Average Social Security Payment

According to the Social Security Administration , the average estimated monthly Social Security payment in 2022 after the 5.9 percent cost-of-living increase is*:

| Retiree type | |

|---|---|

| Aged couple, both receiving benefits | $2,753 |

| Widowed mother and two children | $3,187 |

| Disabled worker, spouse and one or more children | $2,383 |

*Data for this table is based on the 2022 Social Security Fact Sheet2

Reporting Excess Wages To The Social Security Administration

So, how will the Social Security Administration know that you earned more than the annual limit? The answer is that you will need to tell them. If you are going to earn more than the earnings limit, you should notify the Social Security Administration right away. This notification will allow them to properly adjust your benefits so that you are getting the correct direct deposit amount each month. Failure to notify the SSA could have adverse consequences.

If you fail to notify the Social Security Administration that you will make more than the earnings limit, they will eventually find out. When you file your income taxes the following year, they will be aware that you made more than the limit in the previous year. If you were still receiving full benefits during the previous year, that could spell bad news for your wallet especially if you didnt pay the proper amount of Social Security taxes. You will likely be forced to repay the excess benefits that you received. In addition, you might even owe some penalties and fees on the excess benefits you received.

Therefore, it is extremely important to notify the Social Security Administration right away if you think you might make more than the earnings limit before you reach full retirement age. If you have any questions about how it might affect your payments, you should consult a licensed financial advisor in your area. They can give you advice on the best approach for your personal financial situation.

What To Do If Your Benefits Are Already Being Withheld

If youre subject to the Social Security earnings limit, dont wait for the SSA to start reducing the benefit you receive. Instead, Id recommend voluntarily suspending benefits.

If you wait for the Social Security Administration to discover that youve earned too much working while receiving benefits, your risk of an overpayment notice is higher.

Either way, you arent missing payments that youll never get back. Your benefit amount will be recalculated at your full retirement age to reflect the months that benefits were withheld.

The best way to avoid the earnings limitation is to wait until full retirement age to file for benefits. If you cant wait, make sure you have a clear understanding of how working impacts your Social Security benefits.

If you still have questions, you could leave a comment below, but what may be an even greater help is to join my . Its very active and has some really smart people who love to answer any questions you may have about Social Security. From time to time Ill even drop in to add my thoughts, too.

You should also consider joining the 365,000+ subscribers on my YouTube channel! For visual learners , this is where I break down the complex rules and help you figure out how to use them to your advantage.

Recommended Reading: How Much Is Social Security For Disabled Veterans

How Much Will I Get From Social Security

Your retirement benefit is based on your lifetime earnings in work in which you paid Social Security taxes. Higher income translates to a bigger benefit . The amount you are entitled to is modified by other factors, most crucially the age at which you claim benefits.

For reference, the average Social Security retirement benefit in May 2022 was $1,668 a month. The maximum benefit the most an individual retiree can get is $3,345 a month for someone who files for Social Security in 2022 at full retirement age , the age at which you qualify for 100 percent of the benefit calculated from your earnings history. FRA is 66 and 4 months for people born in 1956 and is gradually rising to 67 for those born in 1960 or later.

Youll only know your own amount for sure when you apply, but there are ways to get a sense of it in advance. The quickest and easiest is to use AARPs Social Security Benefits Calculator or check your online My Social Security account. The latter draws on your earnings record on file with the Social Security Administration for the AARP calculator, youll need to provide your average annual income.

Both tools project what you could collect each month if you start Social Security at age 62, the earliest you can file for retirement benefits at full retirement age and at age 70. Between 62 and FRA, Social Security reduces your benefit for filing early between FRA and 70, it increases your payment as a reward for waiting.

Keep in mind

What Is The Average Social Security Benefit At Age 70

Social Security was never meant to replace 100% of a workers income in retirement. However, among elderly Social Security beneficiaries, about 12% of men and 15% of women still rely on Social Security benefits for 90% or more of their income.

More: 5 Things You Must Do When Your Savings Reach $50,000

Regardless of whether Social Security is your primary source of income or just a supplement to your personal savings, there are steps you can take to maximize your benefit. One of those is to defer claiming until age 70, which is the latest age you can file for benefits. Heres what the average Social Security payout is at age 70, along with a brief description of how benefits work.

Also Check: How To Calculate Social Security Taxes

Here’s How To Pocket The Most Money Possible From Social Security

The maximum Social Security retirement benefit you can collect in 2020 is $3,790 per month, but very few people will receive that big of a payday. Why? Because Social Security benefits are based on each person’s work history, including how many years they worked, how much they earned per year, and when they decided to begin receiving their benefits. Qualifying for Social Security’s maximum benefit requires decades of high-income employment, plus the patience to put off claiming benefits as long as possible. While most people won’t receive the maximum benefit in retirement because of these hurdles, there are still ways to increase the size of your Social Security check substantially.

Social Security Benefit: How Much Is The Maximum You Can Receive In 2022

Retirement is the new question around the corner

Social Security is part of the retirement plans for every American worker.

Providing a replacement income for qualified retirees and their families is one of the crucial tasks made by the federal government.

In 2022, there’s a maximum Social Security retirement. However, it all depends on your earning’s history.

The maximum amount granted is $3,240 per month. This quantity applies to someone who files for full retirement at 66 years old.

Meanwhile, there’s $4,194 as the absolute highest retirement benefit for those who qualify and delay claiming until 70 years old.

Recommended Reading: Social Security Ticket To Work 2021

Costs Of The Solution

Two issues that are likely to arise in any discussion of fixing this problem are its cost to the Social Security trust fund and its cost to the federal budget. With regard to the cost to the Social Security trust fund, there are three ways to look at the issue.

One way is to view the cost relative to costs in a world in which no pandemic had occurred. For example, the cost could be measured using the economic assumptions in the most recent Social Security trustees report , which were formulated before the pandemic began. From this perspective, the cost would be zero because the legislative change would restore the world of Social Security benefits to what it would have looked like had there been no pandemic.

A second way of looking at the issue is to view the cost of the change relative to costs in a world that reflected economic assumptions indicative of the economic recession caused by the pandemic. From this viewpoint, there would be a cost associated with fixing the problem. For example, the chief actuary of the SSA estimates that if the AWI in 2020 were to fall 5.9 percent below its 2019 level, the AWI adjustments proposed by Chairman Larson would cost $90 billion in present-value dollars for the 75-year period from 2020 through 2094about 0.02 percent of taxable payroll over that period. . The cost over the 10-year period from 2020 to 2029 would be about $21 billion in nominal dollars.

How Long You Work

The second requirement is you must have 35 years or more on your Social Security work record.

The 35-year threshold is related to how the Social Security formula averages your income. It is your average, inflation-adjusted income in your highest-paid 35 years that drives your Social Security benefit at FRA. If you worked fewer than 35 years, the missing years are included in the average calculation as zero income.

Unfortunately, those zeros reduce your average income, which in turn lowers your monthly benefit.

You May Like: Social Security Disability Review Status

Want To Max Out The Size Of Your Social Security Checks Youre Going To Have To Earn A Lot Of Money

The maximum Social Security benefit a retiree can receive in 2021 is $3,895. Thats well above the average benefit of $1,553. Both the maximum and average benefits go up most years.

Sadly, most people dont have a chance at the largest benefit check. To get it, your earnings need to meet or exceed a certain income amount and not just for one year but for 35 years.

So how much do you need to earn to score the maximum benefit when you retire?

Image source: Getty Images.

You Can Still Increase Your Benefit

Don’t fret if the maximum Social Security check is out of your reach. As long as you’re still working, you can make moves to increase your benefit. Raising your taxable working income is one strategy. You can do this by getting a promotion, switching to a higher-paid role with a different employer, or getting a second job.

You can also increase your benefit by delaying your Social Security application. However, this strategy may lower your cumulative Social Security income. To understand the risk of that happening, run a break-even analysis. That’ll show you when your higher, delayed benefit will make up for the income you would have received if you’d claimed earlier.

Read Also: Social Security Disability Overpayment Law

How Do You Qualify For Disability Benefits

To qualify for benefits, you must have a medical condition that meets the SSAs definition of disability. The organization considers you disabled if:

- Your medical condition prevents you from working as you once did and

- You cannot adjust to other work because of your medical condition and

- Your disability is expected to last for at least one year or result in death.

In addition, you need to meet the technical requirements for Social Security Disability Insurance or Supplemental Security Income benefits.

Ways To Estimate Your Social Security Benefit For Retirement

With so many varying factors, estimating your Social Security benefit can be a challenging task. Take advantage of these four useful ways to calculate the most accurate retirement benefit estimates:

Recommended Reading: I Need The Number To The Social Security Office

The Social Security Tax Limit For 2022 And How It Works Explained

- 8:37 ET, Mar 2 2022

MILLIONS of senior citizens and disabled Americans claim Social Security benefits.

About nine out of 10 individuals aged 65 and older receive monthly Social Security benefits, which account for nearly 33% of income for the elderly.

To qualify, seniors must have worked for a certain number of years and paid into the Social Security system for a certain amount of time.

The amount received depends upon when you were born, your earnings history, and when you begin to claim benefits.

Some households are also subject to pay taxes on their Social Security benefits, usually if there are additional significant earnings including wages, self-employed earnings, dividends, or other taxable income.

It’s important to note that Supplemental Security Income differs from monthly Social Security benefits. SSI payments are not taxable.

Special Monthly Income Limit Rule For The First Year

Many people who retire mid-year have already earned more income than the limit allows. This is why there is a special rule where the earnings limit switches from an annual limit to a monthly limit.

This rule allows you to receive a check for any month you are considered retired by the SSA even if you have already exceeded the annual earnings limit.

That sounds straightforward enough but the interpretation of retired as defined by the SSA can cause some confusion. Heres what they mean by this term:

You are retired if your monthly earnings are 1/12 of the annual limit or less and you did not perform substantial services in self-employment.

Essentially, you are considered retired unless you make more than the income limit. The rule for the year you reach full retirement age also applies when working with the monthly limit. In this calendar year for 2021, the limit is $4,330 .

Its very important to remember that in the year following this first year, the monthly limit is no longer used and the earnings limit is based solely on your annual earnings limit.

Read Also: Is The Social Security Office Open On Saturday

How To Apply For Disability

People who cant work because of a medical condition thats expected to last at least a year or result in death are eligible for Social Security Disability Insurance benefits as long as theyve worked long enough, SSA says. Once a disability begins, a worker must wait five months before receiving benefits.

You can apply for benefits online or by calling 800-772-1213. SSA will send your application to a state agency that makes the decision based on information provided by your doctors. Seventy percent of applicants are denied in their initial application, according to Disability Benefits Help, a group that provides information to applicants and those rejected.

Understanding your statement:What your Social Security benefits statement tells you, and what it doesn’t

But denials can be appealed and the success rate for appeals is much higher, according to Disability Benefits Help. Many people hire lawyers to help with their appeals.

People with disabilities can also receive benefits under the Supplemental Security Income program, which is based on financial need.

Contributing: Robert Powell and Elisabeth Buchwald

Ssa Announces New 2023 Maximum Social Security Benefit

You may have seen the cost of everything going up the past year. High inflation has led to the … highest Social Security COLA in over 40 years.

getty

Maximizing your Social Security income should be a key part of your retirement plan. As Americans often enjoy longer retirements, the guaranteed lifetime income for Social Security is an even more important part of maintaining your financial security as you age. With a near record Social Security cost-of-living adjustment for 2023, the maximum Social Security benefits will increase again next year.

You May Like: Can You Get Credit Card Without Social Security Number

What Does Ittake To Get The Maximum Social Security Benefit

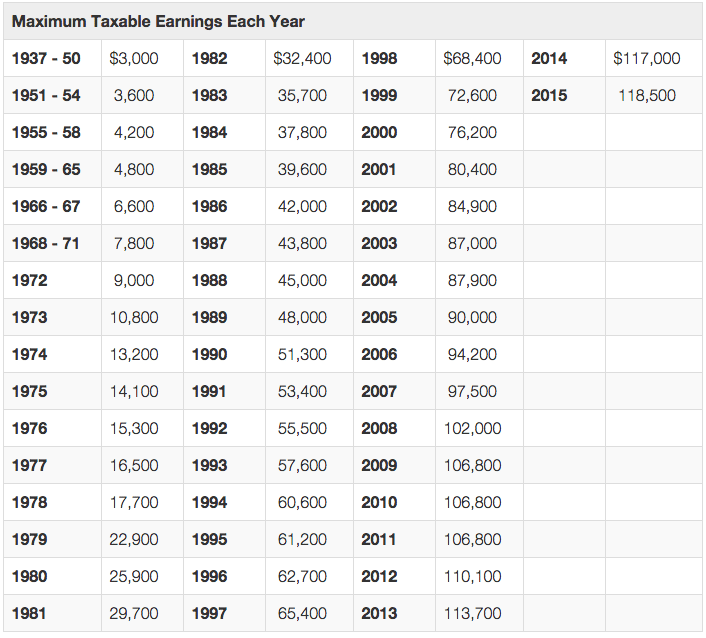

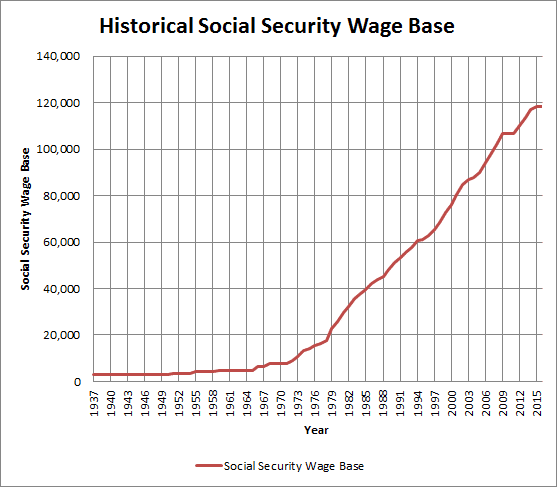

How does someone get the maximum Social Security benefit?The simple answer is from 35 years of real earnings at or above the maximum taxable earnings for Social Security.

Once you hit $147,000 in income , you pay Social Security taxes on that amount but not on any income above that. The Social Security Administration only considered wages up to that $147,000 mark for their maximum because you quit paying into the system on any dollars above that point that you earn.

You can expect the maximum taxable earnings number toincrease, usually annually. The Social Security Administration makes thesechanges to stay in step with the national average wage index.

For example, in 1984, the maximum wage considered for SocialSecurity taxation was only $37,800. Inflation and wage growth drives thatnumber higher most years.

Understanding The Social Security Family Maximum

Related Content

FAQ: Is there a limit to the amount of monthly benefits my family can get on my record?

Social Securitys family maximum rules limit the total benefits payable to a beneficiarys family. Different family maximum rules apply to retirement and survivor benefits than to disability benefits. The rules for calculating family maximum benefits are complicated. In some particularly complex cases, it is difficult to properly implement the family maximum, which can result in over- or underpayments. This article explains how the family maximum rules work and describes their evolution. We use Modeling Income in the Near Term, Version 6 data to analyze who is affected by the family maximum and to what extent their benefits are changed.

Kathleen Romig is a senior policy analyst at the Center on Budget and Policy Priorities. Dave Shoffner is a social science research analyst with the Office of Retirement Policy, Office of Retirement and Disability Policy, Social Security Administration.

Acknowledgments: The authors thank Joni Lavery, Andrew Hanks, Eric Herbert, Karen Glenn, Mark Sarney, and Natalie Lu for their helpful comments and suggestions.

The findings and conclusions presented in the Bulletin are those of the authors and do not necessarily represent the views of the Center on Budget and Policy Priorities or the Social Security Administration.

Recommended Reading: Social Security Offices In Chicago