joint return with a spouse who is also 65 or older, you must file a return if your combined gross income is $27,800 or more.

- If your spouse is under 65 years old, then the threshold amount decreases to $26,450.

- Keep in mind that these income thresholds only apply to the 2021 tax year, and generally increase slightly each year.

Child Recipients December 19742020

As of December of the program’s first year, 1974, 70,900 blind and disabled children were receiving SSI. That number increased to about 955,000 in 1996, declined to about 847,000 in 2000, and increased to 1,108,612 in 2020. The relatively high average payment to children is due in part to a limited amount of other countable income. The spike in average monthly benefits in 1992 is due to retroactive payments resulting from the Sullivan v. Zebley decision. As of December 2020, blind and disabled children were receiving SSI payments averaging $675.

Don’t Miss: What Is The Social Security Phone Number

Why Do I Pay Social Security Tax

Workers pay Social Security taxes to support government programs in society. Social Security benefit payments issued by the government to retired individuals are funded using the aid of Social Security tax payments from current workers. When current workers retire, they will then become eligible to claim these government benefits in the future.

Withdraw Taxable Income Before Retirement

Another way to minimize your taxable income when drawing Social Security is to maximize, or at least increase, your taxable income in the years before you begin to receive benefits.

You could be in your peak earning years between ages 59½ and retirement age. Take a chunk of money out of your retirement account and pay the taxes on it. Then, you can use it later without pushing up your taxable income.

This means you could withdraw funds a little earlyor take distributions, in tax jargonfrom your tax-sheltered retirement accounts, such as IRAs and 401s. You can make penalty-free distributions after age 59½. This means you avoid being dinged for making these withdrawals too early, but you must still pay income tax on the amount you withdraw.

Since the withdrawals are taxable , they must be planned carefully with an eye on the other taxes you will pay that year. The goal is to pay less tax by making more withdrawals during this preSocial Security period than you would after you begin to draw benefits. That requires considering the total tax bite from withdrawals, Social Security benefits, and other sources. Be mindful, too, that at age 72, youre required to take RMDs from these accounts, so you need to plan for those mandatory withdrawals.

Recommended Reading: Social Security Office New Hampshire

Does Social Security Income Count As Income

Yes, but you can minimize the amount you owe each year by making wise moves before and after you retire. Consider investing some of your retirement savings in a Roth account to shield your withdrawals from income tax. Take out some retirement money after youre 59½, but before you retire to pay for expected taxes on your Social Security before you begin receiving benefit payments. You might also talk to a financial planner about a retirement annuity.

State Taxation Of Social Security Benefits

Most states don’t tax Social Security benefits. But the ones that do either follow the same federal provisional income rules or have special rules and income thresholds to determine what’s taxable.

These 4 states use the federal PI formula: Minnesota, North Dakota, Vermont, and West Virginia. The taxable portion of Social Security for these states is the same as the federal amount.

Nine states have special rules and income thresholds. Most use the federal modified adjusted gross income formula rather than the federal PI formula for taxing Social Security income.

These states are: Colorado, Connecticut, Kansas, Missouri, Montana, Nebraska, New Mexico, Rhode Island, and Utah.

If you live in a state that counts Social Security benefits as taxable income, you should consult your state tax department for details and a qualified tax advisor.

You May Like: Social Security Office Albuquerque New Mexico