How Govt Pension Affects Social Security

Massachusetts is a non-Social Security state. That means that your Massachusetts public employment is not covered by Social Security. Neither you nor your employer pays into Social Security. Instead as a member of the Hampshire County Retirement System you and your employer pay into our system, which is a Government Pension Plan under IRS code 401.

Since you and your employer do not pay into Social Security, you do not earn Social Security credits or quarters for your Massachusetts public employment. However, you may still qualify for Social Security benefits through other employment or through your spouses employment. If you are eligible for Social Security benefits you may also be subject to provisions that offset or reduce your social security benefits due to your receipt of a government pension. There are two provisions that may affect your receipt of social security benefits: 1) the Windfall Elimination Provision and 2) the Government Pension Offset .

In Summary:

If you are eligible for Social Security benefits from other employment of your own, then Social Security, under the Windfall Elimination Provision , may use a modified formula to calculate your benefit. Under this provision, your social security benefit will be reduced, but you will still be eligible to receive a benefit.

There are exemptions to these provisions. You are exempt from the WEP provisions if 1) you have at least 30 years of substantial earnings under the Social Security system.

Minimize Taxes Now Or Maximize Benefits Later

Should you skip some or all of the business tax deductions youre entitled to increase your future Social Security benefit? Maybe. The answer is complicated because lower-earning business people stand to gain more in the future than their higher-earning counterparts due to how Social Security retirement benefits are calculated.

Another critical factor is where your Schedule C earnings fall compared to your previous years earnings. If you have a full 35-year career behind you and youre not earning nearly as much in your current self-employed pursuits, it makes sense to take all the deductions you can, as your Social Security benefits will be calculated based on your 35 highest-earning years. In this case, you want to minimize your Social Security taxes.

But if youre currently in the high-earning part of your career, a higher Schedule C income can help you get higher Social Security benefits later. Unless you enjoy complex math problems or have a top-notch accountant, its probably not worth the headache to figure out whether youll earn more in future Social Security benefits than youd save by claiming all the deductions you can today.

Of course, suppose youre on the cusp of not having enough Schedule C income to give you the work you need to qualify for Social Security. In that case, it may be worth foregoing some deductions to make sure youre entitled to any benefits at all.

Can You Do Any Other Type Of Work

If you cant do the work you did in the past, we look to see if there is other work you could do despite your medical impairment.

We consider your medical conditions, age, education, past work experience, and any transferable skills you may have. If you cant do other work, well decide you qualify for disability benefits. If you can do other work, well decide that you dont have a qualifying disability and your claim will be denied.

Read Also: How To Pass Social Security Disability Mental Exam

How To Receive Federal Benefits

To begin receiving your federal benefits, like Social Security or veterans benefits, you must sign up for electronic payments with direct deposit.

If You Have a Bank or Credit Union Account:

- Call the Go Direct Helpline at .

If You Don’t have a Bank or Credit Union Account:

- Direct Express debit card – a pre-paid debit card. Get help by calling the Go Direct Helpline at .

Make Changes to an Existing Direct Deposit Account:

On Go Direct’s FAQ page, learn how to make changes to an existing direct deposit account. You also may contact the federal agency that pays your benefit for help with your enrollment.

Is Your Condition Severe

Your condition must significantly limit your ability to do basic work-related activities, such as lifting, standing, walking, sitting, or remembering for at least 12 months. If it does not, we will find that you do not have a qualifying disability.

If your condition does interfere with basic work-related activities, we go to Step 3.

Read Also: Attorneys For Social Security Disability

What Else Affects Your Retirement Benefits

Everyones retirement is unique. Beyond deciding when to begin receiving retirement benefits, other factors that can affect your benefits include whether you continue to work, what type of job you had, and if you have a pension from certain jobs.

Continuing To Work

You can choose to keep working beyond your full retirement age. If you do, you can increase your future Social Security benefits. Each extra year you work adds another year of earnings to your Social Security record. Higher lifetime earnings can mean higher benefits when you choose to receive benefits.

Specific Types Of Earnings

While Social Security earnings are calculated the same way for most American workers, there are some types of earnings that have additional rules.

Earning types with special rules include:

Pensions And Other Factors

Pensions and taxes have the potential to impact your retirement benefit. Review the resources below on pensions and other factors you should consider:

- Windfall Elimination Provision : If you have a pension from a job for which you didnt pay Social Security taxes, this policy may lower your retirement benefits.

- Government Pension Offset : This policy affects benefits as a spouse, widow, or widower if you have a pension from a government job for which you didnt pay Social Security taxes.

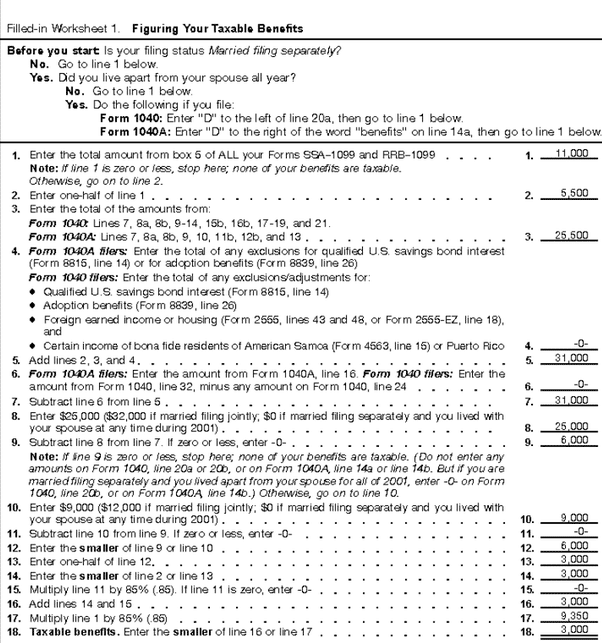

- Income Taxes And Your Social Security Benefits: You might have to pay federal income taxes on your Social Security benefits in certain situations.

Special Rules For People Who Are Blind Or Have Low Vision

We consider you to be legally blind under Social Security rules if your vision cannot be corrected to better than 20/200 in your better eye. We will also consider you legally blind if your visual field is 20 degrees or less, even with a corrective lens. Many people who meet the legal definition of blindness still have some sight and may be able to read large print and get around without a cane or a guide dog.

If you do not meet the legal definition of blindness, you may still qualify for disability benefits. This may be the case if your vision problems alone or combined with other health problems prevent you from working.

There are several special rules for people who are blind that recognize the severe impact of blindness on a person’s ability to work. For example, the monthly earnings limit for people who are blind is generally higher than the limit that applies to non-blind workers with disabilities.

In 2022, the monthly earnings limit is $2,260.

Also Check: Social Security Ticket To Work 2021

How Credits Are Earned

Since 1978, you earn up to a maximum of four credits per year.

The amount of earnings it takes to earn a credit may change each year. In 2022, you earn one Social Security or Medicare credit for every $1,510 in covered earnings each year. You must earn $6,040 to get the maximum four credits for the year.

During your lifetime, you might earn more credits than the minimum number you need to be eligible for benefits. These extra credits do not increase your benefit amount. The average of your earnings over your working years, not the total number of credits you earn, determines how much your monthly payment will be when you receive benefits.

Read our publication, “How You Earn Credits,” for more information.

How Much Work Do You Need

In addition to meeting our definition of disability, you must have worked long enough and recently enough under Social Security to qualify for disability benefits.

Social Security work credits are based on your total yearly wages or self-employment income. You can earn up to four credits each year.

The amount needed for a work credit changes from year to year. In 2022, for example, you earn one credit for each $1,510 in wages or self-employment income. When you’ve earned $6,040 you’ve earned your four credits for the year.

The number of work credits you need to qualify for disability benefits depends on your age when your disability begins. Generally, you need 40 credits, 20 of which were earned in the last 10 years ending with the year your disability begins. However, younger workers may qualify with fewer credits.

For more information on whether you qualify, refer to How You Earn Credits.

Also Check: North Carolina Social Security Office

Who Is Exempt From Paying Social Security Tax

OVERVIEW

Most people can’t avoid paying Social Security taxes on their employment and self-employment income. There are, however, exemptions available to specific groups of taxpayers.

Just like the income tax, most people cant avoid paying Social Security taxes on their employment and self-employment income. There are, however, exemptions available to specific groups of taxpayers. If you fall under one of these categories, you can potentially save a significant amount of money. However, if you do take advantage of the exemption, you will be ineligible to receive any of the benefits offered by Social Security.

How Can You Supplement Your Social Security Income

When it comes to investing for retirement, it’s essential to start saving as early as possible whether that’s through an employer-sponsored 401 or pension plan or through an individual retirement account.

Though experts recommend saving between 10% and 15% of your annual income, you can start small and increase your savings rate over time, especially if you have outstanding debt from credit cards, healthcare expenses or student loans.

If you have an employer that matches your 401, maxing out your matching contributions should be your first priority as it’s essentially free money. Many employers will offer to match typically between 2% and 4% of an employee’s annual salary.

After you’ve maximized your employer match, you might consider opening an individual retirement account which is a retirement account separate from your employer. The traditional retirement account and Roth IRA are two types of popular retirement accounts.

Both retirement accounts offer different tax advantages. A Roth IRA is an after tax retirement account where individuals use income that’s already been taxed and their investments grow tax-free over time. This means you won’t have to pay taxes on your investment gains later in life.

On the other hand, a traditional IRA is a pre-tax retirement account where individuals’ contributions are tax deductible now, but they’ll have to pay income taxes later when they withdraw money in retirement.

You May Like: Social Security Office Coconut Creek

Fact #: Social Security Is More Than Just A Retirement Program It Also Provides Important Life Insurance And Disability Insurance Protection

Over 65 million people, or more than 1 in every 6 U.S. residents, collected Social Security benefits in January 2022. While older adults make up about 4 in 5 beneficiaries, another one-fifth of beneficiaries received Social Security Disability Insurance or were young survivors of deceased workers.

In addition to Social Securitys retirement benefits, workers earn life insurance and SSDI protection by making Social Security payroll tax contributions:

- About 96 percent of people aged 20-49 who worked in jobs covered by Social Security in 2020 have earned life insurance protection through Social Security.

- For a young worker with average earnings, a spouse, and two children, thats equivalent to a life insurance policy with a face value of nearly $800,000 in 2020, according to Social Securitys actuaries.

- About 89 percent of people aged 21-64 who worked in covered employment in 2020 are insured through Social Security in case of severe disability.

The risk of disability or premature death is greater than many people realize. Some 7 percent of recent entrants to the labor force will die before reaching the full retirement age, and many more will become disabled.

Fact #: Social Security Provides A Foundation Of Retirement Protection For Nearly All People In The Us

97% of older adults either receive Social Security or will receive it.

Almost all workers participate in Social Security by making payroll tax contributions, and almost all older adults receive Social Security benefits. In fact, 97 percent of older adults either receive Social Security or will receive it, according to Social Security Administration estimates.

The near universality of Social Security brings many important advantages. It provides a foundation of retirement protection for people at all earnings levels. It encourages private pensions and personal saving because it isnt means-tested it doesnt reduce or deny benefits to people whose income or assets exceed a certain level. Social Security provides a higher annual payout than private retirement annuities per dollar contributed because its risk pool is not limited to those who expect to live a long time, no funds leak out in lump-sum payments or bequests, and its administrative costs are much lower.

Universal participation and the absence of means-testing make Social Security very efficient to administer. Administrative costs amount to only 0.6 percent of annual benefits, far below the percentages for private retirement annuities. Means-testing Social Security would impose significant reporting and processing burdens on both recipients and administrators, undercutting many of those advantages while yielding little savings.

Don’t Miss: Negatives Of Getting Social Security Disability

Who Is Exempt From Paying Into Social Security

Kirsten Rohrs Schmitt is an accomplished professional editor, writer, proofreader, and fact-checker. She has expertise in finance, investing, real estate, and world history. Throughout her career, she has written and edited content for numerous consumer magazines and websites, crafted resumes and social media content for business owners, and created collateral for academia and nonprofits. Kirsten is also the founder and director of Your Best Edit find her on LinkedIn and Facebook.

Almost all U.S. workers are required to contribute part of their paychecks to the Old-Age, Survivors, and Disability Insurance program, which most of us know as Social Security. This pension program is an important source of income for many retirees. According to the most recent statistics, 79% of individuals received at least 50% of their retirement income from Social Security. About 27% of recipients get 90% of their income from this source.

Social Security benefits go back to the days of the Great Depression. They were created as part of a social safety net designed to reduce poverty and provide care for the elderly and disabled. The program is funded by taxpayer dollars, primarily through payroll deductions. While most American taxpayers do not qualify for an exemption from Social Security taxes. However, they do exist for a small number of people.

Certain State And Local Government Workers

State or local government employees, including those working for a public school system, college, or university, may or may not pay Social Security taxes. If they’re covered by both a pension plan and Social Security, then they must make Social Security contributions. But if they’re covered solely by a pension plan, then they dont have to contribute to the Social Security system.

You May Like: Can Husband And Wife Both Collect Social Security

Why Is Social Security Important

Social Security is vital to many retirees and is one of the few social programs that enjoys broad support across the political spectrum. A 2020 AARP survey found that the program was supported by 90% of Democrats, Republicans and independents.

While Social Security is intended to supplement peoples’ retirement savings, many retirees end up relying on the program’s benefits as their primary source of retirement income. According to the Center on Budget and Policy Priorities, half of seniors get half of their retirement income from Social Security.

The National Institute on Retirement Security describes retirement income as a ‘three-legged stool’, consisting of Social Security, a pension plan and individual retirement savings through accounts like a 401 or an individual retirement account .

With only half of private sector employees having a 401 at any time, Social Security is one of the most important aspects of retirement income’s ‘three-legged stool’, says Munnell.

“The 401 system has worked well for, let’s say the top 40% of workers and is not much help for the bottom 60%,” says Munnell. “A lot of our population has nothing else to rely on other than Social Security, so you really don’t want to have that benefit level cut.”

Will My Medicare Coverage Be Affected By The Social Security Double

No although your Social Security benefits may be reduced by these two provisions, your coverage will not be affected. If you believe that, based on your age and/or amount of creditable service with the MTRS, you are exempt from either the Windfall Elimination Provision or the Government Pension Offset, the Social Security Administration will require you to submit a letter from us that states the date on which you met the eligibility requirement. To request this letter,

Also Check: Us Social Security Administration Fresno Ca

You Still Have To Pay Into The System

InvestopediaForbes AdvisorThe Motley Fool, CredibleInsider

Kirsten Rohrs Schmitt is an accomplished professional editor, writer, proofreader, and fact-checker. She has expertise in finance, investing, real estate, and world history. Throughout her career, she has written and edited content for numerous consumer magazines and websites, crafted resumes and social media content for business owners, and created collateral for academia and nonprofits. Kirsten is also the founder and director of Your Best Edit find her on LinkedIn and Facebook.

When you work for someone else, that employer takes Social Security taxes out of your paycheck and sends the money to the Internal Revenue Service . But things work a little differently for people who are self-employed. If you fall into this category, keep reading. This article will help you understand how to calculate the Social Security taxes you owe.