C How Is Contribution Liability Of The Self

For the reasons just outlined, the social security contribution position of a self-employed individual is often different from that of an employee. Insofar as it depends on the income tax laws, the calculation of earnings must reflect the different income tax rules. The effect in most cases is to delay any contribution liability until the net profits of the individual for each accounting or tax year can be established. The only ways to claim a contribution in advance of this are to demand a flat-rate contribution or to attribute a notional income to the individual.148

Because the entire contribution of a self-employed individual must be paid by that individual, it may seem to be a higher rate than that of employees. It may prove inappropriate to impose full contributions on the self-employed for reasons noted previously. For example, the self-employed may be required to contribute only to basic minimum pensions and not to a full earnings-related scheme. If the self-employed receive the same benefits as employees, any reduction in the contribution of the self-employed may amount to a cross-subsidy by employees and their employers. If the net cost of contributions of the self-employed is reduced by allowing income tax relief, the effect is partly to shift the cost to general taxpayers.

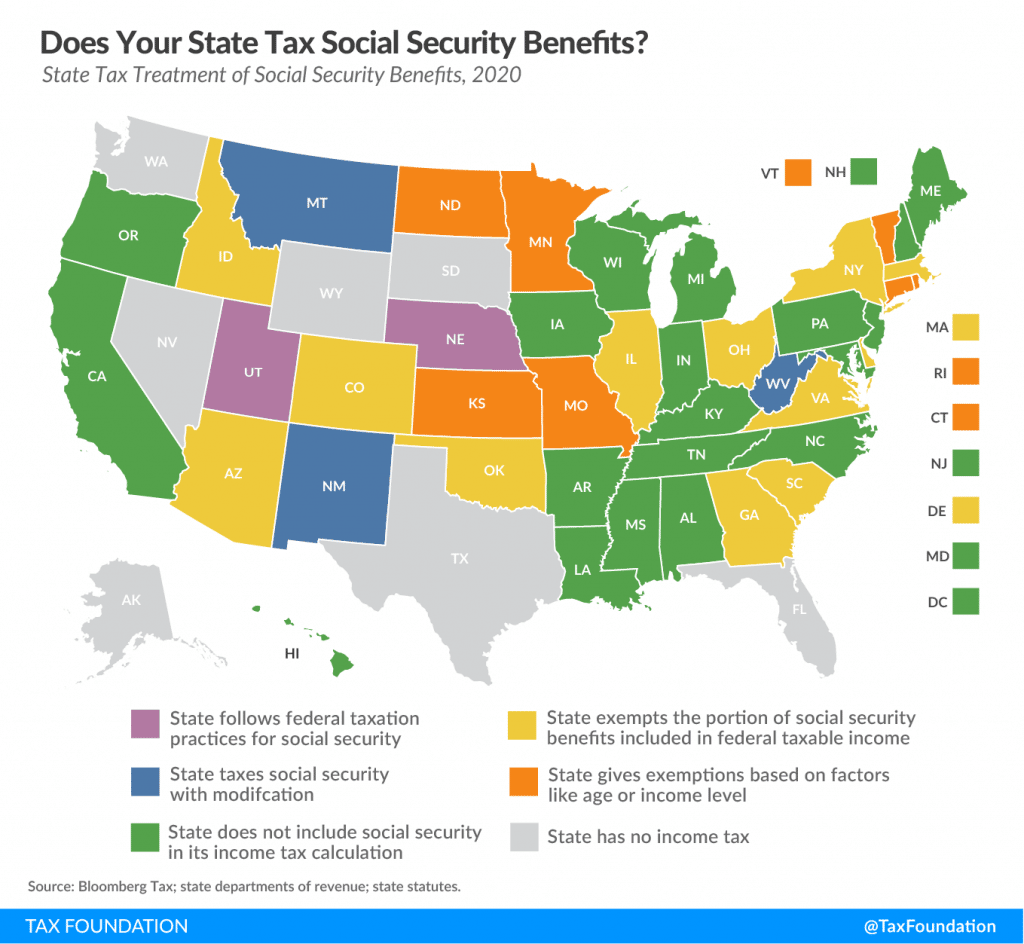

State Taxes On Social Security Benefits

Everything weve discussed above is about your federal income taxes. Depending on where you live, you may also have to pay state income taxes.

There are 12 states that collect taxes on at least some Social Security income. Two of those states follow the same taxation rules as the federal government. So if you live in one of those two states then you will pay the states regular income tax rates on all of your taxable benefits .

The other states also follow the federal rules but offer deductions or exemptions based on your age or income. So in those nine states, you likely wont pay tax on the full taxable amount.

The other 38 states do not tax Social Security income.

| State Taxes on Social Security Benefits | |

| Taxed According to Federal Rules | Minnesota, Utah |

To Find Out If Their Benefits Are Taxable Taxpayers Should:

- Take one half of the Social Security money they collected during the year and add it to their other income.

Other income includes pensions, wages, interest, dividends and capital gains.

- If they are single and that total comes to more than $25,000, then part of their Social Security benefits may be taxable.

- If they are married filing jointly, they should take half of their Social Security, plus half of their spouse’s Social Security, and add that to all their combined income. If that total is more than $32,000, then part of their Social Security may be taxable.

You May Like: Social Security Office Cincinnati Ohio

Control Your Taxes Now & Later

The longer you wait to claim Social Security benefits, the better chance you’ll have to boost the overall tax efficiency of your retirement income plan. Here’s how.

Drawing down traditional tax-deferred assets before collecting Social Security can enable you to control both your current and future taxes.

The amount you withdraw from a traditional IRA, for example, lowers your account balance, which may reduce your future required minimum distributions .

Since your RMD is considered ordinary income, having smaller distributions while you’re collecting benefits may reduce the taxes on your benefitsor keep you from paying taxes altogether.

In addition, managing your retirement income in this way can also help you qualify to pay lower Medicare parts B and D premiums, which are income-based.

Will You Owe Taxes On Your Social Security Benefits

As with most questions about taxes, the answer is “it depends.”

About 40% of people who get benefits pay income taxes on them, according to the Social Security Administration . That’s because their income in retirement exceeds limits set by tax rules and regulations.

Generally, if Social Security is your only retirement income, you won’t have to pay taxes on it. But if you have at least moderate income, you’ll most likely owe the government some money.

The good news is that while up to 85% of your benefits may be taxed at ordinary income rates, it’s never 100%. That’s considered tax-efficient compared with other retirement plans whose distributions may be fully taxable. In addition to the federal tax bite, 13 states also tax Social Security benefits using either the federal provisional income formula or their own.

Don’t Miss: Do I File Taxes On Social Security

How The West Taxes Social Security

Nine of the 13 states in the West don’t have income taxes on Social Security. Alaska, Nevada, Washington, and Wyoming don’t have state income taxes at all, and Arizona, California, Hawaii, Idaho, and Oregon have special provisions exempting Social Security benefits from state taxation. That leaves Colorado, Montana, New Mexico, and Utah, which impose taxes on Social Security for some individuals.

Five Groups Exempt From Social Security Taxes

Nearly every American worker as well as their employer is required to pay Social Security and Medicare taxes, including the self-employed. If you dont pay into the system when you work, then you cant collect the income benefits later in life. And for many older Americans who havent saved enough on their own for retirement, Social Security may be the only money they have to rely on.

However, there are certain groups of taxpayers for which Social Security taxes do not apply, including:

Recommended Reading: Social Security Administration Phone Number

What Percentage Of Social Security Benefits Are Taxable

The share of your benefits that are taxable depends on your filing status, adjusted income and the Social Security Administrations income minimums that trigger taxes.

None of your benefits are taxable if you earn less than the threshold amount for your filing status. But 50% of your Social Security benefits me be taxable if the following applies:

- Single filers: Your income is between $25,000 and $34,000

- Joint married filers: Your income is between $32,000 and $44,000

Lets say youre a single filer who received $30,000 from Social Security benefits and had no other income. Because your income falls between the $25,000 and $34,000 guideposts for a single filer, 50% of your Social Security benefits$15,000may be subject to tax.

And 85% of your benefits are taxable in the following instances:

- Single filers: Your income exceeds $34,000

- Joint married filers: Your income exceeds $44,000

So if youre a single filer who received $35,000 from Social Security and had no other income, then 85% of your Social Security benefits$29,750could be taxed.

Make Sure To Pay Your Estimated Taxes On Time To Avoid Penalties

A Tea Reader: Living Life One Cup at a Time

People who work for companies have estimated taxes withheld from their paychecks, but the self-employed, business owners, and those who live on investment income are required to proactively pay estimated taxes on a quarterly basis.

In the United States, income taxes are pay-as-you-go. If you dont keep up with payments, you could potentially end up with a large tax bill, in addition to penalties for late payment, when it comes time to file your return.

Dont Miss: Are Uber Rides Tax Deductible

Also Check: Nearest Social Security Administration Office

Do You Pay State Taxes On Social Security Benefits

If you are wondering, are state taxes taken out of Social Security, the answer to this question depends upon the state you live in. 13 states namely, Connecticut, Colorado, Kansas, Minnesota, Montana, Missouri, Nebraska, New Mexico, North Dakota, Rhode Island, Utah, Vermont, and West Virginia levy a state tax on Social Security benefits.

Fortunately, there are also some states with no tax on Social Security. In total there are 38 states that dont tax Social Security. So, if you reside in any of these states, you will enjoy tax-free benefits. However, these states do charge other types of taxes. Given below is a detailed explanation of the same.

State Taxation Of Retirement Pension And Social Security Income

The following chart provides an overview of how states treat retirement, pension, and Social Security Income. It also shows the starting point for computing state income tax liability. You can find additional details on these topics and more in the CCH® State Tax Smart Charts on CCH® AnswerConnect.

Read Also: Lee County Social Security Office

Who Pays Social Security Tax

Nearly all employed individuals must pay Social Security tax on their work income. The employee pays one-half of the tax through payroll withholding and the employer pays the other half of the tax.

Under the current rate, employees must pay 6.2% of their total earnings up to the maximum wage base employers pay 6.2% of each employees earnings up to the maximum wage base. This amount equals the 12.4% that makes up the Social Security tax.

The 12.4% Social Security tax does not include the Medicare tax this amounts to an additional 2.9%, which is divided between the employee and employer.

While the Social Security tax is paid by almost all U.S. employees, there are some exceptions, which include members of some religious groups, temporary students, temporary student workers, nonresident aliens, foreign government employees, employees of state and local governments that already pay into a government pension plan, and individuals who are self-employed who earn less than $400 annually. Also, those under the age of 18 who work for a family business and those under the age of 21 who are employed as babysitters, housekeepers, or who perform domestic work are exempt from Social Security taxes.

A What Limits Do Schemes Impose

All countries find it necessary to impose limits on the jurisdiction of a compulsory social security scheme. A scheme requires two sets of limits: those applying to individuals claiming benefit, and those applying to persons liable to contribute. The limits may not be the same, but both normally require some continued economic activity, or at least some continued presence, in the territory of the state. The comparable direct tax rules are the residence of the employee or self-employed person and the residence of the employer within the state.152 Labor relations principles do not follow this basis. For labor relations law purposes, the usual rule is that a state claims competence over employment if the place of employment is in the territory of the state. An employee who resides in one state and works in another state is treated on these principles as working in the state where the work is based. Income tax is generally charged where the worker lives, but may also be charged where the employment is carried out. Particularly in areas bordering two states or in states with many migrant workers, the tax and labor relations rules may frequently have different and conflicting effects on an employee.

Don’t Miss: Social Security Office Jonesboro Ar

How To Get Out Of Taxes In Retirement

There is a loophole that can help you get out of federal taxes: a Roth account. Withdrawals from a Roth IRA or Roth 401 don’t count toward your provisional income. If you have significant savings in one of these accounts, it could reduce your provisional income enough to lower or even eliminate your federal tax bill.

For example, say you’re still receiving $20,000 per year from Social Security, but rather than withdrawing $40,000 per year from a 401, you pull it from a Roth IRA. In that case, your provisional income would be just $10,000 per year, putting you below the income limit for federal taxes.

Taxes may be unavoidable for many retirees, but it’s still wise to know how they’ll affect your benefits. When you know what to expect in retirement, you can ensure you’re as prepared as possible.

The $18,984 Social Security bonus most retirees completely overlook

If you’re like most Americans, you’re a few years behind on your retirement savings. But a handful of little-known “Social Security secrets” could help ensure a boost in your retirement income. For example: one easy trick could pay you as much as $18,984 more… each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we’re all after. Simply click here to discover how to learn more about these strategies.

The Motley Fool has a disclosure policy.

Why You Can Trust The Annuity Expert

The Annuity Expert is a licensed annuity broker and insurance agency since 2008. We offer the largest selection of annuities in the United States. Information provided is written by a financial professionalnot a content writer with no financial experience.

We have been recognized as an authority of annuities and insurance by:

Dont Miss: What Can Be Itemized On Taxes

Read Also: Do You Automatically Get Medicare With Social Security

Are Social Security Benefits Taxed After Age 66

Are Social Security benefits taxable regardless of age? Yes.The rules for taxing benefits do not change as a person gets older. Whether or not your Social Security payments are taxed is determined by your income level specifically, what the Internal Revenue Service calls your provisional income.

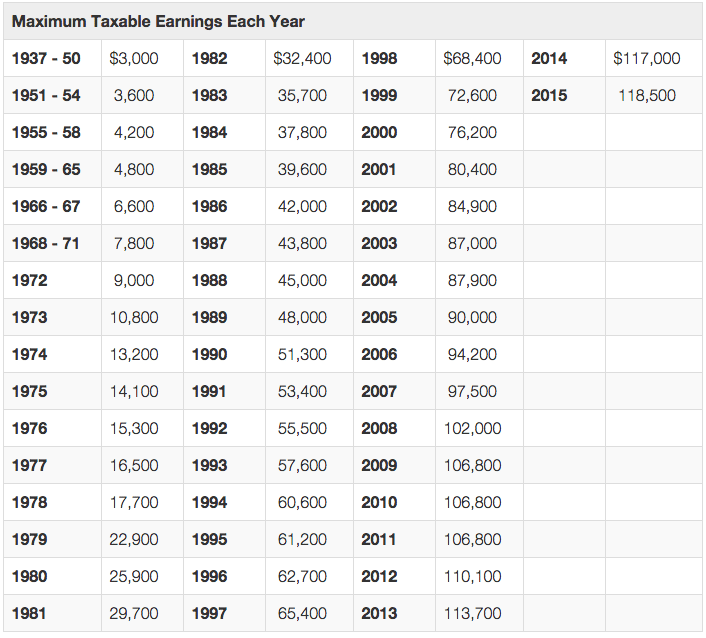

How To Calculate Social Security Tax

Its fairly easy to calculate your Social Security tax. You multiply your earningsup to $147,000by your Social Security tax rate, depending on whether youre an employee or are self-employed.

For example, lets say Michael works for a company and earns a salary of $150,000 in 2022. The Social Security tax applies to the first $147,000 of his wages, so his tax liability is $9,114: his $147,000 income multiplied by 6.2% .

If hes working for himself and earns the same $150,000, hell owe the full Social Security tax on his first $147,000 of income. So his liability would be $18,228: $147,000 multiplied by 12.4% . However, his tax bill may be lowered if he qualifies for the self-employment tax deduction.

Don’t Miss: What Is The Phone Number To Social Security Administration

C Should Benefits Be Subject To Tax And Contributions

The interaction between social security benefits and the income tax and contribution treatment of those benefits involves several complex issues.

1. Making Benefits Subject to Contributions

The first issue is whether benefits are subject to contribution liability. When benefits and contributions are related to the same fund, the simplest approach is to treat benefits as not subject to contributions. The fairness of this policy depends on how the rate of benefits compares with the income being replaced by the benefit. If, for example, the benefit fully replaces the income, the beneficiary will gain by having saved the contribution. The easiest approach to avoid overcompensation is to reduce the level of benefits by the amount saved. If the benefit only partially replaces the income, then exempting the benefit from contribution increases the net value of the benefit.

2. Notional Contributions

3. Imposing Income Tax on Benefits

With respect to the income tax treatment of benefits, there are two issues of principle. The first is whether benefit income should be liable to income tax. The second is the legal nature of the benefit income if it is to be subject to income tax. It is not earnings, although it will normally be of an income nature. It may or may not be paid to replace earnings.

Are States That Tax Social Security Benefits Worse For Retirees

Including Social Security benefits in taxable income doesnt make a state a more expensive place to retire. According to the Missouri Economic Research and Information Center, as of the third quarter of 2021, while four of the states that tax Social Security benefits have notably high cost-of-living index scores, the remaining eight fell within the two lowest-scoring groups. Kansas, in particular, had the second-lowest score in the U.S., after Mississippi.

The inverse is also true, as states that dont levy a Social Security tax arent inherently tax-friendlier places to live. When a state government doesnt garner income from one potentially taxable source, it typically makes up for it with other forms of taxation.

For instance, while Texas doesnt levy a state income tax at all , it relies heavily on taxes from a variety of other sources, including insurance taxes sin taxes on mixed beverages, tobacco products, and coin-operated machines and motor fuel taxes.

Other states that dont earn revenue from Social Security incomesuch as Arkansas, California, Louisiana, and New Yorkhave some of the highest income or sales tax rates in the U.S.

Living in a state that levies fewer taxes may be good for your budget, but it can limit the local governments ability to invest in social services that you or your loved ones may rely on, such as healthcare, infrastructure, and public transportation.

Don’t Miss: States Tax Social Security Benefits

What Retirement Income Is Taxable In Michigan

Michigan retirees born before 1946, about of all Michigan pensioners, are unaffected and whose public pensions are fully tax-exempt. Retirees born between 1946 and 1952 can deduct the first $20,000 of pension income for single taxpayers and $40,000 for married couples filing jointly prior to age 67.

C Independent Workers: Are They Employees

Experience in many countries80 shows that employees will be strongly tempted to claim to be self-employed if the liability to tax and social security contributions is greater for an employee than for a self-employed individual. This temptation is particularly marked when a high level of contributions or payroll taxes is levied on the employer. If an employer employs an employee, the employer contribution is payable. If the employee is instead taken on under a contract as a self-employed person working independently, there is no payroll tax. The saving to the employer may be considerable, even if the employee receives more money. It is also harder for the social security authorities to obtain a full contribution from a self-employed individual than from an employer. One solution to the noncollection problem is to levy a flat-rate tax on all payments made to persons in these categories, whether they are employees or self-employed. However, if the rate of withholding tax applied is too high, a genuinely self-employed person may be overtaxed because this approach makes no allowance for business expenses. This may not be a problem with genuine employees.81

This problem may require a case-by-case approach, with rulings being made for, and agreements being secured with, different groups of employers or employees. These agreements can reflect the fact that contributions and benefits are linked, at the state level if not at the individual level.

Read Also: What Is The Difference Between Social Security And Ssi