Will I Owe State Taxes On My Social Security

Good news for many retirees the majority of states will not be taxing your Social Security benefits. …

Getty

With Social Security being a major part of many people’s retirement income, paying less in taxes on this valuable benefit is like getting a raise. Put another way you should be concerned about how much taxes you will owe on your retirement income, including your Social Security. What may seem like a good amount to live on may not seem so fabulous after taxes.

Depending on your total income in retirement, the IRS may take a cut of your Social Security benefit via federal income taxes. The news is a bit better at the state level depending on where live during your retirement. Currently, 37 states, soon to be 38 states, will not tax your Social Security benefits at the state level. That leaves 13 states, soon to be 12, that will be taxing your Social Security benefits at some level.

While probably not a big enough issue to warrant moving in retirement, it is something to consider when choosing where you want to spend your golden years. At the very least, you need to know about Social Security taxation when figuring out how much additional income you will need to have in order to maintain your standard of living during retirement.

Where you choose to retire will determine if you owe taxes on your Social Security benefits at the … state level.

Getty

How Much Tax Do I Have To Pay On My Benefit Check

Its important to say that all other states are exempt from paying state taxes, but federal taxes are mandatory. So be careful when declaring all your benefits as you have to pay taxes independently. This entire amount of tax depends on what your limit is and whether you also collect any other type of income.

If you have any doubts, see a professional lawyer. This is the best way to avoid legal problems and pay all mandatory taxes. Dont miss the opportunity to do your homework as an American Citizen to help improve the country in all respects.

And remember, there are ways to increase your monthly Social Security payment to give you more purchasing power. The difference can be as much as $16,728, so choose wisely when you want to retire.

Therefore, it is much better to move to one of the states where they do not charge state taxes, this way you will save a lot of money every month and you will be able to have higher purchasing power every year.

These 38 States Won’t Touch Your Social Security

If you live in one of these 38 states or the District of Columbia, you won’t have to worry about state Social Security taxes. Nine of these states don’t have state income taxes: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming . In the other states, Social Security benefits aren’t considered taxable income.

That doesn’t mean, however, you’ll avoid taxes altogether on your Social Security checks. Benefits are still taxable at the federal level if your income exceeds certain thresholds.

For single filers with incomes between $25,000 and $34,000, up to 50% of benefits are taxable. Up to 85% of your benefit is taxable if you’re a single filer whose income is greater than $34,000.

Up to 50% of benefits are taxable for married couples filing a joint return who have a combined income between $32,000 and $44,000. Up to 85% of benefits are taxable for couples whose combined income exceeds $44,000.

Read Also: Aiken Sc Social Security Office

Retirement Account And Pension Income

The way a state handles retirement account and pension income can have a huge impact on the finances of a retiree. Many states do not provide any kind of deduction, exemption or credit on withdrawals from a retirement account such as a 401 or IRA.

How might that affect a typical retiree? Lets say your effective state tax rate in one of these states is 4% and your annual income from your 401 is $30,000. That would add up to taxes of $1,200 on that retirement account income taxes that you wouldnt have to pay in states like Alaska and Mississippi .

Exemptions for pension income are more common. Only a handful of states fully tax income from a government pension, while a few more tax income from a private employer pension. The other states either exempt that income or provide a deduction or credit against it.

Up To 85% Of Your Social Security Benefits May Be Taxable If:

- You file taxes as single, head of household or qualifying widow or widower, and the total of half your Social Security income plus income from other sources sums to more than $34,000.

- You are married and file a joint tax return, and half your Social Security income plus the total income from other sources is more than $44,000.

Also Check: Social Security Office In Milwaukee

The States That Dont Tax Social Security:

In alphabetical order, Alabama, Alaska, Arizona, Arkansas, California, Colorado, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Mississippi, Nevada, New Hampshire, New Jersey, New York, North Carolina, Ohio, Oklahoma, Oregon, Pennsylvania, South Carolina South Dakota, Tennessee, Texas, Virginia, Washington, Wisconsin, Wyoming.

Related: Is There a Maximum Social Security Benefit?

Which State Wont Tax Social Security In the Future:

At some point in the future, West Virginia will be joining the list of states that do not tax Social Security. In 2019, a bill was passed that will allow West Virginian taxpayers to avoid paying taxes on all of their Social Security benefits by the year 2022.

It will be interesting to see if any other states follow suit. Millions of Americans are not anywhere near on track for a secure retirement. Because of that, they will need every penny of their Social Security benefits. Similarly, the states will also need every single cent of tax dollars they can get to provide services to help keep their retirees out of poverty.

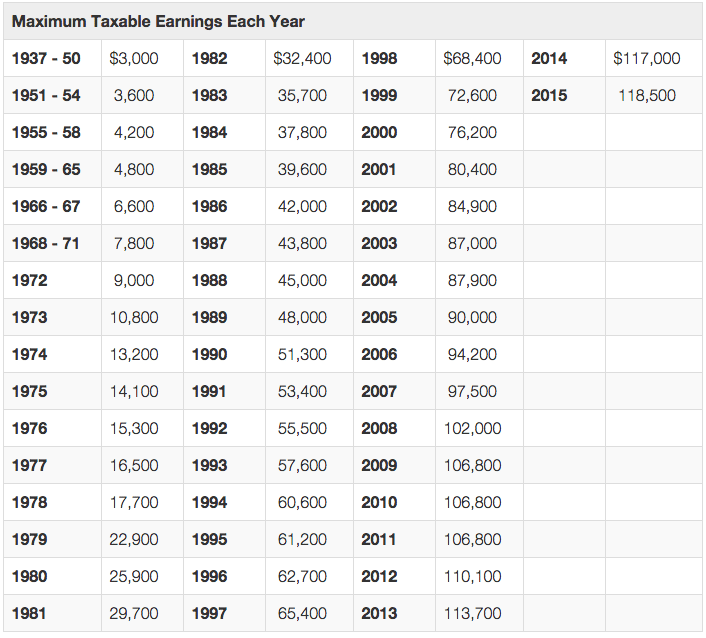

Social Security Tax Rates

Social Security functions much like a flat tax. Everyone pays the same rate, regardless of how much they earn, until they hit the ceiling. As of 2021, a single rate of 12.4% is applied to all wages and self-employment income earned by a worker up to a maximum dollar limit of $142,800.

Half this tax is paid by the employee through payroll withholding. The other half is paid by the employer. So employees pay 6.2% of their wage earnings up to the maximum wage base, and employers also pay 6.2% of their employees wage earnings up to the maximum wage base, for a total of 12.4%.

This 12.4% figure does not include the Medicare tax, which is an additional 2.9% divided between employee and employer.

Recommended Reading: Corporate Tax Rate In India

Also Check: Alabama Social Security Office Phone Number

File 100% Free With Expert Help

Get live help from tax experts plus a final review with Live Assisted Basic.

Answer simple questions about your life and TurboTax Free Edition will take care of the rest.For simple tax returns only

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

When Is Social Security Income Taxable

To determine when Social Security income is taxable, youll first need to calculate your total income. Generally, the formula for total income for this purpose is: your adjusted gross income, including any nontaxable interest, plus half of your Social Security benefits.

If youre married and filing jointly with your spouse, your combined incomes and social security benefits are used to figure your total income.

Then youll compare your total income with the base amounts for your filing status to find out how much of your Social Security income is taxable, if any.

Youll see that you fall into one of three categories. If your total income is:

- Below the base amount, your Social Security benefits are not taxable.

- Between the base and maximum amount, your Social Security income is taxable up to 50%.

- Above the maximum amount, your Social Security benefits are taxable up to 85%.

Recommended Reading: Social Security Office Williamsburg Va

Understanding Taxes On Social Security Benefits

Since 1983, Social Security payments have been subject to taxation by the federal government. How much of a persons benefits are taxed will vary, depending on their combined income , nontaxable interest, and half of their Social Security benefits) and filing status. Regardless of the result of the Internal Revenue Service calculation, the amount subject to taxes wont exceed 85% of the total benefit.

| Combined Income |

| $44,000+ |

Income from other retirement programs also may be subject to federal income taxes. Pension payments, for example, are either fully taxable or partially taxable, depending on how much in after-tax dollars the individual invested into the contract.

Spousal Social Security benefits and Social Security disability benefits follow the same basic rules as the primary Social Security program in that the amount subject to federal income taxes is dependent on the retirees total income. Supplemental security income, however, is not taxed.

Are Social Security Benefits Taxable

Up to 50% or even 85% of your Social security benefits are taxable if your provisional or total income, as defined by tax law, is above a certain base amount. Your Social Security income may not be taxable at all if your total income is below the base amount.

If youre married and filing jointly with your spouse, your combined incomes and social security benefits are used to figure your total income.

Don’t Miss: Social Security Monthly Payment Calculator

How To Calculate Social Security Tax

Its fairly easy to calculate your Social Security tax. You multiply your earningsup to $147,000by your Social Security tax rate, depending on whether youre an employee or are self-employed.

For example, lets say Michael works for a company and earns a salary of $150,000 in 2022. The Social Security tax applies to the first $147,000 of his wages, so his tax liability is $9,114: his $147,000 income multiplied by 6.2% .

If hes working for himself and earns the same $150,000, hell owe the full Social Security tax on his first $147,000 of income. So his liability would be $18,228: $147,000 multiplied by 12.4% . However, his tax bill may be lowered if he qualifies for the self-employment tax deduction.

Blindness Medical And Dental Exemptions

Blindness Exemption

You’re allowed a $2,200 exemption if you or your spouse is legally blind at the end of the taxable year.You’re legally blind for Massachusetts purposes if your visual acuity with correction is 20/200 or less in the better eye, or if your peripheral field of vision has been reduced to a 10-degree radius or less.You’re not legally required to attach a doctor’s statement verifying legal blindness to your return, but you should be prepared to submit such a statement upon request.

To report the exemption on your tax return:

Medical and Dental Exemptions

You’re allowed an exemption for medical, dental and other expenses paid during the taxable year. You must itemize deductions on your Form 1040 – U.S. Individual Income Tax Returns or Form 1040-SR – U.S. Tax Return for Seniors.

If you itemize on U.S. Schedule A and have medical/dental expenses greater than 10% of federal AGI, you may claim a medical and dental exemption in Massachusetts equal to the amount you reported on U.S. Schedule A, line 4. If either you or your spouse was born before January 2, 1950, it has to be greater than 7.5% of federal AGI.Married taxpayers:

Massachusetts does not adopt the federal health insurance credit.

To report the exemption on your tax return:

You May Like: Social Security Office Queens Ny

Information You Need To Calculate Your Benefits If You Are Affected By The Gpo

To estimate your future spouse’s, widow’s, or widower’s benefits under the GPO, you need two things:

Social Security Benefit Taxation By State

Out of all 50 states in the U.S., 39 states and the District of Columbia do not levy a tax on Social Security benefits. Of this number, nine statesAlaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyomingdo not collect state income tax, including on Social Security income.

Out of the nine states that do not levy an income tax, New Hampshire still taxes dividend and interest income.

Below is a list of the 11 states that do levy a tax on Social Security benefits on top of the federal tax, with details on each states tax policy.

Don’t Miss: Is Social Security Tax Free

Which State Is The Most Tax

Although theres no official measure of tax friendliness, Delaware is a strong contender for the best state for retirees when it comes to taxes. The First State levies neither state or local sales tax, nor estate or inheritance tax. Delawares median property tax rate is also one of the lowest in the U.S. Its income tax rate of 6.6% is on the higher side, but its still lower than the rates imposed by 16 other states and the District of Columbia.

How Social Security Benefits Are Taxed

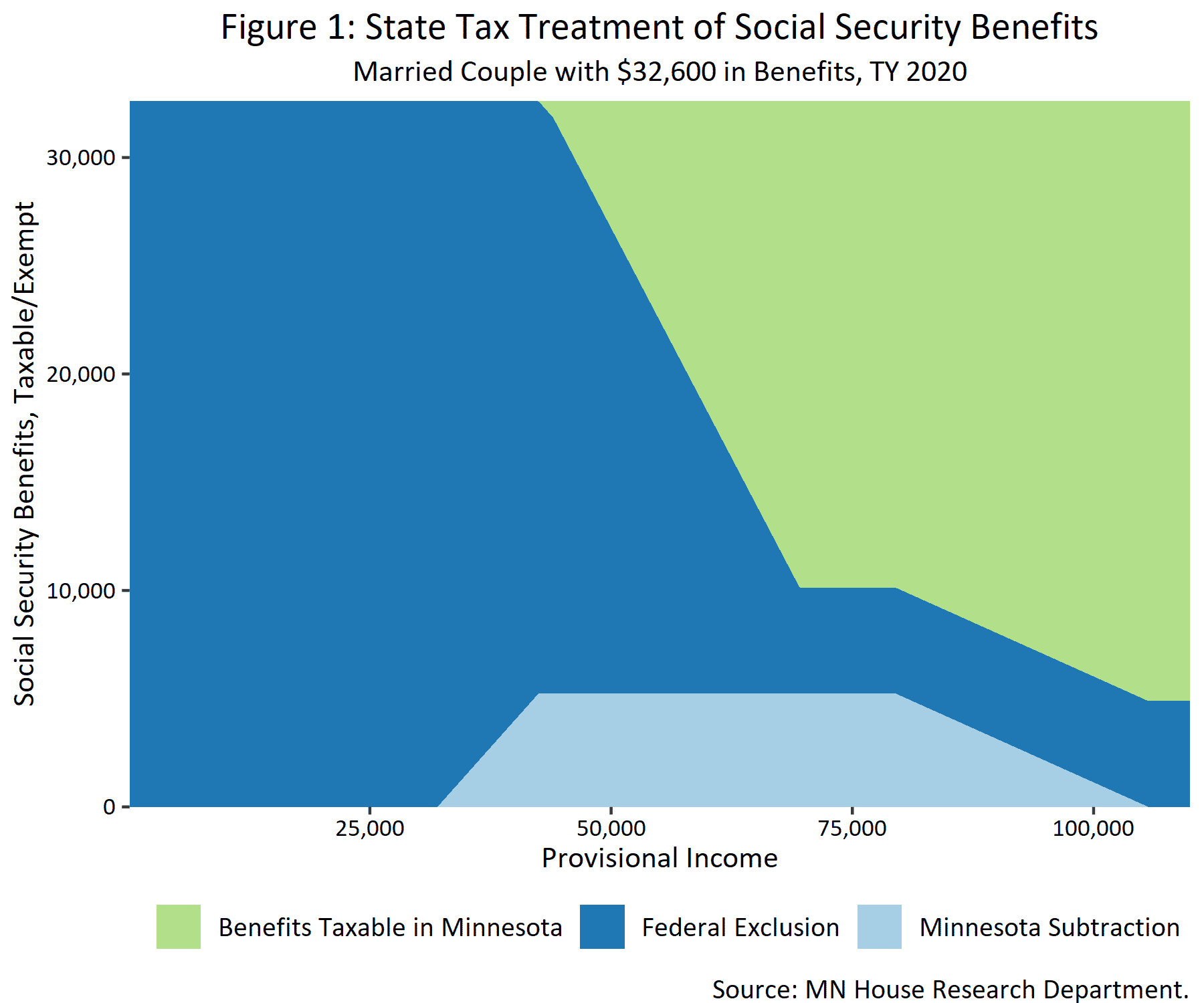

Social Security beneficiaries must pay federal income tax on a portion of their benefits if their income exceeds certain thresholds the portion of benefits that is taxable rises with income. Income for this purpose equals a taxpayers adjusted gross income plus tax-exempt interest, certain other tax-exempt income, and half of Social Security benefits this is referred to as modified AGI. A three-part formula applies:

- For individuals with modified AGI below $25,000 and couples with modified AGI below $32,000, no Social Security benefits are taxable.

- For individuals with modified AGI between $25,000 and $34,000 and couples with modified AGI between $32,000 and $44,000, up to 50 percent of benefits are taxable.

- For individuals with modified AGI over $34,000 and couples with modified AGI over $44,000, up to 85 percent of benefits are taxable.

For a detailed explanation of the tax calculation, see Appendix Table 1.

Also Check: How Is Property Tax Paid

Also Check: Social Security Office Brooklyn Center

How Do I Know If My Social Security Is Taxable

To find out if their benefits are taxable, taxpayers should: If they are married filing jointly, they should take half of their Social Security, plus half of their spouse’s Social Security, and add that to all their combined income. If that total is more than $32,000, then part of their Social Security may be taxable.

Virginia Taxes And Your Retirement

Youve worked hard, and now youre ready to move on to the next chapter of your life. As you enter retirement, dont let confusion about your taxes keep you from enjoying everything Virginia has to offer.

With a few exceptions, if a source of income is taxable at the federal level, its taxable to Virginia as well. This includes most sources of retirement income, including:

- 401, 403, and similar investments

- Tier 2 Railroad Retirement

- Traditional IRAs

Individual Retirement Accounts

With a traditional IRA, you usually can deduct the amount you contributed to the account from your federal taxes. Therefore, your distributions are usually taxable.

A Roth IRA is a little bit different. With a Roth IRA, you pay taxes on the money you add to your account when you earn it. Since youve already paid the tax due, you usually dont pay tax on your distributions.

Social Security

Virginia does not tax Social Security benefits. If any portion of your Social Security benefits are taxed at the federal level, you can subtract that amount on your Virginia return. This also applies to Tier 1 Railroad Retirement.

Age Deduction

Virginia offers qualifying individuals ages 65 and older a subtraction that reduces the amount of their income subject to Virginia income tax:

- If you were born on January 1, 1939, or earlier, you can subtract $12,000

- If you were born on January 2, 1939, or later, the amount of allowed subtraction is based on your income.

Personal Property and Real Estate Taxes

Recommended Reading: Social Security Office Atlanta Appointment

States That Dont Tax Retirement Income: What To Know And How To Plan

Shawn Plummer

CEO, The Annuity Expert

Do you know which states dont tax retirement income? If not, then read on to find out! Many states have a law that states that they do not tax any source of retirement income. This includes income from IRAs, 401ks, pensions, and annuities. So it doesnt matter how much money you make or where in the United States you live if your state is one of these states, then your retirement income will be free of taxation.

Find out how much guaranteed retirement income you can receive for the rest of your life with our retirement calculator.

If youre looking for a way to spend your 401 or IRA money without relinquishing control, keep up with inflation, and never run out of money, read our article: Empowering Retirement.