Strategies For Maximizing Spousal Benefits

Every married couple has to figure out the best way to maximize their benefits depending on their own circumstances.

The three strategies below will help you make the most of your Social Security spousal benefits, depending on your circumstances. However, keep in mind that, regardless of your circumstances, the most a spouse can get is 50% of the amount that the higher-earning partner is entitled to at full retirement age.

Is There A Maximum Benefit

Yes, there is a limit to how much you can receive in Social Security benefits. The maximum Social Security benefit changes each year. For 2022, itâs $4,194/month for those who retire at age 70 . Multiply that by 12 to get $50,328 in maximum annual benefits. If that’s less than your anticipated annual expenses, youâll need to have additional income from your own savings to supplement it.

Explore How The Age You Start Collecting Social Security Affects Your Retirement Benefits

The calculator bases your benefit estimate on current formulas from the Social Security Administration. Your answers are anonymous. Because we do not access or use your Social Security earnings record, these are rough estimates.

Your estimated benefits:

Select claiming ages on the graph to see how your estimated benefit changes.

Claiming at age Age 67 is your full benefit claiming age.

Compared to claiming at your full benefit claiming age.

Social Security retirement benefits are not designed to be your sole source of retirement income, but waiting even one month will increase your benefits.

Don’t Miss: Us Social Security Administration Bakersfield Ca

Compare Two Application Ages

Use the following calculation to compare the financial difference between two Social Security retirement benefit application ages. The U.S. Social Security website provides estimated benefit payment amounts of different claim ages.

The term “Social Security” is used in the U.S. to refer to the system that provides monetary assistance to people with inadequate or no income. The term can be better understood by thinking of it as the “financial security of society.” Although they may not go by the same name, there are many similar government systems in place throughout the world. This calculator is specifically intended for U.S. Social Security purposes.

If Youre Receiving Other Retirement Benefits

The calculation gets a bit more complicated if you are eligible to receive benefits from a government pension or foreign employer that is not covered by Social Security. In that case, you may still be eligible, but the amount will be reduced.

For example, if you have a government pension for which Social Security taxes are not withheld, the amount of your spousal benefit is reduced by two-thirds of the amount of your pension. This is known as a government pension offset.

For example, suppose you are eligible to receive $800 in Social Security spousal benefits and you also get $300 from a government pension each month. Your Social Security payment is reduced by two-thirds of $300, or $200, making your total benefit amount from all sources $900 per month + $300).

Also Check: Lansing Mi Social Security Office

Don’t Miss: Social Security Office Albany Georgia

How Can A Married Couple Maximize The Surviving Spouses Benefits

Im glad you asked! Many Americans are so excited to start collecting checks when they hit their sixties that they forget to plan a Social Security strategy that makes sense for their spouse, too. The age at which you begin taking retirement benefits affects how much your monthly payments will be for the rest of your life and beyond. Your filing age will set the amount that will go to your survivors as Social Security death benefits.

The Bipartisan Budget Act of 2015 changed the auxiliary benefit rules in important ways. First, as of April 30, 2016, the file-and-suspend strategy for maximizing spousal benefits is no longer allowed. That strategy allowed one member of a couple, usually the higher earner, to file for primary benefits at 62 and then suspend those benefits, allowing them to grow until the filer reached age 70. In the meantime, the first persons spouse would file for spousal benefits and let his/her own primary benefits grow. It was a lucrative strategy for those lucky folks who took advantage of it, but it has been phased out.

For everyone else, if you file for your own benefits before age 70 and then have a change of heart and decide you want to take advantage of Delayed Retirement Credits, you can still suspend your benefits. But if you suspend your benefits, any benefits based on your record will be suspended, too. Retirees who un-suspend their benefits will no longer get a lump sum payment as of April 30, 2016.

When Will You Collect

The SSA calculates your benefit amount at your full retirement age . This depends on the year you were born. FRA by birth year is:

- 19431954: age 66

- 1955: age 66 and two months

- 1956: age 66 and four months

- 1957: age 66 and six months

- 1958: age 66 and eight months

- 1959: age 66 and 10 months

- 1960 and later: age 67

Don’t Miss: Social Security Office Kennett Mo

Bonus: How Reductions Are Calculated On A Monthly Basis

One last thing I think is important for those who really want to grasp the fine details of this calculation is understanding how the reductions are calculated on a monthly basis since you may want to file in between birthdays.

There are three separate bands that you have to know about:

For the band of more than 36 months away from FRA, the spousal payment and your own benefits are reduced the same. 5/12 of 1% per month.

Within the band of 1-36 months before FRA, spousal benefits are reduced by 25/36 of 1% percent and your own benefits are reduced by 5/9 of 1%.

After full retirement age spousal benefits are not increased at all but your own benefits are increased by 2/3 of one percent.

I know weve covered A LOT of ground in this article but I hope its helpful when you are planning how to file for social security.

Before you leave be sure to join my members group. Its currently at 9,000+ members and has some really smart people who love to answer any questions you may have about Social Security. From time to time Ill even drop in to add my thoughts, too. You should also consider joining the 273,000+ subscribers on my YouTube channel!

My video on Spousal Benefits

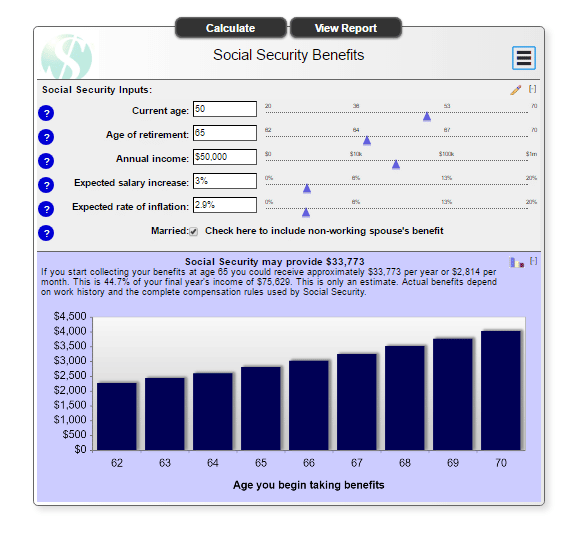

Social Security Benefits Calculator

Do you wonder how much you might receive in Social Security? Use this calculator to help you estimate your Social Security benefits. Remember, this is only an estimate. Your actual benefits may vary depending on your actual work history and income.

This illustration does not take into account certain fees and expenses that may be charged to your investment. Webster Five does not provide tax or legal advice. You should contact your tax or legal adviser concerning your particular situation. Information and interactive calculators are made available to you as self-help tools for your independent use and are not intended to provide investment advice. We cannot and do not guarantee their applicability or accuracy in regards to your individual circumstances. All examples are hypothetical and are for illustrative purposes only. We encourage you to seek personalized advice from our qualified professionals regarding all personal finance issues.

Also Check: Social Security Office In Selma Alabama

The Downside Of Claiming Early: Reduced Benefits

Consider the following hypothetical example. Colleen is 62 as of 2022. If Colleen waits until age 67 to collect, she will receive approximately $2,000 a month. However, if she begins taking benefits at age 62, shell receive only $1,400 a month. This early retirement penalty is permanent and results in her receiving 30% less year after year.

However, if Colleen waits until age 70, her monthly benefits will increase another 24% over what she would receive at her FRA, to a total of $2,480 per month.1 If she were to live to age 89, her lifetime benefits would be about $112,000 more, or at least 24% greater, because she waited until age 70 to collect Social Security benefits.2

Can You Switch From Your Social Security Benefit To A Spousal Benefit

Yes. If you begin collecting your own Social Security benefits at age 62 but your spouse keeps working for another few years, you are eligible to your spouses benefit after they retire if it is higher than your own. Thus, your spouse will get the maximum amount and you can file for 50% of the amount your spouse would receive at full retirement age.

Read Also: What Can Someone Do With My Social Security Number

The Social Security Administration Website

This one is a no-brainer, but the Social Security Administration website provides a number of different benefit calculators there’s a tool to help you figure out when your full retirement age is and another that calculates how your earnings could impact your benefit amount.

The most useful tool that the Social Security administration has is the retirement estimator which calculates your monthly benefits from the administration’s own data on your earnings history. The closer you are to retirement, the more accurate the calculator will be because you’ll have fewer earnings years ahead of you.

However, most of the calculators on the Social Security Administration website don’t account for many factors in the calculation of your monthly benefit. If you have a spouse or other sources of retirement income that could affect the percentage of your benefits that are taxable, you may have to use multiple tools.

Can I Use The Calculator To Figure Out Social Security Disability Insurance And Supplemental Security Income

No. SSDI is aimed at people who cant work because they have a medical condition expected to last a year or more or result in death. Your SSDI benefits last only as long as you suffer from a significant medical impairment while not earning significant other income.

SSI is a separate program for people with little or no income or assets who are 65 or older, as well as for those of any age, including children, who are blind or who have disabilities. The maximum monthly SSI payment for 2022 is $841 for a single person and $1,261 for a couple. But some states add to that payment, and you may receive less than the maximum if you or your family has other income. Get more information about SSDI and SSI from the Social Security Administration.

Also of Interest

Read Also: Social Security Office Sioux City

How Are Social Security Survivor Benefits Calculated

To understand Social Security benefit calculations, you first need to understand one piece of jargon: primary insurance amount . A persons primary insurance amount is the amount of their monthly retirement benefit, if they file for that benefit exactly at their full retirement age.

If your spouse has died and you file for a benefit as their survivor, your benefit will depend on:

- Your deceased spouses PIA,

- Whether your deceased spouse had already filed for his/her retirement benefit ,

- The age at which your spouse died, and

- The age at which you file for your benefit as a surviving spouse.

Lets first assume that you have reached your survivor full retirement age by the time you file for your survivor benefit.

If your spouse had not filed yet for his/her own retirement benefit by the time he/she died, then:

- If your spouse died prior to his/her full retirement age, your benefit as a surviving spouse will be your deceased spouses PIA.

- If your spouse died after reaching his/her full retirement age, your benefit as a surviving spouse will be whatever he/she would have received as a retirement benefit, if he/she had filed on his/her date of death.

If your spouse had filed for his/her own retirement benefit by the time he/she died, then your benefit as a surviving spouse will be the greater of:

- The amount your deceased spouse was receiving at the time of his/her death, or

- 82.5% of your deceased spouses PIA.

How Do Social Security Spousal Benefits Work

You’re eligible for spousal benefits if you’re married, divorced, or widowed, and your spouse is or was eligible for Social Security. Spouses and ex-spouses generally are eligible for up to half of the spouse’s entitlement. Widows and widowers can receive up to 100%.

You can claim benefits based on your own work history or on that of your spouse. You’ll automatically get the larger amount.

If you are no more than three months away from age 62, you can apply online or by phone. If you plan to put off applying to get the largest payment possible, wait until you’re no more than three months from full retirement age. That’s 66 or 67, depending on your year of birth.

You May Like: States That Don T Tax Social Security

Social Security For The Disabled

People who are disabled, are dependents of retired or disabled workers, or are surviving spouses/children may also receive benefits. Note that this is supplementary information and that the Social Security Calculator only provides calculations for retirement benefits.

The SSA’s definition of disability refers to total disability, so partial or short-term disabilities are not qualified for benefits. Under the SSA’s rules, a person is disabled only if they meet all of the following conditions:

- They cannot do work they did before

- The SSA decides that they cannot adjust to other work because of their medical condition

- The disability has lasted or is expected to last at least one year or to result in death

Benefits usually continue until beneficiaries are able to work again. Disability beneficiaries that reach full retirement age will have their benefits converted into retirement benefits, with the amount remaining the same. It is against the law to receive both disability and retirement benefits at the same time.

Social Security Disability Insurance

Supplemental Security Income

In some situations, it is possible to receive both SSDI and SSI. This usually happens when a qualified application for SSDI is granted low enough an SSDI benefit to make the applicant also eligible for SSI.

How Does The Calculator Estimate My Retirement Benefits Payment

Our simplified estimate is based on two main data points: your age and average earnings. Your retirement benefit is based on how much youve earned over your lifetime at jobs for which you paid Social Security taxes. Your monthly retirement benefit is based on your highest 35 years of salary history. You can get your earnings history from the Social Security Administration .

Your Social Security benefit also depends on how old you are when you take it. You can start collecting at age 62, the minimum retirement age, but youll get a bigger monthly payment if you wait until full retirement age, which is 66 but is gradually moving to 67 for people born in 1960 or after. If you can wait until 70 to start collecting, youll receive your maximum monthly benefit.

A single person born in 1960 who has averaged a $50,000 salary, for example, would get $1,349 a month by retiring at 62 the earliest to start collecting. The same person would get $1,927 by waiting until age 67, full retirement age. And he or she would get $2,389, the maximum benefit on those earnings, by waiting until age 70. Payments dont increase if you wait to collect past 70.

Other factors affecting the size of your benefit include whether youve worked for state or local government for more than 10 years your Social Security payment may be decreased if you paid into the civil service retirement program, for example.

Recommended Reading: Who Benefits From Social Security

Factors That Affect How Much You’ll Get In Retirement

Gordon Scott has been an active investor and technical analyst of securities, futures, forex, and penny stocks for 20+ years. He is a member of the Investopedia Financial Review Board and the co-author of Investing to Win. Gordon is a Chartered Market Technician . He is also a member of CMT Association.

Kevin Dodge / Getty Images

Most retirees rely on Social Security. One in four gets 90% of their retirement income from the program. About half rely on it for 50% of their income.

Although Social Security is only one part of a secure retirement plan, it’s helpful to get a rough idea of how much you can expect. If you’re eligible for Social Security, your monthly benefit is based on two factors:

- How much money you earned during your working career

- The age you choose to start getting payments

Let’s look at how each of these affects your future Social Security income.

More Than Just Income: The Social Security Spousal Benefit And Medicare Coverage

If you are eligible for a Social Security spousal benefit, you are also entitled to premium free part A Medicare at age 65. The catch?

Youre entitled to Medicare only if your spouse is at least 62 years old.

If you are more than 3 years older than your spouse, you may have to buy Medicare Part A until your spouse turns 62. Thats when your premium-free benefit would start. The Part A monthly premium is $422 in 2018.

You May Like: Is Medicare Part Of Social Security

How Does Early Retirement Affect Benefits

Social Security is based on your lifetime earnings. Anyone will lose part of their own benefit if they retire early.

If you begin getting a spousal benefit before you reach your FRA, your benefit will be permanently lower. This is true unless youre caring for a qualifying child. Depending on how early you retire, this income will be reduced by as much as 35%.

You can find out the exact amount by putting various ages into the Social Security Administrations website. The website will show you what you can get at different ages and how working longer will change your income after you retire.

Your spousal benefits wont be reduced if youre caring for a child who is under 16 or who receives Social Security disability benefits.

If your spouse and/or you want to take Social Security benefits early, you will need to think about the long-term effects before you do. Taking early benefits will lower the income that may be paid out over your lifetime.

It will also lower the benefit that the surviving spouse can get after one of you passes away. Married couples should plan how and when they should each begin taking their benefit.

You can run these numbers yourself to see how it works by using an online Social Security calculator. You can also talk to a financial planner for advice on how to plan your benefits.

Dont Miss: T Rowe Price Employee Benefits