Who Is Exempt From Paying Social Security Tax

Certain individuals may claim an exemption and not be required to pay Social Security taxes. Some religious groups that openly oppose Social Security benefits may claim a religious exemption. Non-resident aliens may be exempt depending on their type of visa. Students working at their university may be exempt. Lastly, workers for a foreign government may be exempt under certain circumstances. If you believe you may fall into one of these groups, consult your tax advisor.

Three Ways To Reduce The Taxes That You Pay On Benefits

Is Social Security taxable? For most Americans, it is. That is, a majority of those who receive Social Security benefits pay income tax on up to half or even 85% of that money because their combined income from Social Security and other sources pushes them above the very low thresholds for taxes to kick in.

But there are three strategies you can useplace some retirement income in Roth IRAs, withdraw taxable income before retiring, or purchase an annuity, to limit the amount of tax you pay on Social Security benefits.

How To Report Social Security Income On Your Federal Taxes

Every Social Security recipient receives a benefit statement, Form SSA-1099, in January showing the total dollar amount of benefits received during the previous year. This includes retirement, survivor’s, and disability benefits.

Take that total shown in Box 5 and report it on Line 6a of Form 1040 or Form 1040-SR The IRS provides a worksheet to help you calculate what portion of your benefits are taxable and add the amount to your other income. More simply, you can use online tax software or consult a tax professional to crunch the numbers.

Also Check: What Happens If You Become Disabled While On Social Security

Calculating The Medicare Surtax Withholding Amount

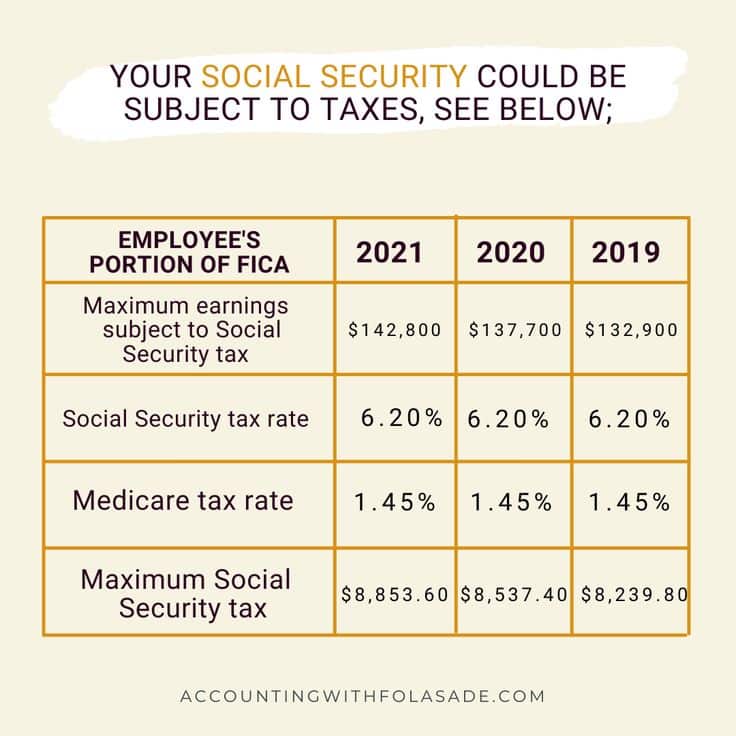

Unlike the 6.2 percent Social Security tax and the 1.45 percent Medicare tax, the 0.9 percent surcharge is imposed only on the employee. You withhold the surtax from employee wages, but there is never a matching payment required by the employer.

The employers and employees obligations with respect to the Medicare surtax are different. In some cases, there may be a mismatch between the amounts you are obligated to withhold and the amount of your employees surtax liability.

From the employees perspective, the 0.9 percent Medicare surtax is imposed on wages, compensation and self-employment earnings above a threshold amount that is based on the employees filing status. Once the threshold is reached, the tax applies to all wages that are currently subject to Medicare tax, to the Railroad Retirement Tax Act or to the Self-Employment Compensation Act.

The threshold amounts are as follows:

| Filing Status |

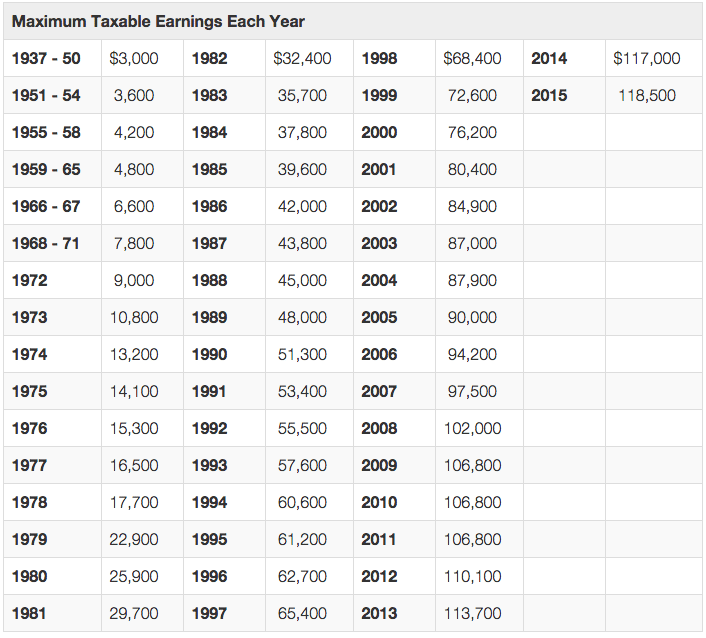

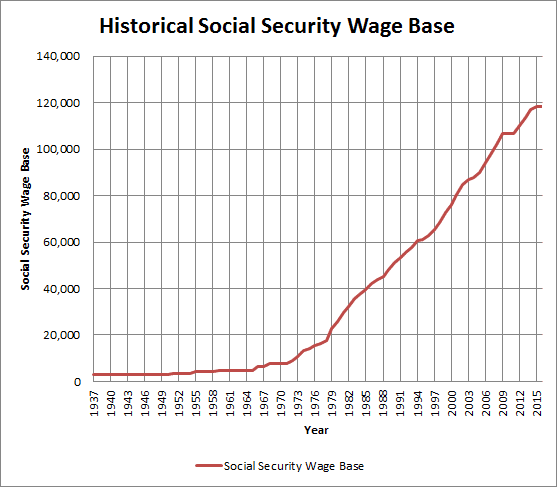

Social Security Wage Base Increases To $160200

The Social Security Administration has announced that the maximum earnings subject to Social Security tax will increase from $147,000 to $160,200 in 2023 . The maximum Social Security employer contribution will increase $818.40 in 2023.

For 2023, the FICA tax rate for both employers and employees is 7.65% .

For 2023, an employer must withhold:

Social Security and Supplemental Security Income benefits will increase by 8.7% in 2023. The average monthly Social Security benefit will increase from $1,681 to $1,827, and the maximum federal SSI monthly payment to an individual will increase from $841 to $914. The maximum federal SSI monthly payment to a couple will increase from $1,261 to $1,371 in 2023. The amount of earnings that is required in order to be credited with a quarter of Social Security coverage will increase from $1,510 to $1,640.

The SSA has a 2023 Fact Sheet on the changes.

For more information on the Social Security wage base, see Checkpoints Federal Tax Coordinator ¶A-6035.

Get all the latest tax, accounting, audit, and corporate finance news with Checkpoint Edge. Sign up for a free 7-day trial today.

Recommended Reading: Social Security Office In Johnson City Tennessee

How To File Social Security Income On Your Federal Taxes

Once you calculate the amount of your taxable Social Security income, you will need to enter that amount on your income tax form. Luckily, this part is easy. First, find the total amount of your benefits. This will be in box 3 of your Form SSA-1099. Then, on Form 1040, you will write the total amount of your Social Security benefits on line 5a and the taxable amount on line 5b.

Note that if you are filing or amending a tax return for the 2017 tax year or earlier, you will need to file with either Form 1040-A or 1040. The 2017 1040-EZ did not allow you to report Social Security income.

Contributing To Retirement Accounts

Another key advantage of ongoing earned income even after you collect Social Security is that you can keeping contributing to your retirement savings accounts like traditional IRAs, health savings accounts , Roth IRAs, and 401s.

Note: If you are over 72, you will have to take the required minimum distribution from your traditional IRA, except for during the 2020 pause because of COVID-19.

Your traditional 401, or similar employer-based retirement plan, is a different story. In general, you can continue stashing away money in your current employer-provided plan as long as you’re still working, even part-time, and you can delay taking your RMD until after you retire.

This additional savings can help, especially if your savings are running a bit behind your goals. The combination of the added savings, tax-deferred growth potential, and the ability to defer tapping into your savings can be powerful, even at the end of your working career.

Recommended Reading: Wood County Social Security Office

Taxes On Disability Income

In the U.S., if you work long enough, pay your taxes, and meet certain income thresholds during your career, you can participate in Social Security programs. Over time, you pay into this system and can expect to receive several benefits for you and your family.

If you work but later become disabled and have limited resources and means to earn income, the Social Security Disability Insurance program can assist. The program pays benefits to you and your children. But because your taxes fund this program, you may wonder is Social Security disability income taxable? Let’s find out.

Ways To Avoid Taxes On Benefits

The simplest way to keep your Social Security benefits free from income tax is to keep your total combined income below the thresholds to pay tax. However, this may not be a realistic goal for everyone, so there are three ways to limit the taxes that you owe.

- Place retirement income in Roth IRAs

- Withdraw taxable income before retiring

- Purchase an annuity

Read Also: Social Security Office Columbus Oh

Not Everyone Will Get The Full 87% Cola

This is due to everyones various primary insurance amounts . Your PIA will be the reason you see the 8.7% COLA increaseor not. Thats because the cost-of-living adjustment is not added to your current benefit, but rather applied to your PIA, and the two might not match exactly.

If you choose to start receiving retirement benefits at your normal or full retirement age which depending on the year you were born, is 66 or 67 the Social Security Administration classifies that as PIA. Conversely, your payment is not reduced if you decide to retire early at 62, but it also does not increase if you hold off on retirement for later in your life at 70.

The bottom line: make sure to compare and contrast if your PIA and current benefits are similar, then plan accordingly for what your expectations are for the 2023 COLA in your monthly budget.

How To Calculate Social Security Tax

Its fairly easy to calculate your Social Security tax. You multiply your earningsup to $147,000by your Social Security tax rate, depending on whether youre an employee or are self-employed.

For example, lets say Michael works for a company and earns a salary of $150,000 in 2022. The Social Security tax applies to the first $147,000 of his wages, so his tax liability is $9,114: his $147,000 income multiplied by 6.2% .

If hes working for himself and earns the same $150,000, hell owe the full Social Security tax on his first $147,000 of income. So his liability would be $18,228: $147,000 multiplied by 12.4% . However, his tax bill may be lowered if he qualifies for the self-employment tax deduction.

Read Also: How Much Of My Social Security Is Taxable In 2021

What Is Supplemental Security Income

Social Security Disability Insurance benefits and SSI benefits differ based on who receives them and why. SSI recipients do not need to meet the same disability or work credit requirements like those who receive Social Security Disability Insurance benefits.

Generally, SSI payments go to the elderly, blind, or disabled. Also, SSI benefit recipients often qualify for Medicaid assistance automatically.

Let an expert do your taxes for you, start to finish with TurboTax Live Full Service. Or you can get your taxes done right, with experts by your side with TurboTax Live Assisted.File your own taxes with confidence using TurboTax. Just answer simple questions, and well guide you through filing your taxes with confidence.Whichever way you choose, get your maximum refund guaranteed.

Does Social Security Income Count As Income

Yes, but you can minimize the amount you owe each year by making wise moves before and after you retire. Consider investing some of your retirement savings in a Roth account to shield your withdrawals from income tax. Take out some retirement money after youre 59½, but before you retire to pay for expected taxes on your Social Security before you begin receiving benefit payments. You might also talk to a financial planner about a retirement annuity.

You May Like: Call The Social Security Administration

Delaying Your Social Security Benefit Claim

“The other strategy, says Kumar, involves postponing when you first take Social Security. Both approaches can help shave dollars off your tax bill in retirement every yearit just takes a little forward planning.”

Consider a hypothetical couple named Natalie and Juan: For every year they delay taking Social Security past their full retirement age , they get up to an 8% increase in their annual benefit.

A hypothetical couple claiming Social Security at age 65 vs. age 70

| Natalie and Juan | |

|---|---|

| Net tax savings | $1,921 |

In general, many people would benefit from waiting to age 70 to take Social Security. Others may need the income sooner and may lack the resources necessary to meet expenses during the delay period, or they may not live long enough to reap the rewards of delaying their claim.

Natalie and Juans strategy is to reduce the amount they withdraw from their taxable IRAs over time and make up the difference in income by waiting until age 70 to claim Social Security. This has a big payoff for them because by delaying claiming Social Security until age 70, the percentage of their Social Security income that gets taxed is cut from 85% to 48.33%.

It gets better: While Natalie and Juans retirement paycheck of $70,000 remains the same, they pay approximately 37% less in taxes and withdraw smaller amounts from their respective IRAs each year.

Tip: To learn more about timing and Social Security, read Viewpoints on Fidelity.com: Should you take Social Security at 62?

If You Work More Than One Job

Keep the wage base in mind if you work for more than one employer. If you’ve earned $69,000 from one job and $69,000 from the other, you’ve crossed over the wage base threshold. Neither employer should withhold any further Social Security tax from your payor pay half the 12.4% on your behalfuntil year’s end.

It doesn’t matter that individually, neither job has reached the wage base threshold. The wage base threshold applies to all your earned income. But separate employers might not be aware you’ve collectively reached this limit, so you’ll have to notify both employers they should stop withholding for the time being. However, you can always receive reimbursement of any overpayment when you file your taxes.

These are annual figures, so the Social Security tax starts right back up again on Jan. 1 until you hit the next year’s Social Security wage base.

Read Also: Are Social Security Benefits Taxable After Full Retirement Age

Calculator: How Much Of My Social Security Benefits Is Taxable

September 15, 2022Keywords: calculator, retirement, Social Security, tax planning

Social Security benefits are 100% tax-free when your income is low. As your total income goes up, youll pay federal income tax on a portion of the benefits while the rest of your Social Security benefits remain tax-free. This taxable portion goes up as your income rises, but it will never exceed 85%. Even if your annual income is $1 million, at least 15% of your Social Security benefits will stay tax-free.

Social Security Benefits: Payment Dates

The January check next year will be based on recipients’ birth dates, according to the Social Security Administration.

- For people whose birthday falls between the 1st to 10th of any month, their payments arrive on the second Wednesday of the month. That means the first check with the 2023 COLA will land on January 11.

- Those with birthdays that fall between the 11th to 20th of any month will have their payments deposited or mailed on the third Wednesday of each month. Their first check with the enhanced COLA will arrive on January 18.

- If a recipient’s birthday falls between the 21st and 31st, their payments are scheduled for the fourth Wednesday of each month. Their first 2023 COLA will arrive on January 25.

Read Also: Social Security Office New Brunswick

What Happens If I Work And Get Social Security Retirement Benefits

You can get Social Security retirement benefits and work at the same time. However, if you are younger than full retirement age and make more than the yearly earnings limit, we will reduce your benefit. Starting with the month you reach full retirement age, we will not reduce your benefits no matter how much you earn.

- We use the following earnings limits to reduce your benefits: If you are under full retirement age for the entire year, we deduct $1 from your benefit payments for every $2 you earn above the annual limit.

For 2022 that limit is $19,560.

- In the year you reach full retirement age, we deduct $1 in benefits for every $3 you earn above a different limit, but we only count earnings before the month you reach your full retirement age.

If you will reach full retirement age in 2022, the limit on your earnings for the months before full retirement age is $51,960.

Starting with the month you reach full retirement age, you can get your benefits with no limit on your earnings.

Use our Retirement Age Calculator to find your full retirement age based on your date of birth.

Use our Retirement Earnings Test Calculator to find out how much your benefits will be reduced.

What counts as earnings:

Your benefits may increase when you work:

When youre ready to apply for retirement benefits, use our online retirement application, the quickest, easiest, and most convenient way to apply.

If you need to report a change in your earnings after you begin receiving benefits:

Social Security And Medicare Withholding Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, , Employer’s Tax Guide for more information or Publication 51, , Agricultural Employers Tax Guide for agricultural employers. Refer to Notice 2020-65PDF and Notice 2021-11PDF for information allowing employers to defer withholding and payment of the employee’s share of Social Security taxes of certain employees.

You May Like: Self Employed And Social Security

Is Social Security Taxed After Age 70

Millions of older Americans live solely on a Social Security check. And while other Americans rely mostly on workplace retirement plans like a 401 or an individual retirement account , these monthly benefits from the government can make or break your retirement. Lets take a look at how your Social Security is taxed after age 70.

For more help figuring out how Social Security will fit into your personal retirement planning journey, consider working with a financial advisor.

How Social Security Benefits Are Taxed

For individuals with more than $34,000 in combined income and couples with over $44,000, up to 85% of their Social Security benefits may be taxed.

Because the thresholds are not adjusted for wage growth or inflation, over time that has pushed more Social Security beneficiaries to pay taxes on their benefits, according to the Center for Retirement Research at Boston College.

When taxes on benefits were first introduced in 1983, just 8% of eligible families paid taxes on benefits. In 2021, that had climbed to an estimated 56%, according to the Center for Retirement Research. With moderate inflation, that was projected to increase to 58% in 2030.

“If inflation rises faster, Social Security benefits will be even higher in nominal dollars and more families will pay on more benefits further reducing the net benefit,”wrote Alicia Munnell, director of the Center for Retirement Research, and research associate Patrick Hubbard.

Recommended Reading: Does Workers’ Comp Affect Social Security Retirement Benefits