Know The Earnings Limits

Those hoping to work in retirement need to be especially careful if they’re planning to claim Social Security benefits early. Even if youâre just working part-time, itâs important to consider how that continuing income will affect your benefits.

The SSA caps how much you are allowed to earn if you start taking your benefits before full retirement age, which is 66 for most baby boomers. For the most recent annual earned income cap, view the current annual contribution limits. For every $2 you earn over the limit, the SSA withholds $1 off the top of your benefits. Once you reach the year that you’ll turn full retirement age, the earned income cap goes up, and for every $3 you go over, itâs a $1 withholding during the months until your birthday.

There is some good news, however: Because the penalty is determined by your individual earned income, if you retire early but your spouse doesn’t, your spouse’s earned income will not be factored into the earnings limit. Additionally, when you reach your full retirement age, the earnings limit disappears and Social Security will recalculate your benefit amount if you were negatively impacted by the earnings limit.

Keep in mind, if you file your tax return jointly, your spouse’s earnings will be included when calculating your combined income for purposes of determining the taxation of your benefits.â1

How To Report Social Security Income On Your Federal Taxes

Every Social Security recipient receives a benefit statement, Form SSA-1099, in January showing the total dollar amount of benefits received during the previous year. This includes retirement, survivor’s, and disability benefits.

Take that total shown in Box 5 and report it on Line 6a of Form 1040 or Form 1040-SR The IRS provides a worksheet to help you calculate what portion of your benefits are taxable and add the amount to your other income. More simply, you can use online tax software or consult a tax professional to crunch the numbers.

Three Ways To Reduce The Taxes That You Pay On Benefits

Is Social Security taxable? For most Americans, it is. That is, a majority of those who receive Social Security benefits pay income tax on up to half or even 85% of that money because their combined income from Social Security and other sources pushes them above the very low thresholds for taxes to kick in.

But there are three strategies you can useplace some retirement income in Roth IRAs, withdraw taxable income before retiring, or purchase an annuity, to limit the amount of tax you pay on Social Security benefits.

Read Also: Does Mn Tax Social Security

Social Security Benefits Worksheet

If your income is modest, it is likely that none of your Social Security benefits are taxable. As your gross income increases, a higher percentage of your Social Security benefits become taxable, up to a maximum of 85% of your total benefits. The TaxAct® program will automatically calculate the taxable amount of your Social Security income .

To view the Social Security Benefits Worksheet:

This worksheet is based on the worksheet in IRS Publication 915Social Security and Equivalent Railroad Retirement Benefits.

Note that any link in the information above is updated each year automatically and will take you to the most recent version of the webpage or document at the time it is accessed.

What Percentage Of Social Security Is Taxable

If you file as an individual, your Social Security is not taxable if your total income for the year is below $25,000. Half of it is taxable if your income is in the $25,000$34,000 range. If your income is higher, up to 85% of your benefits may be taxable.

If you and your spouse file jointly, youll owe taxes on half of your benefits if your joint income is in the $32,000$44,000 range. If your income exceeds that, then up to 85% is taxable.

Don’t Miss: What Is The Difference Between Social Security And Ssi

Who Is Eligible For Social Security Benefits

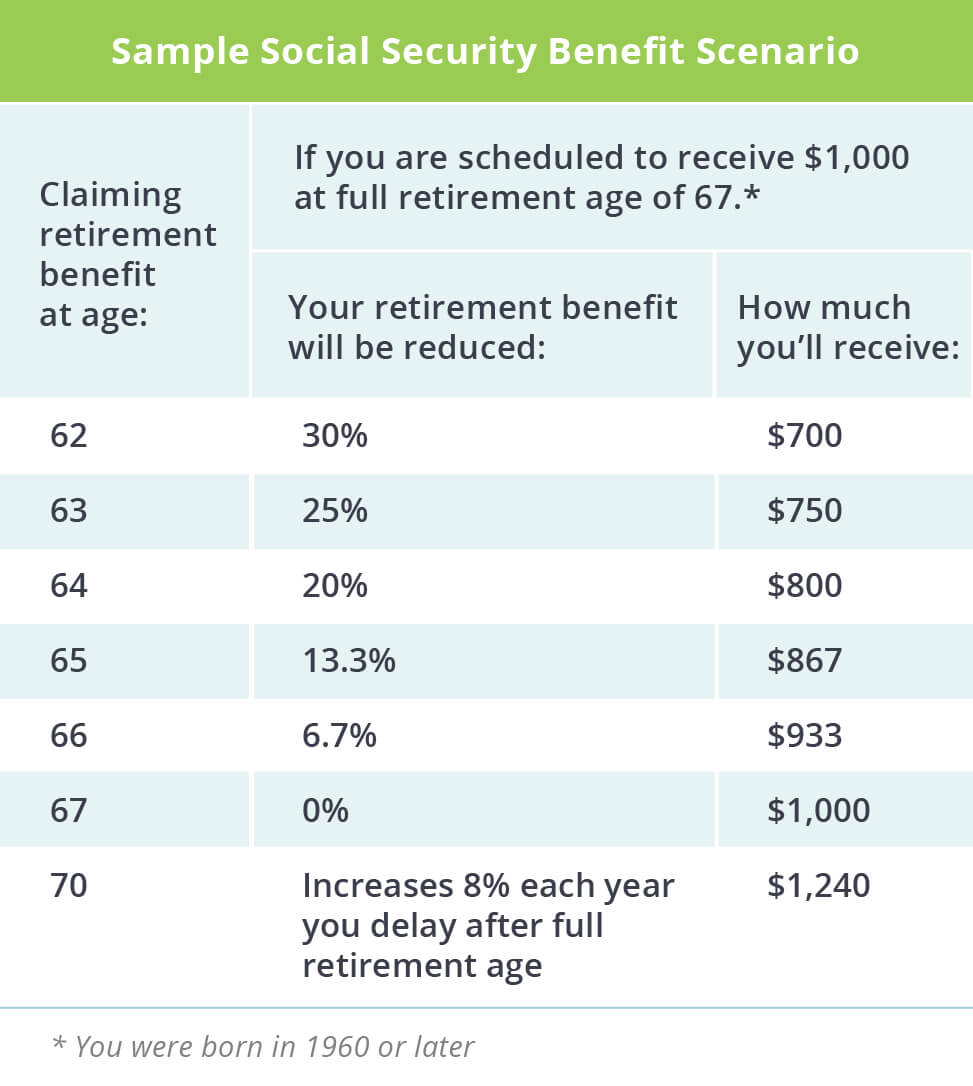

Anyone who pays into Social Security for at least 40 calendar quarters is eligible for retirement benefits based on their earnings record. You are eligible for your full benefits once you reach full retirement age, which is either 66 and 67, depending on when you were born. But if you claim later than that – you can put it off as late as age 70 – youâll get a credit for doing so, with larger monthly benefits. Conversely, you can claim as early as age 62, but taking benefits before your full retirement age will result in the Social Security Administration docking your monthly benefits.

The bottom line: Youâre eligible for Social Security Benefits if youâve paid into the system for at least a decade, but your actual benefits will depend on what age â between 62 and 70 â you begin to claim them.

History Of Social Security Tax Rates

The Social Security tax began in 1937. At that time, the employee rate was 1%. It has steadily risen over the years, reaching 3% in 1960 and 5% in 1978. In 1990, the employee portion increased from 6.06% to 6.2% but has held steady ever sincewith the exception of 2011 and 2012.

The Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010 reduced the contribution percentage to 4.2% for employees for those years employers were still required to pay the full amount of their contributions.

The tax cap has existed since the inception of the program in 1937 and remained at $3,000 until the Social Security Amendments Act of 1950. It was then raised to $3,600 with expanded benefits and coverage. Additional increases in the tax cap in 1955, 1959, and 1965 were designed to address the difference in benefits between low-wage and high-wage earners.

The Social Security tax policy in the 1970s saw a number of proposed amendments and re-evaluations. The Nixon Administration was paramount in arguing that tax cap increases needed to correlate with changes in the national average wage index in order to address benefit levels for individuals in different tax brackets.

The 1972 Social Security Amendments Act had to be revamped due to problems with the benefits formula that caused financing concerns. A 1977 amendment resolved the financial shortfall and established a tax cap increase structure that correlated with average wage increases.

You May Like: Social Security Office Liberty Mo

Withdraw Taxable Income Before Retirement

Another way to minimize your taxable income when drawing Social Security is to maximize, or at least increase, your taxable income in the years before you begin to receive benefits.

You could be in your peak earning years between ages 59½ and retirement age. Take a chunk of money out of your retirement account and pay the taxes on it. Then, you can use it later without pushing up your taxable income.

This means you could withdraw funds a little earlyor take distributions, in tax jargonfrom your tax-sheltered retirement accounts, such as IRAs and 401s. You can make penalty-free distributions after age 59½. This means you avoid being dinged for making these withdrawals too early, but you must still pay income tax on the amount you withdraw.

Since the withdrawals are taxable , they must be planned carefully with an eye on the other taxes you will pay that year. The goal is to pay less tax by making more withdrawals during this preSocial Security period than you would after you begin to draw benefits. That requires considering the total tax bite from withdrawals, Social Security benefits, and other sources. Be mindful, too, that at age 72, youre required to take RMDs from these accounts, so you need to plan for those mandatory withdrawals.

Is Social Security Disability Taxable

You may need to pay taxes on your Social Security Disability Insurance benefits. This can happen if you receive other income that places you above a certain threshold. But, because SSDI requires you to be disabled and have limited income to be eligible, you might not have other income to exceed this threshold.

Common examples for when your Social Security Disability Insurance benefits may be taxable are if you receive income from other sources, such as dividends or tax-exempt interest, or if your spouse earns income. If this describes your situation, you will need to know the thresholds for when your SSDI becomes taxable.

The IRS states that your SSDI benefits may become taxable when one-half of your benefits, plus all other income, exceeds an income threshold based on your tax filing status:

- Single, head of household, qualifying widow, and married filing separately taxpayers: $25,000

For example, if you are married and file jointly, you can report up to $32,000 of income before needing to pay taxes on your SSDI benefits. If you earn more than these limits for these tax filing statuses, you have two different benefit inclusion rates that can apply.

For 2022:

- As a single filer, you may need to include up to 50% of your benefits in your taxable income if your income falls between $25,000 and $34,000.

- Up to 85% gets included on your tax return if your income exceeds $34,000.

For married couples who file jointly, you’d pay taxes:

Don’t Miss: Social Security Office Somerset Kentucky

Ways To Avoid Taxes On Benefits

The simplest way to keep your Social Security benefits free from income tax is to keep your total combined income below the thresholds to pay tax. However, this may not be a realistic goal for everyone, so there are three ways to limit the taxes that you owe.

- Place retirement income in Roth IRAs

- Withdraw taxable income before retiring

- Purchase an annuity

Dont Forget Social Security Benefits May Be Taxable

Tax Tip 2020-76, June 25, 2020

Taxpayers receiving Social Security benefits may have to pay federal income tax on a portion of those benefits.

Social Security benefits include monthly retirement, survivor and disability benefits. They don’t include supplemental security income payments, which aren’t taxable.

The portion of benefits that are taxable depends on the taxpayer’s income and filing status.

Don’t Miss: Social Security Office In Newark

How To File Social Security Income On Your Federal Taxes

Once you calculate the amount of your taxable Social Security income, you will need to enter that amount on your income tax form. Luckily, this part is easy. First, find the total amount of your benefits. This will be in box 3 of your Form SSA-1099. Then, on Form 1040, you will write the total amount of your Social Security benefits on line 5a and the taxable amount on line 5b.

Note that if you are filing or amending a tax return for the 2017 tax year or earlier, you will need to file with either Form 1040-A or 1040. The 2017 1040-EZ did not allow you to report Social Security income.

How Much Of My Social Security Benefit May Be Taxed

Did you know that up to 85% of your Social Security Benefits may be subject to income tax? If this is the case you may want to consider repositioning some of your other income to minimize how much of your Social Security Benefit may be taxed and thereby, maximize your retirement income sources.

This information may help you analyze your financial needs. It is based on information and assumptions provided by you regarding your goals, expectations and financial situation. The calculations do not infer that the company assumes any fiduciary duties. The calculations provided should not be construed as financial, legal or tax advice. In addition, such information should not be relied upon as the only source of information. This information is supplied from sources we believe to be reliable but we cannot guarantee its accuracy. Hypothetical illustrations may provide historical or current performance information. Past performance does not guarantee nor indicate future results.

Read Also: Is The Social Security Office Open On Saturday

The Tax Is Also Subject To An Income Cap

The Old-Age, Survivors, and Disability Insurance program taxmore commonly called the Social Security taxis calculated by taking a set percentage of your income from each paycheck. Social Security tax rates are determined by law each year and apply to both employees and employers.

The Social Security tax rate for employees and employers is 6.2% of employee compensation, for a total of 12.4%. Those who are self-employed are liable for the full 12.4%.

The combined taxes withheld for Social Security and Medicare are referred to as the Federal Insurance Contributions Act . On your pay statement, Social Security taxes are referred to as OASDI, and Medicare is shown as Fed Med/EE. Both Social Security and Medicare are federal programs that provide benefits for retirees, people with disabilities, and children of deceased workers.

How To Calculate Your Social Security Income Taxes

If your Social Security income is taxable, the amount you pay will depend on your total combined retirement income. However, you will never pay taxes on more than 85% of your Social Security income.

Again, if you file as an individual with a total income thats less than $25,000, you wont have to pay taxes on your Social Security benefits in 2022. For the 2022 tax year , single filers with a combined income of $25,000 to $34,000 must pay income taxes on up to 50% of their Social Security benefits. If your combined income is more than $34,000, you will pay taxes on up to 85% of your Social Security benefits.

For married couples filing jointly, you will pay taxes on up to 50% of your Social Security income if you have a combined income of $32,000 to $44,000. If you have a combined income of more than $44,000, you can expect to pay taxes on up to 85% of your Social Security benefits.

If 50% of your benefits are subject to tax, the exact amount you include in your taxable income will be the lesser of either:

- half of your annual Social Security benefits OR

- half of the difference between your combined income and the IRS base amount

The example above is for someone whos paying taxes on 50% of their Social Security benefits. Things get more complex if youre paying taxes on 85% of your benefits. However, the IRS helps taxpayers by offering software and a worksheet to calculate Social Security tax liability.

Read Also: Social Security Survivor Benefits After Turning 18

Tax Withholding And Estimated Tax Payments For Social Security Benefits

If you know in advance that a portion of your Social Security benefits will be taxed, it’s a good idea to have federal income taxes withheld from your payment each month. Simply fill out Form W-4V to request withholding at a rate of 7%, 10%, 12% or 22%, and then send the form to your local Social Security office.

If you don’t want to have taxes withheld from your monthly payments, you can make quarterly estimated tax payments instead. Either way, you just want to make sure you have enough withheld or paid quarterly to avoid an IRS underpayment penalty when you file your income tax return for the year.

Do You Pay Taxes On Social Security After Age 65

Are Social Security benefits taxable regardless of age? Yes. The rules for taxing benefits do not change as a person gets older. Whether or not your Social Security payments are taxed is determined by your income level specifically, what the Internal Revenue Service calls your provisional income.

Also Check: Social Security Office Reading Road

Does Social Security Count As Income

Since 1935, the U.S. Social Security Administration has provided benefits to retired or disabled individuals and their family members. … While Social Security benefits are not counted as part of gross income, they are included in combined income, which the IRS uses to determine if benefits are taxable.

How Do I Calculate My Taxable Social Security Benefits 2020

If you’re trying figure out if your Social Security benefits will be taxed, the first thing you need to do is calculate your “provisional income.” Your provisional income is equal to the combined total of 50% of your Social Security benefits, your tax-exempt interest, and the other non-Social Security items …

Recommended Reading: Social Security Office In Trussville

Does Social Security Income Count As Income

Yes, but you can minimize the amount you owe each year by making wise moves before and after you retire. Consider investing some of your retirement savings in a Roth account to shield your withdrawals from income tax. Take out some retirement money after youre 59½, but before you retire to pay for expected taxes on your Social Security before you begin receiving benefit payments. You might also talk to a financial planner about a retirement annuity.

Calculating Fica Taxes: An Example

An employee who makes $165,240 a year collects semi-monthly paychecks of $6,885 before taxes and any retirement-plan withholding. Though Medicare tax is due on the entire salary, only the first $147,000 is subject to the Social Security tax for 2022. Since $147,000 divided by $6,885 is 21.3, this threshold is reached after the 22nd paycheck.

For the first 21 pay periods, therefore, the total FICA tax withholding is equal to + , or $526.70. Only the Medicare HI tax is applicable to the remaining three pay periods, so the withholding is reduced to $6,885 x 1.45%, or $99.83. In total, the employee pays $8,964.27 to Social Security and $2,395.98 to Medicare each year. Though it does not affect the employee’s take-home pay, the employer must contribute the same amount to both programs.

As mentioned above, those who are self-employed are considered both the employer and the employee for tax purposes, meaning they are liable for both contributions. In the example above, a self-employed person with the same salary pays $17,928.54 to Social Security and $4,791.96 to Medicare.

Don’t Miss: Us Social Security Administration Bakersfield Ca