Is Any Part Of Medicare Free

Premium-free Part A Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. coverage if you or your spouse paid Medicare taxes for a certain amount of time while working. This is sometimes called “premium-free Part A.” Most people get premium-free Part A.

Do Part D Drug Plans Come Out Of My Check

You can have your Medicare Part D premiums deducted from your Social Security check if you wish. When you enroll in your drug plan, the system will give you the option.

Be aware that if Medicare Allies is helping you with your drug plan enrollment, youâll need to let us know if you want that to happen. You may need to pay your premium directly for a couple of months before your request goes into effect.

Key Things To Remember About Social Security And Medicare

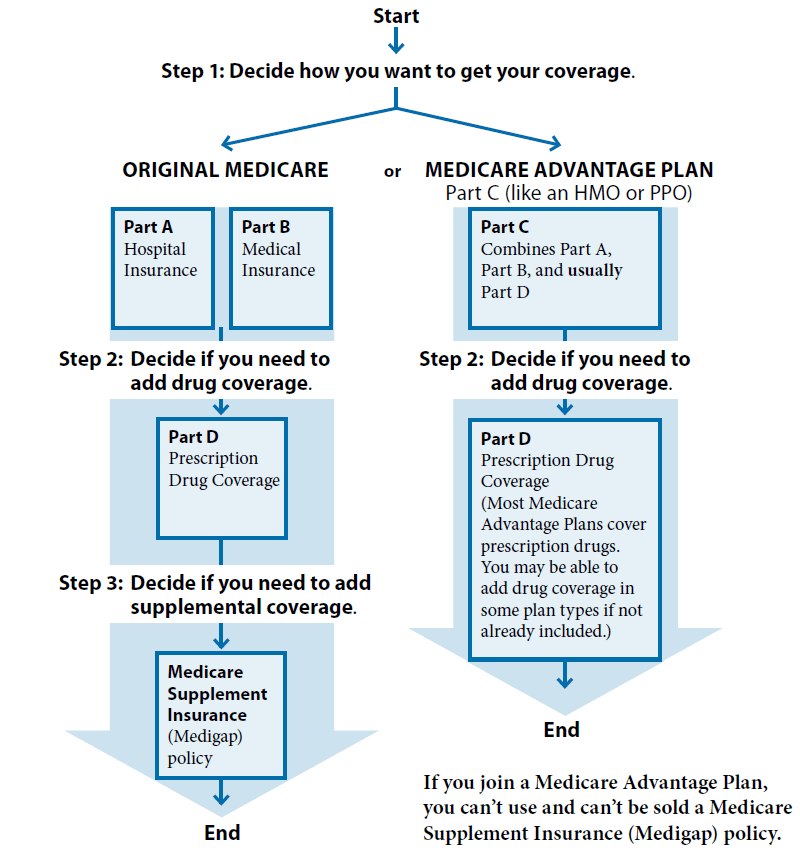

For most people, finding out how much will be taken out of your Social Security check is very easy. If you have Original Medicare and collect retirement benefits, then the process is automatic. The amount deducted is your monthly Part B premium . You likely won’t have to pay the Part A premium if you qualify for retirement benefits.

The main thing to remember is that the process is not automatic if you have a Medicare Advantage or a Part D plan. You will have to call the Social Security Administration to arrange to have your premiums deducted from your monthly benefit. Make sure to check each month after you initiate the process since implementation is sometimes delayed.

Recommended Reading: Social Security Office Ann Arbor

What Do Payroll Taxes Fund

In the United States, payroll taxes are social security and medicare taxes. This means federal payroll taxes are used to fund social security and medicare programs across the country. This is intended to ensure a basic level of medical care and social support in old age, disability and various other cases.

Note, in the United States payment of medicare and social security taxes does not negate the need for comprehensive health insurance.

Fact #: Social Security Lifts Millions Of Older Adults Above The Poverty Line

Without Social Security benefits, about 4 in 10 adults aged 65 and older would have incomes below the poverty line, all else being equal, according to official estimates based on the 2021 Current Population Survey. Social Security benefits lift more than 16 million older adults above the poverty line, these estimates show.

An important study on retirement income from the U.S. Census Bureau that matches Census estimates to administrative data suggests that the official estimates overstate older people’s reliance on Social Security. The study finds that in 2012, 3 in 10 older adults would have been poor without Social Security, and that the program lifted more than 10 million older adults above the poverty line.

No matter how it is measured, its clear that Social Security lifts millions of older adults above the poverty line and dramatically reduces their poverty rate.

You May Like: Social Security Administration Wichita Kansas

Which Forms Of Medicare Take Money Out Of My Social Security Check

Typically, only Medicare Part B. Part A does not usually have premiums. If you wish to add a Part D drug plan, there may be extra payments that would require money that could come from your Social Security benefits.

If you wish to add other parts or adjust payments taken from your Social Security check, you can log into your Social Security account and make those changes.

Read More: Medicare and Social Security: How They Work Together

Working In Retirement: How Does It Affect Social Security And Medicare

Are you retired but considering going back to work?

Whether youre in it for the extra income, or merely getting paid for something you enjoy doing anyway, its important to understand how bringing home a paycheck in retirement could affect your Social Security benefits and medical insurance coverage.

Here are a few things to consider before punching that timecard.

Also Check: Report Stolen Social Security Number

You Still Have To Pay Into The System

InvestopediaForbes AdvisorThe Motley Fool, CredibleInsider

When you work for someone else, that employer takes Social Security taxes out of your paycheck and sends the money to the Internal Revenue Service . But things work a little differently for people who are self-employed. If you fall into this category, keep reading. This article will help you understand how to calculate the Social Security taxes you owe.

Recommended Reading: How To Sign Up For Medicare Online

When Do You Have To Pay For Medicare

If you dont qualify for premium-free Part A coverage, youll need to pay a monthly premium. Youll also have to pay a premium if you sign up for Part B, which is optional.

If you receive Social Security benefits, youll have these premiums automatically deducted from your checks. Medicare will bill you directly if you arent collecting Social Security.

If you sign up for Parts C and D, youll also need to pay premiums for those plans. If you receive Social Security benefits, you can request that the premiums be deducted from your checks, but this wont happen automatically. If you dont receive benefits, youll get a bill from Medicare for Part D and from the insurer for Part C.

You May Like: Both Social Security And Medicare Apex

Cost Of Medicare Part B

- Standard cost in 2022: $170.10 per month

- Annual deductible in 2022: $233

For most people, the cost of Medicare Part B for 2022 is $170.10 per month. This rate is adjusted based on income, and those earning more than $91,000 will pay higher premiums.

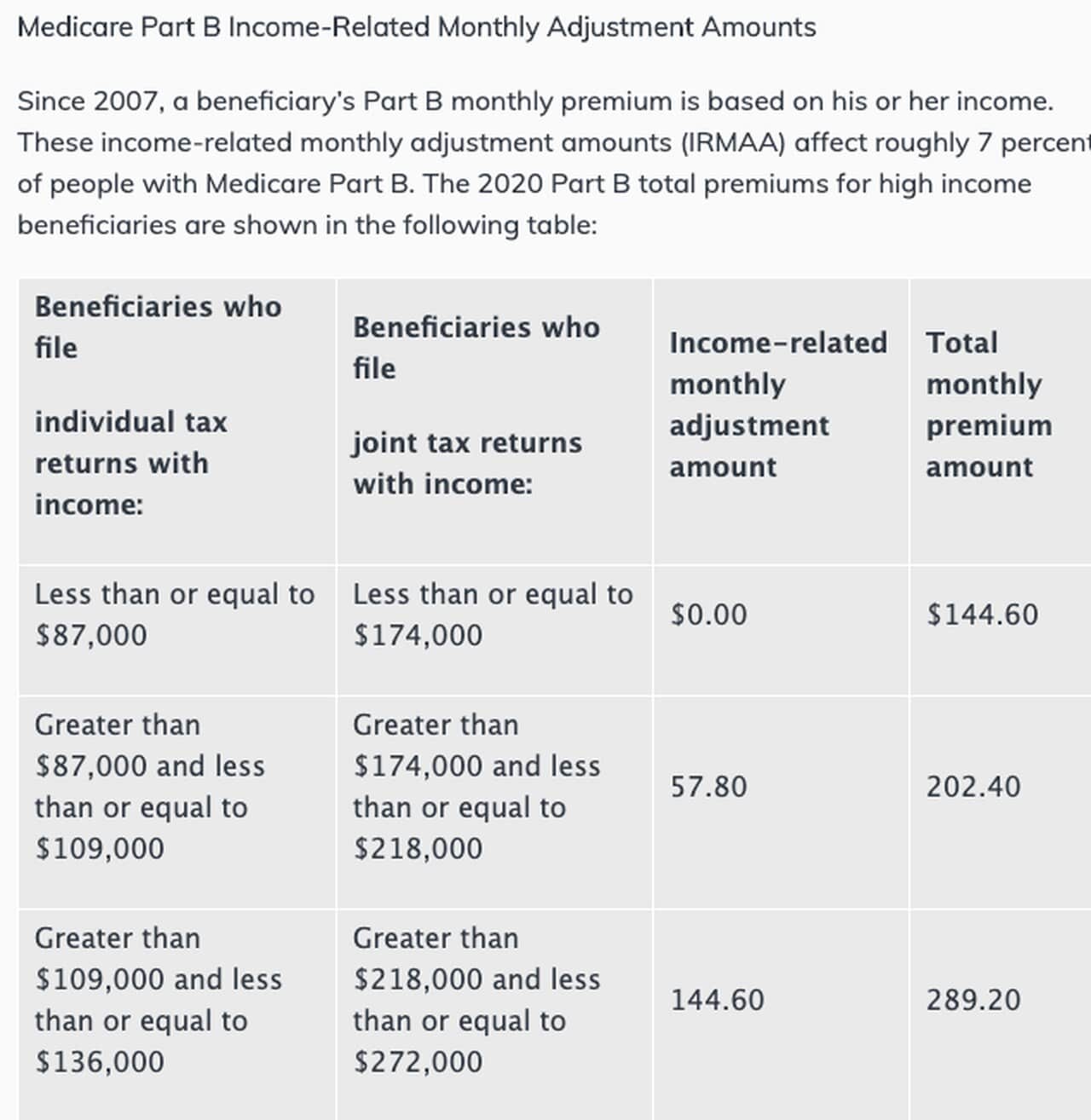

For high-earners, the cost of Medicare Part B is based on your adjusted gross income from your previous year’s taxes. Only about 7% of enrollees will pay these higher rates. If you file joint taxes, then you can double these income levels to figure out what your monthly Part B premium would be. These figures are updated annually by the Social Security Administration .

| Individual income | |

|---|---|

| $500,001 or more | $578.30 |

Those with low incomes can get help paying for Medicare Part B through several government programs including Medicaid, Supplemental Security Income and the Medicare Savings Program.

Besides the monthly premium, enrollees in Medicare Part B are also responsible for paying the deductible.

For 2022, the Part B deductible is $233, which means you would need to pay $233 before coinsurance benefits would kick in.

If you have Medicare Supplement Plan C or Plan F, the supplemental policy will pay for this Part B deductible. If you have a Medicare Advantage plan, the Part B deductible doesn’t apply because the plan will set its own deductible.

Medicare Advantage Premiums And Social Security Benefits

Medicare Advantage, also known as Medicare Part C, is a type of insurance provided by private insurance companies that contract with Medicare. Private insurance companies manage the plans but have to work within guidelines provided by the federal government. They are only available to people who are eligible for Original Medicare.

Medicare Advantage premiums vary in price just like other private insurance plans. This means that there is no way to say how much you will pay without getting a quote.

To have your Medicare Advantage monthly premium deducted from your Social Security benefit, you have to contact the Social Security Administration. Otherwise, you will have to pay the premium directly to your insurance company.

Don’t Miss: What To Do When You Lose Your Social Security Card

How Do I Receive The Medicare Giveback Benefit

You will not receive checks directly from your Medicare Advantage plan carrier. You can get your reduction in 2 ways:

You Can Pay Back Benefits You’ve Already Receivedand Boost Your Future Benefit

If you’ve taken Social Security benefits early at a reduced rate, you have the option of paying back to the government what you’ve already received and restarting benefits at a later date with a higher payout. Keep in mind that you will need to repay the gross amount of your benefitwhich includes any withholdings for Medicare premiums and/or income tax.

For example, say you chose to receive benefits at 62 and nine months later decided you wanted to return to work. You could stop receiving Social Security by withdrawing your application for benefits, pay back the benefits received, return to work, and then defer your benefit up to age 70, when you could restart your benefits at a higher level. The option to pay back Social Security is limited to the first 11 months’ worth of benefits, and the SSA allows repayment only in the first year after you start to receive benefits.

Once you reach full retirement age, another option is to voluntarily stop benefits at any point in time before age 70 to receive delayed retirement credits . Benefits will automatically restart at age 70 at a higher amount, unless you choose an earlier date.

Take note that when you withdraw your application or stop your benefits after full retirement age, you must specify if your Medicare coverageif you have itshould be included in the withdrawal.

Also Check: Social Security Office In Clarksville Tennessee

Beware This Medicare Gotcha When You File For Social Security

Editors Note: Journalist Philip Moeller, who writes widely on health and retirement, is here to provide the Medicare answers you need in Ask Phil, the Medicare Maven. Send your questions to Phil.

Moeller is a research fellow at the Center on Aging & Work at Boston College and co-author of How to Live to 100. He wrote his latest book, How to Get Whats Yours: The Secrets to Maxing Out Your Social Security, with Making Sen$es Paul Solman and Larry Kotlikoff. Follow him on Twitter or email him at .

The Interaction Between Medicare Premiums And Social Security Colas

Social Security and Medicare assist in providing financial security to most elderly and disabled individuals in the United States. Certain interactions between Social Security and Medicare may have important financial implications for individuals who are enrolled in both programs.

Social Security provides monthly cash benefits to retired or disabled workers and their family members. The Social Security benefits that are paid to retired workers are based on workersâ past earnings. Medicare is a federal insurance program that pays for covered health care services for most individuals aged 65 and older. Medicare Part B and Part D are voluntary, premium-based programs for Medicare beneficiaries providing coverage for physician services and prescription medications . Standard Medicare Part B and Part D premiums are set at a rate each year to cover approximately 25% of per capita program costs. High-income beneficiaries may pay higher than standard premiums. Individuals who are enrolled in both Social Security and Medicare must have their Medicare Part B premiums automatically deducted from their monthly Social Security benefit and may choose to have their Medicare Part D premiums automatically deducted from their monthly Social Security benefit.

Read Also: Lansing Mi Social Security Office

How Much Does Medicare Part B Cost

Q: How much does Medicare Part B cost the insured?A: In 2021, most people earning no more than $88,000 pay $148.50/month for Part B. And in most cases, Part B premiums are just deducted from beneficiaries Social Security checks.

The Part B premium increase from 2020 to 2021 was smaller than initially projected, thanks to a short-term government spending bill that was enacted in the fall of 2020, and that included a provision to cap the increase in the Part B premium for 2021.

When To Sign Up For Social Security And Medicare

People are eligible for Medicare when they turn 65. Youll sign up for coverage at that time. Social Security becomes available when you turn 62, but its usually not wise to get Social Security benefits at 62. Instead, you should wait until your retirement age, so you can receive full Social Security benefits.

Read Also: What Is Medicare Part A For

Recommended Reading: Bend Oregon Social Security Office

Republicans Plan To Cut Social Securitywill Voters Let Them

A pair of scissors about to cut a blank Social Security card that sits on a desk top. This image … conveys the concept of Social Security cuts.

getty

Its remarkable that Social Security is notthe front-and-center issue in the midterm elections. Key Republicans say they will cut Social Security and Medicare if their party gains power. Some Republicans are considering raising the full retirement age to 70. These long-promised Republican policies threaten millions of older Americans, and all those who will grow old and they will only make current economic stresses even worse.

Youd think that cutting Social Security when retirement income security is already so fragile would be a singularly unpopular position, yet it is barely discussed in congressional campaigns.

Republicans have done this before. In 1982, President Ronald Reagan and Republicans cut Social Security benefits by raising the full retirement age to age 67, which is just a way to say Congress changed the formula so benefits would be 10% to 15% smaller at every claim age. Now, Republicans want to change the formula to make 70 the so-called full retirement age, which will further cut monthly benefits.

How low is still too high for the Republicans? Social Security has been slashed before our eyes for decades and voters have not noticed. They should.

What Is Deducted From Social Security Retirement Benefits

Social Security benefits are a solid means of support for millions of retirees. When economic weakness and low interest rates sap the income-producing power of some of your assets, Social Security payments are a financial resource upon which you can rely during difficult times. Also, Social Security benefits, like stocks and bonds or a well-stocked bank account, can help you realize your retirement dreams. Be aware, however, that your benefits may be reduced for a number of reasons:

Recommended Reading: What Will Happen When Social Security Runs Out

How To Appeal A Part B Premium Income Adjustment

You may request an appeal if you disagree with a decision regarding your income-related monthly adjustment amount. Complete a Request for Reconsideration or contact your local Social Security office to file an appeal.

You may be able to skip the formal appeal and simply provide documentation if your income changed due to any of the following:

- You married, divorced or became widowed.

- You or your spouse stopped working or reduced your work hours.

- You or your spouse lost income-producing property due to a disaster or other event beyond your control.

- You or your spouse experienced a scheduled cessation, termination or reorganization of an employers pension plan.

- You or your spouse received a settlement from an employer or former employer because of the employers closure, bankruptcy or reorganization.

These methods apply to the Part B premium. Contact the IRS if you disagree with your adjusted gross income amount, which is provided to Medicare by the IRS.

What If I Withheld Too Much

If you deducted too much tax from an employees pay, either for Social Security or for Medicare tax, you may have several things to fix:

- Refund the employee. You will need to pay the employee back for the excess deduction amount. You can give this amount back to the employee in a paycheck or as a separate check. Be sure you dont deduct Social Security from this check!

- File a Corrected 941. If the mistake was included in Form 941 report, you will need to file a correction form to receive a refund.

- Change the employees payroll record. Deduct the over-payment of Social Security taxes from the employees payroll tax record. The W-2 Form for an employee who earns more than $106,800 should show the total amount of pay earned for the year and the total Social Security wages as $106,800. Medicare wages will be the same as the total amount of pay.

Don’t Miss: Back Of Social Security Card

The Costs Of Medicare Premiums

Medicare Part B premiums average $148.50 per month in 2021.

Those with higher incomes may have to pay more. They will get a notice from Medicare about adjusted Part B premium payments.

Medicare refers to these premium increases as the Income Related Monthly Adjustment Amount . These IRMAA payments follow declared income on IRS tax returns from 2 years ago.

Also Check: How To Get A Lift Chair From Medicare

How To Apply Online For Just Medicare

Are you within three months of turning age 65 or older and not ready to start your monthly Social Security benefits yet? You can use our online retirement application to sign up just for Medicare and wait to apply for your retirement or spouses benefits later. It takes less than 10 minutes, and there are no forms to sign and usually no documentation is required.

To find out what documents and information you need to apply, go to the .

Don’t Miss: Fort Worth Social Security Office

Funding For Social Security And Medicare

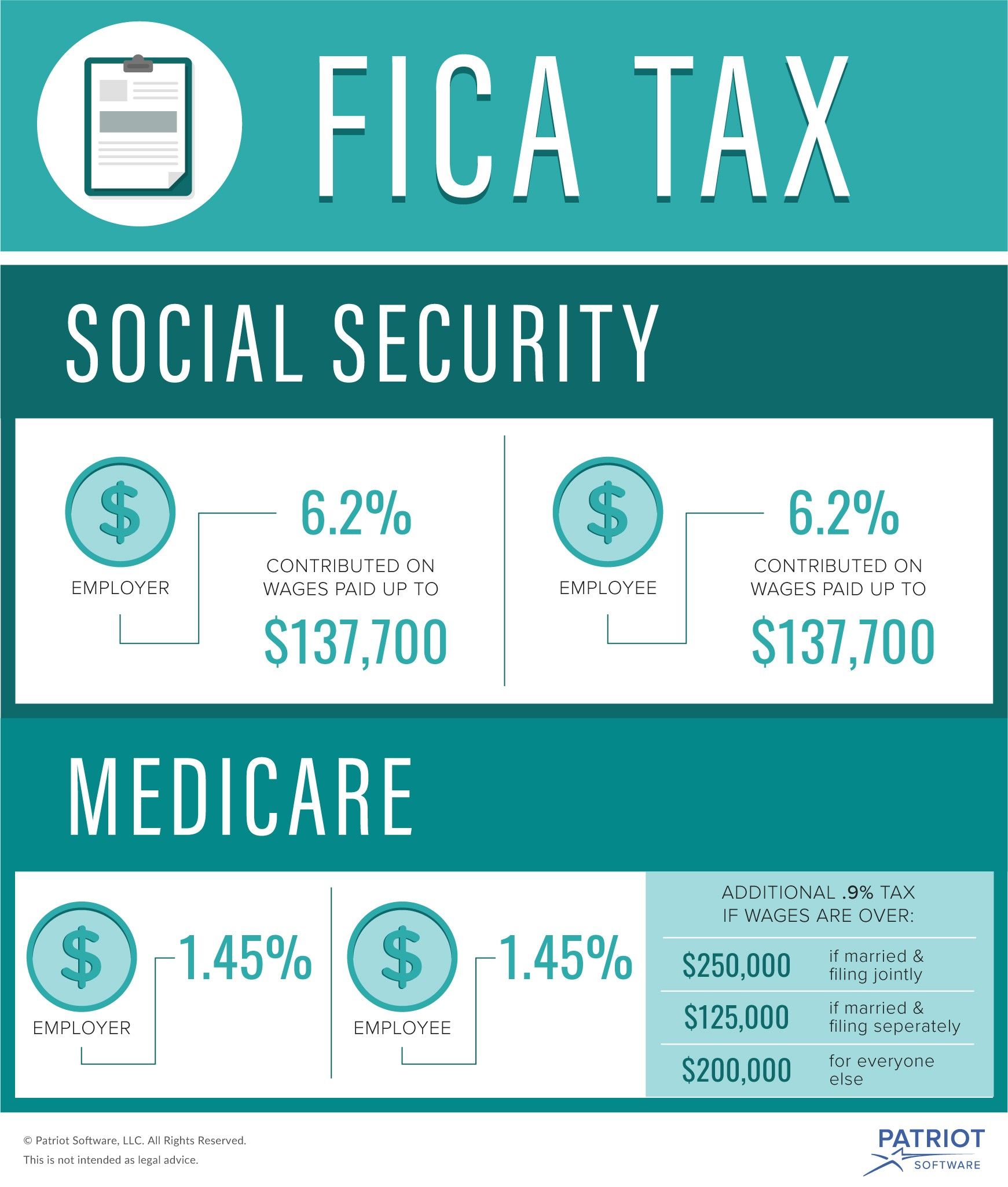

Both programs are primarily funded by payroll taxes, which are split evenly between employees and employers . The Social Security tax rate is higher, but theres an upper income limit above which Social Security taxes are not levied. The Medicare tax rate is lower, but it applies to all wages. Together, Medicare and Social Security payroll taxes are known as FICA taxes .

Lawmakers on both sides of the aisle have proposed a variety of reforms for both Social Security and Medicare, but Republicans are much more likely to focus on privatization, means testing, and increasing the age at which people become eligible for benefits.

Former Speaker of the House, Paul Ryan, proposed various Medicare reforms in budget proposals during his time in office, including privatization, means testing, and raising the eligibility age to 67. Not surprisingly, Ryans proposals failed to gain bipartisan support, but have remained quite popular with Republicans.

Similar proposals have been advanced regarding Social Security, with GOP lawmakers often calling for an increase to the full retirement age for Social Security. Theyve also proposed privatizing the program, adding means testing, or a combination of all three approaches.

Some Democrats have proposed expanding the Social Security tax so that it applies to all income, a move that would increase revenue and stabilize the program without the need to reduce benefits.

Recommended Reading: What Is Medicare Plan F