Switching Is No Longer An Option For Most

You may have heard of a technique that helped couples delay called file and suspend. Until 2016, couples could claim spousal benefits while allowing their retirement benefits to grow. The higher earner would file an application and then suspend it, triggering the ability of the lower earner to apply for a spousal benefit. Typically, the lower earner filed a restricted application for spousal benefits only, and then switched to their own benefit when it maxed out at age 70.

File and suspend is no longer allowed, and only people born before Jan. 2, 1954, can file restricted applications.

There are a couple of other circumstances where people can still switch benefits. If a spousal benefit is not available when you apply because your partner hasnt started Social Security yet, you can start with your own benefit but switch to spousal benefits later when your partner applies, if the spousal benefit is larger.

Also, if youre receiving survivor benefits, you can switch to your own benefit at any point if its larger.

Bankrate Social Security Calculator

Description. This simple single-page tool allows users to estimate their future Social Security benefits based on a few inputs. The number of visitors to Bankrate’s Social Security Calculator in 2015 was unavailable. Overall, the Bankrate website had more than 15 million visitors each month in 2015 .

User inputs. Current age, age of retirement, annual income, and expected annual average salary increase and inflation rate . Married users can also check a box that adds a nonworking spouse’s benefit . The inputs can be entered manually or by using slide bars to select the desired values.

Calculator output. A narrative summary of monthly and annual Social Security benefits, projected income in the final year of work, and the benefit amount as a percentage of final income. An accompanying bar chart shows the estimated monthly Social Security benefit for each claiming age from 62 through 70. Definitions are provided for each input. Clicking a View Report button displays a popup summarizing all of the results, including a tabular presentation of the bar chart, showing the monthly and annual benefit amounts at each claiming age from 62 through 70.

Maximize My Social Security

Maximize My Social Security covers just about any Social Security claiming scenario you might end up with. This includes things like:

- Child benefits for parents

- Whether your spouse is getting benefits

- Survivor benefits after a spouse’s death

This tool also accounts for the windfall elimination provision and government pension offset. This will affect you if you get a pension from an employer who didn’t withhold Social Security tax from your earnings. State employees, for example, may find this helpful.

Maximize My Social Security also provides links to topics and news about retirement. These come from many different sources.

This calculator costs $40 for a yearly household license.

Read Also: What Will Happen When Social Security Runs Out

Which Do You Listen To

The two free calculators pretty much agree in all these relatively straight forward cases. I like the compare alternative feature in Open Social Security. We see in one case a difference of 5 years in the claiming timing makes little difference in total lifetime benefits. So as long as you go toward the right direction, you dont have to be very exact in the actual timing.

Besides the two free calculators, there are also two paid calculators Social Security Solutions and Maximize My Social Security. If you have complex situations such as previous marriages, childrens benefits, disability benefits, etc., maybe the paid calculators will give you something different. If you have straight forward cases, I think the free calculators will do just fine. That said, for a one-time cost of $50 or so, even if you waste it just because you want a second, third, or fourth opinion, it still wouldnt be a big deal.

Finally we need to keep in mind that all calculators make assumptions and projections on longevity, which will not match your actual longevity. We can only make the best educated guesses. A 1% difference in total lifetime benefits according to the assumptions and projections of a calculator can very well be within the margin of error in real life.

Aarp Social Security Benefits Calculator

Description. In four steps, this calculator shows users their estimated Social Security monthly benefit at each claiming age from 62 through 70, shows them how to maximize their benefits, and summarizes what the numbers mean. The tool is designed to help users figure out how much retirement income they will receive at different Social Security claiming ages but considers broader contexts such as their marital status, whether their expenses will be covered, and what happens to their benefit if they keep working. The Social Security Benefits Calculator had almost 1 million visits in 2015 .

User inputs. Marital status date of birth work in local, state, or federal government average annual salary and estimated monthly Social Security benefit at FRA. If the user does not have an estimated benefit amount from SSA, the tool estimates it for them using SSA’s Quick Calculator . Married users are prompted to enter the same information for their spouses. Certain selections trigger popup messages about exceptions. For example, users who are divorced and were married for fewer than 10 years are instructed to exclude information on the ex-spouse. Widows and users who work or worked for the government for at least 10 years are directed to the SSA website for more information.7

You May Like: Social Security Office Charleston Wv

Can I Use The Calculator To Figure Out Social Security Disability Insurance And Supplemental Security Income

No. SSDI is aimed at people who cant work because they have a medical condition expected to last a year or more or result in death. Your SSDI benefits last only as long as you suffer from a significant medical impairment while not earning significant other income.

SSI is a separate program for people with little or no income or assets who are 65 or older, as well as for those of any age, including children, who are blind or who have disabilities. The maximum monthly SSI payment for 2022 is $841 for a single person and $1,261 for a couple. But some states add to that payment, and you may receive less than the maximum if you or your family has other income. Get more information about SSDI and SSI from the Social Security Administration.

Also of Interest

Why A Retirement Calculator For Couples Can Really Help You

If you are in a relationship, you are familiar with two important concepts: compromise and communication.

Even so, a survey by Fidelity Investments discovered that many married couples have an extremely difficult time discussing retirement planning and other financial planning subjects. In fact, the survey found that:

- Only a small percentage of respondents expressed confidence in their partners abilities to manage their finances.

- Less than half of couples make routine financial decisions together, such as budgeting and paying bills.

- Only 38 percent jointly discuss their investment and savings strategies for retirement.

A retirement calculator can actually help you to have a meaningful discussion about your finances in an organized and unemotional way. The good calculators will ask you important questions and guide you through the process. Retirement calculators can be a great thing to use as a couple.

Recommended Reading: Social Security Disability Health Insurance

Find Agreement With Your Spouse On These Retirement Questions:

Some calculators will touch on goal setting, but most do not. You will want to agree to some kind of plan with your partner about:

Where: Where you want to live? Housing is likely going to be your biggest expense and your most valuable asset. So, where you live is a hugely important question. Not to mention that your community is a huge factor on your quality of life.

What? How you want to spend your time and with whom?

Spending: How much money you are willing to spend? This can be a big area of contention. Some people want to dramatically cut expenses and retire earlier. Others want to worry less about what they spend and are willing to save more or work longer to reduce financial anxiety.

Healthcare: How much money do you want to set aside for healthcare?

Care giving: What are each of your expectations if one of you have a long term care need? How do you want to be cared for and by whom?

Priorities: What is really important to each of you individually and as a couple for this long, last stage of life

Legacy: Is leaving a financial legacy for your heirs important to both of you?

Planning your retirement involves more than finances and your lifestyle decisions will impact your financial health. As such, it is important to look for retirement calculators that go beyond just savings and investments. The NewRetirement Retirement Planner helps you assess your Social Security, downsizing, and healthcare decisions, among others.

Calculator: How Much Of My Social Security Benefits Is Taxable

September 15, 2022Keywords: calculator, retirement, Social Security, tax planning

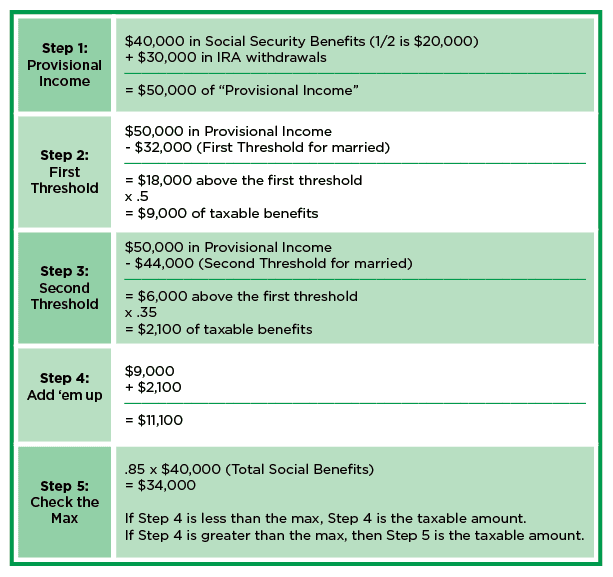

Social Security benefits are 100% tax-free when your income is low. As your total income goes up, youll pay federal income tax on a portion of the benefits while the rest of your Social Security benefits remain tax-free. This taxable portion goes up as your income rises, but it will never exceed 85%. Even if your annual income is $1 million, at least 15% of your Social Security benefits will stay tax-free.

Also Check: Social Security Office In Vidalia

Dont Forget The Earnings Test

If you plan on working between age 62 and your FRA, then wait until your FRA to begin taking benefits. Why? Because the earnings test affects you if you continue to collect earned income as well as Social Security benefits before you reach your FRA. In such a case, your Social Security benefits will be reduced if your total earnings exceed the annual limit. If you have some months where your earnings are high enough that you’re no longer considered “retired,” your benefits may be re-calculated when you reach your FRAand it could take 13 to 14 years for you to get back the amount that was withheld.

Social Security Claiming Strategy Calculators Compared

June 20, 2018Keywords: calculator, Social Security

Mike Piper is the author of the book Social Security Made Simple. In addition to explaining how Social Security works, he recently created an interactive calculator Open Social Security to help you figure out when is the best time to claim Social Security benefits.

I test-drove it with some hypothetical cases. I also ran the same cases through another free calculator by Financial Engines. Both calculators offer some advanced options. I left everything at the default settings.

Also Check: Social Security Office Opelousas La

Taxation Of Social Security Benefits

The amount of the taxable Social Security benefits becomes part of your gross income on your tax return. Its still subject to your normal deductions to arrive at your taxable income. You still pay at your normal tax rates on the taxable amount. 50% or 85% of your benefits being taxable doesnt mean youll lose 50% or 85% of your Social Security to taxes. The actual taxation on your benefits is much less. The tax may actually be zero after applying deductions.

The IRS has a somewhat complex formula to determine how much of your Social Security is taxable and how much of it is tax-free. The formula first calculates a combined income that consists of half of your Social Security benefits plus your other income such as withdrawals from your retirement accounts, interest, dividends, and short-term and long-term capital gains. It also adds any tax-exempt interest from muni bonds. This income is then reduced by a number of above-the-line deductions such as deductible contributions to Traditional IRAs, SEP-IRAs, SIMPLE IRAs, HSAs, deductible self-employment tax, and self-employment health insurance. Finally, this provisional income goes through some thresholds based on your tax filing status . All of these steps are in Worksheet 1 in IRS Publication 915.

A Couple With Shorter Life Expectancies May Want To Claim Earlier

How it works: Benefits are available at age 62, and full retirement age is based on your birth year.

Who it may benefit: Couples planning on a shorter retirement period may want to consider claiming earlier. Generally, one member of a couple would need to live into their late 80s for the increased benefits from deferral to offset the benefits sacrificed from age 62 to 70. While a couple at age 65 can expect one spouse to live to be 85, on average, couples who cannot afford to wait or who have reasons to plan for a shorter retirement, may want to claim early.

Example: Carter is age 61 and expects to live to 77. He earns $70,000 per year. Caroline is 59 and expects to live until age 76. She earns $80,000 a year.

Also Check: Maximum Social Security Disability Benefit

They Range From Simple To Sophisticated

Social Security is a government program serving about 65 million people, so you might use one word to describe it: complicated. Hats off to the Social Security Administration , though. It produces one of the best government websites, using plain English to explain its rules. It also has plenty of calculators and worksheets to help.

We pulled together some of our favorites. Keep this list handy next time youre sifting through the maze of Social Security rules and regulations. You wont need all 11, but some of them will likely help answer some of your questions as you start to plan.

You May Like: Social Security Office Albuquerque New Mexico

Taxes On Social Security

Another factor overlooked by singles and married couples alike is the impact of taxes. Retirement income needs to be viewed on an after-tax basis. Up to 85% of the Social Security benefits you receive can be taxed, although never 100%. With that in mind, there is a clever tax arbitrage strategy people can implement if they also have an IRA. With Social Security benefits having a maximum taxability of 85%, each after-tax dollar from Social Security is worth more than each dollar you withdraw from your IRA.

To take advantage of this arbitrage, individuals and couples should first begin taking IRA withdrawals before starting to take Social Security benefits. Essentially, they would be delaying the start of their Social Security to maximize its benefits and minimize the minimum distribution amounts that IRAs require in their early 70s. This strategy doesn’t work for those with large pensions, but for those with no pension or a small pension, it can help their retirement money work harder for them.

Recommended Reading: Social Security Office Glenwood Springs

How Spousal Benefits Are Calculated

Spousal benefits are based on how much the other spouse would receive if that person began collecting benefits at the full or “normal” retirement age.

The Social Security Administration has an online calculator that can show you what percentage of your spouse’s benefits you will be eligible for depending on your own age when you start receiving benefits.

The short answer to the calculation is this: You’re eligible for half of your spouse’s benefit amount as long as you wait until your full retirement age to apply. The earlier you file, the less you’ll get.

What Is The Maximum Spousal Social Security Benefit

The maximum spousal benefit is 50% of the amount that the spouse is eligible to receive at full retirement age. That’s a cap, by the way. If your spouse delays retiring until 70, the spouse gets more, but you don’t.

Survivors may receive up to 100% of the deceased person’s Social Security amount. There’s a complicated formula for families in which more than one dependent is eligible for benefits. It caps the maximum.

Also Check: Social Security Offices In Austin Texas

The Best Retirement Calculators For Couples

Here are a few of the best retirement calculators that enable you to input information for your spouse or partner separate from your own information. Each of these calculators works slightly differently from the others, and while not all of them necessarily have all of the important questions and results specified above, they are each more detailed than most online retirement calculators.

Who Is Eligible To Collect Social Security Retirement Benefits

Workers who are at least age 62 and who have worked at least 10 combined years at jobs for which they paid Social Security taxes are eligible for Social Security retirement benefits. In many cases, spouses, widows and divorcees are eligible for Social Security retirement benefits based on a spouses or ex-spouses earnings history. Unmarried children 18 and younger can also get survivors benefits. You must be a U.S. citizen or lawful alien to collect benefits.

Read Also: Social Security Rock Hill Sc

How Can I Switch From My Social Security Benefit To A Spousal Benefit

You can only switch from your benefit to the spousal benefit if your spouse has begun receiving retirement benefits and you are at least 62 years old .You can claim your benefit based on your work history until your spouse files, and then you can switch to the spousal benefit. However, if you’re not at your full retirement age, you’ll get paid a reduced spousal benefit, which can be as low as 32.5% of your spouse’s primary insurance amount.

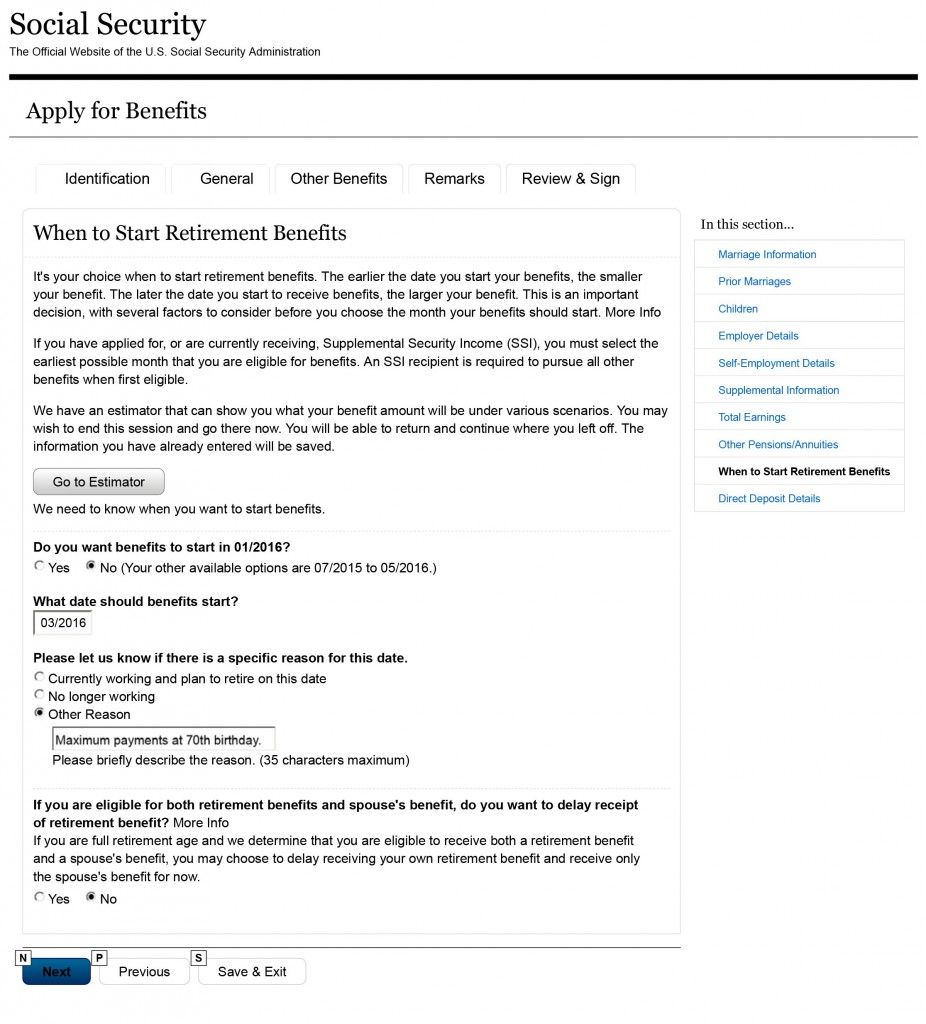

To monitor your benefits or change them, you can create an account on the Social Security site. It contains a wealth of information, and it allows you to make some changes online, although others require a phone call.

Who Qualifies For Social Security Spousal Benefits

If your spouse has filed for Social Security benefits, you can also collect benefits based on the spouse’s work record, if:

- You are at least 62 years old.

- Regardless of your age, if you care for a child who is entitled to receive benefits on your spouseâs record, and who is under age 16 or disabled.

When you apply for spousal benefits, you will also be applying for benefits based on your own work history. If you’re eligible for benefits based on your own earnings, and that benefit amount is higher than your spousal benefit, that’s what you’ll get. If it is lower, you’ll get the spousal benefit.

Recommended Reading: Social Security Office In Murfreesboro Tn